By James K. Galbraith, a Vice President of Americans for Democratic Action who teaches at the University of Texas at Austin. Cross posted from New Deal 2.0.

Economist James K. Galbraith goes behind the scenes at a Pete Peterson gathering of deficit hawks to see what they have to say.

The Fiscal Solutions Tour is the latest Peter G. Peterson Foundation effort to rouse the public against deficits and the national debt — and in particular (though they manage to avoid saying so) to win support for measures that would impose drastic cuts on Social Security and Medicare. It features Robert Bixby of the Concord Coalition, former Comptroller General David Walker and the veteran economist Alice Rivlin, whose recent distinctions include serving on the Bowles-Simpson commission. They came to Austin on February 9 and (partly because Rivlin is an old friend) I went.

Mr. Bixby began by describing the public debt as “the defining issue of our time.” It is, he said, a question of “how big a debt we can have and what can we afford?” He did not explain why this is so. He did not, for instance, attempt to compare the debt to the financial crisis, to joblessness or foreclosures, nor to energy or climate change. Oddly none of those issues were actually mentioned by anyone, all evening long.

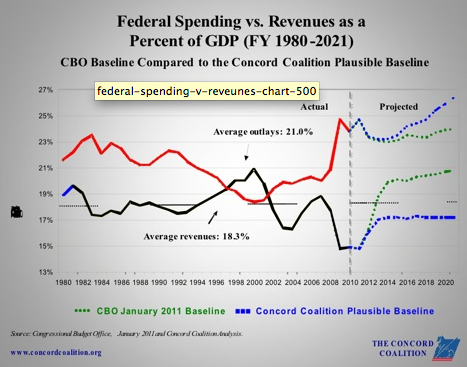

A notable feature of Bixby’s presentation were his charts. One of them showed clearly how the public deficit soared at the precise moment that the financial crisis struck in late 2008. The chart also shows how the Clinton surpluses had started to disappear in the recession of 2000. But Mr. Bixby seemed not to have noticed either event. Flashing this chart, he merely commented that “Congress took care” of the budget surplus. Still, the charts did show the facts — and in this respect they were the intellectual highpoint of the occasion.

A David Walker speech is always worth listening to with care, for Mr. Walker is a reliable and thorough enumerator of popular deficit-scare themes. Three of these in particular caught my attention on Friday.

To my surprise, Walker began on a disarming note: he acknowledged that the level of our national debt is not actually high. In relation to GDP, it is only a bit over half of what it was in 1946. And to give more credit, the number Walker used, 63 percent, refers to debt held by the public, which is the correct construct — not the 90+ percent figure for gross debt, commonly seen in press reports and in comparisons with other countries. The relevant number is today below where it was in the mid-1950s, and comparable to the early 1990s.

But Mr. Walker countered that fact with another, which I’d never heard mentioned before: in real terms he said — that is, after adjusting for inflation — per capita national debt is now twice what it was back then.

The problem is that real per capita national debt is a concept with no economic meaning or importance. (No government agency reports it, either.) Even in the private sector, debt levels matter only in relation to income and wealth: richer people can (and do) take on more debt. Real per capita national income is well over three times higher today than it was in 1946 — so how could it possibly matter that the “real per capita national debt” is twice as high?

Next, Mr. Walker made a comparison between the United States and Greece, with the implication being that this country might, some day soon, face that country’s interest costs. But of course this is nonsense. Greece is a small nation that has to borrow in a currency it cannot control. The United States is a large nation that pays up in a money it can print. There is no chance the markets will mistake the US for Greece, and of course they have not done so.

Finally, Mr. Walker warned that “foreign lenders… can’t dump their debt but can curb their appetite” for new US Treasury bonds. This was an oblique reference to the yellow peril. The idea, when you think about it, is that the Chinese central bank will acquire dollars — which it does when China runs an export surplus — and then fail to convert them into Treasury bonds, thereby choosing, voluntarily, to hold dollars in cash, which earns no interest, instead of as Treasury bills, which do. Mr. Walker did not try to explain why this would appeal to the Chinese.

Walker closed by calling for action tied to an increase in the debt ceiling; specifically for a hard cap on the debt-to-GDP ratio with “enforcement mechanisms,” which could include pro rata cuts in Social Security and Medicare benefits and tax surcharges. He did not specify whether the cap should apply to gross federal debt or only to that part of the debt held by the public (a number which the Federal Reserve can change, any time it wants, by buying or selling public debt). When pressed, in the question period, he would not even say what he thought the cap should be.

I waited for Ms. Rivlin to add something sensible. But she did not. Apart from some platitudes — she favors “serious tax reform” and “restructuring Medicare” — her interesting contribution was to restate Mr. Walker’s comment about “foreign lenders,” who might say “we’re not going to lend you any more money.” That this would amount to saying “we’re not going to sell you any more goods” seems — from a question-and-answer and brief exchange afterward — genuinely not to have crossed her mind.

The Fiscal Solutions Tour comes with a nice brochure, and even (in my case) with a flash drive containing Mr. Bixby’s powerpoints. But does Mr. Peterson think he’s getting his money’s worth? The President, in his State of the Union, mostly ignored him. The Bowles-Simpson effort (which he paid for in part) and the closely allied Rivlin-Domenici plan are fading from view. And as the House Republicans forge their own course, demanding radical spending cuts right now — for political rather than economic reasons, which they don’t even bother to explain — the tired and shabby arguments of these old deficit-worriers hardly seem connected, any more, to the battles at hand.

Thanks yet again, Yves…

important expose’ of disinformation perpetrated, levels of,

agenda for…

I guess distorting facts and telling outright lies is all part of the right-wing propensity for “eliminationist rhetoric”. If you can’t do grievous bodily harm to a subject instead of using reason then it ain’t worth bothering with. Very dangerous simpletons with psychologically disturbed childhoods.

Just think, we have a whole generation of conservative politicians trained in “The Big Lie” and the no so big lies! Everything works, until it doesn’t…

”

charts did show the facts — and in this respect they were the intellectual highpoint of the occasion.

”

You bet your bottom laser pointer, Incredible Bixby! Does the plot conjure image of *Reagan’s Supply Side Smoke and Mirrors* finally generating a modicum of revenue? Bush, the Greater blowing the Reagan Wad on WOW I, World Oil War I? Clinton, the Democrat surprising the hell out of everyone by pinching pennies for our long neglected Fort Knox? Smile when you say, “Fort Knox”, Partner!

Bush, the lesser blowing the Clinton Wad on WOW II, World Oil War II? Oh! Not supposed to call it Clinton Wad. Supposed to call it the BS, Budget Surplus. Got it! Does that play out, “Surplus spent is surplus denied!”? Or just BS! Snort!

Is all of the above immaterial? Is money merely more of smoke and mirrors? It is allocation of resources, Stupid! Money, debt, deflation, inflation, deficit, and surplus are birds of a feather! All distractions every one! We have lost sight of our aboriginal goal, our American Dream which has been stolen from us by the greedy who are now about to die with a fist full of dollars that will rot into eternity with their smoldering souls forgotten forever or recalled with disgust by all betrayed peasants of America the Beautiful.

G B America

!

The United States is a large nation that pays up in a money it can print.

—-

That’s why one big creditor’s mumbling, or maybe just wishing secretly, about lending in a different currency?

I may be wrong but we also are supposed to have faith that the Fed is independent and won’t just print so we can pay up.

Federal debt is not the same as private debt. It merely appears on a balance sheet that way. There is really no such federal equivalent of “paying off” debt like you and I must. After all, what would that debt get paid off in? Currency? Sorry, but federal currency is also debt. It simply has a different maturity and yield (i.e., today and zero).

Federal currency is only a “debt” (to whom?) because issuance and it’s intrinsic value has been “privatized” (wink wink). Reclaim it – as is constitutionally “encouraged” – and it can become public CREDIT.

Big difference.

Oh sorry – forgot to mention that “federal currency is also debt” is not the same thing as debt-based Federal Reserve Notes paid to “employees” who pay taxes on those Federal Reserve Note “wages”.

Give me US Treasury notes any day over FRN’s, as long as I can pay my local, state & federal taxes with them.

OK, call me a sap, but I believe in the American people, no matter who prints and controls the value of the fleeting, but very pretty, currency.

Double entry bookkeeping, Pixy. Everything is double entry bookkeeping. The government spends money as debt, which in turn makes it a credit on your side. Just like magic, you have your “credit money”.

So then just use double book keeping for the new dollars spent.

The UST should just debit a “Taxes Due” account which will be credited when taxes are paid. This would track the deficit liability without having to issue a bond and pay interest which just compounds the deficit and national debt problem.

This way the gov’t would be forced to reduce spending to match expected tax returns (balanced budget) and stop the ever spiraling national debt.

Did anyone see the article just out showing that the IMF is proposing SDR type alternatives to the US dollar as Reserve Currency?

Is the American version of the Shock Doctrine entering a new phase?

Where is my popcorn?

I’m wondering why China parks all of its dollars in treasuries. Why doesn’t it purchase US financial assets like real estate or equities? Those instruments are higher yielding and would better prevent US political pressure on China.

Would you rather hold a gun to the nefarious west American trading company or the in the pit of capture American tax payer.

Skippy…peaches and pear thingy methinks.

Depends who. The PBoC likes very low risk and liquid assets like all central banks. They have a sovereign wealth fund that can take more risk, but in their first big move from being risk averse, they got burned on the Blackstone IPO.

But they didn’t necessarily get burned on the American economy.

(Not the same thing as Wall Street paper-flippers).

I was just narrowing things down to what they can do after they commit to the currency peg regime.

Please explain currency peg regime.

(I’m not stalking you – really really really.

We must be in same time zone. And maybe political persuasion?)

If you are a female, you are welcome to stalk me. Plus or minus 3 hours is fine and I can provide either Bush or Obama posters on my bedroom walls.

But in any case, “currency regime” means we pay China companies in dollars and then their central bank has to do something with them. They can either buy dollar denominated things, which include oil or American products, or buy some US paper asset like treasuries or other things like stocks or US real estate.

If they choose not to do anything like that, they would need to dump dollars in Forex and that would make their currency rise and break the peg.

Yes, it’s really that simple.

Maybe because China is based on the American economic model of currency and economy.

Richard

I’m thinking that it has something to do with their currency peg. Think of their currency peg as China running on a “dollar standard”. They need more dollars to issue more renmibi. They must “mine” dollars and if they actually buy a volatile asset they risk domestic instability in their own currency.

I’ll bet these guys embraced the “Mythical Bankruptcy Theorem” when Bush was racking up war debt off-balance sheet and on the grandkid’s credit card. They probably believed, too, that it would be cheap and Iraq would pay for itself as Cheney said.

Now the sky is falling. Go figure.

Let’s not state the obvious – that the deficit would have been reduced by nearly half by end of Obama’s term if Bush’s tax cuts for his base, the top 2% – you know, the “haves” and “have mores” – would have expired as the passed legislation was written.

meant to say Obama’s “first” term…

The debate about the National Debt is ludicrous because the US should not even have one. It should simply spend debt and interest free money (United States Notes) into circulation and tax it out of circulation and in that order too.

The idea that government should have to borrow its own money supply is a scam. It goes back in the US to Alexander Hamilton who sought to buy the support of the rich for the fledging US government. That excuse is long past.

Isn’t that the truth!

Ben Franklin and Thomas Jefferson knew what they were talking about.

Credit. Not debt.

In borrowing its own money back, the US effectively gets to spend money and then take it back out of circulation for a time (until the maturity date of the bond), where it cannot do lousy things like cause inflation. Of course, the US has to pay the owner of that money for the priviledge of doing so (i.e., interest), which does further increase the money it has to borrow to remove from circulation.

It’s a good deal in the shorter term, but a lousy deal in the longer term. But in the longer term, everything under our form of capitalism is a lousy deal.

Exactly, End the FED and repeal the 16th Amendment eliminating the income tax to be replaced it with a consumption tax (e.g. fairtax.org).

This would put a real time governor on the economy such that when over consumption takes off (inflationary pressure) the tax proceeds would increase (draining money from the system, helping to pay down any deficit accruals). If the economy slows, taxes would be reduced providing more money for consumption or investment. The consumption tax also provides an incentive for saving and investing.

But most importantly gov’t has to be reduced, budgets reduced and balanced. All gov’t subsidies should be eliminated as they just distort the market and favors special interests. It is time to unleash the competitive free market from the bounds of gov’t interventionism.

I’ve always wondered what Galbraith would look like wearing one of those funny nose-mustache-eyeglass disguises. Too bad nobody got any pictures at Big Pete’s seminar.

Other than that, not much new in the presentation or criticism. I am disappointed nobody mentioned the $500K Obama spent on the Cat Food Commission.

And when Pete’s friends say “cut SS”, they really mean make the income stream from FICA-Payroll tax go back to surplus so they don’t have to pay back the trust fund.

Which reminds me. We just decided on a two year payroll tax holiday (employee part)which is being paid by Treasury instead. Shouldn’t they all be going nuts over that? But wait…I recall that idea was pushed by Galbraith’s happy campers???

According to the “happy campers”, the trust fund is an accounting fiction, and therefore all payments into such a fund are also accounting fictions. And they are correct.

Aaahh, ok. Now I understand.

“so they don’t have to pay back the trust fund”

Bada-bing. Tell me this isn’t all about reneging on that $2-1/2 trillion that’s built up since 1984. Actually honoring the deal would require taxes, precisely the way it was planned at the time. And we can’t have that, can we.

I’m one of the millions who’s been over-withheld for most of my working life because of that deal. But then, so is anyone who’s been working and paying in anytime since 1984. The whole point of it was to build up a surplus that could be gradually redeemed from general revenue.

You’d think these guys would have known about it, since it’s been going on for 25 years. And they might have heard of the guy who dreamed it up, something Greenspan? But no, big shock, and God knows we can’t tax those really big incomes and estates or they might all decide to sit on their hands or move to Switzerland or Bimini or New Jersey or some other low-tax haven. Yeah.

These guys are chiselers, that’s all.

Ok. You changed my mind back again.

Just kidding. I wasn’t borne yesterday and actually we have been having quite a bit of fun over at Angry Bear site helping Dale Coberly and Bruce Webb skewer these morons and their moronic arguements.

Not to say they won’t starve to death us in the end, but live for the day I always say.

Meet Neil Codell an Illinois educator with a $26 million state pension.

Slightly OT there, but that’s my specialty…

So…I guess this means we can’t count on these people’s votes on re-instating the Estate Tax?

An assumption of 7% salary increase a year? And he has an assumed 14 more years to go as a school district superintendent (apparently working until he is around 69)? That calculation is complete bullcrap. Of course you can expect these deficit nuts to take it and run with it.

Googling his name will reveal that fortunately they won’t have to find out if he will ever get a $885k salary in 14 years since he has already retired.

Those figures are over 30 years, brought back to present value.

How many people collect 30 years of a pension? retire at 65 and live to 95? Conservatively, one could knock off more than half of the forecast “cost” by simply looking at an actuarial table.

I do agree that school administrators, in general, are paid way too much. I spotted a news story about how many school superintendents in NYS make more than the governor. That seems wrong, anyway you look at it.

But they are in charge, and they get to go out and rail against the teachers in budget negotiations.

Of course, the Fiscal “Solutions” scammers made no mention of why Japan and Singapore haven’t crashed and burnt with their high debt to GDP ratio’s. Right, it’s going to happen any day now. But apparently the bond vigilantes haven’t figured it out, since the interest they pay is rock bottom. If these people weren’t professionals, one could write it off to ignorance. But they are professionals, so the ignorance excuse doesn’t apply. No surprise that some people will prostitute themselves for money.

Japan is a lot closer than you think. CDS’s are somewhere around 80 BP on 10 year debt. That is a huge slice on a 1.5% yield. Time to liquidate for retirement there. No return on money for over a decade to hide bank insolvency. It won’t take much blood in the water to roll Japan over. 40 trillion yen income 1 quadrillion yen debt equals 25 years revenue. 90 trillion expenditures. 4% wipes out all income. Dollar revenue keeps it afloat.

Point here is that at some point you go to absurdity. Remember risk free is 3% and a 3% expected inflation rate makes 6%. It is hard to use Japan for a negative, but can you use it as a positive? Debt inflation out of the US allowed it to survive. Nowhere in 20 years is not a pretty picture. Old people, collapsed birth rate due to monetary and fiscal economics.

possibly of interest: Fiscal Sustainability Teach-In and Counter-Conference from April 28th, 2010 (the same day as the Peterson Foundation’s “Fiscal Summit”).

audio, video, transcripts and presentation materials at the link.

Of course in Ronald Reagan’s era all that government deficit spending to buy military hardware to frighten the Russians was OK with the right-wingers. That was War on Communism but come the Financial Crash War on Recession deficit spending is just outrageously indefensible.

Don’t forget crony capitalism to the tune of trillions in transfers, loans, and guarantees.

What a relief.

And here, I was getting myself all upset about global warming, about pollutants and cancer linkages, about fraudclosure and rampant criminogenic economic systems, and also about global epidemics like swine flu. Silly me.

Hi Jamie, Unfortunately, I’m not sure the Bowles-Simpson Report is fading from view. The consensus in DC seems to be that fiscal policy should be governed by looking at debts, deficits, and debt-to-GDP ratios, rather than looking at public purpose. It’s reported that Dick Durbin and Mitch McConnell are in the process of negotiating a package of cuts, accompanied by tax reforms, both based to some degreee on the Bowles-Simpson Report (there was no official Fiscal Commission report since the Co-Chairs couldn’t get 14 votes for any proposal including theirs).

Initially, Durbin was supposed to be one of the 4 liberal on the Commission who could be counted on to hold the line on cuts, especially entitlement cuts. But clearly Senator Durbin is in Obama’s pocket and will do whatever his friend wants him to do.

At any rate talk has surfaced again of the House refusing to extend the debt limit creating a debt crisis, and the threat of default if there is no compromise. Past history of Obama’s negotiating style suggests that he’ll compromise by giving the Republicans most of what they ask for. “Progressive” Senators who try to resist will then be blamed by the Administration for any forthcoming national default. To avoid that, it’s pretty certain that “progressive Senators won’t go to the wall, given their past behavior. So the likelihood is that the vestiges of new Deal and great Society programs that still exist will sustain some very heavy blows as will the working and middle class Americans who are heavily dependent on them.

Meanwhile, the budget balancing fervor won’t extend to raising taxes on the well off, because this isn’t really about balancing budgets or cutting deficits, or fiscal responsibility. It’s really about creating even more wealth for the wealthy and showing the rest of us who really controls American Society. It’s about the transition to plutocracy, now nearly complete. But I don’t think I have to tell the author of The Predator State about that.

With his “Full Faith and Credit Act,” Toomey is arguing that Treasury could delay default by simply “prioritizing” payments from available funds and ensuring that bondholders get the principal and interest payments due them. The idea has won a following in the Republican Study Committee in the House, and some in the GOP leadership worry that it could lull the large Republican freshman class into believing that Congress can avoid raising the debt ceiling this spring without risk to the United States in world markets.

Read more: http://www.politico.com/news/stories/0211/48825.html#ixzz1DixBkaWw

US Senator Pat Toomey, R-PA, Arlen Specter’s replacement, wrote a letter to Geithner outlining his plan. See above link. No, I don’t think Obama will be licking these boots, grabbing his ankles or otherwise maintaining his oath of fealty to what is coming over the drawbridge. Be prepared for the Harvard MBA and Wall St derivative champ to make many more financial innovation suggestions on how to find our way our the desert of debt, the debacle of deficits, and the spiraling spending.

Speaking of innovation to get around the debt ceiling. Here’s a post, along with some good comments, about using coin seigniorage to do it.

http://www.correntewire.com/president_obama_should_use_coin_seigniorage_now

There’s an extensive further discussion of the idea on Warren Mosler’s site here:

http://moslereconomics.com/2011/01/20/joe-firestone-post-on-sidestepping-the-debt-ceiling-issue-with-coin-seigniorage/

The consensus seems to be that the idea is feasible and legal. Unfortunately, I don’t think Obama will have the backbone to do it.

First I’ll concede that I just skimmed the article, because I didn’t want to spend all the time and energy on a Saturday to understand how to re-invent the economy and monetary system of the world. So I may not entirely grasp the new system yet.

But it did seem to remind me of where Britain’s banking system was at maybe around a couple hundred years ago. (my memory is foggy on this) After they discovered banks were doing fractional banking and had a few rough spots with that, they decided that inspectors needed to inspect gold in the bank vaults and determine if there was enough there to make the banks commitments seem credible. So bank branches would transfer gold the day before the inspector got there from another branch and everything was cool.

But today, fiscal stimulus has become oh so important too as well, so why not combine this concept with a high speed rail system? Build it between Ft. Knox, NYFRB and the Treasury.

Then run a schedule of gold filled train cars (armoured of course) between these locations. I think the value of US gold at Ft. Knox is carried on the Fed’s books in present day accounting (why do they bother with accounting anyway? It’s our money!), so the Treasury and Fed would just select different accounting days and put the value of the gold train on the report when the train shows up.

You may get Ron Paul on board if you say “gold” instead of “platinum”, tho I think he may balk at the train part. And some people think the other choice of metal we may have in Ft.Knox is tungsten, not platinum. But that would save the USG the trouble of buying a whole lot of platinum, anyway.

I’m sure this idea is full of holes, still. But I just roughed it out, and like I say, it’s a Saturday.

Witnesses

Ms. Nicole Gelinas

Searle Freedom Trust Fellow

Manhattan Institute

Professor David Skeel

S. Samuel Arsht Professor of Corporate Law

University of Pennsylvania Law School

Ms. Eileen Norcross

Senior Research Fellow

Social Change Project at the Mercatus Center

Ms. Iris Lav

Senior Advisor

Center on Budget and Policy Priorities

Other Documents

Chairman McHenry – Opening Statement

State and Municipal Debt: The Coming Crisis?

http://oversight.house.gov/index.php?option=com_content&view=article&id=1101%3A2-9-11-qstate-and-municipal-debt-the-coming-crisisq&catid=34&Itemid=39

Bankruptcy on the table as an option for states that have been captured by unscrupulous worker’s unions, extorting retirement benefits and medical care over an above appropriate levels for world wide capitalism to continue increasing profits.

Post: “Walker closed by calling for action tied to an increase in the debt ceiling; specifically for a hard cap on the debt-to-GDP ratio with “enforcement mechanisms,” which could include pro rata cuts in Social Security and Medicare benefits and tax surcharges.”

So Mr David Walker advocates theft.

Since 1935 Social Security has promised a benefit based on contributions and collected payroll taxes to fund that system. When those taxes could not pay the benefit, they raised the payroll tax.

In 1983 ‘boomer’s were told that they needed to increase their contributions to pre fund their own retirement and so the payroll tax was increased to accomplish that. The excess contributions were accumulated in the Social Security Trust fund.

Now a few slimy creatures advocate that this Social Security Trust fund should be used to pay down a deficit caused by President George Bush’s 2 wars or his tax cuts.

These slimy creatures would make the federal government a perpetuator of a large fraud.

Bring on the tar and feathers!

Oops.

The word perpetuator in the text should have been perpetrator.

‘a few slimy creatures advocate that this Social Security Trust fund should be used to pay down a deficit’

Sorry, not possible — not even if Darth Vader himself were running the government, and openly announced his intention to rape Social Security participants.

The reason is that there’s no cash in the Trust Fund. Its non-marketable securities are simply a record of cash that already went out the door. They can’t be spent directly, nor can they be sold in the market to raise cash for spending.

The Trust Fund is like writing a million dollar I.O.U. to yourself on a cocktail napkin, and then waving it around at a party claiming you’re a millionaire. For one thing, the asset (the I.O.U.) is exactly equaled and canceled by the liability to pay it (which is also yours), so the net value is zero. Likewise, intergovernmental obligations cancel out in consolidated accounting.

Secondly, if you don’t actually have a million dollars on deposit to pay the I.O.U., no one is going to cash it for you. It’s a nonnegotiable, non-discountable instrument — like the Social Security Trust Fund.

So the Trust Fund is merely a record of an ongoing fraud which has already taken place. Rest easy — no one is going to steal the Trust Fund, because there’s no money in it.

George W. Bush actually visited the four-drawer metal file cabinet in Pennsylvania where this absurd Trust Fund is kept. (In the Eighties, a back-up copy was maintained on a 5-1/4 inch floppy diskette on an 80386-chipset computer.)

Luckily when Bush opened the top drawer, there were just files in there, not a Jack-in-the-Box clown head popping up on a spring. But it wouldn’t have made the slightest difference, other than alerting a wider audience to the Trust Fund fraud a little sooner. Anyone who’s taken Accounting 101 can discern that the Social Security Trust Fund is a flagrant, transparent fraud.

The value of the “SS Trust Fund” is predicated on the federal government’s taxing power. It only goes to zero when that power is denied or abrogated. It happens that one of our two major political parties has dedicated itself to denying and abrogating that taxing power, especially when it comes to income not gained by actual labor.

For republicans, the federal government is a gigantic and highly effective machine for transferring money *from* saps who can’t avoid paying taxes *to* people with enough connections to snuffle up to the trough. And that’s just about all it is.

Jim Haygood says: “The reason is that there’s no cash in the Trust Fund. Its non-marketable securities are simply a record of cash that already went out the door.”

You seem to set a great store by the term “non-marketable securities”. As though if it is “non-marketable” then it is worthless.

Implying that mere marketability makes something financially sound! Of course our current financial crisis demonstrates that to be nonsense! MARKETABILITY PROVES NOTHING!

If something is financially sound it will be more marketable, the inverse is just propaganda!

If the Social Security Trust Fund is of no value THEN US TREASURY BONDS OR NOTES ARE OF NO VALUE.

The value of both of them is completely dependent on the US government’s determination to repay it’s debts!

The day the the US government decides it will not pay some of it’s debt will be the day that ALL US GOVERNMENT DEBT BECOMES QUESTIONABLE AND THE VALUE OF THAT DEBT ON THE OPEN MARKET WILL DROP LIKE A STONE!

Be careful what you wish for! :^)

So discussing the insanity of spending more than your income is silly?

I get it Yves…just keep spending like fools, eh? Brilliant!

‘Greece is a small nation that has to borrow in a currency it cannot control. The United States is a large nation that pays up in a money it can print.’

Yes, and if it actually DOES resort to printing on a large scale to service debt, its currency will crash in value.

In real terms, a nation cannot ‘print’ its way out of excessive indebtedness.

That a sentient adult could believe such a fable is simply incredible. Evidently joining the gov-worshiping ADA cult cost Galbraith 50 IQ points, and I’m not sure he had that many to begin with.

‘Greece is a small nation that has to borrow in a currency it cannot control. The United States is a large nation that pays up in a money it can print.’

Yes, and if it actually DOES resort to printing on a large scale to service debt, its currency will crash in value.

In real terms, a nation cannot ‘print’ its way out of excessive indebtedness.

That a sentient adult could believe such a fable is simply incredible. Evidently joining the gov-worshiping ADA cult cost Galbraith 50 IQ points, and I’m not sure he had that many to begin with.

Only if the economy is resource constrained. Then you get inflation, then the currency depreciates. We have 15% or so un and underemployment. And with no one wanting to step into the role of being the world currency (you’d have to be willing to run trade deficits a lot of the time) a dollar crash is not imminent. China is making noises but they are at least a decade if not much longer from giving up the advantages of their mercantilist role (which they’d also have to give up if the RMB became the reserve currency).

If we print when we have 5% unemployment, then that would be trouble.

Who is going to give up their assets Yves. Socalled printing is still acquiring property. It isn’t free. It is behind th back stealing. This isn’t as simple as rolling it out on toilet paper. I am going to write more comments below, but what is printing done by Bernanke other than writing free checks for bankers? The debt is still on the account. The poor people are being soaked by the rich in this case. There has to be another angle to the deficit besides debt and low taxes for really rich, rent seeking people.

The problem with wishy washy liberals is that they go on defense whenever someone attacks them. Has no one ever heard that offense is the best defense??????

When are we ever going to get someone with a little common sense to point out that huge reservoirs of excess notational wealth are extremely economically inefficient? Capital is subject to the laws of supply and demand and it is actually those willing to borrow who determine how much wealth can be saved within a debt based currency system and so every effort should be be put into strengthening this side of the equation, not stripping it of all value, as supplysiders think they can do to perpetuity.

Yes, they are right, there are practical limits on how on how many retired, sick, unemployed people any economy can reasonably support, but there are also equally serious limits on how many economic vampires it can afford, draining the wealth out to no viable productive end.

And it needs to be pointed out that while people do need goals, such as financial success, to motivate them, they also need social safety nets and support structures in order to be committed to the general good and participate on the larger economic enterprise.

The truth is that the economic profession has utterly failed at this. Consider the idea that Paul Volcker cured inflation by raising interest rates: Presumably this is done by the Fed selling some of those Treasuries they bought and retiring the money. The problem is that this actually aggravated the situation, since inflation is an over supply of capital and higher rates punish demand and reward supply. (By the Fed’s own logic of selling debt, the surplus is in the hands of those with a surplus.) The result was a deeper recession and little change in the inflation. Now by 82, when he tried lowering rates the second time, inflation did relent and the economy did start to rebound, but what gets overlooked is that the Federal deficit had started to seriously balloon by then. What is the difference between the Fed selling Treasuries and the Treasury issuing fresh debt? For one thing, the Treasury sells a lot more and then uses the money acquired to to invest in public infrastructure. Even if it’s just building more warships, it puts people to work, encourages private sector investment and gets money flowing back through the economy. So not only does government debt create demand for surplus capital, it has a multiplier effect, which the Fed’s efforts do not.

The point here is that wealth must be recycled. It can’t pool in the pockets of the few, or the whole system blows up. Surplus wealth has to be taxed back into circulation, not simply borrowed on the public dime, because this is a short term fix that compounds the long term problem.

This is a lesson which has been proven many times in history, so why are economists so blind? They don’t need long dissertations to put everyone to sleep, so the Petersons of the world can continue stealing us blind. They need clear, cogent points which people quickly understand.

‘Greece is a small nation that has to borrow in a currency it cannot control. The United States is a large nation that pays up in a money it can print.’

This statement was made by Yves, not Galbraith.

Did you read the post? That’s Galbraith.

The topic of the Federal Debt is certainly hot but I believe that something of the larger picture is always missed; I just discovered it.

A web site on the blog roll here-CreditWritedowns

http://www.creditwritedowns.com/ is doing a pretty good job of showing how the government deficit is part of a larger accounting picture.

The conclusion to a recent post there is useful in shedding some light on this.

When

the government sector runs a deficit, the non-government sector runs a surplus

of equivalent size. Draw your own conclusions about what this means in an era of government fiscal austerity.

Another article puts this in the larger context of national income accounting.

Second,

and more importantly, a sovereign government deficit is nothing to fear. It is simply

the mirror image to the non-government sector’s saving. As the US private sector retrenched to

rebuild its balance sheet, the government’s balance moved toward deficit. There is an unrecognized

identity at work.

One sector’s deficit equals another’s surplus. If we sum the deficits run by

one or more sectors, this must equal the surpluses run by the other sector(s). Following the

pioneering work by Wynne Godley, we can state this principle in the form of a simple identity:

Domestic Private Balance + Domestic Government Balance + Foreign Balance = 0

Money has to be put to work because it’s a substitute activator. Instead of having a society without money and some narcissistic Pharoah activator deciding to give instructions for another dumb pyramid to be built because he’s seen a load of people lying around smoking hookahs and drinking coffee we have economies where the faster money is circulated the more resources get used theoretically for the greater good. Hopefully too that use will be sustainably effective. What we can’t “afford” is to believe in some gobbledy-gook that the Invisible Hand of Self-Interest will always ensure that risk is carefully balanced. Much to our social cost we are finally realizing that bad-parenting will always produce some narcissistic predator like a Pharoah (Mubarak,)or CEO from Greed Street, who will want to go rogue and take as much money out of circulation by whatever crooked means possible to create a pool of money big enough to build and own another useless pyramid-style monument to his over-needy ego. We are also slowly realizing that the only way to stop this disruption of money use effectively is to have democratically decided money (capital) use controls at decentralized and centralized levels of society.

As a long time reader, (if three years can be considered a long time) I usually browse the material and simply take in the typically good to excellent posts provided…and then sometimes wonder at the logic behind those I can’t agree with. Suffice to say; Yves, thank you for your near constant input, insight, and commentary on our common plight and condition. I hope one day you too can retire to the background and let someone else run this as a forum for which eager bloggers will volunteer their time and effort and which can then make out like a bandit when you sell the fruit of their labors off to the highest bidder.

(Sorry, that’s an unneeded jab at huffington, but i do wish you the best.)

Nonetheless, I have to post on this one. I have a couple questions for Yves and whomever else cares to answer them.

There seems to be a distinct dichotomy in analysis that occurs on this website. Why is that?

Firstly, the criticism for the peripheral economies of Europe (Which as time goes by includes those on the Euro, but are not either Germany, the Netherlands, or Nordic countries.) emanating from this website is typically the following:

That they have spent too many years racking up debt public or private, or both. That they yes, unwittingly did from those evil bankers (yes I agree ARE evil) who tricked them into borrowing at German interest rates, and spent it on over-consumption either driving up asset prices or ballooning national debts and overly generous social spending obligations. Those countries now must find the only sensible way back to economic stability, growth, and sanity by forcing write-downs by those greedy bankers, who must realize their loses, (Of course not if their political connections can help it) which very well would implode their outsized banking sectors causing a mix between severe recession and massive government bailouts, but would finally send asset prices back toward equilibrium of a sort and then they could pick up the pieces and move on. But not before they reform those huge social spending obligations which would bankrupt them. Unless of course they are the above mentioned Germany, the Netherlands, or Nordic countries.

That the budgetary problems of the European countries would have eventually surfaced without the financial crisis as spark to the powder keg is generally without doubt. Sooner or later it is said. Why? The second major critique of European countries.

The second major criticism of the Euro area countries on this website and it’s contributors is this: Trade imbalances within the Euro area caused massive outflows of capital from the peripheral countries toward those that were more competitive, again the aforementioned Germany, the Netherlands, and Nordic countries. But really just Germany and the Netherlands in this case. As the past decade wore on, the competitive imbalances became worse providing more and more capital to the Bankers in Germany, the Netherlands, France and the UK here too, (and yes, some others) to reinvest back into poorly thought out loans in the periphery be it private or public debts. It was a vicious circle.

What’s more is, I believe you. Sometimes really just simple math, or accounting, or not too tricky interest calculations. Plus a little but of knowing how currency exchange regimes work, (or don’t) and how no one country controls the Euro because no one country controls the ECB. (Unless it’s the Germans). It’s knockout deductive, inductive, and intuitive thinking in general and I AM WITH YOU.

But here’s the question and the paradox of the dichotomy I just don’t get:

If the above are the solutions for the Europeans, why are they not for us too?

There IS one big difference. We are not locked into a fixed currency exchange rate we cannot escape. But SURELY we cannot expect freely floating exchange rates to rescue us. In fact, as the world’s largest economy and reserve currency for at least awhile longer yet, I’m pretty sure it can’t. We all know that for out trade deficit to shrink we’ve got to either export more to others or reduce imports. Plus, in a zero sum world (as far as trade goes, insert tired aside about exports to mars here) everyone cannot be an exporting county. Someone has got to reduce their surplus with us and someone’s going to have to increase their deficit. But really this mostly applies to the few major exporting countries. And even if they DIDN’T resist these changes with every power available to them, I really don’t think it’s enough to fix our deficit/debt problems. I think it’s an important issue, but no the main driver here.

So, why not insist on reducing our social entitlement spending? I’ll help this argument some by going a little further: I think we need to stop so much of this corporate welfare too. But honestly, except for the recent ridiculous bailouts of banks, insurers, and multinationals during the crisis, I think it’s not enough to help with the main culprit: Middle class entitlements. Social Security. Medicare. Just look at how much of a share of the budget they are? Look at how much they will become based on government stats and not some kooks!

Sure we could blame defense spending, but frankly we get something greater than just consumer spending of it (Think global security for the commons to ensure that the world economy and US national interest are protected) and frankly it’s not a very big percent of the GDP. Dear God, Britain was spending something like 24% of it’s GDP on defense prior to World War I. The Soviet Union’s was something like that prior to it’s collapse. During Eisenhower’s farewell address he had presided over a defense establishment that was routinely over 10% of GDP. It looked like it might keep heading north of there. THAT was the military -industrial complex he was worried about. Ours is a bargain for what we and our allies get. That’s also why whenever a liberal candidate gets into office they don’t end up cutting much defense spending if any. They realize it’s relatively cheap now. I don’t think it’ll get cut. So that’s probably a non-starter for the executive branch and definitely congress.

Back to the question: So what is the way out of this? Surely it’s not that we own the printing presses. Yes it means we don’t suffer from the exact same constraints the Europeans are under, and yes that’s a nice thing to have for some elbow room but we don’t want to use it to solve spending problems. So what is? I’ve heard critiques of conservative scares on the deficit and they seem at least halfway right. We won’t technically default on the debt. But what will happen if we don’t solve this? Why is this such a problem for the Europeans and not us?

(As a post-script to any responses any of you might have, I’ll be more than happy to read them. Also, I’ll try and make a list of any decent recommended reading I haven’t already read and try to get to it as soon as I can. Yves, for your response, I’ll make you a deal. Tomorrow I’ll buy your book. It’s not that I didn’t already want to get a copy, but I haven’t had time to read it yet. Well now I do and while it’s not on the topic under discussion here, I’m sure I’ll enjoy it and hopefully your share of the sales will help you continue to provide the analysis and commentary you do here every day. Thank you.)

The Basics:

$10 billion – The amount, on average, that our federal government spends every day of the year.

$6 billion – The amount, on average, that our federal government collects in revenue every day of the year.

$4 billion – The amount, on average, that our federal government adds to its total debt and has to borrow every day of the year.

$1.5 trillion – The current projected annual deficit for the federal government, due to the difference between its annual spending and its annual revenue.

$14 trillion – The total federal debt at the beginning of 2011.

$15.5 trillion – The total federal debt projected for the end of 2011.

$17 trillion – The total federal debt projected for the end of 2012.

$45,000 – The debt, per every U.S. resident, resulting from the total federal debt at the beginning of 2011.

$5,000 — The approximate debt to be added each year to the obligation of every U.S. citizen, if the projected annual federal deficit of $1.5 trillion, per year, continues.

The Entitlements:

The “entitlements” of Social Security and Medicare have little or nothing to do with the federal debt. The federal payroll tax is the dedicated funding source for these programs.

Social Security, which has a Trust Fund that currently holds about $2.5 trillion, has not added a dime to our federal debt. Each year, this Trust Fund receives approximately $200 billion in interest payments. Its annual balance increases or decreases because of this, plus or minus any annual surplus/deficit in the payroll tax revenue.

Medicare also is funded by the payroll tax, but it is also supplemented by premiums paid for Part B and Part D by Medicare beneficiaries. And, it receives funding from the general fund of approximately $200 billion per year.

The Options:

Spending Reductions: Significant reductions in federal spending are not likely in the near future. Too much of the federal spending is connected with “sacred cows.” Many do not want reductions to costs connected with “national security.” Many do not want reductions that would eliminate federally funded jobs, especially in U.S. communities that heavily depend on jobs with the federal government.

Increased Revenue: It is said that federal tax revenue is at a 30-year low, when compared with the nation’s overall economy. Revenue from corporations has been reduced significantly. People in the U.S. have been led to believe that they are paying “enough” in federal taxes. But they are not. Most in the U.S. suffer from “deficit denial.” Most in the U.S. do not realize the magnitude of the current annual federal deficit.

Conclusion:

Implementation of the recommendations in the ”THE NATIONAL COMMISSION ON FISCAL RESPONSIBILITY AND REFORM (of December 2010),” also known as the Simpson-Bowles Deficit Plan, offers a comprehensive set of suggestions for federal financial reform. This document appears to be the best hope we have to turn our “deficit denial” around. The document can be found via the following link: http://www.fiscalcommission.gov/sites/fiscalcommission.gov/files/documents/TheMomentofTruth12_1_2010.pdf

Continuation of our annual federal deficit of $1.5 trillion per year is unsustainable. This requires us to, essentially, find a way to take out and maximize a new credit card every year just to pay our bills. Every year the per-person debt for U.S. residents increases by approximately $5,000. Again, the continuation of our annual federal deficit of $1.5 trillion per year is unsustainable.

We cannot “grow” our way out of this problem. Reducing our federal spending, even by hundreds of millions per year, will not solve our problem. Only a combination of a reduction of federal spending over time, plus significant increases in federal revenue soon, will solve our problem. Again, the recommendations from the Simpson-Bowles Deficit Plan document would appear to be our best hope. These should be implemented by the end of 2011, if at all possible.

A fed Bear is a dead bear.

http://me.woot.net/vancouver/deadbear.jpg

Feeding Greece with grant aids, the West is creating another beast. Greece has created a virtual reality, with a very strong military, (330 Leopard tanks, F 16 jet fighters, a very powerful Navy, included up to date submarines, and more.)

http://www.fprado.com/armorsite/leo2.htm

http://www.hellas.org/military/navy/

THAT GREEKS CANNOT AFFORD.

The Greek people never learned to pay their taxes …. because no one is ever punished.

To make things more interesting Greece has FREE HEALTH CARE, LUCRATIVE PENSIONS, and HIGH PAID JOBS, which they cannot afford either.

So the WEST is feeding another Bear that soon or later will end in a DEAD BEAR.

Finally:

For each ALBANIAN who changes HIS NAME and HIS NATIONALITY from ALBANIAN to GREEK, the Greek Government pays a pension of 400 Euro for life.

The total is 2 Billion Euros per year and is increasing.

There is where Germany Grant GOES …Shame on GREECE, shame on GERMANY.