By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

Probably best if you spike your morning coffee before reading any further.

Another night of Flash PMI data from the Eurozone, and as expected it isn’t getting any better over there. This from Chris Williamson, Chief Economist at Markit Economics.

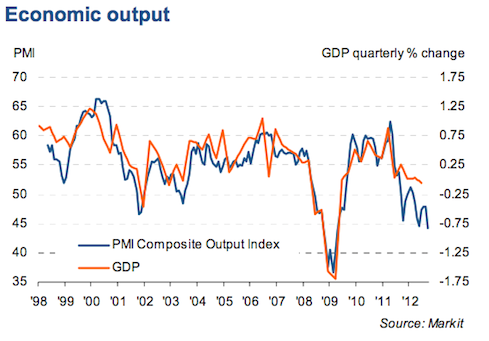

The Eurozone downturn gathered further momentum in September, suggesting that the region suffered the worst quarter for three years. The flash PMI is consistent with GDP contracting by 0.6% in the third quarter and sending the region back into a technical recession.

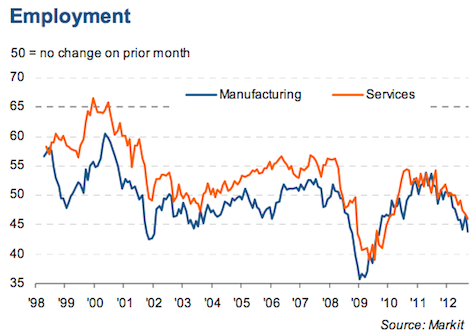

”We had hoped that the news regarding the ECB’s intervention to alleviate the debt crisis would have lifted business confidence, but instead sentiment appears to have taken a turn for the worse, with businesses the most gloomy since early-2009 due to ongoing headwinds from slower global growth. This gloom is clearly reflected in headcounts falling at the fastest rate since January 2010 as companies seek to adjust to weaker demand.

“At the same time, input costs have risen markedly, linked largely to higher oil prices. Weak demand has meant companies have been unable to pass these costs on to customers, meaning output prices fell again in September. The combination of higher costs and lower selling prices will inevitably hit profit margins.

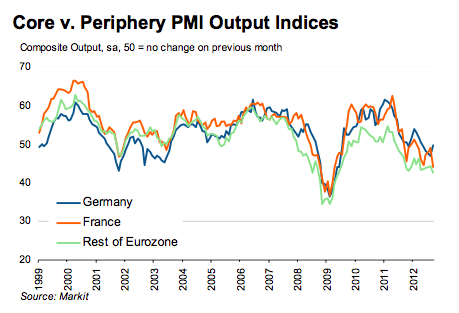

“Some good news came from an easing in the rate of contraction in Germany, though the rate of decline accelerated markedly in France and a deepening downturn was also evident in the periphery. It remains too early to say, however, whether Germany will continue to buck the trend, especially as it continued to see a strong rate of loss of new orders in both manufacturing and services.”

So Germany and France have swapped positions from August, but the summary statement about Germany doesn’t give me much optimism that this is going to be a sustained reversal.

Germany managed to shake off the summertime blues in September, with renewed services growth helping to stabilise private sector output as a whole. Manufacturing also made a contribution to the slightly less gloomy picture, albeit simply by achieving a slower contraction of production compared to August.

However, the halt to the private sector downturn seems to have a fragile veneer, given the reliance on pipeline projects over new business to stabilise output. A lack of incoming new work, combined with a sharp drop in year-ahead expectations for activity, meant that service providers cut back on staffing levels at the most marked pace since May 2009.

That sounds to me like the lead up towards Christmas will probably disappoint as the orders for new work, although better than in August, still appear weak.

I talked about France early last week and warned again that the nation’s current economic structure means that it is unlikely to fare well under a regime of higher taxation. I doubt whether the newly proposed tax increases where to blame for the renewed downturn, but I do expect France to become yet another counterpoint to Ricardian equivalence over the next few months, if it isn’t already. You can see from the charts below that the downtrend is solid and the contraction is accelerating, and can I again remind you that France is the 5th largest economy in the world.

French economic output Index

French Employment Index

The story in the rest of Europe looks no better with the index reading an even faster contraction than France. These are readings we haven’t seen since the height of the GFC.

All up its another depressing picture from the Eurozone and once again highlights the incompatibility of current policy with economic growth. As I said back in December 2011.

So while there is no credible counter-balance for the effects of supra-European austerity any attempt to implement the new “fiscal compact” will make Europe’s economic issues worse. The continent is already on the way to recession and unless we see some additional action from the ECB, or a huge swing against this new framework, the push to implement the outcomes of the summit will simply accelerate that outcome. My assumption is that, if Europe does ratify this framework (there are a few stragglers), after 12-24 months of trying the effect will be so disastrous that they will eventually give up. But until then my base case for Europe is a significantly worse economic outcome.

Obviously my base case remains unchanged. Full reports below.

Germany: Markit Flash Germany PMI

One of house price indices indicated an 8% Y/Y fall in August in the Netherlands. The index has only existed since 1995, but this is the worst fall on record.

In Spain the home price index from TINSA (ÍMIE) indicates a 13,5% Y/Y fall in house prices for large cities. The cummulative fall since the peak reached in 2007 is -35,6%. The fall we are witnessing in 2012 is the worst on record.

One of the house price indices indicated an 8% Y/Y fall in August in the Netherlands. The index has only existed since 1995, but this is the worst fall on record.

Imagine everyone sitting on the porch “waiting for Godot”,’till someone gets an idea; “Let’s get busy!”

a good perspective, which I share and that needs more airing.

Yes wouldn’t it be nice if some confidence returned. Maybe people are smarter than you give them credit for however. People are learning that the last 30 years of “growth” was just a debt orgy pulling in demand from the future. And they’re learning that “assets” may not be assets at all if they’ve been endlessly re-hypothecated, or if the legal system allows theft of those assets without punishment. And they’re learning that inflation is much higher than any official measures. And unemployment. They’re learning that bankers and crony capitalists have a stranglehold on politics and monetary policy. They’re learning that our wars are fought purely for money, not for ideals or self-defense.

So yes, some confidence that it’s not all just a giant “confidence game” with them as the perennial suckers would be just what the doctor ordered…

Rarely are Europe’s current travails analytically linked to the size of the bubble that preceded them.

In the 1990s, hedge funds made billions on the convergence trade, as peripheral bond yields tumbled to only a small premium above German bunds.

Subsequently, the potent combination of lower yields and increased external purchasing power conferred by the euro fueled a consumption boom by both the governmental and private sectors in the peripheral countries.

Moreover, low yields and E-Z finance propelled Spain’s share of residential construction to nearly half of the entire euro zone, even as remote Irish cottages sold for half a million euros.

Central bankers never learn that the depth of an economic hangover is directly proportional to the magnitude of the preceding bubble.

Already they have created a fresh bubble in sovereign bonds, pushing their nominal yields to negative numbers in the capital refuge countries. In the periphery, they have arm-twisted banks into loading up on shaky sovereigns which also present enormous interest rate risk, even from today’s elevated yield levels.

Central bankers are like little boys who, bored with their toy trucks, finally decide to smash them all in a grand destruction derby, and then set the lot on fire.

Fun, fun, fun, till mommy takes the matches away!

I suspect you can imagine the dollar bubble that is being blown as we type our textual white noise………..

I wonder who will be able to afford to buy any of the products that will be in the marketplace after this is all over? Driving the populations in the west back to surfdom, do the idiots believe that they will still have markets?

French main weakness lies in a lack of spending by UK tourists post Sterling devaluation ,with PIig countries such as Ireland & Spain going back to basics after their collapse……..

No amount of new Fixed capital investments such as its wildly successful tram programme can stop this , but they simply need to keep going with what works.

fr.wikipedia.org/wiki/Ligne_1_du_tramway_de_Nice

This will focus commmercial activity into tight areas keeping up critical mass and transfering oil to where it can do some useful work rather then car consumption.

The Aquataine regions TER local rail programme is showing some increase in use……its focus orbits Agricultutral / tourist market towns such as Agen with the local train station showing big increases in passengers.

http://www.youtube.com/watch?v=52dJdA3IaGY

Dear D.C.;

Isn’t public transport a function of population density, and fuel price a distant second? Anyone have good figures for this? Just curious.

Friends;

This is the model that our conservative parties here in the U.S. are promoting!? What alternate universe do they live in? It isn’t the reality we inhabit, that’s certain.

America is best likened to a comatose patient who is going to need some economic shock therapy to wake them up. The Progressive task, (why not just drop all this namesmanship and call it the Sanity Movement,) will be to be ready to pick up the pieces after the dust settles.

Given the importance of China in the world economy, I’d say we were in for some very Interesting Times.

Google

PDF]

Année économique et sociale 2011 – Insee

With RER regional traffic up 8.4 % in 2011

The Agen to Bordeaux route exceeding 100 million passenger KM for the first time.

It goes to show what can be done at a local regional level with enthusiastic local pro rail leadership.

fr.wikipedia.org/wiki/Alain_Rousset

http://www.youtube.com/watch?v=kaYroVkhwuE

@Ambrit

Yes of course – but French settlement patterns despite credit pressures causing Anglo like sprawl in some areas is much more suited to local rail systems – with the local Gare now perhaps the Bus station but the old rail lines remain uncut(good French planning) ……they just need to relayed.

And we are talking about 10s of thousands of KMs of Uncut railways in France !!!!!

Such as the rail line from Auch to Agen (see above) which is now a little used freight line.

However what is little realised is that most of its local rail lines were closed during 3 phases ,immediately before the war as Bus and car transport became popular , post war and the late 1970s as SNCF redirected most of its capital programme to the high speed lines.

Indeed the present rail density is much less then the UK !!!!!

“Isn’t public transport a function of population density, and fuel price a distant second?”

Whats just as important as the above is the correct monetary envoirment……people must have enough tokens in their pockets.

The Sterling devaluation introduced more tokens into the UK without driving up imports for oil much…….The UK now has all time record rail passenger numbers.

Much larger passenger numbers then even back during the Suez crisis , WW II and the Great war on a now much smaller network !!

As countries renationalise their monetary systems rail will be the focus for growth and not much else….

Dear D.C.;

Thanks for that. I hadn’t considered that aspect of the system. Transport is one of those areas where technocrats have a legitimate place. Yes, incentives are powerful drivers. Just witness the deconstruction of Americas Tram Lines by big Oil, Auto, and Rubber after the War.

France is playing a smart game……if it goes back to the Franc it will not have the capital to build its high speed lines

See the Tours to Bordeaux LGV which is costing 7.8 Billion Euros !!!

http://www.eib.org/attachments/press/lgv-sud-europe-atlantique-en.pdf

This is a corrupt PPP programme which is keeping the fiscal stuff off the books but is sucking in real physical capital from the rest of Europe

These are very capital intensive (they require huge amounts of Diesel) but labour light programmes suitable for the anti -labour Euro monetary envoirment.

So France is sucking Greece and the rest of the PIigs dry of capital while it can although it will perhaps have to save Spain & Italy in some fashion.

http://www.youtube.com/watch?v=ovteJek_mRQ

If she goes back to the Franc it can rebuilt rural lines such as this…..which feeds into Le Havre as the ratio of Labour to capital costs is higher on these 19th century rail cuttings

fr.wikipedia.org/wiki/Ligne_du_Havre-Graville_à_Tourville-les-Ifs

Meanwhile they are working through the night to get the Le Havre tramway up and running.

http://www.youtube.com/watch?v=VJUdICZidxQ

It will probally be ahead of schedule (late 2012 ,early 2013) much like the recent Dijon tram system

With a decades-running, hyperinflationary, imperialist policy’s induced shutdown of the trans-Atlantic’s physical economy far beyond any point where further asset-stripping can be organized to sustain a mountain of illegitimate financial claims amassed during the wink-and-a-smile, hope-filled-promise, former phase of the globalization swindle, it is rather plain to see the present phase aggressively ushering in the imperial swindle’s consolidation of both physical and financial capacities under the banner claiming the now dead, former order–this rationalized with more monetarist sophistry than you can shake a stick at–was something other than predestined to result in the present end wherein massive theft, as well as subjugation of sovereign resistance, all along was the sought-after outcome, this without even firing a shot. Thus, ended is time for pretending acquiescence among assorted political accomplices to the still-proceeding imperial swindle can possibly right the sinking ship. Therein, too, lies the object upon which one should focus to ascertain the swindle’s present state: rather than in anything within the certain-to-collapse physical/financial economic realm, the political domain whose many cherished institutions built up over many generations and presently on the chopping block is where the imperial swindle’s doom sooner or later will be sealed. It’s the political realm, rather than the economic, where one’s attention principally should be turned now, as the current crop of sold-out failures are certain to be buried with the system whose fostering the likes not only facilitated, but continue abiding despite the fact it has become obvious to millions upon millions of swindle victims that this still-defended imperial system was predestined to bring ruin to all.

That Germany is beginning to show signs of trouble is something that shouldn’t be ignored. Let us not forget that Germany has been the big winner from the adoption of the euro (no inter-currency re-valuations) and its boom over recent years has been on the backs of German workers.

German wages have steadily risen less than the German inflation rate for a decade, and when productivity rates are factored in (as calculated by the International Labour Organisation), German wages have declined compared to those of other eurozone countries. http://wp.me/p2cpPS-t. That means Germany is becoming more dependent on exports.

But as manufacturing in the Southern rim is run out of business and unemployment rises and wages decline, those export markets are going to decline. German workers can’t make up the difference because their wages are in decline. Eventually, the German “victory” begins to look a bit pyrrhic. And eventually we come to this question, applicable everywhere: Who is going to buy all the products if people don’t have the money to buy it?

And will no one ask why it is necessary to buy all that crap in the first place? Growth isn’t good. More population isn’t good. More energy use isn’t good. So why keep asserting economic positions based on false axioms, folks?

Thanks for that comment.

I keep asserting the same about our definition of work as contribution to society and how deluded that is in relation to the global inherited rich and their ongoing accumulated ownership and control of everything, everywhere.

It is time to question the fundamental paradigms folks!

I have to wonder how much big employment cuts in the services sector combined with the influx of money from the capital runs in the periphery fueled the one bright spot in the German report. I would point out that the employment cuts in services are a form of cannibalization of the sector. In other words, this is not healthy, does not represent real growth, and is not sustainable.

Oh, oh back in moderation. I suppose one cannot use the word ph*oney with impunity.

Here’s a very interesting take on things from the point of view of central bankers’ balance sheet operations:

http://www.youtube.com/watch?v=XgYCAJbT_XI

Re France, I never had any faith in Hollande. Raising taxes on the rich to 70% seemed more like a political stunt. Ultimately, France is just as restricted as everyone else inside the euro.

Europe and its individual countries are kleptocracies. We must never forget that. The euro is being run by the elites for the benefit of themselves and the rich, not the European 99%s. In each country, it is the same story. It might give Romney a heart attack but wealth and a lot of it needs to be redistributed/taxed away from the rich and spent/injected into the 99%.

Marginal rates on the rich need to be 90% or higher and there needs to be a 10% wealth tax on the assets of the rich until these are brought back into line with what the country and the 99% can afford. Changing citizenship to avoid taxation should be banned and taken as prima facie evidence of conspiracy to commit tax fraud.

As Systemic Disorder points out, Germany has been the big winner in the euro stakes, but German workers have not. So where, or more precisely to whom, did this wealth go? Or even in the latest report. The German service sector grew but service sector jobs were cut. Again workers did not benefit. So who did?

The reason that I keep pushing the kleptocratic perspective is that it provides a coherent picture (looting) of what is going on. Other perspectives, especially that the world’s economies are structurally sound but just going through bad patches of varying severity, invariably result in chaos and contradiction. Nor can they explain why the 1%s, despite everything, somehow continue to make out like bandits.

It’s not just you, jake. I have a comment in moderation as well.

I went slumming over to CNBC this morning and there were a couple of editorials on Germany and China and eurobonds. China has agreed to help by buying a few eurobonds and implies it is satisfied with the conditions imposed on the GIPSIS. This was at least one of the deals Angela did with China: Germany will buy Chinese bonds. Huh? Does this mean that Germany will receive some small return while China is freed up to buy up a few club med bonds? So it is just a laundering scheme of deutscheuros? Sounds right. And Germany and China have signed big trade deals, etc. Then there was a blurb that Germany had a conference and proposed various ideas to get the periphery moving again and one of them was that Spain should use all the real estate from the bubble to jump start a medical services industry to provide medical tourism at good value. Sounds smart since Spain also gets plenty of sunshine and so plenty of vitamin D.

China is an important export market for Germany’s producer goods. The two countries are very important for one another. But as investment slows in China, that will be another potential softening for German exports.