Adam Davidson has an article in the Sunday New York Times Magazine, “The Other Reason Europe is Going Broke,” that manages the impressive feat of making you stupider than before you read it. It misrepresents most of the few facts it contains in appealing to American prejudices about our cultural, or in this case, economics superiority, to sell worker bashing.

Davidson uses the spectacle of Europe going into an economic nosedive to claim that one of the big things wrong with Europe is its spoiled workers. The piece is anchored in a glaring, fundamental misrepresentation. It argues that Americans are much better off than Europeans because we have a higher GDP per capita (more on that in due course) and asserts that that is because Europeans are not able to compete in world markets:

After decades of trying, Europe as a whole still can’t quite figure out how to be flexible enough to compete in the global economy.

The basis for Europe’s supposed failure compared to the supposedly more flexible and innovative US? That its trade with the rest of the world is more or less in balance. By that standard, the US is a abject failure from a competitive standpoint, since we’ve run sustained trade deficits since the early 1980s (with a brief period of a surplus in the early 1990s). So by Davidson’s standard of competitiveness, the US is an abject failure, particularly since the euro has risen against the dollar since 2001 (and even with its recent fall is still well above that level).

And even though Davidson presents himself as a messenger, he clearly sides with this anti-worker paradigm:

It’s a core view of U.S. business that success requires a degree of destruction. If workers can’t be fired, companies can’t drop unproductive businesses and invest in more promising new ones. If workers know they’ll get generous government benefits no matter what, so the theory goes, they’ll get lazy.

Funny, German managers actually prefer a system that allows them to maintain staff levels at reduced pay when the economy is weak. And anyone who has managed an operation, as opposed to a soi-disant economist, will tell you that hiring new staff is a painful exercise: the interviews, the initial period when they are less productive (this is not just a matter of job skill; every business has certain idiosyncrasies that a new employee must learn). And firing people is no party either, and it distracts and demoralizes their peers. And the conventional view that European productivity gains lagged those of the US starting in 1995 is increasingly questioned. From Paul Krugman in 2009:

I went back to something that was a hot topic not long ago, and will be again if and when the crisis ends: the apparent lag of European productivity since 1995…I noticed something that gave me pause.

In their paper, van Ark etc. identify the service sector as the main source of America’s pullaway — which is the standard argument. Within services, roughly half they attribute to distribution — roughly speaking, the Wal-Mart effect. OK.

But the other half is a surge in US productivity in financial and business services, not matched in Europe. And all I can say is, whoa!

First of all, how do we even measure output of financial services? If I read this BEA paper correctly, we more or less use “checks cashed” — or, more broadly, the number of transactions undertaken. This may be the best we can do, but it’s a pretty weak measure of actual work done by the financial system.

And given recent events, are we even sure that the expansion of the financial system was doing anything productive at all?

In short, how much of the apparent US productivity miracle, a miracle not shared by Europe, was a statistical illusion created by our bloated finance industry?

Dean Baker has argued for some time that, properly measured, the productivity gap between America and Europe never happened. I’m becoming more sympathetic to his point of view.

Now let’s get to the GDP per head part. The notion that GDP is all that it is cracked up to be as a measure of economic prosperity is challenged in another article in the New York Times over the weekend, “The Myth of Japan’s Failure” (hat tip reader Scott):

There are a number of facts and figures that don’t quite square with Japan’s image as the laughingstock of the business pages:

• Japan’s average life expectancy at birth grew by 4.2 years — to 83 years from 78.8 years — between 1989 and 2009. This means the Japanese now typically live 4.8 years longer than Americans. The progress, moreover, was achieved in spite of, rather than because of, diet. The Japanese people are eating more Western food than ever. The key driver has been better health care.

• Japan has made remarkable strides in Internet infrastructure. Although as late as the mid-1990s it was ridiculed as lagging, it has now turned the tables. In a recent survey by Akamai Technologies, of the 50 cities in the world with the fastest Internet service, 38 were in Japan, compared to only 3 in the United States…

• The unemployment rate is 4.2 percent, about half of that in the United States.

• According to skyscraperpage.com, a Web site that tracks major buildings around the world, 81 high-rise buildings taller than 500 feet have been constructed in Tokyo since the “lost decades” began. That compares with 64 in New York, 48 in Chicago, and 7 in Los Angeles…

William J. Holstein, a prominent Japan watcher since the early 1980s, recently visited the country for the first time in some years. “There’s a dramatic gap between what one reads in the United States and what one sees on the ground in Japan,” he said. “The Japanese are dressed better than Americans. They have the latest cars, including Porsches, Audis, Mercedes-Benzes and all the finest models. I have never seen so many spoiled pets. And the physical infrastructure of the country keeps improving and evolving.”

Frankly, I have been hearing from the mid 1990s onwards that things in Japan were no where near as bad as depicted in the Western press. And from the most savvy Japan watchers (as in people who have lived there during this period), the view I hear most often is that it was to Japan’s advantage to depict itself as a basket case, so the US would not press for a stronger yen (remember, Japan is a military protectorate of the US, so we actually can push it around from time to time. For example, during the 1987 crash, the Treasury market became wobbly, and the Fed called the Bank of Japan and told it to buy Treasuries. The BoJ called banks like my then employer Sumitomo, who fell into line).

But the most important tidbit is later in the article, and it touches on hedonic adjustments to GDP, a topic that is not often discussed in polite company. We’ve covered this in greater depth before, for instance, in this 2007 post:

Let’s look at GDP. That’s a fundamental figure, surely beyond question or compromise. Really? Our GDP stats include something called a “hedonic price index” basically to allow for the fact that computers are becoming more powerful at lower costs. In essence, the US grosses up the price of computers in its GDP reports to adjust for the fact that computer prices are dropping.

These adjustments are significant. The US is the only country that uses hedonic indexing. The Bundesbank complained that if they calculated GDP the way we did, their GDP growth would be 0.5% higher. And the cumulative distortion is massive. In 2005, Michael Shedlock contacted the Bureau of Economic Advisers and they supplied some dated information on hedonics (including a spreadsheet). Even so, he found that hedonic adjustment to GDP was 2.257 TRILLION dollars, or 22% of then-current GDP.

And now let’s get to the kicker. Here is how Davidson characterized the US versus Europe, at the top of his piece:

But G.D.P. per capita (an insufficient indicator, but one most economists use) in the U.S. is nearly 50 percent higher than it is in Europe. Even Europe’s best-performing large country, Germany, is about 20 percent poorer than the U.S. on a per-person basis (and both countries have roughly 15 percent of their populations living below the poverty line). While Norway and Sweden are richer than the U.S., on average, they are more comparable to wealthy American microeconomies like Washington, D.C., or parts of Connecticut — both of which are actually considerably wealthier.

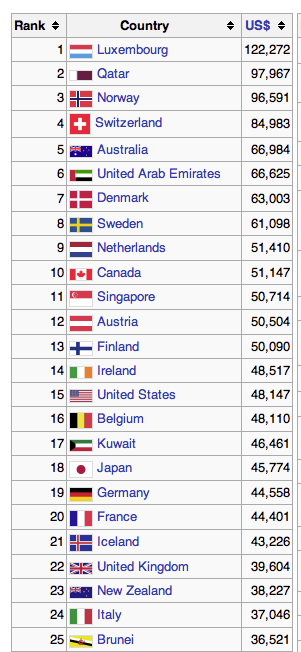

The IMF reported these per capita GDP figure for 2011, per Wikipedia, in the World Economic Outlook Database-September 2011. Davidson apparently chose another source, possibly the World Bank or the CIA Factbook, which puts the US higher in the relative rankiing:

And even before you make a roughly 20% adjustment to US GDP that the hedonic indexing hocus pocus suggests might be in order.

It seems difficult to fathom how anyone could argue for squeezing labor when Europe is a living laboratory in how it simply produces a downward spiral. It was the right remedy when inflation was rampant, but that ceased being a pressing worry over two decades ago. It is now a useful canard to facilitate transfers from ordinary workers to top management, and it appears there is no shortage of propagandists like Davidson to carry the message.

In addition to distortions to US GDP from hedonic adjustments, there’s a second group caused by imputations. For example, the rental value of owner-occupied housing is *added* to GDP, which would be hilarious if it weren’t so…motivated. Yes, the rent you save by owning is somehow part of the economy’s output.

I have no idea who Adam Davidson is, but he should be fitted for a clown suit. The US has had a large annual trade in goods deficit with Europe for the last generation.

our GDP is inflated by parasitic activities with no socially redeeming value, such as the casino on wall street, zero-sum financial sector manipulation, zero-sum litigation, tax avoidance schemes & related accounting fraud, etc…its really hard to determine what percentage of our GDP is really “productive”, and what part of just represents legalized manipulation or theft…

STUPID IS AS STUPID DOES

Makes one wonder if davidson laid this rotten-egg from the Hamptons … or has he actually spent some time in Europe.? Like maybe more than five years?

As a member of multiple American Clubs since residing in Europe, I think I express the common praise amongst we “expats” for Europe’s far more egalitarian system.

The fact that no-one goes broke because of a serious malady or that 100% of the population is covered by a National Health Insurance – which in most cases reimburses 70% of all Primary Medical Care (France) or 100% (the UK).

Or a Tertiary Education (vocational, college, university) which in most countries costs only an inscription fee of about $1000. Of course, we don’t have the prestigious schools of Harvard and Yale – but these universities here have been around for a lot longer and they are every bit as good.

The piece is anchored in a glaring, fundamental misrepresentation. It argues that Americans are much better off than Europeans because we have a higher GDP per capita (more on that in due course) and asserts that that is because Europeans are not able to compete in world markets

PLAYING WITH NUMBERS

I love it when dorks “play with the numbers”, because I can do that too – when I’m too lazy to look behind those numbers.

GDP per capita is an interesting ratio to look at globally, but it doesn’t show Income Distribution – that is where goes exactly that nation’s wealth that GDP represents?

For that one has to look at, for instance, the Gini Coefficient. (The higher the coefficient, the worse is Income Disparity.) Where the US is right up there with China. Which, given China’s huddled masses in the countryside, is no great company.

Looking further at the Gini Coefficient, we see that the EU-countries have almost uniformly a much lower Gini Coefficient and therefore much more fair Income Distribution. How does that happen? By more rigorous taxation and expenditure in Public Services. (Like Health and Education, as mentioned above.)

And then, if one wants to get down into the nitty-gritty of wealth distribution, there is always the study (which provoked the usage of the phrase “One Percenters”) accessible here. My take on the pie-chart résumé there is not at the level of 1% but that of 20% – which leaves this amazing conclusion: 20% of American households enjoy 93% of its wealth, whilst the remaining 80% try their damndest to bring up a family on the remaining 7% of wealth generated.

Only a born ‘n bred Rabid Right dork can justify that result as typical of a Great Nation. And yet, we have five of them up in New Hampshire at this very moment who would be very pleased to have 5 minutes of your face-time to do so.

MY POINT

If Europe is fundamentally different from the EU, it is because its trajectory towards Progressive Values under Social Democracy was very different from that of the US post WW2.

Of course, Europe started from scratch – whilst Americans went into the 1950s with a bright ‘n shiny economy that pumped out all sorts of household goodies. Keeping up with the Jones became priority Number 1 for most members of the middle-class.

So be it. Americans got fixated on consumerism whilst Europeans were focusing on building a tax ‘n spend accountability that had the general well-being as its First Priority.

POST SCRIPTUM

And as for the malarkey that Europe does not know how to compete internationally, Davidson seems to not know that in absolute terms Germany exports more than America.

Yep, the truth is stranger than fiction.

I really wish people could understand basic statics! Your point about the top 20% controlling 93% of the wealth is on the mark to show how nearly irrelevant GDP per capita really is.

If my nation of 100 people “produces” $100,000 worth of GDP, the GDP per capita is $1,000 reguardless of whether or not each person actually gets $1000 or the man in charge get $99,000 and the rest have to “be compeditive” for that remaiing $1,000.

Super simplified example, but the math remains the same as you scale…

I agree, a completely pukeworthy piece that reinforces all the dumb received wisdom of the American mainstream mentality.

One might also note, apropos the claim that Western Europe had little to do with the Internet and Web, that the Web was invented by a European at CERN, Switzerland…

Davidson is either an out and out idiot or simply a shill for the right-wing. Even if his estimates of per capita GDP were correct – and they manifestly are not – this measure says little about actual per capita wealth and quality of life since the wealth and income distribution of the US is so wildly skewed and getting steadily worse.

Well, not exactly. There were quite a few chefs in the kitchen at the time (late 1980s).

Tim Burners-Lee took a nifty piece of Apple software (called Hypertext) and employed it at CERN (the European Nuclear Research Agency near Geneva) to link different texts in electronic documents.

He then developed the Universal Resource Locator (URL) that became an Internet addressing protocol. Adding something called TCP/IP – developed by two Americans at the Defense Advanced Research Projects Agency for use on ARPAnet – to make differing computers interconnect with one another and we have the forerunner of the Internet. The backbone of the Web was available finally in the early 1990s.

My company at the time, based in Geneva, overlooked Tim’s work because it was fascinated by something called Videotext, that has long since been left to the wayside. So much for “management wisdom” about developing New Technologies. (We brought management several times to see the work Tim was doing … to no avail.)

Tim was on the right track … and he still is. Tim, now Sir Tim, knighted by Queen Elizabeth, is head of the World Wide Consortium at MIT that guides future developments of the Internet.

How long is this country, in its seemingly infinite vanity and arrogance, going to lie to itself, pat itself on the back in smug superiority, before we finally wake up and stop lying to ourselves? Given the vicious, lazy and corrupt history of management labor relations, the now legendary paunchiness and indolent stupidity of American media as exemplified by this Davidson fellow and his superiors at the Times, it seems never. Its funny — the Times itself is sacrificing its workers pensions and pay raises just to pay its failed CEO a huge $15 million golden parachute. Poor Davidson, maybe its not all his fault — his boss’s boss’s boss is the true culprit.

And I love that final bit where he compares entire Scandinavian nations to “Washington, D.C., or parts of Connecticut” where some of the richest (and most corrupt) people in the world are congregated. He of course was not referring to the I-95 corridor in Connecticut, but to Greenwich and Westport, nor the D.C. slums just a few blocks from the White House.

Workers treated with dignity and respect, and not cheated for overtime or finagled with petty dictats and zero paid leave, or sexually/racially harassed, work well and are happy at their jobs. But American management has had its head stuck up its ass so long they think their “ideas” aren’t dung but roses. Dispirit your workers, keep them on edge about losing their jobs, then they’ll work hard!! Maybe they will when you’re watching, or maybe they’ll just look like they are… and they certainly won’t have anything invested in your product’s success, which to my mind is the golden bliss of employee attitude. I’ll take someone who cares over someone with experience any day. But what soulless lickspittle would actually care when they are treated like fungible tools to be knocked around and discarded at will?

The lie that is American exceptionalism is merely swelled and hollow pride, and these jokers who promote it are living on borrowed time.

I like your style, YankeeFrank. And your content, lest you think me shallow. :-)

Excellent comments Yankee Frank which relieves me from stating as a Canuck much of what is accepted. The NYT I can criticize for having the writer use space to demonstrate what a mental midget he is.

I have long considered the NYT a very useful newspaper, so long as one does not read it.

I imagine that this sort of propaganda in newspapers is designed principally to sell corporate advertising. It seems unlikely that more than a dozen people actually read the article. Perhaps, it will also serve CNBC television flacks as ‘evidence’to throw around between commercials and guest appearances by financial parasites and political stooges.

Are some of you still scouring newspapers for truth? It makes more sense to deploy one of those home metal detectors in your back yard as a second job.

Surprisingly this is the only rebuttal to the argument so far, but I think you might be stretching the immagination to suggest hedonistic adjustment plays a significant part. Certainly the hedonistic adjustment seems a fudge to me, but the real problem with it is that it suppresses inflation measures. The real question that should be asked is what is the GDP per capita of the 99%. I think Adam Davidson would get a real surprise to see that on those terms much of Europe with the exception of the UK has done signifcantly better than the US.

Here is a short discussion on this at the world bank site.

http://blogs.worldbank.org/psd/removing-oligarchs-from-per-capita-gdp

Did you miss the part that the cumulative adjustment figure came from the BEA? You seem to be shooting the messenger. I don’t know how Shedlock got the BEA to send him this information, but this is the government’s own computation, not an outside estimate. I rounded down to 20% from that, but frankly, the gap between GDP ex hedonic indexing and with it in has to be bigger (if the effect is to boost growth every year, which it is, the gap will get even wider over time).

I’m reluctant to quote John Williams of Shadowstats on this (or any adjustment) although the Times piece on Japan does. Williams is VERY reliable on describing how and when the calculation of certain government figures changed. However, his efforts to come up with adjusted figures are often very questionable.

There are two hedonic adjustments. The more commonly referred one relates to inflation computation, when goods are substituted for other goods (say seasonal availability or the more commonly complained about one, when, say, flat panel TVs replace old CRTs0.

This is different. This is the output level being increased. Computers are included in GDP at (effectively) mid 1980s computing power prices. Imagine what the power of a standard desktop or laptop would be in mid 1980s hard disk and memory terms. This leads to massive distortions. I recall an article in Barrons in the early 2000s in which they drilled into the productivity increase for that year, and it it was almost entirely attributable to computer production, and they showed how the figures were utter nonsense (they didn’t get at the hedonic indexing issues, but it was the apparent driver).

GDP is inflated because we are not sure how to handle imports. Parts are imported at $ and attached to equipment and then sold for $$$$. We count them as being made in the US and worker productivity has improved.

Are you saying that Apple’s iphones, ipads and such, which are manufactured in China, are put down as American manufactured because it’s an American brand?

Oh for pete’s sake, you cannot obn one hand defend the EU as a whole and on the other hand break out GDP on a per country basis in Europe. THe same aplies to trade.

You also might figure in the USA’s defene of Europe and the huge protctionist racket of the EU

(And you cant bet the your figures are fudged by the Leftist apparats too).

What profound intellectual dishonesty. Typical Democrat.

The whole arugment for the EU, if you had been paying attention, has in fact been that Europeans canot compete with out it.

Europe has a positive to neutral balance of trade as a whole unit (EMU too), compare that to parasitic USA which is importing using credit.

I’m not fan of the EU institutional arrangement and the current state of affairs in Europe, however most of the damage is self-inflicted (EU could easily solve a lot of the problems it has if it had done the same the FED or the BoJ have done and there was political will).

Economically and socially speaking, I tend to think it has a much more sustainable and cohesive societal structure than the USA right now (that does not mean that is sustainable enough however).

The defense of Europe? Really? From whom? Typical wingnut.

Yes, although he and Planet Money has a promising start, most of his recent utterings leave you looking for his Geppetto.

His Geppeto,

his P. G. Peteo,

his

Pete G. Peterson.

What do I win?

Oh, and th reason Japan’s life expactncy is going up and ours is not is that the Japanese, wisely, are not trying to turn there country into a thrid world hell-hole, unlike what you leftists are trying to do to the USA.

Very suggestive thought.

Would you mind elaborating on the transmission mechanism from “leftist” policies to stagnating life expectancy?

And what leftist policies, exactly?

Don’t bother asking: harumpf is yet another drive-by poster, stopping just long enough to vomit onto his keyboard at various blogs before moving on to the next.

Ah, the internets and stupid people, a match made in heaven

How late are these hell holes open? Do they have a 2 drink minimum?

You need a hug from your grandma or what?

Did you inhale some prohibited substance?

Try to make sense next time you want to post.

won’t be long before the Fukushima disaster turns northern Japan into a hell-hole… will also reduce life expectancy for their citizens.

We will be treated to this false comparison over and over again for the next 10+ months. Romney was using it in the debates over the weekend. Doubt if that was a coincidence. You have to admire the efficiency of that Wurlitzer.

For all GDP, and indeed GDP per capita, calculations, it would be instructive to know how illegal immigrants and their output are treated.

Otherwise “American exceptionalism” = customary American hubris.

Yes, I didn’t get into that either. Davidson runs the American virility line (“Oh, sclerotic, aging Europe, US population is growing”) when demographers expected the US in the 1990s to show falling growth rates just like every other advanced economy and were stunned in the 2000 census when it hadn’t. The two reasons were immigration and higher than replacement birth rates among Hispanics.

And per your point, the immigrants have a direct GDP impact. Even though many hope to send money home, they not only work here, they pay rent, buy food and gas, and taxes (sales taxes).

I can personally attest to “the myth of japan’s failure”, having lived there for three years. Every square inch of flat land is in use. Every inch of coastline has its tsunami defenses. Every river has its flood defenses. Every mountain has its road tunnel. Frankly, it was hard to imagine how the economy could possibly grow. Everything had already been done. That being said, social spending is very low. Relatively speaking, it would cost almost nothing to clear Tokyo’s parks of the homeless. Switch 20% of the infrastructure spending to social spending and it really might be heaven on Earth.

The problem with the US is that it confuses fascism with a free market. It is thus bewildered and angry that so much socialism is required. But he who lives by the sword (socialism for the rich – fascism) also dies by it (socialism for the poor).

Indeed; national[ist] socialism, as it was named infamously if accurately in one past venue.

I always enjoy reading the comment sections of such propaganda pieces. The readers seem to get it right.

“It seems unlikely that more than a dozen people actually read the article.”

My comment to the article at the NY Times:

“Oh please! This is just more neoliberal swill. Lazy Greeks is now morphing into Lazy Europeans. Yeah, that’s it! If only those Lazy Europeans had worked harder, the Euro | economy | banks (pick one or more) wouldn’t be in so much trouble. Forget that all the loot is going to the top. Work HARDER.”

I recall that other commenters were similarly displeased.

Yes, of course, this is propaganda and Davidson is a propagandist. It contains the standard fare of class war: blame the victim (workers) and set groups, in this case American and European 99%s, which might unite to oppose the 1% against each other.

The US Rightwing and neoliberals/conservatives must be desperate to draw attention away from the USA if this is the best tripe they can muster under Davidson extorting the brilliance of the USA – evidently, US companies are World beaters and those based in Germany, or for that matter, any European State outside of the UK must be disaster zones.

Does it not strike the author as odd that only in the past 24 hours BMW/ Rolls Royce have announced increased sales despite the Global economic slowdown and that these automobiles – we call them cars in the UK – stand head and shoulders above the mediocre auto’s your own nations manufacturers produce.

For all its ill gotten gains and contribution to the global financial disaster, even the UK’s City of London/ Square mile is more successful than Wall Street, indeed, it is the only true global financial centre – nothing here to actually shout about, but facts are facts.

About the only thing the USA exceeds its European counterparts in is defence spending on imaginary foes, expropriating the wealth of its lower and middle class and celebrating this fact as a success whilst 20% of its workforce is idle, and at least half of that figure is left abandoned to rot in your decaying cities.

Davidson is a dangerous moron, an idiot of unprecedented levels and an out and out fraud – much like the majority of the top 1-2% of your nation who only give a toss about their bank balance and amount of power they have – look no further than the Koch Brothers.

Has it ever dawned on this buffoon, that the only ‘Real’ American’s are the native Indians – thankfully Europe got rid of its trash decades ago, most of it emigrating to the US.

Given the opportunity, and a large degree of honest, I’m confident most readers would prefer living in ‘failed Europe’ rather than the failed USA.

These snake oil salesmen would sell their grandmothers to the Chinese if it would increase their net worth.

God help the USA if Davidson and his like believe they are US Patriots, they are the scum of the earth and deserve the electric chair.

Please wake up USA, your elites having been taking the piss out of Joe Blogs for too many years. Yes it is time to take your country back from the liars and jesters who inhabit Wall Street and D.C. – Its your country, these fools make idiots of you and then try and ram their failed neoliberal policies down Europe’s throat.

Claptrap is all I can say and forgive my apparent anti-USA rhetoric, but I despise what your political and economic leadership has done to a once proud nation in pursuit of their own happiness at the expense of everyone, and that includes future generations.

LOL. If the financial industry in the US wasn’t so messed up, then this conversation would not be happening. There would be no Eurozone crisis. This article is really kind of funny if you think about it like that. It’s like a Homer Simpson quote, “America, the cause of and solution to all of the world’s problems.”

If you look at GDP per hour worked which is a better measurement of productivity than GDP per capita, Europe looks even better than the U.S. With vacations, and shorter worker weeks Europeans do as well with fewer work hours than Americans.

The link to Dean Baker’s piece on productivity seems to be broken, but here is a working link to the same page. http://www.cepr.net/index.php/press-releases/press-releases/us-productivity-growth-still-trails-europe/

And for those interested, the report is at: http://www.cepr.net/index.php/publications/reports/qusable-productivityq-growth-in-the-us-an-international-comparison-1980-2005

The notion of an economy “being competitive” is peculiar, although the phrase is everywhere there’s economic discussion.

What happened to the idea of comparative advantage? Supposedly Nation A was good at X and Nation B at Y. And they traded to each other’s benefit.

Now they “compete”. What does that mean? They both make Xs and try to sell them to whoever? Or Nation A can’t make anything but a mess, while Nation B makes a to z?

In a competition you have winners and losers, by definition. So when somebody is a winner, it shouldn’t be a surprise to have a loser. And you can even compete with yourself and lose, as people will. So can nations.

There’s so much more to this topic than competitiveness. It’s not the NFL. But that’s all they see, when they measure it like they do.

Yves: ” . . . [Article] that manages the impressive feat of making you stupider than before you read it.” *Ha* I often have that physiological reaction encountering the MSM, especially commentary and editorializing therein. The mental equivalent of carbon monoxide—and intended as such, I suggest. The point isn’t to persuade, as I see it, as much as to narcotize the recipient to curl up into a fetal ball and withdraw from any political or intellectual engagement. That’s the _goal_ of the right wing; a feature, not a but. They don’t want your participation, mentally or otherwise; you’d only gum up their ‘operation.’ They want they great mass of the population to withdraw from policy discourse entirely, leaving the ground free for the toxic nostrums of wealth to proliferate. Just my view . . . .

And on the matter of US ‘productivity’ relative to Japan’s or any other, the US has a lengthy recent history of being first with many innovations, but by no means being best with them in the end. This is notably true of tech, but I think that argument can be defended in many domains.

Why is that? I would argue that this kind of ‘retarted lead,’ to meld a metaphor, is the direct result of the kudzu like growth of our 1% oligarchy over the last generation. What occurs with a useful innovation is that major players, whether in the elite or emergent and ascendant therein, squabble over who will secure quasi-monopoly rights to rip off the larger public, and the squabbles bog down necessary refinements and implementation of known to be necessary and useful refinements. We see this in softwar. We see this in telecom. We surely see this in the internet. We absolutely see this in health care. One could name a dozen fields as applicable. Often what is needed is a regulatory common standard for subsequent growth or proliferation, but major players who stand to lose if not selected howl to a cosmic keen against that, so ‘the market,’ i.e. oligopolistic players few in number, slug it out, taking years or simply tanking market sectors. Better regulated countries make a decision and get on with implementation, often with potent guidance from government. Here, government is deked, bought off, or hired on to ‘stay out of the issue,’ leaving chaos, bumbling, and mediocrity often as the result—to maximum expense, however, of a captive public.

America, the Can’t Do nation. That’s what our 1% have made us into. —And that is our future until and unless we prune back or burn off the kudzu of the oligarchy. The oligarchy has NOTHING to do with productivity: they don’t _care_. What they are after is _MONOPOLY_, because the public can be shaken down regardless of the quality of the product, process, or decision, so long as oligopolitans _block any alternative development_. This, then, is why productivity lags in the US in my view: it is in the interest of the American elite to block development so as to force production or economic activity to pass through their rent-extorting gates. Seriously, folks, think about it. It is simply NOT in the interest of the American oligarchy to enhance productivity or have development. When you grasp that salient reality, much of what has happened to the US economy over the last generation really comes into a sensible focus, which otherwise is impossible to grasp.

The elite doesn’t want development, they want personal monopoly. We will have no meaningful economic transformation in the US until we break the grip of the 1%—or get rid of them. Which ever comes first, I say . . . .

Oh, and I’ll add that this kind of oligarchic scleroticism is nothing new. Four generations ago, Europe had the same experience: a plenitude of basic innovation, but an economic top and government wholly owned by a rent-extractive, oligopolistic 1%. The US of that time, by contrast, had less developed markets and hence more _dynamic development_ because, while there was a wannabe oligarchy in the US c. 1890 those involved did not dominate many emergent economic sectors. Not coincidentally, it was in those emergent sectors that the US experienced optimal growth, but domestically and relative to Europe.

Now, we in the US are the ones with the parasitic, rent-grasping oligarchy suffocating development. The means by which Europe, for instance, temporarily pruned back its own oligarchs don’t encourage imitation: elite discredit through catastrophic wars, elite removal through defeat in same, revolution. Europe didn’t cut it’s way out of the suffocating plastic bag of oligarchy by ‘reform,’ though. At this point, I hold out no encouragement that the US will ‘reform’ itself to transformation; the time for that is past. It’s put my chips on the ‘catastrophe’ square of the matrix just mentioned, I regret to say . . . .

The US is not particularly exceptional. We have only been at a different point in the arc of long-term cyclicality. The more favorable part of the arc: now, that’s done, and we’re on to crunch time. Doesn’t look like we’re going to face up to it or measure up, either one . . . .

Maybe, along with the shock of the sudden appearance of optimism over the last couple of months (reminds me of when they hit the switch in March 2009), it’s just Management’s way to prepare the public to accept the idea that it is right and proper for the US economy to have a couple-year boomlet while the ownership of Europe changes hands at depressed prices. A demonstration in innovative destruction, no doubt:

http://www.nytimes.com/2011/12/26/business/us-firms-see-europe-woes-as-opportunities.html?pagewanted=all

A note re Per Capita Income Chart – this one depicting PCI is in Purchasing Power Parity. It shows US in 8th position. I think I might have posted it here a while back. Maybe that’s what he used:

http://en.wikipedia.org/wiki/List_of_countries_by_GDP_%28PPP%29_per_capita

I see both Japan’s and Europe’s prospects over the next decade(s) as not good at all as both have to operate within a wide array of rules and constraints (including basic resources) they do not have the power to change – why did they (US and all) have to create these incredible layers of pure financial/monetary bullshit if more sound options were available to top policymakers? Only to then, having stubbed themselves and tumbled into the whole of the reality that a fundamental shift in global economic weight is attempting to reset the value of everyone’s assets. It is meeting enormous resistance from the existing financial/power elite in developed countries, who are in turn putting the squeeze on down the line. The global wealth pump team has been deployed and it’s pumping from the bottom up and periphery in to the heart in the US. Note the US CAN change the rules, and do so whenever it wants. Maybe being the first to toss the Law overboard is the flexibility he admires.

Anyway, I can well imagine Japan and Europe both turning away from the US should the disparities widen, strains become too great, and fundamental realignment in post-War institutions of power and wealth distribution arrangements prove impossible – Japan to Asia in its West and South; Europe to the East and South.