I tend to avoid the year end retrospective/forecast blizzard, although some of the more creative compilations can be fun.

However, some 2012 forecasts crossed my screen, and two were such striking outliers that I thought I’d call them to your attention and seeing if readers have come across other Extreme Predictions for the new year (aside from the Mayan end of the world sort).

The first come from Matt Yglesias, “Happy Days Are Here Again! Don’t believe the naysayers: An economic recovery is right around the corner.” No, this is not a parody, this is a real article. And whoever came up with the title at Slate has a subversive sense of humor. The song, “Happy Days are Here Again,” was an end-of-Roaring 20s confection (published and first recorded in 1929), and made famous in a 1930s movie and as the theme song for FDR’s 1932 presidential campaign. Needless to say, happy days (at least on the material front) proved to be far more remote than that standard promised.

Yglesias’s argument is (basically) that with interest rates super low, consumers will start “investing” again in cars, durable goods and housing. He relies on the idea of the natural rate of interest of Knut Wicksell. Yglesias claims it is “so fundamental that people sometimes forget to return to it.” Huh? This is the old loanable funds theory; it has been debunked repeatedly, recently and rather decisively debunked in an critically important BIS paper earlier this year by Claudio Borio (who with William White of the BIS called the international housing bubble in 2003) and Piti Disyatat. This paper makes an key conceptual contribution to economics yet does not seem to have gotten the attention it deserves (certainly not in the econoblogsophere, no doubt because it is too threatening to orthodox ideas).

To give you an idea of how far Yglesias has to stretch to make his case, his argument that the US has a housing shortage refers back to a recent Slate article of his own, which in turn refers back to another article of his that argues that we merely had a bubble in home prices, not home construction.

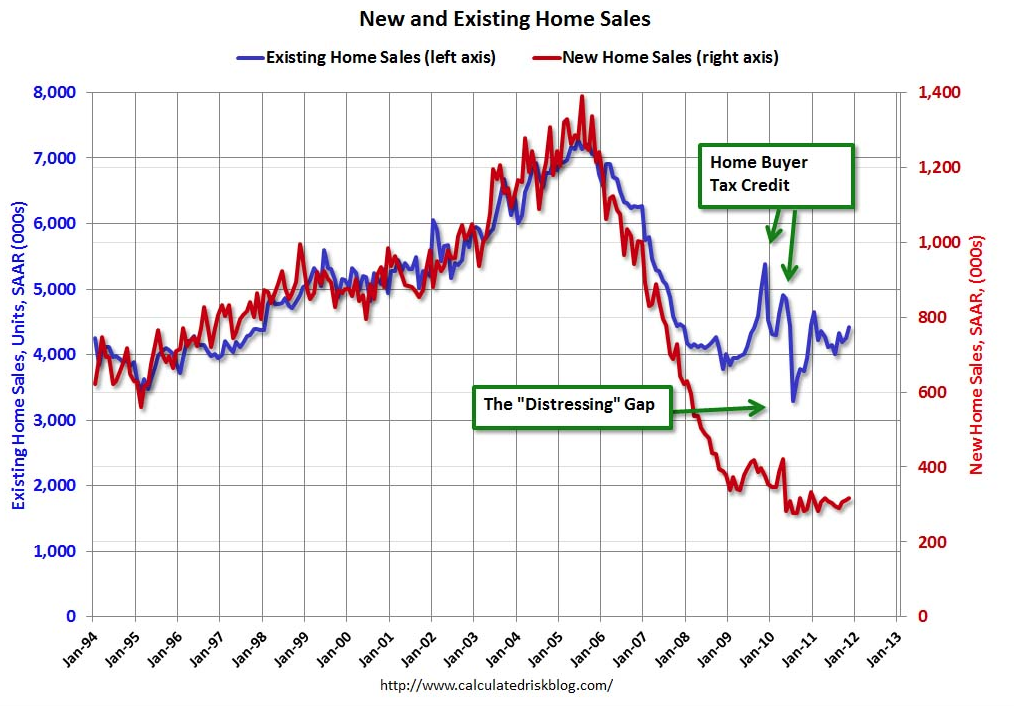

He ignores the overhang of unsold properties and shadow inventory (we have a post from Michael Olenick on that tomorrow that suggests it may be much larger than most people think), or what Calculated Risk calls “the distressing gap.”

Per CR:

Following the housing bubble and bust, the “distressing gap” appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can’t compete with the low prices of all the foreclosed properties.

I expect this gap to eventually close once the number of distressed sales starts to decline.

Let’s put this more simply: Japan has had 20 years of super low interest rates, and banks competing so desperately to lend to corporations that credit spreads are razor thin. People and businesses are not going to borrow and invest if they are not confident of their future. With short job tenures, over 30 years of stagnant real worker wages (and falling in the most recent 12 months), exactly what is there for the bulk of the population to be optimistic about?

We’ve had a very successful three decade effort to break the bargaining power of labor, and covered that up with rising consumer debt levels. That paradigm is over, but no one in authority seems willing to go back to an economic model where rising worker wages drive economic growth. Until we get policies that address that issue, I don’t see a reason to be expect robust growth levels.

On the other end of the spectrum, Max Gardener, a bankruptcy lawyer better known as the informal leader of a large group of effective foreclosure defense attorneys, has published his predictions for 2012. He manages to be more pessimistic than I am (well actually, I find his forecast for unemployment a bit cheerier than mine).

Admittedly, his ones on housing are realistic, which makes them sobering, For instance:

Home Values: Home values will continue to decline during 2012 and I do not expect the bottom of the real estate market to be reached until the 3rd Quarter of 2014. My best guess for any type of sustained recovery in the housing market is no sooner than the 3rd Quarter of 2021. The number of homes in foreclosure will double or triple from 2011 levels and home values will drop by another 15% to 20% by the end of year. I do not expect to see any real recovery in the housing market until at least 2022. A massive number of bank-owned homes (Real Estate Owned or REO property) will be turned into rental properties by the banks and/or mortgage servicers and many more foreclosed on homes will be sold in bulk sales to investors for the same purpose.

And we have this:

Nuclear Nightmares: Early in the New Year, Israel, with technical and logistical support from the United States, will launch a major military strike on all Iranian nuclear facilities and Iran will respond by deploying massive world-wide terrorist attacks and will engage in efforts to cut off all sea routes for the shipment of oil from the Gulf Region. The uncertainty of all out war with US troops on the ground will be present throughout the year and active US military intervention is at least a 50-50 bet.

Eeek!

I suggest you read his Top 12 Predictions for 2012 in full.

Steve Hansen, who did well with his 2011 forecast, wisely choses to duck this year as much as he can (2012 Predictions: Just a Dice Roll). But I have to believe that readers know of other pundits who have made Extreme Predictions. Which are your favorites?

Assuming you can classify hedge funds as “pundits”, Kyle Bass on Japan’s bond crisis beginning within the next few months. I completely agree with his verdict, but I suspect that he might be a bit early on his timing. Still it’s a very interesting and contrarian call

http://www.gurufocus.com/news/154556/kyle-bass-third-quarter-letter-imminent-defaults

As a side note, if he is correct, I can only imagine how the US bond market will react. IMO, either yields become very negative (and no doubt blow up a whole bunch of algo traders in the process), or the forced selling of worldwide government holders of us bonds really picks up, thereby driving interest rates up very quickly.

Given the broad market frenzies on sovereigns elsewhere, it has seemed to me certain that the markets will get around to J-bonds in due course. I’m with you, Typing, that I suspect ‘it’s early yet’ for this to go into run-and-gun mode in 2012, or at least the early part. It’s easy to see the time as approaching head-on to the present out of the mid-term, though.

That Bass guy’s call on Japan appears to be based on the fact that the Japanese savings rate is expected to go below zero in 2012. However, the Japanese savings rate has been going down for a long time. It fell from 11.4% of aggregate disposable income to 2.2% in the decade ending December 2007. Therefore, there doesn’t appear to be any relation between the Japanese savings rate and the demand for Japanese government bonds.

Further, even if there was such a relation, because the risk in Japan is deflation and not inflation, the Bank of Japan can step in and buy Japanese debt if interest rates start to rise. So, although it’s popular in the Austrian-economics blogosphere to predict gloom-and-doom for Japanese debt based on it being 2x GDP, there does not appear to be much (if any) of a relation between interest rates and debt size for sovereigns that can repay their debt via printing.

Interest rates in countries that can repay their debt via printing appear to be mainly correlated to the inflation rate in such countries. I don’t see anything that is going to drive up inflation in Japan, so I expect interest rates in Japan to remain low.

Japan’s export-dependent economy for the last 15 years has been floated on Chinese and US bubbles. Without consistent solid export surpluses (only 1 negative year prior to 2011 since 1980, and that was 2009) Japan is screwed. Their standard of living ranking has been falling for 20 years. Their massive wave of seniors are now redeeming those bonds for income. Japan is virtually without resources, whose prices rocket every time Bernanke overtly or covertly devalues.

They may not go in Bass’s time frame. But they are in serious trouble.

So Fiver, your perspective is much of what informs my own as well. The debt ration per se won’t send J-bonds sideways; there is no magic number. Thus those who want to see such bonds as keeping on keepin’ on have paper justification, just as the illustration that the BoJ ‘stands ready’ is always invoked to putatively prove that everything remains the same. What remains the same, however, is that every economic and financial trajectory for Japan trends down, as it has for two decades. There is a point at which those continuing trajctories and the solidity of Japan’s sovereigns decouple, so to speak. No one can say where that point is, likely because there is no set point but rather a moment of confidence which will be circumstantially triggered. But cross that ‘catastrophe bifurcation’ and private actors will hurl themselves away from J-bonds. Any such debt holders’ revulsion will seriously freeze up public finance in Japan, as it would leave the BoJ to make _all_ markets. The economic and political body blow to Japan that has been Fukushima erased what econo-financial wiggle room still existed there for policymakers. They have no margin for error in a situation that continues to trend down.

The only thing that can save Japan is growth. And no one is predicting that. Ergo . . . it is when, not if, on J-bonds liquifying laterally as damaged collateral. 2012? Wouldn’t be on it. Sometime by 2020 seems likely, though; to me. Could be any time.

If the invisible bond vigilantes do appear out of nowhere in Japan (or if existing Japanese government bond investors suddenly disappear out of nowhere), and interest rates go up, then wouldn’t the value of existing Japanese debt go down?

The last I heard, the average maturity on Japanese debt was 7 years. Let’s round Japan’s total Japanese government debt to $10 trillion. I’m not sure what the average interest rate is on that debt, but let’s say it is 1% per year. That’s probably high, as the 10 year in Japan is yielding a little less than 1%.

If my math is right, the price of a $10 trillion fixed rate 7-year bond yielding 1% would fall to $6.65 trillion if interest rates spiked to 5%. At that price, it makes sense for Japan to buy back their debt for $6.65 trillion and re-finance it at 5%. At a 5% rate, Japan would end up paying a total of $9.35 trillion over 7 years for a bond that originally got them $10 trillion. A pretty good deal.

I didn’t include present values in my calculations, but if investors fear inflation, then the price of the debt would fall further, making it even cheaper to buy back that debt. If investors fear deflation, then the price of Japanese debt would be higher. However, a high price for existing Japanese debt implies strong demand for Japanese debt which is paradoxical to a funding strike. If demand is strong for existing Japanese debt, then why wouldn’t it be strong for new Japanese debt with a higher yield?

There’s zero evidence Japan’s bond market will do anything in 2012. There are, however, a lot of discredited theories. Just let go.

Bond traders need to pick their battles carefully, as Bill Gross learned over the summer. Japan is not favorable terrain. If Kyle Bass trades his predictions he’s going to need facial reconstructive surgery.

I guess your view (and Tony’s above) is why I placed the comment as a reply to a post asking about extreme predictions.

Having said that, it’s simply stupid to think that Japan can continue borrowing at their current rate forever (~50% of their current budget requires borrowed money). Something will have to give–the question is the timing of it.

By the way, THE MOST LIBERAL President the United Sates of America has EVER SEEN, signed MARTIAL LAW into effect.

Salon (yeah, left leaning…but I’m looking for left leaning “call outs”)—Calls Obama to task under “indefinite Detentions”

http://www.salon.com/2011/12/16/three_myths_about_the_det

The NEW YORK TIMES! (calls out Obama)

Read the Salon Article…if that doesn’t scare the Wizz out of you. (Remember, the list that qualifes you to be a “Terrorist” is pretty long (and cray).

http://www.shtfplan.com/headline-news/do-you-qualify-as-a-domestic-terrorist_04062011

If you are a “Ron Paul Supporter” (have his sticker on your car).

1. Expressions of libertarian philosophies (statements, bumper stickers)

2. Second Amendment-oriented views (NRA or gun club membership, holding a CCW permit)

4. Self-sufficiency (stockpiling food, ammo, hand tools, medical supplies)

5. Fear of economic collapse (buying gold and barter items)

6. Religious views concerning the book of Revelation (apocalypse, anti-Christ)

7. Homeschooling

8. Declarations of Constitutional rights and civil liberties

(so, assertion of YOUR CONSTITUTIONAL RIGHTS, makes you a “Terrorist Watch List”

************************

And we wonder why the Pentagon is offering *FREE TANKS* FREE TANKS to any police force in America that asks for one.

WHAT IN THE “F” is the Government “preparing for” in 2012?

Why did Dodd retire? Where’s he running off to?

http://articles.businessinsider.com/2011-12-05/news/30476833_1_armored-vehicles-military-equipment-police-forces

The Government is preparing for Greece to Collapse, thus causing the U.K. to go sideways….those clowns burn the country to the GROUND.

Sentiment is HYPED in America. We then have “Pot Smokin Hippies” and “Tea Party Radicals” buddy up and start to torch buildings in America.

It will make “Mad Max” movie look like a day at the Park with friends.

Be sure to click the Link (it will fast forward you to the 1:45 mark, where it shows ALL THOSE RED NECKS packing heat.

Yeah, more guns in America than we have Humans.

http://www.youtube.com/watch?v=XqjVWifq4Kc&t=1m45s

Would not surprise me AT ALL, if a couple of these clowns have Explosive Fertilizer and some Rocket Propelled launchers….Remember, these are the dudes that read “Soldier of Fortune”.

WE.

ARE.

F’D.

2012

Only if they are being supplied by the FBI.

The Bushehr nuclear reactor is already up and running. A strike would probably cause a meltdown and that’s really going to go down well with public opinion. Bibi can’t be so amazingly stupid as to decisively shift sentiments against Israel throughout the world. He can’t really…?

As I said myself, I’m seriously concerned about a US-Iran confrontation over the next 12-18 months; more concerned than at any previous time. It’s madness and nothing but for the US, but ‘miscalculations can be made.’ In case anyone has the slightest lack of clarity, an economic blockade is fully acknowledged as an act of war in international law . . . But then the US has declared itself _above_ international law several decades ago, so obviously that convention is no constraint on policy or action by the US.

It is not something I think any significant number of Americans understand but a broad miscaluclation on the part of the US provoked Pearl Harbor. In essence, the US ratched up—wait for it—an economic blockade of Japan over four years on the faulty assumptions that a) it would me madness for the Japanese to retaliate militarily, and b) therefore the Japanese ‘would take it’ regardless of the economic damage. In the last months/weeks prior to Dec 1941, key policy makers in the US did finaly grasp that war was imminent—and chose to push into the crisis rather than ease back because a broader policy consensus had already cohered that it was in American interest to get into WW II. However, pushing to the crisis point and only then realizing that it was such was a miscalculation of tremendous proportions.

Iran is not Japan 1941, or close. I seriously doubt any ‘worldwide terrorist attacks’ will ensue. Interdiction of the Strait of Hormuz is a virtual certainty, though, and has been for decades. To me, it is impossible to handicap the outcome of crisis turning into war in SW Asia should we get crisis. But the potential is very, very real. Bushear? That’s the very least of the problem. The Fifth Fleet sinking in pieces to the mud at the bottom of the Gulf: try to get your head around that one, folks. Think American public majority opinion will lean anti ramping up war then?

The 1% could really use a good war. Stop and read that sentence again, I suggest. Having been broadly discredited, and facing extreme public disapproval of public government response to the economic crisis/slavish serving of the 1%, the oligarchy could really use a ‘sedition will be suppressed while we have a {Forever) war on’ moment. I’m not being paranoid bruiting the potential about, it’s all to real. Will it happen? Let’s seriously hope not. But it makes just a bit too much insane-sense for the oligarchy to dismiss the possibility as one might otherwise. Of course Germany thought a good war was just the ticket in 1914, too. Miscalculations can be made . . . .

People forget how much WWII was about resources as vital interests from the Japanese and German perspectives if they were not to simply cede the World to the strongest existing powers – the US cut off Japan’s oil. Might just as well’ve bombed Tokyo.

But don’t forget either that the US embargoes to Japan were sanctions designed to deter aggressive action by the Japanese in China. And as for Hitler…

One said yea and the other no, funny how it works.

Skippy… the twist at the end was a hoot.

So you are telling us that sanctions don’t work? Good to know.

And when did the US become the arbiter of events on the other side of the Pacific?

US has been an expansionary Empire since the get-go. Read Ronald Wright’s “What is America?: A Short History of The New World Order” for a nice intro to that Empire’s launch in the earliest days.

The Japanese had invaded how many countries by that time ?

Mainly Korea and China. Korea was occupied 1910. Manchuria (NE China) was occupied 1931. The main attack on China proper began in 1937.

You mean compared to the US? Or what? We were ahead of Japan by two or three countries over the previous two decades by my count. —Oh, I get it: we’re only counting the _other_ guy’s crimes.

Japan was being grossly imerialist, sure; who wasn’t? Should Japan have ‘been stopped?’ Yes, their imperialism should have then been opposed. But that wasn’t the point of my comment, that the means of opposing their policy were the direct precipatant into war at that time. Nobody comes off clean from those events, as so typically the case in history . . . .

Richard appears accurate, from historical perspective, to forecast as he does: William Blum-“Killing Hope”=CIA documented historical

Any credibility to the story that the Chinese refused to

pay off the bonds paid for and held by Japan for the construction of the railway in Manchuria? And therefore

the Japanese were out to collect on a “legitimate” debt?

And the US had been appointed Global Decider…when was that again?

Richard, you are almost right about WWII. You ignore substantial evidence that Roosevelt deliberately provoked Japanese attack because he saw no other way to overcome America First sentiment. Remember, there were at least 25 million German Americans who had no quarrel with Hitler. For reasons I could never understand Roosevelt felt it was important to save England. As for the liklihood of another war, nuclear politics have proved to be different for the past seventy years. Iran rattles sabres but probably doesn’t want to become a hole in the ground. Even Stalin was smarter than that. What Iran wants most is to continue subduing its own population by feeding its fantasies of zenophobia. No doubt our imperial government will turn its attention in a similar direction. War justifies austerity and also creates full employment, although a good many of the jobs are rather dangerous. As for terrorism, there doesn’t seem to have been any for ten years except in the movies. Homeland Security seems to be just another corporate boondoggle. What seems most likely is an uptick in the spying and snooping economy, with massive waste on high technology. This is nearly as good as war for corporate profits, and at least nobody gets killed except during training. Of course, one should never become complacent about the possibility of diplomatic or military idiocy in any country, particularly our own, so instead of making predictions perhaps we should all just cross our fingers.

The war machine the Germans had built up could not be ignored, as you’ll recall they had neighbors.

They knew trouble was scheduled.

US planners had already decided to go to war in the late ’30’s. They also had already decided pretty much how the world was going to be carved up, with guess who running the show? It was all very coldly, “rationally” calculated. One aspect of this was quite intentionally leaving the Soviets to absorb virtually all of Germany’s offensive capability at utterly horrific cost. The US walked in after Germany had already lost the war and picked up the marbles.

So Fiver, yes, that was the grand strategy—put provoking Japan to attack too soon partially spoiled it. The huge advantage of the US in the WW I was entering late after Germany was not only siginificantly spent but seriously overstretched holding the territory it had overrun eastward. So the quite rational approach for US policymakers c. 1940 was to repeat that; to wait until Germany was significantly overstretched before the US entered WW II. I very much doubt that any serious think anticipated Germany’s sudden attack on Russia in 1941; I suspect most would have bet on the reverse, that Russia would choose the moment as advantageous to attack. But certainly in the autumn of 1941 the US wasn’t ready for war in a material sense, and could have very advantageously waited another 12-24 months before entering the war. The ‘squeeze Japan’ policy wasn’t geared to pop off a war in early 1942 is how I read events; more like to contain Japan and for the time being and let it expend its material trying to occupy China until the US could get around to them.

But when the miscalculated over-firm confrontation with Japan clearly accelerated to ultimatum in Nov, 1941, US policy makers understood the implications, but considered the advantages outweighed the short term costs. Things got going too early for the grand strategy, but it worked out more or less as the grand strategy intended, just a messy start.

So jake, I suggest that you re-read my second paragraph. I directly addressed the possibility of an intentional incitement to war by the US in my remarks. As to ‘substantial evidence,’ I would say that there is sustantial argument and suggestive evidence. As I mentioned, there was a policy consensus that the US needed to get into WW II. As in WW I, public opinion was strongly opposed to that course. Roosevelt and all of his advisors knew intimately how the US used the Lusitania incident and domestic propaganda about other events to overcome American public opinion to enter WW I, and there is no reason to doubt that they were looking for a similar ‘we wuz attacked!’ instance. It’s less clear that the kind of attack Japan pursued, or the timing, were deliberate American goals, and so less sure that the pressure on Japan c. 1941 was deliberately pursued as of that date to provoke ‘some incident.’ There is ambiguity there, and ambiguity elides into my larger point, that miscalculations are easily effected when pressures are heightened while motivations are kept obscured.

As for ‘Iran rattling the saber,’ you may be using that phrase as rhetorical boilerplate, but to me it’s seriously inapt. You do understand, I assume, that we fought a war with Iran throughout the 1980s and were significantly responsible for their defeat in a concurrent war with Iraq? Or did you miss that one? Yes, I know that we never ‘declared war.’ The US did, however, destroy the Iranian navy such as it was by armed action, shot any Iranian aircraft capable of interdicting traffic in the Gulf out of the sky, directly attacked by armed force Iranian oil and military installations in the Gulf, shot, quite indiscriminately, civilian craft out of the sky, and otherwise ‘used lethal military force by design for policy purposes,’ i.e. fought a war.

You do understand, I assume, that we are presently conducting an undeclared low-intensity war on Iran? Invading their airspace; assisting in or directly conducting sabotage of civiian and military installations; inserting US covert military ops for rather more than ‘surveillance’ and regardless violating that country’s territory; and manifestly sponsoring peripheral nuisance insurgencies within Iran’s borders. We _are_ fighting a war of a kind NOW. Talking about this behind closed doors by Iran is useless, as we, the US, have effectively refused any meaningful negotiations that aren’t predicated upon surrender—“stop doing anything we say stop”—and regime change. So the only media Iran has to communicate threat levels, responses, and the like lies in broad public posturing, with an intent to influence world opinion concurrently. What would you suggest they do that they aren’t doing, make nicey-nice faces? The only thing that in any way gets US policy attention are statements of capability to retaliate, so that is what they use. Pretty limited discourse, but I’d say it’s forced upon them rather than self-chosen at this point.

I don’t make these remarks from any sympathy with the regime that governs Iran: their domestic behavior is quite contemptible, if in a highly complex context including the urban-rural divide mentioned by another commentor. If we ceased pushing hard on Iran, the regime there would collapse; that is my opinion. So our intention to push hard says that policy makers in the US want something more or different than collapse of that regime: they want surrender. That is were wars come from, and pressure is high enough miscalculations have swift and major consequences. That’s my view.

Also jake, I’m surprised that you’re surprised that US policy makers defined then, and still, that the defense of teh UK was a fundamental American interest. The extent to which UK and American capital were and are intertwined absolutely mandated that, and still does. And don’t neglect American economic penetration beyond capital into territories under British control. Or for the very relevant extension, when Britain became incapable of maintaining its empire, the US broadly stepped into the same territorial footprint and took on the role: the British Empire is OUR empire inherited, plus and minus a few spheres. So if the UK fell under the control of another nation, and it’s capital and it’s imperial footprint thus fell under foreign control as well, that is a tremendous net loss for the US.

Their are many complexities above that matrix of course, but that is the warp and the woof of things; the rest is just embroidery.

Well, of course, you are talking about the ‘interests’ of the US financial and industrial establishment, as opposed to the interests of its people, which seems to be a constant in diplomatic and military idiocy for the past one hundred odd years. As for Iran, frankly I do not care about what happens there and if I did care I could not do anything about it. It seems to me that any change in Iran could only be a plus for its population or what will remain of it after that change occurs. Nevertheless, I do not approve of military action of any kind until invasion of either California or New Jersey appears likely. As to what “we” are doing vis a vis Iran (or anyone else), don’t blame me as I do not vote or otherwise encourage either imperial aggrandizement or financial chicanery. I find it trying enough merely to survive in spite of them.

I am in general agreement with what you’ve said so far, but there’s a great big difference between the “national” interest, and a nation’s elite’s interest. To suggest going into WWII to save London’s financial role and Empire from falling into “enemy hands” was reason enough just does not cut it – particularly given GB was already in steep decline and its Empire’s constituents in various states of serious chafing for independence.

We have no idea whatever how long the Third Reich would’ve lasted absent US intervention. Given the Soviets did well over 90% of the fighting, it may well have gone down in any event. But the decision by the US in the late ’30’s to go for Empire was a disaster that keeps on giving.

So Fiver, the US didn’t go for empire in the 1930s, it went for empire in the 1880s. Seriously; what followed to Yalta was baked in. It is when one enlarges the policy frame by including more of the timeframe that the interactions define their trajectories more clearly. We were perhaps politically closer to Germany than to Britain or France in the 1880-1910 period, that could be argued, but we were economically deeply intertwined with the latter and really trivially with the former. The fundamental policy error of the later German Empire, frankly, was a failure to invest _in the US_. Had Germany made itself a significant economic partner, we very likely would have chosen them agains the British and the French, but our elite voted their wallet after 1910 as had become their increasing preference anyway.

And Fiver, I think that you seriously underestimate the role and scope of Britain’s Empire in the 1880-1960 period. Britain was the international guarantor of ‘free trade,’ i.e. western ‘free market’ classical capitalist exploitation zone. You confuse the formal sovereignty of portions of the British zone since with economic sovereignty or political autonomy. What was econo-political hegemony by the British became econo-political hegemony of the Americans, quite deliberately on the part of the UK and the US both.

Think of this as a gravity well. Big, rich, massively armed states sit at the bottom, and wealth and authority runs downhill to where they slouch. If the zone which the British had established, and it was broader than their nominal Empire btw, had a portion which tilted toward another power, than the gravy does not sluice into the maw of the Anglo-American elite. It is no coincidence that the centers of international financial transactions are in New York and London: that is the function and result of keeping the largest single gravity well centered upon those two political actors.

Conquering countries is hard work, as the US is again reminded. Intimidating them to accept being robbed with a fountain pen is where the big money lies.

Has the US Empire been a disaster? Morally, certainly. But what I suspect that you haven’t really pulled into the foreground of your analysis yet, Fiver, is that the US would have been _in no way so wealthy_ during the mid-20th century after Yalta if we hadn’t seized hold of the perimeters of Britain’s hegemonic gravity well while preventing Europe as a whole from reestablishing a rival pool. We have lived very fat and rich compared to the rest of the globe’s populace because we’ve rigged the global economy to run the honey down to where we are. Now, with real competition in the offing, the American 1% has decided to cut the rest of the American population out of the dinner party and engorge all of the honey that still comes by itself.

If the US gives up attempting to control it’s hegemonic gravity well—and absolutely we, as Americans, should give that up—we will live on significantly poorer comparative terms to the rest of the world than Americans ever have in our life times. I don’t see that as bad; I see that as both better living by subtraction and as just. But most Americans as I read them are not yet ready to vote themselves poorer by giving up our warring, cheating, and robbing. This, to me, is where ambivalent but sustained support comes from for our neo-imperialist adventures. Not that everyone would articulate this the way that I do here, but that most clearly understand it’s to our _material_ benefit to keep ‘those people’ in ‘their place’ which means living on a very lesser standard of living and autonomy than Ole Exceptional US. I don’t see the US population giving up our hegemony voluntarily. I do see us giving it up because we’re kicked out of parts of it and bankrupted out of the rest. And if so, that’s the fate we deserve since the fate we will have chosen.

To and including kidnapping and killing the most popular Non-Interventionist’s baby and blaming it on a German?

They wouldn’t do that would they?

These people pursue brinksmanship as a policy, calling of bluffs, etc.

People have been predicting this every few months for the past few years, decade? Yawn.

And people were pounding the drums for destroying Iraq for years before enough people believed enough bullshit to make it not only palatable but positively received by most of the population – the bulk of the public had no problem with it UNTIL the insurgency took hold. There are only 2 outcomes acceptable to US policymakers – the regime cracks in the US vice and falls, or it’s going to be knocked over.

Am I too cynical, or does the Iran posturing work to drive oil speculation? I mean, not that GS insiders would have any access to the administration’s next moves. Or anything.

LS,

It has been shown that between 40% and 50% of U.S. intel is now obtained by “Private contractor”…in whose interest it is to drive intel for such, profiteering from destabilization…

Drum beats on Iran serve another very useful purpose, one which I suspect just might be the primary purpose: US fighter jet sales to S. Arabia ($30B) and missile sales to UAB ($3.48B) within the last couple of days. Add to that the missile shield the US has planned for E. Europe. All based on the supposed potential Iranian nuclear threat. Very good for the military-industrial business.

So lambert, I don’t discount that oil price and speculation may have an angle in opporunistic boosting of Western confrontation with Iran. But the policy actors who run nation-states don’t generally think in such terms.

What is far more relevant, to me, is that this confrontation now sigificantly bolsters the despicably corrupt autocrats who rule most of the oil states of the Arabian peninsula. All of those states have seen _significant_ popular unrest over the last year. Left to themselves, regime change would be in the offing or underway in every single one of them; their rulers are than discredited and fundamentally weak. But several—Kuwait, Bahrain, and Arabia—have substantial Shiite populations, and most of the rest are directly on any front line of a military confrontation with Iran. Ramping up ‘the Iran threat’ to this area has been the single largest propaganda/policy campaign of said autocrats over the last twenty years, as an excuse for suppressing popular dissent and a figleaf on the American military presence upon whose implied readiness to intervene said autocrats depend on, realistically, to stay in power.

There are many other vectors of interest—Israel against everybody; US in so Russia/China kept out; fragment local territories to improve penetration of Anglo-American capital; etc. Nothing is ever of uniform intent, sure. But the reason we have an ongoing confrontation ratcheted up tot he point of crisis now is very much to bolster the autocrats who govern throughout Arabia and to thereby excuse American military protection of them when we should really be doing the opposite. As someone else said in another comment below, US policy makers are broadly risk averse, so increasing pressure with a potential for real conflict with Iran seems at odds with that. But the real risk to which US policy makers are clearly averse is regime change _in the oil states of Arabia_. That is seen as the worse risk for continued American dominance, so using a tiff with Iran to bolser our clients’ standing domestically west of the Gulf seems the rational choice. Especially since as I read the tea leaves those autocrats all but told the US to back them up or consider themselves on the outs during Spring, 2011. Barack and Hilary are weak, and so they caved and went all in on the autocrats (especially since what’s been shaping up for twenty years, a Zionist-autocrat bloc in the Near East, seems to come into focus during this past year).

But that is part of the condition which raises the likelihood of miscalculation. We are pressuring Iran not because of anything Iran is doing differently but as a disguise for bracingup Sunni autocrats on the other side of the Gulf. It’s easy to blunder in Iran since our ‘real goal,’ in my view isn’t there at all. Most great historical miscalculations work exactly like this, btw, being part of my basis for concern: something is done in Context A really to improve the state of Context B, but because not done in response to local conditions that something is wildly inappropriate and causes Context A to explode spectacularly. People are stupid, what can I say.

How can the 1% percent Global Financial Elites want this war when they usually like stability and predictability when it comes to profit making. If the 99% percent can’t buy $300 a barrel oil, how do they profit? If mass numbers of the 99% percent are thrown out of work by the disorder to the markets caused by a war with Iran and can’t buy the exports of the 1% percent, how is it good for them????

“How can the 1% percent Global Financial Elites want this war when they usually like stability and predictability when it comes to profit making”

Easy. Profits have ceased to be stable and predictable. More than that, exponential growth demands exactly that – exponential growth. This year’s gains are tomorrow’s baseline. The treadmill’s going too fast now and the rat’s can’t keep up anymore. Not to be deterred, the beatings will continue until morale improves! Ever wonder how it felt to be a galley slave? No need to imagine, most of us in the “first world” are about to find out. Most in the rest of the world already have.

Precisely, the 1% *ALWAYS* profit over war…why do you think we always have a new one to fight every 10-years….they figured out back in the 60’s it was “profitable”..

the 1% could CARE LESS if you can afford $300 a barrel of oil.

there is only *SO MUCH* money out there in the “pool” to share. And once YOU DON’T HAVE IT.. chances are THEY WILL..and you starve to death, no worries…they’ll simply go retire in their 30,000sq.ft “hideaway” in Aspen.

Precisely.

Any strike will also piss off Russia big time since the reactor is partly operated by Russian technicians and Russia

also help get it built.

“Bibi”, as it were, doubtless sees Iran as an investment. Take it from there.

Dude, are you kidding me? Here’s how it plays out in 2012.

Russia with a wink and a nod allows Iran to make a move on the Strait of Hormuz. Israel, with United Sates implied consent sends in a couple 1000 “pawns” to get slaughtered trying to fend off Iran.

Iran or Israel (your guess is as good as mine)—first decides to lob a few Nukes towards the other side.

America, meanwhile…is IMPLODING because Bank of America is going Tits up and OH, by the way, the $70 TRILLION, not a typo the $70 TRILLION worth of Derivatives they just moved to *DEPOSIT BACKED ACCOUNTS* to securitize…. goes sideways.

So, the FDIC has to make good on $70 TRILLION worth of Securities back stopped by *YOUR* money in B of A. (thank GOD, I don’t have money there).

Source:

http://articles.businessinsider.com/2011-11-12/wall_street/30389914_1_derivatives-bank-fdic-officials

Bank of America is saying it’s “Legal” because of a tip of the Hat to Graham, et.al getting rid of Glass Stegal (who thought a Fox guarding the Hen house would work????).

China, therefore PANICS—they already are slapping us for the last TRILLION we had to raise our debt ceiling. Obama needs another TRILLION increase he’s asking for now (leaving “who’s fault” out of the discussion right now). —-So, China looks to Russia to help it back stop some of our debt that’s going south. Russia says “Heck No” (assuming this is a PG board).

Russia convinces China America is worth more under their leadership, than it is with us trying to pay off our Ponzi scheme of Debt.

You do realize America is *NOTHING BUT* one big Ponzi scheme. *THE DAY* we went of the Gold Standard…a BUNCH of Bankers laughed all the way home…because *NOTHING*..not one single thing (but our good word)—had to back our debt anymore..Heck, we need another Trillion, screw it…just print more money. Won’t happen.

So, while Israel is Lobbing Nukes Back and forth with Iran, the entire Middle East goes sideways…and we can’t pull oil out….

China and Russia move on America (while we’re spread thin trying to save Israel and buddy up to Saudi for future reasons). China/Russia/and that Chavez who has a hard on for us…don’t ship and make a move on America….and suddenly you’re learning to speak Cantonese and Russian.

And, all those Crack Smokin Hippies who thought 2012 was the end of the world were right all along…

WE.

ARE.

F’D.

Mark my words….Bank of America goes BANKRUPT in 2012—the Dodd crowd with “too big to fail” makes good on the $70-TRILLION.

And that my friend, will be the answer as to

“Why is the United states Government offering a FREE TANK—FREE MILITARY TANK to any Police force in America that wants one”

http://www.businessinsider.com/program-1033-military-equipment-police-2011-12

And WHY is Obama (probably THE MOST LIBERAL PRESIDENT EVER)—signing documents that create Martial Law in America?

Ask yourself, why is Dodd, et. al. retiring..because those dudes want to be in Yucca Mountain, 1000 feet under ground when “All this” hits the fan..and my friend…it’s about to come too roost….

And if you think I’m a PESSIMIST…just read up on THIS GUY.

Will make me look like a WUSS.

**************************

http://www.maxbankruptcybootcamp.com/o-max-gardner-iiis-top-12-predictions-for-2012

3. Big Banks: One of the top 10 United States banks will fail or be forced into a take over by the end of the year. My best guess is Bank of America. BOA

8.The War that Will Never End

9. Nuclear Nightmares: Early in the New Year, Israel, with technical and logistical support from the United States, will launch a major military strike on all Iranian nuclear facilities and Iran will respond by deploying massive world-wide terrorist attacks and will engage in efforts to cut off all sea routes for the shipment of oil from the Gulf Region. The uncertainty of all out war with US troops on the ground will be present throughout the year and active US military intervention is at least a 50-50 bet.

************************************

To quote Cramer….the best position to be in, in 2012

“Cash and Fetal” (and stock up on Can Goods…but not TOO FAST, you buy more than 7-days use…you’ll end up on a Terrorist watch list (I kid you not).

Welcome to the new Amerika!!!!

Land of the Fr…..Yeah RIGHT!

the Mayan predection was wildly optimistic, at least for Mayans.

I have two simple predictions for 2012: a civil war in Iraq leading to skyrocketing oil prices; and Greece will default.

Also likely but with uncertain effects: Merkel will continue to lose support, and Sarkozy’s tenure will end.

Oh, and not a single EU member will amend its constitution to give Germany a say in its fiscal policy.

@SteveA

Yep, Greece goes bankrupt…AND Europe does too…Those Europeans will TORCH TO THE GROUND…anything taller than 3-feet….They will absolutely go SIDEWAYS…

Heck GREECE has PRIESTS…PRIESTS…losing their minds fighting each other over who will SWEEP what side of the Temple..and they gotta bring in the PALESTINIANS…the PALESTINIANS…as the “voice of reason” to break up the fight????

HUH??? (wiping my eyes, hoping this is some horrible dream).

PALESTINIANS the voice of reason…

Geesh, so you think the Priests are making news all bent out of shape over who’s gonna sweep wide side of the Temple..think about Geppto and his lost job and his “401K” and all the other investments are worth less than the toilet paper in his house….He’s gonna go APE…and also burn the place to the ground.

If you think those Occupy people were nothing but a bunch of “Pot smokin Hippies”—you ain’t seen NOTHING YET. Wait until the Euro goes sideways, they go bankrupt, they TORCH the place to the ground….

Then, BofA goes sideways…takes $70 TRILLION to bail them out….and *YOUR* 401K is now worth about $0.15 cents..*TOTAL*….you don’t think ‘the common man” in America will want to burn something to the ground.

Heck, we got as many GUNS in America as we do HUMANS…and I’m just glad I’m not Brian Moynihan or Lloyd Blankfein when those Pitch Fork carrying mouth breathers come looking for them……

Just DANG!!!

My guess is all those guys will be in Yucca Mountain along with the rest of the “chosen one’s” when the “button” is hit.

Keep this link handy. It’s for watching where charter jets travel (comes in *REALLY HANDY* if you know the tail number of your favorite College Team—see where “coach” is landing during recruiting season… (just remember me by sending me good karma–thank me that way).

Also comes in Handy (if you know the Tail numbers..I don’t)–but find the Tail Numbers of the corporate Jet…and you’ll see where ‘ol Pop is headed.

http://flightaware.com/

The day you see Blankfein, Dodd, Moynihan, et.al Charter the corporate Jet to “Nevada”…..get ready for “IT” to hit the fan……

>….but no one in authority seems willing to go back to an >economic model where rising worker wages drive economic >growth. Until we get policies that address that issue, I >don’t see a reason to be expect robust growth levels.

On the 1st of the year, the minimum wage in Colorado will go above my current pay, so I’m going to get a raise and become a minimum wage worker at the same time.

That BS in math and physics really paid off.

First get it out of your head that Iran is developing nuclear weapons, the idea is too WMD, but do expect them to have their nuclear energy facilities fully up and running, and no Israel will not like it. What is important is the battle of wills between the liberal mostly city people of Iran and the less educated more rural populations who tend to gravitate towards the Iranian army and Navy.

I would not be surprised if Iran annouces an embargo on unauthorised sea traffic through its waters in response to sanctions. You can expect a tanker to accidentally stray into those waters and be impounded. I expect the arab league to ask for help in patrolling that area from Nato and the UN, but this will be turned down through Chinese and russian votes.Oil and Gas prices will rocket and the russians will think it is their lucky day. Expect arguments about what is international and Iranian waters, but no real escalation as the chinese and russians keep a lid on Iran stepping too far beyond what is acceptable.

As for interesting forecasts for next year then I thought Saxo banks idea of el nino forcing a wheat shortage and rampant food inflation an interesting concept. One idea not mooted much is a clash between the IMF and ECB over whether PSI (Private sector involvement)on Greek bond haircuts will involve those held by the ECB. I expect the bonds to be shifted from the ECB to the EFSF first, thus reducing the fire power of the EFSF to virtually nil. A rather remote chance is the idea that the next european bank stress test will actually have teeth as they come to realise that banks have ignored them and increased leverage anyway. Not so remote an idea in my opinion is that despite exceptional support through bad incentives a major US financial institution gets into difficulty and the FED gets its regulatory powers severely clipped. How about Australia and Canada sufferring some banking problems and a downturn on the back of a slow down in construction in China, or even questions about debt in Brazil. Somewhere I saw a prediction that Pakistan will have a sovereign debt problem, a government collapse ,with a taliban friendly government to replace it.

As for: “As for interesting forecasts for next year then I thought Saxo banks idea of el nino forcing a wheat shortage and rampant food inflation an interesting concept.”

big picture agriculture: Global Wheat Stocks are at their Highest Level in Twelve Years

http://bigpictureagriculture.blogspot.com/2011/12/global-wheat-stocks-are-at-their.html

The push for the inevitability of rising global food prices serves a very useful purpose:

Global land grabbing and trajectories of agrarian change: A preliminary analysis

http://farmlandgrab.org/post/view/19825

if what people mean by “a recovery in the housing market” is to suggest that we’d return to a time where real home prices appreciate, it will never happen again in our lifetimes…

the lesson of this recession is that houses depreciate, just like cars…

The “lesson” is that “times change”.

That’s my prediction for the year to come as well: that the times will keep on changing.

But one thing won’t change: my hopes that all who read these words will enjoy a happy and prosperous New Year!

My prediction=another thing that “won’t change”-the U.S. government and both political parties will continue to obscure=LIE to the American people about Wall $treet’s involvement in demise of U.S. $6.5 trillion, world $16.5 trillion per year economies….

I tend to agree. I frankly think anyone banking on housing prices returning to their previous appreciation schedule is not looking at the big picture. Ever rising housing prices are dependent on new buyers coming into the market with stable incomes and access to credit. In order to support ever rising housing prices either wages need to continually rise or access to credit needs to continually loosen.

Anybody looking at current trends can see perfectly well that the emerging two-class society of the US will have rising wages for the elite/digital class and falling/stagnant wages for everybody else who has to compete in the global labor pool. This will put a natural floor on housing prices in locations with non-high scoring school districts. The places where home values will be stable and even rise is going to be mostly focused on schools – parents buying schools for their children. Those with rising incomes will buy into high performing school districts keeping home prices stable there.

So, my extreme prediction is continued decline in housing prices in non-top-level school districts. Housing prices will fall to match the incomes of buyers. Of course, loosening credit standards can throw that off. Demand for housing is still there and always will be – income and credit availability will determine what happens with pricing.

i.e. The Cupertino Union School District in Silicon Valley

and Reed Union, Mill Valley, Ross Valley and

Larkspur School Districts in Southern Marin County just north of San Francisco? You mean like those?

Psssttttt…the next bargain is the San Rafael School

District just north of them with property prices in the affordable range.

Meant to say that those are the best school districts west of the Mississippi, not the worst.

The upper Midwest–Iowa, Minnesota, and the Dakotas have excellent school systems that produce educated graduates. Yet, with some exceptions–the twin cities, e.g.–the area is dying, and those graduates leave. The jobs don’t come here, the graduates go there.

Most of the predictions about recovery seem predicated on a belief that the Western Empire is not in declined. If one does not expect the “next unknown big thing!” to save us, the picture looks like that decline rather than recovery.

Or first the Empire collapses, then the Jedi return. I swear, sometimes the next big thing is staring you right in the face and you can’t see it. But then, I’m both darkly pessimistic and sunnily optimistic at the same time. :-P

James Petras has dire predictions over at globalresearch.ca

I don’t need fantasy when reality is staring me in the face. On the whole, both in the U.S. and Europe the expectations are of a lost decade. That’s not a view of an end of the world. Nor, by the way are statements that we will not have another dot com bubble, or a real estate bubble to save us, signs of fantasy. its just prudent not to assume some unseen miracle is going to come along to save the day if no one can define what it is outside of discussing discredited economic theories. The only reason these theories ever gain any value is that people need the fantasy. The reality, when looking at present day situation, is that the western empire (the U.S. and Europe) are in economic decline. The signs have been around us for 30 years now. Brazil, for example, is now bigger than the UK. Wages are stagnant. Europe was contemplating begging China for help. There is economic and political corruption. None of that is fantasy. What is fantasy is the idea, once again, that some unexplained miracle is going to come along to save us. if someone believes this force is on the horizon, they should be able to name it. The fact is both the dot com era and the real estate bubbles were things that one could see coming. Not so much the bubble, but the booms from them. What’s the next big thing now?

Yglesias exists in a coma of denial. Recovery? How is that possible in a casino economy run by a house of crime? The juice is way too high for any recovery and is getting bigger and bolder every day. See MF Global.

A better prediction would be for banks to start snatching non-financial “assets” like the right to peaceably assemble. Oops. Already done.

I live in a small city in a neighborhood that’s about 100 years old. Since 2008, there have been about a half dozen empty houses in a 5 block radius from my house. Not the same half dozen; one will sit empty for a year or so, maintained but no For Sale sign. A sign will go up or someone just moves in, then another house will go empty. It’s pretty bizarre.

Iranian terrorism, huh? Funny, aside from a lot of accusations from D.C. that lack, whaddayacallit, oh yeah, evidence, I can’t think of a single incident. Unless, of course, you mean terrorism against Iran. That happens a lot.

Ericj,

Friends in Detroit note housing for 2.8 million, while only

around 800,000 remain…

The rental market around here is healthy, and even though real estate is subdued, houses are still being sold.

I just walked past a house that has been empty for quite some time. Now it has a HUD For Sale sign in front of it. That’s another trend I’ve noticed. It used to be the only HUD homes in the city were tar paper shacks on Tobacco Road. I think I’ve seen at least 5 HUD homes near here over the last few months, all of them quite nice.

I guess this is natural in a down market, but I can’t shake the impression that something other than an invisible hand is keeping the price level afloat.

For instance, the only openly bank owned property around here has been empty and on the market for over two years. It was supposed to be a flip; the non-resident owners poured a ton of money into it in 2007, then let it go into foreclosure after the bust. I keep imagining a children’s book about a lonely house that bravely and unselfishly keeps comparable prices high.

Please note that HUD owns most of the urban housing projects in the country. Draw your own conclusions.

Detroit’s remaining population is only 700,000, was over 2M in 1950’s. Almost all middle class has left Detroit and moved to surrounding areas, trend accelerating in last 7 years, poor and unemployed remain. Empty houses are stripped of plumbing fixtures, furnaces, roofing material, etc. That is why you can buy a shell-house in Detroit City for only $3,000. Those sales are counted as part of value of sales.

Max Gardner III –

“6. Chapter 13 Relief: FHFA will implement the NACBA Chapter 13 mortgage principal reduction program for all Fannie and Freddie owned residential mortgage loans by June and the number of new Chapter 13 cases filed in the 3rd and 4th Quarters of 2012 will reach historic levels.”

Does he know something the rest of us don’t? With very rare exceptions, government (OCC anyone?) and State Attorney Generals are doing everything possible to enable banks, not help The Citizenry. Pretty sure banks would never agree to any write down, or, I could see it as part of the so-called 50-State (not so much now) settlement.

Looting bank of choice would go something like this: “Sure we’ll give everyone write downs, but we want releases from ALL liability for future claims”

Of course this will sound great for political PR and the masses, until they find out the write down is 2%.

Israel wholly lacks the military ability to set the Iranian nuclear program back more than a few months (and in the process assure that Iran will proceed directly to a weapon.) The Israelis understand the limits of their own military abilities perfectly well.

Israel will not carry out a unilateral strike. There’s no margin in it for them.

Their one and only goal is to have the US carry out the strike. Even that is merely a delaying maneuver–maybe a year, or two, rather than months.

FWIW, my take is that the 1% are very happy with Obama’s service so far, and have taken the decision that he’s to be re-elected.** (This is why the R clown show will be permitted to continue.) Therefore, I think that the economic boot will be lifted slightly from the electorate’s windpipe. Cue the “morning again in America!” theme, or whatever The Droner’s shills in Chicago come up with.

If I’m right, Yggles, in his weird column, may be re-echoing/prefiguring (and exaggerating) this elite decision, which will be percolating through the backchannels in the Beltway that he’s wired into.

So in terms of prediction, look for economic data that’s colorably an uptick.

NOTE Although, as usual, they’re managing a portfolio of techniques to ***us over. Americans Select if either party implodes, RP on the right, Warren on the left, and so forth.

right-the R clown show is a sidebar-Chris Christie is being

sanitized for 2016, having already been annointed at secretive fundamentalist-corporate clan gathering…

@ lambert, agreed, i’ve been having intuitions based on bits of news here and there lately that we’re going to have a definite uptick in $$$ hopeyness infused (via any truthy, propagandistic, circusistic means possible) into the discouraged part of the electorate (what’s left of it that will be allowed to vote) from here to election day.

as for reality, i am sorry to say i personally am with the earlier commenter, simple crossing of fingers says it all. i’ve never before felt at the new year such a strong sense of foreboding about the year to come, and i reckon that’s a pretty widespread feeling. OWS notwithstanding–and yes, occupy will spread and lead a resurgence of people power, but i expect it will be at least a couple of years before that is fully grown.

den again, i hab a cold. dat must account for some of dat foreboding feeling.

@aletheia33: On foreboding….

FWIW, I think there will be an unusually large number of chances to do good this coming year. That’s not the same thing as saying the economy will “recover,” whatever that might mean, or that Consitutional government will be restored, or anything like that.

For the first time in a long time, I feel that the situation is fluid, that there are more degrees of freedom than usual. That’s down to the Occupy movement, which I’m convinced has shaken the elite in ways that we don’t understand yet. For the first time in a long time (since the mid-70s, really, when they flattened real wages) they are RE-acting rather than acting (and of course doubling down on what they are good at, which is violence (which they also enjoy). For my money (hah) the action to watch won’t be in the kabuki of the electoral process, but in parallel structures at the local level, like Occupy, DIY, etc.

@lambert yes, agreed again, occupy is already a major force, like you i see it as having big unknown potential. i am glad you feel things are fluid and unpredictably more open than in a long while. i’ll take your word for it for today. also agree about the kabuki. i’m engaged locally with DYI already, it’s clear that’s where our efforts will most avail. plus, DYI and working with one’s neighbors is fun. thanks for the reminders and the good cheer. may you thrive and continue to speak your mind as you do so well in 2012.

It is so easy to be negative, so very hard to be positive. If it’s obvious, it’s obviously wrong.

your comment obviously sucks…

The economy is not magic. If you can’t describe how an event will occur, then either you lack the ability to do so, or doesn’t exist. Either way, its not on others to make you feel positive. There’s a book i want you to read: Bright-sided. I think that’s the title. The core point is that people feel the need to be positive in the face of being realistic. realism doesn’t mean negativity, because that’s also wrong. I think its an error to think of the economic indicators as negativity merely because someone has an economic theory to push. The numbers are what they are. The question becomes for those position rosy outlooks to realistically explain how they come to their conclusion, and if their arguments are discredited theories, for us to realize we aren’t dealing in a person who is grounded in science, but in magic.

Never discount the power of magical thinking. It’s Wall Street’s stock in trade. One trick pony, that. It’ll work until it doesn’t – again.

It may time for a big volcano.

Quite soon we’ll enter another Little Ice Age.

There have been two Dark Ages in our civilisation: one before the Classical period in Greece, one after the fall of the Western Roman Empire. Will there be a third one soon?

But the Good News is that the Euro madness might conceivably end, which would probably be less disastrous than frantic attempts to keep it limping on.

dearime: “There have been two Dark Ages in our civilisation …”

A reading of David Graeber’s “Debt the first 5000 years” suggests that the fall of the Roman Empire was the last time the debts were wiped clean. So while trade may have collapsed, it is not clear that the average (now free) peasant didn’t benefit from the Imperial void. The Dark Age may only have been Dark for the banker classes, in other words …

As Graeber points out, it was much better to be a serf than a slave. So the 99% did OK.

How do you start a volcano?

It takes a REALLY, REALLY big IPO.

“Quite soon we’ll enter another Little Ice Age.”

So we can stop worrying about global warming?

“It may time for a big volcano.”

The effect of a big volcano is limited to a year or so, unless by big you mean Yellowstone caldera big.

state of montana just handed down a timely state’s rights /corporate finance bombshell re: Citizen’s United etc, on the eve of 2012.

2012: we will marvel at the ensuing US supreme court smackdown of the western bumpkins!

It will be a fun year, if one has objectivity reinforced by a cast-iron stomach, food, water, shelter and income…

From the dumbest guy on the internet, wishing everyone a safe, peaceful, and satisfying new year– Yves, thanks for the grist

link to article on state of montana decision:

http://www.greatfallstribune.com/article/20111231/NEWS01/112310303/Montana-high-court-upholds-ban-election-spending-by-corporations

Fuel costs will soar. Food costs will soar. City folks will roam the countryside in search of food. Chaos will ensue.

Government and Religion will lose control of the masses.

Farm land prices will soar. Housing and durable goods prices will drop.

Deflation and inflation.

Isn’t this fun?

Farmland prices (in the US) will soar? I’d say its already happening, and its beginning to look like a bubble. Once everyone is on board (as with this line of thinking) its time to question.

Sale of farmland sets record:

http://globegazette.com/news/sale-of-farmland-sets-record/article_ba6c730a-2229-11e1-aa13-001871e3ce6c.html

Farmland prices in the US are rising in large part due to an increase in corn production. 40% of corn now goes into ethanol production, which is increasingly being exported.

http://bigpictureagriculture.blogspot.com/2011/12/why-are-we-depleting-and-polluting.html

Expectation of rising farmland prices based on belief that grain prices will rise. Farmland is worth only as much as it produces a profit. But what happens if grain prices continue to go down?

Crop futures end poor year on upbeat note

http://www.agrimoney.com/marketreport/evening-markets-crop-futures-end-poor-year-on-upbeat-note–1417.html

“Home Values: Home values will continue to decline during 2012 and I do not expect the bottom of the real estate market to be reached until the 3rd Quarter of 2014.”

We just got the taxable value notification from the County that puts the new value of the house at 65% of the old value. that puts us technically underwater. It’s odd because 2 out of 3 sale prices this year were running at 90-95% of the old valuation. The other 1 out of 3 were short sales, that averaged out at the new valuation level. Does this mean the county expects all future sales to be short sales? Or are they shooting themselves in the foot by creating these new values that will lower their income by a third?

I’m good at “dicting” the past, not so good at dicting the future.

Got your ‘future estimable’ tense wrong there. It’s “dicting the past”, but “being dict over by the future”.

Yglesias is very silly. Did he even look at the sectoral balances?

http://blogs.ft.com/martin-wolf-exchange/files/2011/12/Wolf-newest-US-balances.gif

So those high rates of saving are just supposed to magically reverse? Right… Why exactly? Low interest rates?

http://www.stringfellow.co.za/wp-content/uploads/2011/08/us-official-interest-rates-august-2011.jpg

Looks like they’ve been down for over two years now. And yet the private sector savings continue.

I didn’t even know the guy did economic forecasting. Sorry, economic ‘forecasting’.

United States of Pottersville. We’re all Detroit now.

how about we revisit some of the predictions that appeared and were linked to here a year ago for 2011 and see whose were most on target?

i mean, did anyone predict…. on second thought, i don’t think i want to revisit 2011.

The uncertainty of all out war with US troops on the ground will be present throughout the year and active US military intervention is at least a 50-50 bet. Max Gardener

What a bummer. This could be The End. But God specializes in last minute saves. Jerusalem was facing destruction by the armies of Nebuchadnezzar outside their walls. In desperation, the king and people freed their illegally held Hebrew debt slaves. A miracle happened – the armies withdrew!

But alas, with the danger past, the people of Jerusalem reneged on their vow and re-enslaved those they had just released. God was not amused: Jerimiah 34:6-22.

Now the whole world is drowning in debt and we need a Miracle to prevent a major war. Steve Keen recently proposed a universal bailout of the entire population with new leverage restrictions on the banks. I don’t see why that would not work.

It’s the most humane way to solve the crisis so it will be the last considered. But promising that more are being to suggest this path.

Happy New Year!

When God created this world, did He give it to us or just lend it to us?

Can this debt be wiped out?

“Can this debt be wiped out?” – MLTPB

Sin is the ultimate debt issuance, it has only one clearing house and the only legal argument to break its chain… is poof of lobotomization.

Skippy…nice racket… eh.

Predictions in extremis. Here’s a highly improbable but potential two by four to the heads of ‘investors’ in 2012 from one Walter Zimmerman. Who knows, maybe Mr. Zimmerman is about to become the Roger Babson of our times.

http://blogs.wsj.com/marketbeat/2011/12/27/sp-500-falling-below-600-this-will-even-make-the-bears-shutter/?mod=WSJBlog

The situation at Fukushima is going to get worse and much clearer to the world which will cause a crisis, bringing down all economies as folks react to the unknown aspects of ongoing growing nuclear pollution in Japan and world wide.

Reporting on a thought emerging from my nausea: If carbon nano molecules can “capture” electrons, can’t they be used to also capture radiation polution. Forget sun energy – this is an emergency. We need to clean up this mess now. Maybe plutonium capture plants along the west coast of the Americas. Not a prediction, just a frantic dream.

Those wonderful little workers called bacteria can sequester radioactive matter and perhaps use the energy of decay.

There is no doubt that God can fix our physical problems if we repent of our moral ones.

Cue skippy…

Cue… Dismissal of fact by spirituous mumblings ( checked a few favorite bias confirming web sites ) reminds me of… Which of us who beholds the bright surface of this ethereous mold whereon we stand. – Milton.

Skippy… Go tell it to the sub contractors doing clean up at fookmeshima. I’m sure the would welcome the pep talk, its all good as long as you soul is clean, god will sort it out in his own_do good_time. The solution is always in the future… Barf.

BTW… very rude to make statements and when countered, run away. Only to pop up in another thread and insinuate – cue Skippy.

http://www.nakedcapitalism.com/2011/12/public-money-for-public-purpose-toward-the-end-of-plutocracy-and-the-triumph-of-democracy-part-iii.html#comment-582776

Skippy… how can you change the root language? Oh yeah, you make stuff up, aka the bedrock of critical thinking!

I did not run away.

I do not understand Hebrew but I understand English. The King James Version, written long before Hubble, indicates continuous “stretching” in at least some verses.

Oddly, many Christians are opposed to the Big Bang theory even though it supports ex nihilo creation.

But while we argue about religion, the bankers are busy destroying the world. On their side are you?

How daft are you, seriously. You claim ignorance as your defense ( don’t understand the root language – Hebrew )[?], in English translation ( King James Version ) its all good? Did you see the other bits ie.

Akkadian Literature

There is an interesting parallel with an Akkadian phrase in the Poem of the Righteous Sufferer which says, “Wherever the earth is laid, and the heavens are stretched out” (e-ma sak-na-at ersetim rit-pa-su same; Lambert 1960, 58-59). So in Mesopotamia the heavens were also seen as being stretched out.

***One should not read into this modern science, like the expansion of the universe, or the Big Bang theory.***

The Hymn of Amon-Re states, Who suspended the heaven, who laid down the ground, Father of the fathers of all the gods, Who suspends heaven, who laid down ground” (COS, 38-9). Wilson translates, “Raised the heavens and laid down the ground” (ANET, 365).

Skippy here… reading comprehension a problem too[?] or is a case of *my book* is the correct one? BTW Blakinfiend is doing gods work too, whats your point? This is a settled matter, unless you refuse to acknowledge the massive amount of material fact in front of your nose. Such actions does not sit well when proffering any kinda of solutions or deductions within the realm of this blog.

Skippy… “On their side are you?” – beard. Nice libertarian – quasi religious paint brush you got there. Go read the thousand plus comments I’ve made here, over the years before you go casting dispersions. First tool out of the bag for that mob, look the devil! Just remember in Econned economics is likened_too_religion, this is not a positive endorsement of either. Divinity is the tool of the 1%, see history. *Too many heathens* is always the problem… in economics and religion… shezzz.

Hey skippy,

I am sorry the Bible annoys you but that is your problem not mine. I used to be annoyed similarly. You should wonder at something that annoys you so much. Atheism does not annoy me that much; the truth will out. Apparently, your unbelief is beyond my pay scale and frankly beyond my patience and interest too. I’d much rather talk ethical money creation on this ECONOMICS web site.

But here’s a guy with a PHD in astrophysics who calls science “the 67th Book of the Bible”: http://www.reasons.org. Argue with him. He is a nice guy (besides being brilliant and knowledgeable). Maybe he can help you.

You made a material statement of fact “sky’s spreading equals expanding universe”. This is incorrect and has been proven empirically by submission of peer reviewed linguistics. “A guy with a PHD in astrophysics”, is not, qualified to refute. You conflate the issue. And links to sites again, with out any evidence, passing the buck?

FYI religion and economics share great deal, the dogma of economics is largely based on religious beliefs. SEE:

s. Today the most powerful alternative explanation of the world is science, and the most attractive value-system has become consumerism. Their academic offspring is economics, probably the most influential of the “social sciences.” In response, this paper will argue that our present economic system should also be understood as our religion, because it has come to fulfill a religious function for us. The discipline of economics is less a science than the theology of that religion, and its god, the Market, has become a vicious circle of ever-increasing production and consumption by pretending to offer a secular salvation. The collapse of communism makes it more apparent that the Market is becoming the first truly world religion, binding all corners of the globe into a world-view and set of values whose religious role we overlook only because we insist on seeing them as”secular”.

So it is no coincidence that our time of ecological catastrophe also happens to be a time of extraordinary challenge to more traditional religions. Although it may offend our vanity, it is somewhat ludicrous to think of conventional religious institutions as we know them today serving a significant role in solving the environmental crisis. Their more immediate problem is whether they, like the rain forests we anxiously monitor, will survive in any recognizable form the onslaught of this new religion. The major religions are not yet moribund but, on those few occasions when they are not in bed with the economic and political powers that be, they tend to be so preoccupied with past problems and outmoded perspectives (e.g., pronatalism) that they are increasingly irrelevant (e.g., fundamentalism) or trivialized (e.g., television evangelism). The result is that up to now they have been unable to offer what is most needed, a meaningful challenge to the aggressive proselytizing of market capitalism, which has already become the most successful religion of all time, winning more converts more quickly than any previous belief system or value-system in human history.

http://www.religiousconsultation.org/loy.htm

Although scientific research by myself and others (Zuckerman, Rees, Norris, Inglehart and Bruce among them) are solving many of the questions surrounding belief and nonbelief in the supernatural, many questions remain. Such as why a large minority of well-educated, science oriented persons with secure incomes continue to ardently believe in deities despite the lack of compelling evidence? – G.S. Paul

http://gspaulscienceofreligion.com/

Paper prepared for the 1993 SSHRC International Summer Institute on the topic:

“Population And The Environment: Population Pressures, Resource Consumption, Religions And Ethics”

The central thesis of this chapter, then, is that the market can be made to capture more of the social and environmental costs that must be taken into account in arriving at equitable resource use, but in the end both our obligations to others and our obligations to Nature can be sufficiently communicated only through broadly accepted social ground rules or religious principles. These may be captured to some extent in “green consumerism” or “socially responsible business”, but in either case they reflect a move away from utilitarian calculation toward concerns for fairness and procedural justice.

http://web.uvic.ca/~rdobell/assets/papers/sies.html

Skippy here… so I refute your “I’d much rather talk ethical money creation on this ECONOMICS web site.” – beard… also as my statements, to you, are relevant. Even in your own statement you justify your thoughts with religious underpinnings, hence why I take you to task.

Skippy…. No Atheist here, that is a polemic assertion based on the_assumption_of divinity.

FYI religion and economics share great deal, the dogma of economics is largely based on religious beliefs. SEE: skippy

The God I believe in condemns counterfeiting and forbids usury between fellow countrymen. Yes, modern economics is a religion but the god is Mammon, not the god of the Bible.

We are a world of humans, not countrymen. Yet again your statement is out of context, Jewry specific. It, when written was a law, that was only for the children of Israel.

To barrow or use it in any other way, shape, or form is deceitful, a lie. Any way it seems to be a pattern, see:

ark Markets | March 15, 2011 at 3:30 pm |

@ F Beard: re “DEBT JUBILEE” (Dueteronomy 15) &

“Hopefully the greater fool you sell to will be a panicky banker elite just before we have fundamental reform”

For once, I agree with you. But in all your bible thumping and “moralizing”, you neglect to notice that the bible is used as a font of authority, and justification, for many of the sins & crimes of this GS, JPM, Fed, big bankers’ serial larceny & economic sabotage.

The list of bible ATROCITIES “KILLING IN THE NAME OF GOD” is far too extensive to highlight more than one (below) but just remember, the word “SERVANT” is an euphamism for “SLAVE” in the bible – and everyone who was anyone desired many “servants.”