By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

Sorry for the lateness of this post, one of those days I’m afraid.

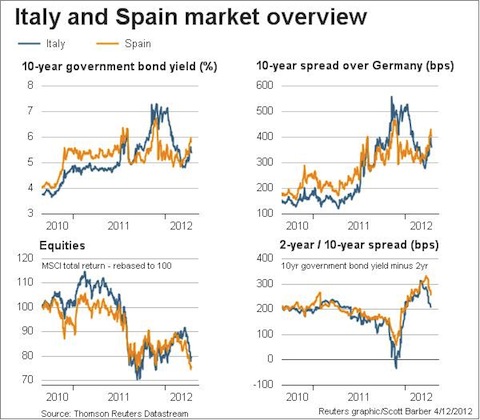

Italian borrowing costs were seen rising overnight as the country moved into a second day of auctions of bonds and bills.

Of note €2.884 billion in three-year debt at a yield of 3.89% were sold. The last auction of few weeks ago came in at 2.76% so there has been a 1.1% jump in under a month. The bid to cover was also down to 1.44 from 1.56. On Wednesday Italy’s one-year borrowing costs doubled. Treasury raised €4.88 billion which was under the full allocation of €5 billion.

Although these number are way down from the heady heights of late November yields, across the Italian curve yields have been rising since the end of March. The Italian authorities, ignoring yesterday’s message from the Spanish, blamed contagion for the higher yields.

Interestingly, however, the movement of Italian and Spanish debt markets in unison isn’t all that uncommon.

In a positive sign yields have been falling since the auction. Apart from the obvious problem of bond investors losing money as yields rise, the major issue with the new uptrend in Spanish and Italian yields is something Imentioned on Wednesday:

Spanish banking capital isn’t going to be helped by the fact that they purchased €68 billion worth of Spanish government bonds in an artificial market that are now falling in value. Italian banks have also been participating in similar action,

Overnight I noted the that Ambrose Evans Pritchard reported on the issue:

Credit experts say the Spanish and Italian banks are trapped with large losses on sovereign bonds bought with ECB funds under the three-year lending programme, or Long-Term Refinancing Operation (LTRO).

Andrew Roberts, credit chief at RBS, said Spanish banks used ECB funds to purchase five-year Spanish bonds at yields near 3.5pc in February and 4.5pc in December. The same bonds were trading at 4.77pc on Wednesday, implying a large loss on the capital value of the bonds.

It is much the same story for Italian banks pressured into buying Italian debt by their own government. Any further dent to confidence in Italy and Spain over coming weeks – either over fiscal slippage or the depth of economic contraction – could push losses to levels that trigger margin calls on collateral.

A quick check of the ECB’s weekly financial statement tells me there has been a recent uptrend in margin call activity, but nothing of any magnitude to be concerned about. However, as reported above, a return to yields seen back in November 2011 would see a scramble by the banks for new collateral. With peripheral Europe coming under increasing pressure due to issues in the real economy it is an open question as to how yields are going to be maintained at a level similar to those of LTRO induced purchases.

In that context recent comments by a seemly delusional ECB board member, Beniot Coeure, make more sense:

Mr Coeure, the ECB board member in charge of market operations, said the central bank still had the Securities Market Programme (SMP) in place allowing it to purchase debt of euro zone nations, should the need arise.

“We are seeing today growing signs of normalisation on a whole group of market segments … but the situation in recent days shows that this normalisation remains fragile,” Mr Coeure told a conference in Paris.

Referring to Spain, where sovereign debt yields have spiked amid concerns over the government’s ability to cut its deficit, Mr Coeure said: “The political will is there, which makes me think that what is happening at the moment in the market does not reflect the fundamentals.”

Feel free to check out Spain’s fundamentals here and here.

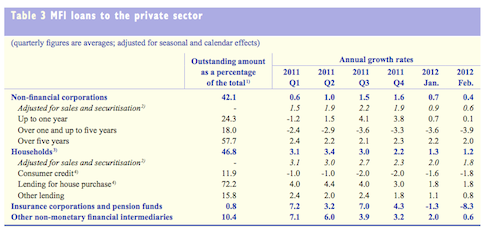

Speaking of the ECB, the monthly bulletin for April was published yesterday focussing mostly of February data. The document is below and is very comprehensive for those of you who are interested in the details. In my opinion the most important data reported in the document is private sector credit issuance because without it austerity driven government budgets in much of the European periphery are going to lead to shrinking economies. Although the data isn’t reported on a per country basis the trend is very obvious and it would appear that the private sector of periphery Europe continues to deleverage at pace while the demand for credit in other regions is very weak:

More bad news for periphery banks I am afraid. Full report below.

Looks like it’s time for the ECB to do another 1 Trillion euro LTRO. The last one bought what? Three months of relief? When will the ECB stop beating around the bush and admit that the only “solution” at this point (total bankruptcy) is to monetize the Portugese, Spanish and Italian bonds markets IN THEIR ENTIRETY. And damn the consequences.

Question about the LTRO. Let’s assume that the ECB will front another trillion Euros. Don’t the Spanish banks need to post collateral in exchange for the funds? What happens if the Spanish banks post Spanish bonds trading at a yield of 6%, and the yield subsequently goes to 9%? At that point, would the ECB issue a margin call to Spanish banks? And if so, would that precipitate the need for another LTRO?

Sorry that I’m not going to be of any use with this particular comment but what came to my mind was:

(1) I could not discern “Italy” in the title’s made up word “Spainaly”. I actually read “Spain finally”, go figure! “Spaitaly” would have done better although maybe then I would have dreamt of spas near the Vesubius or something like that. Oh, Pompeia, how decadent and apocalitptic!

(2) But specially I could not get rid from the cynic notion that I have already read this a thousand times before only this year. My subconscious was joking: “Oh, it’s the Fall of the Roman Empire! Been there, done that… Oh, it’s the Fall of the Spanish Empire! Been there, done that… Oh, it’s the loss of Cuba! Been there done that”…

I warned you: useless comment. Sorry about that.

Thanks Maju for your entertaining comment. Much more fun to read than the neverending drumbeat of slowly unwinding financial fiascos.

At first I though ‘Spainaly’ was a typo, then realized it must be a shorthand for Spain and Italy. Esthetically speaking, IMO, Spainaly is terrible wordsmithing. I prefer your suggestion. ‘Spaitaly’ works better as it is instantly evocative, and the ‘spa’ element reminiscent of the elite’s seemingly cluelessness. Although this is a bit crude, I offer up the shorthand SPIT, for Spitaly.

Here’s one vote for just sticking with ‘Spain and Italy’.

I prefer something simple, like Siptaailny, in which every second letters spells Spain and Italy. That would be much less confusing than your suggestion.

SPITaly

Nobody expects the Spainaly Inquisition!

Collective and delusion of CBers and cognitive dissanance of MSM(shameless access journalism) continues.

Denial of reality has been a prerequisite for post-crsis bull market, masked by trillions thrown by Ben.

Pretend and extend operation continues!

All Spain has to do is print money and give it to the poor (preferably in exchange for them doing useful work, say, installing solar panels or something.) This might require leaving the Euro, it might not.

It will have to happen. Only question is when.

Nay, they build the rampart walls so strong for a reason, to prevent the reeking masses from breaching them, and ’tis better to starve those masses than associate with them.

Now, what will have to happen, and when will it happen?

Oh, and how the government gets replaced by a government which will print money. That’s also a question. (Electorally? Peaceful revolution? Violently?)

Of course it requires leaving the Eurozone. Otherwise, Argentina could have printed dollars in 2001, thereby maintaining the dollar peg.

There should never have been a monetary union in Europe. But since there unforunately is one, there should never have been resuce parachutes, LTROs, EFSF.

And whatever else the nice names for the instruments are which have just one real reason to exist: to shovel limitless heaps of money from the core countrys taxpayers to the finance industry (and to a leser extend to the GIPSIF-countrys).