How owls swivel their heads BBC

The Power of Kawaii: Viewing Cute Images Promotes a Careful Behavior and Narrows Attentional Focus Plos One (Deontos)

CES tells CNET: You’re fired! ars technica (Chuck L)

Obama Administration Considers Joining Publishers In Fight To Stamp Out Fair Use At Universities TechDirt (Chuck L)

Proposed EU data protection reform could start a “trade war,” US official says ars technica (Chuck L)

What to make of the contradictory China manufacturing PMIs FT Alphaville

We Haven’t Seen The Spanish Stock Market Get Slammed Like This For A Long Time Clusterstock

Colbert offers recruitment tips to the new, ‘non-racist’ KKK Raw Story (furzy mouse)

Barclays in Qatar loan probe Financial Times. The headline is awfully weak. Better would be: Barclays lends Qatar money to meet Barclays cash call.

Israel faces repercussions of air strike on Syria Guardian

Focus on Mental Health Laws to Curb Violence Is Unfair, Some Say New York Times

Texas prosecutor shot multiple times in broad daylight Raw Story (furzy mouse)

Validity of Consumer Bureau at Stake in Legal Challenge Bloomberg. Ugh, a foreclosure mill!

Elizabeth Warren, Elijah Cummings, Maxine Waters Call For More Transparency On Failed Foreclosure Reviews Huffington Post. Some people in a position to know think our series helped.

Doubt Is Cast on Firms Hired to Help Banks New York Times

Unemployment claims rise as fragile US jobs market takes hit Guardian. In isolation, this is noise, but stay tuned…

GDP Gap Stuck at 6% EconoSpeak

In memory of Frank Hahn, a rare jewell of a neoclassical economist Yanis Varoufakis

‘London Whale’ Sounded an Alarm on Risky Bets Wall Street Journal

Jacob Lew, Mary Jo White and Dunbar’s Number Simon Johnson, New York Times

US bank bosses must live up to their pay Meredith Whitney, Financial Times

‘Fabulous Fab’ Says Au Revoir to Goldman New York Times

Student Debt Is More Subprime Than Ever Gawker

Exposed: How Whole Foods and the Biggest Organic Foods Distributor Are Screwing Workers Alternet

Late Night: Unfriendly Skies cocktailhag, Firedoglake (Carol B)

God Freaks Self Out By Lying Awake Contemplating Own Immortality Onion

Also, can anyone recommend a foreclosure defense attorney in California that will take a case either on a contingency basis OR installment payment? This one in some ways is more straightforward than most. The person got the servicer to sign a tight agreement not to dual track if payments under a mod were made on time…which they demonstrably were…but they are foreclosing and the sale is scheduled for Feb 13. Any leads VERY much appreciated.

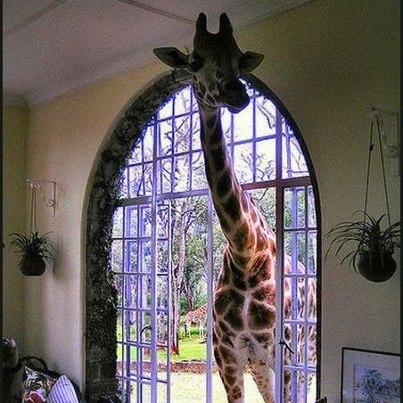

Antidote du jour:

“Focus on Mental Health Law Unfair”

I think this law is well intentioned, that people really don’t understand it, and it has unintended consequences.

My reading of this provision is that all RN, CSW, Psychology and Physician personnel, in ANY capacity, licensed in New York, are mandated to report, to law enforcement, anyone who is a potential danger to self or others.

This duty to report may target registered gun owners and “non-owners” equally. And the judgment is based on any licensed healthcare worker’s interpretation of what “imminent” threat means. And it applies to all people, not just people pursuing mental health treatment. Law enforcement then must decide if they will invade the reportee’s home and take away any guns, or put said person on a list to keep them from getting a gun ever.

My concern here is: potential for abuse (frivolous reporting leading to illegal search and seizure) and the risk of discovery of “other problems” during the search. Like your kids’ pot stash that you didn’t know existed, etc…

Many unintended consequences here. Just sure healthcare workers should agents of law enforcement.

Perhaps my interpretation is wrong, but I don’t think so.

correction:

“Just NOT sure healthcare workers should be agents of law enforcement”

Not to worry. Lawyers have had this obligation regarding imminent crimes for decades and yet corporate crimes just keep happening.

I assumed this was already existing law in all states.

I’ve worked in mental health since 1979. I’ve been required to report anybody who is dangerous to themselves or others and can be held liable if I don’t. In addition, if a specific other person was threatened, that person must also be notified that the threat had been made. In fact, any citizen can file a petition with the court alleging “danger to self or others” and get a hearing and an emergency evaluation by a licensed provider within 24 hours (with police assistance if needed) who can then recommend a 72 hr hospitalization for further evaluation if necessary.

Unfortunately, those who ARE mentally ill and suicidal/homicidal often are in denial of their illness, frequently suffer from paranoia, and won’t accept treatment willingly. It may be a slippery slope but a necessary one. Abuse hasn’t been a problem, as unless both a family member/close friend AND professional concur, or something is said to the professional admitting intent, no intervention occurs. Oppositional-defiant disorder, to poster below, is a conduct disorder that is diagnosed only in adolescents (can be precursor to antisocial personality disorder, but not always……. and antisocial alone would not be sufficient, there must also be imminent threat) and is not considered harmful to self/others. However, different rules apply to minors, who can provide voluntary consent to treatment and at different ages, varying by state.

Physical and sexual abuse also require mandatory reporting, domestic violence in some states now too.

It’s certainly been the law in Ky. for many, many years.

They should call it Abraham’s Act, for Abraham Bolden and other pesky whistleblowers who need to be be put away with no fuss.

http://www.rollingstone.com/politics/blogs/taibblog/new-sec-chief-mary-jo-white-thinks-the-government-should-bring-cases-to-a-point-20130130

“White, who was representing Morgan Stanley in this affair, went over Aguirre’s head to talk directly to then-SEC enforcement chief Linda Thomsen about “reviewing” the case. After Aguirre was fired and the case against Mack went away, the official responsible for terminating the case, Aguirre’s boss Paul Berger, was given a lucrative, multimillion-dollar job with Debevoise and Plimpton, closing the circle in what looks like a classic case of revolving-door corruption.”

Maybe we need a reform – you can come from industry to work in the government, but once you have worked for government you can never work in the regulated industry….forever (or maybe 10 years???).

We don’t need reform, we need a guillotine.

Here here!

Right On!

I think you might be on to something there, diptherio. As Joseph Stalin said, “A man can be a problem. No man, no problem.”

The argument against this idea – restricting govt regulatory staffers from taking a job in the industry they regulate – is that the best and brightest will not want to work in the gov if doing so will forever foreclose them from working in that industry.

The argument has appeal. It has merit. I would even say its accurate: imposing such a restriction will cause the gov to lose the benefit of having the most accomplished citizens taking jobs as regulators.

The answer is to impose such a restriction only for sectors where damage is demonstrated. The failure of financial regulators has caused catastrophic damage. Therefore here is my new rule proposal: “Beginning on Jan 1, 2014 any person working for a federal financial regulatory body (or the Treasury, Fed, or doing financial cases at DOJ, etc) shall not take a job in the financial industry.”

This rule gives the current staff almost a year to find a job in their preferred investment bank, fund, etc. Since my rule is extreme (because extreme circumstances require it) in that it f**ks up the employability of these staffers we will need to add some hefty labor protections for staff who stay on after the first of the year so they won’t be fired without serious cause.

So my rule would likely mean we would have to make due in the future without brilliant citizens serving the public such as Geithner, Holder, and Hank Paulson. Methinks we will be better without the brilliant regulators and can make a go of it with average Joe’s (and Jane’s).

There is no evidence that the government would be losing intelligent enforcers if a career in industry were foreclosed. To say otherwise is unscientific. In fact, in our parents generation, people who made careers in government were often much more experienced, much more well versed in the law, and generally more intelligent than their industry counterparts because of the stability and support of their workplace. Businessmen could not abide them. In fact, it was ridding the government of its cadre of excellence that has been the first — and most successful — goal of the Reagan-Thather revolt.

I agree that the “best and the brightest” problem will likely turn out to not really be a problem. But as noted its essentially resolved in piling on lots of security to the regulatory position.

I’m in favor of this with Congress, by the way. For each year as a legislator, the legislator gets paid for an additional year, but likewise for each year as a legislator, the legislator is banned from private sector employment for a year after leaving office. Something like this formula should apply to all positions within government. For federal judges, they would draw their salary for life, regardless of whether they are actively serving on the bench, but essentially could take no other employment (elective office and cabinet positions excepted).

Focus on Mental Health Law Unfair

This is a sliperry slope. The healthcare workers are likely to err on the side of covering their own asses. Since mental health definitions are vague as is, this opens up the door to diagnosing people with oppositional defiant disorder (ODD). To quote from Wikipedia:

According to Dickstein, The latest DSM attempts to redefine ODD by emphasizing a ‘persistent pattern of angry and irritable mood along with vindictive behavior,’ rather than DSM-IV’s focus exclusively on ‘negativistic, hostile, and defiant behavior.’ Although DSM-IV implied, but did not mention, irritability, DSM-V now includes three symptom clusters, one of which is ‘angry/irritable mood’ —defined as ‘loses temper, is touchy/easily annoyed by others, and is angry/resentful.

A blanket excuse to raid the home of anyone who displays public anger. It’s funny how the law did nothing to improve the abysmal state of mental health care in the US, it just opened the doors for the law enforcement action.

It’s also funny how the same legislators who want to focus on better mental health treatment passed the fiscal cliff legislation (which was AFTER the Newtown shooting and the clamoring for better mental health care) which CUT mental health funding even more than it already is. Mental health is always the first part of any budget to get slashed, esp. at the state level. The hospitals no longer keep hardly anybody and there are few community resources for those who don’t have means to pay. Not only that, but the newer and safer medications to treat psychoses (and more acceptable side effects) easily cost several hundred dollars each month. If mental health care were adequately funded period, that would go a very long way indeed, including substance abuse, as that is a far greater predictor of violent/suicidal behavior than mental illness, as in 10 times greater (I disagree that mental illness plays a large part in our gun homicide problem).

The worst part with the DSM is, it prevents the true disease from being studied. Most “psychological problems” are REALLY from low level infections and probably gastro intestinal issues.

Infections that one can not clear do to bad genetics, pesticides, weak immune systems, heavy metals, etc…So when the person has a real physical disease, he gets disgnosed with mental illness instead.

This happens to be going on since Sigmund Freud, and other psychiatrists brought the United States the mental illness plague in the 1930’s….

the DSM and psychiatrists need to be watched very closely if you ask me…..People can be locked up by these guys without a trial. Psychiatrists have immense power with the way the DSM is progressing.

We should consider calling this the mental patriot act.

Also Thyroid dysfunction.

I have family with thyroid issues. Both from direct experience with them and perusing some of the research, I found it surprising the degree of psychiatric symptoms that can be caused by that.

Also, it appears that thyroid disease is not yet fully understood – sometimes current lab work and treatment modalities do not work, but this is not well known.

You can look at this site for more:

http://stopthethyroidmadness.com

For myself it is another example of the failure of ‘experts’ and ‘elites’.

My endocrinologist says 1/3 of the women on anti-depressants have low testosterone. Giving them testosterone would clear up what looks like depression.

Women are just about never have their testosterone levels checked. It’s a pricey test.

And don’t get me started on vitamin and mineral deficiencies. Because they’re fundamental to so many biochemical processes, they can mimic *everything*.

A lot of doctors discover this with one particular vitamin or mineral and become “one-vitamin nutcases” claiming that this vitamin is the cure for everything. They are wrong.

However, the fact is that the RDA amounts are too low on the vast majority of vitamins and several minerals.

Any single vitamin deficiency (A, C, D, B12, niacin, riboflavin, magnesium, potassium, etc.) can cause a huge mess of seemingly unrelated symptoms.

Magnesium deficiency is exceptionally common because most plants these days are grown in magnesium-depleted soil. B12 deficiency is very common because B12 is hard to absorb (it ought to be generated by symbiotic gut bacteria, but most of us don’t have those). The most common form of B12 for sale isn’t absorbed at *all* — cyanocobalamin is only useful if injected. (Methylcobalamin can be absorbed.)

And on and on and on. First thing to check is nutritional deficiencies, second is chronic infection, third is hormonal dysfunction (note that this can be caused by nutritional deficiencies or infection, so), and there’s a whole gob of varieties of each of them.

I guess I’ve had a few bosses over my lifetime with ODD. Too bad I couldn’t report them for mental health issues:(.

I wonder if George Washington would be diagnosed ODD? He was rather touchy about the British, a real obsession.

Maybe start with SSRIs: http://ssristories.com/index.php?p=school

From last month but relevant again as it’s come up vis a vis the Hagel fight.

Chas Freeman on hasbara:

http://www.mepc.org/articles-commentary/speeches/hasbara-and-control-narrative-element-strategy

And yet another disgusting bit of hasbara from Jennifer Rubin of the WashPo as she comments on Freeman’s piece.

http://www.washingtonpost.com/blogs/right-turn/wp/2013/01/28/chuck-hagels-colleague-so-many-jews-so-much-disloyalty/

Senators McCain, Inhofe, Graham, they really should be embarrassed by their “performances”. Our senior armed services senators were put to shame by freshman members, who at least asked serious and thoughtful questions. There are serious global issues that we should be hearing how Hagel intends to deal with, e.g. threats by N. Korea, Pakistan, instability and terrorism in N. Africa, etc. Yet instead our experienced legislators focus on questions on his views over a war we’ve ended in Iraq; who in Congress is intimidated by the “Jewish lobby”; used his support for nuclear arms reduction to question him on his alleged support of “unilateral disarmament”; and because an Iranian “ministry spokesman expressed “hope there will be practical changes” under Hagel”, wanted to know why Iran was endorsing his nomination. While overall Hagel didn’t perform so well in the face of his inquisition, his answer to the last question was stellar. He said he had enough difficulty with American politics and that he had no idea.

Doesn’t matter who the SecDef is.

We’ll deal with countries and groups that refuse to genuflect before their Usraeli masters exactly how Obomber prefers to deal with them: drones, sanctions, and spec-op goons.

Winslow Wheeler’s commentary on the hearings at Counterpunch are worth a read. He was not impressed with Hagel’s performance.

http://www.counterpunch.org/2013/02/01/the-hagel-hearing/

Speaking of Hagel, though his nomination fight is undoubtedly going to focus on foreign policy, it might be worthwhile asking the former member (through 2008) of the Senate Banking Committee (and ranking member of the Subcommittee on Financial Institutions) a question or two about his role leading up to the financial/banking crisis.

But then, considering who his donors are and the boards he sits on now, the questions kind of answer themselves.

http://nakedlypolitical.com/2013/01/24/haggling-for-hagel/

Good point. In summary:

“It’s not surprising that an Administration as Wall Street-friendly as Obama’s would choose a man with close ties to finance like Hagel, particularly to head the largest employer in the world, the US Department of Defense. He’ll control half the federal discretionary budget and decide whose contracts get cut and whose remain. Instead of focusing entirely on foreign policy controversies, watchdogs would be wise to follow the money domestically as well.”

P.S. You have a great blog list. Especially #14. ;-)

We aren’t going to get a SecDef who is Corporate-UpperClass-neutral. That won’t be allowed regardless. At least he is not a “send-the-marines” chickenhawk, and he is also feared and disliked by AIPAC. That should count for something.

Amy Zegart, of Foreign Policy on the lies of Zero Dark Thirty:

Zegart also explains how manipulative the movie is:

Instead of seeing torture as immoral and sadistic, people will leave the movie, like Jon Stewart did, viewing torture as “difficult”. Once the crimes of the CIA become filtered through shades of gray, the next step is to support keeping the public in the dark:

Re: Obama Admin Goes After Fair Use At Universities….

The writer of this piece at Techdirt doesn’t seem to realize how Obama’s support for education is mostly a ruse to allow the corporate sector another feeding ground.

Basic neoliberal playbook.

—“It would be a complete embarrassment for an Obama administration that has argued that improving our education system is a key policy issue to turn its back on education by having its Justice Department argue against a public university library and students, and in favor of a blatantly self-interested copyright collection agency, funding some foreign publishers, trying to shake down students for extra money to learn.

Just the fact that the US Copyright Office is supporting this and asking the Justice Department to make this move is a sign of how screwed up the Copyright Office is today.

And it remains unclear why this is even an issue that concerns the Justice Department at all.

Since when is access of students at a public university to educational materials an issue that should be of any interest to the Justice Department?”—

http://www.techdirt.com/articles/20130131/00310621834/obama-administration-considers-joining-publishers-fight-to-stamp-out-fair-use-universities.shtml

Another example of regulatory capture: RIAA bigwig who architected anti-technology lawsuits is now #2 at the US Copyright Office: http://boingboing.net/2013/01/31/riaa-bigwig-who-architected-an.html

Of course the record industry runs the US. Nobody does payola better.

RE Texas prosecutor shot. Too much noise on gun violence these days. Can’t pick out trends. Looks like time to dig in a get a real idea. Tips on good sources regarding gun violence?

RE: Student loans. Nah, there is no subprime, b/c Kennedy and Obama cut out the banks and bought all their loan stock between 2008-2010. Its like TARP, but no vote!

So, in this Reuters piece on the Unemployment Rate rising to 7.9% the “economy” is seen as some kind of ship or craft that needs to “weather” the “headwinds of higher taxes and spending cuts”.

Typical silly journo-speak.

—“Steady job gains could help the economy weather the headwinds of higher taxes and government spending cuts. A payroll tax cut expired on Jan. 1 and big automatic spending cuts are set to take hold in March unless Congress acts.’—

http://www.chicagotribune.com/business/breaking/chi-january-jobs-report-20130201,0,5155643.story

Illustrated — the power of myth:

Kitty Genovese’s murder was an infamous event. It was preached from southern pulpits as a definitive example of the irredeemable iniquity of Sodom & Gomorrah (a/k/a New York City). Thirty-eight uncaring witnesses were as iconic a total as the six million murdered in the Holocaust.

Now it seems that the Gang of 38 alienated urbanites — seemingly lucky to have escaped prosecution for callous indifference in those pre-911, pre-9/11 days, when you actually needed the phone number of your local precinct — might have totaled … erm, well, five or six.

Myths, Pulitzer prizes, infamous events that loom large and shape our culture: things ain’t always what they seem.

Friends;

In reference to “Texas Prosecuter Shot”: do notice the graphic. A pistol magazine in the background and a file of .22 calibre bullets in the foreground. .22s? Those are the preferred rounds of professional killers. The usual scenario is a round to the head from a silenced .22 revolver. This murder fits the category of a ‘drive by’ killing. And Texas? If the narco angle proves out, the Cartels have just begun to flex their muscles ‘en El Norte.’ This will get very ugly.

This will no doubt get the feds’ attention. It’ll be interesting where this leads.

Friends;

While over at Gawker, do, yes do, cross click to the Cookie Monster story. That “ransome note” is just great! The coments aren’t too bad either. “Krummel Monster” indeed!

Something said yesterday aobut posting the Julian Assange transcript?

Apparently Lambert has it. I’m sure he’ll email it to you if you ask nicely :)

Yves asked her readers to clamor for the Assange transcript as a post if we wanted it. Just a very few of us responded in the affirmative.

I still think the Assange video and transcript deserve a wider audience than NC Links, and hope they will get it.

This is just awesome:

“Bank of America began hosting a mortgage outreach workshop at the Charlotte Convention Center today, aimed at helping the 4,500 people within a 75-mile radius of the city with a loan serviced by the bank that’s more than 60 days delinquent.”

http://obsbankwatch.blogspot.com/2013/01/bank-of-america-hosting-mortgage.html

When Do They Admit They’re Wrong?

Another day. Another triple-digit gain for the Dow. Hmmmm. What’ve we heard for three years now? The economy is not recovering. We’re going back into recession. The banks are insolvent. The market’s gonna implode. You’re a fool to buy stocks. Everything is overvalued. etc. etc. etc. When do they admit they’re wrong? When do they pull an “Alan Greenspan” and look into the camera and say “There was an error in my analytical framework”? Unfortunately for me, I let all these people — and you all know who you are — bedazzle me with their erudition. The completeness of their perspication. The detail of their comprehension. And I thought — because I followed their meanderings — that I was “more informed” than the average Joe Moron heavy into the market. hah. I could have been in Paris by now if I’d gone long. I wouldn’t be wasting my time here in the peanut gallery. I’d be there with glass of red wine in hand navel gazing into some realm of inner being wasting time as intensely as possible, not flailing around with the white collar ditch dig. Just another stiff. Another moron behind a desk. That’s me. I don’t know. Either this is the absolute pinnacle of the top of the top, or some folks are gonna have a lot of explaining to do.

Dear craazyman;

I feel for you pard. However, the key phrases here are: Irrational Enthuseasm and Crap Shoot.

BTW, I don’t have enough to play the market in any meaningful way. (The last time I did at all well in any gaming was when I used the license number off of an interesting foreign car I espied whilst driving along Interstate 10 to play the Louisiana Lottery Pick Five. Won a couple of hundred dollars. That and the fabulous Random Darts Thrown at the WSJ Stocks Page investment game some business school plays every year prove to me just how much blind luck plays in human affairs.)

yeah, the only big gamling I’ve ever done is the scratch off lottery in Virginia — the $1 and $2 cards. Once I spent $5 on a Redskins theme scratch off card but lost. I think you could have won up to $50,000 and I felt lucky, there in the 7-11 at 5:30 am getting coffee.

But I didn’t even win my $5 back. I didn’t win anything. I could feel it coming halfway through the scratching. I could feel the zero. It hurt and I never did it again.

Once I won $10 on a $1 card. Then I won again the next day. I was on a roll. I think I hit a cold streak after that — for about $12 bucks. if I do the math it comes out negative.

It’s never easy unless you really get lucky. That’s why I sit around and carefully think through all the ways I can be unlucky in the market. It’s hard to get rich quick when you think that way. I don’t know what to do.

I am thinking the same and wonder if I should pull out of Hussman’s fund and go into a 3xDow ETF.

Yeah he’s the Pied Piper and I’m one of the ragged kids who follows him around. :) Him and Shedlock and Martenson. All three of them. Even Ed Harrison with his recession call. All four of them. I look up to all four of them like they’re my 4 smiling gurus and I’m some yoga fool trying to learn to lay down straight on the mat.

I’ve had this deep unconscious inarticulate feeling that I should have been in the market now for months, but every Monday I read Hussman’s column and get intellectually frozen. Then I read Ed’s posts and I get confident. Then I read something on Martenson’s site and I get very confident. yes, everything will crash, it will, no doubt. Then the market goes up 190 points for some reason. And it keeps going. And going. After a while you begin to wonder.

I’m pretty certain that whichever day I choose to buy that 3xDJI will mark the multi-year top.

Well, to make up for lost ground, one either has to go 3XDow or put $$$ into buying a high-end home.

Apparently, homes over $5 million are hot.

I just need a few partners.

Jesse recommends going long the VIX. Probably less stomach-churning than shorting stocks.

Not darts. You just need the right cat.

http://www.guardian.co.uk/money/2013/jan/13/investments-stock-picking

There’s a reason they form such a large proportion of NC antidotes.

Seriously though, I too would have benefited from listening more to Calculated Risk, and less to John Hussman. CR has been right about pretty much everything so far, but I still cannot accept his sunny view of the future. Apart from all the social issues and human suffering, there’s Stein’s Law, and things certainly cannot go like this on forever, just ask Bill Black.

That there’s going to be another financial crisis is a certainty, but it can happen in 3, or 5, or 10 years and there’s not way to tell.

But more relevant to the near future, I believe that a real economic recovery will inevitably cause inflation. Yes, I know inflation has been predicted for years and hasn’t happened for years, but that’s because of the lukewarm recovery, low capacity utilization, and high unemployment. I think it’s almost a certainty that if the economy picks up for real, so will inflation. Krugman might cheer it, but he might get more than he bargained for. I’ve seen inflation and attempts to fight it – both can wreck the economy, it’s a very dangerous and unpredictable phenomenon.

And P/E ratios in high inflation environment tend to be low. That doesn’t bode well for the Dow, even in nominal terms.

I’m in the same boat.

I remember saying, in my innocence, well DOW’s down to 8000, I said I might buy if it went below 10,000.

A guy said, ‘it’s not coming back.’ Checked calculatedriskblog, doomsters all, (except CR, itself, called the bottom).

Then after nightmare of HAMP, caught some things here.

Left 300,000 on the sidelines all this time. Could have been in Paris, too, or at least faced higher-quality catfood in the future. (knock on wood, just kidding, I hope, I hope).

This market has nothing to do with fundamentals. CR looks right only by accident. I have a buddy who is very good at parsing data. Two things have been clear for a long time:

1. Harder indices are generally more negative than ones that are based on softer data or require more massaging (that does not mean bad faith by statisticians as much as likely normal statistical adjustments being based on “normalcy” which is not operative now).

2. Indices that normally are pretty consistent being inconsistent to the point of conflicting, routinely. Look at today. NFP up 247,000 v. the Household Survey up 17,000. WTF??? He has zillions of examples like that (including housing start related data, BTW).

There is a long standing saying “Don’t fight the Fed.” Problem is all the fundamentally oriented people have been reluctant to recognize that is what they are doing (I include me, I was up only 1% last year. My big rule is never lose money and I have still managed not to do that).

Did you know, for instance, that S&P earnings peaked 1Q 2012 and have been down every successive quarter since then? You’d never infer that reading the financial press.

This market is all about the belief that the Fed will do whatever it takes to save the markets, and who cares about the real economy.

Did you know, for instance, that S&P earnings peaked 1Q 2012 and have been down every successive quarter since then?

I didn’t. That’s amazing – there’s a lot of talk of earnings but that simple fact is never stated, at least I’ve never seen it.

Another fact, John Hussman’s favorite, is that profit margins (and the share of profits in GDP) are the highest ever. That’s not a projection or estimate.

And the share of wages is the lowest ever, which has been covered a lot here.

And then there’s underinvestment, also covered at NC.

Lots of ominous hard facts indeed.

…hmmnnn….S & P is owned by bushit family corporate buddies McGraw & Hill, who were awarded NCLB contracts for new textbooks…

not as far as I could throw them, and I have some experience in throwing..

The depression — before the big final skyrocket in oil prices — has been an exceptionally good time to invest in hard goods, like upgrading your house and land for greater energy-efficiency and durability.

Since I’ve been doing that, I don’t feel bad at all about the amount of money I don’t have in the stock market. It will be a lot more expensive to do those retrofits in 5-10 years.

Has it occurred to you, craazyman, that maybe the reason the Dow is doing so well is because you’re not invested in it? You know, like how taking your umbrella with you ensures that it won’t rain.

absolutely!

No doubt about it. That occurs to me every day.

Abe and I are on the same investment team. The minute we plow in big, that will be the top.

The Dow became unhinged from reality when it became dominated by High Frequency Trading.

That said, the current corporate-criminal-friendly administration has made it very easy for many corporations to steal or print very large amount of money.

The risk you take when “investing” in them is that the CEOs will get tired of sharing the loot with the stockholders and will take it all for themselves. This happens intermittently.

Dear Nathanael;

“The risk you take…” Exactly that is happening now at the DIY Boxxstore I work in. (Hint: We’re not those guys in Orange.) Funny part is, all the old timers recognize this and are scrambling to ride this wave before the curl crashes.

The large issues opened up with Platinum Coin Seigniorage are How is our money created? Who controls the creation of our money? And Should this system be changed? It beats me why these issues are rarely defined or discussed in public discourse. Having read much, and understanding some I’m fervently wishing that our Dear Leader (YS) would weigh in on this. Joe Firestone sounds absolutely right to me (with one exception, addressed later) but I haven’t the depth to assess.

Joe Firestone’s latest at FiredogLake, part 1 of 6.

http://my.firedoglake.com/letsgetitdone/2013/01/31/framing-platinum-coin-seigniorage-part-one-basics/

A much-needed opening para

“How many times have you heard that the Government can only spend money after it raises revenue by either taxing or borrowing? Nearly every time someone talks or writes about the US’s public deficit/debt problem? How come nobody asks why, since Congress has the unlimited authority to create coins and currency, it doesn’t just create money when it deficit spends? The short answer is that Congress in 1913, constrained the Executive Branch from creating currency or bank reserves, delegated its power to do that to the Federal Reserve System, and never looked back when we went off the gold standard in 1971, even though this removed the danger of money-creation outrunning gold reserves, and also created a new monetary system based on fiat currency.”

And an astute comment from Wigwam which must be absorbed into Joe’s series:

“Article 1 Section 8 gives Congress three ways to fund its appropriations: taxes (etc.) [Clause 1], borrowing [Clause 2], and coining money [Clause 3]. These powers have been delegated with restrictions to the Treasury, which is part of the Executive Branch of the government. It has also, delegated to the Federal Reserve the power to issue money (bank credit) in exchange for similarly valued assets (securities, and IOUs), and Congress has placed no limit on the amount of money that the Fed can issue, e.g., per rt.com:

“But, we were talking about the “coining of money” by the Treasury, which has been going on each year for the past 220 years since the founding of the U.S. Mint. And the seigniorage from that coining has been supplementing taxes and borrowing in defraying government expenses each of those 220 years. Also, in spite of the that until 1996 Congress specified the denomination of each coin it never put a bound on the quantity of any coin and thus did not impose any limit to the amount of money that could be coined during any period of time. The only limiting factor has always been logistics, and in 1996 the passage of 31USC5112(k) left the denominations on platinum bullion coins to “the Secretary’s discretion,” which removed the logistic limits to the coining of money.

“I bring these points up because some lawyers argue that 31USC5112(k) is visibly unconstitutional, claiming that it violates the separation of powers, etc. But, it has long been established that Congress has the right to delegate the power of unlimited coinage to the Treasury and the power of unlimited credit creation to the Fed. The only thing new about 31USC5112(k) is that it removes the de facto logistical limitation for multitrillion-dollar coinage.”

******************************

My problem with Joe F is both strategic and tactical issues with his $60 trillion coin. I can happily digest the notion of resolving some $6.8 trillion of intra-governemental debt…. But even this would be a heckuva a hill to climb in any dimly possible real-life scenario. But it is doable and example-setting. Where a $60T coin may be legitimate, US bondholders (esp foreign) would be screeching that their T-bills are completely devalued. The financial world aflame! As good as that sounds, a $60T coin would be a risk, totally uncharted waters in the real world. Hey in one fell swoop we go from being most indebted to Wheeeeeee, we’re rich, unlimited! What could go wrong??

Jack H

This topic has received lots of coverage here.

LucyL, I’ve read it all– certainly all thats on NC. And carefully. The bigger issue is rarely addressed anywhere. I’m not ploughing old furrows here… Your “lots of coverage’ hasn’t really plumbed the subject…..

To keep from buying an AK-47 and exercising my 2nd amendments rights and going jihad on all the horribly complicit gov’ment wastes of human flesh who have overseen the bankrupting of the Americasheeple, I have been working on a mental Rubik’s cube of various forms of the black comedy series the “Three Bank Stooges.” First, we have Holder, Breuer, and Khuzami, and the fourth occasional stooge [just like in the movies!], Schneiderman, who – depending on Mary Jo White, who is set to become the first female stooge- may become a permanent stooge.)

There is Three Bank Stooges set two, (different movie, same script, just like the old Doris Day/Rock Hudson pics) Obama, Geithner (soon Lew) and Bernanke.

Official Bank Stooges: Lyin Dimon, The Orifice of Omaha, Uncle Tuffett, and a rotating cast Stumpf, Rubin (who is rumored to be dead or in hiding from the Mob of pissed of Americans who have yet to find their mojo) and any other bankster CEO who is hot that week.

Anyone can play.

Year five of fighting Wells (servicer) BofA trustee, Morgan Stanley (Trustor) refusing to take my payments in order to foreclose. Yeah, LPS is in there too.

Waters, Cummings and Warren. More transparency on the foreclosure fraud debacle. Surely the NC series on the foreclosure review process will give them ammunition. It’s all there in black and white. Waters especially will go after it, and Cummings too. But I’ve got my doubts about Warren’s motives. Time will tell if she is significant.

I may be in the minority but I think Warren is being underestimated.

Warren and Waters. Now there is an unlikely combination.

I’d like to think so, but the Democrats have a honed technique of using charismatic and honest-seeming shills to rope in the marks and leave them worse off than before. See under Obama, Barack. If Warren’s up to scratch, she’ll pronounce the words “accounting control fraud,” let Bill Black testify, call for some bankster CEOs to be jailed, and follow through until it happens. Sure, there’s always a million to one chance, but my bet is na ga happen.

She reportedly raised a heck of a lot of money for her Senatorial campaign. Has anyone done an analysis of her donor list and highlighted to whom she is in hock?

“Individual contributions” i.e., not PACs.

Could be worse, but oddly, or not, the top donors are from the Obama faction of the Democrats: MoveOn #1 and EMILY’s List #2. Otherwise universities, hospitals, law firms. Top zip: 02138 (Cambridge, MA). Small donors online were handled by Kossacks.

So, based on funding sources and in policy terms, she’ll be a female Obama who doesn’t smoke.

Adding: Warren’s net worth is $4,609,025 to $14,696,000. Most of her money is in real estate, interestingly enough.

EMILY’s List isn’t from the “Obama faction” and neither is MoveOn.

EMILY’s List simply gives money to women who run as Democrats. (If Yves ran, she’d get EMILY’s List money.)

MoveOn… well, it’s a somewhat inchoate organization, but its many members vote on where to put its money and it can therefore shift on a dime, as public opinion shifts.

Warren to take action against Wallstreet. Thats not even a remote possibility. This is America. And Washington is Washington.

Warren is a U.S. Senator recently elected due to substantial financial assistance from the Democratic Party (just stating the obvious). As a Democrat, she has little choice but to tow the party line. I don’t recall the party looking to hold anyone accountable recently.

She is even further indebted to party leadership since she was given a seat on the Banking Committee. A seat on this committee means you don’t even have to actively work much on hated fundraising. The donations will come in unsolicited on a steady basis from (drumroll) the finance industry. They are her friends now. And the money she can raise is not just for herself. That seat enables (and obligates) her to raise substantial sums for the party. And I doubt Warren would want to dissapoint Harry Reid after he gave her such a superb committee assignment.

Also, that committee has a powerful Democratic chairman (Tim Johnson) who will let committee members play whatever inconsequential games they like to play at; i,e, games like writing letters to the Federal Reserve wanting to know what became of the foreclosure reviews. Should Ms Warren ask the Chairman to hold a hearing to investigate, lets say, the foreclosure review, or the derivatives holdings of B of A and subsidiaries; or even better to issue a subpeona to Blankfein to see how many times he has visited Obama at the Whitehouse (ha ha) and dined with Bernanke and Geithner and how much the bottle of red cost; the answer will be we have other matters that more senior committee members have been waiting for and you have to wait your turn.

If the rambunctious Warren stands up for herself (and the victims of Wallstreet) and says I promised voters I would find who was responsible etc.. In that case she will politely be reminded of how important it is that the party be able to raise enough money to retain the Senate. “And it would truly be damaging for America if the Rs got control and that is what’s really important Liz. And you know how much trouble Harry had meeting fundraising goals we need refill the coffers for 2014 and don’t forget Massachussets will now have an expensive election. And Obama visited Mass. to do a fundraiser for you even though he was in a tight race himself. He doesn’t bring a hundred secret service guys at taxpayer expense to do fundraisers for just anyone. He genuinely cared about you winning your race. He thinks you are a rising star in the party. The party is your new home and the sky is the limit, just look at your co-senator John. He’s the Secretary of State! And you know Obama has a million things he wants to get done this year and hates this damn crisis as much as anyone but this sort of hearing you want can distract us from important priorities. So lets have one of the subcommittees hold a hearing in Feb or Mar on something you know about like a hearing on “Making Sense of Credit Reports.””

Just saying…

“Sure, Liz. Whatever you want. Just after the midterms.”

Warren is perfectly capable of standing up for what she believes in and ignoring the “party line”.

Because it doesn’t matter.

Unless there are 51 of her, all she can do is talk. The other Senators can prevent her from actually getting anything done.

She can be the exception which is advertised to the Democratic base, to distract Democrats from the Harry Reids and Dianne Feinsteins who really run things.

A bit like Bernie Sanders, really. Or Tom Harkin when it comes to the filibuster.

It’s always fine to have one or two token Senators who stand up for doing the right thing. As long as they aren’t a *majority* the establishment really doesn’t care.

Curb your enthusiasm. I have a post coming which is unduly polite because saying what I really think won’t be helpful to the process (I hate having to be polite but for once I recognize the necessity).

Go read the press release. The goal of the investigation is to restore confidence in the settlement.

Now tell me what that says about how serious it is meant to be.

I think the best strategy in this case is to turn the tables and co-opt Senator Warren to counter the awful possibility that she may try to co-opt this story from the whistleblowers and Obamacise it.

How to do this? FWIW a few suggestions

1. Be gracious and thank Senator Warren for having NC on her morning blog roll.

2. Remark on the coincidental timing of her interest in this story with last weeks NC advocacy for the whistleblowers and the cynical role of the formerly OCC staffed ‘independent’ reviewers at Promontory.

3.Recommend she explore the significance of the sudden dismissal of the OCCS Senior Deputy Controller in charge of large Banks, who must have played some role in this

http://www.americanbanker.com/issues/178_21/occ-senior-leadership-gets-another-surprise-overhaul-1056319-1.html

4. Congratulate her on her outstanding commitment to the middle class by acknowledging that it was the efforts of honest middle class whistleblowers heroes who brought this to her attention.

5. Congratulate her for aggressively trying to put a face of middle class misery on the “too complex to prosecute frauds” that any 12 year old can understand as cliqueish bullying by the cool kids.

Missing property tycoon found lost, ragged and scarred:

http://www.bbc.co.uk/news/world-europe-21291356

The power of Kawaii.

I think the reason Nihon-jin like Hawaii so much is that it sounds like kawaii, though there is no evidence to say young, honeymooning couples are more careful there than back home in Nippon.

Welcome to kawaii Hawaii.

Oh, yes, Hawaii’s kawaii.

“Canadians’ possible role in Algeria attack of great concern to U.S.”

http://www.thestar.com/news/world/2013/02/01/canadians_possible_role_in_algeria_attack_of_great_concern_to_us.html

So, is the Torturer in Chief about to put the citizens of an allied country on his kill list? Not that the Conservative PM would lift a finger to stop him.

Re: Focus on Mental Health Law

There are many unintended consequences to policy and nomenclature, some of which undermine their larger public purpose in civil democracy.

In a few months the DSM V will replace the 4th edition.

On the potential “good” side, this will mean funding is available for medications and treatments for those needing such, after 14 days of suffering.

On the potential “bad” side, this means that those getting council will possibly be involuntarily classed with such a disorder, perhaps subject to the stigmas that go with it, and, subject to the restrictions to lifestyle or employment of those under such classification (like firearm restrictions).

Is 14 days really a sufficient or realistic duration for grieving in any and every case?

Perhaps the Newtown and interested groups can form to lobby and inform the editors of the DSM to rectify the status of grieving.

Relatedly, was a stomach content analysis performed, or an autopsy, on the perpetrator of the Newtown massacre? It seems he had the neuro-developmental disorder Aspergers and had been left home alone for 2 days prior to his willful carnage. Moreover, federal funds for programs to bridge youth-to-adult for those so handicapped were not accessed, nor was the formation of an online or local personal support group accessed to remedy times of acute isolation.

The public purpose of health system policy, law, insurance, classification, and the focus, development, and intense funding of the pharmaceutical sector and its resultant specialized medications, need be guided by the better, larger public purpose.

(somehow the 3rd paragraph in the above dissapeared, it sould read as the following)

In a few months the DSM V will replace the 4th edition.

One of the changes in it is to the status of “grieving,” which will become a “major psychological condition” after 14 days.

bank of satan’s online banking crashes

(but get this)

Customers of another bank, BBVA Compass, also hit social networks on Friday to complain about problems accessing their accounts online.

The bank responded on Facebook, telling customers that it was working to resolve system issues affecting direct deposits, such as payroll and Social Security checks, online banking and phone-banking access.

The lender announced a few hours later that the problems had been resolved.

Spokesman Thaddeus Herrick did not elaborate on what might have caused the problems.

BBVA Compass is the U.S. division of Banco Bilbao Vizcaya Argentaria SA, Spain’s second-largest bank.

http://finance.yahoo.com/news/bank-americas-online-banking-crashes-211558505.html?l=1

ground hog holiday, nothin to blink at

Matt Taibbi on Big Banks’ Lack of Accountability

February 1, 2013

Rolling Stone‘s Matt Taibbi joins Bill to discuss the continuing lack of accountability for “too big to fail” banks which continue to break laws and act unethically because they know they can get away with it. Taibbi refers specifically to the government’s recent settlement with HSBC — “a serial offender on the money laundering score” — who merely had to pay a big fine for shocking offenses, including, Taibbi says, laundering money for both drug cartels and banks connected to terrorists.

Taibbi also expresses his concern over recent Obama appointees — including Jack Lew and Mary Jo White — who go from working on behalf of major banks in the private sector to policing them in the public sector.

“The rule of law isn’t really the rule of law if it doesn’t apply equally to everybody. If you’re going to put somebody in jail for having a joint in his pocket, you can’t let higher ranking HSBC officials off for laundering $800 million for the worst drug dealers in the entire world,” Taibbi tells Bill. “Eventually it eats away at the very fabric of society.”

http://billmoyers.com/segment/matt-taibbi-on-big-banks-lack-of-accountability/

Applebee’s waitress fired for sharing rude tip receipt:

http://www.upi.com/blog/2013/02/01/Applebees-waitress-fired-for-sharing-rude-tip-receipt/9051359728472/

RE: Link for Late Night: Unfriendly Skies

Boeing once exemplified the great American enterprise. Their products were legendary for their reliability, durability and safety. Short-termism, financialization and outsourcing have transformed it into a corporate Dorian Grey.

A comment to the article captures the current image of the company: “Can it be a coincidence that ‘Boeing’ is the sound made when a spring pops loose?”

More good insights on what went wrong with Boeing:

part 1:

http://www.forbes.com/sites/stevedenning/2013/01/17/the-boeing-debacle-seven-lessons-every-ceo-must-learn/

part 2

http://www.forbes.com/sites/stevedenning/2013/01/21/what-went-wrong-at-boeing/

They were warned; but they chose to ignore it.

http://seattletimes.com/html/sundaybuzz/2014125414_sundaybuzz06.html

Albaugh said that part of what had led Boeing astray was the chasing of a financial measure called RONA, for Return on Net Assets.

This is essentially a ratio of income to assets and one way to make that ratio bigger is to reduce your assets. The drive to increase RONA thus spurred a push within Boeing to do less work in-house — hence reducing assets in the form of facilities and employees — and have others do the work.

20 years ago, while working in engineering for a Fortune 200 manufacturing company, I was tasked with pitching the gospel of RONA in a business literacy class for employees. Compensation incentive payments for all employees were computed on the basis of hitting RONA targets. Fortunately this strategy did not produce the negative results experienced by Boeing, due, I believe, to the lesser complexity of our products and the close communications with domestic, rather than foreign suppliers.

Great article(s).

‘Last year, more active-duty soldiers killed themselves than died in combat. And after a decade of deployments to war zones, the Pentagon is bracing for things to get much worse’

http://www.guardian.co.uk/world/2013/feb/01/us-military-suicide-epidemic-veteran

‘Missing Irish millionaire found after eight months’

http://www.guardian.co.uk/world/2013/feb/01/irish-tycoon-kidnapped-found

‘When Vallely and her partner Peter Rehill picked him up on the Leitrim-Cavan border, he had a one-word insult – reported to be “thief” – carved into his forehead.’

No wonder the 1% are installing panic buttons and safe rooms.

Great find Glenn.

This is a real-life Peasant Pinguin Chronicle!

Awesome article.