A number of writers, such as Mike Lux, Bob Kuttner, Matt Taibbi, and Justin Krebs, have been willing to convey the Administration message that the current version of the mortgage settlement is a “much tougher deal” and even a pretty good deal, thanks to Schneiderman’s intervention.

It is important to note that any recent improvement in terms has come at the cost of Schneiderman moving from being decidedly against the settlement to being in the “maybe/maybe not” camp as an apparent part of his decision to join an Administration investigation on mortgage abuses. But as we have stressed, the fact that the Obama team is pushing to wrap up the settlement agreement before the probe underway is a very bad sign. How can you settle when you don’t know the full extent of the bad conduct?

In addition, the change in Schneiderman’s posture has undermined the solidarity of the dissenting attorneys general, which is no doubt what Obama hoped to achieve.

While there is every reason to believe there has been some improvement in terms due to the resistance of Schneiderman and other state attorneys general (Beau Biden of Delaware, Martha Coakley of Massachusetts, Catherine Cortez Masto of Nevada, and Kamala Harris of California), the notion that, per Mike Lux, “the settlement release is tight” appears to be patently false.

Since there has yet to be any disclosure of the draft terms, we can’t be certain, but a reading of a letter sent by Nevada’s Masto gives plenty of cause for pause. Reaching inferences from her 38 questions is a Plato’s cave exercise, but some of the items seem pretty clear.

By way of background: remember that the big concern about the release was that it would go beyond robosigning and waive other types of liability. The ones observers were most concerned about were what we called chain of title issues, namely that the parties that had put mortgage securitizations together had failed on a widespread basis to take the steps stipulated in their own contracts to transfer the notes (and in lien theory states, to assign the lien) properly.

The securitization agreements were rigid, requiring that the transfers through multiple parties be completed by a date certain, typically 90 days after the closing of the trust. Most deals elected New York law as the governing law for the trusts, and New York law allows them to operate only as stipulated. Since the notes were supposed to be transferred in by a particular date, trying to move them in later is a “void act” having no legal effect. That makes attempts to make transfers legally at this juncture a non-starter.

Having realized somewhat late in the game that their failure to do what they promised could interfere with trusts’ ability to foreclose and create tons of liability, servicers and their various agents have relied on not just robosiging, but widespread document fabrication and forgeries to fix their transfer problem when judges have taken notice. Anyone who has been on this beat knows of numerous cases where foreclosure documents are challenged, say for being too late, not having the right transfers, etc, that new versions of supposedly original documents that tell the right story miraculously show up in court.

The other big concern was origination issues, such as misrepresentation of mortgage terms, steering minority borrowers into more costly mortgages, and violating the representations and warranties made to investors about the loans backing the securities they purchased (that is, they were sold dreckier loans than they were promised). However, many Federal statues have five year statutes of limitations. One effect of dragging out the settlement talks forever has been to extinguish a lot of liability, since the subprime origination market shut for good in June 2007. A lot of grounds for suing deals from January 2007 and earlier have gone poof; the subprime market was in freefall for February, leaving only the last (admittedly dreckiest) March through May (and a few in June) securitizations exposed. Was this a bug or a feature?

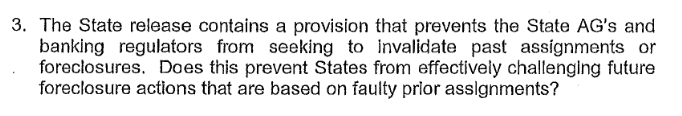

Now to the Masto letter. Most of her queries are sufficiently technical so as to make it hard to guess with any certainty as to what the language of the agreement might be, but two questions at the top stood out:

This certainly looks as if Masto sees the origination release as broad. Asking for an itemization of what is NOT included suggests a lot seems to be included.

But this is the whopper:

From early on, we have stressed that this is a cash for release deal, and this looks like a VERY big release. The banks will pay an amount into the fund, and all issues relating to robo-signing and foreclosure will be released by the AGs: the banks will have a state level release from all bad assignment/transfer issues.

Note this does not stop private parties, meaning individual borrowers, from suing on these very grounds. But taking the AGs out of the picture prevents them from using their subpoena and prosecutorial powers to determine how widespread these abuses are and to negotiate broad solutions. So we’ll have the worst of all possible worlds: individual borrowers getting better and better at fighting foreclosures (or if you are a pro bank type, getting better and better at throwing sand in the gears) with the AGs sidelined in their ability to shed light on these issues and bring them to resolution on a broader basis. And given that the OCC has already entered into weak consent orders with the major servicers, and past servicing settlements have been violated, I remain skeptical that this deal will stop these abuses. Remember, bank executives piously swore in 2010 that they stopped robosigning, yet their firms continue to engage in that practice.

Our Tom Adams concurred and added:

This is the point of the settlement whitewash – all the press on robo-signing has always be about “sloppy practices” when the truth was that it was about covering up bad transfers. The settlement will cement this false narrative.

If Schneiderman signs onto this, it will almost certainly invalidate an important piece of his motion against Bank of New York in the $8.5 billion Bank of America settlement (and you can be sure they’ll be in court the next day, pointing that out) and it will certainly invalidate Biden’s claim. From Schneiderman’s objection:

One of BNYM’s primary obligations as trustee under these PSAs was to ensure the proper transfer of loans from Countrywide to the Trusts. The ultimate failure of Countrywide to transfer complete mortgage loan documentation to the Trusts hampered the Trusts’ ability to foreclose on delinquent mortgages, thereby impairing the value of the notes secured by those mortgages. These circumstances apparently triggered widespread fraud, including BoA’s fabrication of missing documentation.

Economically, if the banks get released from failing to properly transfer thousands of mortgages into the trusts for a mere $5 billion they will have gotten the deal of the century. Especially because this settlement will do nothing to stop borrowers and courts from challenging foreclosures and continuing to expose the failure to transfer. So not only will investors pick up the cost of most of the settlement, but they will then still be exposed to the bad transfers, while the banks get a get out of jail free card.

If that isn’t bad enough, there is yet another element of the deal that many of the attorneys general seem to have missed: the money part of the deal is now wildly skewed in favor of California if Kamala Harris were to relent and sign on. Other states hit hard by foreclosures, like Florida and Nevada would get table scraps. Their AGs seem to have missed the information conveyed in this story by the Financial Times’ Shahien Nasiripour (emphasis mine):

California, home to the largest US property market, spurned an offer of roughly $15bn in lower monthly mortgage payments and reduced loan balances for its residents in talks to settle allegations of mortgage-related misdeeds by leading US banks…

California would have received more than half of about $25bn of aid that would be available to borrowers in a nationwide deal under discussion to settle allegations that banks illegally seized homes using faulty documentation.

Deal terms, sent to state attorneys-general late last week after nearly a year of talks between the banks and various states and federal agencies, did not include guaranteed minimums for any other states, people familiar with the matter said. Various state officials said they were unaware of the California offer.

Note Masto’s letter went out the same day that Shahien published this story. Her question 24 shows that she does not have any indiction of how much Nevada or other states would receive.

It is hard to fathom how any responsible attorney general can agree to this deal not knowing what they are getting for their constituents. It is particularly bizarre that Pam Bondi of Florida has been pushing so hard for California to join the deal rather than do her best to secure terms at least as good as those offered to California for Florida homeowners.

And the same question can be asked of Schneiderman. Why has he gone from pushing for a better deal or no deal to sitting on the sidelines? This brave talk of investigations is all well and good, but this settlement agreement is being finalized now, and all the PR related to his new Federal role seems to have taken him off his day job responsibilities at a critical time.

I’d like to think better of Schneiderman, but his apparent failure to oppose what looks like the release all of us had feared is not encouraging. It would be much better if the Masto letter were somehow poorly written and hence a mischaracterization, but it looks to be carefully thought out and drafted. And if the footprints in her missive are indeed accurate, the fix is in.

I’m sorry, but there is no other conclusion to draw. Schneiderman has defected.

★★★★★ My friends told me about—onenightcupid.c/0/m—. She told me it is the best place to seek casual fun and short-term relationship. I have tried. It is fantastic! Tens of thousands pretty girls and cute guys are active there. You wanna get laid tonight? Come in and give it a shot, you will find someone you like there. Have fun! >_<

You can ask him yourself–Mr. Schneiderman will be speaking about mortgage matters at DL21C, a group of youngish mostly-Democratic political enthusiasts, on March 6, somewhere in Manhattan, open to the public–will post details when they are available.

I just worked up a case where a mortgage was claimed to have been transferred to a trust in November of last year – more than 6 years after the trust was closed!

hey tx, can you or anyone recommend a good NY lawyer experienced with these issues?

“good NY lawyer” may be an oxymoron!

TPTB are just going to steamroll right over The Citizenry yet again. I’m not sure why readers aren’t getting this. You can write (which I appreciate) or call your “elected” Representatives about this issue all you want, but they don’t care. They have sold us all out for their own self interests.

When they sell us out again, nothing will happen. Sure it will be written about here and elsewhere, but that’s it. The country has grown far from its roots and most of the civilian population has become a country of pacifist.

FYI: This is the reply I received from MD AG two days ago:

Dear Mr. G Man

Thank you for sharing your interest in the proposed settlement among state attorneys general, the federal government and the five major U.S. banks involved in home mortgages regarding allegations of fraud and deception in mortgage origination and servicing (i.e., “robo-signing”). Like you, I want to be careful to put the interests of Maryland homeowners first in any agreement we reach, and I appreciate your thoughtful input.

Since the beginning of the mortgage foreclosure crisis, our office has been looking into and addressing the wrongdoings that contributed to the upheaval, as well as the ensuing frauds and scams that preyed upon homeowners caught in the mortgage foreclosure crisis. Links to several of our efforts are detailed at the bottom of this letter.

As part of these efforts, we also have been actively engaged over the last 15 months in every aspect of the investigations into and negotiations with the five major U.S. banks that have resulted in the proposed settlement. I recently traveled to Chicago to meet with my counterparts from other states to discuss the proposed settlement, ask tough questions and begin a review of the final terms presented.

Our office has not commented on any settlement prior to this time because nothing had been proposed. Now that an actual settlement is on the table, we are thoroughly examining its terms. In determining whether to join the settlement, the one and only paramount question driving our decision is: “Is the settlement in the best interest of the people of Maryland?”

This question must be evaluated in the larger context of all our ongoing efforts to combat the mortgage foreclosure crisis, because the proposed settlement only concerns claims of misconduct in mortgage origination and servicing carried out by the five major banks.

To that end, I want to clarify what the proposed settlement does not address:

• Potential misconduct at other private lenders, or other government lenders like Fannie Mae and Freddie Mac. Claims against those entities may still be brought.

• Immunity from criminal prosecution for any banking entity or bank official that has broken the law. It leaves open the possibility of criminal prosecution.

• Claims of misconduct related to the securitization of mortgages, electronic registration of mortgages (“MERS”) or state fair lending laws, and thus does not prevent any such claims from being pursued by our office in the future.

All of these potential criminal and civil actions and remedies remain open and our office continues to actively explore them. It is with these additional avenues for relief in mind that we will consider the benefit created by the proposed settlement.

Thank you again for inquiring about our efforts to pursue justice for all Marylanders harmed by the wrongdoings that led to the mortgage foreclosure crisis. Your input has been very helpful in this process. Please know that whatever decision we make, our office will not stop the pursuit of justice for the victims of mortgage fraud and deception perpetrated by banks and other financial institutions.

Sincerely,

Douglas F. Gansler

Attorney General

Examples of Prior Attorney General Actions to Combat Mortgage Foreclosure Wrongdoing

• Ameriquest to Pay More Than $7 Million in Restitution to Maryland Consumers

http://www.oag.state.md.us/Press/2007/071207.htm

• Court Places Laurel-Based Mortgage Payment / Investment Program into Receivership

http://www.oag.state.md.us/Press/2007/110107.htm

• Attorney General Settles with Vladislav Zagranichny and Community Mortgage Group

http://www.oag.state.md.us/Press/2009/052709.htm

• Attorney General Gansler Announces Judgment of More Than One Million Dollars in Restitution and Penalties in Foreclosure Rescue Scam

http://www.oag.state.md.us/Press/2009/092909.htm

• Attorney General’s Consumer Protection Division Stops Foreclosure Rescue Scam

http://www.oag.state.md.us/Press/2009/121509a.htm

• Attorney General Gansler Issues Cease and Desist Against Maryland Mortgage Company

http://www.oag.state.md.us/Press/2010/042210.htm

• Attorney General Gansler, Governor O’Malley, Congressman Cummings Call on Mortgage Companies to Halt Foreclosures in Maryland

http://www.oag.state.md.us/Press/2010/100410a.htm

• AG Gansler: Wells Fargo Settles Over “Pick-a-Payment” Mortgages

http://www.oag.state.md.us/Press/2012/010512.html

Thank you for posting this letter. What I find notable is the assumption that the welfare of the people of Maryland is the primary responsibility of the Maryland AG. I happen to disagree. You see, those who favor the status quo could argue that if the banks are taken down by this scandal a broad financial crisis could ensue. In such a crisis, both investors and the public could be injured. Hence, the desire to “get to yes” would supersede the rule of law. Instead of focusing on the welfare of the people of Maryland, the Maryland AG should see his/her prime directive as upholding the rule of law. Ergo, even if enforcing the law could arguably be shown to be adverse to the welfare of the Maryland people, the AG has a duty to enforce the law. If enforcing the law is adverse to the interest of Maryland’s citizens, they could press the Maryland legislature, which does have the responsibility of protecting Maryland’s citizens, to change the law. It is more than somewhat disturbing that the AG does not understand his/her role in society. Fire him.

It has become clear that we must fire all politicians currently in office. Ignoring our own laws, proofs that they beleive in lawlessness.

But they have been told: “The law is a ass.” (Mr. Macauber, “Oliver Twist”)

A Maryland class action robo-signing law suit was thrown out of Federal Court some days ago. Grim, but not entirely hopeless.

http://www.nakedcapitalism.com/2011/04/bill-black-fiat-justitia-ruat-caelum-let-justice-be-done-though-the-heavens-fall.html

“We should leave felons in charge of our largest financial institutions as a means of achieving financial stability.” –

Black is as cynical as I am, which emphasizes my point/post.

Harsh language no longer matters because TPTB don’t care about being cursed at. The question people are going to have to ask themselves is:

“How far and what am I (and others) willing to sacrifice to intervene in this completely corrupt Plutocracy/Babana Republic in order to re-establish The Rule of Law?”

If the answer is nothing, then The People get what’s coming to them.

*edit: Banana Republic

Interesting. Thanks for the link.

Just looking at some of those links confirms my anecdotal experience of prosecutors going after low level mortgage brokers (serving mostly ethnic communities) and real estate professionals and lawyers conducting mortgage relief “scams” after the bubble burst.

Oh, and there are a couple of nuisance settlement fees paid by the big boys mixed in there.

I don’t mean to imply the mortgage relief scams weren’t scams. People are better off going straight to a bankruptcy lawyer rather than messing around with the mortgage relief people.

But the more I think about it the more I realize this enforcement priority dampened the willingness of lawyers and others to assist people in need. The bar, prosecutors, and the courts put more scrutiny on “modification” lawyers and professionals so the effect was fewer people were willing to help.

There is one question I have about all this: why hasn’t any of the A.G.’s been beating the drum about all the fees that were lost? Most states are in a hole as well as counties too. Perhaps I’m either naive of too simplistic, but just those fees seem like a big chunk of change, that is owed to each state by the T.B.T.F. or who ever it is/was that cheated by not paying said fees.

They’re being told the banks don’t have the money to pay those fees. That’s also why they’re being told to be team players and go along with the settlement, because banks are just too strapped to pay anything beyond these paltry sums, and if the banks are subject to ongoing liability claims then it could trigger Armageddon.

“Big” can charge and collect fees by the ton. But pay?

I’m with you on this. I haven’t seen many promoting this theory of liability:

The banks and other perps defrauded local government out of recording fees. They should be able to get those fees back (plus interest) and probably have liens on all that property (!?). Just think, we can use that money on schools and parks again.

I think professor Black summed up the current snow job rather nicely…

The Working Group does not pass even the most generous laugh test. No one who has ever been involved in a successful, complex criminal investigation of a large organization could take this Working Group seriously. It lacks the capacity to conduct a competent investigation of any of the largest financial frauds – and there are scores of huge institutions engaged in MBS frauds and hundreds of large mortgage banks engaged in MBS frauds.

If this farce does get done, Charles Ferguson should have plenty of material for an Inside Job sequel.

“Since the notes were supposed to be transferred in by a particular date, trying to move them in later is a “void act” having no legal effect. That makes attempts to make transfers legally at this juncture a non-starter.”

Perhaps this is so, in the context of securitized mortgages, but generally speaking it’s not so. Defective titles can be cured, and missing documents can be proved up. After all, there was a loan, there was a note, there was a mortgage.

Title company’s files will contain copies of all of these documents, and they will have been properly recorded in the real property records. A buyer took possession of the property and made some payments. The buyer will have cancelled checks and bank statements showing the dates and amounts of payments.

There is absolutely no legal reason why the truth should not out. The obstacle is expense and complexity.

What should happen is, the states should adopt a streamlined method for homeowners and note holders to repair defects in the chain of title. The banks should have to pay the costs. This whole AG settlement thing is entirely beside the point. It solves nothing.

You’ve made a lot of assumptions. The first one you missed was widespread origination fraud in the great ‘Murican tulpenmanie, also “missing documents can be proved up” or forged on demand. No one can handle the truth. Onto Iran!

Origination fraud, as in liar’s loans? That may expose the borrowers and originator’s to criminal prosecution, but has nothing to do with whether or not the loan was actually made, notes and mortgages validly drafted and recorded, and buyers actually taking possession and making payments. (or failing to make payments)

“missing documents can be…forged on demand”

Duh. It’s called robosigning. The whole point is to devise a streamlined way (outside the courtroom) to prove up missing documents or cure defective or non-existent assignments. The fact remains that mortgages and lien documents all allow for assignment. The fact that assignments weren’t made properly, or at all, does not generally mean that the situation can’t be cured by redoing the assignment. (validly redoing the assignment, not backdating it and forging signatures)

The author of the post asserts that any attempt to move the notes after the fact in the case of securitization trusts is legally void. I’m not at all certain that is the case, but even if it is, that should be the focus of yhe effort to resolve this quagmire….legislate a process by which the cures can be made.

“That may expose the borrowers to criminal prosecution”

Don’t be insane. “buyers actually taking possession” Moving in with their clothing and dish rack? They weren’t permitted to take possesion of anything. Well maybe for a few minutes.

DOT. The actual house doesn’t really mean anything.

“The author of the post asserts that any attempt to move the notes after the fact in the case of securitization trusts is legally void. I’m not at all certain that is the case, but even if it is, that should be the focus of yhe effort to resolve this quagmire….legislate a process by which the cures can be made.”

You aren’t certain because you likely haven’t read the laws that prove up that statement. Those of us that are deep researches, and long time followers, of these issues are certain that is what the laws equate to – attempts to convey after the closing date of the trust (plus 90 days) are, in almost ALL cases, void (there is usually additional language in the PSA that allows for late transfers and conveyances but in my read of thousands of instances I’ve not seen one, not a single one, that meets with the conditions as defined in the PSA).

attempts to convey after the closing date of the trust (plus 90 days) are, in almost ALL cases, void (there is usually additional language in the PSA that allows for late transfers and conveyances but in my read of thousands of instances I’ve not seen one, not a single one, that meets with the conditions as defined in the PSA).

First of all, assignments are not attempts to convey, so I’m not sure what you are referring to.

Secondly….who, exactly is the language regarding late assignments in the PSA meant to protect? Why, the investor, of course. The investor can most certainly waive defective assignments and consent to late assignments if it’s in their favor to do so, which, clearly, it is.

The only participant who benefits by the robosigning problems are the borrowers who use the defective transactions to avoid foreclosure. The borrowers are not party to the PSA, they are not third party beneficiaries of the PSA, and if the investors wish to waive defective assignments and cure chain of title problems legally and after the fact, the borrower has no legal standing to complain.

All very interesting points including origination matters which used to be ignored, with the focus on assignments.

but we don’t see much about the following and would very much appreciate all your comments.

It’s not just about first time or young buyers taking possession of homes after closings. Also its about older folks and often quite older folks retired and long in their homes when being encouraged to refi or modify etc. With all that we know now these “offers” entailed.

And now have nowhere to go and on very fixed incomes no extra money like yes for lawyers, if that would help. The offspring moved, away as happens frequently now in most countries.

It’s not ‘turn a new page’ time. It can be life or death time. Floated away on the iceberg of hopelessness added to homelessness … not golden years, not silver, not bronze – what should we call it… foreclosurecide?

Is this ok with us? Have we come to that mode of adjusting the demography (loadings of the) generations? And if so, what name for this… (think of grandparents, living afar and no room at the Inn)…

Any suggestions? Used to be “move to Florida” but that doesn’t now seem like a very “cool” solution” even with the money or physical strength to migrate. If that were true.

Best, in accord, EIF.

CB, that is the point: “MORE” — “Onto Iran”–yes, I hear the jets overhead, mustering, mustering.

“It solves nothing”? Amazing how Randian-think destroys any concept of justice and civility.

Civil Person: Woh, wait a minute. This is about not letting cheaters prosper. It IS a fundamental responsibility of government to maintain law and order, to prevent criminals from cheating people. And in this case we’re talking about a huge syndicate of organized crime that has stolen trillions of dollars and severely damaged the foundations of our economic and political systems. By not demanding justice we have allowed a global mafia to captured our corporate and government institutions? Corruption is now rapidly breeding. The only civilized way to take back our government is to demand that our laws be upheld, that the criminals be indicted, prosecuted, their loot taken back, and they be severely punished to the point that they deeply regret having done what they did. (note: no Randian would let you say this much).

Randian: Get over it you loser. If you got ripped off it’s your fault. That’s just stupid to think that you, or any number of you losers, no matter how many, should be able to go crying to government to protect you from your own stupidity. Suck it up and get used to it. It’s a new world baby! No more pussies crying to mommy! No mambi pambi government’s going to take care of you. It’s a winner takes all world now! Get used to it. The stupidity of organizing a government and rule-by-law is history. Quit whining, get smart, get tough, get a gun.

The most difficult thing for a civilized persons to understand today is that the Randians ARE the majority. And more frightening still is that the numbers appear to be shifting in their direction. I never thought it could get this bad. I’m now starting to understand what was happening one hundred years ago. Amazing how 19 years of formal eduction taught me nothing of what really needed to be understood.

Did you manage to miss that this ENTIRE settlement is about securitization? New servicing standards? Robosiging? That takes place ONLY to cure defective transfers. You don’t need to do an assignment on a mortgage you own.

And since the 1990s, the overwheming majority of mortgages have been securitized, well over 80%.

Better trolls please.

As I indicated in my response to the self styled “deep researcher” above, trying to rescue delinquent borrowers from foreclosure through the mechanism of asserting rights granted in a PSA to which the borrow is neither a party nor a third party beneficiary is going nowhere. Ain’t gonna happen. No free houses, except maybe to those who have been improperly foreclosed upon. As in, those who are not actually delinquent in their loans, or otherwise protected like absent military personnel.

Parties to agreements can change them. Just because the PSA says the assignment has to be done 90 days in advance doesn’t mean it’s written in stone that is has to be done 90 days in advance if all parties to the agreement want to change it. The investors who purchased securitized mortgages pursuant to a PSA will eventually partner with those who sold them to cure the defects in chain of title. They can use well accepted, time consuming, expensive, and cumbersome methods of doing so, or they can lobby for legislation to streamline the process.

post script

Yes, I understand perfectly that robosigning was done to cure defective transfers. The problem with robosigning wasn’t that defective transfers are incurable. It’s that the robosigning itself was defective. Proper waivers or consents were not obtained from the investors, signatures were forged, foreclosures were handled without accurate information as to the delinquency status of the loans, etc. etc. etc. Lots of problems, no doubt. Lots of people should be criminally punished, no doubt of that either. But the cure is not free houses to free loaders. The ire of the neighbors will be as nothing compared to the ire of the 401K holders, pensioners, and insurance claimants when they discover that the mortgages in the portfolios of the companies they rely on have been nullified and the house turned over to some guy who put nothing down.

“How can you settle when you don’t know the full extent of the bad conduct?”

When the contributions are laund- bundled?

There are two sides to this fight.

On one side, we have a broad group of people I would call, for lack of a better word, “the establishment.” By this, I mean not just the country’s elites — though they are certainly part of it — but everyone else who wishes they could turn the clock back to, say, 2005, when “things were going well.” This includes most executives, lawyers, doctors, accountants, entrepreneurs, managers, technologists, scientists, and, yes, editors and journalists.

When presented with evidence that the financial sector engaged in massive systematic mortgage fraud during the housing bubble, this group’s reaction is to ask, why delve on the past? Why not put all this behind us so that we can focus on rebuilding our economy? We want things to go back to “normal” – to an economy that is growing again and a country where there is no social unrest.

The people on this side want the states to sign the settlement, so that we, as a country, can move on.

On the other side, we have the masses, who have no voice except through movements like OWS. When presented with evidence that the financial sector engaged in massive systematic mortgage fraud during the housing bubble, this group’s reaction is to ask:

What about The Rule of Law?

Those wishing to just sweep all of this under the rug and “get growing again” also are confused by what is causing the lack of growth –> insufficient demand, caused primarily by too much debt-based money still in the system, being propped up and (its continuance) condoned and perpetuated by government force.

The problem with writing off all the bad debt? It bankrupts a LOT of elites.

In fact writing off all that bad debt would bankrupt anyone with a lot of liability (can you say US Government?).

Additionally, as money appreciated by deflation and everyone defaulted on their loans, it would destroy the divine established sanctity of paying back a debt, and the debt-merchants don’t want that. Thus the game continues.

“Rule of Law” ? Say wuh? “The past is not past” only brought home to roost:

http://www.youtube.com —

“the united fruit company” (aminohuana1 on Dec 28, 2009) – in Spanish

“Boston Company eats *Untied Company* yields *United Fruit Company*

Arbenz elected, too good to his *People* of Guatemala (land reform)

Eisenhower 1954: CIA brings “anti-communist” coup, Arbenz OUT, Empire IN

*United Brands* becomes *Chiquita Brands International*

CONNECT: Boston Company’s *Keiht MINOR* with *United Fruit* in New Orleans with Judge John MINOR Wisdom of New Orleans–pushed up legal ladder by Eisenhower after Wisdom *fixed* school integration in New Orleans, while his caste at Trinity Episcopal Church sent their kids to private schools. Note “Wisdom” street/avenue in KENNER, LA (org. crime stronghold).

CONNECT: Sam ZEMURRAY with Tulane University with Doris Zemurray Stone, from New Orleans to Costa Rica and back: a FRUITFUL relationship.

View confessions of John Perkins, “Economic Hit Man,” on YouTube; read “The Shock Doctrine” by Naomi Klein; for *How It Works* come home to roost.

We are all Guatemalans now.

“Got bananas?”

Bananas are an effective antidote to being pissed on: http://videosift.com/video/Randy-Marsh-takes-one-bananna-for-the-team

The really amazing part of all this is that Orruption and his merry men are running their powerplay now – unless they think that The Voter in all His stupidity will safely forget any bad press – as if – by election day, they have to know that they are running some risk despite the GOP never, ever objecting to the abolition of the very notion of property.

Did they come to the conclusion that the GOP primaries will inevitably deliver a “favorable” outcome that will render onto OCaesar his “win” desired above all, no matter what? Is this a 2nd term commecing early?

Or have the Too Big Too Ignore donors pulled hard on their purse strings and called it “Cash On Delivery” only, and Orruption is trying to deliver? History – i.e. FISA retroactive immunity – might educate – what and when were the telecom donations then?

Or has there been bipartisan – banks and administration both – concern that the window of corroportunity is rapidly closing? Dare we “hope” … actual re-election concerns?

No, that would be dopey in-word-and-deed.

“Cause for pause” (Yves) can be deconstructured into —

1) a rush to cover up

2) a delay to obfuscate

The games being played presently employ both tactics.

And the winner is…the usual one, the hierarchy.

If I build a house that’s not to code, I end up building it again to code. My bad.

This is exactly how undeveloped and military led countries deal with law. I’ve been working on a fraud case involving a major lender whose undeniable crime spree was experienced deeply, not just in my state, but nationwide. I’ve been working with my state regulator and AG on bringing this fraud into the light. It’s a tough sell on a good day.

If this deal goes through, thousands of past, present, and future illegal and thus totally unfounded foreclosures will be granted immunity. That’s just plain wrong, I don’t care who you are. Homeowner meet curb. Welcome to the last hurrah.

Can anyone bring RICO? Will anyone bring “The Tyrannicide Brief” (Robertson)?

Our “Dear Leader” is an Agent of the Global Organized Crime Syndicate, and Schneiderman received an offer he couldn’t refuse.

It looks like there’s no point in pretending we are citizens of a valid nation-state anymore. We are all Guatemala now?

http://www.youtube.com/watch?v=rb7XaF1rs1E

http://www.youtube.com/watch?v=NeU_Z-v4_n0&NR=1&feature=endscreen

http://www.youtube.com/watch?v=vZG0b02zCdg

“In our dreams, people yield themselves with perfect docility to our molding hands.” — Frederick Gates (The World’s Work, August 1912).

Someone has brought a RICO against Chase and the good ol’ boys, Jeff Barnes Esq. This is the only case I have been able to find. More attorneys need to follow suit on the RICO.Fraud is Fraud. and these AG’s need to find the major people fighting the FRAUD and consolidate with them. These investigations would go much quicker and much easier with this kind of help.

george, thanks. Right, why aren’t those “greedy” trial lawyers out in force?

A RICO suit brought by private parties would have to get by a judge. In theory this could happen. In practice it will never happen. The only party that gets to bring RICO actions is the government, as a pactical matter.

The Political Class is there to protect citizens, not fraud. It has completely failed. Very disappointing. I’m so disgusted with Obama I’m actually thinking about voting for Romney. Ugh. I don’t understand Schneiderman at all. Except that I’m sure he knows things the rest of us will never hear. I stumbled on some articles in Business Insider by Gary Anderson who bashes how dumb the Republicans are. They are busy circling the firing squad with moronic enthusiasm and will not give the Fed and the TBTF banks a chance to write down principal or second liens and prevent the implosion of the entire mortgage market and therefore the entire banking system. And he implies that there is still so much hot money in a frantic, peripatetic existence that it could be induced to create another real estate bubble. That some are considering this. He also wrote a good article on Sweden and Norway.

What? Isn’t it clear yet that they all work for the same syndicate boss?

Except that they have got themselves so screwed up, I don’t think they know their boss from a hot rock.

meanwhile mainstream media obsesses about mitt’s words showing a lack of sesitivity to the poor while totally ignoring this story

One thing that struck me reading the letter is I didn’t realize the federal government is signing onto the deal as well.

I would like to know the details of what claims the federal government is releasing and how this will happen (will individual agencies be named or just a general federal release clause releasing ALL federal claims, etc?).

Also, we need to see the tolling agreement on the statute of limitations that was signed while these negotiations have been going on. Has anyone seen this? This is VERY IMPORTANT to the ability of the government to go after the stuff that isn’t waived. If the tolling was “narrow” then all the other theories of liability are still running as they screw around fake negotiating a “broader” release.

UOB Bank won’t let me take money out for cash from they are ATM and I have deposit in my bank…

I hope that Mastro has a VERY GOOD and LOYAL bodyguard. Although even that won’t protect her from a drone attack.

Oregon AG just signed onto the “multi state settlement”.

He knows exactly how much Oregon is getting, which sounds like peanuts, but then again there’s maybe 3-4 million people in the whole state.

http://www.doj.state.or.us/releases/2012/rel020112.shtml

He also states the liability releases are narrow relative to the money offered.

Oh, this is fun.

“Insight: Top Justice officials connected to mortgage banks”–Reuters

http://www.reuters.com/article/2012/01/20/us-usa-holder-mortgage-idUSTRE80J0PH20120120

Forget Schneiderman. You want to make the banksters squirm? Pass a nationwide law imposing a foreclosure moratorium:

http://strikelawyer.wordpress.com/2012/01/28/crisis-continues-and-the-ags-have-been-had/

That will hit them where it hurts. Even talking about it will give them the willies.

Moratoriums were imposed in a few states during the depression, and really, after all the bank fraud, frauds on courts (willing victims, unfortunately) and perfidy, a moratorium is the least we should be doing.

Forgive my ignorance – but, I’ve seen Inside Job and I believe it.

The thing I have a question about is this:

If the banks bundled mortgages into CDOs and MBS and got the rating agencies to rate them AAA, then shouldn’t it be the investors (USVI gov emp pension fund, etc) that are on the hook? That makes sense, but why are the banks close to or in insolvency if they stopped with the ‘mark-to-model’ pricing of assets and went back to ‘mark-to-market’. How can there be so much of the housing market still on the banks’ books?

Thanks in advance for any enlightenment.

iirc, the main reason is a. because towards the end of the bubble they couldn’t find anyone any more to buy the crap they were selling, and b. because the banks had in some cases come to like the revenue streams these things generated, either because they figured it would take longer for the crisis to hit, or because they had come to believe their own lies about how securitization decreases risk (rather than spreading it around).

While some issues probably do need to be tabled it’s a terrible way to begin a process. Beau Biden said it just right, if the banks believe we are too afraid to peal back the onion..well you know the rest.

Being that Schniderman is the A.G. from NY and the major banks reside in NY I suspect a deal was cut and something offered(I could be wrong, but that’s my gut feeling).

The process is ass-backwards, first you investigate, then you prosecute then you settle. What we have makes no sense, unless you are banks that want to reduce exposure and a President that wants an issue taken off the table in a general election.

I shouldn’t be surprised, but I am disappointed.

Reuters positive spin on mortgage settlement: AG’s will be able to monitor and force banks to pay penalties for violating the settlement. Apparently the banks reputations precede them.

http://www.reuters.com/article/2012/02/01/us-mortgage-settlement-exclusive-idUSTRE8101YJ20120201

The biggest thing I can see wrong with this is they are calling the enforcment of violations “penalties” which means bank lawyers will object and fight them tooth and nail. If they just called the penalties “fees” the bank would understand perfectly and not put up a fight.

Housing Wire is trying to spin it as a ‘robo-signing settlement. So Obama and Holder don’t mind document fraud. Perhaps if a few laws had his signature forged, he might change his mind. Fraud is not always a bad thing it appears.

Ya cain’t make deez sheez awp!!!

Foreclosure Accord Deadline for States Postponed to Feb. 6

http://www.businessweek.com/news/2012-02-01/foreclosure-accord-deadline-for-states-postponed-to-feb-6.html

“The deadline for states to decide whether to join a proposed nationwide foreclosure settlement with banks was postponed to Feb. 6 from Feb. 3, according to the Iowa Attorney General’s Office.”

Masto, anyone?

I believe, correct me if I’m wrong, that in NY State the Attorney General cannot legally settle, dismiss, or agree not to prosecute state causes of action without the approval of the state courts.

Which I believe he won’t get.

Which renders the settlement a dead letter in NY with regards to state law claims. Am I wrong?

Should I walk away from my mortgage then?

I think that is among the such a lot significant information for me. And i’m happy reading your article. However should observation on few normal things, The site style is perfect, the articles is really nice : D. Good task, cheers