I’m still mystified as to the market reaction on Wednesday to the coordinated central bank effort at waving a bazooka at the escalating European financial crisis. But as readers pointed out in comments, the big move was overnight, in futures, when trading is thin, and there was no follow through when markets opened. And volume was underwhelming.

The officialdom in the US seems to have been slow to wake up as to the direct effects of the Eurobank wobbles on the US economy. I worked for the Japanese in the 1980s, did some work for the US ops of a major German bank in the 1990s, and the story of big foreign banks in the US is largely unchanged: they provide commodity credit (big corporate lending facilities and acting as participants in loan syndications) as their best route to breaking into more lucrative services at the same companies. So as the Journal noted earlier this week, Eurobank stress is leading to a big crunch on all sorts of lending activities.

I have to admit I didn’t believe the intervention could amount to as little as it seemed to in the announcement. Surely the ECB was also committing to buying more bonds? I figured there had to be more to this and there was some juicy intelligence in the foreign language press that wasn’t yet in the English language papers. Wrong. A short roundup of deserved skeptical comments.

So this looks to me like a non-event. Yet markets went wild. Are they taking this as a signal that substantive actions — like the ECB finally doing what has to be done — are just around the corner? Are they misunderstanding the policy? Was this cheap talk that nonetheless moved us to the good equilibrium? (If so, not enough: Italian bonds still at more than 7 percent)

Tony Crescenzi at Pimco focused on the litmus test: if the ECB isn’t changing posture, this was all a big head fake. Only the ECB can provide a real stopgap, and only far reaching changes (both some sort of fiscal authority and addressing internal imbalances) will provide a solution:

The provision of liquidity is no substitute for other actions that Europe must take to solve its current woes. The world continues to wait on European actions on fiscal rules, discipline, and enforcement, as well as use of the balance sheet that matters most in the current situation: the European Central Bank.

Even the normally discreetly cheerleading New York Times was up front in saying that this move was at best an expedient:

But policy makers and analysts were quick to caution that the Fed’s action did not address the fundamental financial problems threatening the survival of the European currency union. At best, they said, efforts by central banks to ease financial conditions could allow the 17 European Union countries that use the euro sufficient time to agree on a plan for its preservation.

“The European sovereign debt problem will not be solved only with liquidity,” the governor of Japan’s central bank, Masaaki Shirakawa, told reporters in Tokyo. He said that he “strongly” expected Europe to “push through economic and fiscal reform.”

European leaders, increasingly concerned by a deteriorating financial picture, said Wednesday they were forming a plan to convince markets that the debts of nations like Italy and Greece were not overwhelmingly large and to set new rules to constrain borrowing by euro zone members. They pointed to a scheduled meeting in Brussels on December 8-9 as a looming deadline for those efforts.

The provision of liquidity is no substitute for other actions that Europe must take to solve its current woes,. The world continues to wait on European actions on fiscal rules, discipline, and enforcement, as well as use of the balance sheet that matters most in the current situation: the European Central Bank.

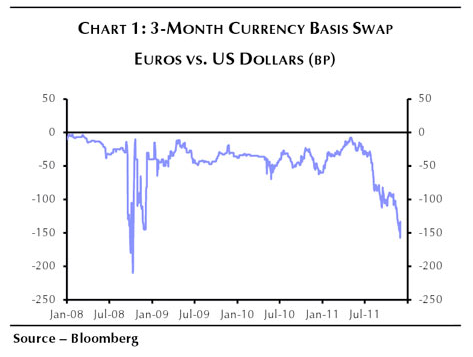

There are also two elements to this story that appear to have gone underreported. As witnessed by the reports of strained credit in the US, dollar funding for Eurobank (remember, they need to fund in dollars to support dollar lending) was approaching crisis levels. This chart comes from the Guardian:

It’s rather easy to ignore the talk of the withdrawal of dollar funding from Eurobanks. We’ve been hearing about it for months, first money market funds pulling back from Eurobank repo and other exposures, then US bank examiners asking pointed questions of US banks regarding their lending exposures to Eurobanks. But the graph shows the condition suddenly became acute. So the action was really not about the reduction in interest rates on the dollar swap lines (Krugman correctly points out it really doesn’t mean much) but that the system was visibly seizing up, and the authorities were telling the markets they were on the case. But this needs to be put in context: this is giving a probably dying patient emergency oxygen when he needs to be put in intensive care.

Second, there is a very important note by Nouriel Roubini at the A-List section of the Financial Times. Roubini is back to being very good, another sign we are in full on crisis mode. His analysis is devastating: Italian sovereign debt needs to be written down, period. If the ECB steps in to buy Italian debt, the result will be that pretty much every private holder will hit its bid. And he doubts the ECB is prepared to balloon its balance sheet up the level of 1.9 trillion.

Now there is one way to improve the picture: the ECB could fund Italy at much lower bond yields. There would be an initial rush to hit the ECB’s offer, but that action would lead spreads on outstanding debt to tighten, producing profits for current holders and making Italy’s finances much more manageable (that does not necessarily mean no restructuring, it creates vastly more breathing room). But for some weird reason, this is a course of action the Eurocrats seem to have ignored. From Roubini:

With public debt at 120 per cent of gross domestic product, real interest rates close to 5 per cent and zero growth, Italy would need a primary surplus of 5 per cent of gross domestic product – not the current near-zero – merely to stabilise its debt. Soon real rates will be higher and growth negative. Moreover, the austerity that the European Central Bank and Germany are imposing on Italy will turn recession into depression…

Even if austerity and reforms were eventually to restore debt sustainability, Italy and countries in a similar position would need a lender of last resort to support them and prevent sovereign spreads exploding while they regained market credibility. But Italy’s financing needs for the next twelve months alone are not confined to the €400bn of debt maturing. At this point most investors would dump their entire holdings of Italian debt to any sucker – the ECB, European Financial Stability Facility, IMF or whoever – willing to buy it at current yields. If a lender of last resort appears, Italy’s entire debt stock of €1,900bn will be soon supplied.

So using precious official resources to prevent the unavoidable would simply finance the exit of others. Moreover, there is no official money – some €2,000bn would be needed – to backstop Italy, and soon Spain and possibly Belgium, for the next three years.

Even current attempts to ramp up EFSF resources from the IMF (which is reportedly readying a €400bn-€600bn programme to backstop Italy for the next 12-18 months), and from Brics, sovereign wealth funds and elsewhere, are bound to fail if the eurozone’s core is unwilling to increase its own contributions, and if the ECB is unwilling to play the role of an unlimited lender of last resort….

So Italy’s public debt needs to be reduced now to at worst 90 per cent of GDP from the current 120 per cent…There should be a credible commitment not to pay investors who hold out against participating in the offer – even if this triggers the payment of credit default swaps.

With appropriate regulatory forbearance, it would allow banks to pretend for a while that no losses had occurred and thus give them more time to raise fresh capital. Since about 40 per cent of Italy’s public debt is held by non-residents, a debt restructuring will also imply some burden sharing with foreign creditors.

Since we seem to have an international policy of “bondholders take no losses until the situation becomes completely untenable,” I don’t see a sensible resolution in the offing. The European leadership has lurched from stopgap to stopgap to avoid taking tough action. Now that the crisis is upon them, badly ingrained habits and tight timetables argue against happy outcomes.

I’m ready for a real black Friday after yesterdays momentum burns out.

some wonk said more people bought stock yesterday than who know what a currency swap is…

the markets were moving irrationally for several days before the announcement…with 6 central banks involved, i doubt it was much of a secret…

I think you will be waiting a long time. Keynes told us eighty years ago that in the long run we are all dead. There is only the short run. It’s Only F***ing Money! They will find a way to print more and more and more and more, to enable all the cash starved “soverign governments” to continue bleeding while maintaining unsustainable and largely useless and counterproductive bureaucratic functions, mostly paying people to interfere with attempts by nongovernmental humans to perform productive work. The big danger here, systemically speaking wise, is the CDS on the soverign debt. You know who is on the hook for that, and the Fed knows who is on the hook for it too. Regardless of what authorities may say, and irrespective of treaties and other diplomatic BS, those CDS ain’t going to pay off. All that requires is maintenance of liquidity, central banks buying worthless toxic bonds, voluntary bond refundings which avoid classification as default, in other words, continued cooperation among world monetary authorities who really have no alternative to cooperation, since default produces no winners. Does this mean the real economy will struggle on on life support or produce a recovery which generates enough new jobs? I don’t know about that but if I had to guess I would say the job seekers will do less well than those with the courage to buy equities at recent lows when these are revisited.

1) short squeeze

2) bank liquidity action translates into more cash for the equity market

3) too much money sloshing around in the 1%’s accounts with nowhere to go

Didn’t we see this movie a few years ago? CBs would rush in, markets would jump with joy on a very thin trading – and, as a result, politicians would say “all’s well, markets are up, right?, so we have more time”, and go into slow-mo mode for another few months.

It is impossible to deal with crisis as a comittee – because every relief rally will give someone in the comittee a chance to stay.

Depending on how much can Merkel/Draghi overrule their immediate colleagues, they might be the only two able to stop EMU splitting up.

BTW, Yves, I don’t believe weaker EUR would solve the problem. If Germany would keep a surplus, it would be either internal or external.

If internal, it would mean that world would have to buy Spanish/Greek/Italian stuff in preference to German. German being almost a brand now, it’s not easy to do, at least not at the same prices as German stuff. Which still means some sort of internal devaluation (wages down) – which would make it hard for them to buy the German stuff in the first place.

If external, that would eat into the markets for the GIPS etc., who again would have to compete on price – at least initially, while Germany would have to recycle their saving somewhere – and EUR would be the easiest. So we’re where we are now.

may sound hilarious (mainly because it is), but the German financial sector lost more money than the current account provided. From this point of view the game could go on for another few years …

I’ve long ago stopped believing the stock market says much of anything. The players and duration of trades have changed such that they don’t communicate anything real. We’re a nation of HFT computerized trading and day traders.

Dear CoaC;

Which would be fine if the actions of the ‘Financials’ in their parallel reality didn’t cause so much generalized misery in ours. This situation is one of many that New Deal reforms were designed to prevent. Good reformers hire competent staffers to keep up with innovations and evolutions in the fields they are tasked with overseeing. The NYFed employee imbroglio highlights the present degraded status of the regulatory regime today. We need a modern Heracles to clean out Wall Streets Augean Stables; preferably by diverting the Hudson through it.

My theory is the Fed stays glued to a Bloomberg terminal all day looking at CDS levels and stock prices of the big banks. When BAC got close to $5.00 they panicked and Ben got into his helicopter.

The stock market is little more than a barometer of ‘animal spirits’ that swings between manic and depressive.

Excellent article in Forbes (surprise!) on the ‘expectations market’ veresus ‘real market’:

http://www.forbes.com/sites/stevedenning/2011/11/28/maximizing-shareholder-value-the-dumbest-idea-in-the-world/

The Dumbest Idea In The World: Maximizing Shareholder Value

[…]

In today’s paradoxical world of maximizing shareholder value, which Jack Welch himself has called “the dumbest idea in the world”, the situation is the reverse. CEOs and their top managers have massive incentives to focus most of their attentions on the expectations market, rather than the real job of running the company producing real products and services.

The “real market,” Martin explains, is the world in which factories are built, products are designed and produced, real products and services are bought and sold, revenues are earned, expenses are paid, and real dollars of profit show up on the bottom line. That is the world that executives control—at least to some extent.

The expectations market is the world in which shares in companies are traded between investors—in other words, the stock market. In this market, investors assess the real market activities of a company today and, on the basis of that assessment, form expectations as to how the company is likely to perform in the future. The consensus view of all investors and potential investors as to expectations of future performance shapes the stock price of the company.

“What would lead [a CEO],” asks Martin, “to do the hard, long-term work of substantially improving real-market performance when she can choose to work on simply raising expectations instead? Even if she has a performance bonus tied to real-market metrics, the size of that bonus now typically pales in comparison with the size of her stock-based incentives. Expectations are where the money is. And of course, improving real-market performance is the hardest and slowest way to increase expectations from the existing level.”

‘seems reasonable….don’t be so old-fashioned.

It’s a virtual reality world now…no place for the facts.

What was important is that all the central banks acted in concert. The State has become acutely aware that the financial system is a threat to it and has reacted. Talk begins about rating the rating agencies and that the role of banks has changed. The state will eventually take over all financial operations. In the USA, I understand, half of us lives directly or indirectly on the largesse of the State. The other half will shortly, not without much confusion by the innumerable prophets of doom, be swaddled by the State.

Reality persists while the prophets continually announce its demise.

I bet for reality.

Mr Campos;

The flaw in your arguement is that there is no unified ‘State’ in Euroland. Even the dreaded central banks each is beholden to a separate political entity with its own populace and agenda. See the present squabbling between Berlin and the other European capitols over whom should first bite the bullet and commence amputating gangrenous financial institutions. The concerted nature of the central banks move is an indication of desperation, not normalcy. That they still aren’t willing to take drastic action to fix this problem is a sure indicator of looming catastrophe. Muddling through is not a viable option. The reality you so blithely endorse is pure D disaster.

Europe is an evolving entity, so to grasp its concept is at this moment impossible. I am not treating of states but of the State as a concept that now realizes that the concept of Financial System is a threat to itself. It is the Other, the Other that is threatening the integrity and viability of the State an so the central banks of various states come together to prevent their common destruction. That is an action of the State as such. The State must survive and how it does it is its manner of existing.

The basis of the problem is the impossibility of there being universal profit. In order to keep the fiction that profit is possible the Financial System has to fall into all sorts of chicaneries but at the end the truth brightly shines. There is no profit. Whatever is said to be profit is a mirage. Why would financial crises happen if profit existed?

‘reminds me of the Penn State cover-up scandal….for the good of all.

or “the end justifies the means.” Machiavelli

Can’t perceive the relationship of what I wrote with Machiavelli’s quote if it is a quote or with Penn State..

> […] the ECB could fund Italy at much lower bond yields.

Huh? That’s not what Roubini is saying. From his article in the FT:

> Italy’s public debt needs to be reduced now […] This could

> be done by offering investors the choice to exchange their

> securities either for a par bond […] or for a discount bond […]

Nowhere does he mention the ECB; the above is just another

description of an orderly default in which, apparently, Italy

itself would offer to exchange its bonds. And which, low and

behold, would actually entail Not Paying any refuseniks:

> There should be a credible commitment not to pay investors

> who hold out against participating in the offer […]

So how would that be any different from previous widely

suggested ways to default?

And the central banks haven’t done anything yet. This is an announcement only that new conditions for Dollar swaps will apply as of December 5, 2011.

Where did my other comment go? Too many links?

Sounds like Obama to me. He comes out, makes a statement then goes to his next fund-raiser while the world is left to deal with it.

So world central banks continue to print more money. Interesting how no one is concerned about the inflationary pressures of this action. Everything time the Fed and other central banks tale a course of action, its always short term focused and never long term focused

Flooding reserves – which is all much of these QE type actions are – is not necessarily inflationary.

Bill Mitchell wrote a great piece on this. Please see here:

http://bilbo.economicoutlook.net/blog/?p=6624

“Tomorrow I’ll think of some way . . . after all, tomorrow is another day.” …

Scarlet O’Hara

It’s gone with the wind.

Europe is Not a Liquidity Crisis Solved by “Coordinated” Support from Central Bankers.

Global central bankers adopted a well-worn-out course of action of promising unlimited liquidity to the financial system this morning. As if that would solve ANYTHING! Just how did that course of action work for the financial system when a full blown credit crisis arrived in August 2007? My wiring fried and short-circuited on hearing this non-sequitur. I thought about some famous quotes from the Robot in the popular 1960s Lost in Space tv show

“I can not accept that course of action…. Does Not Compute….DANGER, WILL ROBINSON! DANGER! (see old youtube clip for a chuckle)

Then I watched how lovingly investors fawned over this non-sequitur. This brought to mind that old Karen Carpenter song: All the angels/central bankers got together and decided to create a dream come true and sprinkled moon dust/unlimited liquidity in your hair financial markets. Why do birds/investors suddenly appear. Every time you/ central bankers are near? Why do stars fall down from the sky? Every time you walk by?

Oh it’s sickening stuff to be sure. The whole charade is an absolute farce. But the kabuki theater of our technocrats pissing and dying and moaning from one day to the next, only to be rescued and resuscitated by central bankers the next does serve one very useful purpose: It creates wonderful volatility for traders to exploit. Investors, well, that is another story. They just have to sit on their hands and watch from the sidelines, content in the fallacious (broken clock) knowledge that in the long run stock returns outperform bonds. Ha-Ha!

The Reuters headlines from yd, “Top central banks move to avoid global liquidity crunch” is grossly misleading. So was their lead-in statement “Central banks from the world’s leading developed economies said on Wednesday they will take coordinated steps to prevent a lack of liquidity in the global financial system.”

To listen to the media, to listen to policymakers, to listen to all the noise out there and absorb nothing more is to get the story exactly 100% wrong. It does not compute to brand this a liquidity-driven crisis. To say this is a liquidity crisis does not follow. If there is a liquidity crisis at all, it is merely a symptom of What-Shall-Not-Be-Named. Europe is facing an Insolvency crisis brought about by creating too much toxic debt and collateral worth less than the fraudulent paper it was printed on.

So, the latest scheme to provide unlimited liquidity to a global financial system “without admitting any wrongdoing” – without taking any writedowns on assets and collateral worth next to nothing, leaves the clogged-like-a- backed- up-toilet global financial system on the verge of overflowing.

The only fix, the only scheme that will work is to get the goddamn plunger out and flush the shit/assets down the toilet. Unlimited liquidity is not a solvent like Drano. Adding unlimited liquidity to a backed-up toilet only adds more water to the clogged toilet bowl. Good luck with that!

Oh, and that other scheme the weekend warriors/technocrats cooked up over the weekend to implement a “fiscal integration process [including] intervention rights” for offending sovereigns with too much debt (bad or otherwise) has holes so big in it you can (as Yves likes to say) drive a Mack truck through them. “Intervention rights” are nothing more than a euphemism for imposing neoliberal policies that inflict economic austerity and depression, social and political disintegration, etc…

Key Observation for SP500:

1) The Santa Claus rally is well underway. No surprise. It should last until either the Dec 9 Summit II date or the Dec 16 payroll tax cut announcement.

2) After Summit II and the Payroll tax cut/extension, the deficiencies in 1) the Summit II resolutions and 2)organized global central bank support should become evident to investors as and when European credit spreads continue to widen.

Summary for investors:

The Santa Claus Rally may be one of the last exits available to you before the shit storm hits the fan in 1H 2012. 2Q 2012 should prove to be as ugly for equity investors as Q2 02 a decade ago during the unavoidable Enron and Worldcom bankruptcies. Q2 12 is fraught with DANGER, given the requirement that EU banks raise reserve requirements to 9% by Jun 30 2012 on top of all their other stressors. This requirement by the drop dead date of June 30 2012 suggests asset firesales will most likely take place in Q2 2012, not unlike the asset firesales seen in Q2 02.

Here, here! That was great John.

Very cleverly put.

Oh, they did quite a lot… nice new precedenct for Helicopter Ben and the others in the Sand Box, this time across the pond. Th frozen turd we insist on kicking down the street is thawing

Heard on Nightly Newshour or Nightly Business Report last night a comment regarding untenable borrowing rates above 7% for Italy and others.

Brought to mind our US-federally insured student loans: loans for students are at 6.99%, loans for parents-of-students are at 8.99%. Progress on that non-dischargeable debt… oh , and good luck getting a job to create the capacity to repay…

We locked a 30 yr fixed rate rate term primary residence refi at 3.85% three weeks ago.

Mixed signals? price discovery? Greed and fear? And the whole thing runs on a diminishing resource which does not seem to be retreating back below $90/ bbl…projected prices in 2020 at $200/bbl… tough to grow yer way outta this coalescence of caca

-from the oil patch

It really only makes sense if the ECB were preparing to flood the Eurozone with liquidity in Euros, and wanted to be sure that any liabilities European banks had in other currencies could be dealt with as well. Without the ECB standing ready to print, these swap lines mean almost nothing.

The only other think I could think of is that the Americans, Canadians, British, Swiss, and Japanese are all preparing for a disorderly end of the Euro and want to make sure it doesn’t cause their own currencies to appreciate sharply, and are trying to insulate their countries.

A month ago, I went and did my annual pilgrimmage… meeting asset managers.

When I asked them how they thought things would evolve their answer was consistent…. If we got a concerted effort, things would work out.

Obviously, they see this as the first step on the road to recovery.

Yes, nice to see Roubini back on track. He seemed to be getting complacent.

I agree with the people who see central banks behind buying future contracts to goose the stock markets. This seems to be a major problem with using liquidity solutions to a solvency crisis. It blows bubbles such as an overvalued stock market.

A strong stock market is ‘good’ in the sense that it provides value to individual and group pension plans that are invested in it. But it is ‘bad’ if it doesn’t reflect fundamentals of the economy and is happening alongside massive unemployment/underemployment, loss of various social safety nets and massive foreclosures based largely on fraud… (ie predatory lending, servicing etc)

I’m no expert but from my understanding, these liquidity swaps only help when banks are about to default (or at least are believed to be insolvent). They are of no use to banks that are known to be solvent. Even when they help, they don’t help the insolvent banks, but rather help these banks’ clients. It allows currencies to continue flowing to the clients (thus preventing some contagion).

The swaps basically just provide liquidity to economies where banks on the verge, awaiting restructuring or bailout, can’t provide it anymore.

They don’t directly help banks known to be solvent. They don’t help insolvent banks to become solvent. They just allow people to continue exchanging currencies in the affected countries.

Setting up such swaps is an admission that banks are on the verge of failing and that there needs to be alternative conduit for currencies other than banks.

It is a non-confidence vote from the central banks.

It doesn’t seem like good news to me.

Strong indicatoins that a French bank was to be deemed insolvent. If these dollar swaps averted that, the Fed can claim that it achieved a 1000 pt Dow move (400 inc + 600 decrease that did not occur, had a major French bank gone under), and its attendant impact on mkt and public psyche.

Moneta

“When I asked them how they thought things would evolve their answer was consistent…. If we got a concerted effort, things would work out.

Obviously, they see this as the first step on the road to recovery.”

I would not invest with any of these guys

That 2% and 20% buys many rose colored glasses.

Yup. However, I can tell you there aren’t many out there with non rose colored glasses!

Let’s say that there’s a 80% chance that it blows up, and 20% that it doesn’t. If it blows up, how many of them will lose their jobs? After all, most of their peers were probably invested in a similar fashion. Now, let’s say that you were all cash, but the ECB and FED continue to kick the can down the road for another year. You underperform your peers, by a lot.

Do you lose your job?

It restores some confidence in the Euro thereby stemming capital flight. So much talk of “the end of the Euro” leads people/firms to consider safer alternatives. Also: I think that MF Global and end-running the Sovereign CDS market have degraded confidence in capital markets somewhat so people/firms may be more inclined to move money than hedge.

It buys time for the Eurocrats to find a solution before their Dec. 9th meeting.

It prepares for possible changes in the Euro Zone – could reduce volatility surrounding an an exit from the Euro.

Lastly, it sparks a rally that punishes shorts (once again).

There were also rumors that a large banks was having trouble (ZH is now speculating that it was Credit Agricole).

The smackdown of the shorts may be more important than it first appears given evidence of Fed’s leaking the action to market participants (who could engineer a strong rally).

We should also be aware that there is a negotiation going on here among Euro countries and banks. How much austerity? How much printing? How much loss of sovereignty? I think the global move strengthens the hand of the Euro-centric Eurocrats. PIIGS might cut a better deal with “the core” if core countries are viewed as desperately trying to save the Euro.

Now to December 9 (which is how a lot of other commentators read this) is not a lot of time, and IMHO, not enough time to come up with more than a gaudier band-aid. It used to be that these dramatic-looking central bank actions were expected to provide real, enduring relief (remember when the TALF was first launched?).

Yes, it doesn’t solve anything. It’s mostly a stop-gap confidence-building measure. And viewed in a darker light, it shows the weakness of the governments and seems a bit desperate.

But it is in-line with what we’ve seen for months: rumors and proposals that go nowhere, yet each propels the markets upward via short-covering.

If you’re looking for “behind the scenes” conspiratorial speculation: Reggie Middleton believes that the Fed acted to ‘bailout’ US banks and hedge funds that had put on trades similar to MF Global’s and were facing large losses for the month of November.

But I think it’s best to view the Euro mess as a negotiation. And the US/Fed is solidly on the side of the the TBTF Bankers and Eurocrats (aka “the core”). To some that makes sense because failure of the Euro could impact the US economy, while others see a global bankster conspiracy.

One thing seems clear to me: the Fed’s much ballyhooed transparency initiative has failed. Everyone is trying to understand what is really going on. But then, it was never about “transparency” was it? It was always about CONfidence.

Roubini:

‘With appropriate regulatory forbearance, it would allow banks to pretend for a while that no losses had occurred and thus give them more time to raise fresh capital’

Isn’t what FASB 157 to mask the zombie banks in US? And still they all are INSOLVENT!

Wow!

” I truly wish the protestors didn’t have a leg to stand on, but the unfortunate truth is that they do.””

http://dealbook.nytimes.com/2011/11/30/on-wall-street-some-insiders-express-quiet-outrage/

Sadly, almost none of these closeted occupier-sympathizers go public. But Mike Mayo, a bank analyst with the brokerage firm CLSA, which is majority-owned by the French bank Crédit Agricole, has done just that. In his book “Exile on Wall Street” (Wiley), Mr. Mayo offers an unvarnished account of the punishments he experienced after denouncing bank excesses. Talking to him, it’s hard to tell you aren’t interviewing Michael Moore.

Mr. Mayo is particularly outraged over compensation for bank executives. Excessive compensation “sends a signal that you take what you get and take it however you can,” he told me. “That sends another signal to outsiders that the system is rigged. I truly wish the protestors didn’t have a leg to stand on, but the unfortunate truth is that they do.”

Speaking as an alcoholic who’d stopped drinking for five months and intends to stop (ya right) after this whole fucking mess is over with in a month or so … yes, a shot of poison can buoy you up for a moment. It is useful for a moment, once in a blue moon. Just not as usual procedure. Anyway, end of lecture. Carry on, assholes. :-(

I suspect that this coordinated was done:

1. To manipulate the stock market upward and create a false confidence (sucker’s rally)to buy time.

2. In reaction to, or anticipation of, European bank depositors fearing an Argentina style fiasco and withdrawing their funds and requesting conversion into any currency other than the Euro.

Boom.

“With appropriate regulatory forbearance, it would allow banks to pretend for a while that no losses had occurred and thus give them more time to raise fresh capital.”

Roubini’s above comment is out of touch with reality. Who is going to give the banks more capital when they are still in the pretend stage and still have large write offs to come (with your new capital). It’s a completely insane idea…the banks need to be nationalized (officially) with equity and debt being written off and down…any other convoluted process is just stealing citizens wealth.

I wouldn’t be at all surprised if this move by the Central Banks turns out to have been a preparatory step for Germany to leave the Euro.

If/when Germany makes that announcement, there will be a “run” on the Euro and into Dollars, Swiss Francs and Yen. These swap lines will help make that process somewhat more orderly.

Can someone explain to me why the Euro is still (relatively speaking) strong, given all the turmoil in the region?

While I know currencies don’t move much generally, is seems odd to me that EUR/USD is still around 1.3, which is where it was in ’06 and ’07. Is it because the dollar has taken such a beating as well?

All I can think of is one word, “Manipulation.” Bet that surprises you!

The political work to be done requires structural changes by the re-writing of treaties, which France and Germany seems to be signaling can and will be done. The market can not wait, so movements from the central banks and other financial institutions will do what ever it can to buy time. But, the fundamental resolutions, are not political or economic fixes, but the need to face non performing loans, write them down, take the losses, and liquidate the destroyed private corporations. Even if the political integration continues, and provides for the fiscal unity of federal taxing authority and lender of last resort backstops from the ECB, the past problems of bad lending won’t go away and still need to be resolved.

This won’t come easily, as the central bank concerted effort indicates. But, in lieu of global sovereign authority, interstate authority in concert via central banks signals the earnest of intent of the nation states to control their fate deliberately with explicit policies and not to be acted upon, subjected to market events. It may not seem like much, it does not do what is required for the immediate needs of the Euro crisis, but if what I see as the emerging negative consensus is the ugly truth, it shows that private capital will not be allowed the free reign to control events within territory that nation state see as their right, if not exclusively, at least with their informed consent as partners with global capitalism. If global capitalism is spiraling out of control, its political usefulness increasingly generates less stability by giving up on providing a middle class life and instead causes rioting, dissent, and a democratic uprising against nation states world wide, then government will reassert itself more and more, if for no other reason, than it realizes how bad the social order has been damaged and much more severe the coming shocks could be. The reason d’etre of the state is to preserve itself in perpetuity, not its allies, and private capital, in particular the finance sector has been a lousy ally of recent years. For raison d’État.

“The political work to be done requires structural changes by the re-writing of treaties, which France and Germany seems to be signaling can and will be done.”

Don’t be such a tool. Financiers in France and Germany ignore treaties as a matter of course. It’s all so much hand-waving to support the pretence that they’re “fixing the problem”, when all they’re really doing is trying to make good on the massive frauds they’ve perpetrated over the last few years.

Walter dickhead, please, you dopes that think financiers are the only source of power are tiring to listen to. Politicians have state power, will have state power when capitalism undoes itself, will wage wars for a reason other than return on investment and will change course when they make the political calculation that they can not afford some allies, that their interests are permanent but not their friends. Please try to grow up and look at a map of the world and take it as seriously as the graph and charts that you read in the WSJ. The whole world is in open revolt, country by country and the people who have more power than money know they can’t print more legitimacy but they can print more money. Do you get that?

But Paul,

Finance/corporations have taken over every part of the State (President, Congress, Judiciary, all important senior department positions) except perhaps some elements in the Pentagon/Security apparatus, as well as the gamut of key institutions (universities, media, many professions like law, economics etc.).

Who is it you view as the “State” that is going to take action to rein these predators in? The people have simply refused to react. I am 100% with OWS and anyone else who wants decisive change, but the numbers of people actually willing to get off their asses say we are getting absolutely nowhere even as we rush headlong into fascism.

while I support OWS, they have yet to lay their hands on any instruments to actually start taking power. If you think setting up tents in a park is taking over power, then the boy scouts have taken over the world many times over by means of the jamboree. Any protesting dissident, and many Occupiers will be the first to say that they are speaking truth, to power. If they had the power to control their lives, they would not be protesting. But that does not protect Social Security, put law breaking bank execs in jail, or rebuild our failing infrastructure.

One of the worst examples of corruption we have witnessed is the lack of prosecution of fraud on many levels of the finance sector. Bill Black, whose book I have and am reading, is a case in point. He is powerless to put anybody in jail, despite his clear analysis on points of law that could lead to charges and successful prosecution. Yet, he has not locked anyone up. He used to, when he was in government. Which is my point. We are not blocked access to power, there are obstacles to be overcome, but I do not believe the government can be held by the regulatory capture syndrome for ever. The National Labor Relations Board is a case in point. It has ruled in favor of unions and ruled in particular against the Boeing Corp for an illegal plant relocation to specifically bust the machinist union by allowing a plant relocation to S Carolina. It was an illegal move and of course, the management is furious. But Boeing can’t do anything about it unless the NLRB is destroyed, which the republicans are attempting to do.

I know many here think they have radical politics or clear headed analysis of how the world works. But what I see is a fatalism, political dead ends, oriented to cursing out banksters, fraudsters, realizing the fascist nature of politics in the modern world and calling Obama a trojan horse hitler or something else. And then, I see, frequently, people attacking any course of action. I call that crowd that is well represented here at NC, the I won’t do anything until we first rebuild society from the ground up faction.

OWS is the heart and mind moving in unison. I would like to see 99 reforms. The first is to limit corporations by government regulation, taxation and oversight. They must obey the law. The second is to protect Social Security by getting rid of the loopholes that allows the wealthy to contribute a fraction of their income while the middle class contributes on 100% of their income. The third is to expand Medicare to anyone that wants it. I am sure that there are more I can come up, with but this is a good start on the way to 96 more. In order to do this, take power, I need to get enough people to vote politicians into power, to take control of the mechanism of state.

What else is there to do to get the laws enforced other than to put people like Prof Black in a position to bring up charges and prosecute? Speaking truth to power is the beginning. Planning and acting to take over the government is the battle in counties and cities across the country that is being waged, in Madison Wisc and Ohio, with the recall of the right wing governor. OWS could learn a lot from the people in fly over territory. They seem to get it. They work together, they support one another and they save their bile and venom for the enemy. And they vote. Why do you think the republicans have a national movement to suppress voting by passing state laws requiring picture ID? If the banksters and the fraudster control evrything, why do they continue to waste their time sabotaging democracy? Why are half of the Congress Reps millionaires? I though if you are sitting on $400 million you lay around a beach. Apparently not, some of the wealthiest people in America forego the wonderful world of capitalism and head straight into political office, like the mayor for life, billionaire Bloomberg, the Berlusconi of NYC. Like DArrel Issa of CA, congressman and passionate hater of all things government and Obama, who is worth $450 million. What is his problem, can’t he just buy a politician, does he have to sit there himself? Of course they do, someone might get elected and stay there following popular demands to do something about the depression we are in.

‘Does Anybody Who Gets It Believe Central Banks Did All That Much Yesterday?’

No. They’re kicking the can down the road again. The banksters have bought themselves time, at a high price, and they will again be looking for the 99% to bear the costs, with interest.

Banks Act, Stocks Surge and Skeptics See a Pattern

http://www.nytimes.com/2011/12/01/business/daily-stock-market-activity.html

Essentially what the banks have done over the last ten years is generate huge profits for themselves – on paper, by creating a gigantic fraudulent debt bubble. Debt enslavement, aka loan sharking, is the traditional tool, and it has been used effectively against everyone from Philip the Fair to Napolean.

Naturally the bubble was unsustainable, based as it was on massive conversion frauds – millions of them, from a few tens of thousands on mortgages to hundreds of billions on the economies of entire countries.

Now the banksters are seeking to make good on their phony paper profits by coercing individuals and governments to trade them for real money and real assets, rather than write them off. They’ve already succeeded in getting trillions. And now they want the rest.

Audit of the Federal Reserve Reveals $16 Trillion in Secret Bailouts

http://www.unelected.org/audit-of-the-federal-reserve-reveals-16-trillion-in-secret-bailouts

As usual, it gets worse the more you look at it.

Walter, Walter, Walter….you’re so negative. Do you think these guys are just in it for the money?

Simply put, “da-uh”.

Any chance that the markets moved because this is an indication that the US Fed will start buying Italian and other Club Med bonds?

1) The short answer is that “markets” are not markets. They have been banksters’ bludgeons for quite some time, but out in the open and completely obvious since the Coup of 2008. Just observe how “markets” interact with key policy decision points all the way through this crisis. Hell, just look at October this year.

2) This was banksters response to their own signal. This is what THEY (banksters) want, i.e., coordinated Central Bank action to bail them out yet again, and “Markets” approve.

3) It buys time until December 8-9. If Germany doesn’t cough up enough then, “Markets” will be “disappointed” again – but there’s no chance they will really crash. None. It will not be tolerated. Period. Look at October. But they already know that. It’s all about bringing enough “Markets” pressure to bear to force the losses on all of Europe’s innocent publics, most certainly including the Germans, via printing.

I’ve long since come to view Roubini as a player, not a disinterested analyst. He’s in full Doom mode, offers a “solution” he clearly thinks has no chance of happening, and trails off with a “if the ECB doesn’t print, we’re all headed to Hel…..”. And note he says “even if it triggers CDS payments”. WHY isn’t he saying “Rip those fucking things up?”

This is all a highly orchestrated attack on sovereignty and public assets across the entire Western world. None of these countries is a total basket case except as defined by banksters’ “markets”. Italy actually has the best debt/liability profile of any major European nation or the US

http://www.investorsinsight.com/blogs/john_mauldins_outside_the_box/archive/2011/11/21/simon-hunt-november-december-economic-report.aspx

The best thing that could happen for EVERYONE is for Germany itself to leave the EZ, form a smaller “core” (with or without France) and for Europe to pivot to face the much bigger challenge coming, i.e., rapid transformation into a low resource-consumption economy.

I posted this last night. Note I could care less about the “investment” angle in this piece. I believe we’re actually going to see a Wall Street-led boomlet in the US for the next couple years or so, as the US capitalizes on its “last man standing” position, THEN the real shit hits. If anything, this very much understates the scale of the problem:

http://www.goldmoney.com/video/martenson-presentation.html

…and this is just touching the surface. Can you imagine what we don’t know?

Remember in the movie “Superman”, when he catches Lois Lane falling from a skyrise from out of nowhere and says,

“You’re okay, I’ve got you.”

Lois replys, “Yeah, but whose got you?”

Pure fiction.

For once I think the old line may be correct only because I have not heard one person say it. I have not read Ritholz lately, so I may be wrong on that, but every other month this happens and there is not a driving event, everyone attributes it to “window dressing”.

I have no idea how group think could take a news event and turn that into window dressing, but I don’t think it’s impossible.

Conspiracy theory number two would be the confidence game. If only we can coordinate a run up in the markets before the holidays people may spend more and we may even have a self-fulfilling prophecy. Considering we don’t live in the real world of cash flows and valuations but the psuedo world of rising yeilds only because of people losing confidence, I have to think a little market goose that keeps on giving must be considered.

The shocking truth about the crackdown on Occupy

http://www.guardian.co.uk/commentisfree/cifamerica/2011/nov/25/shocking-truth-about-crackdown-occupy

In other words, for the DHS to be on a call with mayors, the logic of its chain of command and accountability implies that congressional overseers, with the blessing of the White House, told the DHS to authorise mayors to order their police forces — pumped up with millions of dollars of hardware and training from the DHS — to make war on peaceful citizens.

The Occupy movement has also coordinated national and regional actions. December 6 will serve as a day of action to “liberate” vacant foreclosed buildings. West Coast ports should prepare for the December 12 shutdown, a day that Occupy L.A. is calling “A Day Without Goldman Sachs.”

I think the ECB got the idea from Warren Buffet.

Awesome post