Thirteen ways of looking at a clang bird

By lambert strether.

The words that have never been spoken and perhaps can never be said.–Anonymous

If the Presidential campaign seems vacuous to you, that’s because it is. Here are some questions that “we” — by which I mean the legacy party campaigns, their enablers, and our famously free press — can’t seem to bring ourselves to ask during the campaign. So, I’m going to ask them now:

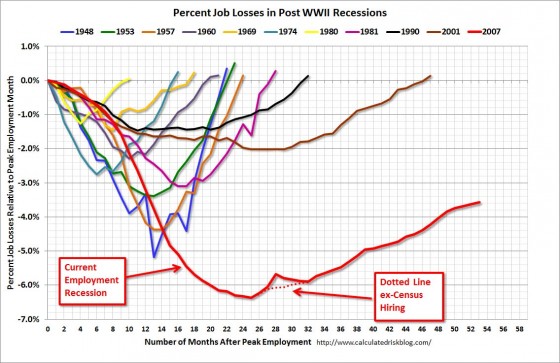

1. How did 8% nominal unemployment become the new normal? Here’s last month’s version of the most frightening chart in the world from Calculated Risk:

Read more...