Yves here. As much as this post makes an interesting observation, note the emphasis on reducing labor bargaining power as the solution to booms and busts, when the era of weak labor bargaining power (which started taking hold in a serious way in the Reagan/Thatcher eras) showed far more financial instability that the preceding period where productivity gains were shared with workers. As a result, consumers didn’t need to resort to debt to compensate for stagnant worker wages. As long as we keep resorting to failed remedies, there isn’t much reason to hope for better outcomes.

By Heleen Mees, Researcher, Erasmus School of Economics and Assistant Professor, University of Tilburg. Cross posted from VoxEU

The latest figures from the US show that the consumer price index rose 0.5% in March, whilst the core personal consumption expenditure price index rose only 0.1%. This column explains the roles of these competing measures and argues that US monetary policymakers should pay close attention to headline inflation. It warns that neglecting headline inflation risks feverish boom-and-bust cycles with prolonged periods of high unemployment.

March headline inflation (all goods) in the US came in higher than expected at 0.5% while core inflation (all goods minus food and energy) came in lower than expected at 0.1%. Rising gasoline and food prices accounted for almost three quarters of the jump in headline inflation. These latest inflation figures have added fuel to the debate what measure of inflation central banks should aim to control.

The ECB and the Bank of England traditionally target the headline consumer price index (CPI), which measures the change in the prices urban consumers pay for a basket of consumer goods and services including food and energy. A spike in headline inflation in the eurozone triggered the ECB recently to increase the benchmark policy rate to 1.25%.

In the past the US Federal Reserve has targeted headline CPI as well. But in the early 2000s, with Alan Greenspan still at the helm, the Fed quietly changed its preferred measure of inflation twice.

In January 2000, at the onset of the housing boom, the Fed replaced headline CPI with the personal consumption expenditure (PCE) index because the latter is less dominated by the cost of housing than the former, as Ben Bernanke explained in Atlanta in January 2010 (Bernanke 2010).

He failed to mention, however, that PCE inflation generally is about 0.5% below the corresponding CPI measure. Since the Fed left the (implicit) target level of inflation unchanged, it effectively loosened monetary policy considerably (Mees 2011).

Subsequently, in July 2004, the Fed replaced headline PCE with core PCE, thus excluding food and energy prices. According to Bernanke, the Fed at the time expected any changes in the price of food and energy to be temporary in nature (never mind that Alan Greenspan actually supported the war in Iraq because of the country’s oil supplies).

Relying on core inflation instead of headline inflation, as the Fed does, is justified in case core inflation is a better predictor of headline inflation than headline inflation itself. Core goods and services tend to be subject to nominal price rigidities, while non-core goods, like agricultural commodities, oil, natural gas etc., have their prices set in auction markets.

For much of the 20th century, core inflation has been both less volatile and more persistent than the inflation rate of non-core goods. However, the integration of China and India in the global market added more than 2.3 billion consumers and producers to the global economy. They entered as suppliers of core goods and services and as demanders of non-core commodities. The result has been a major, persistent, and continuing increase in the relative price of non-core goods to core goods (Buiter 2008).

In Atlanta Bernanke asserted that both the Fed and private forecasters correctly assumed that the increases in energy prices in 2007 and 2008 would subside. While it is true that the financial crisis and the collapse of global trade in the second half of 2008 led to a sharp decline in energy prices and a corresponding drop in headline inflation, energy prices were back at their 2008 level by 2010, despite an anaemic economic recovery in both the US and Europe. A barrel of oil now costs three times what it cost in July 2004, when the Fed replaced headline PCE with core PCE.

At the first post-Federal Open Market Committee press briefing that was held on April 27, 2011, chairman Bernanke nevertheless insisted that the Committee expects the increases in the prices of energy and other commodities to be transitory.

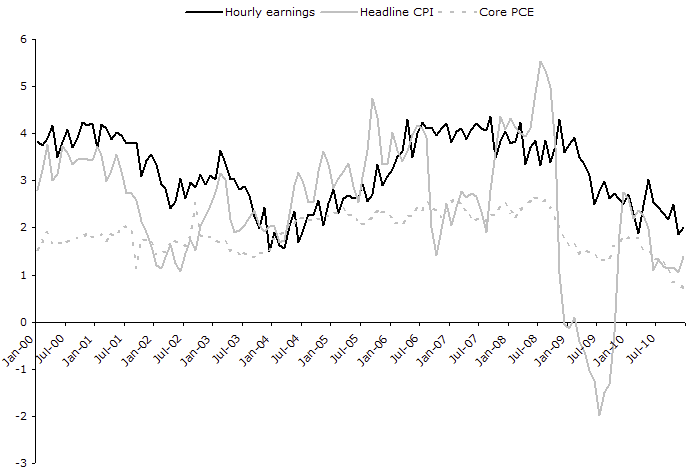

A closer look at US labour market data suggests, however, that there is little room for complacency about runaway headline inflation. Hourly wages in the US track headline inflation much more closely than core inflation (see Figure 1). This is also the case when the unemployment rate is higher than the natural rate of unemployment. From 2000 through 2010 hourly wages of production and non-supervisory employees increased on average 0.7% more than headline CPI inflation (3.2 versus 2.5%) and 1.3% more than core PCE inflation (3.2 versus 1.9%).

Figure 1. Hourly wages, headline CPI and core PCE

Source: Federal Reserve

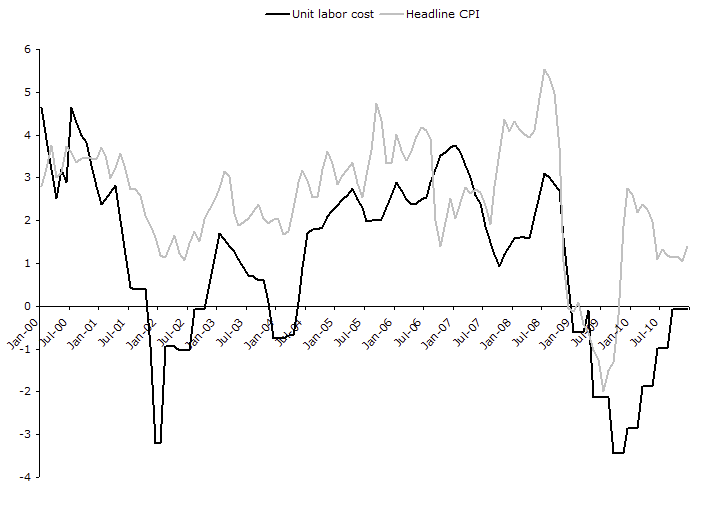

That hourly wages increase on average more than headline inflation is mainly due to downward wage rigidity. When commodity prices fall, like they did in mid-2008, hourly wages remain stubbornly high. Unit labour costs, on the other hand, are not downward rigid at all. Unable to lower the costs per hour, US employers cut the number of hours instead. During the recessions that started in 2001 and 2008, unit labour costs in the US dropped precipitously, reflecting massive lay-offs that resulted in high and prolonged unemployment (see Figure 2).

Figure 2. Headline CPI and unit labour costs

Source: Federal Reserve

Even if the current spike in headline inflation proves to be transitory, past experience suggests that it may well lead to a permanent increase in real hourly wages. Unless monetary policymakers in the US favour feverish boom-and-bust cycles with prolonged periods of high unemployment, they had better start paying close attention to headline inflation, like their counterparts at the ECB do.

Anything which is capable of discussing human beings using only the bloodless synecdoche “labor costs” and “wages” is psychopathic.

Does anyone even understand what humanity is anymore? What’s civilization supposed to be? in all of today’s political and economic arrangements, including the entire economic ideology, we’re dealing with post-civilizational barbarism.

Anyone who thinks and talks that way is a sublimated mass murderer at best, and can always be counted on to at least tacitly support mass enslavement and murder in practice. What else could be expected of anyone who looks at the people walking down the street and sees, not humanity, but “labor costs”.

Compared to this malevolent rot at the very core of the civilizational soul, what’s the significance of wrangles over inflation? Any such detail is nothing but a battleground in a global civil war which goes far beyond the class struggle, which is in its totality a spiritual apocalypse.

A totally fatuous comment by “attempter” above. We all realise that civilisation is about more than labour costs. But that’s not a reason for those interested in economics, unemployment etc not to pay attention to labour costs is it? Civilisation is about more than playing chess or cleaning one’s teeth. Does that mean no one is allowed to play chess or clean their teeth?

Greenspan appeared ‘bloodless’ as he used doublespeak before Congress for his annuals; speaking about progress and passionately about the priority of globalization, while ignoring our degrading health care system, increasing FIRE profits (extortions), shrinking middle class jobs, rising housing prices …

But that’s not a reason for those interested in economics, unemployment etc not to pay attention to labour costs is it?

As I said, anyone who is so “interested” (using that word in its full connotation) as to turn to such ways of thinking and propagandizing in the first place is already demonstrating a malign intent. And sure enough, even this relatively less insane author ends up deploring those annoying laborers and their penchant for wanting to eat.

One’s mode of thinking and speaking and one’s moral or immoral character cannot be disentangled. The latter dictates the former.

BTW, all these theories you defend are proven to be failures and therefore lies. So who’s being fatuous?

“As I said, anyone who is so “interested” (using that word in its full connotation) as to turn to such ways of thinking and propagandizing in the first place is already demonstrating a malign intent.”

We know you said it. The fact that it was previously uttered doesn’t make your thought any less stupid.

As I said before, you don’t know anyone else’s intent. What goes on in anyone else’s mind is (and will always be) opaque to you, regardless of what you infer from others’ actions (or even their own statements about their intent).

See, the difference between my reiteration and yours is that my thought is not stupid. It is in fact incontestable.

That’s what’s important. Not whether you said it before, but whether or not it is stupid.

Also, regarding the word “proven”…you keep using that word. I do not think it means what you think it means.

The other day, when the topic was “Gas Pump Woes”, Anonymous Jones made the following comment with respect to the attempter’s posts: “It’s so tiring to read this crap every day.”

I started to say something then but decided to let it go.

But now it’s time to point out that there are many of us who appreciate the attempter’s comments and what is tiresome is to have to read disparaging comments like Anonymous Jones’ crap every day.

If all of the regular readers had to vote between keeping Anonymous Jones or the attempter, I’m pretty sure that Anonymous Jones would be out of here.

But unfortunately that isn’t likely to happen, so the only solution for many of lurkers who don’t bother to comment very often is to skip over Anonymous Jones’ comments, and just keep reading.

Bullshit.

Economists play this little game of denying their true psychopathic intent, but attempter has ‘em pegged.

As Robert H. Nelson wrote of the Nobel prize winning Chicago School economist in his book Economics as Religion:

Becker at one point suggested that his approach to economics could be applied to the social treatment of “women, Jews, individuals with the same personality type, members of the same caste or social class, etc.” [Becker, ‘The Economics of Discrimination’, 161] As Becker therefore would seemingly have to analyze the matter if he remained consistent to the logic of his approach applied everywhere else, even Nazi actions in Germany could be analyzed as yet another variant on economically rational behavior by ordinary people—-if with very unusual “tastes,” “capabilities,” or other Nazi features affecting their calculations of benefits and costs. The various acts of persecution of the Jews could be condemned only if they were shown to diminish the aggregate utility of all the people in Germany (including the Jews, but who were a small number and whose preferences might be swamped by the majority of Germans) or to be otherwise inefficient.* The morality of the Ten Commandments is replaced for Becker by a morality of advancing or impeding economic productivity in the broadest sense.

To be sure, economic analysis in general has this characteristic—-as discussed in Chapter 3, good and evil are transformed to become efficient and inefficient in Samuelson’s ‘Economics’ as well. Most economists in the past, however, limited its application to the commercial sectors of society. They agreed that behavior in other areas of life might be driven by considerations that are difficult or impossible to incorporate into the standard economic framework of analysis. Implicitly, most economists took for granted that there could exist a dichotomous morality. The pursuit of individual gain might dominate in the marketplace but other value systems transcending the individual would exert a powerful influence in other aspects of life. The great novelty of Becker’s analysis is that he in essence denies this dichotomy. The real influence—-the meaningful existence—-of any collective “values,” “religion,” “culture” or “justice” that go beyond maximization of individual benefits and costs does not exist anywhere.

*Given that many Germans found the near presence of a Jew distasteful, as Becker would presumably want to analyze the matter (following the same approach applied earlier to discrimination against blacks), this presence would create “diseconomies” for these Germans, thus putting the close presence of a Jew in the same technical economic category to which Becker has already said ordinary criminal actions belong. Hence, it would seem to follow from Becker’s uniquely economic approach to the analysis of crime that the Jews as special types of “criminals” (recall, this is just in the “scientific” economic sense that Becker seeks always to apply) might be required to pay compensation to other Germans for causing this diseconomy. In fact, the Nazis initially imposed “fines” by taking money and property from Jews. However, as the presence of Jews seemingly became even more distasteful (caused more disutility to other Germans), many individual Jews could no longer pay enough compensation and had to be imprisoned—-as Becker suggests at one point that poor thieves today may have to go to jail for lack of enough money to fully compensate their victims (in contrast to rich criminals, whom Becker would allow to simply make financial payments to cover their fines). In the framework of Becker’s general analysis of the economics of crime (encompassing, one must presume, also Nazi crime), this would all have advanced the cause of economic efficiency in Germany in the late 1930s. If the behavior of the Nazis might seem to be so morally repugnant that it should be excluded from any such economic treatment, Becker has already warned his readers elsewhere that they must learn to squelch their knee-jerk moral reactions; they should not “be repelled by the apparent novelty of an ‘economic’ framework for illegal behavior.” See Gary S. Becker, ‘The Economic Approach to Human Behavior’ (Chicago, University of Chicago Press, 1976), 79.

I am an economist. I take pretty pictures and ‘facts’ and graphs and charts. And, I make a pretty hypothesis or theory about human relationships in trade. I give it to my employer who pays me to make up conclusions based upon (oft times) erroneous data. My ‘hypothesis’ confirms what my employer is saying, earning me big dollars (or euro or whatever).

I reduce human beings to rational quants. I dehumanize them. They fit whatever mathematical economic model I am currently using to justify my ‘hypothesis’ or ‘theory’. Quants are rational, as we well know. Quants behave like mathematics.

I base my theories around people-quants and mathematics. Yet, the theories always fall apart when the mathematical realm (LTCM anyone?) meets reality. My quants do not behave the way the models predict. I must seek a new ‘theory of all economic behaviour’, the Holy Grail. I will forever be seeking that Grail.

I justify, to my employers, any consequences that negatively effect the people-quants as being necessary. I bask in adoration when my theories and hypothesis are ephemerally confirmed. As an economist, I say nothing and lay the blame elsewhere when those theories and hypothesis inevitably fall apart.

That is about how much of a science economics is.

I agree with you attempter. In this author’s defense though, you’re pointing out a problem with much/most economic literature.

attempter said: “…in all of today’s political and economic arrangements, including the entire economic ideology, we’re dealing with post-civilizational barbarism.”

It is frequently been pointed out that the gassing of the mentally sick had to be stopped in Germany because of protests from the population and from a few courageous dignitaries of the churches, whereas no such protests were voiced when the program switched to the gassing of Jews, though some of the killing centers were located on what was then German territory and were surrounded by German populations. The protests, however, occurred at the beginning of the war; quite apart from the efforts of “education in euthanasia,” the attitude toward a “painless death through gassing” very likely changed in the course of the war. This sort of thing is difficult to prove; there are no documents to support it, because of the very secrecy of the whole enterprise, and none of the war criminals ever mentioned it, not even the defendants in the Doctors’ Trial at Nuremberg, who were full of quotations from the international literature on the subject. Perhaps they had forgotten the climate of public opinion in which they killed, perhaps they never cared to know it, since they felt, wrongly, that their “objective and scientific” attitude was far more advanced than the opinions held by ordinary people. However, a few truly priceless stories, to be found in the war dairies of trustworthy men who were fully aware of the fact that their own shocked reaction was no longer shared by their neighbors, have survived the moral debacle of a whole nation.

▬Hannah Arendt, Eichmann in Jerusalem: A Report on the Banality of Evil

Does anyone even understand what humanity is anymore? What’s civilization supposed to be? attempter

What chance of that is there when our money system is founded on systematic, government backed theft of purchasing power via banking from the entire population including and especially the poor?

If we as a society cannot even obey “Thou shalt not steal”, a simple negative commandment, then how on Earth can we obey “Love thy neighbor as thy self”?

Stealing ummm…by whom, for whom, in the service of whom and to what ends, can be seen as forced redistribution of resources.

Skippy…do about a million+ laps around that and see what pops out the other end.

Relax fellow consumer, it’s all good. Go shopping.

Yes ! Quick to Wal Mart!! To Wal Mart !!!

I would characterize the 5:24 am rant by the BRU (Blog-Responding Unit)– AKA Attempter– as a LWTS (Labor-Wasted-Time-Segment). As such, I propose that this BRU experience SWU (Severe-Wage-Compression). End.

Did you know that Ted Bundy’s first dog, a collie, was named Lassie?

It looks like my comment on spirit struck a nerve with our main resident criminal apologists. I must be on the right track.

Right on Attempter! From the CEO suite humans are synomous with the widgets being produced on the assembly line.

Is it just me, or are other people also bothered by the fact how supply-side analysis often lead to uninsightful conclusions? As Yves notes, there is a problem with demand because of wage stagnation/outsourcing/technology making workers redundant, and this can’t really be compensated for by bubble blowing/debt-finance, because those things collapse after a while. Yet while Mees mentions that “2.3 billion workers have entered the world market”, she seems to forget to mention the dual effect this has had on lowering wages and lowering aggregate demand (because of lowering wages). Certainly this core/noncore product price ratio thing is interesting, but isn’t she sort of missing the elephant in the room by ignoring the rapidly dropping world median income?

Analyzing PCI, CPE, and other wonderful abbreviations seems to me to be mostly an effort at analyzing effects and then trying to figure out how you can get better outcomes in other effects while entirely ignoring the causes and mechanisms that underlie/spawn those effects.

You are missing the point. Global wage median is actually increasing towards other countries that generated very little aggregate demand in the past. Moreover, wages are actually increasing in these countries. The result of this is that aggregate consumption will also move to these countries producing some market tightness in the US regardless of unemployment.

No, I’m quite aware of the fact that that Mees is saying that. My quibble is with her suggestion that this is significant enough to offset wage loss elsewhere.

Robespierre said: “…wages are actually increasing in these countries.”

I believe that to be factually incorrect, as these studies from Mexico demonstrate:

http://www.ratical.org/co-globalize/NAFTA@7/mx.html

http://www.letrasjuridicas.cuci.udg.mx/numeros/articulos10/adrian_miranda_y_soledad_rizo.pdf

And as China’s Ghost Cities and Malls (from “Links” a few days ago) and these photographs so graphically show, an array of “scientific,” mathematical and numerical abstractions is used to cater to a small group of financial speculators. Concepts like money, GDP, CPI and debt—-products of the human imagination—-are manipulated so that they serve only the interests of the financial speculators, while the masses are being slowly but systematically impoverished and politically marginalized. These abstract constructs of the human imagination have lost any connection they once might have had to real live, flesh and blood human beings.

Well said DS. You’re in form today…

I’m not sure I buy this argument too much. The conclusion reached from Figure 1 isn’t compelling. Without a more serious statstical analysis it looks to me like wages track core inflation better than headline inflation. Figure 2 is more convincing but there isn’t much in the way to suggest it’s causation (in either direction) and not correlation.

Anyway, the ECB’s move to raise interest rates was a terrible idea.

Also, I’m not sure where the the idea that energy costs were again back at 2008 levels by 2010 comes from. Even today the CPI energy index is around 13% below its July 2008 peak.

but isn’t she sort of missing the elephant in the room by ignoring the rapidly dropping world median income?

she did it by sleight of hand.

instead of talking about the purchasing power of the median American (or world citizen), she switched it to unit labor costs.

see, when CEO’s increase productivity they get 1,000,000% of the productivity gains into their pockets.

When workers increase THEIR productivity, they get fired for having too high of “unit labor costs”.

=====

someone smarter than me: does the following thesis work or not?

could a LARGE part of the increase in labor costs be due to the fact that companies have already cut to the bone? And they cut the cheapest of laborers. This leaves the bloated executive compensation packets, which makes unit labor costs go up.

if you have 100 people making $30k/yr, and one exec making $1,000,000 per year… and then cut 99 of the people making $30k/year and give all their salary (99 x 30k = $2,970,000) to the exec…

now you have one person making $30k/year and one making $3,970,000 per year.

would this not make productivity has go way up but unit cost per labor has also go way up?

I wonder what our unit labor costs would be if we dropped bloated CEO/executive salaries by 70%?

====

of course, with these types of discussions nobody EVER talks about how CEO unit labor costs need to come down.

No, as always it’s the overpaid unionist with their Cadillac Health Care plan that needs to “compete”.

One of the reasons a real reporter, a news journalist, Dan Rather was smashed to the ground, was his simple analysis of what was going on all around him the CBS newsroom. The right sizing, the downsizing, the new economic realities of news that had to start paying for itself, resulted also in the Hollywood Star system of news celebrities. Dan was replaced by the sultry blonde good looks of Diane Sawyer, former Nixon White House press secretary. How that experience qualifies her for the chair that Rather, Cronkite and Murrow sat in, is beyond me. But Dan frequently pointed out that maybe there would not be so many sad goodbyes to producers, investigative reporters, the backbone of the content which in its finished form is effortlessly read to us by Sawyer, if she could just get by on say, $4 or $5 MILLION INSTEAD OF $12-14MILLION. Oh well.

I think you nailed it. This would also explain various operational breakdowns in many of these companies. The “too many chiefs, not enough indians” syndrome. The top layers stay around and keep collecting the dough (many of them WAY too much of it), while the lower wrungs of the corporate ladder (and often the most crucial jobs that make a company go from a basic “blocking & tackling” standpoint) are wrung completely dry either by wage cuts and/or layoffs, or both.

Those cheeky workers are asking for wage increases – we must stop them at all costs!

The big disconect between unit labor costs and wages is the unit labor costs include broader “compensation” i.e. health insurance which shows up as unit labor costs but are increasingly crowding out wages.

David Frum has made this point really well:

http://pigphilosophy.blogspot.com/2009/11/health-insurance-costs-and-stagnating.html

The other slieght of hand here is that Mees simply asserts that increasing unit labor costs mean employers will cut hours/employment. Except in Figure 2, two of the three major spikes downward in unit labor costs are during recessions (2001ish and 2008). To me that suggests firms cut hours/employment when unit labor costs are falling.

That is, part of the business cycle adjustment takes place with reduced hours/layoffs and some of the adjustment takes place by cutting wages. Again, this seems like correlation and not causation in Figure 2. The demand for labor and the demand for the commodities that drive headline inflation all decline during recessions.

Another economist living somewhere between ‘La-la Land’ and the past.

The ‘labour’ is the giveaway. There is little in the way of wage earner leverage in this country (US). Our #1 product is poverty, more of our citizens (44 million) are on food stamps. Without the establishment lies, unemployment is @ a deflationary 15% (including those who have abandoned the futile task of looking for a job.) Where is the pressure for high wages going to come from in this ‘slack’ condition?

The establishment takes aim at the poverty percentage w/ cuts and more cuts. The outcome of the process is swept under the carpet so as to not scare the horses.

Higher input prices are the consequence of rising fuel costs and the decline of fuel supply relative to demand. Fuel costs are embedded in the costs of all other goods and services within industrial economies, particularly food products.

Confronted with higher input costs, a business has two choices, to divert more cash flow toward inputs — and away from servicing debts — or borrow more. Multiplied across economies, the ‘divert or borrow’ increases prices for input goods — because more funds are available for ‘bid’ — along with the price of credit.

The outcome is the rise in the cost of credit world- wide. Some areas are avoiding the increased costs for the present by herculean efforts (monetary easing and free- flowing bank credit).

If a good becomes more expensive it must be paid for or done without. Doing without fuel is not an alternative to entities who have large capital ‘investments’ in fuel- consumption enablers, also obtained with credit. These so- called investments represent a large percentage of global GDP.

The world- wide strain on credit facilities is both the outcome and cause of high fuel prices. These, in turn are the consequence of decades of wasteful and pointless consumption, rationalized by incompetent economists and those who hire them.

The increased credit costs are far from inflationary. As business entities are priced out of the credit or fuel markets for prolonged periods, they fail. When enough businesses fail legacy debt becomes unserviceable and banks rendered insolvent by the ordinary working of the process … collapse.

If this collapse takes place within an ‘easing’ context the ‘lenders of last resort’ cease to be. The outcome is a money panic or run into currency/liquidity, which is what has happened numerous times since 1973 after oil price increases.

The world economy has inched itself to the end of the gangplank: it dare add more credit due to diminished returns and increased costs, yet it dare not cut off the current astounding credit flow, even as that increases fuel costs! Rising costs allocate or ‘ration by access to credit’. There is really nowhere to go but off the end into the drink.

Funds are allocated toward fuel and away from wages, from ‘hedges’ such as property bubbles and currency unions, soon to be allocated away from government spending. What is taking place right now under the noses of economists is the self- destruction of the fuel use context, whereupon the ability of workers to demand wages will completely collapse.

You may notice no mention of oil price ‘upper bound’ in nominal currency or pump prices. The problem is @ the end of your driveways, time to start taking a hard, cold and realistic look at it.

It’s that or oblivion. There is no other way …

Heleen Mees said:

• In January 2000, at the onset of the housing boom, the Fed replaced headline CPI with the personal consumption expenditure (PCE) index because the latter is less dominated by the cost of housing than the former…

• Subsequently, in July 2004, the Fed replaced headline PCE with core PCE, thus excluding food and energy prices.

Great! I guess in the world that Greenspan, Bernanke and the Fed inhabit, the only thing that matters is the cost of big-screen TVs. We can see how well that sort of “thinking” worked out for Mubarak.

Her article is pretty bad. A few obvious objections:

Wage rates are not subject to hedonic adjustment, as is the CPI. 40% of the CPI is the “owner rent factor”, which itself is mainly driven by interest rates (which are pro-cyclical). Each OECD country uses a different CPI calculation method, so it is extremely difficult to compare them (e.g. Japan’s is very different from the US method). 9 years is not long enough to make any conclusions on the topic she discusses.

She regresses wage inflation and CPI, knowing full well that wages are a significant input to prices in the US (or any) economy. She is then astounded to find that they are correlated!

Finally, correlation is not causation. Her conclusion in the final paragraph is conjecture.

But Yves raised a very important issue about why wages have stagnated in the face of strong US labor productivity growth in recent years. Sadly, this article doesn’t shed any light in this regard.

As much as this post makes an interesting observation, note the emphasis on reducing labor bargaining power as the solution to booms and busts, Yves Smith

The solution to the boom-bust cycle is to eliminate it at its source. I wonder if a government enforced usury and counterfeiting cartel could have anything to do with the boom-bust cycle? Quite a few think so.

when the era of weak labor bargaining power (which started taking hold in a serious way in the Reagan/Thatcher eras) showed far more financial instability that the preceding period where productivity gains were shared with workers. Yves Smith

That makes perfect sense from an ethical viewpoint. Since those productivity gains were financed with the workers’ own stolen purchasing power via the banking cartel then it makes moral sense that those gains should be shared with the workers.

It all goes back to the money system. If we insist on a government enforced money cartel then strong unions are a necessary counterweight.

There is a better way though. Eliminate government privileges for usury and banking and the corporations would be forced (by market pressures) to share their gains with their workers.

Yves advocates that productivity gains should be shared with workers, and I fully agree.

In the Austrian model of ‘Sozialpartnerschaft’ (social partnerhship) between the corporate and labor sector wages were often increased evenhandedly according to the then famous ‘Benya Formel’ which specified that wage increases have to cover both inflation and productivity gains.

Anton Benya, after whom the formula is named, was Austria’s most important union leader after World War II, and died 2001. His main ‘social partner’ was Rudolf Sallinger who represented the corporate sector, and died 1992.

See: Anton Benya (from de.wikipedia.org, translated) and Rudolf Sallinger (from de.wikipedia.org, translated)

Yves advocates that productivity gains should be shared with workers, and I fully agree. gerold k.b. weber

Without the government enforced counterfeiting cartel otherwise known as the banking system, then interest rates would rise to genuine supply/demand levels. Then the workers would receive honest interest rates on their savings and/or the corporations would be forced to share productivity gains with their workers via new common stock issue.

It all goes back to the money system. If that is not ethical then how can we have a decent society? We can’t.

Or is God mocked?

It may be a bit much to expect Americans to be sexually pure but is “Thou shalt not steal” too difficult too? Is there any Commandment we can keep?

This is a pernicious article. What we have is the double whammy of inflation inside deflation, that is Fed financed speculation in commodities in the presence of declining housing prices and high unemployment. Both of these have severe negative effects on ordinary wage earners (what used to be called the middle class). Mees’ solution is to target this group even further. Don’t you get really sick of these apologists and promoters of kleptocracy? It says a lot about how much academia is an integral part of the kleptocratic enterprise that its defenders always seem to have such successful careers there.

Re: It warns that neglecting headline inflation risks feverish boom-and-bust cycles with prolonged periods of high unemployment.

I thought that was a feature, not a bug. How else can the insiders scam the peasants?

Supply = workers/management

Demand = consumers

What consumers pay (= what workers/management get) is determined by the supply/demand curve – i.e. what each side can get away with (as little on one and as much as possible on the other side). It’s a ruthless process.

When a corporation can make a wig, for example, for $10 less, should that savings be splitted 50-50 between supply and demand, i.e. bewtween the workers/management and consuemers?

No.

The moral underpinning of our modern age is that supply is entitled to have as much of that $10 savings as possible, as determined by suppy/demand curve.

It’s not surprsing that in the fight for the spoil, after having dispatched demand, between the partners on the supply side, the workers and management, it’s the stronger who will grab as much as it can get away with.

But there is a third party in this sorrid transaction – Nature, who is likely to lose when we gain in productivity.

Sorry, sordid. Not sorrid.

But there is a third party in this sorrid transaction – Nature, who is likely to lose when we gain in productivity. MyLessThanPrimeBeef

Wrong. Progress allows man to do more with less. Consider your PC for example. It is not expensive and slow vacuum tubes but cheap large scale integrated circuits.

But let’s throw our wooden shoes into the power looms, eh?

It’s not always but likely, when we think about Jevon’s Paradox.

Usually, when you make it cheaper by being more productive, you will sell more.

Overall, after 200,000 years of progress, we are consuming more.

Overall, after 200,000 years of progress, we are consuming more. MyLessThanPrimeBeef

Consuming what? The Earth weighs more than it ever did due to the rain of cosmic dust. As for matter converted to energy and then lost to heat that is less than trivial.

As for energy, there is enough thorium to power the Earth for hundreds if not thousands of years. And when fusion is perfected then energy concerns shall cease.

Our only real physical constraint is living space and that too is a distant concern.

Nope. Our real problems are purely ethical -a money system based on theft of purchasing power being the primary one.

We are not consuming more?

To make the long story short, the question is,

Should profit-sharing be between Labor and Capital or should it be among Labor, Capital and Consumption (the 3 parties to the transaction), leaving aside Nature for a moment?

How about we insist on an ethical money system and let the chips fall where they may? And for the losers – a basic social safety net.

That would be nice, though the supply/demand price determination mechanism is all about getting away with what you can, paying as little and grabbing as much as you can.

Greed cannot be prevented but theft via an unethical money system certainly can be.

Theft will always be possible when greed is there.

I read her post at VoxEu yesterday and linked to her profile. She thinks Europe should shun its “welfare state” and embrace the capitalism of New York City where she has lived since 2000. That speaks volumes of her bias. Perhaps she has a time share in the Hamptons courtesy of JPMorgan. But she is just one more minnow in the pond built and tended by the US Eurozone Hyper Bank jellyfish. yes that is a mixed metaphor and I should not slander the good name of a fine marine organism. I am eternally flummoxed by the past 4 years of nonsense and can only hope that Greece and then Ireland embrace a May to remember default in the Argentinian style. Haircuts, haircuts, my kingdom for some haircuts !

She looks pretty hot from that pic at VoxEU.

If she lives in New York and is single, I’ll take her on as a student and do my best to save her soul.

Free of charge. LOL.

But I won’t do the Hamptons scene with her, unless she really lays down the law. ha ha ha.

I doubt she’s ever heard of Magonia. Just goes to show you how much there is to find out. LOL.

It’s That Brain-Dead Time of the Afternoon When Things Just Get Stoopid

Is this article a form of satire?

The Erasmus School of Economics?

“Erasmus stands as the supreme type of cultivated common sense applied to human affairs. He rescued theology from the pedantries of the Schoolmen, exposed the abuses of the Church, and did more than any other single person to advance the Revival of Learning.”

http://www.historyguide.org/intellect/erasmus.html

ya dont haf to kunekt tha dots to cee thu pikchur . . . :)

This is insane. What mechanism does he propose that will impact oil prices in the slightest?

We know that the demand for oil does not change in response to even large changes in the price of oil. We just had the IMF come out with new estimates of the price elasticity – and it is tiny, tiny, tiny.

We know the demand for oil only barely changes in response to most slowdowns.

I wrote a post about this weeks ago. Smart people ignore energy costs in inflation because monetary policy is likely to have zero effect on them.

So how are we going to get oil to go down in price? The only way I know is through a engineering a massive recession. Anything less than a massive recession will just be a recession with high oil prices, because we cannot impact demand for oil in any meaningful way with small changes in interest rates.

Here is the full discussion:

http://traderscrucible.com/2011/03/08/the-real-reason-to-ignore-energy-inflation-when-core-inflation-is-low/

And additional data about the IMF:

http://wp.me/p1b5Ih-n6

Please, help me stop the madness that is inflation mongering.