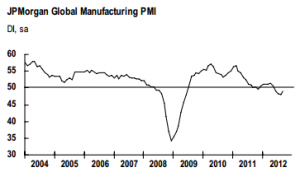

Bill Black: Ryan Talks Jobs and Exposes the Lies about the 47%

By Bill Black, the author of The Best Way to Rob a Bank is to Own One and an associate professor of economics and law at the University of Missouri-Kansas City. Cross posted from New Economic Perspectives.

This Monday, I posted an article entitled: “Let’s test Romney’s claims about the 47% by offering the unemployed jobs.”

The article explained that Romney, Ryan, and Charles Murray claim that 47% of Americans receive governmental assistance because they are morally defective and shiftless. It goes through why Romney and Ryan know that they are lying when they use the 47% figure to slander Americans as refusing to “take personal responsibility and care for their lives” and as failing to pay taxes. The article points out the obvious – the vast majority of the 47% cannot work because they are (1) minor children, (2) the profoundly disabled and sick, and (3) the elderly. The article reminds readers that the disabled (except when they were profoundly disabled even as children) and the elderly had typically borne substantial federal, state, and local taxes, often for over forty years. Romney and Ryan cannot possibly be claiming that the members of these three groups refuse to take personal responsibility. (There is also the small fact that the elderly frequently vote for Republicans, so Romney and Ryan are slandering their own voters.)

Read more...