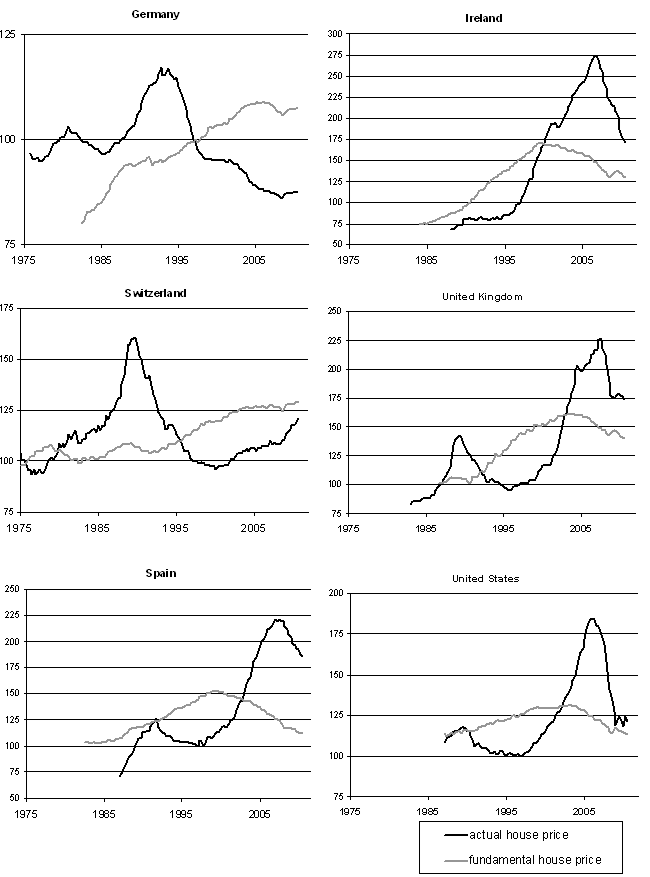

It might surprise readers to learn that economists are still debating whether low interest rates in countries like Ireland and Spain were responsible for their housing bubbles. A new paper by Christian Hott and Terhi Jokipii at VoxEU looked at housing prices in 14 OECD countries from 1985 onward to assess the impact of protracted periods of low short term interest rates. Their conclusion was that they explained up to 50% of housing overvaluation in bubble-afflicted markets.

The interesting part of the paper is that they created a model for fundamental housing market values:

We instead obtain the fundamental value by calibrating a theoretical house price model for each of the 14 OECD countries in our sample. This house price model implies that the fundamental value is given as the sum of future expected imputed rents. Imputed rents, in turn, are assumed to depend positively on GDP (as a measure of demand) and negatively on construction activities (as a measure of supply).

And they compared the model price with actual prices:

Now of course, one should take model-derived prices with some salt. Nevertheless, look at how, despite their sharp falls, prices in Ireland, the UK, and especially Spain, are well above their “fundamental” price. And I wouldn’t take undue cheer from the fact that US prices are close to fair value. The article mentions that in zombified Japan, real estate prices have remained below their fundamental level since the mid 1990s. We have similar issues that look likely to produce a price overshoot to the downside: a broken servicing model, which means far more homes will be foreclosed upon than is necessary; student debt being senior to mortgage debt and keeping a lot of young people from purchasing homes; and the fact that many of the new jobs being created are at much lower wages than the jobs lost, meaning those workers may not be able to buy homes any time soon, if ever.

As I often say, it would be better if I were wrong, but I suspect I won’t be.

In Spain the housing bubble is yet to explode: we all know that prices should be not far from 1990’s but the prices are not suddenly collapsing but only gradually folding to the reality of lack of demand (and rent prices are actually growing, because there is increased demand for provisional housing while prices gradually fall and, hopefully, the economy begins to recover).

And in some places the bubble has been much bigger. When I was 10 y.o., in 1979, my parents bought a holiday apartment for some 2 million pesetas. Now it must be worth at least 10 times that price (20x is very likely in fact). And it’s not a lucky choice of investment or anything: just prices went absolutely mad here in the Basque Country and have not even began to fall almost at all (we have a very high GDP, one of the highest of all EU, although salaries are rather low, not much higher than in Spain proper).

I think that one of the key issues is that Germany has offered a lot of public housing at a fixed (low) price. This is yet another example of how, well directed, public investments and very specially the welfare state (which acts as a subsidy on labor costs ultimately) help the economy and do not burden it all. That’s also the case of Switzerland but not of any of the other example countries.

A few questions.

Is it a good thing to have high or low housing prices?

Better or worse to have appreciating housing prices or depreciating prices?

Does it depend on wether you absolute prices or relative to the fundamental value?

It looks like German prices have been in decline since 1992 or so. Is that the result of their policy to offer affordable public housing?

Looking at the fundamental value (lighter lines) charts, not the actual price charts, one might ask what should a preferred fundamental value chart look like – one that reflects the rate of inflation(protection again inflation – the German and Swiss charts), just flat, up and down (most other countries) or declining (ever more affordable housing, thus a sign of progress)?

It seems to me housing prices should be based on income. If there’s no income in a city the houses aren’t going to be worth anything. That’s where the money has to come from, ultimately, so I sort of buy these methods of calculating the ‘base value’ of housing.

I think declining house prices cause chaos because then investing in houses becomes more difficult. You might add value to the property, but then still lose money because the time to do the contruction makes the sale price even less.

I think if we had overshot too low and then come up from that, at least we’d have all those jobs to renovate houses. Opportunities created because of low prices. As it is now with a property values sort of artificially looming a bit too high due to banks holding back inventory, investing is depressed because there’s always the potential of prices falling further.

Houses are not an investment. They’re just a place to live and keep your “stuff”.

And there’s no such thing as “underwater” on a mortgage. Appraised values are meaningless. People should buy houses based on what they need and what they can afford. The movement of the “appraised” value does not change the house functionally. It still does all the things that it did when it was purchased. i.e. Give you a place to sleep and a place to keep your “stuff”.

Houses are an investment whether you want to admit it or not and if you have just a house value that is 100,000 and a mortgage worth 300,000 then it is a bad investment and a huge burden on the economy. It makes no sense to say a house is not an investment when it typcially can be an asset. Appraised values are not meaningless, them may be wrong, but they are not meaningless. They are at the core of the banks “insolvency issues” as well.

If more people thought of their house as an investment and treated it like a business investment we would probably be out of the housing decline. Is it worth ruining a family’s life and future to be saddled with debt that could keep there children from going to college? I don’t think so and I don’t think the banks have any right to expect people to be the only ones to suffer the housing collapse. The banks have gotten plenty and in certain areas there will be no recovery, such as las vegas, until the banks begin to aggressively allow short sales or rewrite loans. Banks are starting to realize this in Nevada and short sales are becoming commonplace.

Being “underwater” certainly impacts one’s ability to relocate to find work since one may not be able to absorb the loss of one’s equity and afford new housing.

People, normal people, workers, are not businessmen nor economists: they are just people and just want to live their lives. For them a home is something they need, not something to make money of.

And it’s not just a subjective matter, it is objective, the same that you can’t really choose whether to breath or not, to drink or die of thirst, to eat or die of starvation… you can’t choose between having a home (not necessarily property, may be rent, public lease, whatever) or not: you need a place to live.

So you probably can’t always choose whether to “invest” or not, you need a fundamental resource and you do not have much of a choice.

A house is an “investment” the same way a car is an investment. It should be cheaper to own than to rent in the long run, but cars don’t generally appreciate or even hold their value.

Speculating on cars, therefore, is stupid. Speculating on houses is also stupid. The only reason people believe there is a difference is a rising population and scarcity of land. Once the population starts falling, watch that bubble burst!

Germany subsidizes their housing to keep housing prices artificially low. This has the effect of lowering the cost of living, which means that salaries can be lower without impacting quality of life. By reducing labor costs, Germany is making it easier for their companies to compete globally.

Pretty much my point.

How does that subsidy compare to the buy-side subsidy in the US consisting of the mortgage interest deduction?

Two things. One, obviously this strategy works best if only one country is doing it. The advantages evaporate quickly if everyone starts doing it.

And while wages are held down by this scheme, what is happening to profits, dividends, executive bonuses, etc? What is the impact on the Gini coeff? In other words, this could also serve as a subsidy for the executive class, since productivity continues to rise while wages can be more effectively kept down, without so much political fall-out. The difference between productivity and wage is, of course, gravy for somebody.

Possibly but that’s how markets work: everyone is drift to trend towards the best economic equilibrium point, right. However what is happening in Europe is that the opposite direction is being taken, what favors the German economy/bourgeoisie but hardly the rest. It’s a clear case of manipulating the economy with the debt scaremongering and an artificially too strong currency.

typo: should be: “everyone is SUPPOSED TO drift”…

I understand that low, affordable home prices are good for the economy and society in general because:

1. People have homes more easily, they are happier and better integrated and all that returns to society as a better, happier and more stable society.

2. Salaries (labor costs) can be relatively lower if living costs are lower: you can’t ask people to work for less than it costs them to survive (incl. housing, electricity, water, food and clothing, as well as some other extras, like education of their children, although this goes into social reproduction, not mere survival).

Housing prices should be low, how low exactly, I can’t say but if you need people to be working in two or more jobs simultaneously all their lives to pay for their mortgages, then it’s simply wrong. Not the less because nowadays it’s very likely that you’ll spend a good deal of your working life unemployed or underemployed.

The price must be defined by social needs and states should intervene actively, not to make some speculators and banksters ultra-rich but to keep housing affordable.

LA home prices are still ridiculous!

Looking at the US chart, it looks like we are close to the level around 1990.

I think my house today is about twice it was priced 22 years ago.

Lucky you.

Personally, I think it’s too high.

We’re only seven comments in and there’s so much idiocy I don’t even know where to start!

The purchase of house is an investment, no matter how much you utter your mantra that “A HOUSE IS NOT AN INVESTMENT”. It’s an investment. You invest your money. It’s, for most everyone, the largest and most important investment they will ever make. If you don’t want to invest in a house, RENT something for your stuff. OY!!!

House prices are not solely dependent upon income. They are also dependent upon wealth. If you have all the rich New Yorkers move down to a sleepy village in Mexico, housing prices in that village will appreciate far more than local income will rise. OY!!!

And yes, YS is correct. Housing bubbles are goosed by interest rates. Dumb people pile in when interest rates are low because they get all the house they can afford based on the low debt service afforded by low rates. Do not follow the sheep off the cliff!!! When rates rise, there will be no more sheep who can pile in because they won’t be able to afford the debt service. They are idiots. Don’t be one of them. Buy based on all the fundamentals: price, income, wealth, opportunities, value. This is not rocket science. OY!!!

Housing prices in LA are no longer dramatically out of whack. They were, wildly, but they have depreciated around 40%-50%, in all the areas not frequented by the super rich 0.1%. Do not forget that there is an enormous amount of wealth in SoCal and the weather and other amenities draw more wealth by the day. The prices here, by and large, should not correlate to income, and in fact, they do not and likely will not (short of a major natural disaster). This is not surprising, to anyone with any experience or the better part of half a brain. Houses can be overvalued here, they have been overvalued (in at least 5 (!!!) MAJOR bubbles since the 1880s), but they are probably not overvalued right now. OY!!!

Normal people, workers, are not investors: they just try to live and reproduce, and (in most cases at least) society and therefore the state and capitalists want people being able to do that. Speculating with housing, water or other basic stuff is parasitism towards society and if any society (like Britain, the USA and very specially Spain) falls for that degeneration, it gets into big trouble.

Instead if you do like Germany and keep housing and other basic costs relatively low, then everything works better. But for that some welfare state must exist: less welfare state, less sustainability of the economy, less profits for most, except for parasitic short-term speculators.

I agree with most of what you are saying but buying a home when interest rates are very low with a fixed rate mortgage is not that silly, especially after a bubble burst like now. People can get a lot more home for a lot less money and a very low rate can help them do so. I don’t see anything wrong with buying while interest rates are low and home prices are extremely low and lockingin your rate.

By the same token, if you buy at historically low interest rates, you are buying into the likelihood that your house price declines, or at least faces headwinds, when rates rise.

And I suppose if one buys the house to live in it, price appreciation isn’t the primary issue. My mother loves her house, with a nice porch and a beautiful mountain view, bought in 1958. Mortgage paid off in 1977. Taxes stable due to prop 13. She has zero understanding of the current market price, nor does she care. Nor does she remember the original price nor rate of interest on the mortgage. She & my dad worked hard & paid it off and lived there happily. It’s her home.

So, chris’ point I think can be rephrased, that low rates in a period of declining prices can allow people to consume substantially higher utility homes than they could have afforded with higher rates.

A paid off house is a form of savings that you won’t outlive.

Jim A: PROVIDED that property taxes don’t become confiscatory. California’s Prop 13 limit on property tax increases has been in place for a third of a century, benefiting those who stayed put.

Some eastern states are considering similar limits, but only after property taxes have already reached extreme levels. This will only be of much value if inflation really flares up later.

Thanks for insisting on some clarity.

The jawing about Germany subsidizing it’s housing market is irritatingly vague. Living in Germany I would love to get some of that free cash for a posh pad. What I have found is:

– The legendary Eigenheimzulage was dropped in 2005

– Not insignificant subsidies are available from the KfW – one of the federal variations on the Landesbanken. Core competency of the KfW is to refurnish its executive cantine while losing billions on appalling deals, but they have also put some money in the hands of average Germans.

– Riester subsidies are almost insignificant especially in markets like Frankfurt where even if the bubble bursts a sq ft in an average location will cost euro 1500.

– Rental housing is subsidized and tenants enjoy substantial protections. Last I checked circa 40% of Germans own, 60& rent, and for good reasons: it’s cheaper and safer to rent. Takes the pressure off the housing market in most of the country and keeps prices low.

I agree with the premise that housing is an investment. It is telling to see so many people conflate “investment” with “speculation.” It is as if with current poor P/E ratios people forget that there is any other kind of investment, or that dividends are important. It should be emphasized that a house DOES bring a dividend: housing. If the price/rent ratio is right it is a good investment. The high transaction costs and non-liquidness of it mean that it is RARELY a good speculative investment.

Low interest rates lead to bad loans NOT because “people are dumb and impulsive,” but because low interest rates make predatory and fraudulent loan origination easier. Cheap money would not be a problem if sufficient underwriting of loans were being done. Sure, some scruffy poor person might think that they can afford a home and a mortgage that they really can’t, but isn’t it the job of the BANKER to inform these people of that fact? YES IT IS. Do you really think that if a financial professional had told the borrowers that realistically there was little chance they would be able to keep up with payments on their ARM, or that objectively their chance of default was high, that most borrowers would have gone ahead and signed anyway?!? Of course not! They signed because they had FINANCIAL PROFESSIONALS ensuring them that yes, they could afford that house, yes this was a good idea. Stop blaming the borrowers, who are by and large NOT financially saavy, for the bad loans that financial professionals made to them!!!

Seriously…wtf?

Well said AJ, OY!!

But lets not forget that the runup in prices was caused as much by the fraudulent easing of credit, aka liars loans, and the MBS (Morgage Backed Securities) markets that gobbled up questionable paper, (like mine) bribed the rating companies to give A+++ to these MBEs and then Shorted them! (Bet against them being profitable)Our houses are really collateral damage from this smoke and mirrors market that Wall Street invented. With that blowing up, the banks are now turning back to profit from what’s left of the housing market wreckage. That is the mess that they created through lost deeds, MERS bypassing 200 years of Property law including County recorded Deeds and other nefarious and fraudulent recording and assignment preactices.

I was played for a sucker in a 2006 loan when my mortgage broker told me not to worry about the income, he would fill out that part. Don’t worry, he said, they won’t check your tax returns. I paid dutifully for 5 years as my loan was sold and tranferred many times and became part of an MBE.

I recently filed a wrongful foreclosure case in the Federal court which I’ve learned is more open to actual legal arguments than California state courts. I’ve received an Order Granting Preliminary Injuction, which stops all foreclosure action until the case is resolved. The judges decision included this wording, “..Further, given the improprieties allegded here, the court concludes that a TRO would benefit the public interes in maintaining the integrity of California’s non-judicial foreclosure proceedures.” The case has not been heard yet and is strangely being delayed. I feel that judges are starting to feel differently about foreclosure as the evidence of bank and servicing fraud is everywhere. My hope is that brave and courageous judges will begin to make rulings based on law and not rubber stamp the banks attempts at fraud.

I truly believe that our best chance to get our country back on track is to make the banks accountable to the same laws we all have to obey. My Federal lawsuit is more than me fighting for my home, I feel like I’m fighting for our nation of laws, without which we have no freedoms!

The premise that housing is an investment seems to be an oversimplification. If it is cheaper to purchase a home than to rent, does that still mean housing can be viewed as an investment or is it just a practical decision for the use of income reserved for life’s necessities?

In the case where renting is cheaper than purchasing a home and the savings are invested, could one not say that renting is an investment?

Yes, a house IS an investment. You just need to look at an investment differently than the one pushed by adreneline charged investment advisors. Well, if I invest $100,000 today in a house with a payment of $700 a month, then today that $700 may be 35% of my income. In ten years, assuming some people don’t screw up the economy, that same $700 falls to 30% of my income. In 20 years, that $700 is now only 20 percent of my income. Meanwhile, that original $100,000 debt has been reduced down to around $65,000 while the value of my house has increased at a realistic amount each year to lets say $140,000. I consider that a wise investment. Not only have I gained equity if I choose to sell, I also have saved myself a ton of money that I would have thrown away each year on rent. Renting would see my housing cost keep pace with housing price inflation and most likely I would remain at it being at least 35% of my income. No money saved and no equity to show for it at the end of 20 years.

The sad thing about the housing bubble is that there really is no way to replace all the jobs that are lost. It was the goose that laid the golen egg for the economy and the government failed to see that and foolishly allowed Wall Street to kill the goose.

The majority of the “jobs” produced by the housing bubble were nothing more than financial parasites.

Do you really think we would be better off economically if all those mortgage brokers, real estate agents, appraisers and mortgage-backed security robo-signers got their “jobs” back?

I’m not sure about that. Certainly the majority of the MONEY was earned by financial parasites. But there was a were a goodly number of people working in the construction trades who are having difficulty finding much work these days.

Here is a list of all the related jobs and sources of employment that are impacted greatly by the housing decline

http://financialrealityrevisited.blogspot.com/p/list-of-housing-industry-related-jobs.html

Jobs lost during the housing bubble have effected millions of people and been a major drag on the recovery.

http://financialrealityrevisited.blogspot.com/p/list-of-housing-industry-related-jobs.html

Isn’t one of the implications of calling it a “bubble” that many of those jobs should not have been created in the first place?

The irony of course, is ‘Wall Street’ has offshored, crushed collective bargaining, eliminated, downsized and laid off millions of jobs.

“Despite their sharp falls, prices in Ireland, the UK, and especially Spain, are well above their “fundamental” price.”

Presumably this is because mortgages in Europe are recourse, meaning that if you sell your house for less than what the mortgage is, you are on the hook for the difference. So obviously Europeans homeowners will not sell at lower prices and instead hang on and hope for another asset bubble.

In the US. on the other hand, mortgages are non-recourse (or effectively non-recourse, in the Eastern one-action states), so homeowners have no problem walking away from their houses.

Ultimately, of course, all housing prices will revert to their historical mean, adjusted for inflation. It will just take longer in Europe.

(No, I don’t believe that Europeans were calculating the “sum of future expected imputed rents” — they were bubbleheads caught up in the mania and the delusion that house prices would keep appreciating. Just as Minsky said.)

House everyone, I’m shocked at the amount of shock. Housing prices are still Bankster inflated. Only by remediating the disease of mammon will the afflicted, such as Anonymous Bones above, be cured of their ‘keep away’ tulip mania. Let’s not project the poker game enjoyed primarily by sociopaths.

I think it is quite difficult to assess the role of interest rates. For instance, its role may vary a lot depending on the regulatory background including laws that regulate land properties and development, fiscal incentives and so on. In the particular case of Ireland and Spain, where housing bubbles were the largest (biggest?) in relative terms, I believe that unrestricted capital flows were of paramount importance. Of course there are other circunstantial factors and the timing is very important. For instance, you see, we are witnessing again a long period of low interest rates but this time I’m pretty sure it won’t be accompanied by a housing bubble. Not at least in Ireland or Spain.

Great stuff as usual Yves. This is interesting data, and it falls along the lines of something I was thinking about a few days ago.

There have been numerous calls as to a bottom in housing recently,although the real data suggests we my just be skipping along a false bottom. I was thinking of an interesting dissertation topic for enterprising doctoral student. My thought was to study the link between housing prices and the prosecution of elite, white collar crime (i.e accounting control frauds). I suspect one of Mr. Black’s students could do a bang-up job on this and give us some insight into the correlation.

My working thesis is that housing won’t bottom until we actually start prosecuting the control frauds. I would surmise that any bounce we might see will be short-lived until the structural issues (lack of real regulation) are addressed and the frauds prosecuted.

Just a thought.

It is always a bad sign when I look at the y-axis and haven’t a clue as to what it is measuring and/or what its units are. Then too the scales are all different. I mean if you look at Germany, it looks like there is a big deal going on there, but if you compare it to the other scales, it is negligible.

From what I can tell you have to buy into the assumptions used to calculate fundamental value from future imputed rents, which seems a very dicey proposition. And then the Taylor rule is used to calculate the difference between where interest rates were and where they should have been per the Taylor rule.

In short, if we cut out all the dubious methodology, isn’t this just telling us what we already knew? I don’t see how trying to quantify the contribution of interest rates based on such a doubtful model really adds anything. And even if I did buy into all this, I suppose my next question would be if the authors think that interest rates contributed 50% to the housing bubbles what do they think was responsible for the other 50%?

As you, I don’t see the point in any attempt to quantify the role of sustained low IRs (SLIRs) in housing bubbles. It don’t think anyone can even assign a causal role on LIRS. BUT my view is that SLIRS has a role in the DURATION of the bubble, and by extending the duration it allows for increased bubble sizes. This is VERY relevant for monetary policymakers (for future decissions) and with time (when current dinosaurs are retired), they will recognise that monetary authorities should monitor and regulate asset bubbles through IRs as well as current account imbalances.

My first thought, looking at the VoxEU piece, was that they found what they were looking for, i.e. interest rates seemed to play such a large role because that is the variable they looked at. The problem lies in things they may not have considered, such as lax regulatory policy that made wide-scale fraud possible in the mortgage and MBS markets. We know from the foreclosure crisis that many of the loans that inflated the housing bubble were poorly-underwritten and unsound from the get-go. Would the effects of low interest-rates been so significant had there not been regulatory failure, that is to say if all loans had been properly underwritten?

It seems unlikely that they would have. The point is that low-interest rates alone cannot explain the housing bubble and that in the absence of other factors (besides low interest rates) the bubble would probably not have occurred. Assuming that other factors have remained constant throughout time period looked at, such as regulatory oversight, necessarily limits their effects on the results of the model. Another study would be needed to show the relative effects of interest rates and regulatory oversight/presence of fraud on resulting house prices, if we are to get (more of) the whole story.

Such a study might find that changes in interest rate do not greatly affect home prices in the presence of strict regulatory oversight. Of course, given the difficulty of measuring counterfactual events, such a study may not be feasible.

At any rate, as my old Econ advisor used to say, “the numbers rarely speak for themselves.”

Speaking of capitalism, if the stock market is now overpriced by 50% (?) some of that profit taking will find its way back into real estate. It’s gotta go somewhere. But it is such a slow and painful way to run an economy. It would be better if housing were subsidized to become a stable market. I mean, what if we all went to the grocery store tomorrow and all we could afford was wonder bread and peanut butter? Agricultural subsidies insure us a nutritious meal occasionally.

This has all the earmarks of a fiasco passing as a “paradigm shift.” What people relied on since 1950, inflating house values, has been cancelled. And prematurely so, since all those related jobs were eliminated before there was a replacement. Who in their right mind runs a country like this?

Everybody and their dog bought a house because it was the smart thing to do; not because they were dumb. But the banksters (for lack of a more definitive noun) freaked out about inflation; then the Fed turned off the spigot to everyone except the banksters. What amazing moves. Now the new paradigm is going to be something like the pre 1950s culture of housing speculation. It will probably resemble location location location as the pricey end and everything else at the other end. Unless we get some sane new form of subsidy. Or debt forgiveness. Or what? Things are so messed up with securitization and title fraud something is going to have to be done soon.

Consider health care – better examples exist everywhere in the world but aren’t considered here in the USA due to money drenched lobbying. These corporations (Insurance, Pharm) control the argument. Largely a successful campaign, huge numbers consider “single payer” a communist plot, which they must stop by public protest, mouth foaming rants, and mindless sloganeering.

No difference with housing. People generally don’t matter as much as profit does. Consider Fannie. Engaging in widespread discrimination in plain sight, their policies are no different then outright racism, give houses to wealthier people – take housing from the poor.

‘Rates have never been lower!’ says a salesman to close. When the asset price has nothing to do with reality and more with destructive speculation, what does the interest rate to the borrower even matter? A matchbox of aged lumber fraudulently appraised to maximum Wall Street pillferage and ‘sold’ to a pigeon was designed to be out of reach, occasionally ‘teaser’ rates were used to beat victims into further submission. A car stuck in the mud at full throttle will generally dig a hole, without going anywhere, other then into fraudclosure.

I don’t get why people use interest rates as a reason to buy (aka invest) into real estate. You do realize that when the Interest Rates rise the prices/value will go down because even less people will be able to afford buying homes, right?

I can’t wait for interest rates to skyrocket, then when home prices plummet, and Housing Bubble #2 is here, I’ll be paying straight cash homey, because the government won’t have any more magic tricks to use to manipulate prices.

You should only buy a home when your Income is in line with the monthly payment, you can afford 20% down, and the costs of Renting exceed the cost of buying over a projected period. None are the case for the majority of Americans in today’s economy.