By Delusional Economics continues his expose into why economists don’t understand the economy, with a look at Australia’s sectoral balances and our chronic CAD. Cross posted from MacroBusiness.

As you may have noticed I’ve taken an eye off Europe for a short while in order to provide some macro analysis on what is happening in the Australian economy. At present there is a growing gap in the economic conversation in Australia between what is actually happening and the rhetoric….

This post is a continuation of my “adult conversations” thread. In case you have come to this post directly I advice you to pop back to the original post for some frame of reference.

On Friday I discussed the Australian balance of payments in order to explain the economic circumstances the country finds itself in with regards to the external sector. A circumstance very few people in the Australian financial elite appear to even recognise, let alone discuss. However, as you may have noticed, ideas floated on MacroBusiness have a funny way of becoming topical in the mainstream media, so here’s hoping.

Australia’s external sector has been in an ever-growing deficit since 1975. In order to fund this debt with the rest of the world the country continues to sell ever-increasing amount of financial assets. This has led to the situation where the outflows of capital stemming from those financial assets is greater than inflows gained from trade of goods and services, even with the historically high terms of trade stemming from the commodities-led mining boom.

It is no wonder Wikipedia is calling us “secluded”.

As you may have read in my Friday post I tend to analyse the economy via a sectoral view because it lines up with the National Accounts – click here to go to the ABS for an overview. It also provides some fairly good insight into the flows across the sectors, which ultimately means it is easy to predict what the outcome of one sector is going to be if you know what the other two are up to. If you have been following my Europe posts for any length of time you will know that this type of analysis has been fairly successful in predicting the outcomes for the European periphery over the last 2 years.

A very basic, yet often forgotten, rule of economics is someone’s spending is someone else’s income. What the sectoral view of the economy tells us is that:

National Income = Current Account + Private Sector Consumption + Investment + Net Government Spending

A fall in spending, meaning a lesser sum of these elements, therefore results in a fall in national income. The sectoral view also tells us that a fall in one sector can be offset by a rise in another, yet it also informs us that the sectors are linked, and therefore changes in one sector have impact the balance of the others.

As we have seen from nations like Greece and Portugal, a country with a long running current account deficit and a private sector with a desire – or no choice to save (austerity) – has significant problems trying to reach a government surplus. Once you understand that the external sector and the private sector are a net drain on national income it isn’t hard to see the problem. Under these circumstances there is simply no room left in the economy for savings in the government sector and attempts to reach government surpluses become counter-productive as this simply accelerates the decline.

If a country’s current account deficit is structural ( I’ll explain this later ) then these efforts are very dangerous because this can easily develop into a damaging feedback loop. The loss of income through the external sector leads to a loss of income in the private sector, this then drives the stronger desire to save, meaning government revenues fall further. This inevitably leads to calls for higher taxes, which once again drain income from the private sector … and around we go. The result of this dynamic is a rise in unemployment, therefore national production and income, meaning once again the government sectors revenue decline while private sector spending and investment fall further.

As you may have noticed I neglected to mention the external sector in that example. When spending in the private sector falls the current account tends to rise towards surplus as imports fall. If structure of the external sector is such that a fall in imports can bring it back to surplus while the private sector and the government are saving at their desired rate then eventually the balances of the sectors will be restored, but at a lower national income and gross domestic product (GDP).

That, however, is a big ask for most economies, especially those that have spent many years structured around expanding debt and internal consumption. As we have seen in Europe the attempt of the government and the private sector to deleverage at the same time in these economies hasn’t tipped the external sector into surplus because the collapse in industrial production hasn’t allowed it ever to get there. In these cases what needs to occur is a write-off of existing debts, or an expansion of debt in an alternative sector in order to restore the balance. As neither of these things has occurred the economies have begun to fail.

This is an example of what I describe as a ‘structural deficit in the current account’. It means that the structure of the nation’s debt with the rest of the world is such that slowing private sector debt doesn’t necessarily equate to a corresponding rise in the current account. What you would hope to see in these economies is an adjustment in the private sector so that they are less reliant on imports while producing more exports. I think you’ll find that this is the basic definition ‘productivity’.

Greater productivity is obviously the desirable goal but isn’t something that is achieved easily and is dependent on a nation’s ability to provide itself inputs to production. In reality productivity gains require investment in both humans and technology, which means spending, something that isn’t happening while both the private and government sectors are attempting to deleverage.

So how does all of this relate to what we are seeing in Australia at present?

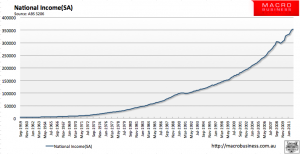

Well obviously we aren’t in the same situation of the European periphery because our country is still seen as an attractive investment by the rest of the world. But the current account data certainly puts the mining boom in perspective. It isn’t so much that the country is profiting from the mining boom and the high terms of trade, more that it has enabled us to maintain a growing national income through private sector debt expansion because the rest of the world has been willing to fund it.

One of the big questions you have to ask is whether this is actually a problem. We’ve had a growing external debt for over 3 decades and in that time our national wealth has grown strongly. So why can’t this just go on and on? Well, actually there isn’t any reason why it couldn’t continue for many years yet. But in order for that to occur given the current structure of the economy it will require either the government and/or the private sectors to continue to expand their debt positions.

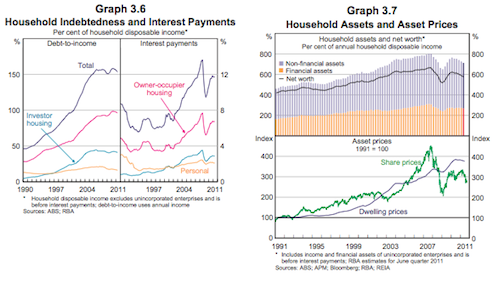

As MacroBusiness has focussed over the last year, the lending statistics appear to show that households have reached their limit in terms of debt to income and businesses reliant on consumption are suffering from the flow-on effects of that behaviour.

Once you realise this you start to understand the confusion in the public arena about what we are witnessing in Mining Boom II. The shock of the GFC changed the spending patterns of the private sector meaning that they desired to save a larger proportion of their incomes. By doing so the rate of credit issuance in the private sector began to decline. Initially this decline was met by additional spending from the government sector via the stimulus programs, which also had some flow-on effects to behaviour in the private sector.

However, as the effects of these stimulus programs has worn off, and the government drives towards a surplus, the downward trend in private sector credit growth has resumed. This dynamic is beginning to show in national income as it appears to be about to roll-over again.

This is why you are now seeing the confusing messages coming from the government over their budget. Their push for surplus is putting downward pressure on national income, while the private sector is attempting to push its balance sheet towards more saving. This is leading to a fall in government income via consumption related taxation, and so, every couple of months Wayne Swan has to re-inform the public that yet another couple of billion has suddenly disappeared from the government coffers. Lately he has been using the excuse that “mining boom II isn’t the rivers of gold of boom I”.

As you may now understand that is nothing like a valid explanation of what is happening in the economy. As I have explained, the facts are:

- The mining boom is having a positive influence on national income, but its magnitude is of insufficient size to offset the larger outflows of interest payments and profits to non-residents as a result of over three decades of growth in external debt.

- Private sector credit growth has been the major influencing factor in national income growth over the last few decades, but its rate of growth is slowing as households change their preferences towards saving over consumption after the GFC.

- The government initially offset the private sector’s change in consumption preferences by increasing government spending.This has now stopped, as the government has set an agenda for surpluses.

The overall outcome of these three factors is that the rate of national income growth has slowed, as has GDP growth. If these factors remain in play then eventually the economy will begin to shrink, even as terms of trade remain high. As you can see, however, these factors have intertwined outcomes, which means that simple one-sided adjustments to reverse the economy’s decline may not have the expected results.

If Oz doesn’t appeal, think sectoral balances, and that this is a nice worked example.

This is a narative without banking. I agree that we should do our sectoral accounts, rather than treat the economy as one giant household account. But what is personified as the sectors themselves deciding wether to spend, save or borrow is better dealt with by talking more about the social actors involved. We have banks, government including treasury, central bank, and political parties. We have industry and agriculture and retail etc. We have the #IMF, international banking, the US, China, and Europe. And we have households. Just for starters. So, how are these actors responding to the #GFC?

I agree in principle, and this is how I see it (apropos below).

“National Income = Current Account + Private Sector Consumption + Investment + Net Government Spending

…

This is an example of what I describe as a ‘structural deficit in the current account’. …. What you would hope to see in these economies is an adjustment in the private sector so that they are less reliant on imports while producing more exports. … the basic definition [of] ‘productivity’.”

I think the equation should be:

Private Sector Income = Current Account(productivity) + Private Sector Consumption(productivity) + Net Investment(productivity) + Net Government Spending(productivity)

because all the terms are functions of productivity.

If a society has become dependent on Easy Money (e.g. Net Government Spending, Net Investments) it will become unproductive, i.e., profligate. Productivity is likely to suffer further as the clamor for government spending increases, leading to less production locally and increased importation. Eventually investments dwindle and the structural current account deficit becomes fully established.

In -this- case, it is questionable that government deficits will prevent eventual collapse or incur growth. Unless government spending is targeted at increasing productivity, and successful in triggering productivity improvements, this is not going to happen. Neither will an independent currency prompt growth: a devaluation may simply spur increased demands for more government largesse rather than lead to increased productivity.

In productive societies, yes, government deficits may be effective in stimulating economic activity. However, one has to consider that it may also put society on a course of declining productivity; it entails moral hazard. But if a dependence on easy money has been fostered, withdrawal is the only thing that will effect the necessary changes. Economics is a social science and the unassailable logic of accounting leads nowhere without considering factors of human motivation and ability. I have long been troubled by my gut sense that austerity is the only thing that will work for profligate countries. Now I understand why – necessity is the mother of invention. Comfort is not. Social factors must be included. Faced with this imperative, mere accounting identities are impotent.

I got real lost in your comment when I started thinking about the productivity of the military component of Net Government Spending.

Something like a hole you could drive a tank through.

Show me some military austerity and I will show you massive increases in productivity….grin.

Take a peek here:

http://www.tai.org.au/

I’m using the home page but look at this unintended consequence:

QLD mining boom to destroy 20,000 non-mining jobs

Queensland’s massive mining boom is likely to destroy one non-mining job for every two mining jobs it creates, costing around 20,000 jobs, according to a new analysis by The Australia Institute. Job creator or job destroyer? An analysis of the mining boom in Queensland by the Institute’s Senior Economist Matt Grudnoff examines 39 new mining projects identified for Queensland and finds that the majority of job losses will be in the already struggling manufacturing sector.

Skippy here… I can verify this with skilled labor, local non mining concerns are bleeding staff (damaging regional micro economics). The mining effect in the end, in my book, at the end of the day its just more productivity out flow to multi national concerns. All for a short term boost to local, state and national accounts.

Skippy… the future is sold for a fob.

Just ripe for nationalization after we get all our debt paid…..

“I think the equation should be:

Private Sector Income = Current Account(productivity) + Private Sector Consumption(productivity) + Net Investment(productivity) + Net Government Spending(productivity)

because all the terms are functions of productivity.”

What????

Why are all these things functions of productivity?

Yes,

it makes sense that if productivity is higher, then the economy can support a higher standard of living. But it has FA to do with flows of money.

P.S.

Hint – hint policies to increase productivity come under the topic Microeconomics. Here we are talking about Macroeconomics. Looks like you can into the wrong lecture theatre. Sorry for the confusion.

Australia grows when the world consumes, from the West and now to the East.

Low savings level / high personal bebt and CAD + overseas capital inflow (foreign savings) generating sufficient returns to pay for the servicing costs of the future and the increase in foreign liabilities = tomorrow.

Skippy… the call for increased manufacturing is hard yacka with Wall st. and mob pumping up commodity’s and by that the AUD.

I agree with your dot connecting and pieces of the puzzle.

I have been trying to get your private email address to ask you to read a report I pulled together 40 years ago about a policy oriented engineering methodology. Let me provide the link here to the 40 meg report. Others may want to wade in.

I think if this methodology was webified and made to be online group developed it could provide a tool to show how sectors/factors interrelate or don’t and combinations that describe existing or desired states. I would appreciate others thoughts on my idea.

E Pluribus Unum

Nationalize the Fed

International Debt Jubilee

Will do and sorry about the e-mail biz, Yves and Lambo are flat out methinks.

Cheers

I am confused here.

The charts appear to show that private sector deleveraging began before the GFC.

The question was, “can credit growth continue to grow safely?”

The answer was, “not if both public and private sector begin to pay back principle and the current account shrinks.”

Yet if the public and private sectors begin to deleverage, credit growth won’t need to grow, and if if fewer interest payments are made to foreign entities, current account will rise, and there will be less dependency on mining to help fund debt payments made to foreign entities.

It’s as if one of the complications hindering an easy solution listed by the author is in and of itself a solution. I sure hope so because my lady and I have thought of moving to Australia, but worries of a nation-wide implosion have helped keep us away.

As a Skippy I feel qualified to make a number of observations, in no particular order of significance:-

1) Your top illustration is misleading – or, at least, incomplete. While in the rear-vision mirror we see the fading image of the GFC of 2008, we most certainly DON’T see clear, blue skies ahead (unless it represents the calm eye of the hurricane). We see NO recovery in the U.S.A. or Europe, and NO sign of any action toward fundamental reform re the problems which led to the GFC in the first place. And little or no investigation or prosecution of the financial criminals responsible, or recognition of this in the MSM. Accordingly, the inescapable conclusion is that 2008 was a mere preview and that the second shoe will be much heavier, and fall further. So people are acting accordingly, and paying down debt, avoiding new debt and frivolous spending; people are saving.

2) Little mention is made of the EXCHANGE RATE. The AUD has gone from around USD 0.65 to USD 1.10 in about 5 years or so. This has made imported goods much cheaper, outbound tourism more attractive; while at the same time inbound tourism has suffered badly, and agricultural and manufactured goods less and less competitive. THANK YOU BEN BERNANKE & TIMOTHY GEITHNER.

3) In addition, agricultural production has suffered from 7 years of drought, and now 2 years of extreme rainfall events — particularly in the eastern states.

4) Government debt is very low, and credit rating rather high. Interest rates are relatively high, and attractive to overseas investors. If such rates applied to the Fed & the U.S. Treasury, both would be smoking holes in the ground.

That’s enough for now — it’s late. ;]

Very nice article and argument.

I think this is the most interesting statement.

“What you would hope to see in these economies is an adjustment in the private sector so that they are less reliant on imports while producing more exports. I think you’ll find that this is the basic definition ‘productivity’.”

At first glance it makes no sense. How do exports impact productivity? This guy mixed up currency depreciation with productivity. However, in an austere economy, where imports drop as well, the goal of austerity is not a surplus due to exports, but a surplus due to reduced demand and reduced expenditures. So, the only hope is that the local sector which is malinvested, is to realign, reduce debt, and provide more for the local sector because you’re not buying anything else from anyone else so you gotta be more productive. Hence,

“I think you’ll find that this is the basic definition ‘productivity’.””

I probably missed the point, but I still think this exercise was fun.