In an perverse case of synchronicity, one headline last night touted regulatory efforts to address systemic risk as another highlighted bank efforts to increase it. And the ongoing efforts of banks to expand risk creation is no accident. As Andrew Haldane of the Bank of England has pointed out, the payoffs to bank employees are like an option: they have capped downside (annual paydays and no clawbacks) and considerable upside. The way to increase the value of an option is to increase volatility. And the financial services industry has and continues to be in the position of generating endogenous risk via leverage, complexity, and opacity.

One part of the telling juxtaposition was a Reuters article on how the Fed and the Office of the Comptroller of the Currency directed major banks to develop “recovery plans” to stave off collapse:

They told banks to consider drastic efforts to prevent failure in times of distress, including selling off businesses, finding other funding sources if regular borrowing markets shut them out, and reducing risk. The plans must be feasible to execute within three to six months, and banks were to “make no assumption of extraordinary support from the public sector,” according to the documents.

Frankly, this reads like a regulatory CYA exercise. Unless one bank suffers a major self inflicted wound, major financial players tend to run off the cliff tout ensemble. That means that there won’t be much of a market for business units, except at very crappy prices that won’t raise enough capital (most if not all of the logical buyers will by trying to shed risk and maybe businesses, and PE funds were battening down the hatches during the crisis as well, since acquisition finance dried up). Similarly, alternate funding sources are also scarce. Sovereign wealth funds were virtually the only game in town and they got leery after their early-in-the-crisis investments in bank paper promptly lost value. And “shedding risk” means “dumping dreck on complacent counterparties and clients.” The banks did a great job of that last time around and it still was not enough to save their hides. Moreover, even three months is far too leisurely a timetable. MF Global went down in mere days.

More obviously troubling was a Bloomberg story on how major financial firms are going to undermine the effectiveness of clearinghouses by engaging in “collateral transformation”:

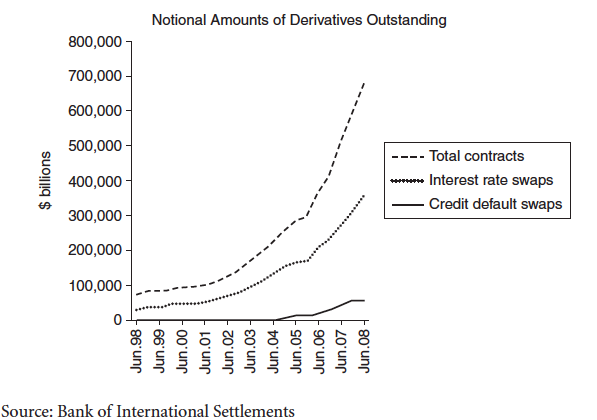

Starting next year, new rules designed to prevent another meltdown will force traders to post U.S. Treasury bonds or other top-rated holdings to guarantee more of their bets. The change takes effect as the $10.8 trillion market for Treasuries is already stretched thin by banks rebuilding balance sheets and investors seeking safety, leaving fewer bonds available to backstop the $648 trillion derivatives market.

The solution: At least seven banks plan to let customers swap lower-rated securities that don’t meet standards in return for a loan of Treasuries or similar holdings that do qualify, a process dubbed “collateral transformation.” That’s raising concerns among investors, bank executives and academics that measures intended to avert risk are hiding it instead.

Understand what is happening here: clearinghouses are one of the major elements of Dodd Frank to reduce counterparty risks. But the banks are proposing to vitiate that via this “collateral transformation” which will simply create new, large volume counterparty exposures to deal with fictive clearinghouse risk reduction program. And get a load of this:

U.S. regulators implementing the rules haven’t said how the collateral demands for derivatives trades will be met. Nor have they run their own analyses of risks that might be created by the banks’ bond-lending programs, people with knowledge of the matter said. Steve Adamske, a spokesman for the U.S. Commodity Futures Trading Commission, and Barbara Hagenbaugh at the Federal Reserve declined to comment

Translation: the regulators are aware of the banks’ plans to finesse the clearinghouse requirements, and they neither intend to put a kebosh on it (which could easily be done by taking the position that any collateral transformation to meet clearinghouse requirements was an integrated part of the clearinghouse posting and could not be done separately on bank balance sheets) nor understand the impact of their flatfootedness.

This massive fail results from the refusal to deal with the derivatives problem head on. For some peculiar reason, economists and regulators have bought the idea that financial “innovation” is always and ever good and should therefore be given free rein. Even though the crisis would seem to have proven decisively otherwise, no one seems willing to question the value to anyone other than banksters of the continuing growth of over-the-counter derivatives markets. And the ever rising “need” for more collateral is the direct result of the explosive growth of the derivatives market. This chart from ECONNED is somewhat dated but gives you an idea:

Mind you, we aren’t opposed to plain vanilla products like simple interest rate swaps. Even though those lead to large notional amounts, the actual financial exposures, and hence collateral requirements, are comparatively small. By contrast, as we’ve argued, the social value of the credit default swaps market is questionable, and the case for limiting it severely is strong (see ECONNED for details). Similarly, bespoke OTC derivative are used almost entirely for either gaming accounting or regulatory arbitrage. Restricting their use would be beneficial, not simply in terms of lowering systemic risk but also in curbing rule-skirting.

It seems that Richard Bookstaber’s observation can’t be repeated enough: in tightly coupled systems, the only way to reduce risk is to reduce interconnectedness. Otherwise, measures to reduce risk actually wind up increasing it. And that looks to be precisely what the introduction of clearinghouses will achieve.

That the banks are willing to take credit risk by swapping lower rated debt (collateral transformation) was very predictible. I seem to recall proposals to do just this very thing almost at the onset. In some ways, the treasury requirement becomes a tax the banks collect for parties who need the treasuries.

Yves said; “Mind you, we aren’t opposed to plain vanilla products like simple interest rate swaps.”

We?

I am opposed to them. Conceptually they are the foundation of parasitic Vanilla Greed for Profit Evilism where the control of credit and money creation is in the hands of the self anointed elite sociopathic few — it is the wellspring of Xtrevilism.

Yves said; “It seems that Richard Bookstaber’s observation can’t be repeated enough: in tightly coupled systems, the only way to reduce risk is to reduce interconnectedness.”

In tightly coupled systems the only way to reduce risk is to insure that all involved are treated fairly.

This is a Vanilla Greed lament. It seems my tag line can not be repeated enough…

Deception is the strongest political force on the planet.

There is a great treatment of “the social value of the credit default swaps market” and “tightly coupled systems” in John Talbott’s “Survival Investing- How to prosper Amid Thieving Banks and Corrupt Governments” pages 36-38.

Yves, as to your comment: “For some peculiar reason, economists and regulators have bought the idea that financial “innovation” is always and ever good and should therefore be given free rein.” once again, I must take issue with your optimistic view of these folks. You and I discussed Econned at a talk you gave here in NYC, and you commented that you have a tendency to be a ‘bit negative’, which caught me offguard, as I explained that 30 years on Wall Street taught me that it’s usually darker than I could imagine. This bullshit about “Innovation” is a code word I was given 25 years ago, to use with regulators to feed the lie.

Can you read? Apparently not. Yves has an entire chapter on LOOTING, fer Chrissaskes, and describes the industry as predatory. Or look at Chapter 9, the end, as to what it says about innovation (as in very critical).

reprobate,

Yes I can read well, but apparently, you not-so. I even referenced that I have read Econned and discussed her book with Yves.

The comment from *today’s post* includes these words (which I shall quote again, for ‘slow readers’): “For some peculiar reason, economists and regulators have bought the idea that financial “innovation” is always and ever good and should therefore be given free rein.”

I thought it worthwhile to make the distinction that these are CONSPIRATORIAL WORDS from economists and regulators, not a simply misunderstanding on their part.

I even disclosed my first-hand experience, so even you could ‘get it’. Seems that’s just not the case.

With all due respect, you are thick. That is what is called “irony”. Maybe you need to Google the word.

Danny,

You are new to this blog. I don’t recall ever speaking with you. I’ve met with readers in the US only three times, the most recent last December, and then in a venue that was too noisy to have anything resembling a serious conversation. You’ve started commenting here after that date.

And reprobate above is right. The line you’ve picked out of the piece is ironic. The clue is that it’s overwritten.

Yves,

Thanks for your reply. Your talk was at Book Culture on W. 112 Street, where, among other hypothesis, you offered the possibility of Mike Bloomberg as Presidential candidate. Does that jog your memory? My wife and I argued against that possibility with you. Quiet venue, conducive to a serious conversation (see: Mike – Wall Street’s Mayor by Neil Fabricant, for some of those reasons).

Also, I am not new to your blog. Long timer. Commented under a different handle.

Now, of course I read the ‘overwritten’ ‘irony’ in your statement (I mentioned that I’m from NYC, right?). If you intended to communicate that these are CONSPIRATORIAL WORDS from economists and regulators when you wrote:“For some peculiar reason, economists and regulators have bought the idea that financial “innovation” is always and ever good and should therefore be given free rein.”, I did miss your understatement. If you meant anything short of that, I stand by my initial comment. Please clarify what you meant.

I’ll do it.

NYC version:

[GRABS CROTCH AND LOUDLY STATES IN SNEERING VOICE]

“For some peculiar reason, economists and regulators have bought the idea that financial “innovation” is always and ever good and should therefore be given free rein.”

FUGGETTABOUTIT!

Bert_S,

Thank you for understanding. Also for *not* beginning your response with:

“Can you read? Apparently not.”

or

“With all due respect, you are thick.”

or

“You are new to this blog. I don’t recall ever speaking with you.”

all of which seem to be conversation stoppers.

Paul Volcker had a great quote about all that great financial innovation and the only thing that was worht while was the ATM .

I agree with Susan, Interest rates swaps are not in the same league as credit default swaps which unlike the plain vanilla libor swaps are quite nefarious.

Personally I’d ban CDS, and truth be told the way those instruments decide on credit events most participants would be better off using other tools(e.g. futures on sovereign debt would be better than CDS)

(e.g. futures on sovereign debt would be better than CDS) CoC

You mean futures on “corporate welfare” don’t you? Since that is what borrowing by a monetary sovereign is?

Well, at least conservatives don’t claim to be for a free market – just one that favors them.

One key point to remember about Nakedcapitalism is that while on the surface it has some populist appeal, at its core it endorses the rentier finance as a viable way to run a society. In that, it’s probably why it’s one of the more insidious outlets out there; while Yves Smith may in fact believe in what she is doing, by never questioning the fundamental assumptions the system is based upon she is in fact a very good asset for banking criminals like Loyd Blankfein and Ben Bernank to keep around.

Actually it would be better for everyone if the entire system were totally deregulated, enabling not only corporations but also individual consumers to borrow as much as they like, at whatever rates the lender decides to charge. This would encourage the development of a system characterized by economist Georges Bataille as “expenditure without reserve,” the basis for the “general economy” he sees as necessary in all societies, an economy based on the willful destruction/sacrifice of all surpluses.

As opposed to the prehistoric and indigenous societies on which he focuses, the effect of such an approach in the “developed” world would be to totally destroy all wealth through the encouragement of wasteful, unregulated excess, which is pretty much what is now happening anyhow, since the activities of the “free market” can no longer be regulated in any case. Once all wealth, including that of the plutogarchs who now dominate the world, is (self)destroyed, which is now for the first time in history a very real possibility, then we will have a unique opportunity to create a truly equable society. For one such strategy, see this helpful post on my blog Mole in the Ground: http://amoleintheground.blogspot.com/2012/07/consume-mass-quantities.html

“Actually it would be better for everyone if the entire system were totally deregulated,”

DocG are you really serious here? Even to an outsider like me who is deeply suspcisious of capitalism generally this makes no sense:

– It begs the question of what an alternative system might look like. Regretably I dont see much in the way of alternatives currently or in history. And what seems to happen is we just get the same old system rising again.

– No regulation has effectively been the case in the past and this led to extreme boom and bust cycles. Why you would want this chaos is beyond me given it isnt constructive.

– Capitalism is utterly dependent on some regulation if only to police contracts – which implies prosecutions, investigations and a whole government apparatus which is regulatory system by any other name. So what you are really proposing is movement to nepotism based capitalism even beyond the current version.

One of the things that bugs me about both sides in this discussion is I’m seeing no serious alternatives on offer which worries me greatly as a ‘mad Greenie’ wanting to see some sort of ecologically sustainable system evolve.

NC shouldnt be criticised here though as it does a great job by detailing the devil and the illogic. Its so far more intelligant than the gossip/sycophant business analysis sites here in the land of Oz that I no longer look to the latter for any intelligent comment. So all power to Yves and you rest.

Perhaps the trouble is the Academy which seems to have failed us by offering no alternatives to current capitalism or some tweaked Keynesian position and at worst spends more time identifying new ways for the banks to exploit the current dysfunctionality.

Well, first of all, Newtownian, as I see it, “free market” capitalism is inherently unregulatable anyhow. So any effort to “regulate” it will tend to be little more than window dressing. Consequently, imo, to break the hold of the plutogarchs, we need a truly radical solution, as in: Sampson bringing the temple down around his head.

Only in this case, Sampson and the rest of us 99% need not be destroyed along with the system. Because the temple being destroyed is only a mirage to begin with, albeit a highly destructive mirage, with real consequences. The resources we rely on to survive will still be there — only the money, and the money changers, will be gone.

Secondly, it seems you missed an important feature of my comment, and the blog post I pointed to, which contained more than a touch of irony, tinged with bitter humor. If we take ourselves too seriously, then how can we effectively mock the powers that be? :-)

The Fed/OCC mandate to “find other funding sources if regular borrowing markets shut (banks) out” is practically code for desperate pension funds. Collateral transformation. What a term. And since treasuries are scarce, this will become rehypothecation in no time. Transformed, rehypothecated collateral.

Lets just get our wise and effective congress to pass a law allowing pension funds to get bank charters. Oh, wait, I forgot – they are neither wise nor effective. Gee, there is always some damn thing screwing everything up.

The extoic derivatives will be a bigger problem every year, is mandatory close some of that markets, my country Colombia have some restriction that i think are good ideas, for example, is forbidden selle any credit derivative, if you want buy it, go to the international market and say it to the central bank.

Another good idea is that here, only the stock brokers are allowed to buy and sell stock derivatives, that focus the market and helps control.

our market is little but probably the derivatives market should be little

“They told banks to consider drastic efforts to prevent failure in times of distress, including selling off businesses, finding other funding sources if regular borrowing markets shut them out, and reducing risk. The plans must be feasible to execute within three to six months, and banks were to “make no assumption of extraordinary support from the public sector,” according to the documents.”

Yves, if a systemically important institution had to engage in such behaviour, on such a short time scale, won’t that blow up the economy? if they are already important, and their failure means certain doom to the economy, any negative actions by them means the economy directly suffers. Say the company (company because more than banks are trying to join this “important” group) starts going down. If they engage in fire sale tactics to save themselves, not only will they scare other players, but they will have significant effect on communities and countries around them. If they are significantly important, then they CAN’T suffer negative consequences, at all. Because negative actions will roll down the hill.

Perhaps this may sound simplistic, but like a roof on a house, just how many shingles can one put on before the roof collapses, so to how many different scams can the do here?

“In an perverse case of synchronicity…”

All cases of synchronicity are,in a sense, perverse. That is why Carl G. Jung invented the word: to show the irrational connections

that occur in the universe simultaneously which cannot be explained rationally. See C.G.Jung: Memories,Dreams, Reflections

Synchronicity is generally seen by the person experiencing it as events that reinforce each other, at least in the mind of the person, say you start planning to go on vacation to an area where an friend you haven’t spoken to in a long time lives and that friend calls unexpectedly. And Jung saw synchronicity as positive, as a way to find meaning.

The “events” as in the news stories, were in opposition to each other as opposed to reinforcing, hence “perverse”.

Sometimes They Scare You Out of Your Mind

True story about synchronicities. Sometimes I explore realms of imagination that most people would avoid. Nothing heavy, just open-minded.

So after reading extensively about shamanism and dreams, one night I did an exercise, which is not uncommon for those of that persuasion. I invited those forces to manifest a sign, which I expected to see in my dreams. Some sign that indicated a path for my troubling life confusions.

When I awoke the next morning, I’d had no memorable dream. I went to part the curtains and saw, to my utter astonishment, a dead bird lodged between the inner window pane and outer windowscreen.

There was no hole in the screen or the window frame, and no evident way a bird could have entered such a restricted space.

We all know what a bird symbolizes in Jungian pyschology, which draws on cross-cultural anthropological religious history.

I gave the bird a solemn burial in the little garden out front of my building. I still don’t know what to make of it. I don’t think I want to know.

Yes, the garuda.

https://www.google.com/search?q=garuda&hl=en&qscrl=1&rlz=1T4GGLL_enUS386US387&prmd=imvns&tbm=isch&tbo=u&source=univ&sa=X&ei=5cNQUIKvG6PuiQKhsoHADQ&sqi=2&ved=0CEsQsAQ&biw=1251&bih=766

The occult will generally leave you alone UNLESS you invite or seek them.

Let that poor dead bird be a lesson to you NOT to.

>>The occult will generally leave you alone UNLESS you invite or seek them.<<

Would that that were true of religion in general.

Oh wait, there's someone at the door. BRB.

Would that that were true of religion in general. ebear

Well, it mostly is, which is kind of sad in a way. I’ve only been solicited twice (JWs both times) in the three years I’ve lived in Auburn,AL.

But the phone is another matter – constant solicitations by banks and insurance companies and constant calls by debt collectors on the trail of someone who once had my phone number.

that’s why they chained Prometheus to the cliffs, so the birds could eat his eyes.

But I say:

Occupy Your Universe!

Who’s universe?

Our Universe!

Who’s Universe?

Our Universe!

Yeah

Occupy! Occupy! Occupy Yer Mind! haha

I just need to perfect my technique.

really Beard, if you read up on South American shamanism for example, this stuff happens all the time.

the real shamans know it’s only a trickster phenomenon, just the barking of toothless dogs, they laugh it at, and just penetrate through it to where the real energy is.

Me, personally, it scares the sh*t out of me. I won’t even put my hands on a Ouja Board. ahah. Even with Xanax. No way.

Ya mon. Check what happened to this crow dude!

http://www.youtube.com/watch?v=hSzo-F9fIbU

http://orlyowl.tripod.com/

Would that that were true of religion in general. ebear

>>Well, it mostly is, which is kind of sad in a way.<>But the phone is another matter – constant solicitations by banks and insurance companies and constant calls by debt collectors on the trail of someone who once had my phone number.<<

…and the change of subject. Very slippery, these religionists.

Also note that it only took about 5 minutes for the comeback.

"At the door" was a poor turn of phrase. "In Your Face" would be more accurate.

Hey, since the banks got off scott free for making unsubstantiated claims (read lies) does that make them a religion too?

"Unwelcome visitors permitted. The temple reeked of time, principle, and agents in force." –William S. Burroughs.

OK, the most important part of that post got lopped off, but WTF eh? It’s only the internet.

“One of the earliest experiences Jung mentions specifically of a meaningful coincidence concerns this figure: Philemon had appeared in his dreams with kingfisher’s wings, and Jung, in order to understand the image better, did a painting of it. While engaged on this, he happened to find in his garden, for the first and only time, a dead kingfisher (Jung 1963: 175–6).”

http://www.bibliotecapleyades.net/ciencia/ciencia_synchronicity05.htm

I got your synchronicity right here, yo:

http://www.youtube.com/watch?v=HZg356pwfdI&feature=related

I dream about these girls every night. Coincidence? I think not!

Craazyman, about “Sometimes They Scare You Out of Your Mind” — I think I know what might have happened…

Five days prior to your finding the dead bird, that same bird had become trapped in your building and was flying around looking for an escape route. Also on that same day, after a long period of studying at Synchronicity University, you stopped in at the local absinthe bar on the way home, had a few drinks, got a nice buzz, and then went home. When you opened the door to your apartment the bird trapped in your building flew in (unnoticed by you of course as you were in your comfortably absinthe buzzed state) and immediately sensed and flew to your window that at that time was open. Fifteen minutes later, as the absinthe further worked its magic you became tired and drowsy and went to bed. Along the way you noticed the opened window, but not the terrified bird in fright mode standing very still in between the window and the screen, and so you slammed it shut. Five days later when you awoke you found the bird starved to death. That’s not synchronocity, that’s cause and effect.

I experienced some amazing, and very real, synchronocity in my life the other day. I was thinking a lot about a robot I am designing and so spent some good deal of time on google trying to locate some servo motors of the correct torque, rotational speed and amperage. After completing my search I visited a lot of my favorite web sites. Amazingly at every web site I went to there were real ads for servo motors, and micro controllers just like the ones I had been first thinking about and then googling. Things I had been thinking about were now popping up all over the place. Wow! Synchronicity is a very powerful force. Its still happening!

I don’t think the synchronicity that Yves experienced was perverse or even synchronicity at all. I think it was just standard good cop bad cop BS. I think everything can be explained by cause and effect and Jung was full of crap deceptions and just talking his book trying to get his billable hours up. Its like all of those doctors doing free prostate exams. Absinthe makes the heart go yonder, but…

Deception is the strongest political force on the planet.

One has to wonder at the incessant need to fill mental voids with supernatural mumbo jumbo rubbish. I mean the OLD’s have an excuse, our species utter lack of knowledge and the control factor used by .01% on any timeline. (if they believed or not).

Its all about the framing, suggestive, button pushing evolutionary cognitive – emotional traits, for gain – control.

To think finance is a derivative of all this past, its constant need to expand, in too, more and more, vaporous boundary’s. Deploy theoretical suspicions, in order to magnify its self, do to physical impossibility’s manifesting them selves ie the finite problem. At some point finance is going Boggs Higson. I hope it takes them to a new verce… permanently.

Skippy… Deception is the – oldest – lie too… imo.

PS. BTW you wouldn’t know anything about facility’s rendered and any papers on glaciers? CMWLTK.

One has to wonder at the incessant need to fill mental voids with supernatural mumbo jumbo rubbish. skippy

Speaking of “mumbo jumbo”, I was tempted to use that EXACT same expression in my comment to Garth at http://www.nakedcapitalism.com/2012/09/links-91212.html#comment-813454.

Spooky? (I hardly ever use that expression and when I hear it it reminds me of Nickolas Cage in “The Family Man”).

Skippy said “One has to wonder at the incessant need to fill mental voids with supernatural mumbo jumbo rubbish. I mean the OLD’s have an excuse, our species utter lack of knowledge and the control factor used by .01% on any timeline. (if they believed or not).”

Its explained by the transition from emotive to rationale thinking. Everyone is on a different point on the trail of transition, and we each, by birth, have individual emotive strengths. Yes, the .01% have the control keys to the rationale side. That’s why we are all in our little boxes, and why the internet is such a liberating gift.

Lost on facility’s rendered Skip(?) but for glaciers here is a great source. I illustrated some of Mayewski’s work on Himalayan glaciers back when he was at UNH. He is a super nice guy.

http://climatechange.umaine.edu/people/profile/paul_andrew_mayewski

Deception is the strongest political force on the planet.

@Warren, Yep that’s the paper. I recognized the name in the wish thanks to bit at the end, drafted figures and design.

Skippy… Sorry about Trev.. cry. Happy about those fighting… yet… devastated at some of the results….

PS… Baloney slime is hard to wash off, the solvent required could possibly kill us and everything else. That’s the diabolical nature of its design… eh.

My aunt is an American native from British Columbia.

http://www.feelnumb.com/2011/04/27/anthony-kiedis-haidi-thunderbird-native-american-back-tattoo/

My brother suggested I might like this web site.

He was entirely right. This put up actually made my day. You cann’t consider simply how much time I had spent for this information! Thank you!

That was my point. In my opinion, “perverse” synchronisity is an contradiction which makes sense,however,taken in the context of the sentence. Well done. I misread it originally.

Are you creating almost all your articles and other content? Then, you have got a pretty effective freelance writing structure. I have been making the effort to learn through various online websites as a way to improve my very own web site. Cheers.