As we and others have written at considerable length, the mortgage settlement was a big exercise in optics. The $26.1 billion number sounds impressive until you compare it to the size of the housing market and the damage done to homeowners. 40% of the value of the settlement can come from junk credits, things the banks would have done anyhow or should be doing in the normal course of business, like razing vacant homes, short sales, and giving homes to charities. And of the remaining part, which was a relatively small amount of actual cash payment ($5.8 billion, but that included over a billion of fines federal regulators rolled into that total), the rest is supposed to be reduction of mortgage principal. Oh, but wait, they can take credit for modifying OTHER PEOPLE’S MORTGAGES, meaning those owned by investors. And they’ve been doing that in more than half the cases. As the Financial Times reported last week:

Investors in US mortgage securities have been forced to absorb large writedowns in response to a deal between leading financial groups and government agencies over the “robosigning” scandal….

The banks – JPMorgan Chase, Bank of America, Wells Fargo, Citigroup and Ally Financial – agreed to forgive billions of dollars worth of distressed borrowers’ mortgage principal in exchange for waivers from potential liability.

On Wednesday, BofA said that 60 per cent of the $4.75bn in first-lien mortgage principal it has thus far agreed to forgive would come from non-government guaranteed loans that were packaged into bonds and sold to investors.

Of JPMorgan’s $3bn in forgiven mortgage debt, slightly less than half has come from investors’ holdings, a person familiar with the matter said. The other three banks either declined to provide numbers or did not respond to requests for comment.

The Charlotte Bank has far and away the biggest settlement obligation, $8.5 billion versus $4.3 billion for Wells and $4.2 billion for Chase, the next two in size rank. Remember also that banks were offering principal mods on loans in their portfolio before the settlement; it’s a no-brainer that most if not all of the mods on bank owned loans were ones they would have done anyhow.

Today, the settlement monitor Joseph Smith released another PR piece, um, progress report. These reports are already sus since the monitor isn’t require to say anything about his work until first quarter 2013. So this looks like an exercise in messaging over moving the ball forward (reports like this take a lot of work and divert resources from oversight).

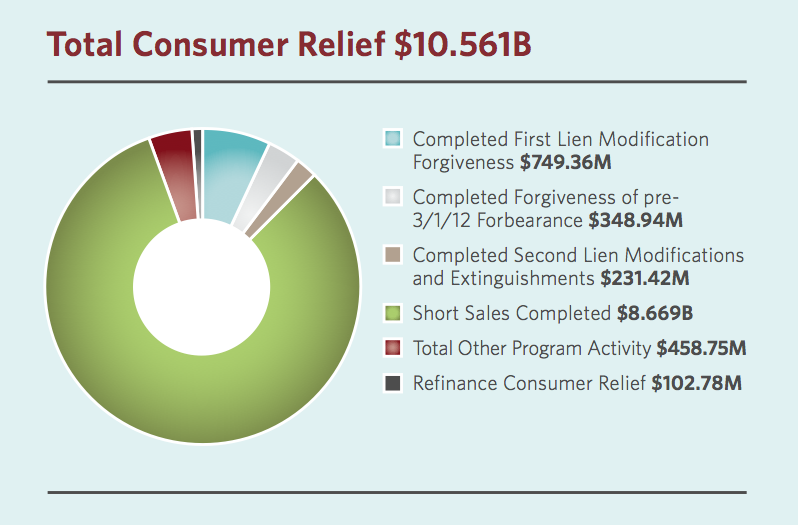

We can see with this report that more effort has gone into creative accounting to make the results look better than they really are. Smith’s first progress report gave prominent play to this chart, which was troubling. Despite the claim, taken up by the media, that borrowers got “relief”, what it showed instead is that they got overwhelmingly was short sales:

We weren’t alone in criticizing the prevalence of short sales, which results in borrowers losing their homes, over various forms of relief, most important, deep principal mods, which keep them in place. Even with the housing market bounce, losses on foreclosures are so high (70%+ of mortgage value) that a deep mod (30% to 50%) is a win-win if the borrower has an adequate level of income.

Dave Dayen hits this issue hard:

$13.13 billion of the $26.11 billion in relief stated here comes from short sales. Not much of this will actually count toward the settlement, so I don’t know why they keep including this number. And it’s not what anyone means when they talk about a settlement that “helps keep people in their homes.” Short sales do the opposite of that. They’re a sale, often a forced sale, of the home. Katie Porter [settlement monitor for California’s side deal] notes:

Short sales should be reserved for homeowners who couldn’t afford to live in a home even with a lower principal or for people who need to move, said UC Irvine law professor Katherine Porter, who was appointed by the state attorney general’s office to monitor the deal.

“I am pushing hard to make sure that … short sales are being used for families for whom other options are really not available,” Porter said.

It’s difficult to see whether that’s the case.

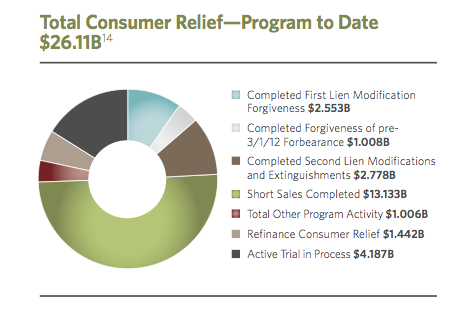

Yves again. So if you look at the updated version of the chart, things look much better, right? I mean, that big green area which is short sales, is still more than half, but at least it’s a much smaller percentage of the total pie than it was the last time. So the servicers are moving in the proper direction, right?

Um, not to the degree you’d think. Notice the dark grey area, the “Active Trial in Progress”? They were not included in the chart in the first report. And there’s no reason they should be. Those are trial modifications. And there is no assurance these will lead to permanent mods; banks have been known to call payment catch up plans, in which borrowers try to make up for missed payments or clear out late and related junk fees, as “trial mods” even though they result in higher, not lower, monthly payments.

Back that out and you have short sales at 59% of the total of the latest version of the pie chart. Yes, that is still a meaningful improvement compared to the 82% it was last time. But this little trick shows how the monitor’s priority is be making the program look successful, as opposed to getting tough with the servicers (which might mean calling them out on lack of progress, what a thought!).

Oh, and even better: the amount of relief from these “maybe they’ll get done, maybe they won’t” mods is $4.118 billion, versus actual completed principal mods of only $2.53 billion.

And get a load of this doozy, from Smith’s cover letter (emphasis mine):

As was the case with my prior report, the consumer relief activities discussed in this report represent gross dollars that have not been subject to calculation under the crediting formulas in the settlement agreement. Therefore, the $26.11 billion in cumulative consumer relief reported here cannot be used to measure progress toward the $20 billion obligation in the settlement. As also was outlined in my first report, neither I nor the professionals working with me have confirmed these figures. No credit will be awarded to a servicer until I, as Monitor, am satisfied that the servicer has met its obligations.

Again, why is Smith wasting money when:

• The figures haven’t been verified and hence who knows how good they are (given the terrible state of servicer information systems, significant misreporting is a real risk)

• He hasn’t/can’t be bothered preparing a pro forma of how these self-reported figures track against the total required by the settlement?

There are additional tidbits in the report that aren’t too pretty. We had flagged that banks were certain to modify high dollar value mortgages, which means fewer people would be helped, and the ones who got help would be the more affluent. Why would they target bigger mortgages? A mod is pretty much the same amount of work regardless of loan balance. So you get to the total required by the settlement faster and cheaper if you modify big mortgages rather than small ones. And we see that in the report:

21,833 borrowers successfully completed a first lien modification and received $2.55 billion in loan principal forgiveness, averaging approximately $116,929 per borrower.

20% is a good guess as to the typical amount of principal reduction (trust me, the average will be well under 50%). So that gives you an average mortgage balance of $585,000.

And the mortgages getting trial mods are likely even bigger:

30,967 borrowers are in active first lien trial modifications as of September 30, 2012, the total principal value of which is $4.19 billion. This represents potential relief of $135,223 per borrower if the trials are completed.

If we use the same 20% principal mod guesstimate, the average mortgage balance is $676,000.

We see the same pattern on the second liens:

Second lien modifications and extinguishments were provided to 50,025 borrowers, representing approximately $2.78 billion in total relief. The average amount of relief for borrowers whose second liens were modified or extinguished was approximately $55,534.

To put none too fine a point on this, $55,534 is a big second lien, and since some were modified rather than wiped out, the actual average amount is even larger.

So this sorry settlement is playing out as predicted: relief for only a small number of borrowers, and then mainly better off ones, with the banks getting a huge “get out of liability” card on the cheap. And to add insult to injury, we have to read colored pie charts doctored to make a bad story look a smidge less awful.

LOL Yves.

You/we are getting the best propaganda money can buy and by gosh, you/we are getting that propaganda ahead of schedule. What is not to like and be dulled into complacency about that…….?

The BofA is still alive Yves. The parts may be flying off but the merry-go-round of our financial system is still churning through other peoples money like there was no tomorrow (which is what they believe, right?)

After all, at the rate the shadow banking system is blowing up the dollar, soon the GDP of the world will just be a rounding error in one of their derivative positions to them.

I actually don’t object to the idea that most of these end up as short sales. Certainly those are hardly some great gift to homebuyers and to pretend that they some how “make up” for the crappy job servicers have been doing is laughable. But unlike most other “solutions” they end in an arms length sale. So they are a true step in the market returning to sanity, as opposed to kicking the can down the road again in the hope that “this” (whatever this is) will end the RE decline. As a loss mitigation effort, they will often end up with a somewhat lower return for investors than a mod (because of transaction costs and the fact that the house is probably worth somewhat more to the current occupants than to a purchaser) but the possibilities for fraud or the servicer misjudging either the occupants ability to service the loan or the current or future market value of the house are lessend. And a combination of inability and disinterest led to those issuing mortgages to be very poor at making those judgements. Expecting the loss mit people at the servicers to do better is wishful thinking IMHO.

If you have no ability to judge whether you can repay a loan you shouldn’t take it. If you do a crappy job judging whether somebody will repay the money that they’ve borrowed from you, you should lose that money, either through foreclosure losses or that person’s bankruptcy.

Sure salesmen are going to entice people, that’s what they DO, whether they’re selling cars, houses or debt. But even if we can’t wade through pages of legaleese, most of us realize the basic truism that if it sounds to good to be true there’s got to be a catch. And most of us learned that at the “not a flying toy, batteries not included,” age.

I’d like to point out some reality about short sales. Living in Northern Calif, as I do, my neighborhood was hard hit by the collapse of the Housing Bubble. Many people here were tradespeople, building the second homes for people who live in the SF Bay area. So they lost their jobs, and also the homes they built themselves. When jobs in the trades declined, so did all manners of jobs -everything from car sales, to stereo sales, to groceries, and trips to the local diner and deli.

I still see many of my old neighbors, even after the banks have foreclosed on them and they abandonned their homes. They managed to get laons from their parents and buy other homes (Sometimes, I imagine held in their parents name.)

But to a person, they tell the same story.

First they ask me if their old home has sold. When I report, “No it is still sitting there, vacant and weeds growing everywhere.” They get a glazed look in their eyes.

“My husband and I brought no fewer than three short sale offers to the bank before they foreclosed. But the bank always said no.”

I have been told this at least a half a dozen times by various former neighbors. And word is leaking out – the banks plan on holding these bhimes until there is a spike in rental prices. Then they will lease out the homes.

Chocolate covered horse shit.

Burn the entire “real estate” industry to the ground.

“Chocolate covered horse shit.”

That’s beautiful. If you made it up yourself, I’m impressed.

And of course nothing is being done to prove the title. Instead, any homeowner who accepts a mod must sign a liability release so that when the title issue is raised, the banksters will not be held responsible. Like the article from Awaken Longford (So African) described the title mess there – ‘securitized SIVs are like a lake into which many glasses of water are poured’ and no glass of water can be retrieved – ever. Fraud is forever.

I just love how those charts are in the shape of an “O”. That’s hilarious to me.

>>

re: resolving chain of title clusterf*ck … just check the fhfa freddie&fannie loan programs that will (of course) require recipients to waive any recourse & force quite title

robo-fraud, robo-forge, robo-regulators, robo-lapdogs, robo-absolution…robo-done!

…. add robo-bonuses!

Too bad the parasites can’t make payroll without taxpayer life-support taxed to death.

I agree with the “horse shit” genius. That is the understatement of two fraud generations.

and isn’t a short-sale considered taxable income to the homeowner?

Until the end of this year, banks don’t issue a 1099 on them, so no reporting, de facto no tax. After the end of this year, the forgiveness of debt is reported (unless the provision is extended) BUT if the borrower can demonstrate insolvency, there’s no tax.

you really want to end this fraud….EVERYONE must stop paying their mortgage

I am not only the owner, i am a hair club member

BOA’s fate was sealed the date they sold the bank to the boys/mob from charlotte its been down hill ever since

The “settlement” does not cover GSE Loans!

That means that 94% of mortgages are not covered by the “settlement”.

It is a huge Broadway production to cover up the “GSE Business Model” and its consequences.