Matt Stoller pointed out this Bank of America story on Bloomberg, “BofA’s Moynihan Said to Press Geithner on Foreclosure Agreement,” which has the perverse effect of revealing how desperate the beleaguered Charlotte bank is:

Bank of America Corp. Chief Executive Officer Brian T. Moynihan met Treasury Secretary Timothy F. Geithner to press for a settlement of probes tied to the industry’s shoddy foreclosure practices….

A settlement among banks, state attorneys general and the Department of Justice would enable lenders to resolve delinquent loans and in turn allow the U.S. housing market to recover, Moynihan told the officials.

“In the states where foreclosure can take place you’re seeing the system unclog and move through,” Moynihan said during in an Aug. 10 conference call hosted by mutual fund manager Bruce Berkowitz. “That’s different than states where foreclosure is going through very slowly.”

Let’s parse what is really going on.

First, with Bank of America stock falling 12% last week from the previous Friday’s close, down 26% over the last two weeks, and credit default swap spreads widening considerably, Moynihan is desperate for any shred of good news to stem the widely growing (and accurate) perception that the bank faces a crushing wave of mortgage litigation. Yes, BoA probably probably put Countrywide into bankruptcy, but it apparently stripped its two major entities, Countrywide Financial and Countrywide Home Loans, of assets. If true, this is almost certainly fraudulent conveyance, since it was well known at the time of the deal that Countrywide was a sinkhole of liability (your truly inveighed on that issue at the time). That means at a minimum Bank of America will still be in the headlines as to whether and how much residual liability it would have to Countrywide.

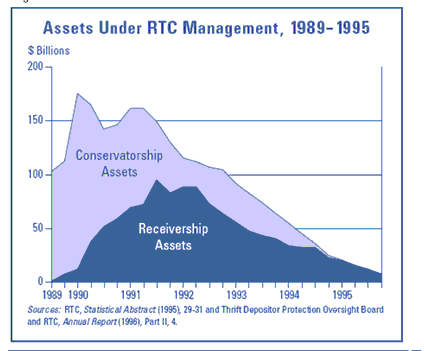

Second, Moynihan’s statement, “In the states where foreclosure can take place you’re seeing the system unclog and move through,” bears a lot of scrutiny. Whether foreclosures are “moving through” may be of benefit to banks, who get paid to foreclose, but I have not seen evidence that faster foreclosures help the housing market clear. For a market to “clear” you need to find a price where enough buyers step forward to take up the available supply. Does anyone think that if someone were to wave a magic wand and put all the defaulted properties on sale tomorrow, that hedgies and speculators around the world would snap them up? It took the Resolution Trust Corporation over four years to sell conseratorship assets that that peaked in 1990, and again roughy four years to dispose of receivership assets that peaked in mid 1991.

In addition, Congress was very unhappy to be appropriating funds to the RTC and it was under considerable pressure to wind up quickly. Subsequent analyses have suggested that a somewhat more attenuated process would have achieved better value for taxpayers.

In fact, Treasury argued the position the opposite of Moynihan’s in defense of its HAMP program: that it was beneficial because it delayed some foreclosures, thus keeping too many from hitting the market at once and depressing housing prices. Indeed, as we mentioned in a post late last week, the evidence is the reverse, that where foreclosures are happening, it is accompanied by serious chain of title problems which buyers won’t touch due to the inability to get title insurance (cash buyers don’ need title insurance, but that is a much smaller market, and they also seem to be deterred by the lack of a clean title). So how does dumping unsellable properties onto the market help anyone, save allowing banks to collect foreclosure-related fees from investors? As we said, vacant properties are crackhouse futures.

And conversely, the state which with the slowest throughput relative to serious delinquencies right now, New York, is for reasons that have absolutely nothing to do with what an AG settlement would address (and the New York AG is clearly not participating). New York state courts now require plaintiffs to certify that they have taken “reasonable” measures to verify the validity of documents submitted to the court. Now this looks like a belt and suspenders requirement, since lawyers are expected to meet that standard now. But the twist here is the certification requirement makes it easier for opposing counsel to ask that the foreclosure lawyer be sanctioned if something does not pass the smell test (normally, trying to get opposing counsel sanctioned is a sign of very bad taste and/or desperation). And more generally, it is a tough, unified message across New York courts that the judges take a dim view of slipshod procedures when people’s homes are at stake.

So Moynihan is trying to imply that it is just the arbitrariness of certain states that is causing his bank grief, when it is the reverse: the states that have a decent proportion of judges that still take the rule of law seriously are where the foreclosure process is grinding to a halt. Even in Florida, with a bank-friendly judiciary, foreclosure filings by banks dropped like a stone in the wake of the robosigning scandal and have not resumed their former pace as banks have tried and not succeeded all that much in cleaning up their “paperwork” problems.

Third, Moynihan is wasting his breath talking to Geithner. Geithner isn’t driving this bus.

Remember, when the already-unwieldy 50 state AG effort came together, the Federal banking regulators decided they would get involved, as in coopt them. We noted early on the leader of the AG effort, Tom Miller, was way too cozy with Treasury and was rumored to be angling to become the head of the Consumer Financial Protection Bureau.

But now that the Feds decided to rope in the states, they are stuck with this tar baby. They wanted this grand global pact to “put this all behind them”. The Federal regulators could have done a deal on their own in January and have been done with it. Instead, we’ve been told regularly since then that a deal is “weeks away”.

Finally, a state AG settlement buys Moynihan little more than a soundbite. The reason to try to get the AGs out of this type of litigation is first, that AG lawsuits get a lot of press attention, and second they facilitate suits by private parties, both by legitimating them (very important for risk and controversy averse organizations like investment managers) and lower the cost by road testing legal theories and providing information that other plaintiffs can leverage.

The problem is enough AGs are proceeding with mortgage lawsuits against banks so as to render that advantage moot. New York’s Eric Schneiderman is moving ahead in a very systematic way, and Delaware’s Beau Biden seems to be moving in concert. Massachusetts’ Martha Coakley is also pushing ahead, albeit on different mortgage issues. Nevada’s Catherine Masto has a major anti-Countrywide suit outstanding that she has no intention of dropping. Karmala Harris in California has nibbled at some foreclosure related issues and may proceed on a broader basis. Colorado’s John Suthers is apparently also likely not to participate in the settlement, which means he may file litigation.

Moreover, any state AG settlement does not restrict private parties’ rights to sue. It won’t stop the $10+ billion AIG action against Countrywide, nor will it bar the various private efforts to derail BofA’s $8.5 billion mortgage settlement. And it will not stop borrowers from using chain of title issues to fight foreclosures.

The spectacle of the Bank of America CEO begging for an insider fix to a broad based, multi-headed problem isn’t just pathetic, it suggests Moynihan may be in denial as to how deep the rot in his institution runs. He is in the beginning stages of getting an expensive education.

Another amazing post by you, Yves.

I am wondering what your thoughts are on how this will ultimately resolve? Does BoA ultimately become a much smaller bank? Does it pay all these claims out over a long period and just be a kind of zombie bank? Receivership? Does it win out on most of the litigation and come roaring back?

I have no idea. But I bet you do!

The 2012 D convention in BoA’s hometown, Charlotte, NC, means that Obama will do ANYTHING to avoid a public relations disaster like a BoA implosion during the campaign.

So long, rule of law, accountability for accounting control fraud, and so forth.

Also, too, “savvy businessmen!”

I’m afraid it’s gonna suck to no end for Brother Obysmal, ’cause he just does not control much on that end.

Just a little more trouble from Legaland or Europe and that’s it! The 2012 convention could feel hotter than the anticipated climate change for the area, which, believe you me, ain’t cold at all.

Obama’s base pleaded with him not to hold the convention in an anti-union state. Now he might have the specter of a big bank failure just down the street. Nice advertisement for his policies!

When I think of Brian Moynihan or Barabra Desoer, I think of the song by John Lennon called Piggies:

.

So if it walks like a piggy, talks like a piggy, by golly it’s a PIGGY!

.

WHERE IS MY LOAN MODIFICATION BANK OF DESTROYING AMERICA!

.

BofA and it’s CEO Brian Moynihan reminds me of that song by John Lennon and George Harrison titled “Piggies” I invite you to listen to this song on youtube and see if it appropriately fits.

.

http://www.youtube.com/watch?v=ovD9rTzs2q4&feature=player_embedded

.

Have you seen the little piggies

Crawling in the dirt

And for all the little piggies

Life is getting worse

Always having dirt to play around in.

.

Have you seen the bigger piggies

In their starched white shirts

You will find the bigger piggies

Stirring up the dirt

Always have clean shirts to play around in.

.

In their ties with all their backing

They don’t care what goes on around

In their eyes there’s something lacking

What they need’s a damn good whacking.

.

Everywhere there’s lots of piggies

Living piggy lives

You can see them out for dinner

With their piggy wives

Clutching forks and knives to eat their bacon.

.

When I filed my lawsuit against Bank of America, I thought of the many others out there in the same situation. It was then that we decided to educate the public on what these piggy banks are doing, as well as unite us all together as one voice. Please help me turn this David vs. Goliath modification process, into a Goliath vs. Goliath.

.

Please stand with me and Brookstone Law Firm, and send an email to Bank of Abusing America that states that we will no longer tolerate their potentially illegal, fraudulent, irregular and abusive business methods.

.

So please send your email directly to Bank of America and include the following:

.

1. Your name

2. Your complaint concerning your experience with Bank of America.

3. Please end your email “I support John Wright vs. BofA Lawsuit!”

4. Please send a copy of your email to piggybankblog@earthlink.net

5. Please send your email to BofA CEO Brian Moynihan:

brian.t.moynihan@bankofamerica.com

.

I HAVE HAD ENOUGH AND I AM FIGHTING BACK!

.

I have created piggybankblog.com for all of those who have been abused by Bank of Destroying Americas potentially irregular, fraudulent and simply abusive home loan modification process.

.

Divided we might have fell America. UNITED WE MUST STAND!

.

http://www.youtube.com/watch?v=PoOJMr7OJ0s

.

My name is John Wright AND I AM FIGHTING BACK!

.

John Wright

piggybankblog.com

When I think of Jimmy Johnson, Thomas E. Donilon, and other notable failures of the last couple of decades – I hope that they don’t lose that sense of security that a home provides, and that criminals aren’t going into their local courthouses to lie, steal and destroy their families. Or that they aren’t being thrown out of their jobs or their life savings, or starving or being bombed.

Reminds me of a song from MC5 that goes like this;

“Ya know, the Motor City is burning babe,

there ain’t a thing in the world that they can do.

Ya know, the Motor City is burning people,

there ain’t a thing that white society can do.

Ma home town burning down to the ground,

worser than Vietnam. “

Right on John Wright!…… I’d like to see bank of america in the trash bin and all the ken lewis kind doin hard time jail. I have a story to tell too and will include it in the mail I send to piggybackblog.

John, I think “Piggies” is a George Harrison song… OTT, Right On!

It’s a shame we are only talking about BOA. Their is no “begging” going on between banksters. Lennon used a folksy riff and put bitter lyrics on top: ” ‘Til you’re so fucking crazy you can’t follow their rules”

Of course it would be convenient for B of A to make a settlement with the states, everyone wins, the states, which are almost broke increase their revenue, the banks can continue to foreclose unabated and the homebuyers get screwed once again!

Maybe we should just go back into indentured servitude in this country? People who want their rights are a pain in the profits.

Some borrowers have decided to kill themselves. We pretend that our Government is a benign burecratic ne’er do well, but that’s wrong. To anyone in a dreadful situation, where they face financial ruin, always remember to avoid violence to ourselves or others. There are encouraging signs everywhere, it looks like Donald Rumsfeld can finally be held to account for torture. My hope is that eventually the obvious purveyors of violence will be held to account, Wolfowitz et al. When the dust settles we can go to the civilian agencies who aided and abetted the larceny of Democracy on an epic scale. These are the other lawyers, in money and banking, not necessarily into torture like Bybee and Yoo.

Maybe Moynihan should talk to Hank Paulson

about begging strategy.

After all, getting down on one knee to beg

got him $800B

Paulson didn’t beg either, he came in threatening to blow the whole thing up if his goons weren’t paid off.

His goons got paid off and they did the typical goon thing: blew up middle America anyway!

As I was reading of a Sunday morning the thought drifted into my head that’s been drifting there for quite some time anyhow. The thought was that in a “competition-based” system of criminality the least fit get eaten first: Bear, Lehmann and now BOA? I’d have been thinking Citigroup, but they seem to be in much better shape now.

When we have one colossal bank what shall be it’s name?

Mr. Moynihan should have learned the value of cooperation as a child. Alas, he learnt instead that small fish get eaten by larger ones. I begin to imagine the scenario developing where his corporation will be slain and devoured now by the remaining TBTFs.

Can’t imagine that any corporation will be able to hold total sway, however. Too many variables to manage. They’ll fall like skyscrapers in a demolition.

We would call it “Master”.

Can’t imagine that any corporation will be able to hold total sway, however. Too many variables to manage. They’ll fall like skyscrapers in a demolition.

True enough. The diseconomies of scale is a top-down process. Most of the examples are productive processes, but it seems as true for money-shifting, crumbcatching, and other secondary processes.

Yves

I love this site. Keep up the excellent work.

But one note to Piggybankblog: ‘Piggies’ was written by George Harrison.

Yves,

Outstanding parsing of Monyhan BS. That’s what I’m talking about!

No wonder Charlie Rose and Planet Money won’t have you on their show; you tell it like it is and they want it like they think it oughta be for the elites.

Why is it so important to keep housing prices up? I thought we covered how the market of fraud drove prices to obcene levels. The whole scam still seems to be driven by a fraudulent ledger entry that says “borrower”. That is a lie Yves and you know it!

You know, I don’t watch Rose anymore because every time I tuned in, it seemed as if another establishment hack, all silver hair and expensive tailoring, was intoning the establishment gospel. Now I see I wasn’t wrong. Rose is just a respectable looking forum for preachers of conventional nonsense.

Mexican anthropologist Sonia Toledo Tello did an extensive study of rich landowners who were evicted by Mayan peasants. For several generations, that landowning class had been a law unto itself after reducing the peasants to serfs on what had once been the peasants’ own land.

Gut’em…

Those who live (and profit by the market) should, when they mess up, wither and die.. NOT get bailed out…

NO MORE PRIVATIZED PROFITS BUT SOCIALIZED LOSSES…

when your 62 or older reverse mortgage its the best way to live