Yves here. Please be sure to read to the end of the post, where Miles discusses what level of equity he thinks banks should carry.

By David Miles, Monetary Policy Committee Member, Bank of England. Cross posted from VoxEU.

The global crisis has called into question how banks are run and how they should be regulated. Highly leveraged banks went under, threatening to drag down the entire financial system with them. Here, David Miles of the Bank of England’s Monetary Policy Committee, shares his personal views on the optimal leverage for banks. He concludes that it is much lower than is currently the norm.

At the height of the financial crisis, many highly leveraged banks found that their sources of funding disappeared – withdrawn due to fears over the scale of losses. In the fallout from this banking crisis, the economic damage has been enormous. The recession that hit many developed economies in the wake of the financial crisis was exceptionally severe and the scale of government support to banks has been large and it was needed when fiscal deficits were already ballooning.

Setting new capital requirements is now a major policy issue for regulators – and ultimately governments – across the world. The recently agreed Basel III framework will see banks start to use more equity capital to finance their assets than was required under previous sets of rules. This has triggered warnings from some about the cost of requiring banks to use more equity (see, for example, Institute for International Finance 2010 and Pandit 2010).

The argument that balance sheets with very much higher levels of equity funding, and less debt, would mean that banks’ funding costs would be much higher is widely believed. But there are at least two powerful reasons for being sceptical about it.

First, we make a simple historical point.

In the UK and the US banks once made much greater use of equity funding than they do today. But during that period, economic performance was not obviously far worse and spreads between reference rates of interest and the rates charged on bank loans were not obviously higher. This is prima facie evidence that much higher levels of bank capital do not cripple development, or seriously hinder the financing of investment.

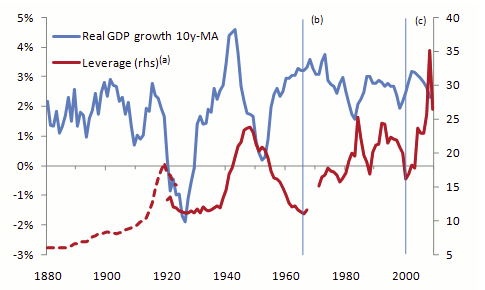

Conversely, there is little evidence that investment or the average (or potential) growth rate of the economy picked up as leverage moved sharply higher in recent decades. Figure 1 shows a long-run series for UK bank leverage (total assets relative to equity) and GDP growth. There is no clear link. Between 1880 and 1960 bank leverage was – on average – about half the level of recent decades. Bank leverage has been on an upwards trend for 100 years; the average growth of the economy has shown no obvious trend.

Furthermore, it is not obvious that spreads on bank lending in the UK were significantly higher when banks had higher capital levels.

Figure 1. UK Banks leverage and real GDP growth (10-year moving average)

Source: UK: Sheppard, D (1971), The growth and role of UK financial institutions 1880-1962, Methuen, London; Billings, M and Capie, F (2007), ‘Capital in British banking’, 1920-1970, Business History, Vol 49(2), pages 139-162; BBA, ONS published accounts and Bank calculations.

Notes: (a) UK data on leverage use total assets over equity and reserves on a time-varying sample of banks, representing the majority of the UK banking system, in terms of assets. Prior to 1970 published accounts understated the true level of banks’ capital because they did not include hidden reserves. The solid line adjusts for this. 2009 observation is from H1. (b) Change in UK accounting standards. (c) International Financial Reporting Standards (IFRS) were adopted for the end-2005 accounts. The end-2004 accounts were also restated on an IFRS basis. The switch from UK GAAP to IFRS reduced the capital ratio of the UK banks in the sample by approximately 1 percentage point in 2004.

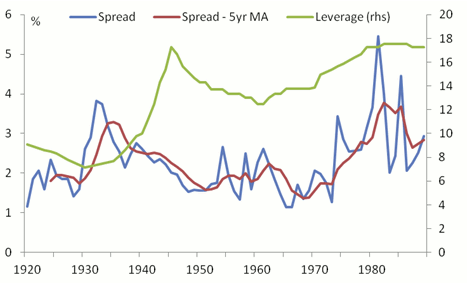

The absence of any clear link between the cost of bank loans and the leverage of banks is also evident in the US. Figure 2 shows a measure of the spread charged by US banks on business loans over the yield on Treasury Bills. The chart shows that the significant increase in leverage of the US banking sector over the twentieth century was not accompanied by a decrease in lending spreads, indeed the two series are mildly positively correlated so that as banks used less equity to finance lending the spread between the rate charged on bank loans to companies and a reference rate actually increased. Of course such a crude analysis does not take into account changes in banks asset quality or in the average maturity of loans or changes in the degree of competition.

Nevertheless this evidence provides little support for claims that higher capital requirements imply a significantly higher cost of borrowing for firms.

Figure 2. Leverage and spreads of average business loan rates charged by US commercial banks over 3-month Treasury bills

Source: Homer and Sylla (1991).

The second reason for being sceptical that there is a strong positive link between banks using more equity and having a higher cost of funds is that the most straightforward and logically consistent model of the overall impact of higher equity capital (and less debt) on the total cost of finance of a company implies that the effect is zero.

The Modigliani-Miller theorem implies that as more equity capital is used the volatility of the return on that equity falls, and the safety of the debt rises, so that the required rate of return on both sources of funds falls. It does so in such a way that the weighted average cost of finance is unchanged (Modigliani and Miller 1958).

There are certainly reasons why the Modigliani-Miller theorem is unlikely to hold exactly. But it would be a bad mistake to simply assume that the reduced volatility of the returns on bank equity deriving from lower bank leverage has no effect on its cost at all.

So in calculating cost and benefits of having banks use more equity and less debt it is important to take account of a range of factors including:

The extent to which the required return on debt and equity changes as funding structure changes.

The extent to which changes in the average cost of bank funding brought about by shifts in the mix of funding reflect the tax treatment of debt and equity and the offsetting impact from any extra tax revenue received by government.

The extent to which the chances of banking problems decline as equity buffers rise – which depends greatly upon the distribution of shocks that affect the value of bank assets.

The scale of the economic costs generated by banking sector problems.

Few studies try to take account of all these factors (one notable exception being Admati et al. 2010); yet failure to do so means that conclusions about the appropriate level of bank capital are not likely to be reliable. In a recent paper together with Jing Yang and Gilberto Marcheggiano, we take account of these factors and present estimates of the optimal amount of bank equity capital (Miles et al. 2011).

We conclude that even proportionally large increases in bank capital are likely to result in a small long-run impact on the borrowing costs faced by bank customers. Even if the amount of bank capital doubles our estimates suggest that the average cost of bank funding will increase by only around 10-40 basis points. (A doubling in capital would still mean that banks were financing more than 90% of their assets with debt). But substantially higher capital requirements could create very large benefits by reducing the probability of systemic banking crises – crises which are very costly (as shown by Reinhart and Rogoff 2009). We use data from shocks to incomes from a wide range of countries over a period of almost 200 years to assess the resilience of a banking system to these shocks and how equity capital protects against them. In the light of the estimates of costs and benefits we conclude that the amount of equity funding that is likely to be desirable for banks to use is very much larger than banks have had in recent years and higher than minimum targets agreed under the Basel III framework.

Our estimate of optimal bank capital (by which we mean equity) is that it should be around 20% of risk weighted assets. This is much higher than the 7% level agreed under Basel III. It might sound like 20% is a dangerously high figure. But since risk weighted assets for many banks are between 1/2 and 1/3 of total assets then even with equity at 20% of risk weighted assets debt would be between 90% and 93% of total funding. The notion that this is insufficient debt to capture any benefits from debt discipline seems unlikely.

Were banks, over time, to come to use substantially more equity and correspondingly less debt, they would not have to dramatically alter their stock of assets or cut their lending. The change that is needed is on the funding side of banks’ balance sheets – on their liabilities – and not their assets. The idea that banks must shrink lending to satisfy higher requirements on equity funding is a non-sequitur. But there is a widely used vocabulary on the impact of capital requirements that encourages people to think this will happen. Capital requirements are often described as if extra equity financing means that money is drained from the economy – that more capital means less money for lending.

Consider this from the Wall St. Journal, in a report on the Basel negotiations on new rules over bank capital:

The proposed rules would have driven capital requirements up for all banks, forcing the quality and quantity of these capital cushions to grow …… That would be expensive for banks, because the money sits on banks’ balance sheets and essentially can’t be invested to bring in more profits. (Paletta 2010)

This is pretty much the opposite of the truth. At the risk of stating the obvious, equity is a form of financing; other things equal a bank that raises more equity has more money to lend – not less.

“”This is pretty much the opposite of the truth. At the risk of stating the obvious, equity is a form of financing; other things equal a bank that raises more equity has more money to lend – not less.””

Rather than consider this ‘more’ money to lend, I would consider it ‘safer’ money to lend or ‘real’ money to lend. It decreases leverage by putting real capital rather than debt behind the loans.. It also puts the equity at a proper amount of risk to help ensure proper lending. If people are putting up equity they should demand accountability. Losing money that is given to you is one thing but losing money that you’ve borrowed is something else. The first is a liquidity problem and the second is a solvency problem.

There are more than a few smaller banks and credit unions have risk based captial ratios close to the 20% range.

It’s pretty obvious the scam the financial industry is up to.

I used to play a lot of high stakes poker, and in gambling parlance what the big financial players are doing is known as “taking a free roll.”

Money management is a big part of the gambler’s job. In order to maximize one’s profits, one has to extend credit. The trick is to extend credit to those who will pay.

A common scam in the world of private poker games is for some big talking, high rolling blowhard to come into a game. He always has some tale about why he “has lots of money.” He plays a few sessions and brings cash to the game. He plays extravagantly. He starts borrowing and pays it back, as long as the cards are with him. In order for the scam to work, the card gods have to hang with him for a while.

The problem comes when the card gods start to frown on him. He starts borrowing large amounts of money from other players. But if the card gods keep frowning, he soon runs up huge debts, debts which he has no intentions of ever paying back.

So as long as the card gods smile on him, he keeps his winnings. But when the card gods finally turn on him, which for every player they eventually do, he sticks his creditors with the losses.

That’s the scam the finance industry is pulling off, maybe with a few more bells and whistles, but the entire thing is set up so that they can “take a free roll.”

Yves,

The issue of how much capital a bank holds is moot if the regulators do not require a bank to recognize its losses first using this capital and then the taxpayers’ money.

While regulators require that capital is used this way for smaller financial institutions, it does not apply to the larger banks and particularly the Too Big to Fail.

Richard

Interesting article. But picking a leverage ratio based on the valuations of risky assets isn’t going to do much good unless we simultaneously tighten up on accounting regulations and ratings – what’s to stop people looking to circumvent the ratios from modeling unrealistic prices or buying instruments with overly optimistic ratings? As long as AAA-rated instruments can lose half their value overnight, it doesn’t matter how much equity banks have or how much cash they keep on hand.

Obviously, I’m not saying “don’t bother fixing this problem”, but rather, “this won’t solve anything on its own”.

“What is the optimal leverage for a bank?” David Miles

Ethically that’s an easy question. In a government enforced monopoly money supply for private debt, the answer is NONE. Why? Because bank leverage, so-called “credit creation”, takes purchasing power from all money holders and lends it out. If the money supply the credit is extended in is a government enforced monopoly money supply for private debts then the population cannot escape the loss of purchasing power and thus suffers an involuntary taking which many would classify as theft.

Should bank leverage therefore be banned? No. Rather all government privilege for it should be abolished, particularity all laws that enforce a monopoly money supply (currently FRNs) for private debts.

Something to ponder; Is your Demand Deposit a loan or a bailment?

What might occur if we removed deposit insurance?

What might occur if corporate officers were held jointly and severally liable?

What might occur if frauds were prosecuted?

And, do you really want ‘free’ markets; or do you really mean that you want fair markets?

I might add that since the current currency is fiat; should not required reserves against demand deposits be 100%?

What happens when all loan losses are deucted from the bank’s equity accounts?

And if you say that the bank can’t make any money at 100% reserves for demand deposits, I say bullocks!

Good questions!

“What might occur if we removed deposit insurance?”

Exactly. The optimal leverage ratio for a bank can only be discovered after the public subsidy of deposit insurance and TBTF is ended.

Mr. Miles (above) wastes a lot of time expounding upon Modigliani-Miller etc. when he knows damned well that the fulcrum of the MM Theory on optimal capital structure is the firm’s bankruptcy risk.

“What is the optimal leverage for a bank?”

Ethically, under our current system, the answer is NONE. Why? Because so-called “credit creation” in a government enforced monopoly money supply for private debts steals purchasing power from all money holders including and especially the poor who are usually not considered “credit worthy” themselves.

Our current money system is not “free market” at all. Instead it fits the definition of fascism.

Is it necessary, nonetheless?

No. Abolish the government enforced money monopoly for private debts and private money needs would be met by the free market. Common stock, for instance, is a private money form that shares wealth rather than loots it. Government money would remain pure fiat (it must for ethical reasons) but only be legal tender for government debts – taxes and fees – not private ones.

The correct amount of leverage is zero.

The corret amount of private debt is zero.

The correct amount of gov’t debt is zero.

That only leaves getting the amount of currency with no bond attached correct.

The correct amount of leverage is zero. Fed Up

Without government privilege for the banks it would approach this over time, I would bet.

The corret amount of private debt is zero.

Without the government enforced counterfeiting cartel, most would have little need for borrowing.

The correct amount of gov’t debt is zero.

Absolutely!

That only leaves getting the amount of currency with no bond attached correct.

That would be determined by trial and error. Government spending should be such that no price inflation occurred in its fiat. The private sector might have any number of private currencies to handle private debts and each one should be at liberty to set its own monetary policy.

So Miles does not explain how to counteract two strong forces which have pushed banks away from equity financing toward debt financing:

(1) Banks’ expectations of profits and losses are asymmetric– banks (chiefly their managers) keep all profits while taxpayers absorb all the losses.* Bank managers have very strong incentives to leverage their plays, since they care only about the upside of each bet. Potential equity investors feel the same way! Anytime an investor buys into a “heads I win, tails you lose” proposition he wants to lever up the size of his bet as much as possible. So bank investors and managers agree that equity should be the minimum allowed by regulators and most funds should come from leverage (debt).

(2) To the extent banks are funded by equity (in proportion to lending) the equity investors will expect compensation (return on equity) in proportion to profits. That compensation would come out of managers’ compensation (“bonuses,” profit-participation, whatever you like to call it). By contrast, the interest banks pay on their debts is not proportional to profits so doesn’t cut into managers’ take-home. No rational manager wants to share, so he would rather operate on debt than equity.

If Miles were serious, he would not propose tinkering with easily-gamed, likely-to-be-evaded “equity capital standards” but rather attack the root problems of TBTF.

Really, if I could have just one banking reform, it would be a simple limit on the size of each bank. No bank should have more than 1% of any OECD national market. That’s well above the threshold of diminishing marginal returns to scale** for banks in OECD-sized economies, so the limit wouldn’t increase transactional costs for bank customers. If no banks were TBTF it would be easier to let some of them fail, pour encourager les autres. Smaller banks would have less political influence and would therefore achieve fewer triumphs of rent-seeking and cartelization.

*True for small banks as well as TBTF’s… the FDIC cleans up after smaller banks while their pre-bankruptcy managers get to keep the pay and bonuses they collected while running their institutions into the ground.

**Leaving out returns to rent-seeking, which continue to increase with scale until the banks own the country; see the “Federal Reserve.”

Optimum leverage for banks? Hard to work it out when they are so prone to corruption:-

http://www.guardian.co.uk/business/2011/apr/29/banking-credit-default-swaps-eu-investigation