Yearly Archives: 2012

Class Warfare, Darien Style: The Cabbie v. the Morgan Stanley Executive

Those of you who have any degree of contact with the financial blogosphere no doubt caught the news today that one William Byran Jennings, the co-head of fixed income for the Americas for Morgan Stanley, was arrested and charged with second-degree assault, theft of services and intimidation by bias or bigotry and released on bail of $9,500. He has been put on leave.

Read more...Adrift in a Sea of Economic Data

Yves here. This post from MacroBusiness provides a good point of departure, and I’ll provide some comments further down.

By Sell on News, a global macro equities analyst. Cross posted from MacroBusiness

A little known fact about John Maynard Keynes, detailed in Jane Gleeson-White’s book “Double Entry” is that he was responsible for the development of national economic statistics and that he expected them to be aggregated only on a temporary basis.

It was being done for the war effort, and would, he reasoned, not be necessary afterwards. This certainly puts “Keynesianism” in a different perspective, and poses the intriguing question: where would we be without economic statistics?

Read more...

Links 3/2/12

Current Rate of Ocean Acidification Worst in 300 Million Years

Science has published a troubling but not entirely surprising article on the fact that the oceans are acidifying at the fastest rate in 300 million years. Actually, it could be the fastest rate over an even longer time period, but we can only go back with any degree of accuracy for 300 million years.

We first wrote about this issue in early 2007, and this section, which quoted Stormy from Angry Bear, will help bring readers up to speed:

Read more...Wolf Richter: Deep Trouble at the Core of the Eurozone

In France, new vehicle registrations are plunging: -17.8% in December, -20.7% in January, -20.2% in February. French automakers suffered the most. PSA Peugeot Citroën -29.2% and Renault -28.5%. The German auto industry is still basking in last year’s glow of record worldwide sales and profits, and record bonuses for their beaming employees. But in January registrations edged down, and in February they collapsed brutally. And it’s just the beginning.

Read more...9/11 Commissioner and Co-Chair of Congressional Inquiry into 9/11 Say in Sworn Declarations that Saudi Government Linked to 9/11 Attacks

Two Senators with Access to Classified Information Say Saudi Government Backed 9/11 Attack

Read more...Links 3/1/12

The New Priesthood: An Interview with Yanis Varoufakis Part I

Yanis Varoufakis is a Greek economist who currently heads the Department of Economic Policy at the University of Athens. From 2004 to 2007 he served as an economic advisor to former Greek Prime Minister George Papandreou. Yanis writes a popular blog which can be found here. His treatise on economic theory ‘Modern Political Economics: Making Sense of the Post-2008 World’, co written with Nicholas Theocrakis and Joseph Haveli is available from Amazon.

Interview conducted by Philip Pilkington.

Philip Pilkington: Without getting into too much technical detail what is it that you refer to in your book Modern Political Economics: Making Sense of the Post-2008 World the ‘inherent error’ in all economic theories and models?

Read more...Bailout Ingrate Bank of America to Impose Monthly Fees on Many “Basic” Checking Account Customers

Of all the big US banks that managed to survive the global financial crisis, Bank of America and Citigroup were the two widely recognized to be at risk of failure in late 2008-early 2009. Sheila Bair, then head of the FDIC, really wanted to replace Citi’s CEO, Vikram Pandit, but settled for forcing the bank to do some pretty serious downsizing and streamlining. By contrast, Bank of America has not only been spared this sort of treatment (save being told it can’t pay dividends until its balance sheet is stronger) but it’s also the biggest beneficiary of the most recent “help the banks” full court press, namely, the mortgage settlement.

So how does Bank of America propose to shore up its equity base? Now that bank stocks have traded up smartly, it might be able to unload some more operations (it did a bit of that when it stock was under stress). But bankers prefer to run behemoths because executive pay is highly correlated with total asset size. And that means it’s a given that BofA has ruled out another way to improve its earnings: cutting manager and executive pay, as the Japanese banks did in their bubble aftermath.

Nah, the path of least resistance is to charge customers more.

Read more...Mark Ames: Why is Ron Paul’s Superpac Headquartered in Mitt Romney’s Backyard?

By Mark Ames, the author of Going Postal: Rage, Murder and Rebellion from Reagan’s Workplaces to Clinton’s Columbine. Cross posted from The eXiled

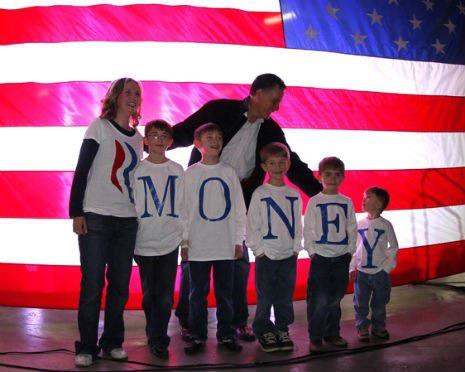

Last week it finally started to dawn on the slow-as-Stegosaurs media: Why is Ron Paul going so soft on frontrunner Mitt Romney, his natural ideological opposite? Dr. Paul has been flaying every other candidate, particularly when that candidate threatens Romney’s front-runner status—why is Ron Paul so protective over internationalist/neocon Rockefeller Republican, Mitt Romney? Does this point to some sort of alliance between the two? And if so, doesn’t that raise further disturbing questions about the supposed rock-solid-principles guiding Ron Paul’s campaign?

Read more...Satyajit Das: Pravda The Economist’s Take on Financial Innovation

By Satyajit Das, derivatives expert and the author of Extreme Money: The Masters of the Universe and the Cult of Risk Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives – Revised Edition (2006 and 2010)

In the old Soviet Union, Pravda, the official news agency, set the standard for “truth” in reporting. Discriminating readers needed to be adroit in sifting the words to discern the facts that lay beneath. Readers of The Economist’s “Special Report on Financial Innovation” (published on 23 February 2012) would do well to equip themselves with similar skills in disambiguation.

Read more...Cathy O’Neil: Economists Don’t Understand the Financial System (Quelle Surprise!)

By Cathy O’Neil, a data scientist who lives in New York City and writes at mathbabe.org

A bit more than a week ago I went to a panel discussion at the Met about the global financial crisis. The panel consisted of Paul Krugman, Edmund Phelps, Jeffrey Sachs, and George Soros. They were each given 15 minutes to talk about what they thought about the Eurocrisis, especially Greece, the U.S., and whatever else they felt like.

It was well worth the $25 admission fee, but maybe not for the reason I would have thought when I went. I ended up deciding something I’ve suspected before. Namely, economists don’t understand the financial system, and moreover they don’t get that they don’t get it. Let me explain my reasoning.

Read more...Links Leap Year Day

Brace Yourself for Election-Driven Enforcement Theater: Token Roughing Up of Crisis Bad Banksters, While Corzine Gets a Free Pass

It’s bad enough that we are being subjected to relentless propaganda about how housing is just about to turn the corner and the state-Federal mortgage settlement is such a great deal for homeowners. In fact, as we’ve stressed, and bond investors such as Pimco have reiterated, the deal is above all a back door bailout of the banks.

But to add insult to injury, the chump public will be given bread and circuses enforcement theater to distract it from the fact that the banks are getting a sweetheart deal.