By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

The fallout from the Spanish bank “bailout” continued overnight with Spanish yields moving back up and over their November 2011 euro area highs:

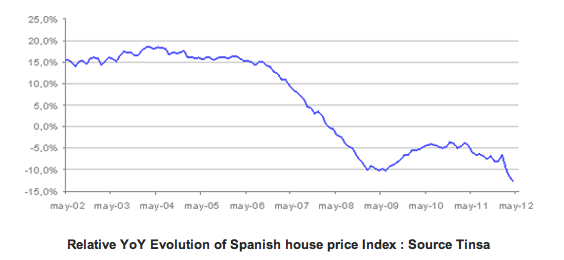

Sovereign yields, however, are the outcome. The root cause of is a mix of enforced government austerity and collapsing housing bubble, and on the latter the news continues to get worse:

The house prices fell by 11.1% yoy in May, which accumulates and a drop of 30.2% from their peak levels in December 2007, according to the Spanish Real Estate Market Index (IMIE) of Tinsa.

By area, the towns of the Mediterranean coast were those who returned to mark the sharpest annual decline in May, 14.1%, followed closely by the capitals and major cities (-13.3%) and metropolitan areas (-11.8%).

Below the market average stood for other municipalities, whose year decline amounted to 8.4%, followed by the group of Balearic and Canary Islands, which ranked last, with a drop of 6%.

In terms of cumulative declines, the Mediterranean coast has experienced a fall in prices from their peak levels of 37.9%, followed by the capital and big cities (-32.9%), metropolitan areas (-31.2% ), the rest of the municipalities (-25.9%) and the Balearic and Canary Islands (-24.1%).

The full report from Tinsa can be found here, but the major take away is the YoY evolution chart showing that the rapid acceleration in housing declines in April has been added to in May, albiet at a slower rate of change:

Relative YoY Evolution of Spanish house price Index : Source Tinsa

It seems that the backfiring bailout it also dragging Italy back into the spotlight as we see the country’s yields also trending up again. That probably wasn’t helped by the Austrian finance minister’s latest comments on the country’s outlook:

Raising the stakes in Europe’s debt crisis, Austria’s finance minister said Italy may need a financial rescue because of its high borrowing costs, drawing a furious rebuke on Tuesday from the Italian prime minister.

Maria Fekter’s assessment of the euro zone’s third largest economy amplified investors’ fears that Europe is far from ending 2-1/2 years of turmoil.

“Italy has to work its way out of its economic dilemma of very high deficits and debt, but of course it may be that, given the high rates Italy pays to refinance on markets, they too will need support,” Fekter said.

She sought to soften her remarks on Tuesday, saying she had no indication Italy planned to apply for aid.

Mario Monti was obviously less than impressed, but showed some restraint:

“I consider it completely inappropriate that a European Union Finance Minister should comment on the situation in another member state, particularly in a way she did,” Monti said, adding that he would “restrain” himself from commenting on her words.

But this wasn’t the only overnight stoush. As I mentioned a couple of times over the last few weeks Europe’s “fabulous 4″ (European Commission President Jose Manuel Barroso, European Central Bank President Mario Draghi, Eurogroup Chairman Jean-Claude Juncker and European Council President Herman Van Rompuy ) are supposedly working on grand plans for Europe to be presented at the next EU summit. Mr Barroso has been focussing on a banking union as one of the key deliverables in what appears to be a mix of supra-European macro-prudential regulator and bailout fund:

A banking union giving a cross-border agency supervisory powers over major lenders in all EU states could be enacted by next year, European Commission President Jose Manuel Barroso was quoted on Tuesday as saying.

The EU needed to take a “very big step” towards deeper integration if it was to learn the lessons of the sovereign debt crisis, he told the Financial Times in an interview.

The plan would also include a regional deposit guarantee scheme and a rescue fund paid for by levies on financial institutions. It could be implemented by 2013 without changes to the bloc’s treaties, Barroso said.

But it wouldn’t be Europe if we didn’t see grand announcements of greater co-operation immediately quashed by another party:

Andreas Dombret, a key board member of the Bundesbank, said the grand plan by Brussels is unworkable. “It has to follow a deeper fiscal union as it would imply significantly increased risk sharing amongst countries.”

Mr Dombret said a pan-EMU deposit-guarantee scheme and a debt resolution fund would require “a genuine, democratically legitimated fiscal union” and a new treaty.

The Bundebank’s vice-president Sabine Lautenschlaeger hammered home the point in what is a clearly co-ordinated push to kill the plan. “The result would be a pooling of the governments’ liabilities through the back door,” she said.

“Whoever is footing the bill must also have a right of control, particularly when it comes to the large sums that are seen in banking crises,” she added, alluding to rulings by German courts that unquantifiable EU liabilities breach Germany’s constitution.

Chancellor Angela Merkel endorsed the tough line at a party conference yesterday, insisting that Germany will not accept variants of debt pooling or eurobonds until Europe has created a machinery of joint government.

Which brings us back to the old chicken and egg dilemma we’ve seen from Europe for this entire crisis. Although Germany will “talk” about long term goals for the Eurozone they have been uncompromisingly steadfast in their message that it is fiscal/political union first, everything else second. In the eyes of Germany, the first step is that all countries must bind themselves, and enact, the fiscal compact and until this has occurred Germany is unwilling to move. Obviously I consider this entire thing totally misguided, but it certainly is not new.

Given the economic situation of peripheral Europe, many nations are finding that they are being ensnared in the fiscal compact like it or not. Although Mariano Rajoy would like to believe otherwise it would appear that Spain is now firmly latched up to the European austerity wagon, with Cyprus likely to follow in the coming weeks. The outstanding, and rather large, entity left is Italy and that is where the focus will now turn.

Interesting times ahead!

Just a note for those of you with a little too much time and a penchant for European economics. The ECB released the June 2012 European (in-)stability review overnight, and I am slowly making my way through it. The press release is here and the report is here. But be warned, at 125 pages it’s not small.

I ran into my friend who grew up in Rome over the weekend and said the same thing to him, Italy is next. He didn’t like hearing that, grimaced a bit and said Italy was fine.

Italy is whatever the financial folks want to make of it. More Shock Doctrine posturing, IMO….excuse me, maybe it is a faceless sort of genocide to keep the global population in check. What is the next anti-humanistic penance the 99% must pay to the global inherited rich and their puppets that set and enforce the usury levels of governance.

To the credit of Delusional Economics I have to say that he has picked the best housing price indicator in Spain. I would add that if we look at the change in house prices seen in (taking the index that focuses in capitals and larger cities) the annualized drop would be 22.4% which is comparable or even worse that the worst CASE-SHILLER 20 data. This is in line with data from the Banco de España on new “lending for house purchase” to households wich is the earliest indicator we have on housing in Spain.

See here the latest release with april data(in english):

http://www.bde.es/webbde/es/estadis/infoest/a1918e.pdf

It is also possible to pick all the monthly series data from 2003 here (.csv format):

http://www.bde.es/webbde/es/estadis/infoest/series/be1918.csv

You can see that lending for house purchase has been falling for years and we still don’t see the bottom. This is very telling as an indicator of the confidence of the spanish households and complements very well the consumer sentiment series.

Sorry for the typo, my computer erased 2012 from this phrase:

“I would add that if we look at the change in house prices seen in ….(2012)”

The csv file is f*cked up my man!

I deleted a few lines that were not headers nor data and got a file with the month and 14 numeric series in millions of euros. How these 14 series differ?

To see the data in correct format you can follow the instruccions in this site:

http://www.bde.es/webbde/en/estadis/infoest/htmls/recomendaciones.html

yeah well, those instructions assume a Windows OS and a gross violation of the csv standard. Nevermind, I’ll manage.

When the so-called European Constitution Treaty (TCE for short; read about it here: http://en.wikipedia.org/wiki/European_Constitution ) was temporarily blocked (by an example of popular involvement in governmental policy-making, i.e. real as opposed to sham democratic participation) in 2004, the popular rejection–which, had they been really informed and actually consulted, should have met with much wider and deeper opposition than was then the case–put a halt to the Euro-Neoliberal pipe-dream juggernaut of subjecting all Europeans to the manic logic of globalized financial totalitarianism——-temporarily.

But the miracle of the market-melt-down offered a marvelous (though specious) excuse for the re-launch of the centralization of politico-economic power once again.

This single-minded ambition of the elites is what drives everything else in the making and the advantage-taking of this phoney world economic crisis. It’s the globalized elite’s neoliberal system which is in crisis, not some nation’s “economy” here, there or yonder.

Imagine that a chemistry facutly ran a department of chemistry and it happened that every year or two, the department’s labs blew up, causing deaths and destruction of the immediate and surrounding property; then imagine that, each time, the labs were re-built and the same faculty remained in charge of the teaching. Then imagine that this process goes on for hundreds of years without any of the authorities being held to account.

That’s an analogy for the economic insanity we suffer in and from.

If someone proposed something as mild as arrest and detention of the faculty, they’d be accused of fomenting violence. But, look around. Violence is what we have and its worsening and spreading with each passing day. It’s idle to object that reformers entertain violent suggestions for reform. The real violence is already upon us. What we need now is simple: self-defence from the violent elite.

To use your analogy, what would a rational chemistry student (a member of the 99%) do in such a case? QUIT TAKING CHEMISTRY CLASSES!

What does a rational member of the 99%, who either does not or shortly will not have any alternatives anyway, do now? Start finding local decentralized alternatives to the current system and withdrawing their support for the centralized fascist capitalist state we now live under. Will there be a price to pay for such a strategy in the short term? Almost certainly. But you’re merely mortgaging your eventual future on very and increasingly unfavorable terms by delaying. Timing either markets or systemic collapses is a fool’s game. Better to get out now while you can still do it on some semblance of your own terms. Reject the corrupt system before it rejects you.

I’m an Australian living in Germany, and as far as I know, it’s not Stockholm syndrome, although, I guess one wouldn’t know if it was. From the German perspective, the problem is that, Italians on average earn more money than German’s, but the Italy looks like it’s bankrupt. German’s are working more than they have in the last 20 years and many Germans are struggling to make ends meet. It’s against this background that they are being asked, as the citizens of Germany to finance other countries.

Germany isn’t Australia and it isn’t the US, or like the US was up until 5 years ago, where everyone’s pretty much comfortable. I’ve been involved with Germany for bout 20 years now, and for a long time, income and living expenses were pretty comparable between Germany and Australia. My feeling is that life in Germany has gotten comparably harder. Living as I am on the border to Switzerland, I can tell you our town is swamped every weekend by Swiss shoppers .

Germany cares about Eruope and most Germans that I know believe in the EU, but nobody can understand why, when they themselves are not feeling financially comfortable that they should pay other countries debts. And nobody can understand the financial system, it all seems like a massive swindle.

I think you have painted very well the problem: it is not precisely clever to frame ones frustrations (with salary for instance) with a simple comparison of average salaries between two countries. For instance, if what you say is true, then the average german worker would have good reasons to ask for bigger salaries: the italians would give them good reasons to ask for more money. Of course the average comparison is meaningless and you should compare apples with apples to check if it is really true that italians earn more than their german counterparts in equivalent positions.

In Spain, salaries are much lower than in Germany, particularly in the manufacturing sector. Again, this is a meaningless comparison since the manufacturing sectors in Germany and Spain have different structures. Anycase, if you compare salaries between workers in automotive industries I bet that german salaries are significantly higher. Nevertheless the spanish guys are told one day after the other that they should accept lower salaries to be competitive. Of course this is not good for german workers since the greater reduccitions in salaries in Spain, the higher the pressure in Germany to reduce salaries.

But you know, workers are ordinary and divided people, try to teach them simple lessons like this…

“But you know, workers are ordinary and divided people, try to teach them simple lessons like this”

Ignacio, even within countries, this is true. Whether in Italy or even Spain, I’m certain that given an opportunity, certain regions would relish an opportunity to secede from the central government.

(to somewhat play off a format lambert used yrs ago, and might still)

[ ] I love this stinkin’ sh**! Please sir; may i have another!

[x] OPT-OUT!

a choice on every ballot ;-)

Love

“it all seems like a massive swindle.”

Oh, I think you understand the financial system just fine. Just keep remembering, banks OFFERED money to people who could never pay it back (and then made massive bets that it would not be paid back), and are now making YOU pay it back rather than having the bank go out of business. Does this sound like a massive swindle to you?

You are correct Sir!

Not only that; They are a Counterfeiting Cartel, so the supposed “money” they lent never existed in the 1st place, let alone being backed by any true Assets. (as i’m sure you know). ..and.. as you mention they did the (Unlawful and Publically Backstopped) Insurance Scam of betting that those loans would fail — duh

Talk about Welfare Queens, heh

Love

Do you honestly believe that the easing of German “intransigence” could possibly resolve all the many issues leading inexorably to economic collapse? Do you really think that an about face on the part of Angela Merkel and the massive printing of Euros by the ECB could resolve the crisis, rather than simply delay it while ultimately making it worse? The core of the dilemma can be encapsulated in the following four words: THEY ARE ALL RIGHT.

Tsipras is right. Samaras is right. Venizelos is right. Monti is right. Lagarde is right. Rajoy is right. Hollande is right. And, yes, Merkel is right. And by the same token: Obama is right. Romney is right. Michael Moore is right. And, yes, even the House Republicans are right.

What we are facing now is not your grandpa’s old economic crisis, but something entirely new a full blown economic/political aporia. Everyone is right, but no one has a clue as to the extent of the problem. An aporia is not simply a paradox, it is an unresolvable dilemma. To deal with it the study of economics OR politics won’t do you a bit of good. What you need is a hefty dose of ZEN.

I originally wrote the following in reference to the crisis of 2008, but it works just as well for the European crisis today (which is in any case just an extension of the original crisis, which remains ongoing despite the many efforts to delay the inevitable):

“the economic system cannot be allowed to collapse because that would be a catastrophe; on the other hand, there is no way to prevent the economic system from collapsing without producing a catastrophe.”

http://amoleintheground.blogspot.com/2009/02/aporia.html

Sorry but I can’t resist quoting myself some more. Here’s another gem, from 2009:

So the plan will lurch along half-heartedly, winding down a bit when the deficits become too alarming, picking up the pace whenever the stock market takes too steep a plunge. One thing I can say for sure, however, is that the madness will continue to the bitter end. Because, as we’ve learned from Vietnam, and as we’ve learned from Iraq, once a certain level of commitment is made, there is no going back. Once so many billions of “taxpayer” dollars have been invested, no one in government will be in a position to say, “this was a mistake, we are on the wrong track, we have to cut our losses and get out.” So what we’ll be hearing more and more in the coming months or years is: “Don’t panic. There is light at the end of the tunnel. Stay the course.”

http://amoleintheground.blogspot.com/2009/02/shape-of-things-to-come-part-10.html

Yet, the US did leave Vietnam, and I believe that Germany will allow the peripheral countries to leave the Euro.

Of course, if Greece, Ireland and the other peripheral countries agree to adopt the German language as their own and allow Germans to lead the armed forces of a United States of Europe, than perhaps the Germans will agree to a political/transfer union.

Yep, we did eventually leave Vietnam (officially in ’75 IIRC) ,.. but look what followed; the rise of Maggie and Raygun! () ..trust me, i looked for one :-p

Love

bah .. inside the parentheses was supposed to be;

[insert shameless Conan O’Brien ‘if they had a baby pic’ Here!]

but i used ” tags or something which formatted improperly

Love

enouf, witty comments.

For me it’s gonna be the Great Gatsby — halfway through a third read in 20 years and each reveals new levels of wonder and genius. I have stood like a pilgrim on the worn steps of F. Scott’s boarded and abandoned boyhood town house home fronting a vacant St. Paul boulevard, but won’t bore anyone with that story — instead of the 2012 European Stability Review, but I am very glad Mr. Delusional Economics is willing to pour through and tell us about it. Many excellent posts on the euro situation and thayze much appreciated.