Bloomberg has a useful piece up tonight describing how markets are reacting in no consistent way to ratings agency actions on sovereign debt. The story is long and prominent enough that it looks to be an indicator of shifting stances in the media on deficit cutting. A mere few months ago, it was hard to find major press stories that didn’t push deficit hawkery.

This story stresses there have been noteworthy examples of downgrades leading to bond yields tightening, which is the reverse of what you’d expect to see. It also makes clear that the ratings agencies have based their grades on deficit orthodoxy: that balancing budgets are a Good Thing. In fact, as we’ve explained and results increasingly prove out, trying to cut government spending when the private sector is deleveraging will produce a downward spiral. GDP falls faster than deficits do (in fact, they often rise as tax revenues fall and banks get sicker), making debt to GDP ratios even worse.

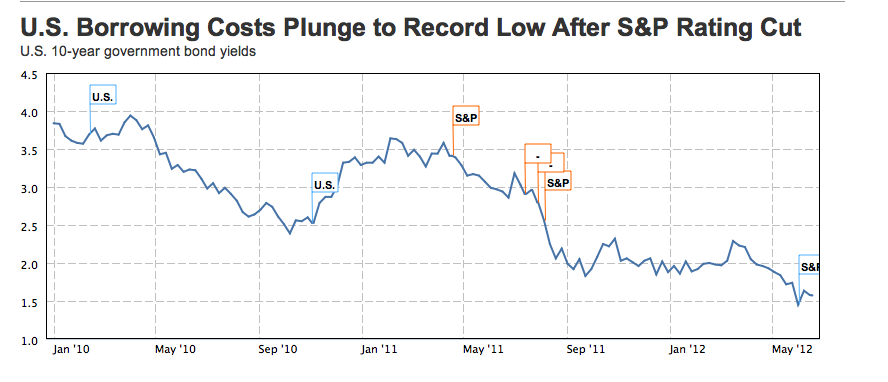

The most noteworthy example of markets dissing a rating action was S&P’s effort to browbeat the US over its downgrade from AAA, which we predicted would wind up looking like a scare. The key excerpt from the Bloomberg story:

Almost half the time, government bond yields fall when a rating action suggests they should climb, or they increase even as a change signals a decline, according to data compiled by Bloomberg on 314 upgrades, downgrades and outlook changes going back as far as 38 years. The rates moved in the opposite direction 47 percent of the time for Moody’s and for S&P. The data measured yields after a month relative to U.S. Treasury debt, the global benchmark…

Other organizations have also used market prices to study the effectiveness of credit grades, including the International Monetary Fund, the European Central Bank and academics at Rice University, Indiana University and American University. In a January analysis of Moody’s rating changes, researchers at the IMF used credit derivatives to show that prices moved in the expected direction 45 percent of the time for developed countries and 51 percent for emerging economies.

And it has cute interactive graphics:

Cuteness aside, it would have been nice if Bloomberg had parsed out sovereign currency issuers (whose defaults are voluntary/political) versus countries that don’t control their currency (who can’t “print” and therefore can be priced out of markets). You’d expect to see a much greater correlation for members of the Eurozone (who are not sovereign issues) and countries running currency pegs (who have given up monetary sovereignity) than the others.

However, it also looks as if Bloomberg is falling in line with the new Wall Street push to stop or at least lessen the impact of the coming “fiscal cliff,” which is a combination of end of tax breaks and spending cuts that will lead to a fiscal contraction which most economists peg as having an impact of 5% to 8% of GDP (note a few have argued those estimates are too grim). So the shifting media posture may actually reflect some empiricism finally penetrating the pro-deficit-cutting ideology, or it may simply reflect Wall Street economists changing their tune. The story makes the pitch:

The austerity policies prized by the rating companies have the global economy on the brink of renewed recession, according to Paul Krugman, the Nobel laureate economics professor at Princeton University. As government funding shortfalls from the U.S. to France to Spain widened during the recession, S&P and Moody’s stepped up warnings and downgrades of sovereign debt…

As part of the deal that raised the U.S. debt limit three days before S&P’s downgrade, $1.2 trillion in automatic spending cuts over the next decade will begin to take effect at the end of this year unless Congress and President Barack Obama block them. The tax cuts enacted by George W. Bush in 2001 are set to expire Jan. 1. That fiscal cliff may send the U.S. into recession again, the Congressional Budget Office said in May.

So it’s good to see a bit of progress on this front, even if it’s late in coming. But there is still a lack of airtime for the most important remedy for our current mess: that of writedowns and restructuring of private debt that is badly impaired. Yet a lot of commentators seem to react that recognizing losses is the same as creating losses (well, if you are holding overvalued bank stocks or MBS, you might want to keep the truth under wraps until you can unload your position). The myth is something like Scrodinger’s cat in reverse: if you put a dead cat in a box, you can pretend it’s in an indeterminate state and really might be alive if you open the box again. But the magnitude of to-be-realized losses on residential real estate will eventually force a change in tune on that front as well.

Great piece Yves! The media are being shown to be nothing but an orchestra conducted by people like Bill Keller and other Very Serious Persons with scores and librettos in their hands written by the Fat Cats.

time to re-read Perkins’, “Confessions of An Economic Hit Man”-question-is this

precursor to IMF “loans” guaranteed to lead to “privatization” manipulations?

Also read Perkins’ second book “The Secret History of American Empire” for more examples of skullduggery by the economic hit men/economists/consultants, shock docs, etc. There is also an explanation of how women of the night are used in these endeavors. Perkins third book is called “Hoodwinked” and has some positive stories about rejuvenation in Latin America at the end of that book.

Austerity would make sense if they suffocated the sectors where misallocation of capital has occurred.

Unfortunately, the same ones who created the mess are discriminately deciding what gets cut and what gets funded.

Therefore, austerity is sure to flop.

The debt “disease” is far too advanced for the “austerity cure” to do any good.

The patient has advanced syphillis and cirrhosis of the liver, so there’s no point in calling a stop to the orgy. Party on!

Bill Mitchell has a similar article at: The Euro crisis is all their own doing.

an excerpt therefrom:

Conclusion

The point is that the bond markets will always fund nations that issue their own currency because they know that the government carries no solvency risk.

At times when growth is robust, the investors will diversity into corporate debt instruments to seek higher returns. The consequence is that government bond yields will rise as demand for them falls. We cannot interpret that as saying that the bond markets think there is an increased risk in holding government debt. It is just that growth is robust enough to reduce the risk of holding private debt.

When times are tight, the bond investors will increasingly seek safe havens in government debt and yields drop. That choice is irrespective of whether the government is pursuing austerity or expansion. The bond markets know that irrespective of the state of the economy the currency-issuing governments can and will always pay up.

The opposite is the case in the Eurozone. It is only when the prospects of growth are good and tax bases strong that the bond markets will take the risk and lend at low yields to governments that use a foreign currency (the Euro). That is because they always know there is solvency risk.

Thinking that austerity will solve a sovereign debt problem in a monetary union where all the member states face solvency issues is like thinking that pigs might fly. It is a fantasy. from http://bilbo.economicoutlook.net/blog/?p=19893#more-19893

“The point is that the bond markets will always fund nations that issue their own currency because they know that the government carries no solvency risk.”

Patently false, no? Zimbabwe issues its own currency and has (technically) no solvency risk? Something doesn’t add up, or the words we use change meaning, for most people would consider Zimbabwe to be insolvent despite its surfeit of currency. Hungary issues its own currency too, its 10-year bond is around 8.6 %. Spain, in contrast, has the 10-year at 6.9 %.

Bill Mitchell: Zimbabwe for hyperventilators 101

Thank you, reading….

Zimbabwe doesn’t use much domestic currency anymore since their hyperinflation incident. The local papers report that consumers and shop keepers are accepting a basket of currencies, including local currencies like the Batswana Pula and the South African Rand, and others like the US dollar.

Great catch! Sure, as long as cuts to the deficit are all about firing teachers and cutting the standards of living of the little people, it’s all great and sound economic policy. When revenue equivalents like expiration of tax cuts benefitting mostly the rich come into play with no way to suppress them, budget balancing is counterproductive and will lead to more problems.

It has really gotten to the point where future historians will look at this period and shake their heads in total disbelief at how easily a plutocracy can manipulate the public “debate” into a total theater of the absurd for total morons, with said morons including pretty much the vast majority of all the professional classes entrusted with supposedly paying attention for the benefit of society.

Correction: vast majorities in all the professional classes. My apologies.

Austerity is not stupid. It is intentionally “stupid.” It is the method by which then 1% distances itself from the 99%.

Austerity always wreaks greater hardship on the 99%.

All the wealthy 1% preach austerity. You never will hear a 99% man say the government should spend less on benefits. Unfortunately, the 99% have been so brainwashed by the 1%, they actually get angry when you tell them federal deficit spending needs to increase.

Those who do not understand Monetary Sovereignty do not understand economics.

Rodger Malcolm Mitchell

Can we put a bunch of dead fat cats in a box and pretend they are alive?