By Philip Pilkington, a journalist and writer living in Dublin, Ireland

In waking a tiger, use a long stick.

– Mao Tse-tung

Well, it looks like it could finally be happening. The Chinese housing bubble could well be bursting right before our eyes.

The bubble has long been present for all to see, with news reports popping up earlier this year about ‘ghost cities’ and ‘ghost malls’. Indeed, it’s been so visible and so well observed that even the mainstream media picked up on it. That’s right, folks… you heard me right: the mainstream media picked up on it! God, it must be serious!

People have been calling the bursting of this bubble for a while now. But this is the first real indication I’ve seen that this particular house of cards – excuse the pun – is beginning to topple.

On Sunday Gordon G. Chang over at Forbes noted:

“Residential property prices are in freefall in China as developers race to meet revenue targets for the year in a quickly deteriorating market. The country’s largest builders began discounting homes in Shanghai, Beijing, and Shenzhen in recent weeks, and the trend has now spread to second- and third-tier cities such as Hangzhou, Hefei, and Chongqing. In Chongqing, for instance, Hong Kong-based Hutchison Whampoa cut asking prices 32% at its Cape Coral project. “The price war has begun,” said Alan Chiang Sheung-lai of property consultant DTZ to the South China Morning Post.”

Conservative estimates say that property prices in China will fall by 10% next year, while some, such as Cao Jianhai of the Chinese Academy of Social Sciences, see potential price falls of 50%.

So, why did this bubble inflate and what will be the consequences if it deflates?

Dude, where’s my communism?

We could look at the superficial reasons as to why the bubble inflated – you know, the usual non-story of low interest rates and a boom in bank lending. But this is not the root cause – it never is. The real underlying cause is the same as that of the financial bubbles that have plagued our fair Western lands: income inequality.

When the rich stockpile money in bank accounts they often get a bit bored. They then get weary of tiresome productive investments and look around for a bubble to inflate. Property is the name of the game these days.

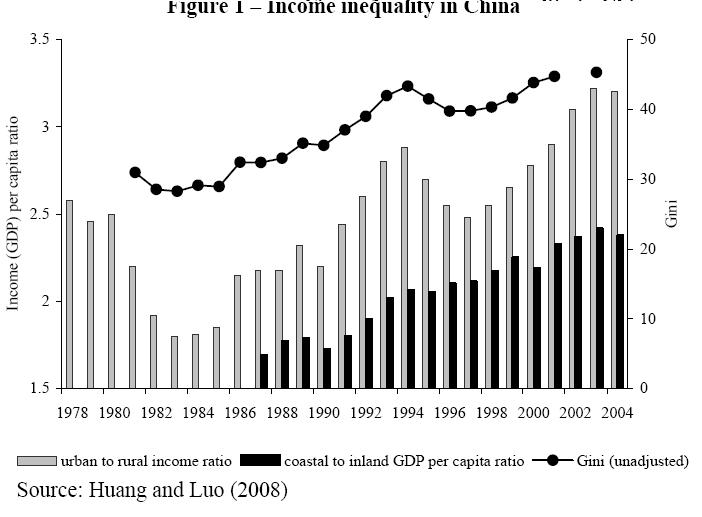

A 2008 World Bank report says it all. Not only is income inequality rising, but people in the urban centres are seeing their incomes rise much faster than people from the rural areas. You can see all these dynamics on the chart below which is taken from the same paper.

As we can see, the difference between urban and rural incomes rose sharply as China’s economic growth took off. In addition to this those on the coast saw their incomes rise substantially faster than those that live inland. This geographical dispersion of wealth likely exacerbated underlying trends, ensuring that wealth was concentrated in certain geographical centres that would then become hotspots for property speculation.

The bubble got a boost in 2008 when the Western finance-o-sphere melted down from… erm… another housing bubble. In response to flagging demand from the West, the Chinese government initiated a humongous stimulus package of $586bn. This stimulus kept the property market intact, together with the robustness of the Chinese economy.

But it looks like it’s all over now. How sad.

Is the housing bubble a paper tiger?

So, what happens when this thing falls apart? Worst case scenario: we get total meltdown. The Chinese banks would probably hit the wall, the economy would fall apart and China would finally have to deal with all those disgruntled and underpaid workers that have, until now, been off the streets only because they have crappy jobs.

In addition to all that domestic nastiness, the current commodities bubble would probably deflate and the Australian mining sector would grind to a halt – finishing off one of the only remaining English-speaking economies worth a damn. (There would also probably be a knock-on effect in that the Aussie property market would finally implode as well).

Not very pleasant, huh?

Well, the doomsayers are probably going to be a little peeved because in all likelihood the bursting of the Chinese property bubble will likely prove a paper tiger.

You see, we in the West seem to think that a financial crisis – and crises related to the extension of excessive credit – must be catastrophic for the real economy. But this is not so. If there is a strong government in place that operates under its own sovereign currency and has no childish qualms about increasing deficit spending, then pretty much any financial-ish crisis can be deficit-spent into oblivion.

As Bill Mitchell put it the other day in an excellent post about Western doomsday fantasies surrounding China:

“The Chinese government is the currency issuer and they demonstrated during the early stages of the crisis that they know exactly what they are doing with respect to using that monetary supremacy to maintain growth as one component of spending collapses.”

That says it all really. If the property bubble collapses, the Chinese government can simply extend and expand the already existing government construction projects. Hell for the environment, of course, but not so much for the Chinese worker. They can boost this with New Deal-style direct government works projects if they so wish. In fact, they can do pretty much anything they want to boost domestic employment and demand because they don’t have the likes of John Boehn-head cock-blocking them every time they try to get anything done.

This will probably provoke inflationary pressures, but given the choice between widespread unemployment – ‘unemployment’ being Chinese for ‘social unrest’ – the government will likely start to ignore it. Indeed, they will probably come to realise, if they haven’t already, that their inflation problems are likely due in large part to income inequality. This will spur them on to create the domestic consumption base that they sorely need. And if it doesn’t the inflation itself might just do the work for them in the coming decades.

Either way, the money currently be splurged on property will find its way into the domestic consumption base and into investing in productive capacity that supplies this base. The Chinese government can either do this directly through redistributive taxation policies or the inflation will take care of it by eroding the value of the upper-classes hoardings… erm… I mean ‘savings’. I’d favour the former, but if ignorance (and power-plays) win out the latter will suffice in the medium-to-long run. Just ask Latin America!

Yes, the property bubble in China looks like its bursting. But no, this will probably not prove to be a catastrophe. Instead, we in the West are going to get schooled once again, when our Eastern ‘comrades’ show us just how to run an advanced capitalist economy. History, eh? It’s just one big irony.

I want some of what he’s smoking.

Paul Volker may be smoking the same stuff:

http://www.nybooks.com/articles/archives/2011/nov/24/financial-reform-unfinished-business/?pagination=false

If i were smoking what your smoking id be ready to try something else too. Have you considered getting clean?

wow. just…. wow.

seriously….it’s like crack mixed with heroin in an lsd laced pipe.

I mean, making that kind of argument is sort of like saying there are no economic consequences to anything. So ridiculous I don’t even know where to begin.

Economics is not physics.

We’re not dealing with an impersonal system with mechanical response to stimulus. We’re talking abut a dimensionality that describes human behavior. It’s not a natural system. There are no laws that aren’t describing human behavior.

An economy is a man-made thing, and human preferences make great differences. If you don’t imagine this degree of control, it’s a lack of imagination, or information.

And, your point? (other than we can just play calvinball and there will be no cost to it.) Geez….

The way that I would put it is that a lot of this is social relationships, not physical realities. But we tend to treat certain social relationships as if they are more like physical realities.

Concretely, right now in China, there is much empty housing and many people who need better housing. Physically, all we need to do is match them up. That we can not do so is a social issue, not a physical one.

If we want to drive so much that we need 10 million units of petroleum and we only have 8 million units, then that is a physical issue.

These are two different situations. MMT will work in the first situation but not in the second.

Going one step further, I think that capitalist industrial economies always produce more goods and services than they create income to buy those goods and services.* A shortfall in demand is endemic. We may get around it for a while through borrowing or by export-dependence (Germany, east Asia). But those “solutions” create an even larger shortfall in demand down the road.

If we create money out of thin air, as long as we stay within the limits of that shortfall in demand, this will be economically beneficial.

There would be social issues to deal with, such as free-loading, loss of motivation to work, and the creation of moral hazard. But our current insistence that debts must be repaid, regardless of how much damage this creates is already creating these social problems. So they can not be used as an argument in favor of staying the current course.

If the amount of extra money we created exceeded the excess goods and services (=the shortfall in demand) or I am wrong and there is no such excess/shortfall, then yes the extra money would make no difference overall. (Although by causing inflation, it might have distributive effects, for better and/or worse)

This recognition of endemic overproduction/shortfall in effective demand is what makes a limited MMT make sense.

* I know that theoretically (Say’s Law for example), this overproduction/shortfall in effective demand can be explained away. But empirically speaking, capitalist industrial societies all seem to either be slowly building up debt or be dependent on exports (to someone else who is building up debt) or taking advantage of a temporary reduction in overproduction (for example, the US after WW2 enjoying an advantage from the destruction of Europe and Japan’s productive capacity).

when i read your very well written, learned, reasoned response, all i can think to myself is this

“nobody really knows how the economic system actually works, but we all rely on it to work for our very existence. we are screwed”

So Jessica, I agree with the thesis of capitalist overproduction, in the broad sense. There may be absolute overproduction relative to aggregated demand. I think that there is certainly _misallocation_ of production such that there are far too much of some things while rather too little of others. Whether the imbalances are structural or behavioral is a ripping good argument (to which I haven’t the foggiest of an answer); sum of both, I’d expect, to pun upon it.

I would be more of the view that the first focus of effort would be to depress overproduction, most logically by taxing it on an exponential scale above target thresholds but perhaps in other ways too. Monetizing demand will never be exact, and I expect systemic issues from it that are hard to foresee and harder to optimize, so from that position monetizing demand should be administered by the grain, not by the ton.

All of this will be very difficult to achieve politically in the present context. Present financial governance operates on the principle of giving money (or monetary opportunities) to Very Important People. Very Age of Absolutism and all that. The idea of restricting to much production/profiteering on X is hundreds of years ahead of the minds of our time. And society is a slow learner; needs lots of reps.

I think her point was ECONOMICS IS NOT A FORCE OF NATURE ITS A LIFSTYLE CHOICE. Did you catch it that time?

and human beings are not natural. or something.

The west is better than China at allocating capital but China is better at hiding debt.

China was able to hide bad loans from the Asian currency crisis. Why will their housing bubble be different?

A strategy only works until it doesn’t. Some day China’s strategy won’t work but its failure may or may not be a direct result of the housing bubble.

They dont hide them. The govt spends them out of existence.

All written from Ireland, I might add. That bubble popping was also a paper tiger? *crickets*

You’re kidding right? Ireland not only has no way to offset it’s bubble popping as it doesn’t have control of its own currency, it also has all these huge foreign banks and nations shoving it around. See any difference from China? I’m not saying Pilkington is completely correct but your comparison is meaningless.

Morons. The Impenetrable density of being. Dont grapple with them its better to get up on the balcony and shout down to them.

A meaningless comparison? Hardly. Orientating an economy to development and construction (and consumption of such) – and built up upon debt – and then to have that facade fall apart? And expecting that just because a nation can print that will solve all of those nasty unintended consequences? Environmental degradation, lack of water, social upheaval. Yup, we can print those away…

Pettis on similar point –

Don’t panic, China’s economy is not on the rocks yet

http://www.ft.com/cms/s/0/0b20afde-0937-11e1-a20c-00144feabdc0.html#ixzz1d58yYxxP

Off-topic, thought this was kind of interesting on Greece: the local oligarchs’ gameplan is 1) squirrel away Euros 2) use the media they own to whip up anti-Euro sentiment 3) post-devaluation, settle tax evasion charges cheap and buy up assets cheaper 4) profit!

http://www.ft.com/intl/cms/s/0/618e57d6-0937-11e1-a20c-00144feabdc0.html

http://policyandmore.blogspot.com/2011/11/leaders-songs.html

“Instead, we in the West are going to get schooled once again,”

http://english.aljazeera.net/programmes/talktojazeera/2011/11/2011114434664695.html

http://www.forbes.com/2007/05/17/bernanke-subprime-speech-markets-equity-cx_er_0516markets02.html

Reminds me of this story. What is there to worry about? Everything is going to okay guys.

Creating inflation via fiscal spending is a nice dream, what you’re likely to end up with is stagflation.

That depends largely upon Industrial Capacity. If it is sufficiently high, then yes, stagflation can occur as additional spending does not increase growth but does augment price inflation.

Our industrial capacity is at 77% at present (see here). Meaning there is plenty of room in it.

Any increase in stimulus spending is unlikely to create inflation. It did not when Obama employed it upon first coming into office and for the very same reason.

So, our economy could do well with some spending. Of course the troglodytes presently in Congress will have none of it.

Last time we saw stagflation it was due to oil price rises and a serious wage-price spiral. It had little to do with government spending. Check yo’self!

In an ideal world, demand side economic crisis are very easy to resolve. Very easy.

But there’s one little problem that Pilkington is just assuming away, as if China was a “special case”.

In all those bubbles implosions, those who stand to lose from resolving the crisis are the very one who are in power. And it will work exactly the same way as everywhere else, as it’s working in the US and Europe, no matter how “special” the Chinese Communist Party.

They will delay, delay and delay to try to save the winners of the boom, the rentiers, at the expense of everyone else, until it’s too late. We’ll probably see a few property owners left to hang with their loses, a few developers and local politicians made to hang from their neck. We’ll see resolve and grand speeches.

But in fine, it will be the same as in the US and Europe. Power is the same everywhere.

Power is not the same everywhere. American and European politicians do not fear their citizens. Chinese leaders, however, FEAR their citizens. That makes a big difference.

They lived through Tiananmen, when many folks literally thought the entire thing was going down. And, much more importantly, CCP leaders lived through the Mao era. They saw what happened to intellectuals, and politicians, and businessmen, etc., when the people rose up. And it wasn’t pretty.

That fear is alive and well in Chinese society today, and that’s part of the reason why there isn’t really a Chinese equivalent of the Republican Party and douche bags like John Boehner and Eric Cantor. In China, they could literally be strung up from light posts if they pulled their nonsense. In America, we merely complain in public opinion polls and buy their ghost-written books when they retire. Oh, and watch them gyrate on Dancing with the Stars.

Big difference.

You are correct here when describing the present situation. However do not succumb to extend the past and present into the future. Paradigm shifts can happen within a very short period of time and things might turn out ugly for some crooked politicians when this should happen. The masses are slowly getting the drift of the situation and it sometimes needs just a match to light up a fire when sufficient inflamable material has been piled up.

The occupy movement is maybe an initial sign of things to come. These movements come usually in waves and no one can predict how the next wave will look like and how peaceful it will remain.

“They will delay, delay and delay to try to save the winners of the boom, the rentiers, at the expense of everyone else, until it’s too late.”

With sufficient fiscal stimulus they can save everyone at the same time. There will be inflation, but my bet is that they either allow it to occur or shift tax policy to reduce inequality. I don’t know enough about Chinese politics to say which.

Just to say, I’m not just blindly making these assertions. We see a pretty clear policy trend in China over the past few years. I think it’s pretty obvious what they’re going to do. I’d almost put a bet on it.

My guess is that everyone will forget about the Chinese property bubble in the next two years — except dumbass Chinese property developers, of course.

So PHilip, I am very much of the view you express in the post, and have been arguing this position for several years. Yes, there has been a bubble. No, it’s demise will not be a major impact on the real economy.

Banks and developers may go bust; the Chinese authorities will simply pixelate money to make new banks. Unlike in, say, the US or Spain, property in China has been far less pumped by _leverage_; rather, the driver was finding places to store new income where equities were unreliable and banks paid nothing. Huge price drops will wipe out savings, not cause debt cascades in the same way as levered bubbles. The money stashed in houses was even ‘out of circulation’ in a way, and will impact liquidity much less than in a levered situation. Commercial organizations were not heavily involved in borrowing or real estate speculation; sure, they’ll have losses, but not of the kind that wipes out entire sectors.

—And that is _if_ the price drop of the deflation is major. If the price drop is on the order of 20% or less, I’m with you: no one will even notice two years after the event. Prices have been _far_ more labile in China at this stage. What matters are cash flows, which aren’t going to be allowed to collapse; leverage, which outside of the property builders hasn’t been catastrophic; and demand, which is not going away and regardless will be heavily stimulated by the government there as it has been for the last three years since the start of the financial crisis.

The deflation of the Chinese property bubble will be among the least salient economic events of 2012, that’s my view also.

“Unlike in, say, the US or Spain, property in China has been far less pumped by _leverage_; rather, the driver was finding places to store new income where equities were unreliable and banks paid nothing. Huge price drops will wipe out savings, not cause debt cascades in the same way as levered bubbles.”

I don’t see why it makes any difference. If the banks were overlevereged they could simply be recapitalised by the Chinese central bank.

In the case you lay out we’ll see a saving/hoarding wipeout which might threaten the banks anyway as assets held fall in value. This may require intervention too. Either way, the central bank will probably have to intervene in the banking sector — but, as we saw in the US, this is not inflationary. (Not that I like TARP… they should have ripped apart the offenders, but macroeconomically speaking it didn’t make a huge difference…).

The key issue is going to be the employment and aggregate demand effects. The Chinese property bubble — like the US and Irish bubbles — hired a lot of people in the construction sector and in the secondary industries tied to it. These people will be thrown out of work. So, that’s the key issue the CCCP will have to deal with. The banking sector, whether overleveraged or otherwise, will be fixed with keystrokes. The employment/aggregate demand issue will require keystrokes + government work programs of some form.

What I am wondering is what happens when the building dance stops? They can play games with the money and debt. We do it here in the USA. But, can they keep their economy going by building 2 billion square meters of housing a year on top of the supply they already have? This is a figure I gathered from an Andy Xie post a few years ago and the average person takes 30 meters, so the typical unit is about 1000 square feet or 100 meters. Building in itself drives building.

Also, Keynesians seem to forget or not realize that breaking windows so you can replace them is a loss and building public monuments squander what could be used in another place. The idea this is rich people bidding this stuff up, means they borrowed the money to inflate this from themselves. If the rich did indeed inflate this bubble, it was the savings of others used to build these projects and speculate in them. There will be blood.

Much of the money used to purchase apartments was not borrowed. Remember that China is unlike America; Chinese people actually save their money. My in-laws own five apartments throughout China and they don’t even have a single mortgage.

And they aren’t obscenely rich. In fact, they’re simply middle-class engineers who (like most Chinese people) save their money.

That’s not to say that there hasn’t been speculation or that middle-class and rich folks don’t invest in development funds, but real money is at the heart of China’s boom, not garbage sub-prime loans and Countrywide trickery.

This is somewhat off-topic, but:

“Also, Keynesians seem to forget or not realize that breaking windows so you can replace them is a loss and building public monuments squander what could be used in another place.”

Do you really believe such a sophomoric Hazlettian rebuttal would constitute any meaningful argument against so-called “Keynesians,” when Keynes spent a large part of his career arguing the very equilibrium that you seem to presuppose is not omnipresent or universal?

When someone has made a tremendous effort to argue “A is not necessarily B,” saying “Don’t you realize that A is B?” is categorically meaningless, and quite frankly very disrespectful even if you absolutely hate your opponent’s position.

This is typical. I called Haygood on it the other day. It’s a central part of right-wing/Austrian thinking (that has crept into the left in the past few years because they lost access to a good economic theory).

Basically, you use metaphor to scramble the argument. It’s usually a rhetorical argument, in the Aristotlean sense.

Although all these arguments are different. For this particular one I’d quote Marx:

“Men make their own history…”

Economics is not physics. We have pretty significant agency. Or at least, the Chinese do. The West still subscribe to the Faith and so their superstitions block them from effective action. (“Opium of the masses”? to quote Marx again…).

“What I am wondering is what happens when the building dance stops?”

When they switch to a consumption based economy. So, 5-15 years? Maybe less? It’s in the works and I’m guessing the unfolding of this crisis will push in this direction hard.

We might even see a Yuan revaluation in the coming 5 years. Let’s just hope the ozone layer doesn’t melt away!

“When they switch to a consumption based economy. ”

Exactly right.

Everyone thinks that the Chinese are fools for excepting worthless IOUs from the US for real goods but they aren’t.

What they have been doing is using the export and lend cycle to get their peasants out of the fields and industrialize there economy………….and it worked.

Who are the fools here?

There intention is eventually 5to run a closed economy and become the next global empire, is my not so difficult, guess.

And I saw Mao mentioned up thread……well, he started them in this direction many years ago whether the current leadership wants to admit it or not.

Great points. I’ve covered similar territory in the NC comments section a few times before, but it’s worth reiterating a few quick points;

1) China can be (and has been) Keynes on steroids. They have enormous cash reserves, incredible fiscal flexibility, and a certain level of economic autonomy due to the fact that they actually…you know, produce things! And as the author noted, they don’t have a Republican Party purposely driving their country into the ground. In other words, they’re going the FDR route while we’re going the Herbert Hoover route.

2) Declining housing prices in China will be a boon to many people. Yes, they will hurt developers, but housing prices in many areas have risen beyond the ability for many average Chinese to pay. The rich will take a hit, but the middle-class and poor will see opportunity. In particular, many recent college graduates find it incredibly difficult to find/afford apartments in and around the major cities. A decline in prices will go a long way toward ensuring their stability and future consumption.

3) When housing prices fall, the average Chinese homeowner will not be destitute because many own all or most of their apartment(s). Mortgages are always short-term and down payments are high. Chinese people literally think it’s strange to take out a 30-year mortgage, and absurdities like interest-only mortgages just don’t happen over there. Different culture.

~~~~~

That being said, I don’t think the Chinese government is omniscient or has the ability to completely defy the “laws” of economics, but they have done many things that may very well carry them through tougher times, e.g., invest in infrastructure, attract multinationals in droves, develop an incredibly skilled generation of students, etc. They have flaws, but they also have fundamentals. I wouldn’t bet against them.

China is going the FDR route? Can this be serious? Like dismantling all remnants of social welfare support, government by fraud and corruption, serious environmental consequences, massive over development co-existing with severe poverty, void of anything even resembling democracy like free associate and free speech, absolutely no respect for human rights. I could go on and on, only to bore readers to tears.

Can we put the blinders aside, please?

if you ask me, it’s the same part of the brain responsible for the “noble savagery” history books.

“they do it over there that way, which is what i think should be done here, so im going to hype the shit out of it regardless of evidence”

see also: people utopianizing the soviet union in the 20s, even the 30s.

“they do it that way over there, which is what i want done here, therefore i will hype the shit out of it, regardless of evidence”

see also the American writings about USSR in the 20s/30s,

academic writings about ‘native cultures’, etc etc etc.

see also American writings at any time on any topic

Surely, the point should have been that the Chinese government reserves the right to alter the numbers on a computer screen due to its control/monopoly of the banking system…

Am I the only one that grows tired from reading such a simplistic and mechanical worldview, repeated in one form or another by monetarists? Is that really all it takes: having one’s own currency while running high deficits, and from that sustain growth to infinity, while at the same time ending gross inequality by expanding domestic consumption?

What a wonderful world. And am I to infer from this . . . that monetarist/deficit state capitalism is something which we here in the U.S.A. should emulate, once and for all ending the financial crisis so we can get back to business?

Is this utopia or dystopia?

Resignation, anyone?

Monetarism?

http://en.wikipedia.org/wiki/Monetarism

“Monetarism is a tendency in economic thought that emphasizes the role of governments in controlling the amount of money in circulation. It is the view within monetary economics that variation in the money supply has major influences on national output in the short run and the price level over longer periods and that objectives of monetary policy are best met by targeting the growth rate of the money supply.”

Uh… did you mean Keynesianism? I think you meant Keynesianism…

If you read the commentary around the term as opposed to being rigidly pedantic, he clearly meant “technocratic.”

As in China has a totalitarian political (non)culture.

That was upthread by one or two comments. (Because I’ve already know your own authoritarian attitude means you like to troll people, I figured I’d point that out):

“don says:

November 8, 2011 at 12:16 am

China is going the FDR route? Can this be serious? Like dismantling all remnants of social welfare support, government by fraud and corruption, serious environmental consequences, massive over development co-existing with severe poverty, void of anything even resembling democracy like free associate and free speech, absolutely no respect for human rights. I could go on and on, only to bore readers to tears.

Can we put the blinders aside, please?”

Seriously, Pilkie. If Mao were around today, he’d take away your MacBook and ship you off to Foxconn so you actually learn something.

Monetarism? I think he meant Keynesianism…

I know what is meant by Keynsianism and I know what is the specific and narrow meaning of monetarism. But, it should be obvious (but admittedly isn’t), that I’m using a definition for monetarism that is more general, namely, the focus on money — as in printing, depreciating, etc., — as a means to engineer desired socio-economic effects.

The world is much more complex than one which can be orchestrated by merely adding to or withdrawing money from circulation whether fiscally or by printing (digitally, of course).

Your views as expressed in this post is technocratic, a form of social engineering.

I retract the notion that running a fiscal deficit is a form social engineering. Obviously it is not.

Having said that, monetarism as I use it here in generalized terms, as opposed to the more technical definition, is technocratic when used to engineer desired social and economic outcomes.

I’m just saying what the Chinese government are likely to and what the likely results of such an action might be.

Is it technocratic? A bit. Social engineering? Doubtful. Standard macroeconomic policy? Definitely.

The good news is that it probably means that some of the inflated commodity prices that were up due to excessive building will return to more normal levels.

I note in passing that China’s Gini Coefficient (a measure of Income Disparity) is almost identical to that of the United States. That’s quite an achievement in that both are amongst the highest coefficients of Unfairness on this planet. (Barring some African countries.)

See here.

economics in the context of an industrial revolution is different to economics in the context of a decadent western economy. They’ve got lots of people very keen to work _and_ consume, just for starters.

Phillip is correct, the Chinese dont yet have a political system thoroughly warped by lunatic right wing billionaires, austrian nuts, Chicago school cronies, libertarian media moguls and ignorant T pottery.

They will use the full power of the sovereign to recapitalize and nationalize any failing banks. They will sacrifice overleveraged regional party heads and over reaching developers without skiping a heart beat. They will minimize any impact of the masses by appropriate fiscal stimulus.

Bill and MMT will be correct (as usual) and the doom mongering nuts will invent some new economic theories to explain their own shortcomings.

No economic collapse, no hyperinflation and no stagflation.

MMT’s latest prediction is doing remarkably well too. Here’s the prediction:

http://www.nakedcapitalism.com/2011/10/philip-pilkington-my-european-nightmare-%E2%80%93-an-infernal-hurricane-gathers.html

And, lo and behold…

http://www.guardian.co.uk/business/2011/nov/07/eurozone-crisis-eu-demands-ecb-rescue

Of course this will probably turn into a nightmare. But still. An investor could have made a few €€€s if they’d played this right. Still could, as far as I can see.

DISCLAIMER: The content of this comment is not meant to advise investors on… blablabla…

Where do you think the enormous 2009 “fiscal stimulus” went if not into exactly the sort of mindless construction/development of Instant Megalopoli that was going on previously? This huge mass of under-utilized everything IS the “Project”, and it IS going to blow in on itself if the leadership doesn’t get even more serious about slowing everything down. If they let up yet again (let alone stimulate) when it does go the scenario so blithely forwarded here is going to be their most fervent Group Wish when they all scramble for their ruby slippers. Causeway to the Moon anyone?

Oh, and try thinking about the word “sustainable”. What it really means – for all of us.

“This will spur them on to create the domestic consumption base that they sorely need.”

“Either way, the money currently be splurged on property will find its way into the domestic consumption base and into investing in productive capacity that supplies this base.”

You so completely miss the point it’s difficult to attempt another response:

The entire Chinese economy is “development” spending/activity, and is an enormous mistake. They are constructing a late 20th-century American-style (now somewhat globalized) ultra-urbanized economic architecture at exactly the same time it is proving too difficult to sustain in the US. And they are doing so years out in front of any sort of natural, evolutionary growth of the economy to in any way effectively utilize it. Those “ghost cities” are not something that cropped up in the last year. They go back at least to 2008. The first one I saw is STILL empty, and they are building 10 a year:

http://www.youtube.com/watch?v=rPILhiTJv7E

China simply CAN’T attain a US level of consumption, and should not even try. And the US CAN”T continue as it is either. The only hope is to meet half-way in terms of material consumption. To get there, we have to be very, very smart. To take the path you advocate is precisely the opposite.

There are plenty of regression analyses of data that describe and even predict collective (macro-economic) human behaviour. It’s when one tries to predict individual (micro) human behaviour that we must call in the sociologists/psychologists.

Most economy policy is performed on the macro-level. For instance, we know very well, from historical fact, that Keynesian Stimulus Spending is a remarkably effective tool for bringing economies out of the Deep Doodoo.

Of course, the T-Party (T for Troglodyte) reps in the HofR are impervious to history, or even modern thought, stuck as they are in their mindless dogma.

The American Congress is making exactly the same mistake as made in the early 1930s by trying to “balance the budget” – which simply prolonged the Great Depression until WW2 came around. Ditto Europe, where the Germans are afraid of inflation (because that happened 90 years ago during the Wiemar Republic), when European industrial capacity is substantially idle.

If one looks at the Roaring Twenties (frenzied consumption) that led up to the Great Depression, itself triggered by unregulated financial excess, one understands the similarity between 1929 (the Stock Market Crash and 2009 (the Seizure of our National Credit Mechanism).

Paraphrasing Sanatayana: “Those who refuse to learn the errors of history are condemned to repeat them”. History has a way of repeating itself, each time in a maddeningly different way.

…truer words… never spoken…

I like this quote though:

“History does not repeat itself, but it does rhyme.” — Mark Twain

This post is *sort of* right, but not quite.

Even the Chinese government can’t reinflate a collapsing bubble. So they won’t.

What they *can* do is build up spending *somewhere else* to compensate for it.

For instance, massive money-printing-based government spending employing armies of people to “improve” rural conditions would probably do the trick nicely.

The Chinese government most likely has no strong attachment to the particular developers who overextended themselves. So, let that bubble pop and start another one somewhere else to keep everyone employed.

Hell, the US could do it if our government weren’t nuts.

“Hell, the US could do it if our government weren’t nuts.”

Hell yes, but we are the mad ones because we don’t believe in the fairytales.

Follow the story line, we can’t spend because……Bond markets would drive yields to unsustainable levels, hyperinflation would engulf us, Government would create millions of *useless jobs*, feckless lazy workers would be rewarded for doing nothing, so called *wealth creators* are crowded out….blah, blah, blah, blah…

Take me now Lord! It’s getting more and more absurd.

Does the Chinese political system even have the wherewithal to do what needs to be done to stimulate domestic consumption?.

As far as I’m aware the consumer boom in the US after WW2 was achieved (among other things) through wealth redistribution and euthanasia of rentiers.

Well there might be a few things standing in the way of a consumer boom with Chinese characteristics.

Doesn’t China have a massively powerful class of people who got/are getting mega-rich from being the assembly plant of East Asian exporters.

Aren’t the interests of this powerful export oligarchy totally at odds with building domestic consumption as they benefit from; low wages, land theft from farmers, no union representation, hellish working conditions, super high savings rates and endemic corruption.

All those things would have to change if there were to be a society with domestic consumption as it’s base.

Aren’t the representatives of these powerful classes, i.e. the ‘Guangdong model’ a leading faction within the communist party at the moment, vying with the more social democratic ‘Chongqing model’ for control.

Even if the ‘left’ wins does the communist party even have enough ‘relative autonomy’ from the major business interests in the country to cut them down to size for the sake of sustainability. I have no idea

“As far as I’m aware the consumer boom in the US after WW2 was achieved (among other things) through wealth redistribution and euthanasia of rentiers.”

I don’t think it really was. The left tends to romanticise these policies — and they were certainly useful (progressive taxation brought inflation under control by my reading and financial reform ensured that there were no bubbles). But the key factors in the post-war boom in the US were:

(1) The accumulated wartime investment, which was a direct result of government spending and planning.

(2) The massive savings that accumulated during the war. These were also the result of the government spending and they stimulated domestic demand in the post-war years. This led to a ‘virtuous cycle’ of ever higher investment and wage growth.

(3) The existence of devastated industrial economies in Europe and Japan, freshly awash with newly issued $$$s from the Marshall Plan etc. (I think this last factor was less important than some claim, but it WAS important).

The Chinese can increase government spending without increasing taxes. However, they will get inflation. As I said in the piece, no matter if they go this route or the more sensible route that the US took after WWII, with a progressive tax system, the result will be the same. Because inflation will erode purchasing power at the top levels and this will rebalance. Either way, GDP growth should remain strong.

Which route they take, as I said in the piece: I have no idea. I don’t know enough about Chinese politics. What I do know is that they will not tolerate high levels of unemployment because they’re terrified of social unrest. They still remember the Cultural Revolution where bureaucrats and government officials were beaten, imprisoned and humiliated by students and workers. And nothing incentivises a government bureaucrat quite like the impending threat of getting his ass kicked!

The US had NO economic competition after WWII so could immediately become “manufacturer to the world” while at the same time using all that central planning genius to create history’s biggest military Empire, one that destroyed many countries with many millions dead and many more millions lives’ utterly ruined.

To use the US post-WWII as the model for anyone else’s economics (a la Krugman et al) is simply daft – those circumstances were as historically unique as the discovery and conquest of the New World to begin with.

Well I’m happy to be corrected

and perhaps the US was a bad choice as an example, i was trying to pick something iconic.

but the point (I think) remains.

After WW2 most of the worlds major economies attempted(or were compelled) to restore economic growth not just by rebuilding, but by redistributive policy and efficient capital recycling, which stimulated domestic consumption. Even in the ‘manufacturer of the world’ as you say, domestic consumption was the mainstay of the economy in the ‘golden age of capitalism’ (according to the dept of commerce In 1960, exports made up 4.9% of GDP). (again happy to be corrected if wrong)

Hell, even the USSR attempted to do something like this under Khrushchev

A consumer society need not be the monstrous chimera of US consumption. It could be music, sport, gourmet cheese or whatever the bulk of the population want to do with their increased wages and leisure time.

I think the rule remains that if you want to have a country that is not a basket case, domestic consumption will have to account for most of your economy (there are exceptions of course)

well I hope your right(great article btw)

That Chinese developer was really tempting the fates when he decided to name it “Cape Coral”.

Obviously, he’s either never been to SW Florida or has a sadistic streak in him.

good article

The responses to this article are hillariously telling. “OMFG!! RU SERIOUS??!” . The liberalfreemarket brain is not born, its force fitted over years. “The economy is an unstoppable force of nature”, and blah blah blah blah.

The fact is China can go on building cities all over China till theyre out room. Then the govt can spend money on something else.We’re paying for it.

The argument presented rests ultimately on the notion that there is no such thing as malinvestment (Austrian sense or not), no such thing as wasted effort, no such thing as a “smart” vs “dumb” investment, all activity having the same value so long as it “employs” people.

China (and others) have swapped modes of living that sustained them for thousands of years for one that only made sense in the unbelievably resource rich temperate lands of the New World emptied of its original inhabitants – that is, until it could no longer maintain it based solely on its own resources.

What China needed to do was create a sustainable 21st century mode of living that completely by-passed the dead-end of US-style mega-consumption. For China (or us) to stay on this present course will prove calamitous.

Oh, and the “ghost cities” have been around for many years, not some recent phenomenon. A colossal waste:

http://www.youtube.com/watch?v=rPILhiTJv7E

It’s amazing to see such thinking even as we bear daily witness to this failed tactic being attempted with Greece.

yes. the soviet union was so successfull with it’s make work programs, i’m sure our glorious leaders in the Red Army (aka the NASDAQ supply chain) will not allow the world workers to falter in their march towards social.. capital.. hwatver. some kind of ism that is really awesome and you should get behind. or else you are a traitor and a spy.