Yearly Archives: 2011

Satyajit Das: The Main Game Looms – The Problem of US Debt (Updated)

By Satyajit Das, derivatives expert and the author of Extreme Money: The Masters of the Universe and the Cult of Risk Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives – Revised Edition (2006 and 2010)

In the first of three articles, the problems of US debt are outlined. The next two articles look at how America needs to control its public debt and how given political exigencies it may actually be dealt with.

Read more...Planning to garden next spring?

Reader comments on this previous post on heating issues encourage me to post this interesting interview with Portland, ME permaculturalist Lisa Fernandes on gardening, resilience, and abundance. (Portland has the largest permacultural meetup in the world.) You might not agree with everything Fernandes says, but man, is her garden awesome. So I hope you enjoy the segment.

Read more...Links 11/20/11

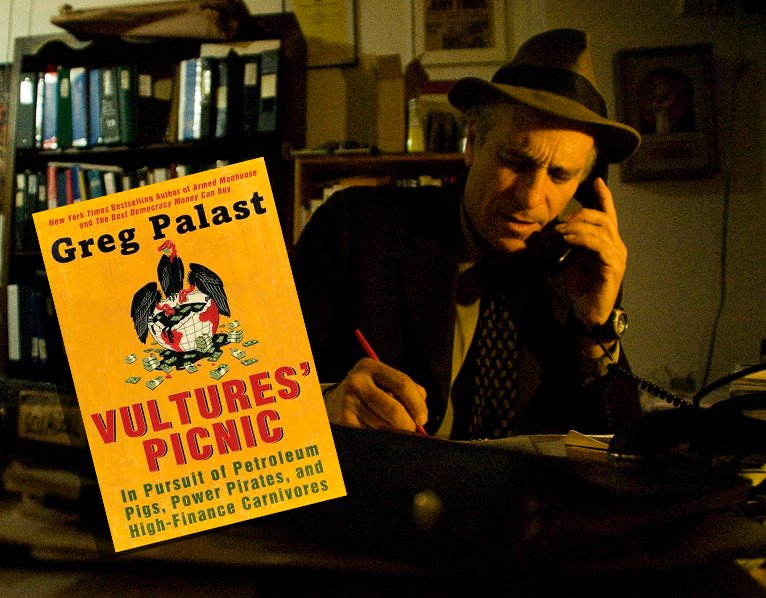

Greg Palast: This is it, folks

By Greg Palast

This is it, folks – our last chance to make the New York Times bestseller list – we’re doing well – but we want to slam it – we want to make sure that people can’t miss Vultures’ Picnic when they go on Amazon, walk into stores and browse at airports.

This is it, folks – our last chance to make the New York Times bestseller list – we’re doing well – but we want to slam it – we want to make sure that people can’t miss Vultures’ Picnic when they go on Amazon, walk into stores and browse at airports.

Let’s make sure the media can’t ignore our book.

Read more...On the narrative of pepper spray at UC Davis, or “Mic Check for President!”

UPDATE Sunday 12:36PM A second, different, and longer video of the incident is at the end of the post.

Here’s the YouTube:

The congealing narrative (supported by the YouTube’s title) goes like this: Online Furor After Police Pepper-Spray Demonstrators at UC Davis (Time; Atrios). I’m not so sure. After all, the pepper spraying takes up the first twenty seconds of the video; but 8 minutes and 14 seconds remain. So what happened after the pepper spray? I thought I’d see.

Read more...George Washington: “If Only They Enforced Bank Regulations Like They Do Park Rules, We Wouldn’t Be In This Mess”

By George Washington, cross-posted from Washington’s Blog

The following tweet captures the fact that the laws are only being enforced in favor of the 1% … and against the 99%:

Read more...If only they enforced bank regulations like they do [Zuccotti] park rules, we wouldn’t be in this mess.

Michael Hudson: Some Modest Proposals for Reforming the U.S. Financial and Tax System

By Michael Hudson, cross-posted from New Economic Perspectives.

Michael Hudson: The Occupy Wall Street movement has many similarities with what used to be called the Great Awakening periods in America. Such periods always begin by realizing how serious the problem is. So diagnosis is the most important tactic. Diagnosing the problem mobilizes power for a solution. Otherwise, solutions will seem to come out of thin air and people won’t understand why they are needed, or even the problems that solutions are intended to cure.

Read more...Links 11/19/11

Planning on heating your home this winter?

By lambert strether of Corrente.

The great state of Maine is more dependent on home heating oil than any other state in the nation. And nobody up here I’ve talked to — not my friends in the coffee shop, not the convenience store cashiers, not the cabdrivers — thinks that the price of heating oil is anything other than completely manipulated.

Readers, are Mainers right?

Read more...Bill Black in concert at #OccupyLA

“I’m coming with a message of hope, actually. In the Savings and Loan crisis, which was 1/70th the size of this crisis, our agency made over 10,000 criminal referrals, and that resulted in the conviction on felony grounds of over 1000 elites in what were designated as major cases.”

Read more...Links 11/18/11

Swiss Central Bank Forces MegaBanks UBS and Credit Suisse to Shrink and De-Risk

The Financial Times gives prominent play to a story that I suspect will go largely unnoticed in the US, that of the way that the Switzerland’s bank regulator, the Swiss National Bank, has forced its two biggest banks, UBS and Credit Suisse, to shed risk in a serious way and shrink.

Read more...Debunking Economics: An Interview with Steve Keen – Part II

Steve Keen is an Associate Professor in economics and finance at the University of Western Sydney. The second expanded edition of his popular book Debunking Economics is available now.

Interview conducted by Philip Pilkington, a journalist and writer based in Dublin, Ireland

Part I of the interview can be found here.

PP: Let’s move on to another interesting point about neoclassical economic theory. It’s my understanding that the whole system is assumed to be, at its very essence, one of ‘truck and barter’. In that I mean that they tend to ignore the fact that capitalist economies are, in reality, monetary economies and have nothing to do with barter-based economies. Yet, am I correct in saying that the neoclassicals abstract away from this in order to get away from all sorts of things that make their type of analysis more difficult? I’m thinking in particular of where profits come from and the role of credit in the capitalist system of production. Could you talk about this a little?

Read more...“Validated Carbon Credits”: a Correction, a Confirmation, Questions, and No Hint of an Apology

The Gibraltar regulator confirms by email that James Richards company Baron Traders Limited is registered in Gibraltar.

Read more...