Readers may recall that we posted on the credibility-straining claim by the former GMAC’s, now Ally’s CEO, that his bank was no longer engaging in robosigining.

Now in fairness, we might have a little clever use of terminology at work. Robosigning narrowly speaking, refers to the use of low paid staffers to execute documents used in court filings by the hundreds per day. This created a huge scandal when it broke because it was a flagrant violation of court procedures. Affidavits, for instance, are used in place of testimony and are required to be based on personal knowledge. A $12 an hour functionary churning out signatures clearly has not even read the paperwork, much the less has any knowledge of the various foreclosures he is pushing through the pipeline.

Ally and other major servicers now piously claim that these systematic abuses of legal procedures that date back to the 1677 Statute of Frauds were mere “sloppiness” or “paperwork errors” and they’ve cleaned up their act. Should we believe them?

While services like #5 Ally may well have dispensed with factory-style signing procedures. there is evidence on the ground that says that the banks have not made meaningful changes. But there is even evidence that robosigning is still taking place, AFTER the banks were supposedly investigated by 11 Federal regulators (we’ve repeatedly expressed our skepticism about that efforts, and our doubts were confirmed by the GAO) and after the servicers entered into consent decrees which made this sort of thing impermissible.

In July, two separate investigations, one by Reuters, one by the Associated Press, found that past robosigners were still cranking out signatures. Reuters identified six robosigners at five different servicers. As we wrote:

So…the banks have perjured themselves, made commitment to regulators that they are brazenly violating. The Reuters investigation determined that at least 5 of the 14 servicers that signed consent decrees in April are not complying with their requirements: OneWest, Bank of America, HSBC, Bank USA, Wells Fargo and GMAC Mortgage. Note that three of them (Bank of America, Wells, and GMAC, now Ally) are among the five biggest servicers, so the impact is greater than the number of derelicts suggests. And one is the annoyingly pious Wells, which keeps maintaining, contrary to all evidence, that it is better than the other servicers. In addition, another six servicers that did not sign the consent orders were also found by the Reuters exam to have engaged in abusive practices.

The AP report found that servicers were continuing to generate documents signed by well-known robosigners, including the notorious Linda Greene. This seems to be asking to be caught out…

Remarkably, the head of the industry lobbying group admits this is happening

Now it’s possible that Ally has since reformed, but that seems highly unlikely. Remember, many of the major servicers halted foreclosures, either in many states or all over the US, and claim that they resumed only after investigating and remedying any problems. Thus Congressional investigations, regulators, investors, and the general public have been told, falsely in some, perhaps most cases, that this fraudulent behavior was a thing of the past.

But it gets even better. The Nevada attorney general, Catherine Cortez Masto, was instumental in getting legislation passed that makes it a crime (a felony) to file improper paperwork with the courts, subject to 10 years in jail and fines of $10,000 per violation. Note that this legislation did not change the legal requirement for foreclosure; it simply criminalized failure to comply.

What happened when the law became effective? Foreclosures stopped. In other words, no one who had been filing foreclosures was confident that their procedures complied with the law. Moreover, Masto says in this segment today on Dylan Ratigan, “There’s no doubt that there’s robosigning occurring”

Visit msnbc.com for breaking news, world news, and news about the economy

Further proof comes courtesy April Charney. Last October, New York implemented a requirement that all attorneys in residential foreclosures certify that they take “reasonable” measures to verify the accuracy of documents submitted to the court. From a formal standpoint, all this did was reaffirm existing law, but procedurally, it makes it much easier for borrower’s counsel to get attorneys who play fast and loose sanctioned.

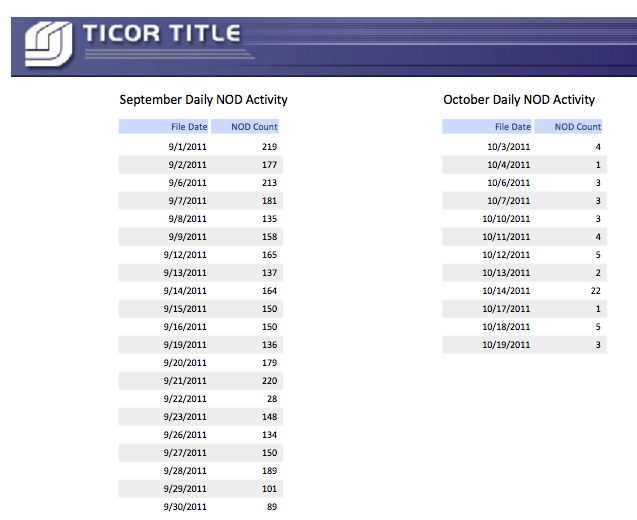

Look what has happened to foreclosure activity before the requirement was put in place versus this past October:

So if you want to believe the sanctimonious claims of the likes of Michael Carpenter, be my guest. But the evidence strongly suggests that he and his peers have and continue to lie brazenly because they have the Federal banking regulators in their pocket.

I know I shouldn’t laugh. It really is sad but the thought that came to me was that they don’t make a rug big enough to sweep this shit under and it made me smile…..I get incensed with the killings around the world in America’s name but flagrant criminality like this is sickly humorous to me. I think it is because it represents the final throes of their bankrupt way of thinking.

So now what? We are all Greece or should it be,

As Greece goes, so goes the 99%.

Laugh the global inherited rich out of control of our society and into rooms at the Hague. If the 99% around the world of “western socialized” countries could make that happen, we could finally change the narratives around what it is to be human in a, hopefully less, class based society.

What a concept.

How much guts do the Millenials have?

http://www.washingtonsblog.com/2011/11/bad-moon-rising.html

While I don’t believe everything in the above posting I do like the description and relative population chunks that are laid out….millenials is one of them.

Sorry, but that essay is deeply flawed. I posted a response but don’t know if it will pass moderation. Neither Strauss nor Howe were historians, for starters, meaning that his very first sentence is invalid.

We are ordinary citizens. This is why JPMorgan Chase Bank and Judge Phillip Pro, a federal judge, can make an open Record of collaborating to subject us to a fraudulent foreclosure of our home. We reside in the state of Nevada and the fraudulent Order rendered by Judge Pro is under Ronald Williams and Jann G. Williams vs. JPMorgan Chase Bank, Chase Home Finance, California Reconveyance Company, The Cooper Castle Law Firm, et al. USDC No. 2:10-cv-00118 PMP-PAL, USDCA No. 10-16102. It is in the face of the legislation making foreclosures based on fraudulent documents that the 9th Circuit Court published an unpublished opinion that affirms the fraudulent Order made in our federal case by Judge Phillip Pro. I can make these claims because, ironically, the federal record establishes them. When Judge Pro made the Order finding that JPMorgan Chase Bank was empowered under our loan documents to foreclose our home, there was absolutely no mortgage instruments in the Record authorizing this. Furthermore, Pro made the Order also in the face of document proof of Chase Bank’s effort to get us to execute a contract that would have fraudulently replaced Washington Mutual Bank, our original lender with JPMorgan Chase Bank. Our case that we continue trying to shop nationwide for some response involves a major bank’s fraudulent scheme to take our home by a fraudulent foreclosure, and a federal judge colluding by knowingly making a Order that enables Chase Bank to complete the fraudulent scheme. I have completed a Complaint under RICO that includes Judge Phillip Pro as an Associate in Fact. Notwithstanding the impediment as the result of being an ordinary citizen, I will shop my complaint – including the fraudulent practices by federal judges – all over this nation until we obtain a fair and just response. Anyone who would like to review the draft of my RICO Complaint may contact me at rnwil3@aol.com. Perhaps if we publish the well documented claims enough we will get an appropriate response. I have filed complaints with the FBI, the Attorneys General – state and federal – and made a complaint with the Comptroller of the Currency. All of these while fully realizing criminal sanctions for providing false information to a government agency. We are only left with publicity as a last resort. This country is becoming scary. In the mist of all that is going on about foreclosures based on fraud, the United States District Court of Appeals for the Ninth Circuit, published an Opinion clearly shown to radify the conduct of JPMorgan Chase Bank and Judge Phillip Pro – the collusion to take our home by a foreclosure based on fraud. We are confident that one day someone with authority to do so will take action against Chase Bank, Judge Phillip Pro and the panel of the 9th Circuit – that the Record open for the whole world to see, documents each of their fraudulent behavior.

Given the account of R. Williams, my reply is that it has been an honour by Americans to say “I am proudly American” but with what he has said it remains for me to be most fortunate to be born and lived as Canadian in Canada and damn proud. America is truly a long way from democratic society.

What would have happened had they been busted selling small quantities of pot? (hint) PRISON

“As Greece goes…” is likely to prove apt. Have a good evening.

Another solid piece.

Is there a rock left anywhere something won’t crawl out from under?

Possibly, but they’re still looking for one that has a clear title…

Banks haven’t changed –

A freind of a friend who works to help folks with bank issues in a near by garrison town says that when caught the banks simply moove on to the next client (victum) – never admitting guilt or making any changes.

Although it won’t make any difference perhaps we should ask that Linda Green and her coworkers be charged ?

I fully approve that. People like Linda Green and Lynndie England are bringing shame to our great enterprises.

Too true. If it weren’t for those hideous degraded folk like Linda Greene our pristine FIRE sector would have never come to such a pass.

And everyone knows that Lynndie inveigled BushII and Cheney into approving torture so that she could get her freak on!

If we could simply rid the world of the 99% what a much better world it would be. eh?

Of course the course at the moment appears to be exactly something along those lines. The insane thing is that morons like the Kochs and Dimon et al appear to believe that when they rid the world of the 99% that they will magically make peace with one another and live in paradise.

Perhaps Linda McMahon could contrive some sort of Wrestlemania Cage Match that would pit the various one-percenters in a battle royal to the death. That might be a way to show them very graphically the end result of their current trajectory. *sigh*

Is Linda Greene even a real person? Or is she a Max Headroom for the banks? If she is a convenient fiction, a name w/o an actual person — who gets prosecuted?

The more amazing thing is that this country has sunk so low morally there’s nobody in charge who wants to charge the banks and their robo-signers.

An Open Letter to Eric Holder

Dear Eric:

Hope you are enjoying a pleasant Friday morning. At 5:00 pm you’ll be able to have a relaxing weekend and perhaps enjoy he last of the fall colors. Oh and a man in your position can always slip out a little early to beat that Washington traffic – no one will complain.

One item you might consider in your busy career – the banks – you know those guys who loan money – are still submitting fraudulent documents.

Now we all know that you are busy with urgent pressing national matters of great weight but how about assigning a few junior staffers to the robosigning fraud. After all if Linda Greene is still robosigning is that not wire and mail fraud – a federal crime ?

And if per chance the junior staffers actually turn up something you can always go after Linda Greene – she is most likely a small fry who is unlikely to put up a fuss. Your attorneys can easily force or threaten Linda in to a guilty plea.

Or if you wish you can use the investigation to pry more funding from the bankers for you boss’s fall campaign.

So this is a win – win for you.

Have a great weekend.

Letter in short: Mr. Holder,

Could you please take a little time out from your busy schedule to, uh, enforce a bit of law?

Signed,

the 99%

P.S. Occupation coming to a building near you.

The moral contradictions of American society and business and courts and government will eventually bring down the meagre scaffolding of democracy to be succeeded by military junta.

It is difficult to understand why the Fed, which is chartered to regulate financial institutions, does not have an audit function. (Yes, perhaps it does – I wouldn’t know. But with stories such as this one that come to the fore, one is obliged to wonder …)

Which means that over a given region that auditors, unannounced, will enter a credit institution and conduct analyses of policies and procedures.

Moreover, it would help if a set of regulatory guidelines (aka “Policies and Procedures”) were established and, to receive their accreditation from the Fed, the credit institutions would be obliged to sign an adherence to those guidelines.

We are not sufficiently policing this activity – which is very sadly obvious – and, if it is a question of jurisdiction (local, state or national), then that should be settled by law.

Otherwise, we are living in a land of non-law. We must all respect the law – but the law must also respect the rights of its citizens. Law enforcement is at the heart of any civilized society or economy.

I am confused by Yves explanation of the Ticor Title chart showing a dramatic drop-off in foreclosures, starting in October 2011. In this post, she refers to the NYS court procedure change as occurring “last year”, and she wrote in 2010 a blog post about the then new requirement for foreclosure lawyers to certify that they had taken “reasonable steps” to ensure the accuracy of documents:

http://www.nakedcapitalism.com/2010/10/more-on-judicial-pushback-against-bank-foreclosure-proceedings-new-york-requires-reasonable-verification.html

So what is the significance of 2011 data? What am I missing?

This is a before and after comparison. If the banks had fixed their little paperwork problems, as they claim, why aren’t they filing foreclosures in New York?

These are notices of default, the first step in the foreclosure process. September 2010 was the last full month before the new New York certification requirement was implemented. October 2011 is the most current data. If they’d straightened matters out, you’d expect filing level to be similar to or not much below last year’s levels. The dramatic drop says attorneys aren’t filing foreclosure because they can’t meet normal legal requirements. If this is the case in New York and Nevada, it is almost certainly true in all state, but the abuses are continuing because no one faces a realistic prospect of punishment for bad conduct.

Yves,

All the data you posted is labeled 2011. None of it appears to be from 2010. Is the year label (2011) on the September data wrong? Is it supposed to say 2010? Thanks.

In the phrase

“that makes it a crime (a felony) to fine improper paperwork with the courts”,

The word “fine” should be “file”.

Perjury and forgery transmute “careless paperwork” into fraud. So much simpler to do things correctly in the first place.

I think it’s a “people like us” distinction.

“We house servants don’t break laws, just cut a few corners. It’s those field hands who commit actionable felonies.”

Right now the slogan is “nobody’s coming here with clean hands.” I’ve never understood how someone else’s crime excuses your crime, but never mind. Assumes agreeing to a loan on the advice of a banker is criminal.

“Clean hands” is a concept from civil, not criminal law. A foreclosure action isn’t a criminal case. Not paying your mortgage isn’t a crime. In these actions one party violated the contract to pay back the money that they borrowed and the other party has neglegently failed to maintain their records and files. “I lost the paperwork” isn’t a crime either. There isn’t a crime until either the lender claims that the paperwork was indeed done correctly back when the loan was sold. THEN they perjure themselves to the foreclosure court. And possibly become a party to fraud upon the bond purchaser by the securitizer. But those crimes are separate matters from the civil case that they’ve brought against the borrower. Although I think that with the endemic level of fraud going on, bringing in the signers of all the alleged transfers to testify or at least to be deposed is perfectly reasonable.

RECONTRUST (Bank of America’s personal foreclosure “trustee”) has STOPPED ALL FORECLOSURES IN THE STATE OF WASHINGTON.

WHY?

Because Attorney General Rob McKenna has SUED them for, in HIS WORDS, repeatedly breaking the law by foreclosing in his state without being an actual LEGAL TRUSTEE. He went so far as to say that, in fact, ALL FORECLOSURES CONDUCTED SINCE 2007 IN WASHINGTON STATE ARE NOT LEGAL!!! The potential fallout from this HUGE lawsuit has not been discussed a lot yet, but you can look at RECONTRUSTS search function on their website for foreclosures in Washington and it comes up with NONE.

MORE state attorney generals need to do this. Mr. McKenna has started with RECONTRUST because they are one of the BIGGEST perps, but(I happen to know) he is also looking at going after other big “trustees” violating the Washington Deed of Trust Act. Northwest Trustee Services is in 9 states and ALSO owned by common principles who own one of the largest foreclosure mills in the west, Routh Crabtree Olsen. I would expect that they better be putting on clean panties too, although they don’t appear to have the slightest worry and continue to violate the law every Friday.

There are MANY forces acting behind the scenes that don’t quite make the mainstream, that give us all a strong hope that things are finally starting to change. I have been very busy fighting this fight in my own state (Washington) with a crew of others who are not going to take it, and we ARE seeing things about to get REALLY nasty for those who think they have gamed the system without fear of being caught.

CAUGHT THEY SHALL BE.

Caught breaking the law and all you get is sued. Must be nice.

Get caught selling certain drugs, be a nobody and you get time. Occupy!

I just checked records in Whatcom County — Recontrust did some foreclosure sales up here as recently as October–altho they do seem to have stopped sending out foreclosure NOTICES in July–I don’t see any notice of trustee sale in their name after July.

Who says banks don’t have principles?

check out–

http://www.huffingtonpost.com/2011/11/03/bofa-foreclosure-missing-1-already-sold-home_n_1074538.html

Looks like OWS has been reading Naked Capitalism or CREDO.

http://occupywallst.org/article/occupy-wall-street-obama-dont-be-big-banks-puppet-/

“President Obama is on the brink of cutting a backroom deal that would give bankers broad immunity for illegally throwing tens of thousands of Americans out of their homes. The Administration is pressuring state attorneys general to abandon an ongoing investigation into the massive “robo-signing” fraud, in exchange for a relatively small payoff by the banks.”

Hi. Minor yet significant typo:

…makes it a crime (a felony) to fine improper paperwork with the courts…

I reckon you mean ‘file’.

No offense, just trying to help.

A quick check of online property records in our county of about 200,000 people in nortwest Washington state showed that one company–Nationwide Title Clearing–produced 189 signed property documents related to local real estate since June 1, operating out of Pinellas County, Fla. Just a quick check of these documents shows that one person, Kim Goelz, signed as vice president of Midfirst Bank, Washington Mutual, Pentagon Federal CU, Suntrust, and JP Morgan Chase.

I went to the County Clerk’s office to check on the deed of trust for my property, specifically to know what name(s) are affixed. I found out that the lien on my property is listed as National City Mortgage filed July 2003, but I was notified years ago that PNC bought out National City Mortgage. They sent a coupon book and I have been sending my payments to PNC. Should PNC have filed on the deed of trust at my court house?