Beware of financiers bearing gifts.

A scheme proposed by a group called Mortgage Resolution Partners, which is being considered by San Bernardino, CA, to use the traditional power of eminent domain to condemn mortgages, was pretty certain to be a non-starter, so I’ve ignored it. But it’s gotten enough attention to have roused the ire of a whole host of financial services industry lobbying groups, as well as endorsements from Bob Shiller and Joe Nocera, and a thumb’s down from Felix Salmon, so it looked to be in need of serious analysis.

One of the big problems with this plan, which seems to have been overlooked so far, is that any municipality who goes down this path is likely to be the designated bagholder. Mind you, that isn’t based just on the general tendency of municipalities to be easy prey for clever bankers, but also based on the few, but nevertheless troubling, operational details that have been made public.

This is the theory of how the plan would work, from one of its prime promoters, law professor Robert Hockett:

Protecting the citizenry and heading off blight is what municipal eminent domain authority is for…And it is for them to do so in partnership with private investors who effectively render the Plan publicly costless – just as we’ve done since the earliest days of our republic in carrying out and financing local projects

If you believe that, I have a bridge I’d like to sell you.

No, this plan isn’t a “partnership”. There has been troubling little detail about what Mortgage Resolution Partners will do or how it will be paid. This whole process has been hidden from public view. Why wasn’t the original request for proposal made public? Why haven’t the operational arrangements, as in what the roles and obligations of the parties are, and most important, what the fees are, been reported anywhere?

The way this plan works is that MRP and its allies plan to steal. And no, I’m not exaggerating. But the odds are high that if this program were to go anywhere, it would be a costly and embarrassing disaster for its municipal backers.

MRP’s Fees Are Obscene

Individuals who’ve met with people involved in the MRP scheme have said, consistent with the very sketchy presentation on the MRP website, that it is acting only in an advisory capacity. Translation: it is not a partner, it’s a hired gun. And for that, it is to get a fee on every mortgage condemned, reportedly 5.5% (I assume of the value paid by the authority to the investors, but this is the sort of detail that needs to be made public). 5.5% is an egregious fee, particularly for a large scale, largely repetitive process where key tasks like servicing will be contracted out. My sources say MRP has a $6 million budget for PR (and that number suggests PR is defined rather liberally, and probably includes inducements like sports tickets). That give you an idea of how rich they expect the pickings to be. And it’s even more unreasonable when you look at the risks that will be borne by local governments detailed below (I’d be stunned if the authorities were shrewd enough to have MRP indemnify them against any of these hazards).

Municipality Bears Valuation Risk

The proposal has the municipal authority (the idea is that various localities will join one umbrella authority, presumably per state) borrowing funds from “investors” (key terms not specified) to condemn mortgages. MRP’s own website makes clear that they intend to target only performing mortgages. Yet various accounts also say consistently that MRP thinks it can condemn the mortgages at a discount to face value, and refi them at a profit. This premise is fundamental to the entire scheme working; it’s how the municipalities can afford to pay the considerable operational costs as well as MRP’s fees. And it amounts to theft.

One of the requirements of eminent domain is that the property owner be paid fair market value. For a performing mortgage, it’s awfully hard to argue that that is less than 100 cents on the dollar (in fact, as Felix Salmon points out, it’s actually more these days since interest rates have fallen). MRP argues that they ought to be less since 18% of homes that were performing but underwater in 2010 became delinquent in 2011 (aside, I wonder how many of these were people who defaulted because servicers told them they needed to be delinquent to qualify for HAMP). First, that figure should be lower for the remaining mortgages (presumably, the weakest borrowers default, so the ones who are left are presumably sounder). Second, that logic cannot extend to specific mortgages, since it is specific mortgages that are being condemned. Would you accept an offer less than the blue book value of your car simply because someone said you had a 5% odds of being in a car wreck in the next year? No, but this is the argument that is being made.

And the examples all presume large discounts. From Nick Timiraos of the Wall Street Journal:

For a home with an existing $300,000 mortgage that now has a market value of $150,000, Mortgage Resolution Partners might argue the loan is worth only $120,000. If a judge agreed, the program’s private financiers would fund the city’s seizure of the loan, paying the current loan investors that reduced amount. Then, they could offer to help the homeowner refinance into a new $145,000 30-year mortgage backed by the Federal Housing Administration, which has a program allowing borrowers to have as little as 2.25% in equity. That would leave $25,000 in profit, minus the origination costs, to be divided between the city, Mortgage Resolution Partners and its investors.

Now remember how this works: the municipality condemns the mortgages, then supposedly takes over the mortgage (more on that assumption soon). The loan would still have to be serviced but then would be refinanced, with FHA loans as the targeted takeout (properties would be pre-screened to fit FHA parameters) Institutional investors or banks would then loan the municipality the money to pay the prior owners of the mortgages the supposed fair market value for their condemned mortgages. So if things work out, the investors are providing a fairly short term bridge financing facility. If not, they’d presumably be repaid from ongoing cash flows from the mortgages. But how does that work? The last thing investors want is to be at risk of having a short term loan become a long term loan. Presumably, there are penalties of some sort if that happens. And what happens if borrowers who can’t refi default (if nothing else, shit does happen, a homeowner could die or suffer a job loss after the condemnation but before the takeout was in place). Given that the whole premise was to refinance the mortgages, would the municipalities be prepared to make new loans to replace the existing ones? I sincerely doubt the investors intend to provide longer-term financing. You’d need to see how various scenarios are dealt with and how risks and fees are shared to assess this plan. Yet these crucial details remain under wraps.

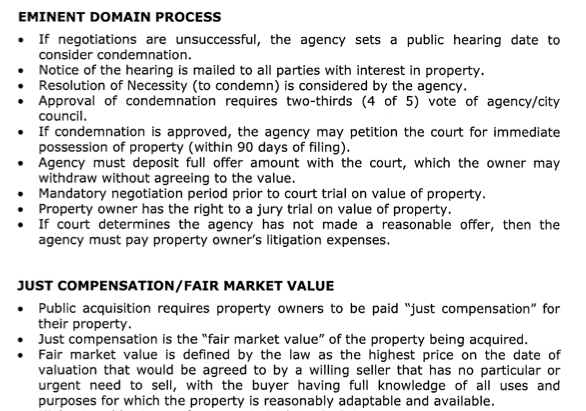

What happens if this all proves to be more costly than MPR promised? It’s certain that the municipality is on the hook, and it’s not hard to see how expenses could spiral out of control. Consider this layperson-friendly overview of the eminent domain process in California:

I’m not a lawyer, but it looks like it would be trivial to overturn the effort to buy performing mortgages out for less than par. First, whole loans are bought and sold, so it would not be hard to find comparables trading at vastly higher prices.

Second, the very act of condemning with an intended takeout at a higher price via a Federal government program smells an awful lot like a scheme to defraud. Clearly the ability to refi ad a much higher price than the condemnation price is proof in and of itself that the condemnation price was too low. And the best part? The party whose property is condemned can take the money offered and go fight in court for more. And if he wins, the other side, the municipality, pays his legal fees. The examples contemplate only $25,000 or say $50,000 of “spread” between the condemnation price and the refi amount. $25,000 doesn’t even get you started in litigation. Any level of lawsuits (particularly if the municipalities also have to repay the costs of big ticket lawyers on the other side) will run into the hundreds of thousands of dollars per borrower, pronto.

Municipalities/Special Authorities Would Be Targets of Suits on Constitutionality

This use of eminent domain is a huge stretch from its intended aims. It’s meant for public purposes, such as roads, new amenities, removal of blighted property, or redevelopment. You can see how disingenuous this approach is from the Robert Hockett paper attempting to justify its use. His evocation of the “public purpose” is to prevent foreclosures and neighborhood decay. But the program has nothing to do with that. It targets an only somewhat at risk population, and that capriciously. Fannie and Freddie borrowers (contra Felix) will not be eligible. Borrowers are also to be chosen to minimize the risk of litigation as well as on FHA eligibility, rather than based on some notion of need. For instance, my moles said that MRP was making sure no more than four loans would be condemned out of any one trust.

Given the unified outrage from the banking industry lobbyists (SIFMA, the ABA, the Financial Services Roundtable, the American Securitization Forum, the Mortgage Bankers Association, and the only bona fide investor, as opposed to sell side group, the American Mortgage Association), I’d expect a broad-based challenge on constitutionality, possibly in addition to a loan by loan war of attrition on pricing.

Now at first, you’d think that the big boys wouldn’t care. Aside from a few peeps by AMI, there were pretty much no complaints of the transfer from investors to banks embodied in the mortgage settlement. And no wonder. The banks are vastly more powerful than disenfranchised investors (who are in for the most part in the hands of institutional investors who don’t want to ruffle the banksters).

I had initially thought that the reason for the unified uproar was the ongoing top priority of not exposing the insolvency/impairment of the four biggest banks by making them write down their second liens to realistic levels. After all, one would think that condemning a first lien would force the wipeout of the second, right?

It turns out that may not be the case. Despite Hockett’s and others efforts to treat mortgages the same as real estate, they aren’t. Specifically, the reason the MRP scheme isn’t touching Fannie and Freddie mortgages apparently is that they are subject by Federal pre-emption from action by state authorities (given that Fannie and Freddie are private, I find that argument strained). Arguably, the same logic would apply to any second liens made by an OCC chartered bank. If the OCC said they were off limits, they may well be off limits (and notice, in keeping, the silence in all the public discussions about what would happen to the second liens. Update: a reader who asked MRP principals was told that they will not condemn second liens). In addition, remember that FHA is the planned takeout, and FHA refis allow the seconds to stay in place as long as the lender agrees to resubordination. What lender wouldn’t be delighted to agree if the principal balance of the first lien gets reduced a ton? It makes his second a much better asset.

So if this program might help alleviate the second lien problem, why are the staunch defenders of Big Finance up in arms? Despite the huffing and puffing, it certainly doesn’t have anything to do with “no one will ever lend to you guys again.” The residential mortgage market is on government life support, and the incumbents have been completely unwilling to back reforms that might bring investors back into the pool.

The reason may be that if any mortgages that were condemned got a court ruling supporting a well below par value price, the ramifications would be considerable. Remember, these would be jury trials, and litigation is a crapshoot, even with the facts stacked in favor of investors, a few condemnations could still get a clean bill of health). A price that low is justified only if the court bought the idea that the mortgage was at imminent risk of default. The fact that these mortgages could be refied (and the investors were at risk of a takeout below that amount) would mean the servicers would be exposed to large scale litigation for their failure to do mods for similarly situated borrowers. The PSAs that limit mods either contain percentage restrictions, like 5% of the pool, or require that the borrower be in default or at imminent risk of default. Classifying a large new group of borrowers as being at imminent risk of default, and putting a discount on their mortgages would make it easy to arrive at pretty large damages.

What Happens If/When Servicers Can’t Produce Properly Endorsed Notes? The promoters are blithely assuming servicers can produce properly endorsed notes and assign liens. Has anyone done an analysis of the issues here? Recall, as a particularly prominent example that in Ibanez, two different servicers had two years to produce evidence of ownership. As noted in the concurring opinion:

The plantiff banks….have simply failed to prove that the underlying assignments of mortgages that they allege (and would have) entitled them to foreclose ever existed in legally cognizable form before they exercised the power of sale that accompanies those assignments.

Lack of Transparency Many elements of how this scheme came about are troubling. While the interested municipalities have released the agreement that creates the joint authority, that tells us pretty much nada about the money and risk issues.

This program looks to have been awarded to MRP with insufficient competition. Was there a request for proposal? If so, why has no one seen it? This process smacks of special dealing (for instance, designing a process to favor MRP, say by drafting the RFP to assure they’d be selected, or having too narrow a window for proposals to allow other firms to come forward). The RFP, the proposed agreement, any correspondence, and a record of meeting between public officials and MRP should be made public. Par for the course, San Bernardino announced only today that a public meeting on this issue will be held Friday. And this also comes as the municipality city is considering filing bankruptcy.

If you are in the San Bernardino area, the meeting notice claims “all writings received by the Board of Directors related to these items are public records” and will be available for review. I hope an NC reader can go and see if the RFP and contract are indeed being made public. If so, it would be very helpful to provide a summary of them for the benefit of the public; we’d be delighted to publish it. And if they aren’t, it would be hard not to surmise that the officials are pulling a fast one.

Update: I misspoke on the valuation of current mortgages in distressed areas, in that valuations of less than par may indeed be defensible, but it does not change the conclusion, that the program’s economics hinge on paying prices that are less than fair market value of the mortgages.

The pricing is driven by “condemning” the mortgage at 85% of current value of the house. They need to get it at a level along those lines to allow a takeout at a “profit” and still meet FHA LTV requirements. But the fair value of the property is not the same thing as the fair value of the borrower in that property. In the examples presented to the media, that results in discounts from the mortgage principal amount of 40% or even higher (the Wall Street Journal example was 60%). A guesstimate from an expert is that would be above appraised value but below par. And this program absolutely will not work if the fair value exceeds the home’s appraised value.

Thanks for taking the time to explain just how perfectly awful this idea is.

for what it’s worth, i saw this last week and dismissed it:

Investors With Ties To Buffett, Soros, Obama Plan Mortgage Eminent Domain Grab – A group of businessmen with ties to Warren Buffett, George Soros, President Obama, and socialist senator Bernie Sanders are pushing a plan to use the government’s power of eminent domain to seize billions of dollars worth of underwater mortgages from banks and bondholders. Word of the plan surfaced earlier this month in a Reuters dispatch that reported the eminent domain strategy but not the political ties of the businessmen involved in the plan nor their links to two of America’s most prominent and outspoken billionaires. The Reuters article said a firm called Mortgage Resolution Partners, chaired by Steven Gluckstern, a former owner of the New York Islanders hockey team, was working with politicians in Nevada, Florida, and California’s San Bernadino County to advance the plan.California, Florida, and Nevada all changed their state laws to make it harder to use eminent domain after the Supreme Court’s 2005 decision in Kelo v. City of New London allowed a Connecticut city to seize a private home for a corporate development plan and ignited a national political storm over government property condemnations via eminent domain. In the case of the mortgages, lawyers may be able to argue that the anti-Kelo laws do not apply because the houses themselves aren’t being condemned, just the mortgages. They may also argue that the mortgage condemnations, by preventing foreclosures, are actually consistent with the anti-Kelo law’s intent of allowing people to remain in their homes.

http://www.futureofcapitalism.com/2012/06/investors-with-ties-to-buffett-soros-obama-plan

bernie sanders is gonna be killing it!

They are going to have one hell of a time condemning property that is outside the boundaries of the municipality. The mortgages and notes are likely in a vault somewhere between Countrywide’s old offices and a sub-basement in lower Manhattan, and eminent domain law requires that the property to be condemned be within the relevant jurisdiction. I don’t think the fact that these instruments establish a lien on real property that happens to be inside the jurisdiction is relevant, because it is not the real property itself that is being condemned.

What’s also funny is the flummoxation that will occur when RMB trustees receive service of process regarding the eminent domain proceeding from the municipality–they’re not really going to know what to do, and then when they realize what is happening they’re going to have to figure out how to defend a face-value-or better valuation in court.

Harris v. Balk, US Supreme Court 1905 – held that situs (location) of debt is location of debtor. So if municipality wants to buy the debt that homeowner owes (to someone) – the debt is right there in the county (unless homeowner is in Cabo vacation home).

Let’s see: Homeowner has a $200,000 first mortgage. Municipality claims it is only worth $135,000, succeeds in court, acquires the mortgage by eminent domain, then persuades homeowner to refinance $150,000 at a lower rate and helps him do it, resulting in a $50,000 principal mod. Who loses here? The bank which consistently refused a principal mod since 2008. Why the outrage over this? Of course the problem is that the banks are merely ‘servicers’ not owners of the mortgages. The owners are securitized investors who have sat with hands folded collecting fictitious principal and amortization payments from the servicers which have been sucking them out of the Fed. Maybe this proposal will energize them? It doesn’t seem as though anything else will.

You’ve missed that these are PERFORMING mortgages. Borrowers paying on time.

Mods, by contrast, are a form of restructuring. Borrower missing payments. Is he worth more to me dead or alive? Do I cut a deal or foreclose?

Yes, it’s a crime that mods aren’t happening at all when borrowers have payment problems. But this scheme has NOTHING TO DO WITH THAT.

Buying out a mortgage that is performing for a large discount is theft, period.

So, its okay to keep screwing the borrowers who are so terrified of default that they keep paying on houses that are under water? I thought the idea of mods was to write down the mortgages to the value of the collateral.

i understand the problem with MRP and how they will make their money in a “fraudlike” manner and the problems with muni bag holders and federal law trumps. i do not understand the stance of yours in relation to the writedown, specifically the chance to properly define “imminent risk of default” in PSAs and it’s relationship to “barely” performing loans.

if you do not understand debt deflation and that todays performing is tomorrows default. your eye is not on the ball. sure in normal times, performing is performing. homeowners are squeezed financially to the point of breaking. no raises, lost income, higher expenses and continued debt service etc. today an underwater loan with abusive servicers, obstructive 2nd lien holders, non functioning govt. entities and sham federal programs all wrapped in a giant fraudulent origination sandwich is one bad customer service call away or from default, much less a medical bill or car repair.

I assure you most of these loans are “imminent default” status. this line needs to be drawn somehow.

I agree with Jake’s sentiments here. If anyone is a victim of theft it is the underwater homeowner. Of course, the investors who bought the loan are probably victims of theft by fraud. In both cases, the bank is the perpetrator.

Steve Keen’s universal bailout would fix everyone from the bottom up and if combined with a ban on further credit creation and metered appropriately could be done with little price inflation risk too. For a 15 year bailout period at an average APR of 3%(?) that would allow every US adult to receive $702/mo initially rising to a final payment of $1120/mo at the end of 15 years.

Yves,

What you don’t get is that the buy side of the investment game is just as fraudulent as the sell side. You have a collection of overeducated dummies sitting on a pile of superfuluous capital owned by others, who have no idea how to achieve a return on it except through usury on the working class. They achieve prudence by relying on transparently phony ratings and don’t even bother to insist upon adherence to the securitization contracts. In reality they own nothing and should be grateful to get anything on account of these mortgage instruments, which have disappeared down the rat hole of phony assignments. You cannot begin to solve our economic mess without a bailout of the 99%. Might as well start here.

You are both incorrect in your assumptions. Jack asserts that these are “barely performing mortgages.” No, the borrowers will NOT be screened for signs of payment stress. In fact, given that the takeout will be a FHA loan, the incentives are to screen for borrowers who have decent credit ratings and where the LTV on the new mortgage is in line with FHA guidelines. The incentives for MRP are to pick borrows who will fly through the FHA approval process. The really deeply underwater borrowers would be screened out.

This is cherry picking and using condemnation to buy mortgages at below market prices, which is contrary to the requirements of eminent domain.

All the “investors” have to do is offer their own principle mods and assist the owners in refinancing. Instead, they choose to stand on their rights, which makes them fair game for eminent domain. I see no reason to cry for them. Let the courts decide what the fair market value is.

“This is cherry picking and using condemnation to buy mortgages at below market prices, which is contrary to the requirements of eminent domain.”… YS.

Um… GWB baseball stadium deal.

How George W. Bush made his millions

By Joseph Kay

1 August 2002

Much has been written over the past month about President George W. Bush’s actions while at Harken Energy. This is, indeed, a significant history: in the early 1990s Bush made hundreds of thousands of dollars in a deal that reeks of the same insider trading and accounting fraud the president now claims to oppose. (See “On eve of Wall Street speech: Bush’s past business dealings come back to haunt him,” 9 July, 2002).

However, the media has paid far less attention to what Bush did with the $850,000 he made through the sale of Harken stock options and the manner in which he transformed that windfall into the $15 million that now constitutes the larger part of his personal fortune. If anything, this story is even more revealing.

If the Harken deal was a smaller scale version of the accounting scandals at WorldCom, Enron and other firms, Bush’s purchase and sale of the Texas Rangers baseball team reveals other characteristic features of the past several decades of American capitalism: the plundering of public assets for private gain, the confluence of political and economic power, the defrauding of the American people.

By the time he cashed out in 1998, Bush’s return on his original $600,000 investment in the Rangers was 2,400 percent. Where did all of this money come from and what did Bush do to get it? Much of the story was first reported nationally by Joe Conason in a February, 2000 article for Harpers Magazine. A report from the public interest group, Center for Public Integrity, and recent columns on July 16 in the New York Times by Paul Krugman and Nicholas Kristof have filled in some of the details. – Snip

———-

There is a history for this kind of deal, albeit a variation.

See:

According to documents obtained by the Center for Public Integrity, the Rangers owners would locate a piece of land they wanted, offer a price far below the market value, and if the owners of the land parcel refused, bring in the ASFDA to condemn the land.

http://www.wsws.org/articles/2002/aug2002/bush-a01.shtml

Skippy… Now if the ASFDA had that kind of power, what kind of agency could this mob – create – for said propose…. sigh.

MRP: “No more than 4 loans would be condemned out of any one trust.” The investors in the original MBS are being undermined selectively and relelntlessly. It would all be so much easier if the original securitizers just admited they screwed up; they don’t have the paperwork; etc. If a municipality can force eminent domain on an untitled mortgage contract (because the note was never securitized) why can’t the Federal Gov do something similar by invoking the UCC? And do it democratically and universally for everyone with a sleazy mortgage. It won’t solve any of the housing problems to just do this nonsense. And further, the problem does not rest in the properties which are mortgaged, but with the improper handling of the note. States control land law. The Federal Government has jurisdiction on interstate commerce, etc. Note to Leonova: here is a sample of begging the question.

Thanks again, Yves. Without your putting it all together we would never see the loopholes. I think NC should take bets on what crap they will pull next. It would be fun.

Because doing anything “democratically and universally” is bad. It gives people ideas.

It seems too me, a vast majority of housing price was based on fraud from circa 200?, theft leads to more theft?

Skippy… Its like digging down to find out whom was the first kiddy fiddler. Was it the priest or the gawdking creating the first priest. At least we know the high priests banished the gawdking to the delta, but, in the end he became both gawdking and high priest, that sorted out that mess… for a bit.

What a total scam. So much for counting on government to help regular folks. I could envision a foreclosure leaseback trust of non performing loans where municipality puts in equity in the form of say the property taxes, rented to the residents at market rental rates–such that cost of occupancy is lower than mortgage and taxes until such a time a new mortgage can be obtained or if there is appreciation split it with residents and municipality etc. But this is a total grab. Ughh.

Governments can’t help whom they can’t afford to help. This is direct fallout from the policy of letting local governments go broke. Cain and the mess of pottage, etc. If they’re hurting enough, maybe they’ll sell their eminent domain for pennies on the dollar.

Seems authorities are really bad at consequences; try to impose objective, market-oriented reinforcement and get this. Banksters kill the economy so give them more money; the Gambler’s Fallacy says they’re not due to kill the economy again for another ‘x’ years. Municipalities sometimes misuse their money, so take money away, guaranteeing that whatever they did in the past, they’ll do even worse in the future.

Classic death-spiral there.

From a Reuters article in June:

“Meanwhile, Mortgage Resolution Partners got caught up in a controversy earlier this year after Reuters reported that Phil Angelides, the former chairman of a Financial Crisis Inquiry Commission, was the executive chairman of Mortgage Resolution Partners. Angelides left the firm soon after, when some on Capitol Hill began raising questions about potential political influence by Mortgage Resolution Partners.”

Nah, this don’t stink too much.

Ugh! Quelle surprise.

Wonderful. So Angelides used his investigation to find the best way to profit off the mortgage mess and ran with it. If this eminent domain idea’s the best he could do he’s a pretty sorry scammer. One honest man in DC? Good luck widdat.

San Berdo has filed BK per the LA Times

This is disgusting. I expect it to become widespread before being belatedly condemned and prohibited. Thanks for explaining yet another way the hedges that used to protect working people are being gamed/stolen.

What hedges that used to protect working people? Are they long mortgage CDO’s ?

If we could lessen the debt load on true working people, who have been making their payments but could use a break, while screwing for once someone like CDO investors — sounds good to me.

Sure it may be illegal, but why should illegal bad stuff only happen to the small people? For once they should get a happy surprise at someone else’s expense.

And so the Fraudocracy proliferates.

Leave it to the schemers and conivers to come up with something that involves local government money, eminent domain and the phrase that pays “blight”.

In our town they have already spent themselves into insolvency by giving money

to developers in the TIF district to rid us of “blight”. Now the developers have taken their money and left us with the same downtown we had when this process started, vacant store fronts and low sales tax figures.

Can you imagine what would happen if they started this in single family areas?

Concur with the universal disgust here.

I also wonder how many municipalities actually have people on staff who could handle these transactions? It seems like a precise level of expertise in property law and real estate, coupled with sophisticated finance knowledge, and cities are already laying people off…so the overburdened remainders are going to be handed yet another, rather complicated, fraught-with-peril task? Sounds like Shock Doctrine to me.

San Bernardino, CA, just filed for bankruptcy ….. bring it on ……

As with many things, there is a nugget of goodness here inside the layers of muck, and that nugget is the concept of using eminent domain to give distressed/underwater owners a shot at the cram-down that was otherwise removed from the menu in the 2005 reforms to the Federal Bankruptcy Code.

Imagine that a non-profit social benefit corporation was set up to use this nugget–instead of fees of 5.5%, say it took fees of 1% (i.e. enough to cover its costs in the aggregate and not much more) and instead of targeting cherries that could essentially be flipped at a profit to the GSEs, it targeted defaulted mortgages and tendered a discount to par on those based on reasonable, defensible write-downs (i.e. based on old-fashioned conservative underwriting–loan-to-value and owner ability to pay).

Our non-profit corp would then own a (for example) $500,000 face-value mortgage that it bought for $300,000, and it could then write down and reamortize the loan to what it paid for it (the $300k in my example). It could then sell the loan, or hold it to maturity, or even (heaven forfend) securitize it. If the underwriting is solid, this would self-perpetuate after being seeded with capital to get the first round going.

The interesting thing about this is that the securitization trustees would be facing the difficult choice of whether to accept the discounted offer or to litigate it, neither one being attractive due to the inevitable sunshine this would provide in the mark-to-fantasy realm of RMBS–in any event I think it would be fun to litigate against a securitization trustee over “just compensation” for underwater defaulted mortgages.

As an aside, what if an enterprising authority with condemnation powers were to condemn second mortgages where the first mortgage is defaulted or distressed, and tender compensation at or near $0? It would be extra fun to see how second-lien holders come up with theories about how their holdings are worth anything, since, in a rule of law environment, they should be worth nothing, and I still hold on to the quaint belief that there is still a thin residue of rule of law here and there.

Here in California, Jerry Brown just cashiered the Redevelopment Agencies that had served as a funnel for public largess into the accounts of deep pocketed real estate affiliated political contributors. Unfortunately that graft obscured the beneficial aspects of Redevelopment, those that naturally were barely used, such as the ability of the municipality via redevelopment to go into business.

I’d imagine that the notion of eminent domain on mortgages, suitably divorced from the scam cartel outlined here, would be a viable option for municipalities to venture into if they are large enough to have sufficient staff and cash flow as well as a small enough number of underwater mortgages, to manage the details.

A technicality, but the entity that just filed for bankruptcy is the City of San Bernardino. The entity considering the proposal from MRP is a joint powers authority of the County of San Bernardino and the Cities of Fontana and Ontario. So the bankruptcy filing has nothing to do with the MRP plan at this time.

That said, this is a pretty compelling case that the county should think twice about this plan. It seems like a “heads MRP wins, tails the county loses” situation. Thanks for the analysis Yves; I’ve been wondering about this plan since the Shiller op-ed.

Dear Friends

I am a teacher of Faculty of Economics in the University of Coimbra, but in the situation of retirement. As free time in a country that now is no longer a free country, if can say it, once given the draconian austerity policies, I occupy most of my time to provide texts for students, who no longer teaching, but with the permission give by our University. I can make it , once the University gives me the right to do so via the Internet, I spent also my time to provide texts to blogs and also to newspapers, texts that I write myself and or texts that are write by others authors but that I particularly like a lot.

Example from today, the weekly newspaper O Expresso , the best and most important Portuguese weekly will publish monday on its version on-line a text that my friend Mario Nuti just published in Italy, The Monti-Merkel Double Act, which I translate freely, another times I try published in local newspapers other texts, as for example the Initiative for a Protectionism in Europe or the articles from Roosevelt Circle of Paris. Another example I have just published in our blog a text send directly to my by François Morin that I consider my friend from long time ago.

In this case I was very interested in publishing several texts published in your blog in Portuguese language that much liked and so I come to ask you your permission for its disclosure of personal translation in Portuguese for my students, for my blog also or for local papers also..

Our best regards, friendly

Júlio Marques Mota

After reading your review of the plan MRP it is rather curious that you quote Wall Street as a main credible source. Further you question the motives of the homeowners who have been cheated and defrauded as though they still are trying to get away with something. As noted “aside, I wonder how many of these people who defaulted because servicers told them they needed to be delinquent to qualify for HAMP”. Right, banks have financial done to the Western world what communism couldn’t do in 50 years but people defrauded of a future are so coniving they present themselves as delinquent just to qualify after spending half a decade pleading for honesty and morally fair hearing to present their case to so called higher ups that can actually get rid of MER and begin to behave as though they actually were accountable under long established law.

Interesting, Matt Taibbi likes the plan, so does Bernie Sanders.

– I don’t like the people involved, too many Wall Street hacks (even if Soros isn’t involved).

– It doesn’t solve the real problem — an economy that monetizes waste that is bankrupt because it has worked too well for too long. Face it, the country is bankrupt.

– It is more banking fraud: loans that the banks now hold (in the form of securities) that are currently marked to fantasy: these will be ‘seized’ by eminent domain at a decreased price that satisfies the new entity. In other words, the proposal is to put markup losses on the investors that currently hold mortgage-backed paper.

– There would have to a multi-hundred-billion dollar bailout equal to the losses the banks would take on these loans. No bailout and the holders would fight to the bitter end (as SIFMA has already fired the first shot).

– The assumption is that real estate prices are at the bottom and that this program would have no effect on prices. Enough eminent domain mortgage writedowns to have an effect on an economy … would have a NEGATIE effect on that economy, setting up a positive feedback loop whereby the ‘new’ lower prices would push more homeowners underwater leading to more defective loans. The suggested process is self-amplifying or non-working.

– The local jurisdictions would be (temporarily) on the hook if they aren’t nimble (or able to hedge themselves somehow: don’t tell me Goldman-Sach isn’t behind this somewhere). What if something goes wrong (another collapse in real estate prices)? Communities would be stuck with billion$ in losses.

Fools look for painless, easy solutions to a structural problem that is world-wide. The solutions include a physical restructing of the country away from automobiles and fuel waste. The waste is where the bankruptcy lies.

This plan is not much different from LTRO offering ‘cheaper’ structured loans to entities that were bankrupt.

“One of the requirements of eminent domain is that the property owner be paid fair market value. For a performing mortgage, it’s awfully hard to argue that that is less than 100 cents on the dollar (in fact, as Felix Salmon points out, it’s actually more these days since interest rates have fallen).”

It’s not hard to argue it at all.

To the extent that the original mortgage amount was based on comps, rather than replacement value or rental cash flow, it was a fraud in the first place.

Even performing mortgages have specific, definable harm.

The anger that “people who followed all the rules and get no bailout” live with is a significant symptom of this.