By Matt Stoller, a fellow at the Roosevelt Institute. You can follow him on twitter at http://www.twitter.com/matthewstoller

Over the past three years, the big four servicers have been keeping hundreds of billions of dollars of second mortgages on their books (mostly in the form of Home Equity Lines of Credit, or HELOCs). Many of these mortgages would seem effectively worthless, because a home equity line of credit or second mortgage on top of an already deeply underwater first mortgage has no value. You can’t use it to foreclose, because you’d get nothing out of the foreclosure – all of that would go to the first mortgage holder (usually some investor in a pension fund somewhere). It has only “hostage value”, or the ability to stop a modification or write-down from happening. The best way to clean up this situation is to have the regulators (FDIC, OCC, Federal Reserve) simply tell the banks that they must write down their second mortgages on collateral that has been impaired. That way, the incentive problem goes away. By forcing the bank to recognize the loss now, the bank will no longer stop a modification on a first mortgage. And in fact, the regulators pretty much agreed that this is what their examiners should do, when they issued new rules earlier this year on accounting for second liens.

Only, the regulators haven’t done it, because the banks claim their seconds are performing. Bank of America says that these loans are worth 93 cents on the dollar. Several of the other banks don’t break out their loss reserves for seconds, so it’s hard to tell, but I think it’s clear they aren’t reserving enough. We can tell that because the Federal Reserve itself is dramatically overvaluing these seconds. In a stress test, the Fed said in its worst case scenario that the banks would lose only “$56 billion”. These are low numbers. According to their most recent investor report, Wells Fargo alone has $35 billion of second liens behind first mortgages that are underwater.

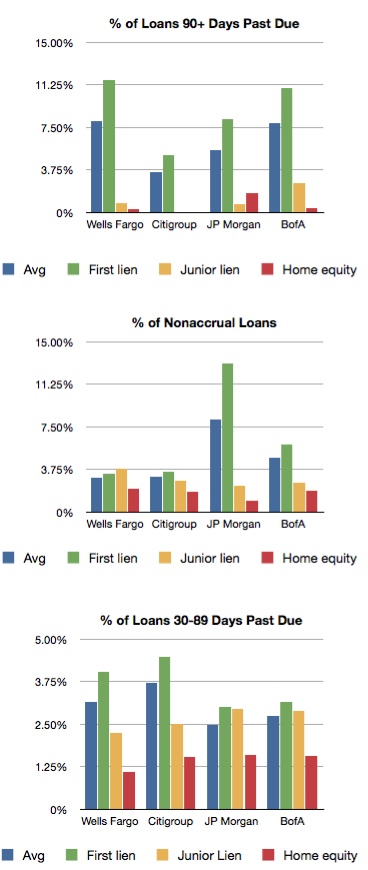

I did an analysis of some of these numbers, downloading FDIC data on the bank holding company level. I’m not a bank accountant, so I ran these numbers by a few people who know what they are doing, and they were not surprised by what I found. Here’ the percentage of loans at various stages of impairment, by loan type. You can see that junior liens and HELOCs do far better than first mortgages, which is puzzling considering that delinquency rates are still at crisis-era levels. Something interesting happens at 90+ days, where essentially no seconds get put into that category. In fact, Citi has zero seconds in the 90+ days past due category, which a Citi rep told me was because they place their 90+ day plus loans in the non-accrual category. And the Citi rep. wouldn’t tell me how much the bank is reserving for these seconds, nor would he tell me how many of these loans are amortizing, or being paid off (more on that later). Citi’s actually in the best shape of any of the banks regarding these seconds, with a book about a third the size of Bank of America, Wells, and JPM Chase.

These second liens are doing really, really well. Oddly well.

So how valuable are these seconds? I took a look at the expansion of the second lien book for the top four servicers (you can see my spreadsheet here). Basically there was a massive expansion of these second liens from 2007-2008, and then a very slow reduction of the books from 2009 onward. The banks extended a lot of credit in 2008, and have been withdrawing it ever since. But it’s not as if their loan books are entirely going down because the loans are being paid back. They are going down because some of it is being paid back, and some is being charged off. There’s a mix of healthy payoffs and unhealthy charge-offs. That means we can sort of assess how healthy these loans are overall by looking at the mix. And indeed, for the top four banks, the trend is positive. From 2009 to 2010, for instance, Wells reduced its second lien exposure by $4B. But it wrote off $5B of second liens! That means it was actually extending more loans than it was paid back, even as its loan book shrank. Very bad. JP Morgan, Bank of America, and Citi weren’t quite as bad, but their experience with second liens from 2009-2010 wasn’t good. This improved the next year. The latest data we have is that from the end of 2010 to the end of 2011, Wells reduced its HELOC book by $7B, with $3B or 45% of that being charge-offs. Citi’s percentage was roughly 40% ($2B reduction, $900M in charge-offs), JPM’s percentage was roughly 20% ($7B in reductions, $1.9B in charge-offs), and Bank of America was roughly 40% ($9B in reduction, $3.6B in charge-offs).

There are other reasons to think these liens aren’t worth 93 cents on the dollar and should be written down. For instance, Ed DeMarco recently discussed second liens behind Fannie/Freddie loans. Here’s what he said.

However, for Enterprise loans that are underwater and seriously delinquent, the population from which HAMP primarily draws, about half of the loans have subordinate liens. Therefore we believe that well over a quarter of this population, perhaps nearly half, have an associated subordinate lien.

That’s a lot to write off. And I’ve seen a securitization of quality Countrywide second mortgages that were actually securitized, and so do not face the same accounting fraud and conflict of interest problems. On that trust, losses were upwards of 30%, so far.

The real question here is data. We don’t know a lot about this market, and the banks like it that way. They don’t have to write down their seconds, they don’t have to take a big capital hit, and the OCC gets to continue its love affair with the banks. But I suspect, based on what I’ve seen here, that examiners should begin to demand more information from their banks on whether these second liens are really worth what they say they are worth. Otherwise, the foreclosure crisis will continue, investors and homeowners will continue to bear losses, and blight will spread as vacant homes continue to have their copper wiring stripped out.

I welcome your thoughts and comments, as this is somewhat new territory for me and I would like corrections on where I’ve gone wrong.

So unsecured debt is worth nothing? Every month, plenty of people pay their CC debt, and people pay on completely underwater 2nds. While 93% is CERTAINLY too high, the non-accural and greater than 30 days late buckets don’t total up to that high a percentage of loans. Anecdotally, we hear cases of people paying their seconds while stiffing their firsts. (people are often more concerned with minimizing the number of delinquent accounts rather than their balance or intrest) BUT even if we make the reasonable assumption that ultimately most borrowers 30+ days late on their firsts will eventually stick their creditors with loss of principal, ISTM tha in aggregate the seconds are still probably worth greater than 80%.

HOME EQUITY LINE OF CREDIT…! DUH…..! THEY USED OUR OWN EQUITY TO SCREW US OUT OF OUR HOMES…! HOW DO YOU BORROW YOUR OWN EQUITY…? HOW DOES THAT WORK…? I’LL TELL YOU HOW..WE GOT SCREWED BY A PLAY ON WORDS…LIKE OLD PEOPLE ARE GETTING SCREWED OUT OF THEIR HOMES WITH REVERSE MORTGAGES..! THEY PAID FOR THEIR HOMES EXPONENTIONALLY AND THATS NOT ENOUGH FOR THE BANKSTERS. THE OLD FOLKS SHOULD TELL THE BANKSTERS CUT ME A CHECK OR SCREW YOU AND YOUR FAKE CREDIT..!

“Deception is evaluated from the perspective of an unsophisticated consumer.” (FTC -V- STANDARD EDUCATION SOCIETY, 302 U.S. 112, 115, 1937), (CLOMIN -V- JACKSON 988 F. 2d 1314, 1318,-1319 2d Cir 1994), and (GAMMON-V- GC SERVICES 27 F. 3d. 1254, 1257 7th Cir 1994). “The maxim of fraud vitiates every transaction into which it enters, applies to judgement as well as to Contracts and other transactions.” (THE PEOPLE OF THE STATE OF ILLINOIS-V-FRED E. STERLING, 357, IL. 354;192 NE 229; 1934). Absent the transfer of the debt, the debt is a nullity. Carpenter-V-Longan 83 U.S. 271 (1871), BAYVIEW-V-NELSON 382 ILL App 3d 1184 (2008).

Matt,

You are spot on. Many of us have been writing about this for years now. See my Washinton Times Op-Ed from 2010:

http://www.washingtontimes.com/news/2010/sep/3/save-your-house/

And this from the American Banker:

http://www.americanbanker.com/bulletins/writedowns-second-mortgages-scarce-1025840-1.html

Thanks for keeping this critical issue in the public’s eye.

The Fed’s stress tests were a total whitewash, esp. the 10-15% writedowns on 2nd liens.

Just because the banks write it down for regulatory purposes doesn’t mean that the seconds aren’t worth something. The ‘hostage value’ practice only works in a market where you think that housing values are going to go back up soon. Time to face reality and write it down. Any subsequent collections or sales of the loans could get booked as profits. Good idea. They need to be forced to do this.

Hostage value is worth a lot more than you’d think for short sales, and is worth most when home values are continuing to slide. The bank owning the first mortgage wants to get out before they accrue any more losses, and so they pay off the hostage taker/blackmailer for a lot more than the zero the blackmailer should have gotten. And the real crime is the buyer is the one paying off the blackmailer in the end.

It should be illegal and probably is but happens routinely.

They want a loan mod, short sale or refi? Tell them to produce the legal assignment and the other legal docs and a full accounting of the “loan file.” They won’t, because that would reveal their massive fraud. So therefore, their contracts and notes are a nullity and they should have to eat their losses. They made gagillions by committing exponential mortgage fraud with our notes and mortgages. They want us to pay for their $1.2 Quadrillion dollars in unsustainable derivatives fraud debt which is driving America into bankruptcy. Well, up theirs. These banks, GSE’s and Wall Street firms should have been held accountable instead of bailed out and they should all be in prison!

..And then way off in the distance are borrowers (serfs, victims, pivot points, slaves, the untouchables) who “owe” somethin’ allegedly.

Wasn’t there a Mason Professor who strongly urged Chapter 13 lien strips for families under attack by Banksters? If memory serves correct he was going to use Lesko as a metaphor when he gave a speech at Brookings to suggest letting people out of Bank inflicted debt-hell would be bad for business. Sort of like water boarding people in the name of information extraction, only in this case, destroying them in the name of money.

Of course Lesko was busted for fraud unlike Banksters. Gosh this blog is so confusing, but it’s easy to tell where some vested interests lie. (lay? lie?)

They are unsecured debts so they should be fully extinguishable in a bankruptcy. But, instead of punishing the crooks for committing $1.2 Quadrillion dollars in unsustainable derivatives fraud with our signatures, the bailout of the crooks continues, unabated. The never-ending bailout for the crooks and the fact that their debt can never be repaid proves to me that this was a plan to rob us of everything.

I am seeing something very odd going on with one particular servicer of second security deeds (mostly HELOCS originated through BB & T) as they relate to foreclosures here in Georgia.

I have noticed several dozen of these situations in which The servicer of the second security deed forecloses subject to the first security deed. (In other words–seconds foreclosing prior to the first security deeds, while the first security deed is still outstanding!) Then, after foreclosure, the servicer of the second security deed records a satisfaction/cancellation of debt of the first security deed.

But I am unable to ascertain if the servicer for the second security deed is actually paying off the first security deed in full or if they are simply cutting some sort of “side deal” with the servicer of the first security deed.

But I do know that some homeowners have stopped making the payments on their seconds when they began to have trouble paying their firsts. They were working with the servicers of the firsts when–all of the sudden–the servicer for the second swoops in and forecloses and ends up with the title to the house.

I call this “When HELOCS Attack!”

(Matt–I inadvertently pulled down some of this data that I thought was free, and ended up getting charged for it. I would be happy to send it along to you if you think it would be useful in your research.)

Please, send it my way. My email is stoller at gmail.com.

Matt–I will absolutely forward to you all that I have on these little anomalies. However, I am a technological idiot, and I didn’t know how to download them electronically. So I have actual hard copies and will have to scan them for you first. This might call for a trip to Staples! (Which is totally fine, because our Staples is next to our Target–where the leftover Easter candy is now 75% off :-) )

But I promise that you’ll have them within 24 hours. (And within just 12 hours if Target still has a good selection of the leftover CHOCOLATE Easter candy!)

The banks are sort of right. The banks ane the home owners are treating this product like credit cards. The home owner has written off the value of his home and so won’t pay the 1st lien, but pays the 2nd in case he needs to draw on the LOC. Ironic that an underwater loan from a credit impaired borrower is “current”. You’re also correct in that the 2nd lien has nuisance value where by the banks may get go-away money. The other value is the current interest on the balance which floats. I think the solution is bringing banruptcy judges back into the process and give them the authority to declare the 2nd lien worhtless with one important out for the banks, allow them to buy the 1st lien loan at face value. That’s my solution.

When Banks went into neighborhoods and held guns to people’s heads they were preying upon the public’s impression of trust and social responsibility associated with financial institutions. In light of the epic violence that followed, it’s clear that powerful corporations took hold of the illegal methods of loansharks and legtimized them through deregulation and regulatory capture. An academic institution, such as George Mason, is similarly vulnerable to capture by industry, philosophically or otherwise. Todd J. Zywicki, for example, made noises that seemed far less academic than expected by most thoughtful readers.

I have two probably minor thoughts to throw into the mix. I have a Wells home equity line, which is behind a Wells first mortgage. Before the crash, I figured I had $35K in theoretical equity on top of my first+second. Now, according to market conditions, I am way underwater on even the first mortgage. My two thoughts:

First, the required interest-only payment on my $25K Wells home equity line is only $150, which would be manageable even if times got tough for me.

Second, my home equity line has a fairly direct effect on my credit score. For example, if I pay some of it down, that becomes “available credit,” which tends to improve my score. I believe first mortgages are treated differently in credit scoring algorithms, and I believe home equity lines are somewhat lumped in with consumer credit.

Neither of the above applies to my first mortgage, which has about an 8X higher monthly payment and which does not factor into my credit score related to consumer credit in the same way.

Point being, according to a certain way of thinking about it, if times were tight for me, I might be more able and willing to keep up with my $150 home equity line payments before some other payments I might need to push.

Excellent post Matt.

In the typical Short Sale, the 2nd usually releases the debtor for 5-10% of the unpaid balance. DeMarco’s comments that half the underwater and delinquent HAMP loans have an even more underwater 2nd lien means that theoretically, the 93% valuation the banks have given these “assets” should probably be a 93% write-down in value, which it eventually will be as soon as these homes foreclose or change hands in a short sale.

Just another example of delaying the inevitable losses and keeping the TBTFs on life support at the expense of a healthy housing/mortgage market and economic recovery.

the 2nd usually releases the debtor… good grief that’s one way to think about it I guess.

The reality of the moment is per contract they should get JACK being the junior loan and all! And the debtor/seller isn’t paying a dime, its a three way deal worked between the buyer the 1st mortgage holder and the 2nd mortgage holder. The seller is along for the ride wondering when he will be able to get off, when the 3 parties reach an agreement. So the 1st holder and homebuyer are getting screwed by the 2nd holder.

Reason numero uno why after one experience trying to buy a short sale with a second lien, I vowed never again for me or anybody else I cared about in this world. I ain’t doing business with a crook being a crook.

Thats funny I have a Citi HELOC past due 1185 days. I am fighting the bastards in court with some success. The judge gave them a lifeline to present more b.s.

i have heard more and more people speaking openly about having $100,000+ HELOC and not making a payment in over 2 years…..word of mouth will make all these HELOC worthless

I have 4 loans that are years overdue plus 5 cars that are awaiting reposession and I am still buying cases of the best wine and fresh beef from a small organic farm in the midwest. My kids are in private shools and my wife travels for pleasure extensively. But now I need cosmetic surgery. Darn Banks, Matt this is really outrageous what they get away with before I vote for President again.

Can’t imagine why your wife would need to travel, extensively, for pleasure–can she not find it at home?

I don’t understand why 1st lien holders tolerate 2nd liens on their collateral or why many borrowers pay for an optional second with no intention of ever exercising the option. Seems like the seconds impair the primary claim in several ways, including reduced flexibility to modify delinquent loans described here. A “no seconds” loan clause could reduce first mortgage costs for many, especially those not interested in 2nds. These folks are now paying the costs of the 2nd option without getting any benefits.

Many 2nd and 3rd were rolled into new 1st mortgage’s during the boom which answers part of your questions.

I think the big piece that is being missed here, or maybe I am missing it, but certainly Yves has stressed it in other posts: most of the second-lien holders are affiliates of the servicers that are servicing the first mortgages that are owned by MBS investors. Because the servicing banks’ own balance sheets are affected by losses on seconds but not directly impacted by losses on firsts, they have a huge glaring conflict of interest that incentivizes them to not foreclose because in foreclosure, the proper lien priority would (hopefully!) be respected and result in massive writedowns on the seconds, as Art Vandeley described above. And of course the lack of foreclosures/writedowns of underwater homes is part of what is kinking up the housing market. It’s also unfair to MBS investors, to whom the servicers owe a duty of due care if not a full-on fiduciary duty. (It is the MBS trusts that hire the servicers in the first place.) @Pearl above, from your research, can you tell if the servicer for the first is actually the same bank as the servicer for the second? If so, they may simply be screwing the first lienholders, although that would be fraud and we all know that’s not allowed.

It’s very surprising to me that large pension funds and other MBS investors have not sued the servicers for breach and/or replaced them with non-conflicted servicers, but perhaps (a) the same investors are beholden to yet other affiliates of those same servicer/banks for things like prime brokerage and credit lines that the investors depend on and (b) there may not be alternatives in the servicer area.

James Cole–that’s a great question. The servicers appear to be different entities–but who knows, right? It’s not as if there is a lot of “transparency” in these transactions.

When I view the images that correspond to the particular first security deed satisfactions/cancellations, I cannot ascertain “who” did the paying off. Just that it “has been satisfied and should be cancelled.” However, many of the satisfied first security deeds seem to have been “MERS-involved” loans.

So I pulled down an indexing of a few hundred of BB & T foreclosures here in GA, and I am noticing some odd commonalities in quite a number of the HELOC security deeds.

An entity called “Lenders Advantage” seems to have been involved, somehow, in quite a number of them. I googled a bit and came up with the following company directory:

http://www.firstamsandiegolinks.com/docs/Directory.pdf

On page 15 of what turns out to be the 2010 First American Corportion (as in the title insurance company) company directory, the “Lenders Advantage” subsidiary/entity describes itself as offering “Multiple title insurance-related services for refinance and equity lenders offered through electronic, real-time ordering and tracking system.”

That whole “electronic, real-time ordering and tracking system” thing makes me nervous–because it sounds an awful lot like a MERS. (A MERS for seconds?) (:-o) If that were the case, the 2 registry systems, (MERS and this one) conceivably, could have made some sort of quid pro quo arrangement with each other–“We’ll cancel some of our firsts if you cancel some of yours…..”

(But I’m probably wandering into tinfoil hat territory with that idea.)

The real time tracking system could just be for processing of title insurance policies but who knows. As far as the mystery satisfactions of first liens, it is possible that the first lienholder is refinancing the first mortgage once the property is in the hands of the second lienholder; I can think of various scenarios where that makes sense. Do you have a way of seeing if there is subsequently a new lien put on after the satisfaction of the old first lien?

All the above posts, while illuminating, are relying on the purported ‘ownership’ of the 2nds, as well as the first,by ‘investors’ owning MBS. We should, as Adam Levitin suggested, call them ‘non mortgage-backed securities, as there has been no proof in any court case nationwide, that the notes were ever deposited into the ‘trusts’. The loan level tapes are useless, and, by searching the IRS 938 reports, one can see that a huge number of the MBS were never reported to IRS, which clouds their REMIC status. The ownership of the ‘mortgages’ appears to be, more accurately, ownership of (false) collection rights to defaulted mortgages, all of which have been rendered unsecured by splitting of the note and mortgage/deed of trust, and further rendered ‘paid’, due to CDS payout, monoline insurance payout, GSE payout, and on and on. UCC states clearly that ‘all payments on a debt reduce the debt by the amount of the payment, even if such payment was made by a stranger to the transaction’.

Now- rebuttals?

Ian, I don’t know how you could evaluate the completeness of reporting on the 938s unless you had a complete list of MBS trusts to check against.

A monoline payment under a financial guaranty insurance policy satisfies the debt that the trust owes the MBS investor but does not satisfy the debt of the underlying mortgagor; in fact, the monoline, upon payment under the guaranty, acquires the rights from the MBS investor to compel the trustee to exercise remedies. I am fairly certain GSE guarantees work the same way. CDS payouts do not affect the underlying mortgages at all although the CDS protection seller may take delivery of the defaulted debt and thereby be in the same position as a guarantor.

However I do not challenge your assertion that many notes were not deposited properly in the trusts and that everyone (excepting a few foreclosure defense attorneys and even fewer judges) is pretending that that is not the case, which is part of why this whole mess is rotting out the rule of law.

There are no trusts, no trustees and no legal liens. That is how they committed the massive mortgage fraud with our notes and signatures A/K/A THE ORIGINATION FRAUD. When the notes were oversold into insolvency they went public, it is in your recordings. That is when they dumped the toxic mbs’s into a global pool. Chicago T&T dumped mine in HSBC..It is all a load of b.s. There is no legal way to correct their massive fraud. Once fraud is committed it enters into every transaction and destroys the legal contract. Even though there never really was a legal contract because nothing they did was legal. Now they must rescind and eat their losses.

The vast majority of HELOCS are “interest only” for the first TEN YEARS. It is only AFTER that point that the principal starts amortizing. Since HELOCS are usually done at or even below the “WSJ Prime Rate” which today is 3.25%, the monthly payment on a $50,000 outstanding balance would only be about $133. Not too hard to stay current on that.

The real problems for the banks will start once these HELOCS reach the 10-year mark and God forbid if interest rates ever go up.

Indeed Bam Man you are correct. I am an example of that. My heloc isn’t technically interest only for the first 10 years, as each payment is amortized over 20 years into principal and interest components, but that doesn’t matter because I can simply write a check the next day drawing the amount I just paid right back out. I can draw on it up to the maximum for the first 10 years of the credit line, then the principal amount is amortized over the next 10 years as the pay down period where I can no longer draw on it. (draw the first 10 years, pay down the next 10) For me, the 10 year mark is 6 years away, so I can keep this baby maxed out for the next 6 years, if only to make it look like I’ve used it (and maybe put it into my retirement accounts or buy a prepaid tuition plan). I want to make it look like I’ve exhuasted it because I do not want the bank to cut me off or lower the credit limit (once they see how far underwater I am). There are a lot of people in this boat waiting for the next precipitating event which gives the green light to simply stop paying. Although they could lose the house and go through hell dealing with the default, homeowners have 2nd lien holders in a pretty good position right now and stand to potentially get a lot of debt forgiven, and keep the house.

I am involved in a situation currently in the courts.

Initially, the first and second were done simultaneously by Countrywide to take out a construction loan. In CA, the courts consider this a single loan (purchase money) as far as deficiency rights on the second are concerned.

We had multiple short sale offers submitted to the Bank (B of A / Countrywide) that were just dropped on the floor and ignored, each subsequently less than the previous. During the process, they transferred the “servicing” to a third party – Real Time Resolutions (RTR) of Dallas.

This complicated things unecessarily, as now 3 parties were involved instead of just 2. In the end, RTR would not sign a complete release of the debt and agree not to even try to pursue a deficiency judgement. This was suspicious, as was the document they tried to get me to sign – that’s a story in itself.

They were completely washed out and didn’t even own the note, yet were able to blow up the sale, which had prceeded to the point of funding escrow. Another 6 months of wrangling with B of A (who had provided a complete release on the first and presumably still owned the second) and RTR transpired when all of a sudden the property was sold out from under everyone in foreclosure auction.

That was 1 1/2 years ago and the property is still sitting empty. How on earth does this nonsense work in favor of the banks, much less the larger US economy when extended to the millions of homes in similar situations.

Oh, and the difference between the first offer and the last that went to escrow was $1M less, that was squandered by delay and inaction. Plus carrying costs and legal fees to the bank/investors.

I will admit embarrassingly that I have a house in fl with a 1.05m outstanding mortgage- 550K 1st and 500K 2nd both countrywide. The first is owned by a small bank in middle florida, bank atlantic, and I assume b of a has the 2nd. Stopped paying in july of 2008 and the house is still sitting there. Any theories here? I have been guessing that the loss on the second is so big that b of a would rather hold it non performing and record the 2nd as performing on it’s balance sheet than suck it up. Why the holder of the 1st allows it to sit, I have no idea.

Their loss is so big….? They gave you your own equity and hyperinflated your first mortgage and charged you interest for another 30 years. We got screwed and they NEVER LENT ANYONE A DIME…! IT WAS THE UNSOPHISTICATED HOMEOWNER THAT GOT SCREWED AND RANG UP BIG TIME. There were no protections for us and that was intentional. This was a plan by the elite to steal every home and business property from the American people under the guise of money lending and they never lent us a dime. They did the same thing with our land by fraudulently inducing property taxes. Wake Up America! We need a referendum on the 2012 ballot to abolish the FED.

These were not loans. This was our equity. This is what they did. You went for a refi and they told you they could lend you 20% of your homes value. In my case my house was “worth ” $550,000.00. We only financed. $192000 at the origination in 1992. We magically ended up owing the bank…AMCORE BANK N.A. MERS $550,000.00 plus a side note for $87,000.00 which was only some of the equity we had in our home. So we “borrowed” our own equity of $87,000.00 and ended up owing the banksters $637,000.00 plus interest for 30 years. This was the biggest scam in history because they knew this fraud could not be sustained when they could no longer pay their investors because they. oversold them interests in nothing and these homes were never really worth the bubble price. They ALL need to go to prison. The banks are who overborrowed and oversold interests in ZERO. The fact they aresill still stillstill making money and gambling on this fraud

Is an outrage!

Front page error: ‘reign in’ should be ‘rein in’ a common error.

What story, Jack? I must be dense, but I just did a quick search and I can’t find. Thanks.

CNBC just posed the question …..Is global insolvency imminent? We The People must accept NO FIXES FOR FRAUD such as a Vatican/Rothschild gold standard or a World Tax. We need a referendum on the 2012 ballot to abolish the Fed and issue our own currency in the form of U.S. BANK NOTES backed by our own natural resource revenues. Demand clear title to everything! WE THE PEOPLE FUNDED AND PAID FOR EVERYTHING IN THIS COUNTRY AND THE FED INSURED FINANCIERS NEVER LENT WE THE PEOPLE A DIME!

Then you may want to view the youtube video on the Wizzard of Oz…fascinating financial history of the US and how the bank dealth with everyone that tried to do what you are suggesting…simply assasinated them, presidents, et al…for wanting or trying to do this…I like what Iceland did though…

Hi To Tell The Truth! It’s lvent. I already saw that video. I don’t believe there are many I’ve missed. Thanks though!

I have a question…is there a difference with an equity line as the only lein on the homestead? And what is the difference of the mortgage and the equity line?

Someone I know recently received an offer from Chase to reduce a $40K equity line by paying $2500 in 4 equal payments!!! That person did not do so…another one was offered to pay $8K to be released from a $180K Equity line for another purchase also…and both equity lines were from the same bank that offered the first and the second…WAMU CHASE

They are getting caught up with. People are waking up and realizing that none of this crap is secure. The debt is only secure when the lender has the cash on their balance sheet at the Origination to back up the loan. They lent no money, they lent credit. The banks were loaned the money from the U.S. TREASURY DEPT. The fractional reserve system is a big scam. There needs to be real audits.

Your equity became the second lien …that’s right, your hard earned money that you already paid is what they used to screw us out of out homes. In our case we needed the equity for business purposes. They told us they could lend us 20% of our homes value. But they were really giving us our own equity. What they did is, they appraised your home at the bubble price. They gave you your equity as a second lien, and they bumped up what you owed on the first, your home mortgage. In my case I probably only owed $100,000.00 and I ended up with a new $550,000.00 30 year mortgage and an $87,000.00 second lien that was my own equity. I told my husband we got screwed.

Why is it puzzling? The second mortgage, aka equity loan, usually has a much lower monthly payment, right? It’s easier for a distressed borrower to come up with $160 for the second than $1800 for the first! Especially if he also has HOA and other expenses, like insurance and maybe an assessment on the first of the month.