If you are going to lie, it appears the Obama Administration believes there is nothing to be lost by telling a Big Lie.

Late Tuesday afternoon, HUD Secretary held a conference call with member of the Association of Mortgage Investors. His remarks were consistent with previous rumors we have heard about how the settlement deal is supposed to work.

Several items stood out. The first is that Donovan claimed that the settlement respected the creditor hierarchy, when that is a patent falsehood. He has, in other calls, described the treatment of second liens as “at least pari passu”. As we have discussed, second liens are to be written off when they are more than 180 days delinquent, but banks can pretty much arrange that that does not happen (they can put the loan into negative amortization or increase the credit line on HELOCs, so the borrower is paying with newly-lent money). The treatment of second loans is set forth starting on p. 3 of this “General Framework” document from late January. You don’t need to understand the formulas. All you need to know is anything other than “second liens are extinguished before undertaking any modification of a first lien” is contrary to the payment priority of second liens. And that is most decidedly not what is happening.

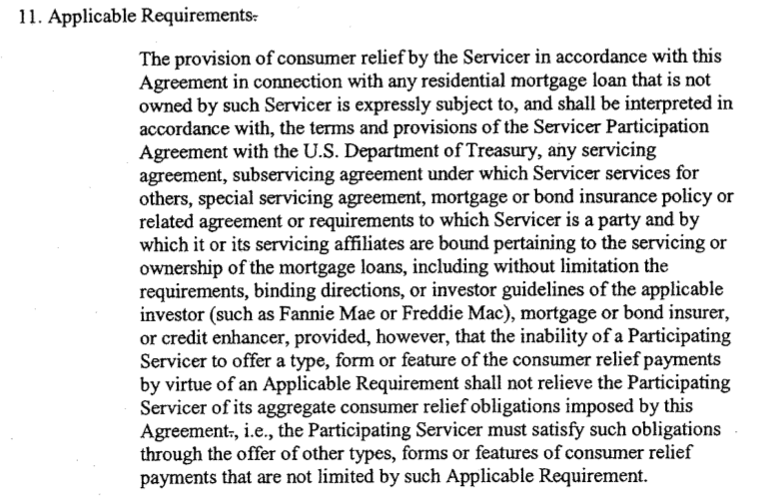

Second is that Donovan claimed that the servicers would not violate their existing agreements with investors. There is verbiage to that effect in the General Framework document:

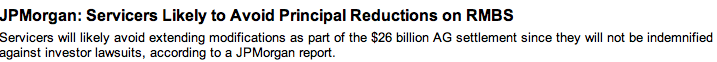

This is taken in some circles to mean that mods are not likely to take place, per Structured Finance News:

So why does Donovan say otherwise? First, he said most of the mods were expected to come from Countrywide deals. Tom Adams looked at two randomly-selected 2006 Countrywide PSAs, and found that both place a 5% ceiling on loan modification and also required that the modified loan be repurchased from the trust. That would mean Bank of America would be taking modified loans (oh, which are subject to redefault) back on its balance sheet, which would seem to be the opposite of what an undercapitalized bank would be keen to do. Here is the language from one of them:

Section 3.12 Realization Upon Defaulted Mortgage Loans; Determination of Excess Proceeds and Realized Losses; Repurchase of Certain Mortgage Loans.

(a) The Master Servicer may agree to a modification of any Mortgage Loan (the “Modified Mortgage Loan”) if (i) CHL purchases the Modified Mortgage Loan from the Trust Fund immediately following the modification as described below and (ii) the Stated Principal Balance of such Mortgage Loan, when taken together with the aggregate of the Stated Principal Balances of all other Mortgage Loans in the same Loan Group that have been so modified since the Closing Date at the time of those modifications, does not exceed an amount equal to 5% of the aggregate Certificate Principal Balance of the related Certificates. Effective immediately after the modification, and, in any event, on the same Business Day on which the modification occurs, all interest of the Trustee in the Modified Mortgage Loan shall automatically be deemed transferred and assigned to CHL and all benefits and burdens of ownership thereof, including the right to accrued interest thereon from the date of modification and the risk of default thereon, shall pass to CHL. The Master Servicer shall promptly deliver to the Trustee a certification of a Servicing Officer to the effect that all requirements of this paragraph have been satisfied with respect to the Modified Mortgage Loan. For federal income tax purposes, the Trustee shall account for such purchase as a prepayment in full of the Modified Mortgage Loan. CHL shall remit the Purchase Price to the Master Servicer for deposit into the Certificate Account pursuant to Section 3.05 within one Business Day after the purchase of the Modified Mortgage Loan

The third claim by Donovan is that investors have given consent to mods. Huh? The Association of Mortgage Investors formally expressed its reservations about the deal in writing. There has been quite a lot of communication among the bigger and more active players, and the general view is only Pimco and Blackrock have been in communication with the Administration and have given a nod. The Fed can also be assumed to approve mods, but the Fed owns fewer mortgage bonds than it did in the past.

How much it takes to get investor approval varied by deal, but 50% is the minimum (some deals require 50% of each tranche, some set hurdles higher). MBS are widely held and Pimco, Blackrock and the Fed don’t account for 50% of most or even many Countrywide deals (and you can probably assume no greater concentration among other issuers).

Remember Pimco, Blackrock, and the Fed teamed up to put back loans to Countrywide . The threshold for putbacks is that investor need to represent at least 25%, not 50%, of bonds outstanding. Recall further that the Fed holdings are smaller than they were by virtue of having sold from its Maiden Lane II portfolio, which included RMBS. That suit was reported as representing $16.5 billion of $47 billion of bonds (presumably face value). So notice they look to have just made the 25% level. The eventual “$8.5 billion Bank of America settlement” which is now very much in play thanks to numerous motions objecting to the deal, increased to include nearly all of Countrywide’s legacy bonds because more investors joined the deal. The face amount was $424 billion. So if the Fed, Blackrock and Pimco now account for even less than $16.5 billion, and are almost certain not to account for 50% of the face value of even the $47 billion of bonds that were in the original Countrywide putback suit, which is only 11% of the total, how can he assert he has gotten investors to consent? It appears that:

1. He underestimates how much investors talk to each other and/or

2. Since investors have no easy way to prove that consent has NOT been obtained, a Big Lie will carry the day.

It is nevertheless yet another sign of Obama Administration brazenness: to have officials tell lies to an audience that will KNOW it is being lied to, with no concern about backlash. They clearly assume that they have sufficient control over the media that they need not worry about disgruntled participants spreading word of the offensive conference call. Even if negative stories leak out, the officialdom is apparently confident that it has enough paid or brainwashed cheerleaders to drown them out.

Maybe Wednesday’s antidote goes well with this.

Incredible what the adminstration is doing…..the arrogance is appalling but with control of the media I guess they can do whatever they want with little repercussion and still keep the banks on their side. Unreal.

chris, not *Unreal*. Goebbels proved that the Big Lie works best. KKKarl Rove is the successor to Goebbels.

Connect KKKarl Rove of Mormon Texas with Morton C. Blackwell–the *NOBILITY* sycophant for the Reagan Republican Reich, who wrote the Foreword to the book published in York, PA, 1993: “NOBILITY and Analogous Traditional Elites in the Allocutions of Pius XII: A Theme Illuminating American Social History.” Blackwell was the *Minister of Youth Education* for Reagan. Was KKKarl Rove not his disciple?

The book presents the Reich philosophy of the Bavarian, former *Hitler Jugend* Cardinal Joseph Ratzinger, in anticipation of his gig as Pope Benedict XVI. It’a all there in CODE, in preparation for the Big Lie to Come.

Apparently, you are suggesting that there are elements within society who not only believe that a class divide exists, but that the divide is natural, if not Divine and that the noble must lie to the masses to maintain social order – and finally, that the Obama Administration is one of those elements and thus feels duty-bound to lie to maintain social order. Are we egalitarians then the heretics?

steel, doesn’t the NDAA prepare for this *reality*? (“We make our own reality,” said the Magister in Chief, the *Decider*.) They are *as gods*:

http://www.youtube.com — “Do You Believe in Magick? (4 of 6)” [see 1-6] by pq92k2 on Sep 7, 2011. LINK:

http://www.youtube.com/watch?v=UTT9rj0mJAc&feature=related

File “the Tyrannicide Brief” against the Traitors who were Agents of a Foreign Power while in Office as President and Commander in Chief.

Let’s not forget the lobbyists http://selfdeprecate.com/wp-content/uploads/2011/10/occupy-wall-street.jpg

Fortunately people are wising up to this http://www.johnlocke.org/images/articles/screen_4e9eb81507270.gif

For some reason the first link doesn’t work when you click on it, but if you copy and paste the URL into the browser the cartoon comes up.

A problem — or THE major problem — is that too many people who are thinking rightwing incorrectly believe themselves to be “liberal” or left-thinking individuals.

Several cases in point: (1) Cap-and-trade, which ostensibly the republicans oppose, and some truly nonthinking dems support — presumably because it has wrongly been associated with climate change eradication, and the republicans for some odd reason oppose it.

I say odd as Greenpeace is against it, Kucinich and Defazio are against it, and everyone I know who is both sane and honest is against it — because it’s simply an extension of the shadow banking system, a plus and profit for the banksters and oil companies (read the GAO report in the USA on it, and the Euro activists’ reports against it); and it originated in 1983 within the Reagan Administration, with some later addons by Enron when it was at its most corrupt!

(2) Disbelief that Microsoft Corporation (by a number of Northwesterners) contributes to rightwing and bankster-type organizations. (The facts speak for themselves, so I’m not going to bother to elaborate.)

(3) Individuals who are supposed to be “radical” or “progressive”, such as Noam Chomsky and Lessig of Harvard, are going around the country the past year, giving speeches as apologists for Wall Street and the banksters. Sorry, true progressives and liberals are Michael Parenti, Paul Cienfuegos, Chris Hedges, etc., but Chomsky claiming that the banksters are decent folk and it’s “the system” are full of feces and just another bunch of disinformation specialists in support of the status quo.

When Stephanie Miller (who supports Bradley Manning being tried and found guilty of treason, and Wikileaks being shut down and Julian Assange being extradited) came to Seattle, her show was sadly sold out!

Sadly, because there are simply too many faux crats and limousine neolibs who are zero information voters — which is why Washington state has the senator with the most consistently anti-worker (anti-American worker, that is) voting record, phony crat, Maria Cantwell!

When I was a kid, it seemed like people actually could tell the difference between a true radical and progressive, and a rightwinger, and today I cringe everytime someone announces “I’m a liberal, I listen to NPR!”

(Holy Mother of God……..)

Please tell, where and when Chomsky and Lessig

were “apologist for Wall Street”.

Bond Market needs to wake up and stop committing money to rigged markets. Only when Donovan can’t find buyers for his mortgage bonds will he wake up and realize how he’s destroying an important economic function. If Obama keeps this up the only buyer for mortgage debt will be the Federal Reserve.

Sorry, but that’s the silliest statement I’ve yet to hear!

Securitizations (process) and credit derivatives (instruments) didn’t come about by accident or “unintended consequences” but by quite a bit of lobbying and predatory jurisprudence and predatory legislation (in other words, typical economic predation).

With the top five banksters controlling the vast majority of credit derivatives, and wielding them like a global financial virus, and stridently lobbying, and having their alums in the Treasury backing them up, against any negation or modification of naked swaps or derivatives in general (note the massive loopholes in Dodd-Frank not only didn’t alter credit derivatives, but now changed what was the norm: no more awareness of future bailouts, as with that legislation the Fed will do the bailouts at the private clearinghouse level ICE Clear Credit LLC, instead of that last way — via Treasury and TARP).

Your pronouncement lacks any factual framework.

And … Obama is going to get reelected?

Romney is going to be better?

There is not free market. There is no free elections. There is no rule of law.

Pitchforks for sale

Tin foil hats for sale

“There is not free market. There is no free elections. There is no rule of law.

Pitchforks for sale” –

You’re correct, when “Obamney” is elected it won’t matter. There are still over 500 CONgress Members to deal with as well. The math of everything wrong through looting and corruption will catch up with us. The only unknown is the nailing down of when it crushes “us”.

Since Americans have relegated themselves to spectator status (i.e. harsh language, peaceful protesting), it is status quo until the weight of corruption buckles. Life goes on for some, but for many not hedged, or poor planning, or believing what

politicianstelevision tells them, I no longer have sympathy for, they stood and did nothing and get what they deserve.Of course politicians will state to their Sheep: “We didn’t see it coming, but here’s a piece of bread, remember to vote!”

remember to vote!”…WW.

Skippy…. That has been replace by machines too, soon there will be no need for citizens to give even any vestige of validity to the process.

Obomney, LOL. Or Otorum. Or OBush (Jebbie!).

When Joan of Arc was badgered with this question from the inquisitors in her trial — [what follows are paraphrases]

“Do you think you are in a ‘state of grace?'” (trying to trap her into a yes or no answer, either of which would be vulnerable to attack — on one hand, false pride; on the other, admission of guilt.)

Joan answered — “If I am, thank goodness. If I am not, I hope to get there.”

That’s the kind of common sense strategy the Progressive base needs. We’ve seen how the Republican ‘tail’ has wagged the ‘dog’ in the primaries. Common wisdom has it that Progressives have no such option. With no claim to originality, there is an option — the “negative vote.” Progressive voters can abstain from voting for the “lesser evil” in states where polls indicate the lesser evil will win in any case, while pursuing their duty to vote for the lesser evil when it does matter. This would enable voters to avoid the yes or no trap.

WW, Why Oh why do people keep saying: *WHEN O. is re-elected*? Where is our imagination? Who are the Just Agents for We the People?

OCCUPY Charlotte 2012: Regime Change for Democracy Now!

BILL BLACK/YVES SMITH 2012: We the Agents for JUSTICE NOW!

Chris Hedges: Secretary of State

(you know the rest)

*UPPITY* AGENTS UNITE! We have nothing to lose but our shame.

I think you may have misread what WW said,

WW commented that when Obamney was relected — meaning samo samo choice — NO CHOICE!

Either way, the bankster party wins….

Thanks for this post Yves, a splendid summary of essential details.

Doesn’t the administration have to pretend that it’s all going to work out? They can’t blink: financial industry talent (I have sworn off the term “bankster” – call them what they call themselves: talent) has succeeded in degrading the notion of private property to an extent far beyond the frustrated dreams of Brooklyn’s last socialist.

how should RMBS issues be resolved?

is there a way to make everyone whole?

Yes. Set up title courts in every state to clear the titles of all property that has MERS in the chain. Once true standing is established anyone without it will be eliminated from the claim, and if there are irregularities going back to failure to securitize or the fraudulent double pledging of MBSs, the investment banks and the investors can come to a quick settlement. If there is a true note holder and beneficiary of a borrower’s note who can establish endorsement and assignment of the mortgage, the borrower can renegotiate and or pay up. If it is established that the investments were bogus, as we all suspect they were, it gives all investors standing to sue the banks. And we know the Fed will never let the banks go down. So the banks will stagger through by taxpayer life support.

Susan, this would be just, but who would dare to do it? Those ready to be *suicided* by a shot to the base of the skull, the time-honored *remedy* for the uncooperative?

I don’t strongly disagree, but I would prefer not to assume that the banks are indemnified from failure by the Fed/Treasury. Take a look at Greece. It is facing a legitimation crisis. Would Obama let cities burn to protect BOA? I would prefer to assume not.

The banks were already *indemnified against failure* once (that we know about). Why not again and again and again?

“Would Obama let cities burn to protect BOA?”

Hmmmm…perhaps you’ve been out of the country or off the planet and haven’t noticed O’s working to end habeas corpus, due process (at least by the legislation he’s been signing, and the DOJ suits he’s been supporting), not to mention the 100% neocon appointments of his — and his support for the further offshoring of jobs by signing those three “free trade” agreements (and that South Korean one which has set asides for 65% of the work going East, but not to South Korea — appears to be slave labor camps in North Korea??)?

From at least Reagan to the present, ALL those in the White House have been consistently Wall Street stooges, only their ages and backgrounds have changed a bit….

Well, the Administration lies about the mortgage settlement, the Republicans lie about the deficit. If elections changed anything they would stop holding them. I wish I could say not voting was a satisfying response, but I have been doing it for 40 years with no visible results.

Would limiting the modifications to loans in Fannie, Freddie, and FHA pools (i.e., no private label RMBS) perhaps square this circle of contradictory statements by the administration?

No, the AMI letter complains that Fannie and Freddie loans will not get principal mods. That was also in some of the PR around the time of the announcement. But a good guess!

There may be short term rewards, but this will come out and it will further enrage ordinary people. There are repressive laws on the books now and I wonder if these people are trying to encourage a total societal breakdown.

TS, just imagine the profits to *Private Equity* from breakdown/Martial Law.

Yes. Not only has the Obama administration adopted the Big Lie as SOP, senior officials have a competitive race on as to who can tell the biggest whopper, with a straight face. (Source: R. Emmanuel, in off the record comments to Chicago Tribune columnist J. Kass). Though Mrs. Clinton and Geithner can lie about anything effortlessly, Obama has a commanding lead to date. Still, notwithstanding the administration’s obvious skill in dissembling, prevarication, and mendacity, it has a way to go to exceed the Olympic standard: the Nobel Peace Prize Committee.

GG, Will the Nobel Peace Prize Committee please take a Stand for Peace and REVOKE the Nobel Peace Prize conferred upon Barack Hussein Obama? Then they can revoke the Prize conferred upon Kissinger and Carter. This is at least ONE ACT that *Europeans* CAN perform to help We the People Enslaved in the U.S.A.

If they don’t do this, is their so-called Peace Prize not to be mocked to death?

Will the Europeans please return the favor of American troops in WWII? I appeal directly to Sweden’s vaunted *Moral Authority* to grant Nobel Prizes. If you be such officially Supreme Moral Arbiters, then recall: “The Lord giveth and the Lord taketh away.”

Swedish *Nobility*, are you mice or men? Are you not Sovereign Agents? If so, DO YOUR DUTY for Peace and Justice NOW! DEFY the power of war-mongering despots to DECEIVE and MAKE WAR PROFITS under the CLOAK of the Nobel Peace Prize. REVOKE the Peace Prize you granted to these lying, duplicitous Men who serve Mars to profit the Fourth Reich. You have the POWER to restore the meaning of HONOR, by dis-honoring the dishonorable, through the revocation of the Nobel Peace Prize granted to Obama and Kissinger at the very least. WILL you stand against the Despots of the Reich in time in C.21?

Sweden, we await the performance of your *Noble* Agency. Now PROVE your august substance. Come to America’s rescue. Revoke the Nobel Peace Prize granted to Obama, Kissinger, and Carter–proven Enemies of We the People of the U.S.A., who presided over the subversion and conversion of our Constitutional Democracy into a dictatorship of the 1%. JUST DO IT.

Just do it right now.

I’m likin the “revoke the Peace Prize” pathway.

Who’s raelly behind Obama? http://rt.com/files/online-exclusive/galleries/cartoons/organization-occupy-street-wall/i92dbbbc6864de6d429e06124517ae0c8_wall-street-01.jpg

Of course there is reason that politicians have mostly been despised throughout history, and there are many quotations to that effect. Politicians only tell the truth if it benefits them in some way.

People or groups in position of power and authority often lie for all kinds of reasons, but generally some variant of “for their own protection” (which really means for the authority’s own protection). In companies, management lies as needed… in families parents often lie to their children… people lie to their friends and family all the time, generally about little things, but they do it nonetheless. The trick is to figure out what’s going on behind the lie. Truth is rarely popular, which is why there are so many cartoons on that topic.

Who’s behind and what is Susan Webber?

Yves – given the multiple hurdles, approvals, sign offs, waivers, assembling of a group at 25/50% to comply with the indenture provisions of the resepctive trusts and required to give a modification of size (say 40%) which will be very hard to do –

is all this window dressing for mods – that will never really take place – and all that is going on is that the banks get a “get out of jail card free” for the fraud on the courts (phony made up docs/robosigners) which is actionable in this settlement agreement?

yes i admit it, I hate Shaun Donovan

It is nevertheless yet another sign of Obama Administration brazenness: to have officials tell lies to an audience that will KNOW it is being lied to, with no concern about backlash. They clearly assume that they have sufficient control over the media that they need not worry about disgruntled participants spreading word of the offensive conference call. Even if negative stories leak out, the officialdom is apparently confident that it has enough paid or brainwashed cheerleaders to drown them out.

This is an excellent description of the strategy they use for virtually every scum-bag thing they do, from mandating fealty to private profligacy, to smirking as they wipe their ass with the Constitution and the Bill of Rights, to laughing in our faces as they dog-whistle the country’s children off to preemptive undeclared wars.

recognizing the inability of romney to close the deal

i see this as pursuing of wall street support in lieu of any other republican

the deal is you can say bad things about me in public just allow the looting to go unpunished and continue in different forms

in related vain of moral rot and sweeping crimes under the rug for no practical reason other than politics see jesse’s recent items on MF Global

truely justice is for sale

YVES, are you sure that *HELOCs* is not spelled *HELOTs*–a *tell*?

why do ppl continue to argue that the PSA has anything to do with what the banks can and cannot do?

they have completely ignored them for at least 10 years…why would they be expected to comply with them now? lol

Gee, not too long ago the criticism (e.g. A.L.’s YJ on R article) went on and on about how servicers were acting against investor interests by not offering mods and rushing to foreclosure. But now servicers are criticized for a settlement that would require or encourage mods.

Why the switch now to the claim that mods harm investors? Wasn’t the prior argument that mods are more efficient by providing at least opportunity to avoid foreclosure, and avoiding the cost of foreclosure (which harm investors not servicers)?

Sounds like anything anyone does to try and resolve this mess, short of 42 years of litigation (that’s what it will take to fully investigate and litigate this) will get criticized here – one day for not doing something, and the next day for doing it.

Expectations about the future are not Remarkable Whoppers if genuinely believed and with a reasonable basis in reality. Where a year ago there were meaningful questions being raised, now there’s just mud throwing and shrillness.

There’s no such thing as a perfect settlement, and evaluating the outcome requires understanding the leverage each side had (about which few have shown much insight), and how the future will play out (if you know, just start your hedge fund tomorrow – don’t waste time blogging).

Check out this article at http://nationalmoratorium.org/the-new-national-settlement-with-the-banks-will-not-stop-one-foreclosure/

By Jerry Goldberg

The writer is a Detroit-based anti-foreclosure attorney and a leading organizer in the Moratorium NOW! Coalition to Stop Foreclosures, Evictions & Utility Shutoffs.

A settlement has been trumpeted between the federal government and 49 state attorneys general with Bank of America, Citigroup, JP Morgan Chase, Wells Fargo and Ally Financial “to address mortgage loan servicing and foreclosure abuses.” (Department of Justice, Feb. 9) While acknowledging the massive fraud perpetrated by these institutions in carrying out foreclosures, the agreement provides minimal compensation for the hundreds of thousands of families who have lost their homes.

The $25 billion settlement will not prevent or stop one foreclosure. Instead, it is projected that the banks, with the settlement behind them, will actually accelerate the pace of foreclosures in 2012. (Global Finance News, Feb. 11) In 2011 a whopping 2.7 million foreclosure filings were reported in the U.S. (RealtyTrac, Jan. 12) This figure will likely rise significantly this year.

While the settlement details have yet to be published, the Department of Justice notes that $1.5 billion will be used to establish a fund to “compensate” borrowers who lost their homes between 2008 and 2011. This means the banks will pay less than $2,000 per loan file for “lying to courts and end-running the law.” (New York Times, Feb. 11)

$17 billion of the $25 billion settlement is for principal reductions on underwater loans. (Underwater means the current value of the home is worth less than the amount owed on the mortgage.) Approximately 11 million borrowers are underwater on their loans to the tune of $700 billion in total, so $17 billion in write downs amounts to a measly 2.4 percent of the total negative equity weighing down homeowners across the U.S.

Moreover, these write downs do not affect any Fannie Mae- or Freddie Mac-backed loans, which encompass at least 56 percent of all mortgages. Fannie and Freddie are U.S.-government-owned and taxpayer-funded agencies that insure and own mortgage loans.

The settlement earmarks $5 billion for compensation to the states for the losses they suffered due to the foreclosure epidemic. But there has been $1.9 trillion in home equity loss due to foreclosures. (Center for Responsible Lending, August 2010) This huge home equity loss has destroyed the tax base of city, county and state governments across the U.S. and led to the destruction of public services and the elimination of millions of jobs. This $5 billion in “compensation” is a paltry sum and cruel joke to the workers and communities who have been devastated by the foreclosure epidemic.

Demand moratorium to stop foreclosures

The settlement website lists a set of new servicing guidelines that are supposed to help homeowners avoid foreclosure. In fact, most of the guidelines listed are already encompassed in directives and regulations published in connection with the federal Home Affordable Modification Program, or HAMP.

The HAMP guidelines are routinely ignored by the banks, however. This is acknowledged in the new settlement as well as in previous consent decrees with every major bank and the Federal Reserve and Office of the Controller. Families who qualify for modifications under federal law and regulations, who submit every document required, and who make every trial payment required under these programs, suddenly find themselves in foreclosure.

Government entities refuse to enforce the very programs they create mandating modifications by the banks, and judges routinely side with the financial institutions. The settlement has no mechanism for individual borrowers to enforce their right to loan modifications. And, with the attorney general litigation now over, the banks are freed up to continue their routine disregard for federal laws and regulations without fear of prosecution.

While this settlement provides little actual relief to homeowners, the acknowledgement by the five largest mortgage banks of their fraudulent activity strengthens the argument for the immediate implementation of a moratorium on all foreclosures and foreclosure-related evictions in the U.S. The settlement will take three years to be implemented. Why should there be one foreclosure while homeowners await the little relief being promised?

There is already an independent foreclosure review of all foreclosures initiated in 2009-2010 pursuant to a Federal Reserve consent decree for servicing abuses. Why should one homeowner face the loss of their home while their foreclosure is being investigated for bank fraud?

Why should the same federal government which trumpets how it is allegedly fighting for homeowners, be the primary conduit of foreclosures and evictions through Fannie Mae, Freddie Mac and the Federal Housing Authority? These government-controlled institutions together own or insure 75 percent of mortgage loans in the U.S., and have funneled approximately $200 billion to the banks through the silent bailout that occurs with every foreclosure when the bank receives full value for the underwater mortgage.

A national conference in Detroit on March 31 called by the Moratorium NOW! Coalition will strategize furthering a campaign to demand President Barack Obama place an immediate long-term moratorium on all foreclosures through executive action. A national moratorium on foreclosures will keep people in their homes while they organize for real relief for the victims of the foreclosure epidemic, along with criminal prosecution of the bankers who created the crisis.

Contact nationalmoratorium.org to register.

Yves, are you seeing this? Eric Holder and Shaun Donovan post article “Holding Banks Accountable” in the Las Vegas Sun, Huffington Post and Daily Kos. The response is… THUD.

http://www.huffingtonpost.com/shaun-donovan/holding-banks-accountable_b_1279073.html

http://www.dailykos.com/story/2012/02/15/1065029/-Holding-Banks-Accountable

http://my.firedoglake.com/janeeyresick/2012/02/15/amazing-diary-at-kos-by-hud-and-justice-secretaries/

I have only looked at a few of the interviews and statements made by Donovan over the past three years, but based on those exposures I’m not sure that he would recognize that he is propogating a lie.

(Heck of a job, Brownie.)