Yves here. By happy coincidence, a mere day after Jamie Dimon offered yet another misleading defense of the 1% (among other howlers, claiming that their marginal tax rates were their effective tax rates), the gurus of income inequality, Thomas Piketty and Emmanuel Saez, say there is no good case for coddling the rich. Their analysis shows that top marginal tax rates could rise to near Eisenhower administration levels (the top tax rate then was 91%) and not hurt growth.

By Thomas Piketty, Professor, Paris School of Economic, Emmanuel Saez Professor of Economics, University of California, Berkeley and Stefanie Stantcheva, PhD candidate in Economics, MIT. Cross posted from VoxEU

The top 1% of US earners now command a far higher share of the country’s income than they did 40 years ago. This column looks at 18 OECD countries and disputes the claim that low taxes on the rich raise productivity and economic growth. It says the optimal top tax rate could be over 80% and no one but the mega rich would lose out.

In the United States, the share of total pre-tax income accruing to the top 1% has more than doubled from less than 10% in the 1970s to over 20% today (CBO 2011 and Piketty and Saez 2003). A similar pattern is true of other English-speaking countries. Contrary to the widely held view, however, globalisation and new technologies are not to blame. Other OECD countries such as those in continental Europe or Japan have seen far less concentration of income among the mega rich (World Top Incomes Database 2011).

At the same time, top income tax rates on upper income earners have declined significantly since the 1970s in many OECD countries, again particularly in English-speaking ones. For example, top marginal income tax rates in the United States or the United Kingdom were above 70% in the 1970s before the Reagan and Thatcher revolutions drastically cut them by 40 percentage points within a decade.

At a time when most OECD countries face large deficits and debt burdens, a crucial public policy question is whether governments should tax high earners more. The potential tax revenue at stake is now very large. For example, doubling the average US individual income tax rate on the top 1% income earners from the current 22.5% level to 45% would increase tax revenue by 2.7% of GDP per year,1 as much as letting all of the Bush tax cuts expire. But, of course, this simple calculation is static and such a large increase in taxes may well affect the economic behaviour of the rich and the income they report pre-tax, the broader economy, and ultimately the tax revenue generated. In recent research (Piketty et al 2011), we analyse this issue both conceptually and empirically using international evidence on top incomes and top tax rates since the 1970s.

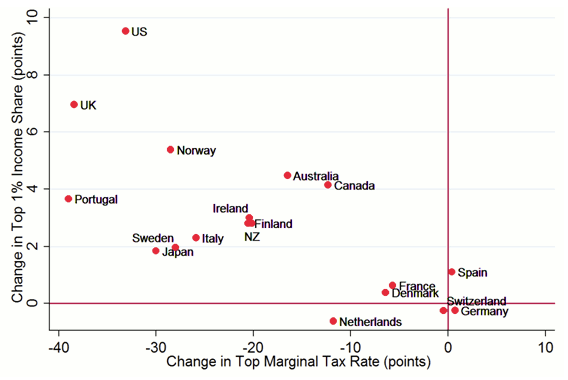

Figure 1 shows that there is indeed a strong correlation between the reductions in top tax rates and the increases in top 1% pre-tax income shares from 1975–79 to 2004–08 across 18 OECD countries for which top income share information is available. For example, the United States experienced a 35 percentage point reduction in its top income tax rate and a very large ten percentage point increase in its top 1% pre-tax income share. By contrast, France or Germany saw very little change in their top tax rates and their top 1% income shares during the same period. Hence, the evolution of top tax rates is a good predictor of changes in pre-tax income concentration. There are three scenarios to explain the strong response of top pre-tax incomes to top tax rates. They have very different policy implications and can be tested in the data.

First, higher top tax rates may discourage work effort and business creation among the most talented – the so-called supply-side effect. In this scenario, lower top tax rates would lead to more economic activity by the rich and hence more economic growth. If all the correlation of top income shares and top tax rates documented on Figure 1 were due to such supply-side effects, the revenue-maximising top tax rate would be 57%. This would still imply that the United States still has some leeway to increase taxes on the rich, but that the upper limit has already been reached in many European countries.

Second, higher top tax rates can increase tax avoidance. In that scenario, increasing top rates in a tax system riddled with loopholes and tax avoidance opportunities is not productive either. However, a better policy would be to first close loopholes so as to eliminate most tax avoidance opportunities and only then increase top tax rates. With sufficient political will and international cooperation to enforce taxes, it is possible to eliminate most tax avoidance opportunities, which are well known and documented. With a broad tax base offering no significant avoidance opportunities, only real supply-side responses would limit how high top tax rate can be set before becoming counter-productive.

Third, while standard economic models assume that pay reflects productivity, there are strong reasons to be sceptical, especially at the top of the income distribution where the actual economic contribution of managers working in complex organisations is particularly difficult to measure. In this scenario, top earners might be able to partly set their own pay by bargaining harder or influencing compensation committees. Naturally, the incentives for such ‘rent-seeking’ are much stronger when top tax rates are low. In this scenario, cuts in top tax rates can still increase top income shares – consistent with the observed trend in Figure 1 – but the increases in top 1% incomes now come at the expense of the remaining 99%. In other words, top rate cuts stimulate rent-seeking at the top but not overall economic growth – the key difference with the first, supply-side, scenario.

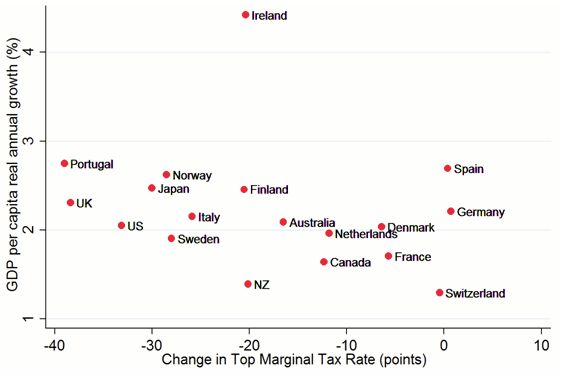

To tell these various scenarios apart, we need to analyse to what extent top tax rate cuts lead to higher economic growth. Figure 2 shows that there is no correlation between cuts in top tax rates and average annual real GDP-per-capita growth since the 1970s. For example, countries that made large cuts in top tax rates such as the United Kingdom or the United States have not grown significantly faster than countries that did not, such as Germany or Denmark. Hence, a substantial fraction of the response of pre-tax top incomes to top tax rates documented in Figure 1 may be due to increased rent-seeking at the top rather than increased productive effort.

Naturally, cross-country comparisons are bound to be fragile, and the exact results vary with the specification, years, and countries. But by and large, the bottom line is that rich countries have all grown at roughly the same rate over the past 30 years – in spite of huge variations in tax policies. Using our model and mid-range parameter values where the response of top earners to top tax rate cuts is due in part to increased rent-seeking behaviour and in part to increased productive work, we find that the top tax rate could potentially be set as high as 83% – as opposed to 57% in the pure supply-side model.

Up until the 1970s, policymakers and public opinion probably considered – rightly or wrongly – that at the very top of the income ladder, pay increases reflected mostly greed or other socially wasteful activities rather than productive work effort. This is why they were able to set marginal tax rates as high as 80% in the US and the UK. The Reagan/Thatcher revolution has succeeded in making such top tax rate levels unthinkable since then. But after decades of increasing income concentration that has brought about mediocre growth since the 1970s and a Great Recession triggered by financial sector excesses, a rethinking of the Reagan and Thatcher revolutions is perhaps underway. The United Kingdom has increased its top income tax rate from 40% to 50% in 2010 in part to curb top pay excesses. In the United States, the Occupy Wall Street movement and its famous “We are the 99%” slogan also reflects the view that the top 1% may have gained at the expense of the 99%.

In the end, the future of top tax rates depends on the public’s beliefs of whether top pay fairly reflects productivity or whether top pay, rather unfairly, arises from rent-seeking. With higher income concentration, top earners have more economic resources to influence social beliefs (through think tanks and media) and policies (through lobbying), thereby creating some reverse causality between income inequality, perceptions, and policies. We hope economists can shed light on these beliefs with compelling theoretical and empirical analysis.

Figure 1. Changes in top 1% pre-tax income shares and top marginal tax rates since the 1970s

Note: The Figure depicts the change in top 1% pre-tax income shares against the change in top marginal income tax rates from 1975-9 to 2004-8 for 18 OECD countries (top tax rates include both central and local individual income tax rates, exact years vary slightly by countries depending on data availability in the World Top Income Database). Source: Piketty et al (2011), Figure 4A.

Figure 2. GDP-per-capita growth rates and top marginal tax rates since the 1970s

Note: The Figure depicts the average real GDP-per-capita annual growth rate from 1975-9 to 2004-8 against the change in top marginal tax rates from 1975-9 to 2004-(exact years are the same as Figure 1 and vary slightly by countries). The correlation is virtually zero and insignificant suggesting that cuts in top tax rates do not lead to higher economic growth. Source: Piketty et al (2011), Figure 4B.

I laid out some ideas a few days ago elsewhere for reversing the transfers of wealth to the unproductive rich. They were:

1) A 50% tax rate for incomes above $300,000. A marginal 90% tax rate for income above $1 million. All income earned here and abroad from whatever source to be declared and taxed as income. Any wealth and/or income undeclared to be confiscated and subject to additional financial and criminal penalties.

2) A yearly 10% asset tax on household wealth above $20 million.

3) Current charitable foundations set up by families which are essentially tax avoidance schemes (think Gates, Buffett, etc.) to also be taxed at this rate.

4) A 50% tax on gross corporate profits. All profits and assets here and abroad to be declared, or subject to confiscation with additional financial and criminal penalties.

5) No employee stock options.

This was a first pass kind of exercise. Amounts and conditions can be varied but the basic principles look sound: higher taxation of the rich and corporations while punishing severely tax avoidance.

Hugh,

I agree with your thoughts on income but what about inheritance?

It is my belief that the global inherited rich don’t have to show income and therefore their ongoing ownership of everything continues unabated.

Good point. It was an oversight on my part. I favor a 90% estate tax on estates say over $5 million although here too I am flexible on the exact size of the estate. $5 million, $10 million, it really comes down to how much society supports the idea of passing down farms and small businesses within families.

Re kensey, my 10% asset tax is what you are calling an estate tax. Having not just billionaires but multi-billionaires and having several of them are not signs of a wealthy society but a sick, inequitable one. You can argue, although tech people might dispute it, that companies like Microsoft and Apple are worth their billions, but Bill Gates and Steve Jobs (yes, I know he’s dead)? I don’t think so. That wealth should have gone to workers, investors, and in taxes back to the public.

Not necessary, the second and third generation simply spend it. The wealthiest merchant in the world passed and within 20 years the endeavor had been destroyed by incompetency.

If you set the estate tax too high, you encourage tax avoidance, e.g. through conditional gifts like real estate outside the country, etc. Estates should be taxed and any tax-preferred or -exempt foundations must not favor relatives and friends of the deceased, but anything like 90% for immediate family strikes me as too high a tax rate, even for billionaires.

Why focus on taxing income? Why not do a one time 10% (or whatever) tax on any estate (net worth) more than a million dollars (or whatever)? These would be much more efficient and immediate. This would in part seek to redress (take back) some of the ill-gotten gains (in most cases) that has taken place during the past 20 years (or so) during these low marginal rates.

However, imagine the posturing of Boehner et al at the thought of introducing any increase in any rate whatsoever. I mean – all these guys have signed pledges to never increase anything. EVER. It just seems so far gone at this point that anything is going to change…

Really – how does it change? The studies are nice, and quaint, but seriously I can’t think of any answer to that question.

Why not do a one time 10% (or whatever) tax on any estate (net worth) more than a million dollars (or whatever)? kensey

One could reduce wealth disparity WITHOUT income or property taxes by bailing out the entire population equally with new fiat.

Example: A has $1,000,000 in savings. B has only $1000 in savings. The ratio in savings is 1000-1. Now give both A and B $100,000. The ratio is now only 10-1 ($1,100,000 / $100,000).

And the beauty is that the rich can’t complain since they would receive an equal amount too!

correction ($1,100,000 / $101,000) = 10.89 to 1

Where does the money come from? QE might not work as markets (bond or other) might not allow that level of QE to happen. The bond market vigilantes (or pigs at the troth) might revolt (or slurp). (I will note however in your favor that in the countries where money printing is occurring, the bond yields are the lowest!).

But ok say it does happen – what happens to the inflation rate?

Where does the money come from? kensey

A monetarily sovereign nation has the right to create money.

QE might not work as markets (bond or other) might not allow that level of QE to happen. The bond market vigilantes (or pigs at the troth) might revolt (or slurp). kensey

A monetarily sovereign nation has no need to borrow money.

(I will note however in your favor that in the countries where money printing is occurring, the bond yields are the lowest!). kensey

Yep.

But ok say it does happen – what happens to the inflation rate? kensey

If a ban on further credit creation was enacted then the bailout could be metered such that the total money supply (reserves + credit) remained constant. The bailout would serve to replace outstanding credit as it is repaid.

“Money printing” == the Central Bank buying the gov bonds, so it is no mystery why yields of those bonds are lowest.

Beard’s understanding of the world is exactly the kind of understanding that has produced our economics disaster. You understand so little that you shouldn’t allow yourself to have an opinion.

“Money printing” == the Central Bank buying the gov bonds, so it is no mystery why yields of those bonds are lowest. Lew G

Hah! It threw the Austrians for a loop who were constantly warning about the bond vigilantes (themselves or their bosses?) showing up.

Beard’s understanding of the world is exactly the kind of understanding that has produced our economics disaster. Lew G

Lew swings! And misses.

You understand so little that you shouldn’t allow yourself to have an opinion. Lew G

I recognize hypocrisy when I see it. Your assertion that government should not create its own money is a clear case of that. You would replace government counterfeiting of private money with private counterfeiting of government money.

That looks like Steve Keen’s Jubilee plan. Great idea.

http://www.debtdeflation.com/blogs/

“That looks like Steve Keen’s Jubilee plan. Great idea.”

As a longtime reader of NC, when I first heard Steve Keen talking about a jubilee I thought “Hmmm, that sounds like F. Beard’s plan.”

Let another praise you, and not your own mouth; a stranger, and not your own lips. Proverbs 27:2 (NASB) [bold added]

LOL! Thanks “another”.

But no more, please.

I am content. The Lord works in funny ways, at times.

It is probably a mistake to tax incomes at all. Why not substitute a corporate franchise tax on publicly held corporations as a percentage of their total capitalization? This would be simple to administer, impossible to evade and have the added benefit of undercutting monopoly. These corporations get 90% of the benefit of government anyhow, they might as well pay for it.

Of course there would be crushing unemployment among tax attorneys and accountants, and most of these have no skills which can be transferred to honest work, but you can’t make omelettes without breaking eggs.

Not at all.

The consumer, an American citizen, must understand that paying taxes is a civic duty. For their taxes, they should expect public services that enhance their standard of living.

All modern countries tax their citizens (and their non-citizens who work in the country). But not all modern countries – namely one, the US – provide the level of public services that a modern nation can expect as a “given”.

Two of the most important are under-subsidized by the American government and need badly large investments to be improved:

* A Public Health-care option that significantly reduces its very high cost. (Twice as much per capita as seen in some instances.) Which requires mandated service pricing in a Very Special Market. That is, a quasi-oligopolistic market where too many Consumers are chasing to few Service Suppliers. It is the latter who, by means of private insurance companies, decide the price of services. Which is why the Public Options were adopted decades ago by those countries wanting to provide this key public service.

* In our Brave New World of Global Competition, the skills/competencies of our work-force – as well as the general level of education in the population – need huge investments to improve quality. Once again, other modern countries have decided long-ago to subsidize this investment that, in the US, falls mostly upon the family to make.

And we have a two-party system almost unique in the world, in that one of the parties is dogmatically contrary to any expansion of government. (Except, it has been seen, for the public service of National Defense, where it has wasted trillions of dollars.)

I agree but would add a third category for public support. Infrastructure. The benefits provided by government-funded quality infrastructure is insufficiently appreciated, particularly now that we live in a global society. Businesses look at the infrastructure support when they decide where to locate as it reduces their operating costs and influences likelihood of success. The number of flights Delta can fly in and out of O’hare is influenced by how many flights the FAA can monitor in the airspace and the flight capacity of the runways and terminals. A new dam might turn large regions of flood-prone land of little value into land that is arable or suitable for building communities. New freeways lead to new industrial complexes in suburban areas outside major urban areas.

After WWII, despite heavy levels of debt (larger govt debt as %GDP than today), Eisenhower approved ambitious infrastructure spending like the interstate highway system and Hoover Dam (and GI bill) that resulted in three decades of prosperity. Multi-national corporations are beginning to rumble that while other factors are beginning to make returning to domestic production more attractive, they have concerns about declines being seen in infrastructure and moving forward. We are competing with nations that increasingly have labor forces that are healthier, are more highly skilled, and their infrastructures are more modern. At risk of preaching to the choir on this site, not investing in infrastructure in the name of cutting deficit spending is being penny wise and pound foolish.

The consumer, an American citizen, must understand that paying taxes is a civic duty. For their taxes, they should expect public services that enhance their standard of living. Lafayette

Nope.

Under our present system, where the banks and rich profit off a government enforced money monopoly that steals from everyone else, any REQUIRED taxes should be paid by the banks and the rich.

It’s bad enough the non-rich are looted by the banks and their big borrowers; asking them to pay for the system that exploits them is pure sadism.

IN RE #3: Charitable Foundations, Trusts for noble purposes like Carnegie’s World Peace etc. All of these trusts and foundations should not be taxed but confiscated by the government altogether. As public trusts, they can be run to fund education and health care, reducing property taxes and health insurance contributions for Medicare. Since this is no longer the property of anyone and since this money was all donated willfully for the public good in some form or another, let’s just actually use it for the public good. As the National Trusts for Health and Education grows, of course over time with a more productive and moral society, more taxes will eliminated, since public funding for public services will be secured by the economy as a whole, giving everyone a stake in working hard, not abusing the system to ensure a Great Society, such a New Deal!!

Okay, Paul, you have your initial funding by seizing these public trusts. How would you fund moving forward, as no new trusts would be created? People really do not like their assets confiscated, particularly after being assured they had protection under law. Ex-post-facto (after the fact) laws undermine public trust in the legal system. What if it was decided that the fine the furnace you installed legally five years ago has been judged to be too inefficient, effective yesterday, and the fine for having one is the appraised value of your home? It’s a silly example, but it’s the same principle.

>A yearly 10% asset tax on household wealth above $20 million.

You are out of your freaking mind.

The banking and money system does that to people, it drives them crazy.

Case in point: Gold-bugs.

Of course, not all gold bugs are crazy; evil is a better description for the desire of some of them.

What is crazier the great wealth inequality that is reducing all of us to serfdom or doing away with that inequality? And are you saying that $20 million is not enough for anyone in our society? Because that sure looks like the implication.

Two precepts about taxation:

*First, we all participate in an economy by or work that produces products/services and by our consumption (of those products/services). It is duality of our nature that runs an economy. The profits realized by means of that mechanism, however, are a matter of taxation. As citizens, we have every right to expect that income (and income that aggregates into wealth) are taxable.

*Secondly, how many millionaires made their megabuck on a deserted island? Without a market economy, neither income nor wealth can be obtained and therefore accumulated. We, as consumers, are the source of all taxable income and taxable wealth (which is the accumulation of income).

*Thirdly, it is a well-known economic notion that beyond a certain point, the accumulation of income cannot possibly improve your lifestyle. How many mansions can you own? How many Ferraris? How many private jets? When accumulation of all the accouterments of wealth is accomplished, the rest goes into an Asset Management account and provides personal Capital Gains. These capital gains have very little utility to the nation as a whole – and are mostly transferred from generation to generation as unearned taxable income. Is that their best usage?

Given the above, we, the sheeple, have every right to expect of our government tax receipts that are spent first and foremost to provide public-services that enhance our well-being. As we are the origin of the source of those receipts, we should also be the destination of their expenditure. How tax receipts are generated and shared is very much both our right and our civic responsibility.

That is the case in many social democracies, but not in the US. We are far too fixated on the accumulation of wealth as a personal demonstration of “success”. Success is not the most important societal value in a nation.

The “well-being” of all its citizens is far more important.

Have you all been asleep for the last 100 years?

Ideology and ideals aside, we have accumulated quite a lot of information about what systems of economic organization and systems of government work, and which can work in combination.

Strong governments end up owning the people, and, if any wealthy people are left alive, the rich own the government. If the rich were all killed, a new ruling class immediately arises, and they become the rich.

Examples of strong governments now owned by the rich : the US, all of Western Europe.

Examples of strong governments that killed their rich : all Eastern Europe, the USSR, Communist China. Mao lived like a the most sybaritic Emperor in his later days, his bed filled with little girls. The man really loved the masses, tho, so his reputation is intact among the Progressives of the world.

So, 100 years of modern history, 100 years of comparisons of economies, etc.

Among that lot of intellectual effort is lots of empirical research about varieties of laws and their effects on society, e.g. countries that use the Napoleonic code as the base of their laws don’t have capital formation. DeSoto’s work on the importants of property rights for transitioning to a capitalistic system. On and on and on.

None of which you seem aware of.

And, off the top of your head, you have the answers! Wow, wish I was that smart.

Pure, unadulterated bullshit.

Governments in Europe, where I happen to live, are owned by the people. It is in America that low voter turnout hands government rule over to those who will manipulate the simplistic media messaging that obtains the politicians that the plutocrats want to bend.

Just have a look at the Gini Coefficient to understand where the money is going. Europe is far better off than the use as regards Income Fairness.

We are the sheeple herded into voting districts that encrust America into a two-party system, itself manipulated money-wise to give desired results. But, we, the sheeple, need not accept that sort of political connivance between wealth and the two-party system.

We can undermine it, should we want to, such that Progressive Candidates are elected to Congress from within the two-party system. This will move the political will off center and Leftwards.

From there, we, the sheeple, just might have a chance to instill some measure of Social Justice in a country gone berserk at the altar of the God of Mammon.

Money, money, money makes the world go round. But where it ends up is what counts the most. And for the moment, it is Trickling Upwards.

What magic!

Lafayette,

Sorry, I was responding to the thread, not your post in particular. It was thoughtful.

Oooppps, read you post after posting the above.

My regrets.

Where is private property in this “I hate the rich” rubbish? Is private property only private when its held by a moderate or low paid employee and everything else is fair game for disbursement to the crowds? And where is capitalism in your wealth creation process? Read a little more Austrian school economics, the basic stuff, then redo your exercise with a longer range horizon to your thinking… just a suggestion …

Where is it in the current steal from the 99%, pass it on to the 1%, and write a law sanctifying the transfer?

Inadvertent but a nice representation of the drain we are headed down.

When I did a short stint with H.M. Inspector of Taxes in the UK around 1970 the top personal tax rate was 83% with a 15% Capital Gains Tax on top of that.

How the worm/world has turned!

I favour an earnings cap and wealth tax across the developed world. The Japanese may take lower salaries but there are other compensations – the figures always contain such anomalies.

The problem with any scheme is pooling the money in a way that doesn’t waste it in the wrong form of government. The deep issue is we are allowing “earnings” that lead to making substantial majorities as serfs working for the amassed “capital” whether government or private. We need a scheme to stop this perversion of democracy – which is a lot of rethinking.

I believe the last graph says it all in regards to economic growth NOT coming from cutting top marginal tax rates.

Playing the devil’s advocate here: there are no data points on the raising tax side. Won’t capital just flee the country?! Get to far to the right-hand side of that chart, and it will drop like a cliff!!! At least that’s what the anti-tax republocrats will tell us. Is there any research addressing this?

Lower taxes in America forced everyone else to go down the same path even if it did not make sense.

That’s one of the reasons why GS was invited in different countries to restructure the debts. Window dressing.

If the US finally raises its tax rate, chances are everyone will sigh in relief.

Mike Kimel at Angry Bear (in the links sidebar) has been running a long series of this type of analysis, and came up with just over 50% as the historical rate in the US that has lead to the best short and long term effects on productivity and growth. Check out his arguments.

There is a fourth scenario: reduced marginal tax rates may be a symptom of corrupt, dysfunctional governance, which also leads to relaxed legal, regulatory and legislative oversight, leading to higher pre-tax incomes for the wealthy.

just so. those earnings mostly are extracted from general well being, FIRE sectors – how many of the 1% earn their fortunes from anything the rest of us might consider constructive? (Job creators? who’s diddling whom?)Retire the buggers,and let’s watch some new mice play.

just so. those earnings mostly are extracted from general well being, FIRE sectors – how many of the 1% earn their fortunes from anything the rest of us might consider constructive? (Job creators? who’s diddling whom?)Retire the buggers,and let’s watch some new mice play.

(to the editor: duplicate? sent twice, but nowhere posted. what am I missing? I get the same turndown at Webofdebt, when I haven’t submitted anything previously? It’s midnight here in Hawaii, and I’m going to bed.)

Two minor points: The decline in the US economy has been visible and widely discussed traces back to Reagan and the changes he made, and others continued to this day, to taxes and values. Table 1 quantifies a reality that is widely discussed qualitatively.

In the US most of the rich contribute very little to the well being of the wider society. The financial sector, where many of the rich reside, is mainly a East Coast Las Vegas without the the entertainment.

Since the rich benefit disproportionately from the government backed/enforced counterfeiting cartel, the banking system, then IF taxes are required then the rich and the banks should pay disproportionate taxes.

But when are Federal taxes required? According to MMT, the only use for Federal taxes (monetarily) is to control price inflation. So why tax anyone unless price inflation is a problem?

It seems to me that one genius of TPTB is to encourage the notion that money is relative – i.e. ‘we’ measure the volume of our personal money v. other people’s and not on an absolute basis (whether we have enough for our own needs or not). Money has evolved from a transaction facilitator to a reflection of self-worth.

That’s might explain why – on an MMT website no less – that only one person (F. Beard) discusses how taxes are completely unnecessary ==> as long as you abolish the fraudulent private banking/money creation cartel. Everybody else talks about how someone else should be taxed more (relative money), instead of recognizing that the entire tax scheme is meant – in no small part – to re-enforce the debt-slavery plan of TPTB. The income tax was created the same year as the Federal Reserve, no coincidence.

Print United States Notes directly from the Treasury, as a sovereign should, jubilee all of the fraudulently created debt, and completely eliminate the tax code. Consider all of the effort, time, and value wasted on the completely unproductive (on a societal basis) compliance with taxes. All of the attorneys, accountants, life insurance salespeople, etc., etc. that support compliance, avoidance, etc. would be rendered useless and could be re-directed.

The current system of debt-money was created to benefit a very select few – not the 1% per se, but the ‘elites’ (I know some 1%’ers who are not a part of that club). Any solution that does not throw off those debt-shackles is still a part of that system. TPTB love austerity – no matter how/who it hits – since it tightens their grip.

The anarchist commenter said it nicely the other day – there’s plenty of ‘wealth’ to go around to create abundance. It’s too bad we’re locked in these mortal battles about relativity – instead of completely revising our thinking.

freeman,

What do you think about F. Beard’s suggestion of allowing other currencies to co-exist (remove all impediments to other currency alternatives — like legal tender laws)?

Mansoor H. Khan

I love it! Being allowed to chose your preferred monetary medium(s) would be a quantum leap in freedom, and do much to obstruct the building/maintenance of the Empire.

A better idea than taxing the rich is to prevent them from stealing in the first place. And the chief means by which the rich steal is the government backed banking system.

And yes, there are deserving rich. But deserving or no, if the rich have made use of the banking cartel, then they should pay for it IF taxes are required.

Exactly.

Why because one has precise rules to weed out good from bad. The other is like a nuclear blast with maximum collateral damage.

I have a different view on all this. If taxes are raised too high on the ultra rich, the mobile non productive finacially extractive indeed will leave and find another host. (positive) The productive people that created businesses are not mobile will be punished severely. (negative) Therefore in the end it will not affect the economy, but still seems a rather blunt/unfair tool to help fund the country’s needs.

It’s silly to rant about increasing marginal rates unless you increase rates on capital gains, too. Otherwise the so-called job creators are just going to switch more of their income from “earned” (LOL) income to cap gains.

The problem with this approach is that historically too much of capital gains is imaginary. When the price of your house goes up, so does everyone else’s. Now you need an exclusion for those who sell their house and buy a new one – or else the real estate market gets constipated. But sometimes the increase in house value is actually a gain.

Most of the time, the taxing authority can’t tell the difference, and the tax attorneys make a fortune making sure that they can’t tell the difference.

I agree and that’s what I was trying to get at in my first comment in the thread. Income is income, no exclusions, no offshore tax havens, no capital gains.

“Third, while standard economic models assume that pay reflects productivity, there are strong reasons to be sceptical, especially at the top of the income distribution where the actual economic contribution of managers working in complex organisations is particularly difficult to measure.”

Ya think? Here’s a typical contemporary corporate org chart in real life . . . ha hahahah ahahah . . .

“He awoke in the morning and turned over in the blanket and looked back down the road through the trees the way they’d come in time to see the marchers appear four abreast. Dressed in clothing of every description, all wearing red scarves at the necks. Red or orange, as close to red as they could find. He put his hand on the boy’s head. Shhh, he said.

What is it, papa?

People on the road. Keep your face down. Don’t look. . . .

An army in tennis shoes tramping. Carrying three-foot lengths of pipe with leather wrappings. Lanyards at their wrist. Some of the pipes were threaded through with lengths of chain fitted at their ends with every manner of bludgeon. They clanked past, marching with a swaying gait like wind up toys. Bearded, their breath smoking through their masks. Shh, he said, shh. The phalanx following carried spears or lances tasseled with ribbons, the long blades hammered out of trucksprings in some crude forge up country. The boy lay with his face in his arms, terrified. . . Behind them came wagons drawn by slaves in harness and piled with goods of war and after that the women, perhaps a dozen in number, some of them pregnant, and lastly a supplementary consort of catamites ill-clothed against the cold and fitted in dogcollars and yoked to each other.”

-Cormac McCarthy, THE ROAD, roughly pg. 93

Latest economic forecast for 2100, thanks to failure of Durban contest. Around xmas I used to regret not having grandchildren. Now I’m rather pleased.

It’s unfortunate there’s so much misinformation on tax rates among lefty commentators.

The authors say “the average US individual income tax rate on the top 1% income earners [is currently] 22.5%.”

That may be what the top taxpayers end up paying, but that’s not their actual tax rate. The tax rate for the highest bracket is about 35%, for regular (earned or salary) income. States add on their own income tax. In Alaska (and maybe Nevada) there is no state income tax, while it’s 9-11% in California and New York. So a high-earner in California end up with a tax rate of about 45-47% for most of his/her salary income.

If the average tax is around 22%, that is because the rate for long-term capital gains is 15%, and because high-income people use a variety of deductions and channel their income to low tax-rate states. Plus you have some rules that qualify stock-options and some hedge-fund returns as long-term capital gains.

The System is never going to accept increases in high-bracket incomes to 50% or more. Right now the Republicans are fighting tooth and nail to oppose increases of just 3%, from Bush-era 35% rates (and 15% LTCG) to Clinton-Reagan rates of 38% (and 20% LTCG).

So realistically, the most you could hope for on regular income rates would be 38%. and maybe the low 40% rates that existed pre-Reagan.

Long-term capital gain rates are a different matter. Historically, LTCG rates have been 10% lower than regular income rates, so you could make a reasonable argument that the current 15% rate should go to 28%.

Most of the super-rich make their money on LTCG and stock-options, so that’s where reforms should be concentrated (i.e. on moving the current 15% to 28%).

Other realistic proposals would be:

– do not allow hedge-fund managers to pay at LTCG rates, since that income is the equivalent of regular income

– make stock-options taxable at regular income rates, not LTCG, since that income is the equivalent of salary

– regularize state tax rates and crackdown on people who shift their income from low tax states to high tax states. Maybe even tax high-earners extra if they live in low tax states.

– disallow as many corporate deductions as possible and crackdown on the current practice of stockpiling cash in offshore countries with no taxes or countries with low rates (such as Ireland, at 11-12% vs US at 35%). Or go after retained earnings.

– crack down on corporate Compensation Committees and allow the SEC or Justice Dept to stand in the place of shareholders and review compensation

An increase of say 3% on very high-earners (over $1m per year) would be good and perhaps achievable, but really this is less important than going after LTCG rates and corporate loopholes and cash-hoarding offshore.

There is no chance of a general national property tax. France may do that, but historically there is no precedent for that in the USA. The rich (and thus the Republicans) would have absolute fit if that were proposed. Plus you have the difficulty of determining the total assets of every rich person in the country.

thank you, pat, for a bit of sanity.

I agree it is so much easier to be lied to directly and shamelessly by Mr. O than to contemplate the dismal GOPers.

Re: The rich (GOPers) having an absolute fit… This is impossible and bad how? Have you seen any of the reality show styled debates this fall? These people are already indulging in massively public spectacles of delusional reality challenged shrieking, and that’s just the ones aspiring to “leadership”. Do we have to go to the tape?

Pat,

Could not agree with you more. I am in California and my effective tax rate is 46.9% (I am reading right off my accountant’ summary of my 2011 returns). I get hit hard by AMT as I have kids and live in a high tax state. Yes, I have a top 2% income, but I started earning it in my mid thirties (long medical training).

I have a lot of respect for Saez, but I think you will see a lot of tax avoidance if marginal rates are increased much further. Well, maybe not avoidance, but a lot of anger. This anger would be diminished if worker bee professionals like myself saw some justice in the tax code. Namely that the top .01% were paying a rate at least close to ours. The fact that hedge fund managers and PE guys are paying an effective rate that is a THIRD of mine is outrageous. So I will GLADLY pay more if it is going to help the less fortunate, but forget it if I am paying more so some 25 year hedge fund guy can pay 15% on a ten million dollar income (likely fraudulently obtained).

We also have to do something about the really high marginal rates low income people face. When people start earning above around 25K per year they begin to lose all sorts of public assistance. This in effect gives them an enormously high marginal rate and is a hugely inequitable. The sad thing is most low income folks I talk to rarely due the math to see exactly how screwed they are getting by working an extra 20 hours a week at a low wage job.

I figure I will get probably screwed by whatever tax changes are proposed by either party. The financial elites control Obama, and will control Romney or Newt or whatever hack gets the job next.

John, your comments are spot on. Productive folks like you (docs, lawyers, other professionals) who work their hind ends off for their few hundred thousand dollars a year are already paying a boatload in taxes, particularly if self-employed or owners of a small business. I work for a small law firm and see how hard the attorneys work and how much they pay in taxes. You all are some of the real producers in this economy. I salute you and agree with your remarks wholeheartedly.

For the record, I am a simple worker bee and see fully one-third of my paycheck go bye-bye to FICA, Medicare, state and federal taxes plus health insurance premiums. Wouldn’t know what unearned income was if it slapped me in the face. And all this talk about retirement planning is complete nonsense for well over 50% of the populace. We quite simply do not have any disposable income. Guess I should have learned how to scam people back when I was in my twenties. Darn those scruples–they’ve made me financially destitute. I hate it when that happens.

You’re not reading your accountant’s reports correctly. Or at least missing a key piece of information. If you are hit hard by AMT, your AMT rate is 28%. That would be your top marginal rate. Only if you were not subject to AMT could your federal marginal rate be 35%.

Sorry. I meant my 2010 returns.

You violate what I call the common sense paradox. If the PTB were reasonable, we would not be in this mess with its vast wealth inequalities in the first place. But they are not reasonable, so it is pointless to postulate what they might do if they were.

The 99% have the choice between revolution and serfdom. I personally find the prospect of being a serf unappealing. So I choose revolution, a good old-fashioned one, like we had in 1776.

I am flexible on the subject of capitalism, but I think it needs to be made smaller and put under tighter control so that it serves society as a whole and not just a few rentiers.

I would say too, as I did in my first comment, that if you want to stem tax avoidance among the rich you force them to declare all sources of their revenues as income on pain of confiscation of any undeclared income with accompanying fines and imprisonment.

I am sure that you find this all extreme and unrealistic, but we as a nation are already in the pre-revolutionary phase. For increasing numbers of Americans, society is no longer working for them. About 3/4 know something is wrong and that we are on and have been on the wrong track for some time. Populist movementts are rising on both the right and the left. We all can see the deterioration in healthcare, education, jobs, income, homeowning, and retirements. We also can see that reform when it is brought up at all proceeds to get gamed out of existence. And it is precisely when reform as an option fails and the legitimacy of elites is lost that revolution not only becomes possible but necessary.

In reply to Pat:

How much of our decline can be attributed to the false idea that we “can’t” do something?

That sentiment is the very thing which has trapped us in our illusory shackles in the first place.

Yes, but one can also make the argument that the ridiculously lax tax-rates provided the incentive to take inordinate speculative risk.

After all, the IRS estimates that the real tax rate, after deductions, applied at a very high level of income is only 20/25% – perhaps somewhat more for unearned income such as capital gains.

Is this not really Excellent Incentive to dive off the deep end in order to make a quick megabuck? And is that not exactly what happened in the fraud behind the SubPrime Mess?

Methinks yes to both questions.

I don’t understand why top management should get the compensation they currently get considering past performance and the fact that most of them are not expose to any downside risk.

These huge companies are more often than not tied at the hip with government, therefore they are quasi government and management should be making government wages. That would fix the revolving door issue.

I propose that high marginal tax rates be assigned to all overpaid managements without much skin in the game.

FAIRY DUST

This is “standard economic model” fairy dust.

Productivity is measured in many different ways. For instance, productivity can be measured in terms of GDP per hours worked by sector.

Does that yardstick apply to CEO’s? Not really.

How does one measure a CEO’s “productivity” if the one applies the yardstick to either total profit or total business turnover? There is no meaningful consequence to that measure. Why?

A CEO – and this is a known fact – can have an excellent result at one company, then be hired at greater pay at another with disastrous results.

Different work forces, different products, different markets – all these are factors that come into play. And the common ingredient factor is that organizations are constituted of staff/workers – which are the key elements of a company’s success. Why don’t they share in the rewards for the productivity of success?

Why are rewards limited to top management and why is it decided by a select group of Board members belonging to the Compensation Committee? These birds-of-a-feather who all know one another very well and thus co-opt themselves for the better benefit of all.

The real-life corporate circumstance is so distant from an economics class as to make one think that both inhabit different planets.

MY POINT

Imho, the practical way to limit excessively unfair pay-scales at the top is to tax the hell out of the salaries and then assure (somehow) that the difference between the lowest and highest pay-scales are limited to a fixed multiple.

For instance, let’s assume that the floor sweeper earns 20% below the national average (which is about $46K per annum). Then why not have a multiple that fixes CEO pay at 100 times that – $3.7M.

Is $3.7M a decent salary for a CEO? (I can hear the hue and cry of NO WAY, HOSAY!) And if we tax that (allowing no deductions) at 70% as the Diamond/Saez study suggests, then that leaves a take-home pay of … only 1.1 megabucks.

Oh, dear me … such poverty.

Such a tax scheme will never fly in America, for as long as it is mesmerized by High Incomes and a Winner Takes All mentality.

Wasn’t the top rate 92 percent under Eisenhower? Seems to me that the rich were still fabulously rich then and the middle class prospered. There really is no excuse not to return to those rates today except greed. How anyone can justify letting the poor and needy go without heat and food during a global economic crisis when it is most needed to protect themselves from having to pay a bit more in taxes when it clearly will not impoverish them is beyond me. They should be ashamed.

They’re missing the “shame” gene.

See the top and lowest rates marginal tax rates here.

Note that the top-rates from the mid-1930s to the early_1960s were consistently above 70% – and, as you say, there was a period above 90%, once during WW2 and then again from 1950 to 1964.

Lowering the top rates has benefited handsomely only the high-income earners. All the rest of us have made moderate, though constant, improvement that has stalled several times throughout the post-war period.

Note also that when Reckless Ronnie lowered abruptly high rates during his tenure, at that very time the National Debt, the green-line in the info-graphic linked above) inflexed upwards dangerously.

We can easily get back to those high rates, all it takes is a radical change in Congress. We replace the current critters with some more progressive candidates with a deep dislike for the Income Inequality that has exacerbated since Reagan.

The additional revenues from higher taxation can help attain two major objectives:

* Social Investments that truly better the condition of the Average American, and

* Help redress the drastic posture of our National Debt.

That is, if we know how to stay out of the Debt Deep Doodoo with our intermittent but repeated wars.

It should be pointed out that even when marginal tax rates were 90%, the effective tax rates were far lower. IIRC, they have never exceeded levels in the low-50’s%. That still certainly leaves more than ample room for levels to be raised to fairer levels (IMHO…. don’t forget all the other taxes we pay).

Four point plan:

Progressively steeper increases on top marginal tax rates on incomes over $2 million to confiscatory levels for incomes over $10 million.

Pigovian externality taxes on corporate pollution (climate change solved) and inefficient use of resources using best in class industry standards with near zero rates for least polluting, most efficient firms.

Abolish tax on salaried income below $50,000 and eliminate payroll taxes.

Estates under $5 million not taxed and 90% tax on estates over $5 million.

Eliminate payroll tax? Without FICA, what happens to Social Security and Medicare?

The revenues from the increased taxes on high incomes, large estates, and the Pigovian taxes would provide enough to pay for SSI and single payer national health insurance.

My plan would include eliminating all exemptions, other than for dependent children, and deductions.

Also, the tax rate and holding period for capital gains would be substantially increased.

Works for me.

The full cup of a prosperous society should spill over and flow generously into the poorest corners to lift everyone up out of dire poverty.

Citizendave,

“Eliminate payroll tax? Without FICA, what happens to Social Security and Medicare?”

At a societal (country) level bank balances (or Treasury Bonds) don’t fund future liabilities.

Only thing that funds these liabilities is the capacity to produce real goods and services (i.e., performing assets like creative efficient businesses, access to raw materials, infrastructure, health and well being of the workers, etc.).

mansoor h. khan

Mansoor – I am reminded of Arthur C. Clarke’s observation that “Any sufficiently advanced technology is indistinguishable from magic”. Funding for Social Security benefits may fit that description. The common frame is that the system is self-sustaining via the payroll tax, with the bonds of the trust fund acting as a buffer for daily surpluses and insufficiencies. Because it is self-sustaining, it is not counted as part of the budget or the budget deficit.

Justicia suggests that Social Security and Medicare could be funded via other mechanisms. I enjoy playing with ideas, looking for new ways to conjure funding for our social safety net. The Warheads have conjured funding for a US military so vast that it has grown bigger than the rest of the world’s militaries combined, or so I’ve heard. Surely we could conjure funding for a social safety net that allows even those of us with the least means to live in relative comfort and dignity and good health, regardless of how we arrived in the circumstance of being unable to obtain money legally.

why not just arrest and imprison anyone with money and take it all away?

No need to arrest or imprison anybody with money — unless they cheat on their taxes.

Good points I’d not thought of that would help push Demand in a salary class that does the most consuming – therefore the measure would goose economic growth.

I gather you mean a Wealth Tax, which is also a fine idea. But your rates are far too high and they should start a $1M.

Otoh, if these are Inheritance Taxes then they are about right – except that the zero rate should not be. That wealth in inheritance is also worth taxing, particularly because it is Unearned Income (to inheritors) and simply prolongates the plutocracy that has a dangerous habit of interfering in domestic policy on behalf of themselves.

The Koch Bros and their fellow plutocrats are not going away just because taxes are increased. They will try all they can to bring back the present tax regime, if they can.

Complete fantasy.

You can’t get such laws passed in the real world.

Money buys power. The system we have prevents any such laws, even if you had proof that the system-level, long-term effects were entirely positive.

Proof which you can’t have in the nature of complex, evolving systems, and the fundamental reason behind the fact that well-intentioned people mostly screw things up when they are in government.

If you can’t see the future, you can’t tell anyone how to navigate to a desired future. If you can’t see the effects of your laws, in very great detail, far into the future, why are you proposing laws?

If you could see the future in such detail, you would be using your ability to make $Bs in the stock market, commodities markets, …

The analysis and conclusions here are so commonsensical as to be stunning. Of course, one of the two political parties will suffer, to their death, no tax increases for the 1%, even thought the majority of Americans now know we live in a rigged system where the cheaters win, and the prosecutors sleep. Still, contemplate a top rate of 80%. Billionaires would leave our shores in droves, a salutary result. If we can’t behead them, we can at least strive to gut their fortunes.

Thanks for the good work gentlemen in denying the suppl side canard. I was reading Mosler’s Seven Deadly Innocent Fictions of Economic Policy and really like his idea of getting rid of the payrol tax altogether for the nonrich.

An idea I have is-on the state level-getting rid of or at least marekdly cutting general sales tax and also cutting parking and traffic fees. Herman Cain was the opposite-he sought to imposed a sales tax at the Federal level.

http://diaryofarepublicanhater.blogspot.com/2011/12/lets-talk-more-about-taxes.html

“Billionaires would leave our shores in droves.” And go where? Even with higher taxes the US would still be the best place to be if you are rich.

Fancy that: you can tax the rich at 91% and they STILL get richer.

Why do you suppose that is?

You might as well tax the heck out the rich, because it is obviously not detrimental to them in the least.

Who do you suppose that the wealthy, who control all the money in the world and have most of it, still need more billions and trillions to get their financial houses in order? Something smells a bit fishy here.

Why limit one’s thinking to the US? It looks to me as though the Euro crisis could be solved by instituting a wealth tax of, say, 50% on all accumulated Euro zone wealth over and above, say, 5 million Euros — unless it could be demonstrated that such wealth is actively invested in truly productive activities.

I find it interesting that remedies along such lines are NEVER discussed. “Austerity” is only for the middle class and poor, apparently — the wealthy need not bother their heads over it.

“First, higher top tax rates may discourage work effort and business creation among the most talented…”

This bilge is repeated so often it has taken on some sort of legitimacy. As if, in a nation of 310+ million people, the only “talented” ones already have the job and must be given special consideration to encourage them to keep doing what they’re doing.

Consider the Green Bay Packers football team. Aaron Rodgers warmed the bench for several years-never playing-while an aging Bret Favre grabbed the spotlight, cash and endorsements. When Favre inevitably failed to deliver, Rodgers proved to be an “adequate” (read: spectacular) replacement.

The notion that there are only a handful of talented individuals in this country, and that they must be coddled and cajoled financially or else they will refuse to work is ridiculous in the extreme. It is more likely that as the fossils pull back, the void will be filled by new, previously unrecognized talent jumping at the newly available opportunity.

To quote Charles DeGaulle, “The cemeteries of the world are filled with indispensable men.”

For God’s sake, take Michael Hudson’s advice and tax the shit out of land. First of all, it’s what we collectively own seeing that it’s our freaking country. Second of all, if you can figure out a way to make a profit without using any land more power to you. You are truly a genius and deserve to be rich. The tax on such wealth creation should be zero. Good luck when you try to store your wealth in land and can’t figure out how to manage that asset well enough to pay the taxes. Hey. You can buy gold! Good luck with that.

So we should pillage apple and jpm equally, tax steve jobs and jamie daimon the same?

Treat systemic risk welfare queens the same as creative inventors?

Don’t prosecute the blatant flashing neon sign fraud on wall street, but just average a tax rate to get some back?

The problem with Dimon is not that he is taxed too little, it is he ought to be in prison and his paper Chase being dismembered by a court appointed receiver like Lehman.

I say that as a libertarian. Free market = bearing costs of failure. It also means punishing crimes like vandalism and fraud.

No. If the rule of law is not enforced equally among all, any plan is a non-starter.

Agreed we also need to be investing more capital in industries that create the “real” assets vs. financialized pricing schemes on those assets.

In the global scheme of things, high taxation rates on personal incomes are just a red herring.

I’m a firm believer in Georgism because of its sound moral foundation – labor should not be taxed at all (any kind of labor!). There is absolutely no moral justification for taking one’s products of labor – not for any kind of a higher cause. Only “land” (i.e. use of natural resources and other unearned income) should be taxed.

That being sad, I can’t see how one’s labor can be really worth more than e.g. a couple of million dollars a year. Anything beyond that would indicate that the income is non-earned or that it’s some kind of a legal or illegal scam. And yes – I do believe that intellectual “property rights”, special banking privileges (e.g. fractional reserve banking and cheap fed access) and a multitude of special big-business legislation should be abolished as well. All of these are immoral and only serve to create multi-millionaires / billionaires.

In a world where the top 0.x% has a much smaller share of income and wealth, where the FIRE sector is a fraction of the size it is today, there wouldn’t be a need for 90% income taxes or 90% estate taxes. We should fix the real underlying causes of problems, not just paper them over with taxes.

Money buys power people. So none of you can get your wishes unless we have a revolution.

If we have a revolution, and continue with high-tax, high-spending government, in a generation we will be back to having the 1% in control again.

Money buys power. You cannot have both a powerful government and the 99% in control of that government : that system state is prohibited by the fact that the government is made up of people, 99.99% of whom easily adopt the thinking of their peers == become corrupt easily.

If you think otherwise, you are living in a fantasy world.

There are 100s of quotes from the people who wrote the Constitutions and the political philosophers bearing on that system dynamic. The Progressives controlled the school systems, nobody knows any of it any more.

Lew Glendenning,

ok. So what is your suggestion for the way forward?

Are there no better ways to manage human nature?

Status quo is as good anything else because we always circle back?

Mansoor H. Khan

The way forward is to adopt the technology of government that handled this point : the original US Constitution, now abandoned.

You can’t depend on people, yet you must have a government. Thus, the government must have minimum power and maximum oversight.

The people who wrote the Constitution and the political philosophers before the had done extensive failure analysis of government : if your gov is organized in this way with these institutions, historically it fails in the following way. Several such volumes were read and written about in their letters.

We know how to do this. However, minimum government is inconsistent with the Progressive vision, which is consistent with the 1%’s control, so the entire line of thought has been suppressed.

Lew Glendenning,

Can you please elaborate why a Progressive Government is inconsistent with 1% control? Is it because the 1% become far too self serving far too quickly?

So we have to reconcile this inconsistency?

Any ideas… Do we have to give up Progressivism? Give up the central bank? Give up large corporations (how do you keep them from colluding and implicitly staying large and acting in concert?)

Even if America did revert to its pre-FED days (small gov and no central bank) and gave up its international leadership role then some other country probably would try to fill the power vacuum (and control resources like oil).

And whichever country fills the power vacuum (China?) will eventually start messing with us.

Unless everybody descends into chaos about the same time (which kinda seems like the base case for the globe) we really don’t want the next power vacuum filler messing with us (which will happen).

Bigness can’t be managed properly? Is this your conclusion?

Mansoor H. Khan

Perhaps I was not clear. Progressive government is completely consistent with 1% control. Why do you think there are so many old-money Democrats? They like laws that freeze the economic order, prevent upstarts from competing with them.

Government passes laws that produce clumps of statsis in the middle of an evolving dynamic socio-politico-economic system. The system changes, we have a crisis of some kind.

Governments must be prohibited from doing things they can’t do. They can’t make the world a better place by passing more than the absolute minimum laws that produce civilization. They can’t be allowed to introduce un-necessary complexity in the business and social environments.

So no national currencies, for example. People and businesses are quite capable of creating and maintaining their own money supplies, it has happened throughout history.

We have nothing to fear from China, given that we are governed intelligently. Any well-governed country will leave China in the dust, and if we wish them harm we should wish they should spend their wealth on armaments. If China decides to ‘mess with us’, various groups will be annoyed and will retaliate. The methods of retaliation will be a lot more diverse than any military can employ, and China will lose far more than they can gain. Use of force is a losing strategy, as the US is proving again in Afghanistan, having just proven it in Iraq. In a world of Freedom, we can all contribute to what we think produces an improvement in our situation, including opposing the use of Force.

Oil? Tell me what the price of oil is, really, and I might have some clue about whether to worry about it. We can’t tell that price because our governments have ‘protected’ us from evil foreigners who might raise the price. I have been hearing all my life about how terrible $100/bbl oil will be. It is, but not for the reasons threatened.

Ditto health care, education, … we have no idea of real costs, thus can have no idea what remedies are necessary or possible.

Education, btw, is clearly another area the gov must be kept completely away from. The uniform mental sets and knowledge bases of most every literate person is how we got into this mess : the Establishment protects itself by producing people who can’t think critically, who don’t have any understanding of complex systems, political systems, …

So remedying the situation is easy, long-run : get back to a minimum gov, e.g. the US Constitution in its original form. Strengthen the limitations on gov powers so the gov can’t get out of control. Strengthen civil liberties. Pass an amendment providing a ‘meta-level’ to interpret the Constitution, e.g. “In cases of doubt, this document shall always be interpreted to minimize the powers granted to government and maximize the Freedoms of the People.” Pass an amendment that provides real push-back to gov employees who try to expand the powers of gov.

Short-run, nobody can straighten out the mess our governments have created. We have to endure the economic crash and the political changes that will follow, very likely including a strong authoritarian or worse period of government. Those don’t work, but it will likely take a lot of deaths to get past them.

So, Progressives have caused the gulags that are in our future, among their other many sins.

So no national currencies, for example. People and businesses are quite capable of creating and maintaining their own money supplies, it has happened throughout history. Lew G

National currencies are absolutely essential to a true free market in private money creation otherwise those private currencies accepted for taxes will have an advantage over those currencies or potential currencies or money forms not accepted.

So no national currencies, for example. People and businesses are quite capable of creating and maintaining their own money supplies, it has happened throughout history. Lew G

Replacing a government monopoly on private money creation with a private monopoly on government money creation is no improvement. It is in fact, fascism.

What is needed is both government and private money supplies per Matthew 22:16-22 (“Render to Caesar”).

Lew Glendenning,

Ok. Thanks for a well thought out detailed reply.

But I still don’t get how will you protect the public from business monopolies?

The standard Oil and the AT&Ts of the world who screw things up.

Mansoor H. Khan

@Lew,

If you substitute big stinking piles of capital for government… I agree.

Skippy…BTW the data used by the founding fathers was not only bad, it was incomplete.

So says you, right?

Got any evidence at all for your sweeping generalization?

Evidence :

2500 years of history in which all governments have a problem with individuals in the government act in the individual’s best interest rather than the gov’s best interest. (People in gov rarely care about the country’s best interest, even if there is some operational definition of such, which there never is.)

Examples from the modern world in which punishments extreme as death are used to try to control corruption. These executions are always interpreted as ‘he lost power, may have been guilty of something’. Correctly interpreted in cases such as China, Russia and the various strongly authoritarian regimes.

All of the various ‘socialist democracies’, including the US. Regulations are failing everywhere in the case of the banking system. Also, name me a regulatory agency here in the US that actually does what intended. The FDA kills people by the 100s of 1000s (if you don’t understand that, you don’t know much). The Dept of Education and the rest of the educational establishment, have produced more illiterates who hate education than any other organization in history. The Fed enhances the business cycle and increases unemployment. The Dept of Justice protects serious criminals of all kinds : Bush’s torturers, all the banksters, …

The evidence is quite strong, hidden there in plain sight. You just have to have the perspective, the broad understanding, necessary to interpret it.

Regulations are failing everywhere in the case of the banking system. LG

Of course. How does one successfully regulate an inherently dishonest business?

I agree we need less government. An equal Social Dividend, sufficient for a decent standard of living, would be far better.

Summary: Forget the social “services” and just send money.

I think you don’t quite get ‘money buys power yet’.

If you give the gov the power to do good, it will do bad because humans are what we are.

Completely independently of that continuing problem, it is extremely hard to do net good passing a law.

I can give several reasons for this. First, few people can see any future in enough detail to make any money out of it, much less a federal-law-level future in enough detail to know whether the law will do what is intended. If I can’t see any future, how do I navigate to a desired future?

Second, laws are the equivalent of computer programs : they are meant to control human rather than a processor’s actions, but otherwise the same idea. However, the world we live in is not at all equivalent to a computer : it is an ‘open environment’, where few of the variables are under control of the programmer. Programming for an open environment is a conceptual oxymoron.

Third, laws are complex, increasingly so, yet there is no technological support for that. Laws can’t be tested before they are implemented, but nothing complex can work without testing. There is no way of checking for coverage of the cases a law deals with. There is no way of checking internal consistency of a law. There is no way of checking the consistency of a law with previous law. All of these steps need to be done by human mental effort and attention to detail. Ask any psychologist in cognitive studies whether that has a chance of working.

Empirically, governments in fact cannot do ‘net good’. The London Economist used to publish summaries of the studies correlating economic growth rates with ‘total government burden’, the effects of taxes + laws. Over 50 years of studies across most of the countries on the planet, the correlation is negative : bigger government produces slower economic growth.

We are currently being instructed that the biggest governments in fact completely kill their economies, something we could have vicariously learned from the USSR and communist China.

If you want to do good on your own, feel free. If you want to run your own foreign policy, feel free. That is Freedom.

But the idea that you can pass laws and make the world a better place has very little positive evidence for it, strong theoretical reasons against the possibility, and a huge amount of negative evidence.

Sorry, I forgot a couple of things.

Mathematical chaos is a major reason for not being able to see any future. Emergent properties of systems, ditto. The sheer complexity of teasing out causation in complex systems ditto.

Read Taleb’s “Black Swan” for a good understanding of various manifestations of these. That is a profound book, very worthwhile.

Like I said, government can do the most good by simply passing out money to the population. I’m not advocating laws or regulations. Where do you get that?

Of course, the “commons” (the air, water, government land,etc) has to be managed and that is a job for government.

And it does not take a big government to pass out money. But free money is a bigger horror to fascists than big government since the fascists might hope to profit from big government.

Money doesn’t buy power at all. You’ve been lied to.

Once , a fellow did actually buy the Roman Empire at an auction…he did not last long!

http://www.roman-emperors.org/didjul.htm

Money bought him not “power”, but only a swift death!

“Money buys power”…hohoho! Pull the other one!

So how do you interpret the fact that the banksters, to select one specific example, are so firmly in control of both Congress and the Executive branch?

The fact that Nancy Pelosi, from one of the most liberal, anti-war districts in the US, who controlled the machinery of the House of Representatives during 2 years of the Bush administration (you know, the entity that originates all spending bills), and who could have denied Bush his wars by merely sitting on her hands, gave Bush everything he wanted, every time? Never a serious objection, merely words to placate her constituents.

The fact that 90+% of the voters opposed the bailouts of the banksters, but a huge proportion of Congress voted for those bailouts?

Money buys power. Always has, always will, as that is built into human nature.

Progressives have to believe otherwise. Consequently, no socialist system has survived 50+ years. All of the European socialist economies are in the process of collapsing, and would have done so without the problems of banks. They are all heavily indebted, they all have aging populations and declining ratios of employeed / retired and they have all reduced their economic growth to below the levels needed to produce jobs for their declining populations. All of their population growth is from immigrants or the children of immigrants. There is no possibility of any of these systems continuing, they are un-sustainable.

The universe is not a steady state equation, see Einsteins bed.

Skippy…capital is power, it has many forms, so to name one is to forget the rest.

Skippy,

Ok. skippy. I have always felt that. Real capital is:

1) peace

2) security

3) rule of law

4) access to raw materials

5) clean air

6) clean fresh water

7) management knowledge (dispensing of justice)

8) engineering knowledge (thirst to learn how the universe works)

9) a culture that values justice/fairness

10) wisdom to balance (justice vs. mercy/forgiveness) – a

culture that is not too mean to its people and other people

11) a culture possessing a worldview which will keep it people from committing suicide when things go REALLY wrong (natural disasters or man-made screw-ups)

12) Sufficient right brain orientation (philosophical / artistic to allow for creativity to come forth)

mansoor h. khan.

I think I’m asleep and this is all a dream. There aren’t really NC readers who believe that money doesn’t buy power, are there? If so, where DOES the 1% obtain their control over the 99%? How do lobbyists get bills passed for their clients, or the Koch Bros influence policy-making?

Nothing about the most obvious danger of the low top tax rates: People who can earn huge income in short time, may not be motivated to care about economic stability and growth. Who cares whether the company or the system breaks down, if I can pocket huge money before it does! Surely, recent crises provide ample evidence of such behaviour among managers of financial institutions.

I agree wholeheartedly, as long as we do not get into a fit about “shovel-ready” construction that builds bridges to nowhere.

I think you have chose the wrong example when you speak of better airspace monitoring – at least from the point of view of ecology. The use of jet engines to provide transport is amongst the greater upper-atmosphere polluters.

We can do what Europe is doing – that is high-speed mass train transport, powered by electricity generated from renewable energies.

Or even atomic, if necessary, which is probably the case. But that is another debate rat-hole for another day.

I think the authors are right that wealth concentration and income inequality weaken the economy, but I find the way they build their case unconvincing.

Correlation is not causation, especially in systems as complex as modern economies.

And GDP is not a good measure of real wealth creation. It treats all activity the same, whether that activity is useful or completely wasteful.

A much more detailed analysis is needed to shed real light on this issue.

A “strong” economy should be redefined, not as one with a high GDP, but as one where a lot of newly-created goods and services are purchased with real money (borrowed money should only count at the time when it is paid back to the lender).