By Paul Amery. Cross posted from Index Universe

The US equity market’s main risk measure is back down to the levels we saw in 2007. But declines in volatility mask substantially different behaviour from stocks than pre-crisis.

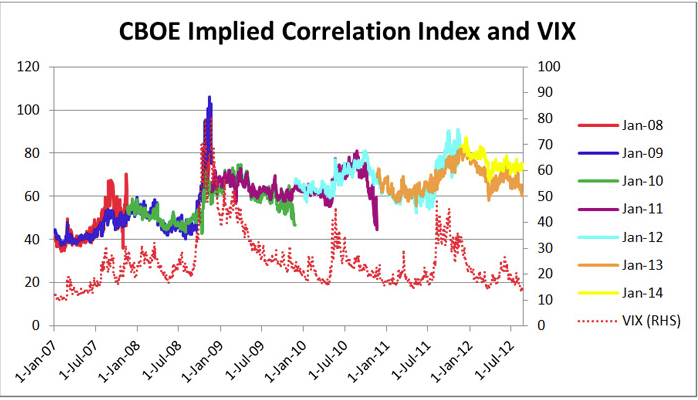

The Chicago Board Options Exchange’s VIX index, commonly known as the “fear gauge”, has fallen below 15 in recent days. These are levels the index last saw in 2007, before the credit crisis erupted. VIX is shown in the above chart as the dotted red line, measured against the right-hand axis.

But another benchmark calculated by the CBOE, the implied correlation index (which, like VIX, is based on the S&P 500 index’s constituent stocks) is nowhere near 2007 levels. In fact the average internal index correlation has been on a steadily rising trend.

Rising volatility and rising correlations at the same time shouldn’t surprise us. It’s commonly accepted that when markets take a plunge, as in 2007/08, stocks move increasingly in lockstep.

You can see this in the behaviour of both VIX and the implied correlation index in late 2008, when Lehman collapsed. As VIX spiked to over 80 in November that year, the nearest-dated correlation index (January 2009) rose to over 100.

But declines in the VIX to below 20 in 2010 and 2011 and, now, to below 15, haven’t been accompanied by a fall in internal index correlation to anything near 2007 levels. In fact the implied correlation of the S&P 500’s constituent stocks is almost twice as high now as five years ago.

Two factors may be at play here. First, increased investor interest in index-based derivative products like futures and ETFs may well be causing stocks in a widely followed index like the S&P 500 to behave in a more synchronous fashion (not everyone agrees, but I think this argument makes sense).

This may be another example, in other words, of a growing “index effect” on equity market behaviour (chronicled by Jeffrey Wurgler in a recent issue of the Journal of Indexes Europe). Wurgler notes increasing valuation distortions in large-cap equity benchmarks like the S&P 500 and suggests that the increasing use of indexed portfolios is the prime cause for such anomalies.

But another type of exchange-traded product may also have played a role in pushing up index correlations.

VIX-based volatility ETPs have attracted a lot of interest in recent years. Purchasers of VIX trackers are effectively buying index put options.

Since the CBOE’s implied correlation index is calculated as the difference between the implied volatility of index options and the implied volatilities of options on the index’s component stocks, it’s possible that a rising correlation index could simply indicate that market participants have been overpaying for index options. And VIX-based ETPs may be behind this steady, valuation-indifferent “bid”.

One hedge fund, Och-Ziff, was reported last year as having taken the opposite side of the trade to VIX ETPs, placing a US$12 billion bet on US stock correlations having peaked. Och-Ziff wouldn’t be the only player in the market to have taken the view that purchasers of VIX trackers are effectively burning their money.

We’ve also written in the past that investors should avoid volatility trackers, at least the naive ones that incur huge roll costs. The increasing divergence between the value of index options and options on the index’s components is even greater reason to shun trackers like VXX, VXZ and their European equivalents.

But even if most VIX-based ETPs aren’t worth investing in, VIX has always been widely interpreted as a useful aid to market timing. Now, however, it seems that the volatility index by itself may be an insufficient gauge of the share market’s health, and we should all be paying much more attention to internal index correlations.

Unrelated h/t (not sure how to h/t here) – someone will shred this bit of Thomas Frank propaganda here, yes? Thom Feguson, Paul Street, Matt Stoller or Adolph Reed (all of whom could shred it in their sleep)?

http://www.salon.com/2012/08/22/thomas_frank_obamas_squandered_hope/

Just take the first question – Obama’s not “cracking down on labor unions” the EPA’s not hostile to the mission anymore…

Resulting, inevitably in, Obama will be more progressive next time around, he learned his lesson over the debt ceiling debate.

I <3 Paul Street.

Yes please – a shredding of the Frank piece would be most welcome.

Option buyers lose over 90% of the time. Selling to the fearful (or the greedy) is an excellent strategy, until one gets carried away (gee, last month I made $5000, this month I can make $10,000). It is best to sell puts on quality stocks, because if you are wrong you can at least own the stocks at a reduced price. The hard part is knowing when to reduce positions. I have been trying to master this for thirty years. Results mixed.

yeah I got nicked in UVXY last week. got in at 5.25 with a 5 stop. it went up over the 5.6s then shot down to 5.0 and took me out. as soon as they had my money, it went right back up.

that’s what always happens. it’s like they know i’m there.

UVXY is gonna fly, but that contango has been fierce.

I hate losing even a penny, which makes it hard to get rich quick.

“Option buyers lose over 90% of the time.”

This is complete nonsense with no data to support it that for some reason gets repeated over and over. If it was true, the many equity “option income” mutual funds, who are sellers of options would have great track records instead of generally lousy ones. And particularly with options it’s not just a matter of what percentage of the time you win or lose, it’s how big the individual wins and losses are.

what would you recommend for somebody who wants a 5 or 10 bagger with very little risk of loss, and if anything is lost, it has to be under, say, $10,000?

And the 5 or 10 bagger has to deliver, say, at least $500,000 in profits.

In about a month or two.

I can’t wait any longer. Paris calls. The city, not Paris Hilton. I doubt I’d be her type.

My own plan is do a 40 day water-only fast, become a genius and invent something. And if I don’t invent anything then at least I’ll be a genius and if I don’t become a genius then at least I’ll be thin and healthy. And if per tiny chance it kills me then “Good-by cruel world!”

that’s a better plan than mine Beard! today it’s up again, to over 5.5! this hurts me so much.

But I will confess, if I ever got that bailout you keep talking about, since I don’t have any debt, every penny would go right into UVXY. haha.

I could lie and say I’d do something useful with it, but I know how I think.

Data? We don’ need no stinkin’ data. You keep buying, I’ll keep selling.

Selling puts (on quality stocks) is a ‘good’ idea in secular bull market (either goosed or otherwise) But the biggest problem with options is ‘TIMING and the time frame for your plans to work out’ There is time decay and $ decay during the run towards exp date!

Besides cash covered put will freeze proportinally your cash/margin in your cash/taxable acct. I have sold puts but the risk is unlimited unless they are hedged. It is NOT suited for most with faint hearts!

One has to be right about timing, trend and the cost of the premium to buy or sell. If you can determine the TREND, both short, intermediate and long term, rest is relatively easy! This is how I preserved my 99% of portfolio during 2008!

After wards, free market ceased to function and trend depended what Ben said, whispered and what NOT! Stats coming out are unreliable. HFT and dark pools will make your trades go awry any time!

Been there and done that.

Just to put this in perspective, the record closing low in VIX (which began in 1986) was 9.04 on 23 Dec 1993.

Much like today, many observers in 1993 found this VIX level absurdly low, coming just over five years after the October 1987 crash when VIX had spiked to 172 intraday.

But volatility is an erratically behaved time series which periodically goes to extreme values.

Given that the historical volatility of the S&P 500 since 1926 has averaged around 19 percent, a VIX level of 15.00 after a 3-1/2 year rally is nothing unusual or surprising.

Besides the rising use of ETFs, the shift to decimal share pricing in 2001 lowered the cost of stock pairs arbitrage, which probably drives higher correlations among individual issues.

Given the mean-reversion in markets, oddly enough, the rock-bottom VIX has not historically led to lower equity prices (after the jump). Perhaps this is due to the upward trend in stocks over time (ignoring the last couple of decades of course).

J.S.

http://www.adsanalytics.com/report.php?report=s-ed

I’m not ashamed to admit that I found this post pretty much incomprehensible. I wonder if it’s too late to get a refund from graduate school.

I agree completely.

However, “Och-Ziff” caught my eye and, after some memory-refreshing googling, confirmed that Och Ziff is the hedge fund that, in sum and substance, bankrolled Mugabe’s stealing of Democratic elections in Zimbabwe in 2008. It’s all tied in with control of platinum, mineral and other ore rights, of course, since the Big Frame is Control and Stripping of Assets.

So, though I understood less than .01% of the main article or the point it is trying to make, it was good to have a reminder about who the “players” in these obscure and awfully clever hedge fund doings really are. Och Ziff = Mugabe’s BFF. All I need to remember about Och Ziff at this point.