Cross-posted from The Disciplined Investor

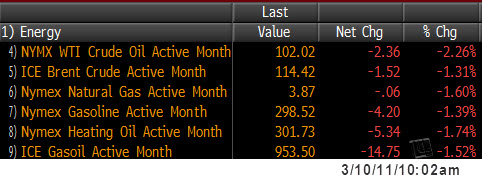

There are several factors that are influencing the markets today. Yes, there is still a great deal of worry about the upcoming “Day of Rage” that will be occurring tomorrow. But beyond this, the media has been making it a point lately to state that the current markets are under pressure due to the high price of crude (now trading at $102)

Yet, with Crude down by more than 2%, why are sellers stepping in (with big volume) and taking down markets?

There are a couple of answers to that question.

1) The underlying unrest in the Middle East is not providing any relief to investors. Investors/Markets hate uncertainty and we are in a period of political unrest and confusion about the outcome.

2) Spain was downgraded last night. Conflicting stories about the health of Spanish banks have been surfacing lately, but with Greece looking worse by the day and now this downgrade, fears about the EuroZone have risen.

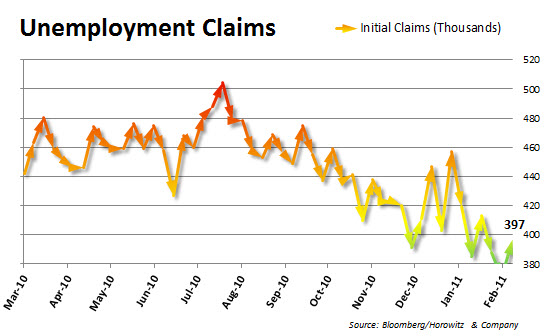

3) Initial Claims ticked up. Most analysts have had a pretty rosy outlook for the employment situation in the U.S. and this restatement from last week and the increase this week was a ‘surprise”.

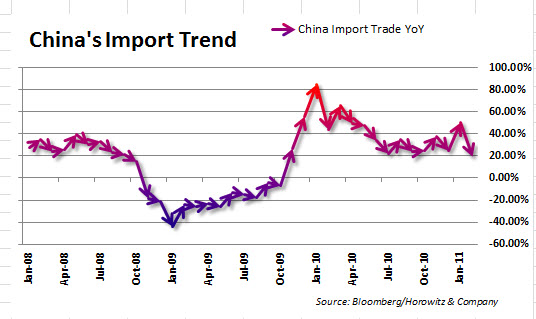

4) One of the economic reports that is really weighing on markets is the Import/Export numbers released last night from China. The drop off in exports is startling.

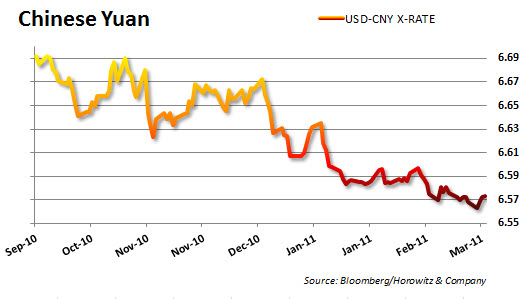

Of course this is what was being pushed by Team Geithner as they were on a non-stop rant about how undervalued the Yuan was. The rising Yuan and the general slowdown of conditions has been the overriding concern as China has been credited as the center of the global recovery.

Of course this is what was being pushed by Team Geithner as they were on a non-stop rant about how undervalued the Yuan was. The rising Yuan and the general slowdown of conditions has been the overriding concern as China has been credited as the center of the global recovery.

Unfortunately, the rising Yuan was not able to keep pace with what was expected for imports. The slowdown in that measure also created jitters about the sustainability of the Global Recovery.

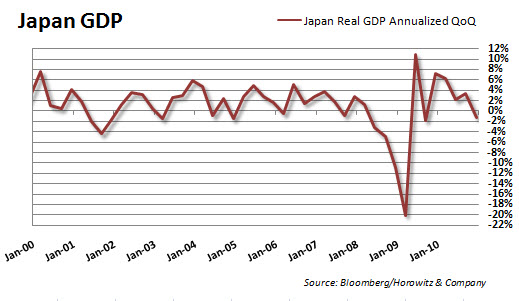

5) Japan’s GDP came in worse than expected. While analysts were looking for a drop of 1.1%, it came in worse at -1.3%. Even though Japan’s Finance Ministers have continues to keep up their rhetoric about coming out of a slump, the proof is in the pudding. Negative GDP is not welcome here….

6) Markets are tired. All of the defending of the 1,300 mark on the S&P 500 and the buy-on-the dip is getting long in the tooth. Markets need a breather and the news and conflicts are just what was needed to slow the bullish fever. Still, we know that Bernanke is not going to be letting up on POMO anytime soon, so there is a floor for markets for the time being… (That assumes that Saudi Arabia and the other conflicts in the Middle East do not escalate.)

China February export numbers are meaningless. The whole country was mostly shut down for 2 weeks during the New Year holiday.

The monthly Chinese export numbers in the chart above were year over year.

I believe they also had 2 wks off last February, unless the Lunar New Year in 2010 was in January that year.

Mr. Smith, I have been keeping up to date on the news in the middle east, and while every country has been using the “Day of Rage” tag, I have not heard of anything planned for tomorrow as you suggest.

Can you please post in comment section specifically what your talking about regarding this statement of yours, “Yes, there is still a great deal of worry about the upcoming “Day of Rage” that will be occurring tomorrow.”

Thanks,

cos

Every Friday is a “day of rage” in the Middle East.

Oh no, you did not…TGDORF…LOL!

4) One of the economic reports that is really weighing on markets is the Import/Export numbers released last night from China. The drop off in exports is startling.

Pretty convenient timing. Timmy is about to denounce China as a currency manipulator, and then China has a sudden drop in current account surplus.

This is the first of two “Days of Rage” scheduled in Saudi Arabia – http://bit.ly/h6273y

The EU is about to go into crisis mode again. If not with tomorrow’s meeting, then with the meeting on the 24th. Unless they announce some sort of permanent restructuring solution, which I doubt.

With gasoline prices being as high as they are, wouldn’t you think that will encumber any housing recovery, assuming they remain high? I don’t see how Americans, who live paycheck to paycheck, will be able to afford their mortgage payment unless they seriously cut back other spending. And Americans, who don’t own homes, won’t consider going long buying a home if oil prices jump around all the time.

There’s too much uncertainty for any housing recovery. And that may be playing in the markets as well.

The housing recovery is in pretty bad shape as prices have started declining again.

http://www.calculatedriskblog.com/2011/03/corelogic-house-prices-declined-25-in.html

Yeah and look at this image: http://3.bp.blogspot.com/-JoaR0ymSlvg/TXFcOHJDO8I/AAAAAAAAABc/JzymYNcv2FA/s1600/financialdata.gif

That doesn’t look like the next generation is ready to buy a house. It also doesn’t look like young people will be able to afford high gas prices given that half of them have no savings whatsoever.

”

this image

”

~~Tim~

amount listed as other debt obviously doesn’t include citizen’s share in the national debt. Debt service on citizen’s debt share will be enormous drag on future home market, not to mention high petroleum demand increment for moving out to the suburbs. Commuters are in for unpleasant surprise of the third kind. By contrast, Russians, famous for doubling up in tiny apartments, are now flush with homeland oil.

I’m moving

!

Chad wrote: ‘The housing recovery is in pretty bad shape as prices have started declining again.’

There was no recovery and they never stopped declining. We’re not even halfway through this thing — it’s gathering momentum, in fact — and I’ll be surprised if the housing market bottoms by 2012.

Tom wrote: ‘…doesn’t look like the next generation is ready to buy a house.’

Oh, they’ll be ready to buy when home prices drop down to the equivalent of 1970s-90s levels (once QE-driven dollar inflation is factored into the equation).

Because that’s where this thing is likely going. Not in Boston or San Francisco, I grant you. But in some areas there’ll be enough empty REO properties that local or federal government may actually try backing some ‘rent-to-buy’ financial boondoggles to get young homebuyers into those properties in order to stop them rotting.

The other option is tear those properties down, and then build new ones. That latter option will shore up construction companies and workers. So we’ll see some of that, too.

Nevertheless, newly-built homes will have to be sold at prices commensurate to the incomes of real people. Well, unless Washington and the financial industry try to go the current Chinese route and have real estate just be an asset bubble for the rich and the upper middle-class to speculate in, excluding the peasants. The thing there, though, is that China doesn’t have a vast inventory of empty REO homes such as we’ll have. Hence, in the U.S case many people will be able to respond to being priced out new homes by moving in and squatting in empty REO houses.

I read the Chinese rating agency Dagong downgraded Portugal’s debt. I wonder who downgraded Spain’s last night?

Everybody is downgrading the other guy. Each nation takes a hard look at everybody but themselves; then they zero in on some poor-dumb-bastard country, and state for the public record, “Oh my God, look at the Ponzi Scheme Nation X is running! It is clearly unsustainable! We are downgrading them!”

The more I look into this, the more I think Japan is doing it right. The idea is: own your Ponzi Scheme. If every everybody is in it together, if each citizen is giving according to their abilities, the Ponzi Scheme cannot fail.

The Ponzi Scheme as a national collective is the ticket to future…well, not prosperity, exactly, but maybe to short-term survivability.

Has the comment policy changed recently? I’ll bet this comment fails to appear on the site.

Interesting. A couple of comments were lost in the ether over the past couple of days. Glad to see a properly functioning comment section.

Oh, the markets “hate uncertainty”. Good to know that.

Since it is near certain that S&P 200 is coming, the Market must love that.

Question for those of you supporting a NFZ over Libya. Should the US also enforce one over Saudi Arabia, as that country fired on rebels today?

Why bother even posting meaningless sh*t such as this? Why do markets do anything on any given day? F***ing magic/animal spirits/corporate financial interests’ intervention! I just assumed everyone knew that.

Guess I should take my MBA and cash in, since I evidently know what some of the east coast financial elite apparently don’t?

The joker elite, making money on money all of the time. Wouldn’t now an honest wage if it knocked your teeth down your throat. It won’t be long now…

According to Yahoo headlines, every up day in the past two weeks has been because “oil prices eased”. All down days we heard stocks suck because “oil prices spiked”. Today, we get a down day and oil is down and the reason is “oil volatility”. I’m convinced. If oil drops and the markets drop, it’s definitely volatility. If we get an up oil day and an up market day I can only surmise that the “growing economy spurs increased oil demand sending asset prices higher.” Why look at the facts when you have Yahoo?