By George Feiger, CEO of Contango Capital Advisors. From Contango’s current “Heard off the Street” newsletter

We question whether the widely held judgment that the US handled its banking crisis much better than the Europeans will survive the inevitable upturn in interest rates.

Homebuilder stocks have been on a tear, rising 79% in 2012 and off to a very good start again this year. You have read that the inventory of homes for sale is at the lowest level for years. According to Haver Analytics, median existing home prices rose by about 11% over the last twelve months and in the west by an even larger 20%. Most recently the Census Bureau released in December a very upbeat estimate of annualized seasonally-adjusted starts of 954,000, up over 12% from November. All this sounds wonderful and we agree that the housing market seems to have bottomed. But the picture painted by these observations – that housing is poised for a period of strong growth – is probably too good to be true.

Lies, Damn Lies and Statistics

Starting with the simplest thing, it is hard to interpret construction numbers because “annualizing” and “seasonally adjusting” data given the extraordinary events in the housing market over the last 5 years are difficult tasks. Of that 954,000 starts cited above fully 216,000 came from the seasonal adjustment, according to Business Insider. Similarly, they stated that, over the last 12 months, we observed monthly average 67,000 permits for new privately owned housing, 65,000 starts, 54,300 completions and only 30,900 sales. Moreover, apartments represented well over 35% of total housing starts, a level over 10% more than has prevailed since the mid-1980s. The single family home market still languishes.

More Homes Than you Think are for Sale

Underneath the number are more fundamental issues that are going to take a while to resolve. First, there remains a large “potential supply” of single family homes for sale. According to BCA Research, if one adds existing homes for sale, single family homes for rent and homes held off the market for other reasons, there remain over 10 million vacant housing units or something well over 7% of the single family housing stock. Foreclosures have slowed down but still run around 1.5 million at an annual rate and delinquent mortgages have fallen but remain around 7% of all mortgages outstanding.

There is another “shadow supply”. Somewhere between 25 and 30% of all house sales in 2011 were cash sales to speculators rather than to potential “final residents”. In all likelihood in the Western states hardest hit by the collapse of house prices the percentage of sales to speculators was even higher. These looked like great investments to generate rental cash flow but some of the original buyers now want out, like the Och-Ziff hedge fund which was one of the early bulk buyers. According to Reuters it proved more difficult than originally thought to manage dispersed single family rental properties and the pick-up in prices provided a reasonable capital gain on exit. But this is hardly a permanent solution to the single family housing market since there needs to be a genuine, long-term buyer at the end of the chain.

But Fewer Buyers Than You Imagine

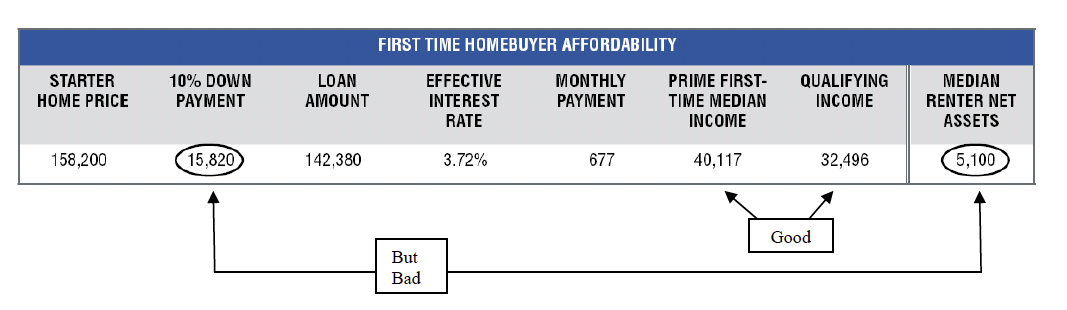

Where will these buyers come from? Optimists point out two factors: the pent-up demand for housing from the rising number of family units that have been kept out of the housing market and are presumably living with families and friends; and the extraordinarily low cost of ownership versus renting. On the latter point, BCA calculates that the typical ratio of hypothetical interest and principal payments to rent of a comparable property is now about 0.35, versus an average of around 0.6. While these things are true, they don’t demonstrate that we will see a rapid upswing in home purchases, as the little table below demonstrates (click to enlarge).

That is, it is no longer easy, or even possible, to get a 95% or 100% loan-to-value mortgage as a first-time (or any time!) buyer. Putting down even 10% appears to be beyond the means of many potential buyers. Why? A combination of two factors. First, household savings rates in the US fell dramatically over the last 15 years as people consumed more, often on credit so that there isn’t much there to make a down-payment. Second, unemployment remains high and people without significant education or highly marketable skills are loath to use all their savings on a home down-payment because they are not secure in their employment.

So What?

We think that housing will get better and gradually increase its contribution to economic growth. But after the bounce from a deep bottom we also think that recovery will be slow and will remain more focused to rental units than has traditionally been the case. In the most distressed markets the easy money in buying distressed property has likely already been made and the complexity of renting it out has only now begun to be appreciated.

There is no “inevitability” about an upturn in interest rates.

In fact, interest rates are historically high. Consider the rates on gilts for the 18th and 19th centuries for comparison.

I stopped reading this article after the first line due to this particular piece of silliness. As long as a sustained economic downturn continues, there is no reason to expect interest rates to go up — ever. Low interest rates *can* continue indefinitely.

It looks like the rest of the article is good, but that howler on the top line is very distracting.

Central banks have a very strong anti-inflation bias. Hawks at the Fed are already champing at the bit to raise rates before the end of the year. Now the publication of the FOMC 2007 minutes increases the odds that dove Janet Yellen will be the next Fed chair, but this is all very much up in the air.

OK, so that’s a point.

However, if the economic downturn is severe enough, the Fed will lose control of rates *on the down side*. Fed rate raises could lead to a spiral which would eventually lead to loss of rate control.

Actually, this is a very nasty scenario, now that I think about it. I haven’t thought it through in perfect detail but it seems like it could lead to currency revulsion.

OK, trying to think this through.

The Fed mainly controls the rate at the “discount window”. If that rate goes up, banks will look elsewhere for funding.

Sound banks can find cheaper funding easily, through depositors, who are not being paid anything.

Bankrupt megabanks can’t, becaue depositors don’t trust ’em.

Result: if the Fed raises the discount rate, the megabanks go under. Not gonna happen with the bank-friendly administration.

The other rates the Fed controls are the rate paid on deposits at the Fed (directly) and the rate paid on T-bills (indirectly).

The rate paid on deposits at the Fed is a subsidy to the Megabanks. It might be increased. This would reduce economic activity somewhat, of course, as money is pulled out of other investments. If it went up well above the rate of return on typical real business investment — say, up to 10% or more — this would suck all the money out of the economy and destroy the utility of the dollar, causing the currency revulsion problem which I mentioned.

Much the same applies to rates on T-bills, but there’s something funny about how the Fed manipulates those, so I think there are some secondary consequences.

One thing to watch carefully is the spread. Most discussion of “interest rates” ignores the spread, which in the case of the Fed is the spread between the federal funds rate and the T-bill rate. I could see a Fed policy which widens the spread, because that’s a bank subsidy.

Aaargh, sorry, wrote “discount rate” when I meant “federal funds rate”. I hate the unnecessary complexity of this banking system.

“Central banks have a very strong anti-inflation bias.” ~ Yves

I’m actually okay with this because I haven’t been persuaded that high interest rates cause poverty to rise.

Yves:Central banks have a very strong anti-inflation bias.

Yes, but to connect that to rates, one must also state that modern central bankers invariably hold the wacky belief that raising rates MUST BE deflationary, must depress while lowering them MUST BE inflationary, must stimulate. When in the very long run, asymptotically, and almost certainly right now, the reverse is clearly true. The “doves” policy would deflate and depress further, while the “hawks” would stimulate and inflate.

Nathanael: This would reduce economic activity somewhat, of course, as money is pulled out of other investments. repeats this error. A percentage point or so higher rates would stimulate, not depress now. A permanent IOR of 10% or more would not suck money out of the economy. It would put more base money / reserves in. That high, reminiscent of Italy a couple decades ago, or Latin America, it would be stimulatory quickly enough and inflationary somewhat after. But “currency revulsion” would not happen. Such high IOR would at first attract foreign savings and strengthen the dollar – it is the traditional method of performing this stupid human trick. Look at the 80s Reagan dollar after Volcker’s high rates.

The Fed/Treas, the government cannot lose control of rates, any more than it can lose control of how many Washington-face dollar bills you need to exchange for a Lincoln-face dollar bill. (True as long as bonds and currency, Washingtons & Lincolns have any value at all.) For the Fed alone, the only thing that could happen is that it could run out of bonds to sell to raise rates with. But it can set IOR wherever it wants, for short rates.

But I’m pretty pessimistic, Nathanael is probably right and the author wrong, interest rates will stay low. Rate rises are very much not inevitable. The doves’ misguided low rates will probably win and further depress and deflate, in light of the low prospect for real fiscal stimulus.

Uh-uh. Think back-to-basics. The basic question is: “is money being spent on *productive activity* or is money simply circulating between financiers without doing anything?”

If the Fed makes it more profitable to shuffle money back and forth between banks and the Fed than it is to put money into machinery, workers, etc., then economic activity will be depressed. *By definition*.

I am a very strong believer in the principle that it matters WHICH interest rates change. The idea that “interest rates” are some generic glob is very misleading.

The South American comparisons are not relevant because the institutional situation was different; it was a situation where the interest rates getting raised were not diverting money from productive activities, but rather directing money into productive activities.

(Note that “strengthening the dollar” by raising T-bill income suppresses exports, hurting US manufacturing, while simultaneously suppressing investment in businesses abroad by capital flight to the US. Result: suppression of real economic activity. In contrast, “strengthening the dollar” by raising returns on IPOs in the US would have quite the opposite effect.

The suppression of private-sector economic activity could be counteracted by expansion in government economic activity — but the Fed will not do that because the Fed doesn’t hire people. That can only be done by *government* spending.)

Yes, there is an inevitability to an upturn in rates. How long before that happens is anybody’s guess. Japan is a perfect example. The U.S. could well end up printing itself into oblivion just like Japan.

“The market can remain irrational longer than you can remain solvent”

The key point here is that while housing may have bottomed, the real estate market is still extremely sick. You don’t bury centuries of sound pratices and rule of law without some damage to your customer base. There’s a reason household formation is still declining. The center of America’s economic engine is getting sqeeezed. I doubt we’ll see any substantive, sustainable recovery until we correct the damage we’ve inflicted.

I sell homes in one of the best real estate markets in the country, and what’s interesting is the disparity you see amongst homes and income groups. We have a lot of working-class professionals who are flush with cash and the upper end of the market is doing quite well. Good demand and limited supply. That being said, we’ve seen only moderate gains considering the small inventory we have. Savy buyers understand that the gains we have seen can all disappear rather quickly. Few, if any are willing to stick their necks out and overpay when a price-pusher wants more than market comps for less-than-prime property.

The lower end of the market would still be languishing were it not for investors looking to pick up cash-flow rental property. Home builders are still very reluctant to put any sizable amount of spec inventory on the ground because they don’t want to damage recent pricing power. First-time buyers are facing an uphill battle. Credit markets are still painfully tight and what limited supply we have is being bid up by investors. Hooray for rising home values!

The point is it’s still a fragile recovery, and we should not forget that paper gains have a funny way of disappearing.

http://aaronlayman.com/2013/01/cinco-ranch-home-prices-tread-water-industry-hype-of-price-gains-overblown/

I think your views would find more traction at Fox Nation.

“Japan is a perfect example.”

Yes, indeed. Your lot have been predicting sky-high rates right around the next corner, for well over 15 years already.

It’s a “perfect example” regarding YOUR problem, largely a psychological one.

Do you notice a difference in structural inbuilt physical quality of houses built before a certain date as against the structural inbuilt physical quality of houses built at or after a certain date? ( or set of years?)

The main section of the house where I live was built before 1900. No styrofoam pediments!

Is that how far back I would have to go? I hope not! I was hoping some kind of quality breakdown didn’t occur till the 50s or 60s at least.

When did we go from boards to particle-board for example?

Does any professional seller-of-houses have some insight into this?

Can’t say. The add-on parts have the world’s most durable particle board, put in I would guess sometime in the 30s — but distinctly inferior to horsehair, laths, and plaster….

Ah. Housing quality. I know something about this.

19th Century: there was actually lots of incredibly junky housing, but it’s already fallen apart. The surviving housing is well-built. In the 19th century, industrial and commercial buildings were *uniformly* well-built.

One other point: houses were built with attention to location, generally outside of flood zones, with windows facing in the appropriate directions for heating, etc — this stopped around 1900 with the invention of central heating and various other techniques which caused people to ignore site considerations.

1900-1929: standards for construction were high across the board, but lots of lead and asbestos create issues. Site considerations were ignored in favor of bulldozing (something which continues forever after).

1930-1945: there was very little construction. There was high-grade construction at the top end and really crummy construction at the bottom end; again, the low-end stuff has mostly been demolished already.

1945-1960: Appallingly bad construction. This is the “junk period”. 1950s houses were built using “modern” techniques which weren’t properly understood, and were built as cheaply as possible to satisfy the demand from returning GIs. 50s housing is practically all crap.

1960-1980: Standards for construction improved. “Lightweight” construction, plastics, siding, and drywall continued to be used, but people were getting a better sense of how to do it properly; insulation started to be used regularly; electrical wiring was done in a more modern fashion; etc.

1980-present: The “green” and energy-efficient housing trend started to change construction techniques; houses constructed in this period are the first ones which *can be* as good as the pre-1930 housing, although made using different techniques. They still often aren’t as good, but that’s just the usual corner-cutting and spec building, which has been going on since the 19th century.

It would be interesting to have some historical data on the issue of quality.

I suspect it was most likely a long, slow slide, punctuated by the occasional industry-wide dropoffs that were implemented nationally over short periods of time.

For studs, my old house in New Orleans, c. 1850, used twelve foot cypress 4X4s, and had a slate roof. For property insurance I always paid premiums for original, replacement. No doubt they would have wiggled out of that one.

It wasn’t. Construction quality has actually been consistently going up since 1960.

1950s houses are *terribly* built, almost uniformly. There was a massive quality drop-off after WWII — during the period when plastic was actually considered “cool”.

Sigh. It’s like an echo chamber in here sometimes. True, rates could stay low. Also true: rates can increase. While it is certainly the case that increasing rates are often associated with economic improvement, it is not always the case. Rates can go up if bond-buyers perceive increased inflation risks. With the Fed now monetizing at a rate of $80b+ per month, that is not an inconsequential risk.

I was thinking of buying a house. But then when I considered that the same scummy criminals who have the government in their pockets are the ones who are handing out the mortgages I realized that renting was the only safe way to go.

The bankers will get you in the rear without even the god damned common curtesy of a reach around, and the government will just stand off to the side and smack you when you try to complain about it.

Just as anecdotal data, talking to pseudo retired real estate agent (traditional market is dead), he is only seeing activity on short sales, auctions, etc, and a premium on people who can pay using 100% cash.

It’s relatively safe to buy a house in cash from someone who owns it outright, provided the house has never had a mortgage which was involved in MERS.

These are things you can have your lawyer check during the title search.

First comment:

Just try to find a house never involved in MERS.

Secondly:

Just try to find a normal person who can fund a complete house price tag with cash.

Well. . . wouldn’t a house that was last sold beFORE MERS was even invented . . . be untouched by MERS?

To lay out an example:

I purchased my house for cash from the first owner, who purchased it in cash from the builder, who purchased the empty lot for cash from the previous speculator, who cleared the last mortage on the land in the 1970s, before MERS was invented.

Another example:

A friend of mine bought his house (on an old farm) from someone who had owned the house since the 1950s and had paid his mortgage off in the 1970s.

Another friend bought his house from someone who had owned the house since the 1930s and paid the mortgage off in the 1950s.

You can find these things.

The problem of having enough money to pay cash for a house? Yes, a problem.

If you find a house that you like, but MERS shows up in the chain of title – I would wager that wouldn’t be a problem – especially if there were subsequent mortgagees.

If you want to buy a house, but don’t HAVE to buy it, are you in a position to force the desperate seller-gang to de-MERSify the title and bring the title back to earth and forcibly re-register in a physical county courthouse?

Is that even theoretically possible to do?

There is no easy way to remove the taint of MERS from a title. Only a “quiet title” suit can do so.

I paid off my mortgage a couple of years ago, and requested the cancelled note. The banker had no idea what I was talking about, mumbled something about fannie or freddie having it.

Still, not much of an alternative other than continue paying interest to these scumbags (Wells-Fargo), and the county recorder lists the mortgage as cancelled.

Count how many years you’re in the house after the mortgage is paid off.

After a while (10 years in most states), you’ll have the right to claim the house by adverse possession. Then, if my understanding of the law is correct, you can file suit to quiet title against any and all comers, including any other banks which may claim that they got rights through MERS. That’s the way for someone like you to clear the title for future resale.

I am not a lawyer and this is not legal advice. It’s probably also different in every state.

The point is that the situation you have to worry about is some other bank coming back and claiming that they were the ones who REALLY held the note and the mortgage and you have to pay THEM instead of the bank you paid.

The best way to eliminate this sort of cloud on the house title is through a quiet title suit, and for that it helps if you can claim title by some other means such as adverse possession. That doesn’t eliminate the ability of the hypothetical bank to demand money from YOU, but it at least eliminates claims on the house.

I’m not sure how to eliminate the ability of the hypothetical bank to demand money from YOU. Perhaps some lawyers who understand what happens if you in good faith make payments to someone who isn’t the creditor, would care to comment.

As a life-long renter I was recently thinking about buying a house. But after seeing all the horror stories of servicer abuse and lender fraud, I want no part of the market. The wrong-doers are still out there operating with impunity.

Feiser’s point about not wanting to wipe out my savings by making a down payment also really struck home.

It’s just too risky to own.

I think one thing this post is missing in the discussion of why there are fewer buyers is the number of people who were burned during the last housing bubble and have little interest in rejoining the market at this time.

I know myself and many friends / family who were first time homeowners during this bubble period who were then stuck with what felt like an anchor. It prevented many of us from moving to places with better employment prospects, or forced us to take relatively large losses early in our careers with money we were hoping would be safely stored in a home. Even more have had to pay rent in a new location, while still paying the mortgage on a house that could not be sold.

These circumstances have lead many of us to continue renting rather than pursue home ownership again.

All you need to know about the shadow inventory and housing market. Almost 4 million properties delinquent or in the process of foreclosure.

http://www.lpsvcs.com/LPSCorporateInformation/CommunicationCenter/DataReports/MortgageMonitor/201212MortgageMonitor/MortgageMonitorDecember2012.pdf

True. But the banks and the administration have been more effective in managing a controlled dribble of REO properties onto the market — and thus in keeping RE prices higher than they’d have been if the market had been left to run its course — than many of us honestly expected.

In other words, I don’t think the TPTB are going to be able re-inflate the next RE bubble, for all the reasons the post above suggests. Simultaneously, though, they’ve gotten this far and kept RE prices from dropping to more reasonable levels. Whatever they’re doing, they can probably keep on doing.

The folks at NC are just not smoking enough Hopium….grin

I perceive the need for a big war in 2013 to get peoples minds off the underlying corruption of the “upper class” in Western countries affiliated with American empire. Then the empty houses all around us will be small potatoes of fear compared to the next global boogeyman country….any but Israel, of course.

Isn’t watching the devolution of society grand fun!!!

“Isn’t watching the devolution of society grand fun!!!”

It does have certain intellectual rewards, I’ll grant you that. In the words of Spock:

“It’s fascinating.”

I often say that if we didn’t have a stake in the outcome, this would make for great theater.

Isn’t all life theater? Wasn’t that Shakespeare’s point?

Then again, who was Shakespeare? The guy held every viewpoint known to man. Who knows what he believed.

I’ll say this, though, if old Shakes was right, and all the world’s a stage, then I’ve had an ongoing bit part in a drama that’s tending more toward the absurd these days.

Note: I will not accept an Academy Award for my performance, either. I can’t. I’m a (non-practicing) Buddhist. So don’t bother voting for me.

Housing bouncing of a false bottom. Good.

The earth’s trapped methane is set to release/explode into the atmosphere at any time. Bad.

Weigh those two on any scale you can think of, and you’d break it.

Giggle …

Some say fire and some say ice. And some say a giant fart.

And some say a hissssssss . . . of steam escaping . . .

Psychohistorian: they tried wars (see Iraq, Afghanistan, Somalia, Yemen).

It didn’t work, largely because the US military is incapable of winning wars. (This is due to sclerotic, obsolete military doctrine promulgated by archaic careerist generals — right now, the military elite is more interested in maintaining its institutions and the military-industrial complex than it is in being COMPETENT AT ITS JOB.)

For a historical antecedent, I suggest researching the domestic political consequences of the Phillipine War. (Which is usually left out of history books, having been dropped in the “memory hole”.) I believe, from my study of history, that those consequences were very substantial.

Gee they’re looking for real, final end-buyers now? Well, they could go out and find the people they foreclosed on, and see if those people want back in. If I were one of the foreclosed I’d make the banks pay me to occupy and manage the property.

The only way housing contributes to the economy is when you are building them or remodeling them. Rising home prices means they cost more and when I see rising income levels, then maybe house prices going up has a chance. Every extra dollar spent on a necessity (food, fuel, shelter) is one less dollar available for consumption. With unemployment and under-employment and stale wages – how does anybody think rising home prices are a good thing? How does rising shelter costs (rent) do any good except for the rentier class at the expense of the rest? Until a reset of the debt overhang is addressed we will continue to make little progress in job expansion and growth over the coming years – just a few folks will squeeze the rest of us on margin – not a good thing.

Yes, in a sane world the price of houses would go down as they age and crumble.

Henry George had a good solution. Land value tax.

Go over to Micheal Hudson’s site and update yourself on a more refined and cogent view.

The problem is increasingly – to the point of inability to pay, is that lowering the cost of business and living is, can be, a competitive advantage. Every dollar saved on energy to produce a good or heat a house is a dollar gain to the bottom line. Currently, to much consumer income (we are all consumers by the way), is going toward servicing debt on inflated asset prices. Those interest payments are then going on to drive asset prices in a spiral up beyond what can be expected to be paid back – debt overhang. Too much to go into in a short response.

I tell you what — this sight and a few others have been the most educational in my life. The games the rentiers play should be a priority learn for as many people as possible — all the intentional obfuscation and bold lies being injected into the public consciousness by the rentier class thru media buys is undermining the ability of citizens to become informed. Without an informed citizenry, our republic is being jeopardized at the voting booth. The mechanisms set-up through the hard won, eons long struggles of human progress are once again being undermined. A rinse and repeat cycle where we would hope to come out a little cleaner.

Yes! Finally I’m not the only one who sees this. These articles are always written in the perspective of people who speculate with their houses and want nothing less than bubble prices.

Sure high house prices are good for builders and those that use their house for speculation, but for people in the real economy, those that just want a place to live in, in the long term, high house prices are not better than high gas prices are for drivers.

I know the older generation seems to have a blind spot about this, but for those of us between 20-40, first time buyers or up-graders, high house prices are very much a drag on our budget. This also includes high rents for the businesses we are starting. My parents were able to buy their first house in their early twenties on a single blue collar income with a %40 down payment that took only a few years to accumulate. That seems utterly utopian among my peers.

The interesting data point in this article is “BCA calculates that the typical ratio of hypothetical interest and principal payments to rent of a comparable property is now about 0.35, versus an average of around 0.6.”. This doesn’t necessarily mean it’s cheaper to buy since people will usually only buy bigger, nicer places than they are willing to rent since selling later is costly so it has to be a place that will meet their standards for a long time.

Instead what the data point shows is that now that houses prices have corrected to slightly more sane levels, we also need rents to correct downwards. When people pay more reasonable rent, they will be able to put money away for down payments and other things.

Sure we want prices to be high enough so that shelters are worth building to meet the demand of a growing population but with technological improvements in home building, the prices of building houses and apartments should go _down_ with time. In a rational market, new house prices should be slightly decreasing with time in real terms and older houses should decrease in prices even faster unless they are constantly upgraded.

Be clear that land value is separate from building costs. Many people believe that house costs went up because construction prices went up – totally wrong. land prices were artificially built up – boom. If you are going to build two identical houses on a 1 acre lots in an area but, one lot costs a million to purchase and the other 100,000 then, obviously one is going to cost 900,000 more than the other. Building each house remains the same. Most houses are kept up and modernized – my home is 130yrs old but it is far more efficient and durable than most because of the improvements – even so, the price I ask is determined by mainly, the land value. The land value is mainly determined by the services, schools and access to places of work. With a boom – the price I could have asked was much higher than the underlying services the community provided – it was inflated because speculators wanted had no interest in living in the community.

As from Tax Facts published back in the 20’s

“Legal Gambling

The gloom is fading from the real estate situation. More nibbles during the last few weeks than the last three years. If January brings us good rains, this next year will open the door to the sunshine – a case of rain bringing the sun.

It is to be hoped, however, that there will never be another boom. The crash of the boom of 1923 was due to the same causes that wrecked the wall street stock market. People sold what they did not own. They made a payment down in the hope of getting the property off their hands before it began to burn. Real estate fell into the hands of sharp-shooting gamblers who had no interest in land. To them it was just a pile of blue chips on a roulette wheel.”

Sure, but is there a reason for median residential land value to go up continuously when median wages are going down?

Sure urbanization has raised the value of some of the land people like to live on but at some point this effect should reach an equilibrium and stop raising prices and they should resume a slight downward trend unless bubbles.

Equilibrium with what?

The housing market did bubble

Building a new home is still about the same as it was 10 years ago adjusted for inflation – it probably comes in below an inflation adjusted rate given the low wages adopted in the trades.

So why the rapid inflation in home prices beyond wage earnings.

Rental rate has to cover all the costs and taxes of owning home plus a profit – who will bare that cost? – Investors or the people renting. Oh and how about the addition of management fees. I can see that either the house is going to go neglected to turn a profit or the Investors are going to lose if they do not time their exit properly – guess who does not care – the arrangers of these deals – they get their fees up front and have no skin in the game IBGYBG

Yes, the reason is the expansion of the supply of credit. The increased supply of credit allows potential buyers to bid up prices.

There are some large regional trends which are obscuring any overall trend. Outer-suburban real estate is suffering a permanent reduction in land value as people realize that the location is not viable (due to transportation costs). Inner-urban real estate is going back up in price due to this shift. Rural real estate remains cheap, as it has been for decades.

There are also shifts away from some metropolitan areas and towards others.

Given all of this, it can be hard to see an overall trend because local trends can conceal the national trend. I suspect that the national trend is a drop in prices, but it’s hard to prove.

When they speak of “pent up demand” what exactly are they talking about? Do they have actual surveys showing that people have the desire the means they plan on buying a house somewhere in the near future or are they just looking making assumptions based on household composition now?

I meant desire and the means and have plans to buy a house in the near future

Even in go-go Charlotte, Nc – home of the great Satan – my Realtor friends tell me short sales, 100% owner financing and cash sales are the bulk of their (paltry) sales. Rent to own is also very popular. I have cautioned my kids to not buy ANYHTING ON CREDIT, EVER.

How about everyone in an upside-down house pull permits for remodeling at least six months before planning on leaving. Remodel permits on kitchens, baths, walls, roofs, floors…everything. Then rip it all out – save the fixtures, cabinets..all the goods in storage. Then do a deed in lieu of. Give the banks their shell-ter back. and buy into the bottom with everything ya need to put it back together.

Sorry, just the rantings of a crazy man. I don’t see progress on the economy until the debt overhang is eliminated and investing directed to the real -economy – tax may be one way to dis-incentive the financial investment vehicles and high speed skimming operations that make everything more expensive and debt burdened. IE disincentivise rentier games

That’s good, but mine is better.

Put the house up for sale, even if it’s a short sale. Get a buyer, then….Submit amended escrow instructions demanding that PRIOR to reconveyance, the servicer provide the original NOTE. Also add provisions that the note be offered up with enough time prior to closing that the document can be forensically examined for authenticity.

ALL Buyers should request that..of cours ethere would be no sales if they did!

I guess I would ask for that and also demand that the house’s deed be de-registered from MERS and re-registered physically at the relevant County Courthouse.

Maybe everyone ought to pay their mortgages on a quarterly basis – take the hit to the credit score but and pay-up when the banks have got their machine in action. Save in separate account then pay – even with some fees – stacked in. That ought to shake things up – clog the courts, demand that chain of title are accurate for all servicers – make it a federal program that the service rs can not make any corrections during the audit phase.

Some folks talk about the the banks lending out credit to un-deserving borrowers – as if the borrowers were somehow to blame. Did’nt the Great recession prove that the it was not the borrowers that were undeserving, it was the creditors that were undeserving, criminal and incompetent of lending in the first place – oversight or not.

Little tip to all those Real Estate SELLERS out there:

Submit amended escrow instructions demanding that PRIOR to reconveyance, the servicer provide the original NOTE. Also add provisions that the note be offered up with enough time prior to closing that the document can be forensically examined for authenticity.

If every single seller did this, we could restore the rule of law without our government regulation.

Sellers regulating the marketplace. Submit your own escrow instructions. The grantor can and should provide them.

“JPMorgan Entices Millionaires to Become Landlords” is one such program where Bloomberg reports, “JPMorgan Chase & Co. is giving its wealthiest clients the chance to invest in the single-family rental market after other investments linked to the U.S. housing recovery jumped in value. The firm’s unit that caters to individuals and families with more than $5 million, put client money in a partnership that bought more than 5,000 single family homes to rent in Florida, Arizona, Nevada and California, said David Lyon, a managing director and investment specialist at J.P. Morgan Private Bank. Investors can expect returns of as much as 8 percent annually from rental income as well as part of the profits when the homes are sold, he said.”

http://www.bloomberg.com/news/2013-02-04/jpmorgan-joins-rental-rush-for-wealthy-clients-mortgages.html

Love NC!

And a few other sites that indulge in “intelligent ranting”!

But,

Anybody, and I mean ANYBODY that believes that this economy (The West in toto) is going back to what “existed” before 2008-09 has a screw really loose!

And, we haven’t even discussed the West’s capitalist economy’s continual environmental damage.

Too much GREED!!

Not enough critical thinking.

Keep up the good work, Yves (and the commenters)

“Reflections on the Current Belief That Housing Will Come Roaring Back” Outside the NAR, I doubt there are many people who are drinking this kool-aid and believe housing will come roaring back.

We have witnessed a price spike, but this is mostly likely attributed to a number of factors including 1) low interest rates; 2) reduction in listings due to the tightening of foreclosure proceedings; 3) an influx of investors (now slowing) who felt there was an arbitrage opportunity on house prices when compared to a dearth of other investment opportunities.

Most articles seem to predict house prices to follow the more boring inflation index.

this may be too specific for this thread, but I don’t understand the Wash DC housing market at all. it continues to soar. Now I know that the influence peddling buisiness had continued to expand, and I know that the War on The Fourth Amendment has made some contractors very rich. But still, the prices make no sense. Dozens of suburban bungalows and split levels are pulled down and million dolllar McMansions are being put in their place. Likewise housing prices in even DC’s worst neighborhoods continue to soar. Houses east of the Anacostia river are being listed for over $300,000. Who has money for houses like that?

There will always be a cadre of very wealthy, protected people who remain unscathed by the economic chaos they unleash upon the rest of us.

The federal government has continued to pay and employ people, even while private businesses and state governments and local governments have engaged in savage layoffs.

That’s what’s going on in DC.

Oh, plus there’s a bias towards cities: rural property continues to drop in value while urban property continues to rise as people flee towards the cities, where the good jobs are, and where the transportation costs are lower. Suburban property behaves confusingly but outer suburbs would be expected to drop while inner suburbs should do well.

Forget houses, thats a dead end, a suckers bet. Who can recommend the best RV size/setup for two people?

I have more than 5 friends (BANKERS no less) who have made the business decision to ‘walk away’ – (well, quit paying – not leaving the house).I think those on the margin have already been forced to walk away. The next wave will be those who are intentionally walking away…The banks are not going to survive this as more and more “mainstream” folks lose the fear and shame promulgated by a society living under the tyranny of the banks and the credit reporting agencies.

At least in 2009, “strategic default” was more likely be practiced by those with high credit scores not those with low.

You don’t get a high credit score by being stupid, or by putting other considerations above your financial situation.

Of course strategic default is practiced by those with high credit scores.

[“Somewhere between 25 and 30% of all house sales in 2011 were cash sales to speculators rather than to potential “final residents”.”]

Yes, yes…Nice twist to the musical chair game. Seize a chair and blackmail your fellow man. Great fucking idea. There you go sports ! You’re a winner! You’re a winner doing God’s work !

Wow! That’s really great discussion guys.I know lot of new things here. Really great contribution by the “George Feiger” .Thank you

houses for rent