As readers know all too well, the very short story of the financial crisis was consumers and banks went on big borrowing party and it all ended really badly, except for the banks.

However, banks built their businesses with the expectation that consumers would continue to rack up debt. But consumers aren’t too keen about that any more. Moreover, banks have also gotten a bit of religion and are more careful with extending loans. Since they aren’t making as much money on consumer lending, their natural impulse is to find other ways to fleece obtain more revenue from consumers.

We pointed out that Bank of America is determined to preserve its egregious debit card profits, and is circumventing the intent of recent legislation by charging all but reasonably profitable customers a $5 monthly fee for any debit card use (save at a BofA ATM). We hope customers will leave in droves.

We noted that Bank of America no doubt hoped that this move would serve as a bit of price leadership and other banks would follow. Citi apparently decided that the debit card fee was a smidge too obvious and it would try another route.

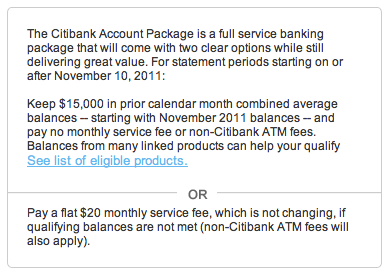

Reader Deloss alos told us, via e-mail, taht Citi has increased its balance requirements for free checking:

For what it’s worth, there was a discreet notice on my online Citi page announcing that either I had to raise my minimum balance from $10,000 to $15,000 or I had to start paying $20/month plus various other fees.

I called to check and yes, that is the new policy.

BoA is merely out in front.

The Los Angeles Times (hat tip Dave Dayen) reported on this change:

Citigroup Inc. was notifying many Citibank customers that they soon would have to start paying for their checking accounts unless they maintained significantly higher balances.

Letters are going out across the country alerting Citi customers of account changes, said the bank’s retail banking chief, Stephen Troutner. In many cases, that means customers will have to maintain fatter balances to avoid fees, although Troutner said a basic account option makes dodging charges easier….

That has caused major banks to impose a variety of new customer fees, although the exact formula varies. Citibank, for example, decided not to impose “usage” fees such as the $5 a month that Bank of America, starting next year, will charge most customers who use their debit cards to purchase goods and services.

“We conducted extensive surveys with our customers, and no one wanted to pay to use debit cards,” Troutner said.

The LA Times story also notes that many customers are not taking these new charges sitting down:

One day after announcing the new debit card fee, Bank of America was inundated with visits, calls and emails from customers….

Cheryl Holt of Burbank said she received one of the Citibank letters this week saying her old account with the bank, a so-called Easy Checking Package that had always been free, was being replaced in December with a new account package with a $15 monthly fee or $6,000 deposit minimum.

That sent Holt, a self-employed writer with a son in college, out to move her accounts to the Burbank City Credit Union, which has free checking and free debit cards.

“Should have done it years ago!” she said….

In imposing the new fees, the big banks are “playing with their futures,” said banking customer-service consultant John Tschohl of the Service Quality Institute.

Tschohl pointed to Netflix, which lost nearly $10 billion in stock market value after surprising customers with a new pricing structure that added as much as 60% to the bills of people who watch both DVDs and online video.

“When you become arrogant and start acting like a monopoly,” he said, “it will come back to haunt you.”

It’s a little late to depict banks as being at risk of “becoming arrogant”. But maybe the blowback from these fee increases will make the big banks realize that they can’t push consumers around as easily as they can the government.

Ironically this may be a good thing, driving consumers to smaller banks and help further shrink the big banks. The problem with behemoths like Citi & BAC is that they are too big and bloated to make a profit in a deleveraging world. So for now they are squeezing their customers even if they know full well it will drive some/many of them away.

‘This may be a good thing, driving consumers to smaller banks and help further shrink the big banks.’

Had braindead behemoths such as BAC, Citi and Chase simply been liquidated in 2008/9, that’s exactly what would (and should) have happened: deposits would have left the defunct money center banks and gone to better-managed regional and local institutions instead of gov-subsidized dinosaurs.

JPM Chase has been offering up-front cash incentives for new direct-deposit accounts. So they hand you some cash, then extract it right back from you with new fees? DUH! — they must think we’re as dumb as they are.

You can lead a dinosaur to deposits, but you can’t expand a bony cranium whose behavioral repertoire is limited to ‘EAT,’ ‘KILL,’ ‘SH*T’ and ‘STEAL.’

I too would have liked to have seen the insolvent banks cut adrift in ’08-09. But then the trillion-dollar question becomes, What about all the CDS’s on their debt? How are they resolved?

It seems the entire financial system has successfully booby-trapped itself: Touch one and they ALL explode.

according to Ron Suskind’s new book, Obama did try to break up citigroup, but Tim Geithner et al just sat on the decision without carrying it out. From this perspective, Obama looks either massively naive and ignorant, or else massively conflicted and corrupted.

Yves Smith wrote about this Susskind book a little over a week ago. If I understood correctly what I read, she considers the book an after-the-fact excuse-mill for Obama’s

pre-set unwillingness to even consider breaking up Citibank.

Geithner is merely set up as a handy blame-absorber.

Yes, it’s an indication of desperation. As looting thins the herd beyond its sickest and weakest members, the predatory looters are now forced to take greater risks in targeting faster, stronger prey with heavier hooves and sharper horns. This is a very good sign indeed, as is the $4.6 million protection money JP Morgan felt compelled to pay to the police in the prior NC post.

This is likely to finally awaken awareness in the larger herd that it is under systematic, existential attack, that its shepherd wolf-politicians are in league with killer coyotes, and that it must find the collective consciousness to stand and fight for survival. Imagine these jackals’ fear as the herd turns and charges en masse. The tipping point is near.

It’s not only C & BAC. Capital One which is about to take over ING Direct – just pulled a fast one.

They change their Free Checking to a Free Interest Checking, but you got to keep $5000 if not it becomes a Reward Checking with a $8.95 fee.

This is what everyone that deals with ING Direct has to look for – a lot of trickery & a lot lower rates (ING 1% vs. Cap One .85% if over $1000 otherwise .10%

For reference, european banks have had this for ages, but they don’t have the stupid overdraft fees like their US counterparts.

Credit union.

we must starve the beasts.

I had a Wells account for years. However, I saw them bleeding people dry and sucking the marrow.

thus: changed to a credit union.

I love it. only issue is that for some people there may not be one near by. luckily for me I have one that is 8 blocks away.

We made a big mistake with the FDIC. Instead of insuring private bank deposits, the US Government as the sole issuer of its currency (ignoring the FED for the sake of argument) should have created a free, 100% risk free-money storage and check clearing service that did not lend or borrow money.

And once the population has a safe place to store its cash then all government privileges for the banks can be eliminated without concern for the depositors. There would no longer be guaranteed interest but on the other hand without the extreme bank leverage that government privilege allows there would be far less price inflation risk and the banks would be far safer too for those who sought interest.

Hear, hear.

This idea is far too sensible to be allowed oxygen or daylight, intolerably practical, logical, and fair. These are the sort of radical ideas that happen when people read the Bible for themselves, bypassing certified Pharisees and High Priests.

Sir, If you thought of that yourself, you are brilliant. If you are repeating someone else’s earlier idea, thank you for posting it here.

Let’s make sure that this comment gets forwarded

to the Ron Paul campaign.

Good idea. Way good. And it should be online so that everyone and their computer has very convenient access. It could eliminate the part of the credit/debit card business that thrives because of the convenience it offers its customers. Really why do banks have a stranglehold on our money? There should be an app for that.

These are the sort of radical ideas that happen when people read the Bible for themselves, bypassing certified Pharisees and High Priests. Doug Terpstra

Bingo! In this case, Matthew 22:16-22 (“Render to Caesar …”) was the inspiration plus the British Postal Savings System.

post office used to be a bank and could be again.

I was thinking to myself, “Well, what about the infrastructure?”. You answered my thought.

Really why do banks have a stranglehold on our money? Susan the Other

Monopolies are very profitable. The question is why has government gone along with it?

Oh, well. Live and learn.

Oh, and of course, like you said, the “Postal Saving Service” should have every modern convenience including Internet access, debit-cards, etc. and all for free. The government would “profit” from the arrangement because storing the population’s government money would be a form of interest-free loan back to the government.

It may not have occurred to you but what you are proposing is one element of what is called a full reserve ‘banking’ system, which where we will probably end up one of those days, as humanity finally sheds away the last debris from the metallic standard epochs.

I put ‘banking’ between quotes full reserve system as, in a full reserve system, banks essentially no longer exist in their current borrow short / lend long definition.

but what you are proposing is one element of what is called a full reserve ‘banking’ system, Fifi

Except the “Postal Saving Service” would not borrow or lend money at all. It would simply store money without risk and clear checks for free and would pay no interest. (Borrowing or lending money is not something the government should do. Government borrowing is a gift of a risk-free return to the rich and government lending is bound to lead to cronyism and/or price inflation if the government lends unwisely).

If folks want interest then they can risk their money in purely private banks or credit unions but with absolutely no backstop from the government except enforcement of the usual laws against fraud and insolvency.

I put ‘banking’ between quotes full reserve system as, in a full reserve system, banks essentially no longer exist in their current borrow short / lend long definition. Fiji

I would not necessarily ban private FRL (fractional reserve lending) but certainly it should have absolutely no government backstopping. Borrowing short to lend long is inherently a gamble and should always be considered such. Plus, a true free market in private money creation should be sufficient to crush FRL for good. For example, common stock as money has all the benefits of asset-backed money but with none of the ethical or stability problems of FR banking.

But I’d lose no sleep if FRL was outright banned. A universal bailout of the population is also needed with reform and that REQUIRES that FRL be banned during the bailout period to preclude price inflation from the new high powered money.

Good idea except look at Social Security, the gummint ‘invested’ the payroll taxes in Treasury bills but now is balking at paying off those bonds, instead opting to gut SS instead. Obviously a post office bank would be run exactly the same way as it would be run by exactly the same sorts of people meaning withdrawing one’s money would soon prove to be problematic as ‘surprise!’, that money went to yet more tax cuts for the 0.1%!

Obviously a post office bank would be run exactly the same way as it would be run by exactly the same sorts of people meaning withdrawing one’s money would soon prove to be problematic as ‘surprise!’, that money went to yet more tax cuts for the 0.1%! darms

No. Not at all. That money would be “stored”. To withhold payment would be to instantly destroy the reputation of the US Treasury. And there would never be a need to withhold payment anyway. The US Government can create ANY amount of its money at will from NOTHING. It does not even need linen, cotton and ink. Keyboard entries would do.

So no. The government could not steal that money any more than Hercules could drain the Oceans by drinking them.

Wait! Make that Thor not Hercules.

f. beard

you post the same, exact thing on every single nakedcapitalism story. what if you are wrong, and your ‘silver bullet’, which you repeat ad nauseum, year after year, will not solve all our problems?

and your ‘silver bullet’, decora

Hah! That’s a laugh. I am not a PM bug. Are you?

which you repeat decora

The Postal Savings Bank is a new addition to my shtick so in no way can that be repetitious yet.

ad nauseum, year after year, decora

We still have a banking crisis, don’t we? I am an engineer. It is my nature to solve problems, particularly ones that irritate me such as the crooked money system. And if Yves wishes, she can ban me for being boring (or for any other reason or for no reason; it is her blog)

will not solve all our problems? decora

Then the Bible and some of the most famous thinkers in history have misled me. And I did not say that fixing the money system would solve all our problems but it is a necessary start.

And in case you do not know, the last major banking crisis, the Great Depression, was a major cause of WWII which killed 50-86 million people.

I have a credit card whose issuer was devoured by Citi. I didn’t cancel it but went one better: I keep it unused with a zero balance. Costs ’em money to reserve against my credit line . . . .

I have done the same thing with Chase, which just emerged with a new ‘Slate Blue’ credit card that is so complicated I cannot understand my ‘privileges’ on it.

Buy one share of Wells Fargo etc and have them send you all the paper which you of course dutifully recycle.

As a BofA customer and a bit of a Luddite, this won’t affect me. I never use my debit card except at the ATM. So no fee for me.

And hey, since the customer is the one making the credit/debit/cash (notice that checks really aren’t much of an option anymore) method of payment decision, it isn’t unreasonable for the associated costs to be openly paid by them. $5.00/per month wouldn’t seem like a horrible price to pay if they weren’t STILL soaking the vender for more than the transaction costs.

I still see a number of folks pay by check at the grocery store, so I would not say its dead. For home repair it remains an option, and for bill paying if one does not use the bill pay service. Of course you make folks in the line behind you unhappy but thats just tough. (At least the add for the debit card tries to say so). Note that the UK bankers tried to kill the check and failed to much public demand for them. Yes with bill pay one writes fewer checks, but…

Note that I see folks use the grocery store as an atm machine, by writing a check for $20 more than the amount of purchase as well.

Is the (or a) goal of the $5 debit card fee to get customers to use credit cards again instead of their debit cards? First, the bank gets a better cut of the credit card transaction than a debit card one. And then, with credit card charges, customers are at risk of running credit balances (which they are probably trying to avoid by using debit cards like cash), thus paying interest. Customers are also then at risk of late and over-limit fees – where the REAL money is for credit-card issuers, as I understand it.

Ahem. The real money for banks is in debit cards. They do not take a flier on credit extension risks, they are still collecting a decent fee, and they still can (and will) charges over limit/overdraft fees if you exceed your card limit.

They went whole hog into debit cards back in the mid to late 90’s because of the value proposition to them. Which is why they went into ATM cards. Processing checks is still too expensive compared to electronic processing, even though they have cut those costs to the bone (Echeck debiting, etc.).

Frankly, I never understood why anyone uses a Debit Card. The law offers less protection than on the older Credit Card and if you pay off your credit card on time(which I always do) you are using their money for an entire month(which prior to the Fed’s ZIRP policy meant an additional 30 days of earned interest.

Yeah, don’t get the concept either (but I’m more a Liberal). To use a debit card, you have to have the money in your account. So you either have to keep lots of money in your account to avoid overdrafts, or monitor it constantly. If you’re doing that anyway, why not use a credit card and pay it off every month? What do people see in debit cards?

I suppose for a small but growing part of the population, they have bad credit histories so they can’t get a credit card. But why do other people use debit cards?

Why should anyone keep an account in a bank that cheat their clients and costermers when you can get better services from a community bank or credit union?

Move Your Money

http://www.youtube.com/watch?v=Icqrx0OimSs

http://moveyourmoneyproject.org/

Exactly. It’s at the point where, if you hold your checking, saving, car loan, credit card or home mortgage account at a TBTF bank, you are actively aiding and abetting the oligarchy destroying our democracy.

And that should keep you up at night.

http://www.findacreditunion.com/

Our loan is with Chase through no fault of our own; it was sold to them after they gobbled up Wamu. Doesn’t matter anyway because I had no clue what was going on back then. Needless to say, this blog and others have been invaluable.

In other words, if you let them use your money, they will use it against you.

It’s a little late to depict banks as being at risk of “becoming arrogant”. Yves Smiths

Banks think they are indispensable is why. And many people unfortunately agree.

It’s a little late to depict banks as being at risk of “becoming arrogant”.

Highlights mine obviously. The point is that the banks ARE and HAVE BEEN arrogant. What’s a word that means more arrogant than arrogant? Because that’s what banks are.

dead

Obstreperous.

I read that exchange fees are being regulated and that’s why the 5 bucks.

Forget that for a moment. If checking fees and debit card fees are bad, too high, or whatever then whats a bank to do? Make loans I suppose with your money and collect the margin. But only good wholesome, non-predatory loans that never default…

Are bank services to be charged for? It’s pretty simple, they should charge what they want and the bank that charges the least will get all those deposits. Only that market dynamic should alter fees charged. Of course this all presupposes the existence of deposit insurance.

OK, and now Citibank has news for you….You are pre-approved to be skimmed every single month!

Leaving the big banks was a good move at the end of 2009 when it became clear that they control us. Now there is a more immediate and selfish reason to do it.

Here’s my story with the banks. I became fed up with them because of the TBTF situation. Thus, I paid off my mortgage and moved almost all my money from Wells to a Credit Union.

But I left a relatively small amount at Wells. (because I pay some of my family’s bills… I have a co-account with my sister in a different city. Thus, I can transfer from my primary Wells acct to the secondary acct, and she has access to the money that second).

Anyway; I recently started getting charged monthly fees. $10 monthly on one checking acct and $15 on the other.

Long story short, there is now complex math to keep “free” checking. One has to have a checking account AND it has to be linked to a savings acct AND direct deposit AND ALSO an ATM card. That’s for EACH checking acct by the way.

Fleecing.

But the rules are so complicated most regular people won’t understand.

the problem of course is that all the TBTF institutions will go to this method… thus it is imperative that we leave them ASAP.

I have a Wachovia Account that is finally being converted to Wells in mid-October. I just received “The Consumer Disclosure” booklets totaling 76 pages of fine print non-sense. Included was also a 26 page transition guide. The “Dear Customer” welcome letter does a poor job at setting out the criteria for avoiding the looming service fees.

I already have one foot out the door and in the credit union. This will just motivate me to hasten my exit. Just another tax on the poor who can least afford the monthly $20 fee for the privilege of keeping their money at Wells.

Here’s my thought

1)

if you leave your money there you help them to lever up and gamble. Thus, we who have deposits at TBTF institutions are part of the problem

2)

if you do stay with Wells, don’t do any auto pay through them. The reason: if you decide to stay you have to get everything transitioned over.

I’m out the door, but it will take 1-2 more months to make sure everything is being paid by my CU account. (like my life insurance, disability insurance, Sprint phone bill, etc).

I don’t want to miss a disability insurance premium and then find out in 10 years “whoops, you’re uncovered!”

3)

There is a lot of fine print.

Again, the way I understood it you need for each checking account THREE or FOUR of the following:

-direct deposit

-minimum of $X (sorry, I forget)

-savings account linked to checking with minimum of $300

-mortgage

-student loan

-Debit card (I don’t think it can be ATM, but maybe it can be… you’ll have to dig).

on a side note: it only took me 4 phone calls and 1 physical trip to see a bank manager to get it all straightened out.

When you see the Wells Fargo Stagecoach logo,

don’t think “strongbox” and “security”

think

“armed robbers with masks stealing everything from

everyone on the stage”

I just went through that recently. I thought I’d read everything and had a grandfathered ‘Free Checking’, but apparently there’s a $2 monthly fee for the statement. Finally went online and canceled it, pulling what little money I had out; now I have a negative $2 balance. Somewhat hilarious.

Haven’t bothered to try to clear that nonsense up. Probably will just close it now, although it’s my only actual checking account for which I have a massive stash of checks.

For my ‘live’ checking account I never ordered checks. They’re expensive and I use about 1 a month.

My wife and I are in the same situation. We have an open credit union account, but we’re still dealing with Wells for the time being. So far, Wells has been good to us and have reversed all kinds of charges. They have been very customer service oriented.

The only reason we don’t leave now is because we’re waiting on our bankruptcy to go through, which is being held up by none other that JPM/Chase. For those that don’t know, Wells locks your account in the event of a bankruptcy. So, we have to move.

My wife and I both agreed we’d dump Wells if they start charging us this rentier fee for using our debit card. If it were up to me I would have already done it, but the wife has the purse strings and doesn’t have a clue about the banks.

Move your money, there are still lots of banks that don’t charge fees -yet-for maintaining a checking account

There’s also the simple fact that they just don’t give a damn about having your money to work with, because they can get an endless supply from the Fed at practically zero interest.

I don’t expect banks to process checks or debit card transactions for free, but you could get them for ‘free’ if you kept a modest amount in your checking account. In the last decade that was because they were hoping to screw you on absurd hidden fees and penalties, but it wasn’t always like that. In say the 1990’s and before they offered these services because they wanted the use of your money, just like they wanted other deposits. That’s what banks do.

It’s nice to be in a business where the Fed can give you your ‘inputs’ for free. How can you loose? Imagine running a pizzeria and having the government give you flour, tomato sauce and cheese for free.

Even better:

Imagine a business where the government would give you all your inputs (flour, sauce, cheeese) for free and then promise to buy your pizza from you for $10/pie. |

Because that’s what borrow at ZIRP and then buy 3% Treasuries means.

I thought the only reason the Fed could be so generous to the banks was because they took our deposits. Our deposits make their “balance sheet” look good (after vast amounts of fudging). And if a bank takes deposits it is insured by the FDIC no matter what other debt it is concealing. And etc. So, by all means, lets take our money elsewhere.

I left BoA when they started allowing NSF debit card purchases and reordering transactions to maximize overdraft fees. I’m not surprised that they are brazenly flouting the law. I am surprised that any individual still banks with these criminals and their ilk.

I’m outraged that my state government does business with these clowns, even to the extent of foisting TBTF debit cards on the unemployed. As long as our public wealth is parked with these goons, they can and will hold us hostages to our own fortunes.

In defense of Citi, I have had them since approximately 2006 or thereabouts. In that first signup I went for the Citigold account. People called me crazy for paying the (at the time) $25/month. But going for that account got me a free, no-credit-check line of credit that was instrumental in re-establishing my credit. It is currently my oldest tradeline. It has helped me get more responsible with managing my money by working hard to not use it.

Fast forward. I’m on Citibank’s basic package. I still have the credit line. There is a monthly fee if I don’t keep a minimum balance or do their Direct Deposit/Bill Pay, so I do Direct Deposit and Bill Pay, and Citi has never dinged me except in error, which they have corrected with a visit to the branch. I don’t get charged for that visit, either.

My debit card still gives me rewards (I’m looking at you, USAA).

They don’t charge me to use my debit card if I choose (I’m looking at you, BofA).

Technically they’re everywhere since every 7-Eleven has a terminal.

This new fee affects people who took advantage of an account type that quite frankly is nearly pointless to have. It’s the next step down from Citigold but just with a lower balance requirement. Targeting this is WAY less egregious than BofA, which targets pretty much every single customer and may be harmful to the lower income families out there. If you’re a Citibank Account holder, you were either paying a monthly fee anyway or you have enough money to meet the balance requirement. If you’re saying you can afford $10,000 but not $15,000, degrade your account. They’ll do it at the branch in a split second. Then you don’t have to deal with the fee.

Ultimately what I’m saying is, Citibank’s change affects a very small percentage of their customers in the grand scheme. BofA’s change affects a much larger population and they know it – in fact, it targets lower income explicitly, whereas Citi’s change affects people who are middle class or higher, and even then they have a choice to degrade the account and really lose nothing except the free checks which, these days, checks are used so infrequently as to almost be more worth it to just pay the $24 once every year or whatever vs. this monthly fee.

Yves,

Any idea how much of BofA and Citi’s operations are dependent on their retail deposit base? My sense is that the TBTF banks are now primarily investment banks and large commercial banks and that the amount of their business derived from or dependent on retail depositors is quite small.

In other words, I’m not sure BofA *cares* if all their retail depositors leave them. After all, they can get as much reserves as they need from the Fed at essentially zero interest. Why build your asset base on much more expensive-to-service retail deposits? If BofA can keep the credit card business and a loss of depositors allows them to downsize their extensive and expensive branch network, they might even come out ahead.

I agree, BofA and Citi will be happy to dump their unprofitable small account customers. I used to have a BofA issue credit card that I paid off religiously every month. A few months back, BofA instituted a mandatory $5 a month interest charge even if you had no balance or paid your card off. They waved goodbye cheerfully as I took my business elsewhere.

Unless you are consistently and heavily in debt AND pay your obligations every month like a good little consumer, they don’t want to waste their time with you.

Which will be a good thing in the long run and push cash and jobs into small credit unions and local banks where the money stays local.

I don’t have a problem with paying a reasonable price for using a credit card. It is a short term loan.

However, for financial institutions to be in charge of and making a profit off of debit cards, where the customer is making an electronic transfer of funds from their “pocket” to the “till” of the merchant, does bother me.

Can we look at this electronic transfer of funds as just another step in the evolution of “money?” Society goes from a barter system, where we lug the goods around, to a “money” system, where we progress from beads or shells to gold or silver pieces, that encapsulate a given value.

Historically, merchants or private banks or cities issued their own currency, minting gold or silver or lead pieces. Then this process was taken over by larger sovereign states, gold standards were discarded and governments took control of the issuance of paper and base metal currency.

We go from beads to gold to paper to electronic bits. Right now various banks are extracting profits from controlling this electronic “money”. Sovereign states could just as easily control the flow of electronic “money,” eventually even abandoning the minting of paper and metal currency. It might even be cheaper than fussing around with all that paper and cheap metal stuff.

Of course, I’d hate to be around when the power supply goes down.

“I don’t have a problem with paying a reasonable price for using a credit card. It is a short term loan.”

Don’t be a lamb happily trotting to your financial shearing.

Every transaction you make skims profit off

the sale from the merchant. Charge $100 and the

merchant gets back $94 to $98, sometimes have to

wait for their money for a long time as the credit

card company is on the hook for the warranty.

The merchant has the option of not taking the credit

card. You should pay cash instead of using a card,

or write a check for large purchases. They kill our

economy with tiny cuts to everyone and thus the only

way to fight back is by resisting in tiny everyday rebellions.

The big banks are openly engaging in petty fraud regarding fees, in my recent experience.

A few months ago, I opened an account for my father at Wells Fargo. We went together and sat down with the banker to go through the account opening process. I was eager to see how the banker would pitch the overdraft protection option, which I knew they really want people to sign up for but now need explicit customer authorization to do so. Surprisingly, the issue never came up in the account opening process. Ten days later, my father received a letter from Wells Fargo confirming that he had signed up for overdraft protection in setting up his account. I went over to the branch and spoke to the manager. He took an apologetic posture and CLAIMED that the banker who opened the account had simply made a mistake in not seeking my father’s permission. Then, in a truly Kafka-esque way, the branch manager started to tell me that my father should have been put into a “better” account structure that paid more interest. I responded by asking him, “What are the requirements to avoid paying fees on that account structure?” He answered by denying that there were any requirements. Skeptical, I asked him again, and he again demurred. After several go-rounds this way, he finally admitted that there is a $50K minimum deposit requirement (my father had deposited $75K with an intention of drawing down most of the balance in the next few months). I had essentially caught him in a blatant attempt to scam my father.

Just a few weeks later, my 18 year-old daughter complained to me that, in recently having opened a BofA account, she had been told that she could avoid all monthly fees by signing up of the “go paperless” option online. She had done that, and was in fact being treated as a paperless customer, but the monthly fee was being charged nevertheless.

Calling all citizens to close their accounts at the big banks that hid under the TARP and that are now parasitizing their customers.

Also, is their some reason that you can’t go into your branch and withdraw CASH? Go into your bank and get

your daily expense money out in this form. Pay for your

big purchases with checks. If you use a credit card,

do so only if there is no monthly fee. Pay it off at he end of the month and never ever ever pay a late fee or even one cent to the financial “service” parasites that have

taken over our economy.

Also re your father’s accounts being switched etc.

You can buy a cheap digital recorder for less than a hundred bucks. A group of friends use one when ever we dispute a bill by phone or set up an account etc.

You must, depending on the state you live in, and should get permission from the other party you are recording.

“Do you mind if I record this for quality control

purposes?” “It’s easier than trying to write all this down”

you remind me of someone i know. they were whining and moaning about the awful experience they had with their car repair. i asked them where they went? they said ‘wal-mart’.

I used Chevy Chase bank when I lived in the DC metro area. On several occasions I had to fight them on overdraft fees, ‘research’ fees, etc etc etc. Sometimes I could get the fees removed, but only after a lot of trouble.

Later I moved to a small town and put my money in a small local bank. I have never had any kind of fee or charge to my account. It is really nice not to have to worry about fees anymore.

By the way, after I left the DC area, Chevy Chase bank, crippled by bad mortgages, was bought by Capital One.

I have not had an account with a “Bank” since 1992. I use two credit Unions, neither of them where I live, I have been a member of one of them since 1970.

I quit banks due to far too many simple errors on their part, cash a check for $40 and the teller hands you $60 etc.

I have not used 25 checks yet this year, I do all my affairs electronically.

As for BofA I hope they cave and disappear.

This kind of behavior is to be expected from the financial sector. They are simply too big, as a share of the economy, to maintain themselves with legitimate activities. See:

http://anamecon.blogspot.com/2010/06/that-bloated-financial-sector.html

They have to be cut down to size, or they’ll keep on bleeding us.

Fees, and the debt bubble, are all that’s keeping them alive. As deleveraging of the economy proceeds, expect more bad behavior as they struggle to survive.

Note the international exposure, too. The goings on in Europe are of more than academic interest to them.

I just heard that unemployment insurance in CA. is now paid on a BofA debit card as of a month ago.I am not making this up.How disgusting these blood suckers are. No more rescues, let them rot in hell!

In addition, Morgan chase basically has the SNAP program (food stamp) debit card business locked up. Assuming the same game theory of airline ticket pricing, once one bank raises a fee they will all raise a fee. Yet one more siphoning of tax dollars and most critically from those who can least afford it, if JPM slithers down the same road.

I heard on the radio yesterday that the merchants’ fees the banks were charging to process debit/credit cards were around .44 a transaction. (Think about that for a moment….nearly .50 every single time someone swipes a card…) BofA said they were netting $2B a year under that structure.

Under Dodd Frank, that extortion has been cut down to .22 a transaction.

Yet it only costs the bank .04 a transaction to actually do the work of processing a debit/credit card.

So, they are whining and crying because their margin has been cut, but it is still a HUGE MARGIN!

And, this same article indicated that BofA, with the new $5 debit card fee, is projecting that they will make over $3B a year from that alone. More than enough to cover their “losses” from the changes in DF, Plus 50% more!

They sure do get you coming and going.

I’ve been with USAA for years and years, and they don’t charge me anything for any service, and in fact refund me money (up to $15 a month) if I use a “foreign” ATM to get cash.

Local Bank will get a transfer of funds this week from me. If I am going to pay a bank to hold my money, it will be one that actually helps my neighbors. I do not need my banks name on a football stadium. Thanks BofA for helping my decission process. Next thing to do is work on buying more American stuff.

One problem with small local banks is that you must stay on top of their financial situation. I moved my significant accounts to a $300M bank three years ago; until this year it was rated A by Weiss and 5-star by Bankrate. In one year it has fallen to a D and one star because of a very few bad loans written before the start of the financial crisis.

This is NOT a reason to stay with the Big Bad Banks, just something to be aware of.

The banks share a nice income stream with Visa and MC, simply by paying depositors (or the Fed!) 1 or 2%, and credit card lending at 12 to 29%. It is hard to feel sorry for them. Vote with your feet!

The more things change, the more they stay the same…

“The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus

the banks.” – Lord Acton

“And remember, where you have a concentration of power in a

few hands, all too frequently men with the mentality of gangsters get control. History has proven that. All power corrupts; absolute power corrupts absolutely.” – Lord Acton

“I have had men watching you for a long time and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank. … You are a den of vipers

and thieves.” – Andrew Jackson, 1834, on closing the Second Bank of the United States; (unabridged form, extended citation)

“If checking fees and debit card fees are bad, too high, or whatever then whats a bank to do?”

A couple years ago, the banks made $37B from bank overdraft fees. Then there’s the Shylockian/load-sharkian 25% APR on unpaid CC balances, etc.

Banks have MANY ways to screw retail customers.

AND ANOTHER THING

after all that bailout money how can they charge poor folks $10 to cash their SS check (which Banks do if they don’t have an account with them). They should be required to cash a government issued check as a matter of respect and gratitude to the people who have bailed them out.

that makes me crazy.

Next thing you know they’ll be charging a fee for making change.

How dare a for-profit company in a capitalist society attempt to make a profit for providing products and services customers want.

None of these big banks are “for profit.”

Well, at least not profit as in “surplus from properly managed transacting in voluntary affiliation with customers and counterparts.”

Rather, every single one of them is a den of “creative accounting,” propped up with massive bailouts stolen from the future earnings of our grandchildren, paying themselves billions of dollars in bonuses while shouting loudly that “we demand more! Pay up or we’ll fail and you’ll pay up anyway!”

Enough. Audit them, put the insolvent institutions into resolution, cancel the stock, cram down the bonds, and charge the perps with criminal conspiracy and fraud.

For profit. Really.

A checking account has value and so does a debit card. It’s nice to have something safer than your pocket to keep your money in. Banks should charge something for these services. If one doesn’t want to pay the bank’s fee(s) then one is free to go to another bank or to a credit union. Or live without a bank account like a lot of people do.