One Act of Remembering Can Influence Future Acts Science Daily

Suicidal termites use chemical weapons to defend colony New Scientist

My thwarted attempt to tell of Libor shenanigans FT. “My naivety seemed to be humorous to my colleagues.”

Internal auditor at a major bank: ‘In the US they can be very uncooperative’ Guardian

Libor Criminal Probe in U.K. Starts as U.S. Readies Indictments Bloomberg. Traders, of course, not executives.

Insight: Banks bristle at breakup call from Sandy Weill Reuters. Film at 11!

Chris Dodd: Breaking Up Banks ‘Too Simplistic’ WSJ

Maria Bartiromo And Barney Frank Were Just At Each Other’s Throats For A Solid Ten Minutes Business Insider. Transcript.

The Big Banker’s Change of Heart (if any) Times editorial.

A Washington reporter’s review of Barofsky’s book is unintentionally revealing CJR. To maintain your media critique, read CJR regularly.

See something, say something, uncover NYPD spying AP (Furzy Mouse)

Drought diminishes mighty Mississippi, puts heat on Congress Reuters (Current U.S. Drought Monitor; U.S. Drought Portal)

Noda hints at using SDF to defend Senkaku Islands Asahi Shimbun

Google Talk, Twitter, Azure Outages: Bad Cloud Day Information Week

Our apologies for today’s outage Twitter’s blog

Facebook revenue growth skids, shares plunge Reuters

Facebook — social notworking FT. For the headline alone.

Facebook Widens ‘Bug Bounty’ Program to Combat Internal Breaches Bloomberg

A Letter from Mark Zuckerberg The New Yorker

Amazon Profit Tumbles as Bezos Splurges on Warehouses Bloomberg

Economy in U.S. Probably Expanded at Slowest Pace in a Year Bloomberg

In the Dumps Financial Armageddon. The garbage indicator.

China’s coal barons struggle amid falling prices Want China Times

Paycheck-to-paycheck: US households barely getting by RT.

Majority of Job Opening Filled by Workers Switching Industries WSJ

More on manufacturing convergence Dani Rodrik

Happyism: The creepy new economics of pleasure TNR

Hedemonics or Humanomics?: A Response to McCloskey’s Critique of Happiness Economics Brookings

‘Something Wonderful Out of Almost Nothing’ New York Review of Books. Maurice Sendak.

The Upside of Default The Archdruid Report

* * *

D – 45 and counting

Lambert here: I apologize for these links being thin; I have to visit a friend in the hospital.

“They have learned nothing and forgotten nothing.” –Talleyand, of the Bourbon dynasty

FL. Legacy parties: “In a wide-ranging deposition that spanned two days in late May, former FL R Party Chairman Jim Greer denounced some party officials as liars and ‘whack-a-do, right-wing crazies’ as he described turmoil in the months before his resignation.” Pass the popcorn. …. Voting: “[A]lmost half of FL’s voters will have their ballots counted this November by machines that can malfunction in as little as two hours and start adding votes. Although not used in Palm Beach County, the machines will count votes in some of the most populous counties in FL, including Miami-Dade. [R]ecounts are sharply restricted by state law: County elections supervisors can examine only a tiny slice of ballots after an election — typically no more than 2 percent of precincts. Worse, audits are allowed only after the winners are declared. ‘It closes the door after the horses have left the barn,” said Dan McCrae, president of the nonprofit Florida Voters Foundation and an analyst for Verified Voting.'”

LA. Public goods: “It’s hard to produce a hurricane to wipe away public education, as happened in New Orleans. Next best to accomplish that goal is a national strategy of closing schools and opening new schools, especially charters, supported by many foundations and the U.S. Department of Education.”

NM. Corruption, mass incarceration: “A FL for-profit prison company [GEO Group] who gave tens-of-thousands of dollars to Governor Susana Martinez has been outed as the secret company whose sudden tax appeal threatens to bankrupt at least one NM city.’

OR. Voting: “Americans Elect, a ballot-qualified Party in OR, has three [count ’em, three] registered members.”

PA. Unions: “I’m disappointed that the vice president didn’t say: Yo, Mr. Mayor, honor the agreement,’ [Bill Gault, president of Local 22 of the International Association of Fire Fighters] said as Biden was shaking hands with some of the 3,200 firefighters at the Pennsylvania Convention Center.” … Unemployment: “One local resident said she tried at least 50 times over the past two weeks to phone in her updated information [to PA’s unemployment call center] but couldn’t because the line was constantly busy. Exasperated, she contacted a regional office for the state Department of Labor & Industry and was given two different phone numbers to try. Both numbers had been disconnected. Filing updated information online was fruitless, too; she never got a confirmation her e-mails had been received and needed to talk to a human being.” Coincidence, I’m sure. … Voting: “‘We walk them through the steps, motivate them, come up with the carfare … travel down to PennDOT to get ID.’ But when they get there, [outreach specialist Benjamin Mitchell] says, they’re still being told they need to pay $13.50 for an ID card—money that many people he works with, especially the homeless population, don’t have.” That’s not a bug. It’s a feature. … Voting: “Applewhite is a spry but motorized-wheelchair-bound 93-year-old Philadelphian who marched one time with Dr. Martin Luther King Jr. in the 1960s, was a first-class welder after World War II, and cast her first presidential vote for Franklin Delano Roosevelt in 1936. The lawsuit to stop the new voter identification law from being enacted carries her name. Applewhite told Judge Robert Simpson she thinks the statute, which was signed by Gov. Tom Corbett in March, is ‘crap’ and she said she is worried it will prevent her from voting this November.” Dittoez. … Voting: “Although a majority of Pennsylvanians still support the law (58 percent to 37) that is down 8 points from a 66 percent to 32 approval rating in a Quinnipiac poll six weeks ago.”

TX. Epidemic: “[P]ublic health officials have declared a West Nile epidemic after 124 reported human cases of the virus have cropped up in North TX alone.”

VA. Universities: “Virginia Union University (VUU), a historically black university tracing its founding to the end of the Civil War, has been publicly sanctioned by its accrediting agency for non-compliance with financial and financial-aid standards. The [Historically black colleges and universities] they have less pricing power — ability to raise tuition and fees — than other institutions at at time that students and their families are rebelling against the unaffordable cost of a college degree.”

WI. Media critique: “The massive spending on political ads for the recall campaign helped [Milwaukee Journal-Sentinel owners] Journal Communications boost its second quarter profit by 24 percent.”

Outside baseball. Hagiography: “Continuing to repair his personal brand, Rove signed on with Rupert Murdoch’s News Corp.” Alrighty then. … Tax cuts: “[U]nder the D proposal, all Americans would still pay lower rates on their first $200,000 (or $250,000) in taxable income. And up to that level, individuals who earn more would actually see a greater financial benefit. As analysts from the Center for Budget and Policy Priorities noted when reviewing a similar proposal back in 2010, ‘high-income people actually receive much larger benefits in dollar terms from the so-called middle-class tax cuts than middle-class people do.'” Film at 11. … Corruption: ‘The [Inspector General’s] report is the third investigation in less than a decade that has found numerous examples of illegal hiring practices, amounting to nepotism, within the DOJ.” … Privatizing education: “This sums it up: We really are living a dystopian novel.”

The trail. Razor-thin margin: “‘And given how close this race is, I wouldn’t be surprised if the whole thing comes down to undecided executives at Dow Chemical or Disney,’ [Nate] Silver [of the New York Times] continued. ‘Let’s not forget 2000, when Philip Morris International single-handedly put George W. Bush into office.'” … Enthusiasm: “I have in my gut a belief that the polls [of likely voters] we are seeing now underrate Romney’s strength. For example, we saw a hugely enthusiastic young voter turnout for Obama in 2008. As a result, polls were weighted to give more voter strength to the category of 18- to 29-year-olds than in past years. In general, younger voters just do not turn out to vote. This year, I am seeing evidence that the enthusiastic and energetic vote of young Americans for Barack Obama has at the very least lost some of its mojo.” … Enthusiasm: “In 2010 Democratic voters and left-leaning independents sent the D Party a clear message at the polls. By staying away in unprecedented numbers — and allowing the worst Tea Party monstrosities to win seats, take over states and take over Congress, even to the point of crippling the country– grassroots Ds made it clear they would NOT vote for Blue Dogs, New Dems and conservative disguised as Ds. 63 seats changed hands, all but two from Democratic to Republican. So what did the Democratic Party learn from this disaster? [The leadership] immediately– and predictably– went out and started recruiting conservatives, in many cases the exact same conservatives who were just defeated.” … Swing states: “Refinancing applications in NV jumped 368.8 per cent in the year to June, and 247 per cent in FL. Both of these “sunbelt” states are expected to be big political prizes in November. OH refinancing applications rose 193 per cent – well above the national average – while in MI they increased 294 per cent over the past year.” … Media critique: “Another day, another Romney ad that takes a perfectly routine quote widely believed by Dems and turns it into proof that Obama is completely indifferent to your economic suffering.” They all are; austerity is a completely bipartisan project, and the only conventional wisdom in town.

Robama vs. Obomney watch. Climate: “[B]oth political parties and their presidential candidates are playing down the climate issue. Instead, what passes for an energy debate in the United States is rivalry over which party is more devoted to extracting oil and gas from the ground and the seabed.”

Romney. Olympic gaffes flap: Compilation from the Guardian; timeline from the WSJ. Of course, the “worst” of them — “[ROMNEY:] The stories about the private security firm not having enough people, the supposed strike of the immigration and customs officials – that obviously is not something which is encouraging” is a classic “Kinsley gaffe”: “When a politician tells the truth – some obvious truth he isn’t supposed to say.” It’s worth noting that the very same scorps going nuts about all this would have covered the same statements from Bush as lovable eccentricities. Which is the real story.

Obama. Gun nuts: “[Spokeshole Carney: “[W]e do need to take a broader look at what we can do to reduce violence in America. And it requires a multi-faceted approach that looks at this problem from a variety of angles, and that’s not just legislative and it’s not just about gun laws.” Mush. … Straight to video: “The D said that presenting Obama as ‘a favorable and credible messenger’ speaking directly to the people in ads is a tactical move by the campaign to drive home its message. ‘I’m Barack Obama and I approved this message because I believe we’re all in this together,’ he says.” That’s from the “Always” spot, which also sounded robotic to me. Obama’s heart, if any, clearly wasn’t in it.

* 44 days until the Democratic National Convention ends with a tuna casseroles on the floor of the Bank of America Panther Stadium, Charlotte, NC. 44 is the UK’s area code. Mitt.

* * *

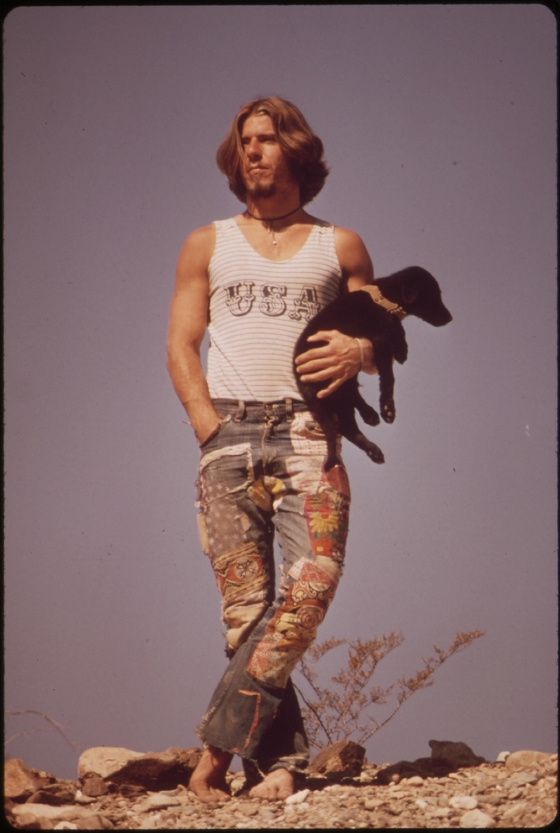

Antidote du jour: Hitchhiker with His Dog “Tripper” on U.S. 66, May 1972

“Libor Criminal Probe in U.K. Starts as U.S. Readies Indictments Bloomberg. Traders, of course, not executives”

The executives of banks always say they had no idea of what was happening. Just out of curiosity, WHAT do they know – o yeah, who to give campaign funds to, and how to keep the revolving door between government regulators and and government regulator go betweens who work at the bank (well, that is redundant as the government regulators actually do work for the banks, just under a future compensation package).

Links comments now work.

Thanks Lambert.

Yves on Libor curiosities at least back to the late 80s; Reuters on big banks bristling against Sandy Weill’s call for downsizing; and an article in the LA Times about Frank Keating of the ABA not liking the idea of breaking up the bigs at all. (Just wondering if Sandy Weill recently bought a Hong Kong penthouse.) The arguments against a breakup boil down to: All the other banks (around the world) are big and integrated and to break up US banks won’t achieve competition. And also that Glass Steagall wouldn’t have prevented the 07-08 blowout anyway because the banks that triggered it (Bear Stearns, Lehman Bros, and AIG) had no depositary. They were straight investment banks.

Questions: 1. Since investment banks can cause a global commercial banking meltdown and Glass Steagall can’t do much to prevent it, what should be done to stabilize world commerial banking? Shouldn’t this be a topic?

2. What difference does Hong Kong as the new City of London make?

3. What might the mysterious “US Tax Implications” of a big breakup be, as referenced acc’d to Bain’s advice to Citi.

4. Going back to the 1980s and the patchwork effort to survive OPEC: Have we just taken control of the problem? Both volatility and inflation?

Instead of turning banks into utilities, have we chosen instead to turn oil into a utility? (Not that they shouldn’t both be heavily regulated.) And if we have just taken over the oil market in such a way as to dictate the market, does that eliminate the necessity for all the frenzied derivatives trades to protect the dollar and try to manage volatility and uncertainty? So then, who needs those “Investment” and “Hedge” departments anyway. They’re no fun anymore.

HK doesn’t have the CB/large enough currency to make it possible for those banks to go there, I think. If one falls, you’d get a kind of iceland/ireland, as its economy is simply too small to believably absorb the blow. (Not that the UK can, but nobody is asking it to. In the case of the country being HK they would.)

Banks depend on government support; it could not have gotten multi-billion dollar bailouts and 0% interest etc. from very many other countries than the UK, US and Germany/NL/France.

Re Glass-Steagall, there are several points to make. First, it applied to both banks and to insurance companies. So at a minimum, it should have prevented AIG from blowing up.

Second, it would have prohibited the overt unions of commercial and investment banking, such as Weill’s Citigroup and Travelers merger.

Third, and here we move into more theoretical territory because Glass-Steagall was considerably degraded by the time of its ultimate repeal, it should have prevented or at least raised considerably more obstacles to the creation of investment products based on bank assets. Banks could still offer stock and buy and sell mortgages between themselves but they could not participate in their securitization into CDOs which would then be offered to outside investors.

Fourth, it probably would have outlawed interest rate swaps (investment) and had a considerable dampening effect on currency rate swaps (hedging with potential for investment).

Fifth, a rigorous application of Glass-Steagall should have had a similar effect on Money Markets. Banks could and did offer certificates of deposit (CDs) based on Treasuries, but I do not think they could have offered Money Market accounts because in servicing them they would be profiting from what was an investment activity.

That’s my reading of Glass-Steagall and where the lines should have been drawn and were drawn, to the best of my knowledge, for several decades after the bill’s enactment. But you can see how and at which points Glass-Steagall was weakened to facilitate banks’ increasing appetite for investment activities and fees related to them.

I don’t think any of us are saying that Glass-Steagall by itself could have done everything. Adherence to sensible mortgage writing standards would have been an important complement. But it would have had prevented a lot of money from entering the investment bubble either through the regular or the shadow banking system. And it is important to note too that a lot of the derivatives business built on itself. If there had been no CDOs, there would have been no CDS and if there had been no CDOs and interest rate swaps, it is unclear whether or how much investment banks would have pursued swaps and other exotic derivatives at all. You see the whole atmosphere for investment would have been different. Would this have prevented TBTF and bubbles elsewhere on the globe? Probably not. But it would have prevented TBTF and the mortgage bubble, but likely not the dot com bubble, here. And it would have acted as a brake elsewhere since the US would have both its political influence and its control over foreign banks operating in the US market.

thanx Hugh and Foppe

Libor shenanigans. “My naivety seemed to be humorous to my colleagues.”

The world needs more people asking questions a child would.

Why?

Why not?

How?

We can’t?

They can?

Embrace simple questions. They are your friends.

Barney, we’ve got some other options if “non-adult” does not suit,

“Maria asked Barney when the fiscal cliff issue would be resolved in Congress saying: “When are the adults going to enter the room?”

To which Barney replied:

“I don’t take kindly to being called a non-adult. .. ”

http://www.businessinsider.com/maria-bartiromo-and-barney-frank-cnbc-interview-2012-7

Perhaps ‘He Who is Banal’ or ‘He Who Performs’ is more to Barney’s taste ?,

Fraud and Complicity Are Now the Lifeblood of the Status Quo

(Banality of Financial Evil, Part 2)

“(The present) state is marked by the rise of the pygmy leader, the sovereign as dolt, the CEO as figurehead that knows little, who has no real need of knowing. …

What is known in the literature as “moral hazard” creates an ecology that results in moral lassitude rather than evil. Thus our bankers are no robber barons, no blood suckers, but rather “dot the i” dolts, and at their best, their very best, they are performers who pantomime what a leader should look like .. or appear to. ”

http://www.oftwominds.com/blognov10/fraud-is-lifeblood11-10.html

One last option for the Barney,

‘He Who Dispenses Discretion at Inappropriate Moments’,

“House Financial Services Chairman Barney Frank (D., Ma.) said:

” This is important for all regulators. We need to give you some discretion in how you react to these things. I am asking everyone — the Office of the Comptroller of the Currency and others — if anything in the existing legislation deprives you of discretion in how you react … I insist that you tell us. ”

Congress passed PCA to remove the regulators’ discretion to cover up or ignore bank losses. Now, the key House Chair – who once rightly criticized the S&L regulators for not promptly closing insolvent S&Ls – encourages the regulators to employ discretion to cover up or ignore bank losses. ”

http://www.benzinga.com/life/politics/10/08/447366/why-covering-up-fraud-losses-impairs-economic-recovery-part-one

FWIW, the businessinsider link didn’t work for me. Page came up blank. This one did work.

http://www.cnbc.com/id/35764459/CNBC_TRANSCRIPT_CNBC_S_MARIA_BARTIROMO_SPEAKS_WITH_REP_BARNEY_FRANK_HOUSE_FINANCIAL_SERVICES_COMMITTEE_CHAIRMAN_TODAY_ON_CNBC_S_CLOSING_BELL_WITH_MARIA_BARTIROMO

Hah. I watched that and actually thought it was a good interview. I can see why Mr. Frank is a succesful politician. I suspect the whole thing was scripted in advance to make each of them look good. I’m in the conspiracy theory mindset these days, now that I’ve discovered Americans never went to the moon and Stanley Kubrick was behind the whole thing.

Mr. FRank did make a very very good point, which is often buried in the “We Hate Washington!” cheer.

Americans elected two very different political perspectives — in 2008 and in 2010. Even if most of these are bankster-funded lapdogs, there are underlying huge differences in the empowering rhetoric. Those differences are very hard to reconcile in any reasonable way.

Mr. Frank must be a good politician becase even I, jaded and cynical as I am, actually thought he made some good points.

I wonder what’s wrong with me. Usually when I feel this way, I’ve just been robbed. haha

“Mr. Frank must be a good politician becase even I, jaded and cynical as I am, actually thought he made some good points.

Usually when I feel this way, I’ve just been robbed. ”

Your solution lies in this,

“.. they are performers who pantomime what a leader should look like .. or appear to. ” ,

for who can argue that he’s good at it, this Mr. Frank.

Barney played a large role in forming the housing mess. It goes well beyond the banks and OCC regulators.

His role with the GSEs was central.

“pantomime what a leader should look like .. or appear to. ”

Why he would grow angry when someone points it out, same as his client Geithner, ..

As they ‘developed’ as politicians they became ‘challenged’.

haha

Well, perhaps our Barney would “take kindly” to being called a full-service provider for consenting “adult” banksters, then. Just saying.

Which begs the question, due to the extent that Barney has labored for these people, what is the true nature of the perks he has received ?

His congressional salary ? Right.

McCain, ‘found out’, as well ??

“McCain didn’t lose because he picked Sarah Palin as a running mate.

He lost because he got on his knees and fellated the banksters one week before the election, and immediately after, by a 300:1 margin, the people told him (and the rest of Congress) not to pass TARP. ”

“Doddering” McCain must have some considerable physical reserves to elbow Barney the Eager out of the way.

Then again, Barney may have dispensed some “discretion” when the need became apparent.

http://market-ticker.org/akcs-www?post=209372

lol

Dodd: Breaking up banks too simplistic.

Simple is good.

Too simple is too good.

Hey skippy,

R U Going to let these baseless assertions go unchallenged?

Err… last time I looked, Lambert, the UK is a country. So that 44 would be a Country Code, not an Area Code.

Canonical ref:

http://www.itu.int/oth/T0202.aspx?parent=T0202

RE: Druidic insight

Greek default, and after that, the default of all non-German countries in the EU, has more than one upside. For example, this myth was placed into the Archdruid’s comment section:

“I recall reading a comment on a blog recently that the recent defaults such as Argentina were contained because they were then able to trade at lower prices into a still functioning global economy – export driven recoveries. But ‘this time it’s different’ – being as all are drowning in debt together.”

Exactly wrong. Part of default is the fall off of cross-border trade, and that’s a good thing. Running a trade deficit often part and parcel of more money going out than is coming in. Government budget deficits are directly tracable to citizens being put out of work by imports.

Being forced to create or revive local industry recreates the local economy. It’s without the grandiose language of the U of Chicago or the Washington Consensus, but people get by.

Austerity is premised on international trade flowing toward cheaper labor. Stop that flow, and there will be less need for austerity.

I read at least some of the long McCloskey piece on happiness (skimmed most of it), and was struck by two things.

First, to my mind Benthamism in practice largely devolved not into promoting happiness so much as into attacking misery and its causes. That laid the basis for a long project of social amelioration which has extended into our own time (though apparently now losing momentum). McCloskey doesn’t seem to realise this.

Second, that whole 1960s thing about self-actualisation seems to have vanished into the memory hole – though McCloskey makes what might be one veiled reference to it (“scope to realize themselves”). Some people might think such a disappearance is a good thing. Maybe, but if you’re writing such a heavily historical piece, just not talking about it doesn’t count as a critique.

Pretty component of content. I just stumbled upon your web site and in accession capital to assert that I acquire actually enjoyed account your weblog posts.

Anyway I’ll be subscribing on your feeds and even I achievement you get entry to consistently rapidly.