We’ve written before about the perverse phenomenon known as “zombie title.” Servicers initiate a foreclosure and complete most of the steps, including evicting the borrowers, but then fail to take title to the house. Adding insult to injury, the banks rarely inform the former homeowner of this cynical move. Not only does often find out years later that he’s on the hook for property taxes and in some cases, fines from the local government, but the servicer has made such a mess of title that the owner can’t get rid of the property, unless he takes a quiet title action, which typically can’t commence until five years after the foreclosure was abandoned.

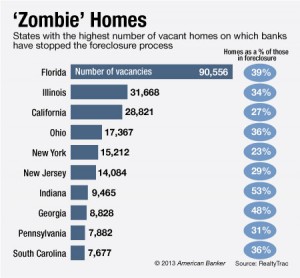

Kate Berry of American Banker provides an update. She flags that this abuse has skyrocketed sin e 2010, when the GAO estimated that abandoned homes ranged between 14,500 and 35,600. They are now pegged at 35% of the one million homes in foreclosure.

Homeowner advocates are up in arms because both the Fed and OCC have issued guidance requiring servicers to inform borrowers and municipalities if they intend not to complete a foreclosure. They also contend that this is a fair lending practice abuse, since, natch, the borrowers tend to live in low-income communities. And abandoned homes are a blight.

Normal local statutes dealing with vacant properties hit the owner, which is the hapless homeowner, not the servicer. This problem is hitting a level where local authorities may start taking more aggressive measures. I’d love to see a “bad faith foreclosure” fine, for parties that evict a homeowner but fail to take title to a property in a stipulated period of time. The fine would need to be punitive, say $10,000, and allow for recovery of costs if the municipality has to take unusual measures to collect (say putting a lien on a local bank branch and then threatening to foreclose).

But there are bigger implications of this sorry trend. The first is that it means the “housing is on a firm footing, look how tight inventories are” story bears some scrutiny. From the article:

Housing experts speculate that banks are purposely refusing to take title of abandoned foreclosures as a strategic move to better manage their ballooning portfolios of real-estate owned or REO properties. If more properties were put on the market, it might dampen the nascent housing recovery, the thinking goes.

“I have long been convinced that the current run up in home prices is a false high,” says Ruhi Maker, a senior staff attorney at the nonprofit Empire Justice Center in Rochester, N.Y. “Once all these foreclosures are through the system we could see another decline in prices.”

James Kowalski, executive director of Jacksonville Area Legal Aid, says he has clients who have tried for years to get their servicers to foreclose and take title to their homes.

“There are literally thousands of borrowers who have been trying to hand the house back to the bank and they won’t take it back,” Kowalski says. “They can decide not to file, to rescind a notice of default, or to ask for continuances, and they’re doing it repeatedly in Florida. If you want any better proof that the banks are slowing down the process state-by-state, based on their own internal analysis, this is it. The banks control the pacing of the foreclosure process, not the homeowners, not the judges.”

Now given the quiet title issue, it will take some time for these properties to dribble onto the market. They’ll be in bad shape and go for rock bottom prices. But they would suit limited-debt-capacity gentrifiers. One can imagine that wrecks could be attractive to young people with student debt who can’t get a mortgage form a bank but might get a relative to provide a modest one. And said young person would need to be willing to put in a lot of sweat equity and have access to someone with construction skills. New York had a successful homesteading program in Harlem in the bad days of the 1970s and 1980s for city-owned property that was very successful. Habitat for Humanity and similar organizations or small scale builders might also be interested in these properties as a play.

The biggest losers from this might well be private equity buyers. These rock bottom properties would compete with the plan that many of them have, to exit via sale. They would also compete with starter home products from homebuilders.

But there’s another big set of losers, namely, mortgage investors. Many mortgage backed securities from the bubble years have paid down substantially between foreclosures, refis, and normal sales. The mortgages associated with these zombie titles are still show in investor reports as having economic value (they are included in principal balances) when the servicers’ excuse for not foreclosing is that they have none (the cost of foreclosing exceeds what the bank could recoup by selling the property). These investors are going to have a rude awakening when they discover that the remaining value of the bonds is much lower than they think.

And this raises yet another troubling issue about bank conduct. When a borrower defaults, the servicer keeps advancing principal and interest to the investors as if the borrower is still paying. This process continues until the loan is non-recoverable. The concept was that the servicer would recoup the money it had advanced when the home was sold (the foreclosure costs, interest and principal advances and all fees are reimbursed before any money goes to the investor).

But the pooling and servicing agreements never contemplated that many homes would wind up being worth less than the mortgage balance. That means when the servicer advances funds to the investors, he won’t be able to recover it all when the home is sold. That problem is particularly large with these zombie title homes.

So what are the servicers doing? Although we can’t prove it, is is almost certain that they are stealing cash from refinancings to reimburse themselves for these advances. This is not permitted under the pooling & servicing agreement, but since banks steal from homeowners and investors any way they can (the whistleblowers at Bank of America, PNC, and a new one at Wells Fargo all report endemic fee abuses, which ultimately come from investors), why should we expect anything different?

And that, dear reader, is why you should care about zombie title. You are paying for it. You are paying via your local government not getting property taxes it is due, and by state and local governments having pension shortfalls that lead to higher taxes and lower service levels (those pension funds were often large investors in MBS). So if measures are ever proposed to contend with some of these mortgage abuses, it’s in your interest to support them, whether or not you have a home with a mortgage on it or not. Put more simply, if you aren’t part of the bank looting operation, you can’t escape being a victim in more ways that you know.

Yves, Can you explain why everyone but Litton are getting independent foreclosure review checks?

Morgan Stanley and Goldman Sachs were excluded from the IFR Payment Agreement. I think Litton is/was owned by GS.

I’m Shocked.

Thanks for the post, Yves. You implied but did not baldly state, as I will: We are paying for this with the destruction of our communities. And that is the greatest price of all.

Think of how much the finance folk make with the whipsawing of the mortgage market….fees, fees and MORE FEES.

The destruction of communities (and the subsequent genocide of the people in them) makes for cheaper real estate and less pressure on global resources.

What is not to like if you are in the one percent that own global finance, don’t own enough property yet and are selfish about future resources for your kids?

The human power structure based on inheritance and accumulating private ownership of property are parts of a religion that we don’t currently have a choice over belonging to. Hell, (pun intended) we don’t even discuss the class based social structure as existing…its always left versus right or other obfuscation term pairs.

As long as there’s no end to the amount of checks being distributed inside the beltway that say “Pay To The Order Of x_____________________”, this problem will never go away. Nor will the recipient politicians who shrug their shoulders as if powerless, “What, me worry?” Their lack of awareness of these issues is no longer excusable….it’s to the point of one and all committing treason through their silence or lack or action, or at the very least, misprision of treason, or misprision of a felony, take your pick.

This is a blight that must be pruned away before we all keel over. We need some Saddam styled stairway shuffles. I’d bet the farm, if I hadn’t lost it to a fraudulent foreclosure, that a long fall with a short rope would be the start of a cure for what ails us.

2little2late,

I like your “long fall with a short rope” idea but would like to add to it.

Tell the guilty we would like to modify your sentence but first, you must spend at least 90 days in solitary confinement. Have their attorney submit paperwork for their release over and over again. Continually lose the paperwork. Run an ad in “American Banker” for 4 consecutive weeks showing their photo and listing their crime(s). Charge them triple the cost. Give them hope and then hang them anyway. Affix a permanent notice to their headstone so anyone visiting the cemetery will know of their crime(s). Pay a kid $6 each month to go by the cemetery and pull a few weeds around the grave. Send a bill to the family for $350.

Good one. But must also stipulate to permanently destroy their credit.

Reminds me of a pleasant practice of the Chinese government: Billing the family for the bullet used in the execution of one of their number.

As for ‘homeowners’ remaining liable for property taxes, why can’t a vacating homeowner execute a quit claim deed to the bank and record it himself? Intuitively, this ought to extinguish any property tax liability.

That sounds feasible. I’d rather see the banksters file quit claims. Maybe some universal document specially designed for them because they put all those titles in MERS and now nobody can decipher them.

Also, if the bank forecloses and evicts, but the title remains in the name of the homeowner, what prevents homeowner from moving back in? Does an eviction remain valid if the homeowner still owns the house?

More to the point, on what basis was it ever legal if the evictor never owned the property? Doesn’t recovery of title preceed eviction in this process? Thankfully I have no first hand knowledge, but doesn’t the sheriff have to confirm that the owner is requiring non-owners to vacate and not the other way around?

See my comment below. I can’t imagine how the banks are getting away with this.

You are correct: it is NEVER legal to evict someone without having ownership first.

(For those who wonder, the government is always considered to have a form of ownership called ’eminent domain’, which is why governments can evict people from unsafe houses and stuff like that.)

What if the crime has been acknowledged (via the AG and OCC settlements) and restitution ($300/bouncing check) paid? All the due process u need?

The problem occurs when the bank doesn’t foreclose. And, at least in my state, no eviction can take place until after foreclosure. Until then, the debtor, not the bank, owns the property.

Nothing of a legal nature stops the homeowner from either refusing to vacate prior to foreclosure, or from moving back in if the foreclosure is not consummated. Ignorance is the problem. Either that or the homeowner has other reasons for abandoning the property….there are many possible.

..more than half the problem=there IS NO TITLE…it’s been broken into bits and pieces, combined with credit card, student loan, car loan debt-which is now known as “mortgage BACKED security”-you know-those “toxic assets” bushbama is QE3ing at FED $80 billion per month from returned “structured investment vehicles” on Wall $treet bank ledgers…

filing a quiet title lawsuit has become outrageously expensive! We reinstated and wanted to find out who has our loan. BoA was assigned to it – the mortgage was sold assigned and transferred together with the note and security interest. A copy of the original was endorsed in blank but BoA (when I sued them for not telling me it was assigned to them)said they don’t have the loan, mortgage or note. They have nothing. In a quit title suit I would have to sue BoA, Freddie Mac, mers and what ever trust it might be in. At $ 3000 per suit plus $1000 advertising it in the local paper….People just don’t have that kind of money.

A valid deed technically requires acceptance, so an owner of a troublesome property can’t simply execute a deed to some unsuspecting schmuck. But in a zombie title situation, it is certainly worth a shot.

“Normal local statues dealing with vacant properties…”

Statues? Shouldnt this be Statutes or something?

Fixed, thanks.

Calling them Banks is insulting.

Hidden underneath the skirts of the servicers and the foreclosure attorneys are Private Equity Funds. These same servicers are either subsidiaries of or have private partnership arrangements with these Debt Buyers. And they are all being protected by specially appointed bottom feeding Attorneys.

Yeah, lets feel sorry for the Private Equity Funds.

Ocwen, Walter Investment Management (owns Green Tree), Blackrock, Fortress (owns Nationstar)and the others either own or control the entities that are keeping this fraud scheme alive.

I had to re-submit this post because apparently the “moderator” didn’t find my original post appropriate.

Anyway, Kate Berry needs to investigate further who is in control behind the curtain.

And, stop calling them BANKS.

From the Pooling and Service Agreements (“PSAs”) that I reviewed back in 2008 and 2009 when I worked at some of the mills in PA and NJ, the servicer advance typically stopped at 3 months or initiation of foreclosure action, whichever was longer. This is why most foreclosures kicked off around the 3 month mark (the servicers want to limit the P/I advances as much as possible).

Until someone starts getting these zombie foreclosures dismissed the servicers will not get hurt financially. However, if the zombie foreclosures are dismissed, the servicer may be on the hook for years of P/I advances based on the terms of the PSAs I reviewed (whether or not the investors would actually pursue such an action is another matter).

It would be interesting to see if someone moved to dismiss a foreclosure action based on the doctrine of non pros how the servicer would respond. If the servicers fight to keep the action in foreclosure purgatory it would confirm that there is a financial incentive to such a status for the servicers. Conversely, if the servicer just let the action be dismissed it would confirm that the issue is simply one of the servicer being lazy.

Also, if I had to guess as to how the servicers recoup the advances on properties that are stuck in foreclosure purgatory, I would think it would be via the junk fees in all foreclosures (i.e., $300.00 BPO, $500.00 title fee, etc.). This would not be theft per se as they are allowed to recoup such fees under the PSAs but whether such fees are necessary is another issue.

No, the servicers keep advancing well beyond that point. I’ve spoken to securitization experts on this. The practice historically was to advance till pretty much the principal balance on the loan had been reached. Now they stop a bit earlier, but not that much earlier.

I guess I was wrong that after 90 days a delinquent loan is placed in “nonaccrual” status (i.e., foreclosure) deeming it uncollectable and resulting in no more interest being advanced. Thanks for the info. Keep spreading the knowledge, it is the only way the average person can hope to stand up to the bank.

There is another potential reason. Properties abandoned in all but areas of desert are likely to rot on the vine. Florida is susceptible to mold, as would be most locations in humid climates. Perfect way to destroy a neighborhood before riding in like a white knight a decade later and hailed as a benefactor after being the cause of the destruction. Ask a remodeler, maybe 20% will be financially viable to bring back to habitancy standards. But not to worry, 20% will be occupied anyway, and the occupants will suffer from disrepair. This is not going to have a pretty outcome when the bulldozer is ordered in.

From David Dayen’s recent zombie title story in American Prospect, “The Fed’s Foreclosure-Relief Fail”:

So, zombie title, house loses value from $165,000 to $50,000 and is a wreck full of mold, woman suffers horrible consequences, but does get $800 check from the IFR. I’m not sure if it ends there though; she plans on donating the check to someone still fighting their foreclosure, no word yet on whether the check bounces.

Also want to say that this reminds me of “In Nothing We Trust”, the Indiana story from a year ago — http://mobile.nationaljournal.com/features/restoration-calls/in-nothing-we-trust-20120419?page=1 — zombie title was just one of the episodes of institutional failure:

There was a kicker; Eric Schneiderman saw the story and tweeted a link to it, saying, “Excellent piece on the loss of confidence in America’s institutions & how to restore it.” But the story was a toilet paper roll of fubar episodes and offered no solutions, so what was he thinking of? The zombie-foreclosed-on man now was responsible for mowing the lawn “at his bank’s house,” had a waived $300 fine as long as he kept mowing, still thought it was the bank’s house (city attorney told him so in above quote), and hoped someday to be able to buy the house back, though he’d been living in a trailer for a year and had lost his job. Other episodes included messed-up City Hall and mayor admitting she had lied to get elected because the electorate couldn’t handle the truth:

Eric’s excellent tweet is here: https://twitter.com/agschneiderman/status/193317775542984705

Checking Eric’s current Twitter feed: https://twitter.com/AGSchneiderman. Much attention today to NYHOPP, NY Homeowner Protection Program, including a retweet that program bears his name:

Anyone?

Would also love an update on his Fraudclosure Task Force. Like did they ever get an office…staffing…phone…existence…?

It’s not an institutional failure. From the perspective of the criminals who control the institute and are looting it, it’s a rip-roaring success. They’re laughing all the way to the bank.

* * *

We should IMNSHO never argue that an institution has “failed” without asking “for whom?”

Interestingly, the local Board of Public Workds actually did the right thing in Whitmire’s case; they recognized that the fees attach to the house, not to him, and changed it from a fine to a lien.

I suspect this isn’t happening elsewhere or we wouldn’t be seeing such problems.

Who owns the house?

Quirk was the Board of Public Works’ attorney and told Whitmire the bank owned the house but Whitmire was liable for maintaining it. That’s crazy. Seems to me Quirk should have told Whitmire that he still owned the house and that’s why he was liable for maintaining it.

CONGRESS AND WHITE HOUSE ARE OWNED BY $$$$$$$$$$$$$$$$$.

GET $$$$$ OUR OF OUR GOVERNMENT

IT IS A SHAME THAT OUR SENATOR WAS A FRESHMAN AND HAD 1.3M IN HIS CAMPAIGN PIGGY BANK ONLY A FEW MONTHS AFTER BEING ELECTED

Max Baucus—Chair Senate Finance Comm—70% poll for Public option–

Bill hit his comm— first act—removed public option for debate

shocked me—I trusted him. Zap. Report=he had $1,900,00 in his campaign kitty from health care industry..

The millions spent by thousands of Lobbyists expect favors. Buy them.

We need a Washington revolution and kick all out

Obama lost me with Gay Marriage. Totally disgusted. I am in a position I trust no one in Washington. I know few are very good but $$$$$$$$$$$$$$$$$$ BUYS ANYONE

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ OUT OF GOVERNMENT—— QUICK

NYT had superb article on Wall Street employees going into many many many government jobs in Congress and White House

They left for a much lower paying job.

Conclusion—Wall Street biggies are placing them in positions to make decisions for Wall Street.

Pay under table or? Many have done this. Worked in Wash for few years then back to Wall street into a higher paying job

This is sad sad. RULES MUST CHANGE

NO $$$$$$$$$$$$$$$$$$$$$$$$ IN WASHINGTON

NYT had article on Interconnectivity between Board Of Directors in WSA firms

You vote for my pay+pension I vote for yours

sickening

5 big banks own 50% of deposits in 7000 banks and 10 own 80%

Restate Glass Steagall—separate Casinos from local banks

County Banking Systems—local wealth kept local to create more local wealth and jobs

WASHINGTON SOLUTIONS (Congress + White House)

Requires overturning Corp is a person

1. fed fund election—6 mos-3 primary 3 general—free equal tv time—debate a week=12=adequate to evaluate candidates NO $$ =O

2. Since they will not need campaign funds Ban them from receiving anything of a financial value this closes K St.

3. Progressive Flat Tax by group—We have the income to pay our way-do it

We rank #2 as lowest taxed in OECD nations. We have an income of $14,00 billion yet tax 2400 and borrow 1300. Dumb?

Hell, the politicians are too busy exempting themselves from

ObaminationObamaScare, opps,Terror, damn, Care (so they tell me) to worry about a few dead beat homeowners stealing our hard earned money by not paying thier RE taxes, etc., for a house they have been thrown out of (and good riddance). The f**king retards should have chosen better parents that would have taught them not to steal in the first place, duh!! Anyway, thank goodness Congress has their priorities right:http://www.politico.com/story/2013/04/obamacare-exemption-lawmakers-aides-90610.html

http://www.nakedcapitalism.com/2013/04/congress-scheming-to-avoid-eating-its-own-cooking-on-obamacare.html

If these dead beats would just get one of those jobs our Lawmakers are frantically trying to create for them!

http://www.huffingtonpost.com/2013/04/24/lawmaker-unemployment-hearing_n_3148362.html

Yves, the sad thing – well, one sad thing among many – is that our rulers don’t care in the slightest about how incoherent all this is. They have a balancing act to perform to keep things on an even keel for as long as possible. So to relieve the social pressure that would otherwise result from evicting everyone who could be evicted, they slow everything down, leave everyone in limbo while they try to “reflate”, but then on the other side they have to impose “austerity” while they keep interest rates low, or maybe not.

This could go on for a decade or more. By then no one will know whose fault it all was, and of course that’s a big part of the objective.

You might check this post:

http://strikelawyer.wordpress.com/2013/04/14/a-glimpse/

And this one:

http://strikelawyer.wordpress.com/2013/04/20/low-interest-rates-and-austerity/

“foaming the runway”

extend and pretend

Geithner

This is NOT relieving the social pressure. That’s why it’s all so stupid on the part of the elites. If it were *actually* relieving the social pressure, it would be smart.

But to *actually* relieve the social pressure, you’d need a Civilian Conservation Corps or something similar.

+ statute of limitations nearly expired…

Here in L.A. our normally useless City Attorney Carmen Trutanchich filed a lawsuit against Deutsche Bank for neglecting all the properties they had foreclosed on.

Guess Deutsche tried to have the lawsuit thrown on (venue change, who knows what ruse it was). Anyway a New York court refused to dismiss lawsuit.(Why a New York court was involved I have no idea. Perhaps venue shopping.) So it’s on. I think it was in Reuters “Legal” section yesterday.

The City of L.A. has imposed some pretty stiff fines on servicers for neglecting properties. As I’ve stated here before, after Chase elected to initiate an “elective” foreclosure on my performing loan, and their reciever took charge of the bldg, only to let in fall into such neglect in six months that the City filed criminal negligence charges against me as titleholder because the bank had let it turn into a wreck.( The refused to clean the exterior and let the plants grow to block the sidewalks on two sides.) I had to go to court to prove the bank was responsible, in fact had moved heaven and earth to get the income stream, I mean take “possession” and all that implies (the income stream, no maintenance) of the property.

My theory is increasing zombie titles actually fits in with the PE funds scooping these houses up to support a neo-feudal solution.

A Blackrock could position itself to be, in PR speak, “uniquely qualified” to take care of this problem for banks and titled owners to buy these homes in mass quantities at low prices. They theoretically could get praised by the cities while making promises to return these houses to “an attractive state”.

Then, they get a company to fix them up for cheap (because now they have scale), and then they rent them out and have another company do the servicing (again, the maintenance prices decline due to scale). Or Blackrock could off-load the lot of them to an investor who then could hire the maintenance companies.

It’s more like a feudal lord looking over his city not as a wide expanse of continuous land belonging to him with the peasants working it, but as a thin veneer of unconnected houses where the peasants in each of the houses is helping the lord make a fine cash flow while his minions pressure the peasants to pay their rent and provide minimum maintenance.

If the PE firm can keep the maintenance low and keep the barriers to first-time homeownership high (and I’ve read first-home buyers are definitely shrinking as a % of overall homebuyers), then I think this could work.

magic word “blight”

Thinking again of the Kelo decision too. Even though Kelo’s house wasn’t blighted, it might as well have been to the Supreme Court. Odd thing was (at least to me), it was my normally good justices (Ginsburg) that were on the wrong side in that case, and Clarence Thomas the dissenting hero (!) who said this:

Hello.

I am a little curious how a bank with an uncompleted foreclosure has standing to maintain an eviction action, since it’s not a real party in interest.

Of course, my license only says “Oregon” and other states do have other laws, after all.

They’re not BANKS.

It’s the Attorneys appointed by and working in concert with the SERVICERS (also not banks) that file these actions. Once filed, the homeowner is screwed regardless of whether the mortgage payment was on time or not. Few can afford to challenge these filings and these bottom feeders know it. The Judges who feed at the same money trough are either willingly blind or have become so numb to the endless stories of abuse that they likely don’t care anymore or more interested in moving on to the next story on their docket.

The homeowner is screwed because he/she will always have this on their public record. It won’t matter who is right or wrong, if it’s on you’re record you’re the loser and it will follow you. Credit reports, job interviews, insurance upgrades, banking.

It sucks.

“Few can afford to challenge these filings and these bottom feeders know it. ”

This is the biggest problem. The people who manage to challenge the blatantly dishonest filings from the bottom to the top courts — tend to win. The servicers and their lawyers rely on wearing people out and making them run out of money for legal fees and on catching people with bad defense lawyers and on snowing judges.

In a securitization, they are the agent of the investors (they’ve been chosen by the trustee of the trust). So they initiate the FC, evict the homeowner, and stop.

Well, as long as we acquiesce to have criminal gangs running the system this kind of thing is pretty normal. Something like this situation exists at every level and in most sectors because the cultural ideal in this country is the con and the hustle–that’s what we reward.

“Servicers initiate a foreclosure and complete most of the steps, including evicting the borrowers, but then fail to take title to the house.”

This is ALWAYS illegal.

Without title to the house, the bank simply doesn’t have standing to evict. This is ancient English law dating from before Magna Carta! The eviction must follow the perfection of the title!

I really wonder how judges have been letting the criminal banks get away with it.

In lien theory states, it’s plain illegal to evict before taking the title. It’s trespassing, forced entry, assault, burglary, kidnapping, god knows what else.

Now, in “title theory” states the bank *always* held the legal title. So it can evict, potentially, at any time. But in those states, the homeowner isn’t on the hook for the taxes or maintainance, because the homeowner never held legal title, only equitable title — and as soon as the homeowner surrendered the equitable title, the homeowner has no interest!

So it’s completely illegal. Always.

This leads me to wonder: are the banks actually doing this *slightly differently* than described in this article?

Yves, please check this out.

If I were a criminal bankster trying to get away with this, I would take legal title, but *fail to register it* with the county clerk, recorder of deeds, or tax assessor. So legally the bank would own the house, they just wouldn’t have *told* anyone.

It would then be the responsibility of the former owner to notify the clerk, recorder of deeds, and tax assessor that the house was not owned by them any more — but the owner wouldn’t know this.

In most states failure to record is illegal but has really minimal fines, which is why I suspect this is the scheme. Am I right?

That’s interesting. Because MERS is all about failure to register at the local level. Makes you wonder if MERS could be keeping a second set of books. Not that I’m foily.

I don’t know where you are getting your information from, but it’s wrong. This is really well settled dirt law.

I’m assuming this zombie title is a title theory state issue (where the borrower owns the property and the bank has a lien) and not a lien theory state issue (where the bank has a deed of trust). This is crude but generally correct:

A mortgage is a secured loan.

Borrower does not pay.

The servicer has the right to accelerate the loan (demand everything due, principal, unpaid interest, fees, etc) at once. He ALSO has the right to take the collateral securing the loan (the house) if the borrower can’t pay the amount due.

Bank gets a judgment in court. It then proceeds to evict.

Some time later (usually a couple to six weeks, but it varies by state), property is sold (colloquially on the courthouse steps) to repay the loan. The bank usually puts in a bid at the mortgage balance amount. That’s how it winds up owning the property. Bank now have different bidding strategies than they once did, so I’m not sure how they are operating now.

What we are discussing is when the bank stops after the eviction step.

Yves, I can’t speak to how it works in a deed of trust state, but where I’m from the bank ordinarily has to take title before it can evict.

…basis uf U.S. system is law…basis of law is private property…therefore there is no law…

FWIW, someone with a really sharp, on-the-ball lawyer can get a free house when this sort of shenanigans happen. The failure to perfect the title constitutes a waiver of all claims of ownership, if the bank has been prodded and notified about it often enough. It’s pretty hard to pull off, of course, but it seems to have happened once or twice.

No, the title is clouded and no one wants to touch the bugger.

It takes 5+ years to clear up clouded title via a quit claim action (also known as quiet title). That’s how long the claim has to have been abandoned before a new party can swoop in in most states.

Or one could try and play “adverse possession” – move back into the house and pretend it’s yours for the statutory period.

Realistically, though, the laws should be corrected such that the homeowner cannot be evicted unless and until the bank takes actual title – or alternatively, that successfully evicting the prior owner as part of a foreclosure action renders the lender liable for taxes, etc.

How is this possible:

“including evicting the borrowers, but then fail to take title to the house”

How does a Bank evict a homewner from a property is does not possess? The Bank has no standing to evict.

***These investors are going to have a rude awakening when they discover that the remaining value of the bonds is much lower than they think.***

I’m sure some enterprising souls will be able to package this as justification for another “bail-out.”

People we need to fight back. They are no match for us all it is only when you give up that you loose. https://www.facebook.com/CaliforniaForeclosureAlternatives?ref=hl

The Banks dont wantall of our homes only the ones we work hard for.

Wow, this paragraph is good, my younger sister

is analyzing these things, thus I am going to inform her.

Is OCC the acronym for Office of Crony Capitalism?

Office of Criminal Complicity, the way I heard it. (h/t Hugh)

Also:

Office of Capital Corruption

Office of Criminal Capitulation

Office of Corporate Capitulation

Office of Corrupted Capitalism

Obligated Capital Courtiers

Obliging Capital Courtiers

Office of Criminal Cheerleading

Organized Criminal Complicity

Organized (Financial) Crime Commission

Office of Capital Concentration

Office for Coddling Crooks

Oligarchs for the Capture of Congress

Office of Banksters Servants Companions & Enablers (OBSCENE)

and

The American Bankers Association

DownSouth suggested “Pimps” — but Yves corrected: “Pimps are in charge of the whores, exercise some control over them and make money from them. The OCC is the one prostrating itself, so it can’t be a pimp.”

Fun reading at http://www.nakedcapitalism.com/2011/04/occ-makes-patently-false-claim-that-slap-on-the-wrist-servicing-penalties-could-hurt-banks.html

From that same NC link, know your OCC:

Read more at http://www.nakedcapitalism.com/2011/04/occ-makes-patently-false-claim-that-slap-on-the-wrist-servicing-penalties-could-hurt-banks.html

Fascism at it’s finest! “I pledge allegiance, to the corporate states of America. One cash cow, under godless people, invisible, with no liberty or justice for 99%!”

no liberty or justice at all

“Injustice anywhere is a threat to justice everywhere” – Martin Luther King

Is there a way to find out what houses in a community have “zombie” titles?

Again, if it works in your jurisdiction the way it does in mine, you might check and see which properties have a lis pendens (Notice of Pendency)that’s really old but no foreclosure has been completed.

Well, they could seek out an attorney who could prepare a private trust in which the beneficiary is the mortgage lender and transfer the title to the trust. Having a trustee can get a little complicated but an offshore corporation acting as trustee poses some interesting hurdles in the area of venue and jurisdiction. Could force someone else to initiate the quiet title action and get the homeowner out of the way.

Yves, re zombie law, is this an old issue (UCC overlay statute) worth your renewed attention?

From Kate Berry’s story (my emphasis):

From your January 2012 story, “Bending the Rule of Law to Help the Banks: Effort to Draft a National Foreclosure Statute Underway” (your emphasis):

Have to admit, I don’t understand distinction between change to UCC versus overlay statute, and whether 50 state legislatures have to approve overlays or not. Wondering as well if new overlay would smoodge away title theory vs lien theory state issues? (And is this = judicial/nonjudicial foreclosure states?)

Apparently the overlay on the plate in January 2012 was doing away with public paper records in favor of private MERS electronic records — shows you where their heart is? (If that had passed, would mortgage doc fabrication bank units be necessary?) Actually, is this the same overlay being reworked?