By Bill Black, Associate Professor of Economics and Law at the University of Missouri-Kansas City, a former senior financial regulator, and the author of The Best Way to Rob a Bank is to Own One. Cross posted from New Economic Perspectives.

The new mantra of the Republican Party is the old mantra – regulation is a “job killer.” It is certainly possible to have regulations kill jobs, and when I was a financial regulator I was a leader in cutting away many dumb requirements. We have just experienced the epic ability of the anti-regulators to kill well over ten million jobs. Why then is there not a single word from the new House leadership about investigations to determine how the anti-regulators did their damage? Why is there no plan to investigate the fields in which inadequate regulation most endangers jobs? While we’re at it, why not investigate the areas in which inadequate regulation allows firms to maim and kill. This column addresses only financial regulation.

Deregulation, desupervision, and de facto decriminalization (the three “des”) created the criminogenic environment that drove the modern U.S. financial crises. The three “des” were essential to create the epidemics of accounting control fraud that hyper-inflated the bubble that triggered the Great Recession. “Job killing” is a combination of two factors – increased job losses and decreased job creation. I’ll focus solely on private sector jobs – but the recession has also been devastating in terms of the loss of state and local governmental jobs.

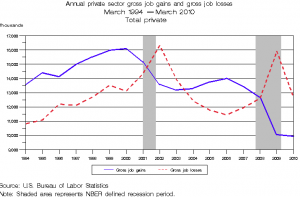

From 1996-2000, for example, annual private sector gross job increases rose from roughly 14 million to 16 million while annual private sector gross job losses increased from 12 to 13 million. The annual net job increases in those years, therefore, rose from two million to three million. Over that five year period, the net increase in private sector jobs was over 10 million. One common rule of thumb is that the economy needs to produce an annual net increase of about 1.5 million jobs to employ new entrants to our workforce, so the growth rate in this era was large enough to make the unemployment and poverty rates fall significantly.

The Great Recession (which officially began in the third quarter of 2007) shows why the anti-regulators are the premier job killers in America. Annual private sector gross job losses rose from roughly 12.5 to a peak of 16 million and gross private sector job gains fell from approximately 13 to 10 million. As late as March 2010, after the official end of the Great Recession, the annualized net job loss in the private sector was approximately three million (that job loss has now turned around, but the increases are far too small). Again, we need net gains of roughly 1.5 million jobs to accommodate new workers, so the total net job losses plus the loss of essential job growth was well over 10 million during the Great Recession. These numbers, again, do not include the large job losses of state and local government workers, the dramatic rise in underemployment, the sharp rise in far longer-term unemployment, and the salary/wage (and job satisfaction) losses that many workers had to take to find a new, typically inferior, job after they lost their job. It also ignores the rise in poverty, particularly the scandalous increase in children living in poverty.

The Great Recession was triggered by the collapse of the real estate bubble epidemic of mortgage fraud by lenders that hyper-inflated that bubble. That epidemic could not have happened without the appointment of anti-regulators to key leadership positions. The epidemic of mortgage fraud was centered in loans that the lending industry (behind closed doors) referred to as “liar’s” loans – so any regulatory leader who was not an anti-regulatory ideologue would (as we did in 1990-1990 during the first wave of liar’s loans in California) have ordered banks not to make these pervasively fraudulent loans. One of the problems was the existence of a “regulatory black hole” – most of the nonprime loans were made by lenders not regulated by the federal government. That black hole, however, conceals two broader federal anti-regulatory problems. The federal regulators actively made the black hole more severe by preempting state efforts to protect the public from predatory and fraudulent loans. Greenspan and Bernanke are particularly culpable. In addition to joining the jihad state regulation, the Fed had unique federal regulatory authority under HOEPA (enacted in 1994) to fill the black hole and regulate any housing lender (authority that Bernanke finally used, after liar’s loans had ended, in response to Congressional criticism). The Fed also had direct evidence of the frauds and abuses in nonprime lending because Congress mandated that the Fed hold hearings on predatory lending.

The S&L debacle, the Enron era frauds, and the current crisis were all driven by accounting control fraud. The three “des” are critical factors in creating the criminogenic environments that drive these epidemics of accounting control fraud. The regulators are the “cops on the beat” when it comes to stopping accounting control fraud. If they are made ineffective by the three “des” then cheaters gain a competitive advantage over honest firms. This makes markets perverse and causes recurrent crises.

From roughly 1999 to the present, three administrations have displayed hostility to vigorous regulation and have appointed regulatory leaders largely on the basis of their opposition to vigorous regulation. When these administrations occasionally blundered and appointed, or inherited, regulatory leaders that believed in regulating the administration attacked the regulators. In the financial regulatory sphere, recent examples include Arthur Levitt and William Donaldson (SEC), Brooksley Born (CFTC), and Sheila Bair (FDIC). Similarly, the bankers used Congress to extort the Financial Accounting Standards Board (FASB) into trashing the accounting rules so that the banks no longer had to recognize their losses. The twin purposes of that bit of successful thuggery were to evade the mandate of the Prompt Corrective Action (PCA) law and to allow banks to pretend that they were solvent and profitable so that they could continue to pay enormous bonuses to their senior officials based on the fictional “income” and “net worth” produced by the scam accounting. (Not recognizing one’s losses increases dollar-for-dollar reported, but fictional, net worth and gross income.) When members of Congress (mostly Democrats) sought to intimidate us into not taking enforcement actions against the fraudulent S&Ls we blew the whistle. Congress investigated Speaker Wright and the “Keating Five” in response. I testified in both investigations. Why is the new House leadership announcing its intent to give a free pass to the accounting control frauds, their political patrons, and the anti-regulators that created the criminogenic environment that hyper-inflated the financial bubble that triggered the Great Recession and caused such a loss of integrity? The anti-regulators subverted the rule of law and allowed elite frauds to loot with impunity. Why isn’t the new House leadership investigating that disgrace as one of their top priorities? Why is the new House leadership so eager to repeat the job killing mistakes of taking the regulatory cops off their beat?

If Bill Black read this in Congress, would anybody hear?

S&L crisis was 20 years ago – 1991. Enron was 10 years ago – 2001. We have still not enacted strict stentencing guidelines for accounting fraud? How painful for all the recreational pot smokers and coke snorters!

Dear Chairman Benjamin S. Bernanke, P.h. D.,

I am not so naive to believe you were wrapped in a time warp as Steve Keen believes. Please publish your next thesis on what you have learned from THIS crisis, then step down.

http://www.nakedcapitalism.com/2010/01/steve-keen-the-economic-case-against-bernanke.html

Thank you for your consideration. Then may you address the true role of the Federal Reserve and the stock market as Dr. Greenspan has done to some extent. I may not believe your BS, but you may earn only an iota of my respect.

Sincerely,

Kathleen

Bank Bernanke does not accept outside mail or critiques.

Have a nice day…..

I have a lot of respect for Black,but he misses with the critique of over-regulation. Finance is under policed, but jobs are being killed by over-regulation of most everything else. Read the Huffpo piece on Steve jobs. That’s what he told Obam. Just because republicans say it, doesn’t make it untrue.

Obama is supposed to work for the American people, but I gather you prefer that he work for corporate persons just as Romney would.

What is good for Apple is not necessarily good for the US, but you seem unable to see the distinction.

Yves, it concerns me that in your rush to make an effectively ideological point about “corporations,” you are missing crucial issues of scale that matter much more than ideology, here at the grass roots of the US economy.

This is common enough among people of all views, but also keeps the discussion from moving forward and solutions from being framed and rooted.

“Republicans” are not entirely wrong about regulation killing jobs. It’s just that arguments delivered in sound bites by the powerful tend to exploit an issue at the grass roots for votes, while working entirely against what the voters intend.

In this case, many “Republicans” I know (and there are fewer all the time as voters realize the party doesn’t reflect their interests) have indeed experienced regulations of various sorts as destroying their ability and desire to create jobs. Why they think the GOP cares about that, I can’t imagine. When they figure it out, they usually become independents IME. That or they continue voting for stupid reasons, like Stone Age religiosity, and then politics increasingly loses any connection to daily reality whatever.

But these people are not Apple, and it’s painful that you’d dismiss them, and the issue, entirely in suggesting that. In doing that, you’re doing the same thing the GOP does: getting glib at just the moment when we need to be thinking harder.

In fact, the job creation that is going to pull this nation’s economy into recovery is not going to be top down. Those structures cannot possibly create the jobs needed to accomplish that recovery; they are structured as instruments to turn wages into capital. There is no way they will ever go the other way. For many years “the government” (i.e., you and me paying taxes) was used as the equalizer. Well, it can’t work forever, and it’s not working. We see that all around us.

What is most needed is job creation at the smallest scale, right down to people generating their own supplemental incomes and self-employment. Or businesses such as I once owned, employing onself, one’s partner, and 1-3 other people, depending on which mix of contracts we had, and whether we could find people with the personal and work skills to entrust our clients to.

What has been overlooked in these discussions is that a person with a good idea and an entrepreneurial streak is magically converted into Wal-Mart the moment the first fiat currency legal tender Fed Buck (™, Reg. US Pat. Off.) changes hands.

That is because as soon as an individual tries to make their spark of entrepreneurial genius into an engine of their self reliance, they are slammed into a network of regulations that have been put there (often but not always with good intentions) by a cadre of litigators, overseers, lobbyists, politicos, and just plain busybodies, ostensibly for the public good, but usually because someone had a bone to pick or a dollar to make in the Reg Biz.

Neither side is dealing with this reality. I constantly see people doing work under the table, in fear, or for barter–and without appropriate remuneration for goods and services that outstrip what’s available in the so called “free” market.

This is a new form of serfdom: a regulatory ecology that turns potential employers, and potential employed, into people barred from competing economically and dependent on the whims of huge corporations. It makes them serfs additionally because not only is their only possibility for wage employment deriving from these corporations, if those wages erode, those corporations offer them debt instead.

This also accounts for the huge growth in public sector jobs over the past few decades, btw, but that’s another topic.

Pot calling the kettle black. You are the one operating on ideology.

1. There were efforts to prove the idea that regulation was bad for business in the 1970s, when the anti regulatory push started. Despite all their funding, there was nothing to support this idea. The meme was that regulation was anti-innovation, but they could not substantiate either that US was less innovative than other advanced economies (in fact, the available metrics said the reverse, that the US was more innovative and innovation had been increasing) or that regulation had anything to do with the claim that American was less innovative than it might otherwise be.

But Carter was desperate to find something, anything to do about the economy, so he took up the theme. Even the chief supporter of the anti regulatory push on his team called it a “perceived innovation gap”.

2. There are plenty of cases where regulation has produced innovation. Fuel efficiency regulations are a prime example. Big auto in the US spent considerable time and lobbying dollars fighting and diluting fuel efficiency rules. In the pretty much all of the rest of the world (BTW, including China) the standards are tougher than here.

Manufacturers in other countries embraced the fuel efficiency challenge with more enthusiasm than US automakers did. I’ve seen studies that have found that a big reason US cars lost so much market share globally is they aren’t as fuel efficient as many foreign cars. Gas is more expensive as a matter of policy in the rest of the world, and consumers proved to be receptive to the mandated cars.

3. Many of the changes imposed by regulation are not an negative and can actually be a plus for the business once the company gets over its “don’t tell me what to do” reflex. For instance, McDonalds was forced by protests that were somehow later backed by a court decision to get rid of styrofoam clamshells for its takeout food. McDonalds has spent a lot of money fighting being forced to use more environmentally friendly packaging. Yet when it was finally required to, it found out that the substitute cost it no more in the end, and the transition costs weren’t high. They would have done at least as well if they had gotten with the program earlier.

Similarly, BP decided in the late 1990s to reduce its carbon footrprint to the level of the early 1990s. It gave itself 10 years to hit the target. It met it in 2 and saved $650 million in the process. Yet companies again fight any sort of regulation surrounding carbon output.

In the case of Apple, I’ve seen studies that argue that Apple could have outsourced much less and have achieved similar product quality and costs. Apple got lots of kudos from Wall Street and the new CEOs’ reputation is based on the success of their outsourcing effort. Jobs was also famous for his reality distortion sphere. The belief of one CEO is not a compelling case. And if you had regulations (presumably re pollution impact of manufacture of components, or work rules, such as prohibitions against content made with child labor), all his competitors would be subject to the same rules, so Apple would not be any worse off competitively.

Reasonable people are going to disagree on these points. It would help not to be attacked for not toeing the line.

I spent the weekend with some entrepreneurs last weekend. One is a successful small shopowner who would like to expand (and create jobs) but can’t figure out how to do it without upending her life. She is no reactionary but plows through miles of red tape every year to run her store. If she accidentally does not pay a tax or fee on time she gets docked thousands. If she asks for leniency she is told it is “impossible.” She would have to get a lot bigger before she could outsource all the duties she takes on herself. So why would she do it? She is not greedy and she has a good life. But she also has capital and skills that could be put to good use and create dozens of NEW jobs.

A second friend has a small shoe company with 4 factories in China. When asked if she would like to return some of that manufacturing back home she said would love to but can’t. Is it wages? No, she said. We’re actually competitive on wages in the US. But she can’t use the glue she needs to use to attach uppers to her soles without running afoul of the EPA. The shoes can be sold here, but can’t be make here. When you reread Jobs’ comments in light of such conversations, you begin to see a pattern.

That’s all well and good, but I can tell you from personal experience with a start-up in the very early stages that i’m about to join, that “Gov’ment regulaaaations and taxkes” is about 4512th on the priority list of worries and barriers that we have to deal with. #1 priority is CUSTOMERS. #2 priority, is CUSTOMERS. #3 priority is customers. #4 priority is customers. #5 priority is customers.

Do you see a pattern here? Ok, truth be told, obtaining investors is probably up there too, but we’re boot-strapping it now, and if we a few more clients, getting investors won’t be as difficult, and wouldn’t be as needed either, except to scale faster. My main point is this: it’s all about demand demand demand followed by capital capital capital. Regulations is about 4512th on the list of worries

We live in a culture of money making at its apex. We are the society that instead of worrying about a Napoleon or Caesar or Khan coming in and destroying us, only had to worry about making money. And building a culture of commerce and trade where the business of America is business and we don’t go to a pope to get the lines of market share demarcated. We have overwhelmed the world with money. And when that does not work, resort to the power that comes out of a barrel of a gun.

When the farmers in France protested the USA, they attacked a McDonald’s not an embassy or airbase. When the Chinese ban an American import, it is more likely to be a movie shown in theaters. And when the women of the world are seen in blue jeans, underneath burkas, underneath saris, or just with a t shirt, it is not because they are trolling for American boyfriends from occupation forces. America is a capitalist culture in a addition to being a capitalist economy with no past baggage of aristocratic land owners, or barriers from superstitious beliefs holding back material progress, technological innovation or widespread penetration of new commercialized products.

So when I hear about government stepping on the throat of business big or small, when I hear that tyranny is a government bureaucrat inserting a regulation into someone’s business with the force of the state, when I hear that taxes should only be lowered and are unconstitutional confiscation of private property, I know I am dealing with business people who have only educated themselves in the only subject they consider to be valid, moral and the first item of importance: how to make money. The fact that they confuse the history of humanity, with kings and priesthoods controlling feudal societies with a democratically controlled republic or confuse a nation, turned into a garrison military society with domestic politics run by a police state organization, with Ben Bernanke and the Federal Reserve as a criminal conspiracy only exceeded by Pol Pot, or even worse, the claims that Obama is a smiley face Hitler sneaking a fascist government into fully operational functioning jack booted, black helicopter privatized government nexus, then I know I am dealing with people who do not know anything about the world other than how to make money, usually, for themselves alone.

It is a social order which enshrines private property to begin with, with its rules, and regulations, and legal system of property rights, and courts and police to back up those rights, which allows businesses to make any money at all and keep it, without having to tithe to god, kick back to the land baron, give some to the king, and on and on and on. What businesses get in return for rules and taxes are for free, the best educated people in the world, who can fly around from airports built by and maintained and operated by the government for the financial gain of any business that uses them. For free, a dedicated federal police force to protect their banking industry in the form of the FBI, where every crime against a bank is a federal offense.

The entire legal system has created for corporate instruments, its own legal code, the UNIFORM COMMERCIAL CODE, which has superceded common law and even the US Constituion. The entire world has gone the way of the business man. And still, they fucking complain that they can’t do what ever they want when ever they want to who ever they want, and not face any consequences. You entire world is being torn apart. You will have to face the fact, that your money will not buy you legitimacy, you will have to beat that out of us in the streets, you will have to shut down our will at the ballot box and you will have to erase all opposition in public. Of course, you will fail, because the costs of paying for violent and soft power repression will force you to raise taxes to hire more police or even worse, pay a premium to private security companies. You will not be able to stomach the costs to protect this abortion of a country you’ve turned America into. You will fail, because all you know how to do is make money, while we make revolution.

It is a social ORDER precisely because it uses the full force of the state to create the meaningful rules, and laws and regulations, and taxes that allows a functioning society to operate for an extended period of time of calm, peaceful, calcuable durations of prosperity and wealth building and capital accumulation, withOUT which order, there would be anarchy, the great libertarian wet dream of kooks like Ron Paul, Any Rand, Friedrich Hayek, Milton Friedman and the end the fed tea party.

I believe compass rose hasn’t been keeping up with current events as the powers-that-be, financially speaking, have pretty much offshore the vast majority of production assets as well as capital assets to those places having no regulation.

Don’t fret any further on the subject……

Regulation in developed countries:

http://flipchartfairytales.files.wordpress.com/2011/06/oecd-regulation-index.png?w=640&h=352

OK, I hate patent law as much as anyone. But it’s not regulation holding jobs back, it’s a lack of demand.

According to the HuffPo piece, Jobs’ examples of “over-regulation” related to the difficulty of building factories in the U.S. compared to China and the inflexibility of public schools.

Leaving aside the public school issue and the environomental cost comparison for factories in China, I’d like to focus on another aspect of the factory construction issue, which is land use regulation. I think there is a pretty good argument that land use regulation in the U.S. is an absolute tangled mess that often imposes huge costs relative to benefits. What’s particularly ironic about land use regulation is that, not only does it stand in the way of private projects, it also imposes huge costs and time delays on public infrastructure projects. As a result, the public itself is directly harmed in the many instances where private parties protecting private interests use land use law to obstruct public projects.

A central challenge of reforming land use regulation is that the regulations are federal, state, and local. Obama could streamline the rules by changing federal laws, but there would still be many legal obstructions at the state and local level. A second challenge is that powerful economic interests, for all of their carping about “over-regulation” often like these many restrictions. They represent a barrier to entry against competitors and a tool that is easily used by wealthy communities and individual land-owners against economically productive activities that they don’t want.

I am not anti-land use regulation, but I do think it could be made much more streamlined, particularly for infrastructure projects serving the public.

And then there is the contradiction that the wealthiest residential communities frequently have the most restrictive land use rules, as the residents in those places seem to take inordinate delight in telling each other what colors they can paint their houses and whether they are allowed to have outdoor clothes lines.

It seems that economic elits don’t mind extremely strict land use regulation when it is imposed by those whom they view as peers.

No, your 2nd post is not a contradiction of the first. Instead, it makes a prima facia case that the most restrictive land use rules should be desirable for the rest of us.

P.S. The folks in central California sure which there were tighter regulations concerning infrastructure projects that allegedly serve the public — such as high-speed trains.

Brilliant point.

But to fix the unbelievable mess of land use regulation, you would also need to get money out of political campaigns and require that media provide free access to qualifying candidates.

It would also help matters if developers and local governments could access loans through some form of bank that is modeled as a utility. After all, if you projects are in the *public interest* then there is no reason to use lending to create a second layer of profit.

In my part of the country, a number of ‘locally owned’ banks that offer mortgages are actually funded by large housing and commercial development interests. So there is huge incentive to create housing units in order to extract the profit from mortgages. If banks functioned as utilities, a lot of the motivation to inflate profit would disappear.

This would translate to more modest projects that people could actually afford (ie, fewer McMansion subdivisions) and less risk taking. In other words, a more stable system.

Obviously, the crooks don’t want that, and they’ve made beaucoup campaign contributions to ensure the House doesn’t even think about investigating fraud,

And yet all those Wal-Marts, Sony plants etc. Somehow manage to get built. With tax abatements, no less.

You really don’t make much of a case.

Well, ouch.

But I was referencing ‘apples’ (McMansion subdivisions), not ‘oranges’ (Wal-Marts and Sony plants). In other words, I was focusing on the land use category that is linked directly to housing — and housing was the source of the bubble.

And, as the post points out, that whole sector of housing lending, along with securitization and all the other elements in the housing bubble, have not been reasonably investigated.

A whole string of factors involved in housing **were deregulated** – realtors are not supervised, appraisers were too often compliant to loan officers who wanted overvaluations, loan officers and mortgage brokers were incentivized to make sales — not worry about long term economic viability of buyers, their own financial institutions, nor society.

Fraud flourished.

That fraud led to economic implosion.

Now there are fewer jobs.

It is reasonable to point out that better regulation creates an environment in which there are more, better jobs.

Fraud is a job killer.

And fraud via deregulation is a job killer.

Wouldn’t Congress want to understand the relationship? (Okay, rhetorical question…)

So getting back to the post’s key point: the argument that deregulation is some kind of ‘job killer’ is pure nonsense, and neither my comment — nor yours — convincingly disproves that claim.

This argument about the economic value of solid regulation is definitely true in the housing sector. I believe that it remains true no matter how many Wal-Marts and Sony factories get built, no matter what the funding sources and loan structures are — provided there is some reasonable regulation that doesn’t overcomplexify matters into a cauldron of sticky, unworkable spaghetti legal code that is full of internal contradictions and legalese and ambiguous terminology.

To reiterate what I see as the post’s thesis: reasonable regulation and a healthy economy correlate.

Land use regulations have tended to jumble into a spaghetti mess of rules. Litigation eats up tons of time and energy. So that kind of regulation needs to be overhauled. But that is quite different from saying that all regulations are job killers. And it is hugely different from saying that Congress can continue to ignore the massive housing-related fraud that has made such a mess economically.

As Wm Black points out, no one is seriously investigating the fraud that drove the Meltdown. That mostly occurred in the McMansion layer, although it also occurred with commercial real estate, a la Wal-Mart.

Most of the fraud was in the housing sector, so your comment about Wal-Mart and Sony is not all that relevant to my comment about the housing sector.

The housing sector was not well regulated – not at the realtor stage, the lender stage, the securitization stage, or the SEC stage. Wal-Mart, nor to Sony don’t fall in the mortgage banking and securitization sectors that bubbled up because of fraud.

The issue of land use regulation is relevant to the economic stability of a jurisdiction, but the best planning staff in the world will never hold up against trillions of dollars of pressure gaming the system through liars loans and bad mortgages. And politicians who are beholden to the banks making the liars loans are the least competent or capable of investigating the fraud.

But Prof Black’s point is that those who claim regulation is a ‘job killer’ are wrong. I think it is important to have a discussion about that claim.

I happen to believe that the nonsense being spouted that blames regulation for ‘killing jobs’ is simplistic idiocy.

My comment got offtrack in the sense that I started down one path of government regulation: land use.

But arguably, if there were more stable economic models for lending institutions (ie, if banks were utilities) then much of the profit driving fraud would be eradicated. On that model, there could be more manageable, stable employment over time by people who — instead of making McMansion subdivisions — might be employed in some fine mixed use or newer style housing that is less vulnerable to the predations of an unregulated housing and finance industry.

We’ve got far afield of the post’s main topic.

The discussion unpacking why claims that regulation ‘kills jobs’ is a bunch of limp-minded twaddle can’t happen soon enough.

For starters, there are people unemployed today who could be quite productive if the fraud-driven housing market had not imploded. That’s reason enough to claim that sensible regulation **is economically productive activity.**

To tease that claim out and provide more evidence, Congress would need to hold hearings investigating the linkages between how deregulation created a criminogenic environment that led to fraud, which is economically dysfunctional.

Unfortunately, our present Congress lacks the cajones.

Might have something to do with their bought-and-paid for nature (exceptions being Sen Bernie Sanders and a few people in the House, including Rep Brad Miller).

The extremely weak point with your comments is that the USA has had (along with the World Bank) foreign aid programs directed at China for quite a number of years now.

(Recall that Rockefeller opened bank exchanges in Beijing and Moscow back in 1973.)

And USAID and OPIC, etc., aid went to build factories, production facilities, R&D labs, call centers and related infrastructure so that jobs could be offshored and created there by American-based multinationals.

A point to be considered.

Leviathan,

First, if you’re going to argue points from an article, at least provide a link.

Second, what makes you think that Steve Jobs was the fount of all wisdom in such matters? You’re arguing from authority, which is a terrible logical fallacy. Has it ever occurred to you that Jobs had his own agenda?

If you think that Jobs had some good points, then argue them on their merit. And be a little more specific than “too much non-financial regulation”.

Alex,

I would have included a link except that it is in the daily links list, so I thought it redundant.

And of course I don’t think Jobs was the second coming (even if he did). But I also don’t think his take should be dismissed.

I hate to see this debate devolve into a Dem-Rep fist-fight. Both parties can be completely wrong, or right in strange ways.

Republicans instinctively attack regulations; Democrats instinctively defend them. And yet jobs have been ebbing away for decades. We must follow the trail back to discover why.

As Yves has pointed out, part of the answer is that other countries have explicit policies protecting jobs–we don’t. So, deregulation works against workers. Chalk one up for the Dems (except that no Dem has campaigned on the issue, but a mere quibble). On the other hand, environmental regs clearly work against bringing industry back to the country. Score one for the Repubs (but you have to ignore that they only reversed laws benefitting energy and power cos. during Bush II, so guess this wasn’t much of a priority for them either when they were in charge).

See what I mean? Both parties are idiots. And yet, we do see that regulations are a bit more “gray” than Black would assume. Just sayin.

Yes, America’s regulatory climate really crippled Apple, didn’t it? They could only come out with a new iPhone every year.

Thank you Prof Black and Yves for allowing the guest post.

I sometimes wonder why it’s so hard for “mainstream” economic “thinkers” to recognize that fraud and Dereg can cause gross miss-allocation of capital, destabilizing bubbles which destroys jobs and the economy. Fraud in particular seems very hard for economists to talk about. Good on you for calling out Paul Krugman for shying away from the fraud issue. Perhaps economists are constitutionally incable of prioritizing fraud – I believe Greenspan once told Brooksley Borne during one of the private hazing sessions she endured in the late 90s that he didn’t believe fraud should be prosecuted because the “markets would correct it”

I remember the late 90s jobs market. I was early in my career at the time. In retrospect it seems almost unreal that there was a time when I could go out and get 4 offers in a month or 2 of searching, about the same number of offers I’ve gotten in sum total in the decade since. It seems like a distant memory that will probably never return ever again. Sad

I believe the reason economists tend not to talk about fraud is because they assume it’s not possible. I am not an economist, so I may have my terminology a little confused here, but as I understand it the rational expectations hypothesis (or is it the efficient markets hypothesis?) assumes that all players in the market have perfect knowledge of the present and the future. Therefore it would not be in anyone’s interest to cheat, because all the other people would know and would refuse to deal with her. Of course, in the real world no one has perfect knowledge, but that’s an irrelevant distraction to the theorists. They also believe that to be good a theory must be based on unrealistic assumptions. Go figure.

Bill Black,

The answer to your questions about why Congress won’t legislate against their benefactors (not the 99%) is because we have 21st century fascism. No more consistently applied rule-of-law, unrestrained competition and exploitation of labor.

We have know for quite some time that as a society we need to regulate our excesses at all levels but people keep denying it and saying it is bad. IMO, most regulation is too complex and more simple and unparsceable rules are needed….something the lawyers can’t make money parsing the infinitives with…..the late night, tired brain example that comes to my mind is that if you don’t have a financial interest in something, any financial position you might take related to it will be considered gambling.

I wish pundits and bloggers and journalists could all get past asking rhetorical questions like “Why oh why doesn’t Congress investigate” and just begin the discussion from the obvious: that our Congress is corrupt and rotten to the core.

Bought and paid for, and real cheap at that. Corporate America could pay ten times what they’re paying now for 535 elected legislators and not blink.

Dr. Black (and the mathematically and economically sophisticated readers of NC):

I have a question.

Given that the housing bubble was inflated by vast amounts of fraud, yet our legislators are paralyzed by the supposed moral hazard of helping underwater homeowners, I wonder whether there is a rough way to calculate, perhaps within particular housing markets and regions, the percentage of an underwater mortgage that was caused by that fraud.

This would seem to be a complex calculation, but very doable; the only barrier I can see is the fact that in the absence of any investigations and prosecutions whatsoever, it’s difficult to set a number for fraudulent mortgages in a market (which would then be part of a calculation of the rate of price run up in comparison to historical norms and concurrent economic activity–something like that, anyway).

Actually, we may have a way of getting a rough “fraud number” by using what we know about the bad tranches of the bundled mortgage securities; or by looking at Countrywide’s business model and its results. As I said, a complex calculation, but surely not impossible, is it? Especially for the modern economics profession, with its dubious love of modeling: let them put that to a better use!

I wish someone would figure this out, because if we could refute the Santelli-moral hazard argument and show that a $200,000 mortgage that is 20% underwater would have been a 140,000 mortgage absent fraud, and so is not truly underwater at all–which seems very conservative here in California, by the way, if you remember the run up in prices before 2006-7–then maybe we could actually convince legislators to allow cram downs and force principle reductions using the “degree of fraud” calculator.

Am I completely off base here in terms of the math? Every time I read or hear “underwater mortgage” it drives me crazy, because except for David Dayen, Bill Black, and Yves Smith, I never hear that followed by “which are, in millions of cases, the result of fraud-inflated prices.”

3.2 trillion

Ridiculous. There has been detailed figures provided regarding the size of the bubble for years, everywhere you look. Shame on anyone who thinks this is an original idea. Have you never read a Dean Baker article? Stupid.

And, NO, $3.2T is NOT correct. Per Dean Baker… the magnitude of the bubble was almost $30,000 per American citizen. That would be $120,000 per American family of four.

Understanding the magnitude of this fraud epidemic is not only essential, it’s the VERY FIRST STEP in understanding what’s happening to, not just the U.S. but, the WORLD economy. It’s absolutely astounding that most Americans still don’t know the housing bubble was $8-9T bubble based TOTALLY on crime. ORGANIZED CRIME. GLOBAL MAFIA. And still more astounding is that, while people still haven’t figured out what DID happen, they still haven’t begun to recognize that the crimes are STILL happening… that the criminals are still busy speculating the markets massively UP and DOWN.

The criminals profit when the markets move, either up OR down. Regulation is necessary to prevent these massive gyrations which allow the criminals to loot the markets by taking percentage pieces of both up and down movements. A ten year old child can easily understand these basic concepts of how the GLOBAL MAFIA CRIMINALS operate.

And yet almost ALL American adults don’t even know the magnitude of the mortgage bubble? If American’s don’t know by now how large the housing bubble was then there is absolutely no doubt that they know NOTHING. Absolutely NOTHING.

BTW… the CASH bailouts of the finance criminals is approaching $3.2T. They were also provided another $13T in zero interest bailout loans (a recent analysis of these transactions concluded that this amounted to over $2T more cash to the criminals).

FACT… $3T is equal to $10,000 per American. And KNOW THIS… when the stock markets bottomed out (approaching a 50% drop) in March of 2009 the markets had lost $6T and home values had dropped $6T. THAT’S $40,000 per American citizen. $160,000 per average American Family of four.

Fact… the bond markets are much larger the the stock markets… the derivatives markets are much larger than the bond markets. When these markets crash we’ll be talking about MUCH larger numbers.

Don’t believe the numbers? That’s the point… this crisis IS much more serious than the average totally-ignorant American citizen has begun to realize. The criminals are MUCH more wealthy and powerful than ignorant Americans realize.

FACT… absolutely NONE of these FACTS are reported by FOX News, NPR, AM Radio OR ANY OF THE CORPORATE-CONTROLLED MEDIA.

Turn off the corporate media lies… only the independent media is trying to identify the problems and develop solutions.

I’ve thought the same thing. I actually played with the idea.

You need to combine several layers of data, some of which is easily available.

City and county councils and other layers of government need this to make policy decisions.

It’s a great research project.

Thank you! I’m glad to know someone agrees. The question now is whether this can be crowd sourced in some way, or perhaps taken up by an academic economist or team with the proper skills, which I certainly don’t (I teach writing).

I posted the idea over at Mark Thoma’s blog a little while ago, because there are many brilliant economists commenting there, with obvious technical chops, but so far no takers. I was sort of hoping that Professor Black might already have done some of this work, or his colleagues at Bard or UM-KC, which is why I directed the question to him first of all.

Kevin, there are publicly available stats from a lot of sources, including US Census Bureau, but the FCIC Hearings did create some good information.

Their website is here: http://cybercemetery.unt.edu/archive/fcic/20110310172443/http://fcic.gov/

The information is administered by National Archives & Records Admin.

IMVHO, the best way to crack this topic you raise is to focus on a specific region or state. Then it would take a while to collect the data, but it’s doable. The other key problem is assessing the quality of the data, but housing numbers should be reasonably reliable because they’re used for taxing purposes (property taxes).

The best method IMVHO is to select a specific area or region, then do the analysis for that region.

I think you are asking, “Can we put a price tag on fraud?”

And I think that Prof Black is saying, “Of course we could, if we had a Congress willing to spend the money to pay people to go find those numbers.”

It’s totally doable.

It’s about time, energy, and the best strategy.

And then, getting a sense of the integrity of the data.

I’m fairly convinced that if a local city council had been convinced in 2005 that 70% of the housing in New Subdivision X was going to end up underwater, sticking their local school districts, library districts, fire districts, port districts, etc… with high social services needs, at the same time losing property tax values, well — I think a lot of subdivisions would not have been approved. But back in 2005, no one had good data to make a convincing case.

And unless someone collects the data from our current mess, the predators will continue to bamboozle unwitting, fairly clueless electeds (and even judges and regulators).

In my view, Congress won’t do it. That will continue to make them increasingly irrelevant, because they aren’t helping struggling cities and states.

So there’s opportunity for whatever academic gets the grant and does the work, I suspect ;-)

Yes, it could definitely be crowd sourced.

Feel free to email readeroftealeaves@gmail.com.

Will do! And I hope other readers will continue to join in.

It is interesting. Regardless the crisis de jour both parties will claim long standing party dogma the solution.–

There is only one party and it’s solution is greed.

At danger of repeating myself here but at the core of the problem is the fact that legislation has been influenced in such a way that allows some people at the top to loot the system and the problem will continue until those looters have to realize that they cannot get away with their loot anymore.

The law has diverted too far from what is perceived to be justice by the average joe (including myself). We have to first find a way back to the real spirit of the rule of law and all those involved in the past have to make way for people of another standard of integrity that is lacking at leadership levels since a long long time.

Clinton made the mistake of buying into the general financial deregulatory schema and signing these types of bills, after being sold on it by the primary charlatans:

Greenspan, Rubin, and especially Phil Gramm, and their banker denizens. They’d been trying to sneak it in for years. After the S&L crisis, I couldn’t believe this happened when I first heard about it. Since then, my eyes have been opened about who bought and owns this government.

Those are the main perps who pushed it on us.

Sorry Linus, I hit the wrong reply button. That message was a reply to Mikey M.

Ya well Bill Clinton was the biggest anti-regulator of all by removing glass-stegall.

This financial crisis was ultimately caused by politicians, not bankers.

Politicians who are controlled by bankers through bribery.

So what? They dont have to take the bribes. If I’m walking down the street and someone offers me heroin, its up to me to say no.

Agreed, but in our system the heroin that politicians accept is mostly legal. That’s the biggest crime of all, that bribery is legal.

I agree with you that ultimately the government is to blame. There will always be people willing to gamble and commit fraud on Wall Street, just (as I say to people who blame individuals that borrowed too much) there will always be those willing to borrow irresponsibly.

But according to some story I heard as a child, the government exists largely to prevent harm to society from the irresponsible actions of individuals. I believe the mechanism for ensuring that the government does that job is called “representation”. Lock me up DoHS, I have a radical idea: each citizen who is at least 18 years of age should have an equal say in that government, regardless of their economic means.

“bribery is legal”

But, But, I thought giving money to politicians was free speech not bribery. George Will told me so and he is SO smart.

(/snark)

Jim

If legislative ethics/ rules committees at every level resolved: no member shall serve on a committee if they solicit or receive money or favor of any kind from any non- human, or money/ favors greater than 100 dollars during one election cycle from any human individual.

Taking bribes is a choice, just as you say.

Bankers don’t have to commit ethical and moral crimes just because the politicians allow it. Just because the politicians allow me to own a gun doesn’t give me the right to start shooting people and if I do who would go to jail, me or the GOP Politicians that fight gun control?

Bankers don’t have to commit ethical and moral crimes just because the politicians allow it. John Wacape

Our version of banking is inherently unethical and immoral.

AND he signed into law NAFTA, which was the biggest job killer ever.

Clinton didn’t sign the NAFTA Treaty, George H.W. Bush did. Go look at a copy of the NAFTA Treaty and you won’t find Bill Clinton’s name anywhere on it …. All Clinton did was get the US Senate to approve a Treaty signed by George H W Bush BEFORE Clinton ever took office

Not to mention the authors, Gramm, Leach and Bliley.

Of course. It is now and always has been due to our corrupt politicians sharing in the booty. Only public funding of campaigns will reverse this and our other economic problems. Let’s not forget that they and the top 1% are making money on this downturn.

Jack Lohman

http://MoneyedPoliticians.net

Let’s elect Bill Black to Congress and find out…..

Aah, that won’t do any good–Congress is regulated by the FIRE industry.

Interestingly Neo-Liberals will acknowledge the dangers of monopolies and cartels stopping markets from working competitively but fail to understand that monopolizing of capital control by the 1% offers the same dangers of producing dysfunctional markets. This, of course, assumes that as a Neo-Liberal you believe that the purpose of markets is for the general benefit as opposed to a handful of sociopathic looters.

Yes. As Yves has pointed out in ECONned, these folks would recommend we all be bled by leeches.

I interpret Congress, the regulatory appointees, and the money that backs them all to deny that a functioning immune system actually helps an organism, economic or otherwise.

White blood cells? Who needs them?

Ability to recognize the symptoms of disease? Who needs it?

Ah, those features that would enable a well regulated system to prevent disease — according to what I hear Boehner and Cantor, et al, say — are too onerous. The system can just collapse because someone will profit from it, and immunology is somehow ‘too expensive’.

Meanwhile the best Financial Immunologists that I see in Congress are Sen Bernie Sanders and Rep Brad Miller. ,that’s 2 of about 535. Meh.

Mikey M says:-

“So what? They dont have to take the bribes. If I’m walking down the street and someone offers me heroin, its up to me to say no.”

I think (but correct me if I’m wrong) research shows that the better financed campaigns tend to win. So why stack the odds against you?

Kevin Egan. In addition modelling economists could also consider the financial effect on political campaign finances once the financial institutions are forced to take a hit on the mortgage values on their books (spreadsheets).

Deregulating the Bankers is like allowing the Mafia to police itself … They’ll never do the right thing and always steal as much as they can get away with, just like the Mafia or any other group of Organized Crime

John, we can regulate them till the cows come home singing Gilbert and Sullivan in Latin…but it’s not going to change the fact that a top-down economy is implicitly putting them in charge.

The only way out of that is more rooted economic structures. Those have been systematically stunted by members of all existing interest groups. Including university professors who make big bucks for life, and in retirement, at public universities, looking only at The Big Players, and leading everyone else to think that that is the only possible place that economics and job creation can happen.

OWS…!

O*!

According to a new report by the World Bank, the United States is the fourth best country in the world to do business in: http://www.forbes.com/sites/kenrapoza/2011/10/20/us-businesses-not-being-strangled-by-regulation-and-taxation-world-bank-says/

Next!

Black’s conclusions are off. Fannie Mae and Freddie Mac were actually the largest buyers of subprime mortgages from 2004 through 2007. This was due in large part to the unintended consequences of public policy mandates to increase home ownership. In addition, he fails to look at regulatory issues that have affected small business’ ability to create new jobs. Here is an excerpt from a SBA report authored in 2010 on the cost of federal regulations: “The annual cost of federal regulations in the United States increased to more than $1.75 trillion in 2008. Had every U.S. household paid an equal share of the federal regulatory burden, each would have owed $15,586 in 2008. By comparison, the federal regulatory burden exceeds by 50 percent private spending on health care, which equaled $10,500 per household in 2008. While all citizens and businesses pay some portion of these costs, the distribution of the burden of regulations is quite uneven. The portion of regulatory costs that falls initially on businesses was $8,086 per employee in 2008. Small businesses, defined as firms employing fewer than 20 employees, bear the largest burden of federal regulations. As of 2008, small businesses face an annual regulatory cost of $10,585 per employee, which is 36 percent higher than the regulatory cost facing large firms (defined as firms with 500 or more employees).”

The problem isn’t regulation which by itself is essential to a strong economy, country and environment. The problem is the bureaucracy involved with dealing with the regulators and those writing and interpreting the regulations.

I work in a highly regulated industry and while the theory behind the regulations were sound at one point, they are antiquated and provide little more than busy work to be worked around in today’s environment. They no longer achieve the desired results but nobody has the desire to start from scratch again.

As an example look at the securities industry and their prospectus requirements on mutual funds. What percentage of investors take the time to read and understand a prospectus that is 30 pages long and the regulations for it were written by a team of attorney’s that work as regulators 60 years ago?