By Philip Pilkington, a writer and journalist based in Dublin, Ireland. You can follow him on Twitter at @pilkingtonphil

Are governments really engaging in ‘financial repression’? That’s what Neil Collins over at FT Alphaville, drawing on the work of Stephen King (HSBC analyst, not the writer), implies.

This meme has been around for quite some time. As far as I can tell it was brought into being by Austrian School types, but then went on to be taken up by more mainstream commentators like Gillian Tett and now FT Alphaville. The idea is that the government is forcing investors into buying pricey government debt by ‘repressing’ yields through their quantitative easing programs. (There are also some tactics that the government supposedly use to force debt down investors’ throats but I won’t mention them here because, frankly, they are a stretch). Collins summarises:

QE allows government to escape the disciplines associated with market forces by pushing bond yields down to low levels even when fiscal policy is out of control.

We will leave aside Collins’ view that the UK’s fiscal policy is “out of control” for the moment and focus instead on the argument that, if it were not for the QE programs, the market would soon ‘discipline’ the government by raising yields on government debt. Actually we have a perfect experiment in this regard. During the 1990s Japan was running exceptionally large fiscal deficits after their housing and stock market bubbles blew — and what’s more, they did this without any QE program in place. Japan initiated their very first QE program in mid-2001, ten years after their financial crisis.

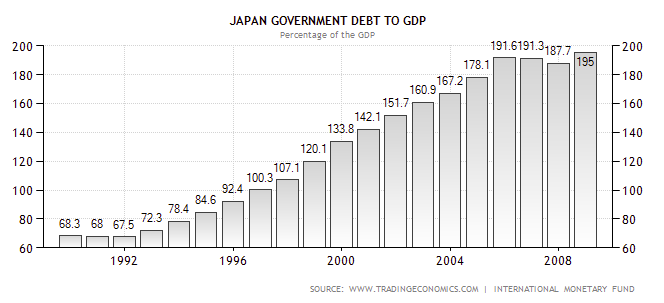

As can be seen in the following chart between 1994 and 1996 Japan had amassed similar amounts of government debt-to-GDP that the UK and US governments now hold:

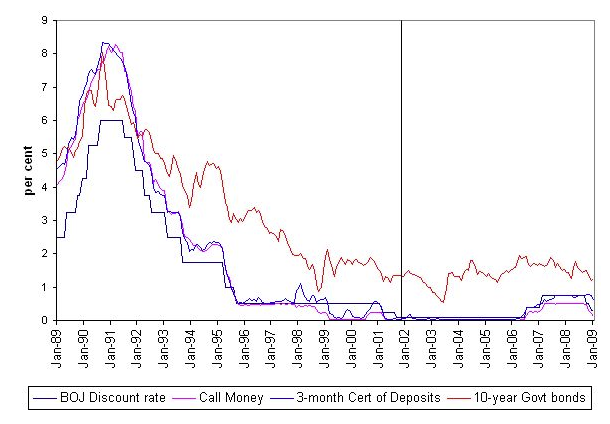

And yet, for all that interest rates remained extremely low:

Clearly then, investors were buying up Japanese government debt even though there was no QE in place. Indeed, the yields on 10-year government bonds changed little after around 1999, with the effects of the 2001 QE program on yields being pretty minimal.

So, the evidence simply does not show what Collins and King — together with many other normally astute commentators — are trying to prove. In the bad times people buy government bonds at low yields regardless of if the central banks are engaging in so-called ‘financial repression’ or not. There is little to no alternative. Indeed, despite what Collins and King imply, this debt — provided that it is issued by a government that issues its own currency — provides the investment community with a perfectly safe asset in order to weather the tough economic times and ensure that their balance sheets remain in relatively good order.

The problem seems to be that financial and economic commentators are suffering from what appears to be almost perpetual anxiety. They’re disoriented and confused right now and they’re jumping at the sight of every shadow they encounter; including their own. The truth of the matter, as other Financial Times writers like Martin Wolf know well, is that the current high levels of government debt are necessary in order for the private sector to deleverage. Without the government taking on debt the UK economy would collapse and the investment community would see their profits margins (which aren’t doing too badly despite their moaning — indeed, King’s own HSBC has seen a remarkable comeback post 2008) collapse.

The fact is that the current government deficits in the UK and elsewhere are the new norm. Investors should come to realise that it is upon these deficits that their profits rely, so they should stop their fear-mongering and get with the program. Western economies have some very real problems right now — like high unemployment and a sustained lack of aggregate demand — but government deficits are the cure, not the poison.

So?

Government debt this time is different?

There’s zero evidence for that. Japan is the best experiment we have. If we want to be scientific we must look at it. Otherwise we’re just engaging in posture and conjecture.

I doubt that Japan is really a valid example as other parameters are simply ignored, e.g. trade balance, worldwide credit bubble dynamics, demographics etc.

Another point I like to issue that something that worked over the past 20 years is no prove that it will continue to work tomorrow or in 2 years or in 5 years. Linear thinking is the most common error of economists.

I would like to hear about the rumored methods the government (or CB’s) are using to compel investors that you hinted at.

It’s very late, and I sort of feel stupid right now, but how does QE lower yields? I thought it would raise yields on government debt because of all the additional purchasing going on.

If you are still here, Philip, I have a question about yesterday’s post. I ran across the following in Wikipedia talking about the British pound:

The Conservatives arrived in power in 1979, on a programme of fiscal austerity. Initially, the pound rocketed, moving above the $2.40 level, as interest rates rose in response to the monetarist policy of targeting money supply. The high exchange rate was widely blamed for the deep recession of 1981.

Couldn’t the opposite have the reverse effect?

(1) QE lowers yields because it buys up government debt. Government debt is thus repaced with money whic yields 0% (actually, 0.25% in US and 0.50% in UK). So, government debt yields go down because investors will then take almost anything for their savings. “If I can only get 0.25% for holding cash,” the saver/investor will say, “then, by God, give me some of that low yields government debt that earns me maybe 2%!”

(2) The methods hinted at are in the original FT Alphaville piece. They’re VERY dubious and amount to an almost Ron Paul-esque vision of central banker motives.

(3) Yes, fical deficits together with low interest rates should theoretically provoke downward pressure on the exchange rate. I think this is part of the motive for QE. Japan, for example, surely know that QE don’t work, yet they announce more. Why? Probably to devalue without pissing of the US by nakedly short-selling the Yen.

Much appreciated. Thank you.

Philip,

Are current high levels of government debt necessary for the private sector to deleverage?

Is this a necessary condition for writing off the debts in excess of what the borrower can repay?

Public sector debt = private sector savings.

There’s some complications to that formula, but in present circumstances it suffices. So, yes, given current circumstances the public debt is allowing the private sector to delever. Putting a brake on public debt leads to much lower GDP growth, higher unemployment, slower deleveraging, lower profits and mass bankruptcy.

Here’s the identity for the US — note that ‘private sector saving’ includes deleveraging:

http://www.levyinstitute.org/multipliereffect/wp-content/uploads/2011/11/US-Sectoral-Balances_Berlin.png

Most central banks understand this, I think. It’s the politicians that won’t accept it. Although, they may be coming around. But the bankers keep scaring them into thinking otherwise — even some otherwise good folks, like our friends over at the FT blog.

I’d like someone to flesh out the FT phrase “…the discipline associated with market forces” using real-world examples of the words “discipline” (for instance, discipline for whom?) and “market forces” as used in the context above. And no econ jargon please.

this is no where near exhaustive – but the golf course beckons…

Discipline:

1) A banker paddles the government with a peacock feather, hands it to the government, then the government paddles the banker.

2)Marty the Keynesian dude gives Larry Summers a job if he promises to talk like a good Keynesian.

Market forces:

EU troika forces private investors to eat 80% of Greek, then forces greece to eat more than that of IMF, EU Fund and ECB debt.

China pulls out of crooked MBS market. Ben buys it. BRICS do same with Tresuries. Ben buys it.

that’s enough for now.

From the post, “Investors should come to realise that it is upon these deficits that their profits rely, so they should stop their fear-mongering and get with the program.”

Perhaps the fear-mongering serves another purpose, say, as a way to introduce measures aimed at weakening labour, cutting social programs and so forth.

In the United States, some of the people calling for deficit reduction like Erskine B. Bowles director at Morgan Stanley may also, consciously or un-, see that if there is another crisis they will be bailed out. Risking profit to attack sectors of society not perceived to be useful to finance is relatively safe, especially b/c of too big to fail insurance.

Possibly. Although I’m not sure the bankers have read Marx! ;-)

Also, my reading is that the bailouts won’t restore profitability per se. For profitability you need a real economy at least ticking over. I think they’re genuinely shooting themselves in the foot here.

“Possibly. Although I’m not sure the bankers have read Marx! ;-)”

Of course they have, Snippity Bippington. They very mention of Marx draws attention away from austerity.

Nope. You don’t need profitablity to pay yourself million dollar bonuses in today’s twisted banker reality. You need profitability to avoid another financial crisis – so it’s our feets that will be blown off again.

Peter, I think my grandfather had this abut right, “A republican is someone who goes to bed happier if he knows someone somewhere is starving.”

Philip:

In what sense is government debt a cure for our economic ills?

Will it allow the world to grow exponentially forever?

If not forever, will it allow it to grow exponentially at 3% for, say, another 30 years and then slow down or level off?

If the world economy cannot keep growing at the desired rates, will government deficits ever make them themselves unnecessary, or is this ‘new norm’ permanent?

Will it push peak oil a few decades into the future, or make peak oil less significant than we have reason to see it as?

Will it restore the ocean’s fish stocks, limit global warming, cause a shift towards sustainable agriculture?

etc.

Assuming that the questions aren’t rhetorical, yes, government deficits will allow positive growth ad infinitum if they are large enough. Japan has been running on them for over 20 years — look at the first chart in the post. The higher the deficits, the higher the growth.

Every time debt is issued money is spent into the economy. This is added to the GDP accounts and thus counts as growth. It’s notmuch more complicated than that.

Obviously not panacea for global warming etc.

if they are large enough

and if they are small enough.

They have to hit the “sweet spot”. Too large leads to positive feedback fueling inflation, too small leads to deflationary spirals.

I’d call it “Goldilocks”, except in re-reading to my daughter, I have come to the belief that it should be called the “baby bear” scenario.

It’s clear that you can get nominal growth by adding money. But I meant real GDP growth, which I’m sure you will be agree is what people are after (after all, when GDP growth rates are released and discussed in the news it’s adjusted for inflation). Now, you offer Japan as an example, saying they’ve done it for 20 years, but that doesn’t show anything about what I was asking. It is no more evidence for the possibility of perpetual growth than is the fact that the world economy has been growing for many decades. If your reasoning is “we’ve been growing so far, so of course we can keep growing forever” then it’s simply the conventional wisdom of neoclassical economists and pretty much everyone else. From where I’m sitting, it’s pretty clear that it perpetual growth (and expoenential, in particular) is impossible, and I assumed the readership at NC (not to mention contributors such as yourself) generally shared this view. Since it seems you don’t, I’m very interested to get your take on the limits to growth study, writers such as Ugo Bardi and Richard Heinberg, and such thought experiments as http://physics.ucsd.edu/do-the-math/2012/04/economist-meets-physicist/ in particular . Because I’m sure you much too smart to believe that the economy is independent of its physical base.

The questions weren’t rhetorical, they were intended to see what your claim was based on, which I’m still very curious about. Now, if this is off-topic for NC, I can drop it, but as an economics blog which takes to task the neoclassical for their various failures, I assumed it’s fair game to consider the relation between economic activity and the physical world.

And I would add that my mentioning global warming, etc. was not just a kitchen-sink kind of thing. The point is that real economic growth is not a matter of injecting money into the economy. It’s a matter of physical activity. You have to agree that if the whole ecosystem is collapsing, then economic growth won’t be continuing. This proves that government borrowing does not necessarily lead to perpetual growth. So your claim that “Every time debt is issued money is spent into the economy. This is added to the GDP accounts and thus counts as growth. It’s notmuch more complicated than that.” can’t be right. But once you admit that it’s more complicated, you have to face the question of the relation between economic activity and its physical base, and justify the possibility of perpetual growth in those terms, which is what I’m asking you to do. At the very least, it’s something I think that you should look into in the future (or look into again if you already have).

Personally, I’ll feel quite relieved when Japan finally explodes, or implodes, or does whatever result happens when we see something that defies rational explanation for a very long time.

Wolfe Richter has been writing on the subject now and then and provides some insights you get when you look under the macro hood(wink) and look for some odd things that macro obfuscates.

For one, they do run a trade surplus most of the time. But domestically they have been fighting the best deflation you can have – the lowering of high tariffs.

http://www.testosteronepit.com/home/2012/4/6/the-real-reason-for-deflation-in-japan.html

For another they do – even still – fund most of the national debt internally. However this does require much financial oppression. They have their “postal fund” which is a supersized version of our SS. They are sold government bonds at whatever the government says the yield will be (1% is a popular figure). Then they pressure banks to buy gov paper at very low yields. How? When the government grants “regulatory forbearance” to a bank, they can threaten to take it away if a bank does not do their bidding!

Any other problem with forced low yields? Yup. The search for yield hasn’t been working so well with unfettered savings and pension funds.

http://www.testosteronepit.com/home/2012/3/2/evaporating-japanese-pension-fund-assets.html

So like I say, I’ll be quite happy when we can stop pointing japan as the Model Economy for the world.

Personally, I’ll feel quite relieved when Japan finally explodes, or implodes, or does whatever result happens when we see something that defies rational explanation for a very long time. Literary Critic

I’ll be happy when people realize that a monetary sovereign has no need to borrow in the first place.

The heads of those who think Japan must implode are more likely to fail than Japan. They must be very frustrated that reality does not conform to their gold standard thinking.

YesMaybe:

In what sense is government debt a cure for our economic ills?

In the sense that the lack of government debt = money in the economy has been a severe economic ill for the last 4 decades. Basically, all the money, all the wealth since then has gone to bloating parasites, while people who work got very little.

Will it allow the world to grow exponentially forever? Probably not.

Will it push peak oil a few decades into the future, or make peak oil less significant than we have reason to see it as?

Will it restore the ocean’s fish stocks, limit global warming, cause a shift towards sustainable agriculture?

etc.

Yes to all. Issuing more debt when it is needed, spending to run economies efficiently, sensibly is like “not chopping off everyone’s weaker hand” or “not randomly sacrificing every tenth person on top of a pyramid”. Everyone who is working to do these Good Things you mention.

Not so brilliant? But infinitely more intelligent than current economic policy, social technology which has degenerated incredibly since the 70s, which consists of “chopping off everyone’s weaker hand” and random human sacrifice. This amputation / sacrifice policy does clearly interfere with doing all the Good Things.

Sure, physical limits must be respected, although there is frequently space to work around them. But so should even more fundamental economic facts be respected too.

Calgacus:

I certainly don’t subscribe to the dogma that government spending is bad or inherently inefficient. But I have yet to see any evidence for what you’re suggesting. I mean, the US debt has increased by 64% since 2008, and I haven’t seen any notable shift towards sustainability, much less one that would be explained by the debt. In fact, the evidence is very clear: ecological damage slows down when the economy slows down and speeds up when the economy speeds up. If the government borrows and spends a lot of money and that causes the economy to grow, it will simply make the overshoot worse. My point is that growth is the problem, not the solution.

I agree that the blame for our global ills lies with the corporate overlords (and their politician pawns, who are full accomplices), not with the common people, and (I would add) definitely not with the poorer people of the world. But within a system of debt as money and investment for profit, what I’ve said above stands: growth is not sustainable, and is leading us towards collapse.

If there is a reasonable case to be made that increased government borrowing will have the salutary effects you’re suggesting, I have yet to hear it anywhere else, and can’t imagine what evidence would be cited for it. But I have seen plenty of cogent arguments (e.g. from marxists economists such as john bellamy foster) against that being the case.

Calgacus:

(continued)

Now, if what you’re talking about is taking property away from parasites and giving it to people who work, that’s all well and good with me. But I can imagine better ways to do it than having the government sell bonds, and I actually don’t see how the government’s increased borrowing is supposed to accomplish it at all. Maybe that’s just blindness on my part.

But until people embrace diminishing economic activity (which they won’t until they’re forced to), we’re on the path of overshoot and collapse. You speak of physical limits being respected or worked around. Please tell me more about how this would realistically be accomplished in your view if government followed your prescriptions.

The truth of the matter, as other Financial Times writers like Martin Wolf know well, is that the current high levels of government debt are necessary in order for the private sector to deleverage. Without the government taking on debt … Philip P

Debt is NOT necessary for a monetary sovereign. It can simple spend new fiat into circulation.

The truth of the matter is that the debt of a monetary sovereign is a gift of a risk-free return which explains its popularity – gifts are popular.

Btw, government privileges for the rich or for special interests like the banks is one definition of fascism.

Second, the simple solution to his “debt” paranoia would be for the US government to change its legislation/regulation environment and cease issuing any public debt. The US Federal Reserve could credit any bank account and clear any cheque that the US Treasury desired/issued and government spending would proceed as usual.

The US government issues its own currency and, in intrinsic terms, never needs to fund its own spending in US dollars. The issuing of public debt is an entirely voluntary act by the US government and provides the bond markets with “corporate welfare”. Just imagine what the uproar would be from the bond markets and investment banks if the US government announced it was cutting off this source of corporate welfare. from http://bilbo.economicoutlook.net/blog/?p=19205#more-19205 [emphasis added]

Emphasis was added to Philip’s words too.

“….just imagine what the bond markets and investment banks would do if the US government announced it was cutting off this source of corporate welfare” Wouldn’t the Junta threaten martial law, credit card shutdowns, fire, brimstone – and all that jazz again? Scare ’em straight as it were?

Wouldn’t the Junta threaten martial law, credit card shutdowns, fire, brimstone – and all that jazz again? Famous Binge

Probably which is why we need a plan to orderly destroy the counterfeiting cartel with little suffering. It can be done. We should never again be at the mercy of the banks.

YES! Absolutely repressive. But not just how you describe here. There are other tactics of repressive economics being employed that have nothing to do with QE or even with the Fed. It certainly is not about shadow-jumping. It has to do with picking and choosing favorites, mid-race, repeatedly.

re: “Are governments really engaging in ‘financial repression’? …This meme has been around for quite some time. As far as I can tell it was brought into being by Austrian School types”

I suggest you do some more research starting here:

http://ideas.repec.org/p/nbr/nberwo/16893.html#author

Written in 2011. Doubtful that this is the original source. I still think the original source was Austrians.

re: source of financial repression

Check out the wikipedia entry

http://en.wikipedia.org/wiki/Financial_repression

It’s doubtful that the politicians understand stock-flow consistent modelling. Take the, UK for example, why would the Cameron led government make such a song and dance about the need for austerity cuts if they understood the necessary role that government was playing in helping the real economy deleverage? Indeed was it not a wilfully ignorant former Tory Prime-Minister, Margaret Thatcher, who was instrumental in having Wynne Godley’s stock-flow consistent modelling research money eliminated after his predictions her economic policies would result in recession came true? Why indeed would Cameron go along with the Bank of England’s policy to provide further gambling money to the Bankster’s to blow asset and commodity bubbles if he understand the effect on the real economy of allowing them to use credit in this way. His government may be corrupt but it’s not that smart!

Yeah it’s obviously “financial repression” if the government refuses to provide risk-free, real-interest-bearing savings vehicles.

The use of that term with that meaning, in the context of current unemployment rates, is deplorable. Thanks, Carmen, for that.

It’s about time the government started issuing dollar bills in place of t bills.

It’s about time the government started issuing dollar bills in place of t bills. Steve Roth

Yep. The hypocritical howls of dismay would be something to behold!

Philip Pilkington:-

“Assuming that the questions aren’t rhetorical, yes, government deficits will allow positive growth ad infinitum if they are large enough. Japan has been running on them for over 20 years — look at the first chart in the post. The higher the deficits, the higher the growth.”

Clearly there’s a connection here with the Chinese Communist Party’s willingness to provide the money to roll-over, or cancel, the state-owned banks’ non-performing loan portfolios and the high average annual GDP growth rate performance of 10% over the last thirty odd years.

Didn’t know the CCCP ran Japanese economy! ;-)

“Clearly there’s a connection here with the Chinese Communist Party’s willingness to provide the money to roll-over, or cancel, the state-owned banks’ non-performing loan portfolios and the high average annual GDP growth rate performance of 10% over the last thirty odd years.”

Could I suggest that the Chinese Communist Party running a permanent debt jubilee might have something to do with containing the costs of the real economy. Unlike the West where Banksters are allowed to run wild under the auspices of Neo-Liberal dogma blowing asset and commodity bubbles that have imposed such high additional debt and price costs on the real economy they’ve forced them into a severe recession.

The 1% stole China’s gold. That is what 9/11 was all about. The patriot act allowed the banks to transfer our wealth to overseas bank accounts. 9/11 was the biggest deception of our time. It was used by the 1% to rob everything….creating chaos is how they pulled it off. The 1% screwed China.

You’re not a gold bug, are you? Gold is merely a previous tool for exploitation by the usury and counterfeiting cartel. Going back to a gold standard solves nothing.

Beard…Do you mean me..? A gold bug..? seriously now…have I not been talking about issuing our own currency backed by our own natural resource revenues…natural gas and electric…? I know what they are up to with their gold backed dollar…a microchipped slavedom.

have I not been talking about issuing our own currency backed by our own natural resource revenues…natural gas and electric… chitown2020

Fiat is already fully backed – by the taxation authority and power of government. You have bought into the gold standard deception that fiat should be backed by anything else. It is already full backed. Any other backing would be superfluous, a waste and government backing of the so-called “backing”.

Beard…The currency is not backed by gold…it is backed by credit….we the people are what the use to create that credit. That is what the IMF did when they hijacked our birth certificates. The birth certicates are used by the Govts As credit instruments. That is how credit is created by our signatures backed by those birth certificate bonds.. Its all a scam and a fraud..I never agreed to that…none of us did. That is how they borrow money off of our signatures…therefore they are the debtors. We all have a cusip#.

Money backed by birth certificates? Good lord, you are a nutter, chitown.

GOOGLE IT HAROLD…Its true….the currency is backed by our birth certificates. They convert them into bonds. I’m not nuts…they are.

While I’m googling that, chitown, you need to google the term ‘crackpot’.

Just google it and let me know what you find. You can take that red # on your birth certificate to the NYSE website and find out what corp holds your bond.

I’ve googled it and found that it’s a nutjob conspiracy theory. Hence you are indeed a total crackpot with zero credibility. Have a nice day :D.

You are a liar Harold and you have zero credibility….Just like the mbs’s the FED is still peddling… Here is another link. These links are being blocked so those who have minds of their own can google search and make their own decisions http://politicalstew.com/bb/viewtopic.php?f=1&t=86336

Things are more clear cut than they appear. The cover up is more complex than their motives or their crimes. That is how they steal with impunity…they use weapons of mass deception.

I am sure Yves knows about this.

I am sure she knows you are a nutjob.

Here’s a link trolls…..you always try to shoot the messenger…EVERYONE…GOOGLE THE WORDS…ARE OUR BIRTH CERTIFICATES USED AS BONDS ON WALL STREET?

http://www.youtube.com/watch?v=?kVCui-BO3ak

Ok Chitown, don’t normally do this, but when someone hijacks a post to push bullshit…

I agree with Harold you are nut, bonds are backed purely by the taxation base of the US and market’s assessment of the likelihood of default – zero.

Be sensible with what you say or go say it elsewhere

Sorry Chris but you are wrong. This is a credit based economy and what do you think creates that credit….WE DO…They use our tax money to fund and pay for everything but what creates credit…our Birth Certificates do….They are used as bonds. Now go google the words THE IMF AND BIRTH CERTIFICATES…You trolls aren’t going to win. I know the truth about their global credit scam.

Here’s a link but, please do your own research…you can also Google the words Strawman and the UCC..they also insure those bonds with life insurance. http://sites.google.com/site/judicial/deception/birth-certicate-bond

The link is blocked but please Google it.

Agree totally Philip, deficit spending is the answer, as long as the spending goes toward something productive. If it goes to bail out banks, well we’ve all seen that disaster.

The problem with how governments have been deficit spending is that they have accepted the advice of the accountants and economists that they must borrow and pay interest on their borrowings in order to fund deficits. The books must balance.

Borrowing to fund deficits involves a transfer from the tax payer to bondholders. Shouldn’t need to happen and governments need more options and they need to understand what happens in the real world. Don’t hold your breath…

Deficit spending ahhh…

Than you would not mind if the government raised your taxes 100% right?

Defiant, you have a lot to say, but you make no sense.

Read my post. In it I suggest that there are ways, other than borrowing, by which a sovereign nation that issues its own unique fiat currency can meet its financial obligations to taxpayers, employees and bond holders.

ie ask your central bank to credit their bank account.

No borrowing, no printing.

People are too caught up with double entry book keeping, bank reserves and so on.

There is no difference between a bank note and a bond, they are both an IOU.

The only time this can’t be done is when your central bank is not government, like the Fed.

Hahaha…

You’ve been conned…. what is money?

If you can answer that you will find the claim that a government can meet it’s obligation as ridiculous as an individual paying his with plantain leaves.

Outside doing a good fees, why would a bond holder fork over his cows, horses, wheat for IOUs?

I am greatful to see the comments about Japan. What the Marxists should be asking, should be obvious, what does Japan have to show for all this money down the hole. Nothing but 200% debt to gdp, that’s what. Unemployment is still a mess and they have squandered the peoples savings. Its ironic that the same people calling banks thieves, Marxists, are asking for the government thieves to grab what little is left.

I am glad you bring up Japan because when it collapses I will be reading through these boards to see all the excuses and lies you will have. I hope all the confused out there realize that the Austrians actually got it right and don’t need excuses. I suggest reading Bob wenzel’s speech at the fed. The man tells it like it is.

Nothing but 200% debt to gdp, that’s what. Defiant

One more time. The debt instruments of a monetary sovereign are THEMSELVES money. Thus Japan has no national debt in Yen.

To pay off that “national debt” would be as simple as swapping new non-interesting paying fiat for those interest paying government bonds. Obviously, the Japanese government bond holders would not like that but that’s the reality.

Stuck in gold standard thinking you are.

Learning some MMT you should be.

There will come a time when you will need more than the sovereign argument to defend MMT. I will be there telling you I told you so. Not only will Japan default, so will most of EU, and us.

Tally Sticks lasted over 800 years.

Also, a monetary sovereign CANNOT default on debt owed in a money it can create unless it CHOOSES to.

You should realize that lending money to a monetary sovereign is not DOING a favor but RECEIVING one.

But as is often the case, the tail thinks it is wagging the dog.

Is that right beard?

Is that why Japan went from a nayltion of savers to a nation of debtors?

Is that why, although demographics is an issue, the government has managed to squander the people’s money?

So let’s ask the question the right way – who is giving and who is receiving?

You speak as if bond holders not liking the deal above is no biggie – chug along nothing happened here. Let me give n analogy, you can rob me once but I would be a fool to lend a thief. You also, conviniently ignore the question, what does Japan have to show for 20 years of deficit spending?

I will save your breath – peoples savings were robbed, yes robbed and Japan’s debt went from 60% of gdp to 200%. Did I mention the infrastructure projects to rob the people while building bridges to no-where, sorry to “create” jobs. You have to love the manipulators. They preach gods words, yet fight the hands of God every day.

Is that why Japan went from a nayltion of savers to a nation of debtors? Defiant

A counterfeiting cartel that lends its product tends to do that – rob savers and create debtors.

But if Japan was smart it would “print” some new fiat and hand it out to its population – after first abolishing the counterfeiting cartel.

Beard,

The minute print the fiat, political event, the minute bond holders run, the minute the yen collapses. Somehow Marxists think moneygrows on trees. Need a couple of billion, just print it. Are we applying any logic here?

So in theory, you are right, a fiat system chides when to default, but is it really a choice if the other option is full blown hyperinflation and collapse. Which will you chose?

BTW I guarantee you that tgmhw rich Japanese haven’t lost a dime by the “share the wealth” campaign. But the savers have for sure lost it all. Not only that, governmenOL’s government has deficit spent their kids future. Those saying that deficit spending is the way and that its ethical will have to explain this astrocity to their kids. Your kids will ask. Although I am not surprised if some of you have thought about this but are so centrist you don’t give a shit.

It sounds to me like you’re taking issue with Keynesians, MMT advocates, or whatever. I don’t see why you bring marxists into it. Do you honestly think marxist economists advocate or even support policies such as Japan’s? If so, can I have some of whatever you’re smoking?

So I’m the one smoking ahhhh..

Let’s see.

– Austrians are the realists. Nothing is infinite, including the amount of debt a fiat system can support. We believe that the root of the issue is the manipulation and nature of the system, fiat, is a ponzy scheme, fraud. To fix the issue we need to end the manipulation and the fraud. Hope that’s clear.

– kenesyans support the fiat system. They believe that the dislocations are normals, bublles are normal and cannot see a collapse even if it was smacking them in the face. They get awards for asking for the devaluation of the currency and for printing. Wow that was hard. So you can sum up kenesyans with lower rates and more printing. This appears to grow the economy but all it does is increase prices while salaries remain stagnant. Essentially stealing from the people. They work for the banks and all they do is to support the banking system. This means that they want a controlled demolition, they will not benefit from a currency collapse so don’t expect free checks from the fed – thank GOD.

– on the other side of reality, Austrians, are the people disconnected from it all. These are MUCH MUCH worst than the kenesyans. The Marxists believe that money has no boundaries. They believe we don’t have enough money because the government refuses to give it to us. Although I know some are dubious at best, they think the government can make us all rich. The government can secure jobs, health insurance, housing, food, a brand new Lexus and coke.

All I can say is that as much as I dislike bernanke, I would rather 100 bernankes than half a Marxist.

Defiant

-now

Austrians are the realists. Defiant

Austrians are fascists to the extent they support a gold standard.

Gold is fascism…. wow..

Beard I know you are coming to your senses. Life is not meant to be easy. Its not fair, but you know deep inside that trying to manipulate the system not only will make it worst, it will make it even less fair. I’m not sure how some still look for deficit spending when most have gone to banks and the military complex. Do we believe our government will now have a faint of heart?

So yes, gold can stop the government corruption on it’s track becacause you cannot print gold. I don’t know about you, but I’m 100% sure that if Congress had the ability to priint we would be awash with hyperinflation.

Fascism is control – giving people “free” money, settingg rates, printing, taxing, union thugs is fascism. Clear?

Gold is fascism…. wow.. defiant

Where have I ever said that?

Never.

I don’t feel like dissecting your comment; it would bore the others and you can’t seem to learn.

But take me at my word; your comment is pitiful.

Come on Beard.

No sense in hiding it. You see as clear as air what I see. The OWS is headed to a wall if Marxists take it over.

I mean, these people are so motivated they go on vacation for a few months. Instead of fighting for freedom, they want free things. Instead of free markets they want controlled markets.

You need better arguments to refute my statement than the words fascism and pitiful

Defiant….the criminals who robbed us STOLE AND HOLD ALL OF THE GOLD..THEY STOLE OR HIJACKED EVERYTHING UNDER THE GUISE OF MONEY LENDING WHEN ALL THEY LENT IN RETURN WAS CREDIT……BEWARE OF A GOLD BACKED DOLLAR….! THE GOLD BACKED DOLLAR, THE WORLD TAX AND THE HEALTCARE PLAN…ARE ALL FRAUDULENT FIXES FOR FRAUD……THE IMPOSITION OF ANY OF THOSEWILL BE THE END OF OUR FREEDOM, PROSPERITY, OUR INDEPENDENCE AND OUR NATIONAL SOVEREIGNTY….!!!! IT WILL BE THE MICROCHIP FOR ALL WHO WANT TO BUY, SELL OR TRADE….!!

Not only are they hogs but they are hogs with a severe gambling problem. Anyone see the newer version of the movie Rat Race…? It describes what they do to all of us…Austin Powers is another good one.

I am talking about the owners …not their puppets.

My critique of the article:

– The whole entry is based on one and one thing only: AGGREGATE DEMAND, or need thereof.

– Presented as Natural Law (something like gravity): “Public sector debt (provided that it is issued by a government that issues its own currency)= private sector savings.

– Presented as science: “If we want to be scientific we must look at it.”

– Infinity is mentioned (domain of religion): “yes, government deficits will allow positive growth ad infinitum if they are large enough”

Question 1: Define aggregate demand. If most of people have 3 tv sets, 2 cars and a mortgage and enough disposable income to eat and get clothed, what happens if food and energy prices go up? Do they eat the extra TV sets they have at home? (metaphorical question – no sarcasm). My conclusion: Tackling Agg. Demand as Quantitative only is incorrect

Question 2:How is it possible to split Public from Private? What is public and what is private? My take: They cater to the same consumers. This is quite blurry. There is no clear split.

Question 3: How is this qualified as scientific? What is scientific? My take: Experiments with natural phenomena are scientific. There is nothing scientific here.

Question 4: Explain infinity. Do you have a scientific equation? Can you measure infinity? What is the unit of account? My take: I strongly recommend the word “infinity” never be used seriously, unless is used metaphorically or humorously. It belongs to religion.

This statement in response to YesMaybe’s question re perpetual “growth”:

“Assuming that the questions aren’t rhetorical, yes, government deficits will allow positive growth ad infinitum if they are large enough. Japan has been running on them for over 20 years — look at the first chart in the post. The higher the deficits, the higher the growth.

Every time debt is issued money is spent into the economy. This is added to the GDP accounts and thus counts as growth. It’s notmuch more complicated than that.”

would be hilarious if it didn’t make so abundantly clear that economists archaic notions of “growth” is insane.

If PP believes that we can construct an economy free from physical constraints, just keep growing, and growing and growing because that’s what we humans have decided we are going to do irrespective of what silly old natural laws have to say about it, well then, I guess we ought to just follow him right over the cliff – why not, since we’ll all have our anti-gravs strapped on?

As to Japan, please note that without US/European and Chinese bubbles Japan would not have been able to maintain huge surpluses, which is the only reason anyone else on the planet will pretend they have a strong Yen. Take that away and they are toast.

I also note that Japan’s strategy of pursuing surplus is by PP viewed as perfectly OK, whereas German surpluses are in his mind pure Evil.

Please answer YesMaybe’s questions as well as addressing the question of just where Japan would be absent surpluses based on exporting into massive bubbles.

What do you mean by growth?

Stagnant salaries while Japanese go from a nation of savers to a nation of debtors thereby stealing their hard earned wealth, right before they head into retirement?

The statement that this can go on for ever and you know it. Also what is it that you guys and gals love so much about deficit spending. Japan has been in recession, with unemployment, debt to gdp went from 60 to 200% and you still want more?

Tax payers need to put a stop to this BS today. Enough is enough.