Yves here. Due to being perpetually distracted, I kept thinking about lightening up on the GLD still in the family portfolio I run (more accurately, neglect these days) and barely missed having a limit order execute at just above $1800. I kept thinking about putting in a sell order for a third to half and kept not doing it (as in I did not want to deal with the stress, since I stupidly stress over every trade). Whoops!

On the narrow question of “whither gold” I have no idea near term. Trading mavens like to say that violent downturns lead to dramatic retraces, but that would likely be followed by further declines. Supporting that point of view is that there is apparently a considerable short interest in gold that will presumably be closed out. But the end of the last big gold bull market, in the early 1980s, saw a blowout and plunge over a mere three day period. So if the past is any guide, it does not point in the direction of much of a recovery from here.

If you subscribe to the theory that this was a bear raid (and some sources say they were told by well placed contacts a month ago that this was coming, wish they had sent me the memo), I’m not sure that this makes for as strong a rebound case as the gold fans might hope.

The problem is that gold was perceived as a safe haven by people who hated what central banks were doing and/or were still traumatized by the crisis and mistrustful of most risky assets. But the 15% fall in two days makes for a holding too volatile for the safety-minded to stomach readily. And if you are of the school that central banks were behind the downdraft (yes this is in tinfoil hat territory but I have several otherwise sane people who have central bank contacts and claim they got warnings), that would put going long as fighting them, one of the no-nos of investing.

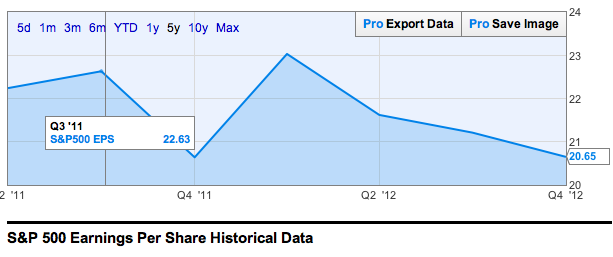

Longer-term depends on what you think the risk to the markets and the economy is, inflation or deflation. The gold enthusiasts say that nothing fundamental has changed, if anything the case for gold is stronger than ever with Japan going for The Big Print and the Fed likely to extend QE as the economy weakens thanks to the drag of budget cuts taking hold and valuations become more extended (weirdly, no one seems to notice that S&P 500 earnings peaked in Q1 2012 and have been falling since then. Yes, this is the most current data, the 4Q result was released Monday morning). Frank Veneroso is also predicting that China will depreciate its currency in response to the fall in the yen, which is something that no one (yet) seems prepared for.

But I guess I question that. The last time around, gold and stocks moved down together in the crisis (in fact, you’d see days when gold would spike down with no obvious trigger, meaning it was probably some hedge fund hit with a margin call and dumping its least distressed position). A big private debt overhang, feeble banks (operating on vitamin injections and amphetamine), and labor with no bargaining power point to deflationary pressures dominating, even if we see liquidity-fuelled speculation helping goose certain types of assets. Gold also does well in deflation, but we are not there yet. And what is the “right” price for gold in deflation? I’d hazard that it is well shy of the $2000 and $3000 that gold believers saw as targets.

Macrobusiness has additional commentary that I hope you will find useful.

By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Cross posted from MacroBusiness

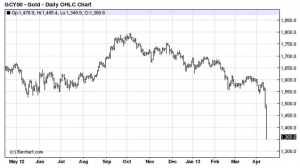

The gold crash has really got going now (and hats off to Deus Forex Machina for calling it) and brings to mind an old truth in commodity investing: that prices ride the escalator up but catch the lift down. Here is the crash on the one year chart:

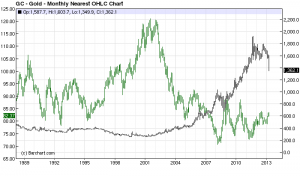

And 25 year chart:

Some are claiming that this is now a once in a 2 million year Golden Swan event which is just a bit rich. Nonetheless, it is dramatic.

But what’s it saying? To understand we need know what makes gold go up in the first place. There are various marginal reasons – sovereign instability, inflation, jewellery demand – but one towers above all else, the value and stability of the dominant reserve currency, the US dollar. Here’s the money chart:

You will note that despite a neat inverse relationship, gold has no one-to-one relationship with the dollar. That is, gold went up much more than the dollar went down. I argue that is because gold’s real relationship is not to the dollar’s value itself but the degree of stability or otherwise in the policies that determine that value.

That is, a high degree of instability in US monetary and fiscal policy, especially of the expansionary type, will lead to gold appreciation. It has a one-to-one relationship with chaos in value determining settings not real value itself.

So, the direct conclusion to draw is that gold is falling because the chaos that marked US fiscal and monetary policy since the GFC is ebbing. And that is the case with the US budget coming slowly under control and, in a world of mad central bankers, monetary policy suddenly seeming much less radical than it did.

Don’t get me wrong, I’m not pretending to have all of the answers here. Gold defies such an approach. Ironically for the true believers of gold’s intrinsic value, it is the ultimate social artifact, more reliant than any fiat currency for its value on the degree of faith or skepticism in policy settings.

Thus for me, the three key events that have caused gold to correct are those that have shifted the perceptions of US money policy stability:

• Mario Draghi joining the money printers

• Stabilisation in the US housing market and its gas boom

• Japan’s mad and bad QE

All of these have prevented the $US falling any further for now and into the immediate future.

The gold correction is thus good news and bad. It heralds the return of King Dollar and is good for global inflation as all commodities deflate relative to this benchmark. But it also means the US is once again saddled with its exorbitant privilege and that that will slow its recovery.

For Australia, gold’s tumble means several things. The good news is that the relative stabilisation in US policy means the Australian dollar will struggle to rise from here. The bad news is that gold is our third or fourth biggest export, roughly the same size as thermal coal, so the terms of trade is taking another hit:

Both undermine the Australian dollar and let’s hope it falls soon because gold is signalling that the dream is over for commodities.

I thought I read not too long ago here that the price of gold was determined by, I think, 7 people.

not any more. now it’s one HFT computer.

this is the end of manual labor.

as long as the food & reefer supply holds there’s no reason to worry

I’d try to say something intelligent about the gold crash but frankly have nothing intelligent to say. My guess is we’ll see $2000 gold in 12 months. This all reminds me of the stock market crash in 1987.

i hope that you’re being ironic…

if not the biggest drivers of gold prices are good ole’ consumption in China/India for luxury and store of value purposes—for a whole host of historical/cultural/economic reasons.

India (especially) and China are both slowing down—-you can only go so far in developing low-value, export-driven economy.

less demand, plenty of supply from new mines = lower prices.

Easy to overlook the fact that gold at its current price of $1388 has still outperformed Warren Buffet’s Berkshire Hathaway shares by a huge percentage over the past decade—-.

And outperformed the world’s (ex) richest and most successful corporation (Apple) over the past six months.

Despite all the “money printing” we appear to be entering a severe deflationary period due to a sharp slowdown in the world economy.

All that “money printing” is being gobbled up by banks paying off trillions in bad bets being held on the books at mark to make believe.

Looking at oil or more specifically the demand for oil it is evident that the world economy is sputtering. It is hard to see how inflation takes hold with much less demand.

Looking at the world economy is very scary indeed at the moment … Unemployment, despite government figures is getting worse, new hires are taking huge wage and benefit cuts.

My take on the future can be summed up by the title to the English-language novel by Nigerian author Chinua Achebe published in 1958 …”Things Fall Apart” …

A healthy dose, and steady diet, of stoic realism helps greatly to handle the stress associated with accepting the truth of your quote. Although it IS scary, it helps to also see inherent in “things falling apart”, the opportunity for those massive life-style changes the planet AND human beings sorely need. The “religion of progress”, arguably the most widely accepted civil religion of the modern industrial world, is coming apart at the seams; perhaps just in time to save our collective asses from the full impact of the religion’s insane excesses. http://thearchdruidreport.blogspot.it/2013/04/the-religion-of-progress.html

I have the “Druid” extensively. His works are indeed eloquent and well constructed. The arguments well thought out.

However they rely too a great degree on equals and opposites, an analogy I find too aggressive in a chaotic world.

I get you. And I find him pedantic as all heck .. :-)

I think our idea of “progress” is faulty–things just change as everything reacts to everything in any ecosystem. Progress occurs in some areas and then recedes in other areas. We have very sophisticated entertainment systems and highly sophisticated means of manufacturing consent but what was once called “wisdom” is melting away like the polar ice caps.

“Things don’t get better over time…they just get bad in different ways.” ~Zeeckster

In this “old man’s eyes” it’s relatively simple:

We have to distinguish between “lifestyles” and “quality of life” in “defining” progress.

“Simplicity, Clarice. Simplicity” (From “Silence of the Lambs”)

“but what was once called “wisdom” is melting away like the polar ice caps.”

I rather think more swiftly than those pikers.

“Wisdom,” these days, seems more or less the platitudes and pleasantries that the lords at Versailles deign to have their footmen share with the tavern wenches and farmers who appear on their many progresses.

As always, those who know wisdom don’t speak, and those who speak don’t know.

But is being silent wise?

“at mark to make believe”

ZING!

There may be another reason for gold tanking: Hedgefunds exiting. Gold is very liquid, smart investors should carry huges gains on it already, so what are they going to sell if customers want their money back? I wouldn’t be surprised to see a big fund being liquidated these days.

It could also be that someone like DB got a message that the next move of “The Troika” would be to force the “The Evil Destroyers of the Euro” to sell their gold reserves in order to pay the wig?

Fixing the price in front of the deal, then doing a little insider trading after the fact is how a “Too Important to Prosecute” operates most profitably.

It also serves the political purpose of the debtors not being able to clear their debt – leaving more assets to be stripped and more austerity to be doled out for the glory of das Reich/the Euro!

The mafia that controls gold didn’t have any in the warehouse, and customers wanted delivery of the physical stuff. What to do? Gotta get our hands on some. Let’s orchetrate a price crash, using the paper gold instruments and some good old-fashioned naked shortselling, then buy up what we need. Very simple.

The value of logic in speculation can only be determined retrospectively. Those buying (or selling) gold are merely placing bets. This is also true of other financial assets, prices of which fluctuate in response to herd behavior, in a world where important elements of the herd are playing with other people’s money, and seriously leveraging that with bank money. Central Banks are funding all this speculation from an unlimited store of electronic wealth. What is truly amazing is that people think they understand all this and can profit from predicting what will happen next. No doubt we will be hearing from a few claiming to have made a killing on this collapse. Every war has its survivors, but personal virtue seldom accounts for their success.

Personally, I am relieved to own only tiny amounts of two gold stocks which I do not plan to sell. I have no idea what is going on in the world of finance but I am very sure of one thing. Whatever is happening isn’t good for anyone who isn’t rich enough not to care about short term ups and downs.

Not a single commentator on the business/financial channels has talked about high speed trading and this plunge in gold. Both Krugman’s and Paul Craig Roberts’ take on the plunge were frankly not credible. This article is ‘realistic’, I suppose at least modest; however it does not mention high speed trading either. Yet, various articles over the years in Bloomberg, Reuters and other sources have talked about commodities being gamed by high speed trading.

Just asking…

What we are seeing in all the markets is “whipsawing”. As you say the big trading houses are using high speed trading to manipulate price discovery to their advantage …

When they see big “holes” in demand they can quickly short the markets creating huge gaps down that accelerate as “calls” get hammered.

Also believe that HFT has given the “biggies” the opportunity to “….create ‘artificial’ price discovery” away and beyond the “normal” markets.

In other words, the whole game is now thoroughly corrupt.

Paper gold – this is all paper! How much of this is real metal?

There is also the political angle – Cyprus is selling most of their gold as part of their bail-in. Is it any surprise that the price gets smashed before they sell, forcing them to sell more?

Demand for physical silver and gold remains high, even in the face of this recent crash. There are fairly long wait times for some silver products, and premiums over the spot price have been widening — it’s a real disconnect. In the recent sell-off, there were over 500 TONS of (paper) gold sold in one day.

Then there is the central banks’ accumulation of gold. The idea has been floated that one cause of the crash could be the central bank of Cyprus being forced to sell its 40 tons of physical gold… but that 40 tons is just a fraction of what Russia, India and China have been buying annually.

I think trying to speculate on what asset *class* will do well, may be the biggest fools errand out there. So hold some gold if you want for diversity, or don’t, but trying to predict which asset class is hot or not this year seems the height of insanity.

Energy demand in Europe is crashing.

Italy is close to system collapse i.e. to major civilization collapse.

People then sell their assets for cash.

http://www.youtube.com/watch?v=er2luQJtefw

Hi Dork … I’m in Italy and your assessment is accurate. It appears that after June the state suggests its questionable whether there will be sufficient funds to cover the building wave of unemployment benefits … And that will likely be the trigger for Italians to hit the streets in force.

However … not sure how the video you posted relates … its about the non-functioning Naples underground .. ?

A breakdown in Italian life support systems coming.

City life will not be possible.

The creatures of the temple as simply extracted too much labour and capital value out of the system.

Naples have seen thousands of years now but if this monetary situation continues it may be the end for it.

havent we been through all this before, say 25 years ago?

http://www.macrotrends.org/1333/gold-and-silver-prices-100-year-historical-chart

From that same series of charts, I liked the one that threw the price of oil and the dollar into the mix:

http://www.macrotrends.org/1334/us-dollar-index-gold-and-oil-historical-chart

Gold and oil prices seem to move in concert with each ohter, and in the opposite direction of the price of the dollar.

We know that the two pillars of the Reagan legacy were things that most likely rebounded to the price of the dollar:

One wonders if Reagan’s two great contributions to rescuing the American rentocracy amounted to little more than kicking the can down the road. Perhaps now the effectiveness of a militarized energy policy has run its course, and a de-industrialized America finds itself in an increasingly uncompetitive standing in the world.

People loved Reagan because he was a realist with a plan. Doesn’t matter what plan. People like strong and determined leaders and Reagan gave people that sense of security they had been missing. Kennedy was killed because he wanted to seriously rock the system. Johnson, to curry favor with the martinets who killed Kennedy, agreed to continue the cold war and stay in a war he knew was not going to work because he feared (if you listen to the WH tapes) the savagery of the right. Nixon attempted to take control of a rather chaotic situation and failed. Ford was a placeholder not a leader and Carter was an outsider that was undermined and hated by the Washington establishment (I know this from the inside) and railroaded out of office through dirty deals made by Reagan’s crafty CIA head with Iran.

Everything was put back together again with Reagan and we could all relax. Since then everything has gone according to plan. There is now no opposition to the American oligarchy and they can do and are doing as they please–the “conflict” that is going on today is just between those who want us to take the express train to our neo-feudal future and those who’d like to go slower with a gentler ride.

You say you know things about the Carter administration from the inside.

Could you tell more? Id be terribly terribly interested.

People loved Reagan because he was a television showman. His entire career was spent giving life to the ideas of others. His primary supporters were happy just looting the S&Ls. I am fairly certain other insiders just considered him a talking head eager to do what he was told.

LBJ had carried spears for Haliburton for thirty years before he assumed office in 1965. His ‘reluctance’ to go to war was as phony as his tender hearted concern for the poor.

How can one explain Jimmy Carter? He was the first outsider to grab control of the Democrats’ idiotic primary reforms (the details of which escape me and don’t matter anyhow, except that they guarantee nomination of a candidate bereft of serious support who is then free to sell himself to the highest bidder, a process perfected by WJC and elevated to high art by BHO)

Carter owed his election to nobody. He seems to have taken his office seriously, but had no idea how to execute it and surrounded himself with crooks and clowns. Of course, establishment politicians and Washington insiders did everything possible to undermine him, but his own loopy moralizing and sentimentality guaranteed his failure, particularly after he appointed some fast talking business type as Chairman of the Fed. I still wonder if the guy knew anything about banking, or economics either?

@Massinissa: As for Carter, my father was involved in that administration, peripherally, and told me what people, particularly in Congress where he spent much of his time felt–they all hated Carter for his lack of understanding the scene. He was a true outsider and did not have senior people who knew WTF was going on–made my Dad’s job harder. My dad was very progressive but he understood Washington and wished Carter had listened more to people like him.

@jake carter: I don’t think you have Johnson right–yes he was corrupt but he understood and recognized power and he made deals. He felt the deals he made and the illegal acts he or his henchmen performed could be leveraged to do good in the long-term. Johnson was an egotist and love the trappings of power but he was a damn interesting person–one of the few who enjoyed and understood how power operates yet love his country warts and all. That’s why he had such a hard time with the Kennedy’s–they believed that you could just go out there and change things through force–Kennedy upset everyone and wanted to change things quickly and that destroyed the two brothers. Yes, KBR had to be assuaged and Johnson knew he served at the pleasure of the oligarchs as every other President knows.

@Banger

It almost sounds to me that your interpretation of LBJ was basically he was Richard Nixon with more of a heart? Because other than the loves country part and a few other parts that sounds an awful lot like Nixon to me.

@Massinissa

No, Nixon was quite different. I used to know a woman who knew Nixon, on a personal level, very well and interacted with him regularly over years and she said he was a real sweetheart as a person–but this was towards the end of his life. Well, I figured, whatever… The I read Russ Baker’s Family of Secrets and lo an behold Baker claims with excellent arguments that Nixon was set up–that the professional CIA men who carried out the operation wanted to get caught–fact was the men put tape over the lock on the door of the burgled offices horizontally rather than vertically so the night watchman could not have possibly have avoided seeing it. At any rate, the point is Nixon clearly wanted to go back to the pre-Kennedy period when the President served at the pleasure of the people not the pleasure of the intel services–he was also, btw, the last progressive President.

Interesting take on Nixon.

I was previously aware that he was more the last type of the presidents of the 30s-60s than the first of the 70s-modern era, being to the left of Carter (surprisingly), being the very last president to expand welfare, etc etc.

Of course I cant really forgive Nixon for certain things, like deliberately sabotaging peace in Vietnam in order to win an election. But to be perfectly fair Ive always felt that in some strange way he was sort of superior to the sleazebags of today. With people like Clinton, Bush (the younger: H. W. Bush is probably the only president since at least carter im not pissed off at…)

I dont know. I guess I should read that book you mentioned.

Nixon was certainly interesting though: In high school (or was it college?), he drove a girl he liked and her boyfriend to dates, basically in order to get closer to her. Thats damn sly, though I would never have the balls to try that.

As for his seeming really sweet and personable to that woman you mentioned… Arnt those sometimes considered traits of sociopaths? Just mentioning that since alot of the mainstream basically implies he was one.

Another explanation for that womans observations could be some sort of personal change at the end of his life, but I find that highly doubtful and I am disinclined to believe that idea. Especially considering im pretty sure if I looked I could find the same sentiments of him from earlier in his life.

Ahh, Nixon. Probably our last good president.

The whole ‘Nixon goes to China’ moment was actually conceived during his vice presidency. In a private meeting with De Gaulle during a tour of Europe. The French leader mentioned that America’s best way to extract themselves out of Indo-China was to open relations with the People’s Republic of China. The boiling relations between the Soviet Union and the People’s Republic of China being an open secret by that point. He passed the recommendations onward to the State Department. Then nothing came of it until he was elected president. Despite what we may think now Nixon’s trip to China was probably ill-advised politically at the time. Still for all the personal slander his name endures to this day his record speaks for itself.

Oh, and we would’ve had a single-payer universal health care system under Nixon’s presidency. But the Democrats under Kennedy’s leadership sabotaged it because they didn’t want Nixon to have another victory. The irony is that Watergate was just weeks away.

@Watts.

I was reading about Nixons Healthcare earlier today: He wasnt advocating single payer.

He was advocating a mandate… Except it was a mandate for employers to buy it.

That actually sounds like it might work better than Obamacare, to be honest. But it still isnt SinglePayer.

However, to give Nixon credit, Single Payer was (and probably is) politically untenable. Too much insurance company opposition.

Massinissa:

The Nixon plan was never intended to abolish the private system of insurance. It was the part of the plan involving Medicare/Medicaid that would’ve transformed them into the single-payer system that I was talking about. Nixon wasn’t entirely clear on the details in his memoirs, but that’s what it sounded like at the time I read them.

Banger: it was documented VERY recently, in the 2000s I think, in the NY Review of Books, that Nixon actually suffered from clinically diagnosed paranoia — actual mental illness — and was under treatment during his entire Presidency and before. It was kept secret at the time.

This explains a LOT about Nixon. When he wasn’t suffering paranoid fits, he was a pretty decent President. When he was suffering paranoid fits, well, you got Watergate.

I think you mean redounded? As I recall Volker was appointed by Jimmy Carter, and his first mission was curbing gold speculation. Gold and oil moved together from 1978-82, and the thing that caused both to collapse was historically high interest rates. I recall Treasury Bill rates of 22% and 30 year Bond rates of 15%, in 1980 or 81.

This collapse has to be an unwind of leveraged speculation. ZIRP removes any possible monetary connection. I would not be surprised if a major lender or two simply decided not to renew overnight credits to major hedge fund players. That would explain the wave of selling affecting the equity markets as well.

@Massinissa

If you read that book banger mentioned and find it convincing you’ll come away more pissed off at Bush the Elder than the rest.

@ from Mexico

For someone as keen on book literature as you seem to be, you might want to examine a recent biography of Paul Volcker by William Silber of New York University. I say this because you attribute to Volcker the “destruction of America’s working-and-middle-classes”. This does not conform to any balanced assessment I have ever read about Volcker.

You seem to think Volcker was a willful agent of capitalist and corporate greed, directly responsible for diminished living standards within the USA. Well, history isn’t so simplistic, and you haven’t presented any facts as to Volcker’s role in this alleged impoverishment of ordinary Americans. Volcker did play an important role in the transition from the gold standard to free floating exchange rates, but that was during the Nixon administration. Volcker’s time as chairman of the Federal Reserve was mostly in the Carter administration, at which time he successfully curbed inflation. Reagan soon had Volcker replaced by Greenspan, and it’s this man Greenspan who deserves your censure and invective. Greenspan fostered the credit bubble in the financial services industry, and advocated subprime mortgages as a good option for ordinary Americans.

Looks mostly like you have your good guys and bad guys all mixed up. Volcker good. Greenspan bad.

Volcker understood what was in the public’s interest and was never a corporate crony as you allege.

Most non-European foreigners are going to have a very low opinion of Paul Volcker. For the simple reason that Volcker was and still is an agent-enforcer of American hegemony. While America only caught a cold due to his actions. The rest of the world caught pneumonia.

@ Andrew Watts

There is no reply link in my browser under your post, so I’ll post here. You wrote the following.

“Volcker was and still is an agent-enforcer of American hegemony.”

That’s completely unsubstantiated. If you are going to make a broad claim about someone’s pernicious role in world affairs, it would help greatly if you had a few facts to back up your claim.

“While America only caught a cold due to his actions. The rest of the world caught pneumonia.”

As to the world ‘catching pneumonia’ because of Paul Volcker, this is a disease metaphor and not an intelligent argument.

If you so fervently believe that Paul Volcker damaged the world economy and was an agent of global poverty, then you should be able to argue your point of view. Otherwise there’s nothing in your post other than misdirected anger and convoluted rant.

Looking forward to an intelligent discussion of issues.

I don’t feel the need to clarify my comment that Volcker was an agent-enforcer of American hegemony. Either you think there’s an American empire or you don’t. Simple as that. The idea that Volcker is immune to criticism is an opinion I find bitterly hilarious though. Due to the fact we are living with the consequences of Volcker’s policies during his time at the Federal Reserve. The economic wreckage at any rate.

It was John Maynard Keynes who first observed that wages are sticky. By which he meant that they do not immediately respond to prevailing economic conditions. Under Volcker’s leadership, the Fed in it’s efforts to fight inflation set the precedent of raising interest rates whenever nominal wages started to grow. By suppressing the money supply and creating unemployment the Fed has ensured that inflation has been tamed, but wages have remained stagnant. Over the last thirty years, this policy has helped to create an uneven distribution of wealth that presents the middle and working class with a dilemma; either the average individual takes on more debt in the form of student loans, credit cards, etc. or they suffer from a decreased standard of living. This is the price of economic growth fueled by debt. When the American consumer could no longer absorb more credit through even the most fraudulent schemes thought up by Wall Street the game stopped.

To be perfectly clear, I don’t think that wage increases cause inflation. Inflation is caused by the over production of money relative to increases in economic growth. Nor does Volcker or the Fed bear sole responsibility for that overproduction of money. Wait a minute, the Fed is allegedly independent of Congress. So it bears full responsibility for what’s happened!

Further clarifications:

Just about any chart covering the last thirty years will show you that US nominal wage growth only becomes unstuck when the economic boom has already begun to fizzle out. A more radically minded person would tell you this is evidence that the Federal Reserve is waging class war on the middle and working classes.

Before I forget, the Fed’s actions are a blunt instrument of class warfare. Har, har!

Volcker was out to crush wages to curb inflation. William Greider in “Secrets of the Temple” described how Volcker carried a card in his pocket tracking contruction worker wages. That was THE key indicator for him that his inflation-curbing policies were succeeding. He wanted to see them fall. And his fear of even 3-4% inflation leads to a deflationary policy bias which leads to bubbles and busts.

Where Greenspan and Volcker differ is that Volcker thought banks needed to be kept on a VERY short leash.

@ Andrew Watts

Thanks for your replies. Agreed, there were some hard times when Volcker ruled the FED. But I think life under Volcker was vastly better than the current conditions brought about by Greenspan and Bernanke.

You wrote:

“Volcker was an agent-enforcer of American hegemony. Either you think there’s an American empire, or you don’t. Simple as that.”

Why must I think there ‘is’ or ‘isn’t’ an American empire? You are telling me things can only be black or white, with no shades of gray? Yes I agree that the financial services industry is currently black rotten. The terms ’empire’ and ‘hegemony’ are fitting enough. My point is that the banking industry wasn’t always so dominant, hegemonic, and criminal as it is today. Turn the clock back before Reagan, and commercial banking was mostly routine and boring. All that changed with Reagan in office, mostly due to Reagan’s ‘deregulation’ of the banking industry. The Savings and Loan Crisis under Reagan’s watch was clearly criminal. But remember, at least back then bankers went to jail in big numbers. Laws and a system of justice were still operational. Today it’s completely different. The big change came with with the repeal of the Glass-Steagall act in 1999. Commercial banks got neck deep into investment banking, grew huge, played casino with tax payer’s money, and then went bust at tax payer’s expense. There is broad agreement among most of us here that banks are currently above the law and are criminal. A point of disagreement seems to be my claim that banking wasn’t always criminal all the time.

Compare Volcker to Greenspan. Volcker believed adherence to a clear set of banking laws kept the financial services industry healthy. Reagan disagreed. Reagan dumped Volcker as Fed Chairman because Volcker didn’t champion the philosophy of deregulation. The new Fed Chairman Greenspan didn’t think laws were necessary at all for banks. Greenspan believed the free market would police itself.

And for all the supposedly innovative products produced by the financial services industry in recent years, I was impressed when Volcker said he only knew of one useful banking innovation, and that was the ATM machine. He has not been an advocate for derivative financial instruments, such as mortgage backed securities.

You are right that Volcker took a very hard line about controlling inflation, even if that meant hard times for ordinary working people. The upside with Volcker in charge was that he never let banks go lawless and criminal. I’d definitely rather live in mildly hard times under Volcker than be hit by financial crisis like we’ve had under Greenspan and Bernanke. The people in my family have lost 1/3 of the value on our homes, and none of us can get any interest on our life savings. In the Volcker years your money grew in the bank, not like now. The Volcker economy was at least safe to live in, not like now.

You may not have liked Volcker’s war on inflation with repression of wages, but Volcker was never a crony to anybody, he stood on his principles, and he never backed criminal enterprises.

“Turn the clock back before Reagan, and commercial banking was mostly routine and boring.“

Wrong. Commercial banking was becoming extinct in the 1970s. When multinational corporations began to issue their own bonds they were eating the commercial banking’s lunch. This was one of the factors that caused commercial bank profitability to tank well before the 1980s. Which led to greater consolidation among the banks, as well as greater risk taking. The monopolization of the banking system began well before the repeal of Glass-Steagall Act in ’99. The failure and subsequent bailout of Continental Illinois in ’84 was the first instance of “too big to fail” at work. As many observers have pointed out, Glass-Steagall was being blown full of holes at the Federal Reserve’s behest. Before finally being finished off by Congress with a formal repeal.

The book Yves referenced covers a most of the changes that occurred during this time period. Despite the grave misgivings I have over some of Greider’s conclusions it is still a recommended read for anyone who wants to understand how we arrived at our current predicament.

“Compare Volcker to Greenspan. Volcker believed adherence to a clear set of banking laws kept the financial services industry healthy. Reagan disagreed. Reagan dumped Volcker as Fed Chairman because Volcker didn’t champion the philosophy of deregulation.“

Not really the point. It wouldn’t have mattered how honest or law-abiding the banking system was. It would not have prevented our present crisis. Fed Chairman Marriner Eccles explains why:

“As mass production has to be accompanied by mass consumption, mass consumption, in turn, implies a distribution of wealth … to provide men with buying power. … Instead of achieving that kind of distribution, a giant suction pump had by 1929-30 drawn into a few hands an increasing portion of currently produced wealth. … The other fellows could stay in the game only by borrowing. When their credit ran out, the game stopped.”

Through their policies Volcker (and Greenspan) destroyed the growth of purchasing power for the average individual. This occurred while worker productivity was increasing. But by depriving workers of their fair share of the economic growth generated they were sowing the seeds of our present crisis.

I don’t really want to get into why the Fed pursued this policy. There isn’t enough space or time to articulate the points that need to be made. As any explanation would have to cover just about everything that has happened since the end of the second World War. Needless to say it was not the sole responsibility of the Federal Reserve. They played a large role and deserve a great deal of the blame though. Which is why I’m not inclined to join in on the hero-worship of Paul Volcker.

Pedantic aside: actually it was Carter who militarized oil explicitly, as well as setting the stage for deregulation. 1977 speech later called the Carter Doctrine.

I got out of my physical position a couple of months ago. Can’t pretend to have seen this coming, but naked shorts, quote stuffing, front running and high speed trading games notwithstanding, I assumed that most people would assume that I would assume that others were assuming that gold had probably reached something of a peak.

I’ve always believed that Keynes had it about right:”successful investing is anticipating the anticipations of other.”

In other words it’s guessing what other people think you’re guessing about other people’s guesses and expectations.

What a way to spend a short life!

Sounds frustrating (or psychosis inducing).

One is shocked … SHOCKED … to learn that Yves is a closet gold bug.

Are there banking and weapons stocks in that portfolio too? 8-O

Wait, why would there be banking stocks, next to gold and weapons stocks? I understand the joke of having weapons stocks and gold, but I dont understand how banking stocks play in. Dont goldbugs not like banks?

It seems to me that, historically speaking, finance capitalism and militarism go together like Thelma and Louise.

Gold is a bet against the success of this partnership.

Therefore banking and weapons stocks would go on one side of the ledger, and gold on the other.

Great metaphor, Thelma and Louise, especially the ending.

Nice comment. This coming war, wherever it may be, will gone nuclear very soon, if big and not so big player join the game. This is unprecedented, thus the bet on gold is questionable, because it imply the functioning of some sort of barter system after the war. Gun and gold ? Banking stock ? What a mess.

The central banks need room to do further QE. That’s the purpose, thus the price of gold will continue to rise slowly to let’s say $2000 and then will be dump down again. Till all the gold are in the hand of true believers of gold. This is a very good environment for speculators.

Dear Massinissa;

I thought that the essence of good investing was balance.

Mr Haygoods comment made me think about the scene from “Casablanca” from which that famous line comes. After that histrionic outburst, remember, the pit boss sidles up to the “poor corrupt official” and slips him his “winnings” for that night from the recently ‘discovered’ gambling den. “Your winnings, sir.” Do watch the wordless interplay between Rick the owner, (Humphry Bogart,) and Emile, the croupier, (Marcel Dalio.) That little bit of pantomime says it all.

I think one could make a moral case against investing in weapons and banks (although if you are just buying stock already out there does it really matter?). But what’s the moral case against gold? It can cause some environmental damage in mining it? Yea, but I’ve always suspected most industries cause more.

Anyone who owns gold is therefore a “gold bug?” We must have different definitions for that term.

Jeez, lighten up, folks. I’m a bit of a gold bug myself, you know.

TBTF banks, guns and gold are often taken to task in this space. But socially responsible investment can be a damp squib.

Lord knows I despise banksters. But my dad’s portfolio that I manage has some JPM shares in it. At least we don’t stoop to owning telcos!

I take it that a “gold-bug” is someone who is opposed to fiat currency and desires a return to gold-backed currency, not just someone who happens to own some gold in their portfolio. I assume that to you, “gold bug” means something else. That’s all I was getting at.

And I don’t care what you own, btw, since the whole stock market game seems fundamentally unethical to me, personally (and I think all ethics are personal, fwiw, i.e. only to be applied to oneself, not to others). If you wanted to improve the world we live in for the sake of future generations, then I would suggest that you invest in solar or maybe purchase some land and donate it to a land-trust; something like that. But if you’re looking to make money simply by having money already, then you are probably well advised to stick with oil and armaments.

What if what all one is looking for is to assure they have some money for thier old age? Other than making sure at least 50% is in catfood futures, well what, one must invest in something (even if just dollars in a bank). Generosity and charity and a better future are certainly something I try to encourage (with money), but if they still mean catfood if we put all our money into them? It’s a viscious world we must play in.

I’m not a gold bug. It was obviously cheap at the crisis low. I bought it at around $730.

I’ve been too lazy and distracted to figure out when to sell. I hate hate hate trading.

Soros saw this coming last year.

You know, just a month or two ago, I remember some fellow in the comments here was arguing that buying gold was essentially Pascal’s Wager, and you couldnt lose so you may as well buy some.

I do hope noone here listened to him…

Alas, I did indeed listen to that commenters advice. I liquidated my long position in beannie-babies (I got in to the collectible plush market heavy in the mid-nineties and have been waiting for it to rebound ever since) and bought a ton of gold (well, not literally, a ton…an oz., actually) from those reputable merchants at Gold-Line (I know they’re reputable cause Glenn Beck told me so).

So now, woe is me. At least I could snuggle with the beanies when I was feeling depressed, but this gold stuff isn’t soft or fuzzy…I feel like a fool.

That might have been me! Though I’m not clever enough to quote Pascal’s wager. Another poster pointed out that.

BTW anyone owning physical gold have not lost a penny, unless they were foolish enough to sell while it is lower than the price they bought at.

It’s not about profit taking, it is about wealth preservation. Let’s leave the speculating to the GLD and SLV crowd, who appear to be on the verge of being totally wiped out.

I do agree that anyone who has gold right now should probably not sell it off. It may rebound, if not now, then at least in a few years.

But ive never spent a dime in investments (only in college right now, though I guess thats an investment, albeit maybe not a good one…), so my opinion probably doesnt matter.

If Soros saw that coming, the whole thing smells even more fishy to me! He’s enough on the inside that he should know what’s coming. The fact that paper gold tanks and at the same time physical gold is nowhere to be found in many markets shows me clearly that there is something severely wrong with this whole story.

I think the “real” price of gold cannot be determined as long as paper is part of the equation, because then gold is just another denomination of a fractional reserve system. And that those are inherently flawed and easily manipulated is not really new.

The reason that many think gold is a “safe haven” is just that: that there is a (at least halfways) finite amount that cannot be expanded on a whim of some market participants. But as soon as we have derivatives and “paper gold” that is not true anymore and so, gold is suddenly not better than the other (rigged) paper currencies.

It will be very interesting to keep an eye on the developments regarding physical gold as opposed to paper gold.

Sold the last bit of GLD awhile back, converted that to diamonds (whos gonna screw with that mob).

Skippy… GLD’s marketing slogan should be… Magic Happens[!!!].

I’m going to disagree w/Yves here regarding a hedge fund sparking the gold sell off. In my opinion, this could only have been a central bank. The Friday sell off was approximately 500 tons of gold in less than 15 minutes. That translates to over 16 million ounces at somewhere around $1,500-$1,550 per ounce. At $1,550@ounce, that is almost a $25 BILLION sell order. I’m not a Wall St. bankster, but I’d wager there are not many hedge funds that would short that much without having a Bernanke sugar daddy around somewhere.

We know the Fed manipulates the stock and bond markets, why not gold too?

Would not surprise me if Italy had already started selling … Things here are DIRE, and downdraft accelerating beyond comprehension. The week-end admission by government minister Fornero that they ain’t got cover after June strikes me as potentially suspect timing …

Yes, indeed. What we have now are markets, in part manipulated by the usual buccaneer investors but mainly by the solid front of all the sovereign funds, central banks and international funds like IMF, World Bank and so on to manipulate the financial markets to ensure stability. This power has gradually emerged and is now solidly in charge. This very factor means that gold or any other commodity of virtual currency has no legs to stand on. This emergent network that has really solidified since the Euro crisis is in complete charge and the fiat currency system is now very robust and can be trusted in my view.

The most important commodity, oil, has been brought under control this time. Last time, in 1971, when gold took off it tracked the price of oil which skyrocketed. This time, with gold sky high, we were not given a dose of high interest rates, but ZIRP. So it’s hard not to agree here. I doubt the value of gold will go to ZIRP. But it probably will track the price of oil again, this time downward. But downward slowly because it is all being controlled. Maybe it’s the end of the whole concept of inflation.

I want to mention, that if Gold is this goddamn easy for the central bank to manipulate, then it sort of invalidates alot of the points goldbugs make about Gold supposedly being better than fiat.

No matter the currency type, banks will manipulate it, whether they are private or public.

heheheheee ‘be like water’, grasshopper…nothing blows up a thread faster than awaking the gold buggers

Gold conjures up a mist about a man, more destructive of all his old senses and lulling to his feelings than the fumes of charcoal. dickens

Well, yes and no. I believe that gold is certainly subject to manipulation. What I don’t believe is that it is subject to manipulation forever. Gold is a finite resource unlike paper money.

“What I don’t believe is that it is subject to manipulation forever”

it was manipulated for over 20 years last time (1980’s to 2000).

I think many people would be upset if the nominal price of gold were $1800 in 2033 (in 2033 dollars).

Please re-read the post. I never said any such thing. In fact, I say very cautiously that the idea that central banks might have been behind this isn’t nuts.

Gold is old people’s bitcoin or as Buffet said:

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head”

I recently watched a clip where rogue Italian politician Beppe Grillo used the same story. It was dated 1998 I think. I wonder who the script-writer is …

Brazza, what do the Italians think about Mr. Grillo? I’ve been following his efforts with interest and glimmers of hope. Do you think he might be able to form a government?

weiner … pardon the delay, only got back to the thread late. I can’t speak for “italians” but I can offer you some observations from a detached perspective. Since the election (elas 50 days have gone by and no glimmer of government) Grillo has refused to compromise on principle and electoral promises. He has NOT agreed to back the relative election winning Democratic Party (Social democrats basically), and he has certainly NOT even cast a glance at Berlusconi’s conservative PDL. First PDL’s Bersani courted his M5S movement to support his attempt to form a government. He refused to ally with ANY political party but asked for an M5S mandate. Next he lobbied for parliament to start commissions immediately; that was nixed by pol parties who want a government first in order to control commissions. Lastly, since parliament now needs to elect a successor to President Napolitano whose 7 year tenure is ending, he set up online voting to ask registered members of his movement to freely name their Presidential candidates, promising that his members of parliament would back the one who emerged as having most votes, regardless of his personal opinion. 10 absolutely great names emerged from this popular poll, no populists, no right-wing fascists and hardly a politician amongst them except for ex PM and Euro Commissioner Romano Prodi who came in 8th, I believe. The top two candidates both turned down the invitation to participate as candidates: the first, an independent lady journalist known for her extraordinarily in-depth TV weekly series “Report” (Milena Gabanelli), and the second is founder of “Emergency” a no-profit organization dedicated to offering free medical services (Gino Strada). Their candidate will be 3rd-in-the-poll Stefano Rodota’, a left-leaning jurist and constitutionalist without party affiliation. http://it.wikipedia.org/wiki/Stefano_Rodot%C3%A0

The media has lambasted Grillo for 2 months now. Remember that he refuses contact with TV and Newspapers whom he sees as tools of a corrupt system, and indeed all receive state subsidies (and pol party support) and feel threatened by Grillo. Media spin on his behaviour and choices is to label them populist, intransigent, belligerent, uncooperative, irresponsible, demagogic, undemocratic, and more. The vehemence of the media attacks has taken a toll on his current popularity, but not as much as one might have thought. Polls suggest he’d probably win 23% instead of 25% if elections were held today. In fact I suspect he’d get higher … but rating agencies are also tools for manipulation of public opinion, and none among them had predicted M5S would reach more than 15 % in the February election. Apparently however the surging power is Berlusconi’s PDL, whose charisma is increasingly attractive to often- desperate Italian voters. Personally I don’t think it will play out that way. Many are impressed by Grillo’s coherence and unwillingness to sell out. Last week he told his own voters that those who voted M5S hoping for a political alliance with the Social Democrats, next election should definitely vote for a political party because the 5-Star-Movement (M5S) would never stoop that low. Frankly .. I think next time round he will receive a chunk of votes from the 25% of the electorate who chose not to vote last time.

Gratzie!

Well, it sure is odd that gold and bitcoin are crashing together such a short time frame. But it would be irresponsible to speculatewhy that might be.

“Anyone watching from Mars would be scratching their head”: as they would have been doing for the last 4000 years. I’m waiting for the moment to buy gold again. How I’ll recognise it, Lord knows; but the deflation will eventually be combatted by an inflation that was violent more than the Central Banks and governments intended. You’ll remember the old analogy of pulling a brick across a table with an elastic band – at first nothing happens except the band stretches; then the brick starts to move and accelerates across the table to strike you a painful blow.

You think inflation, I think deflation. Either way the elastic band WILL pull those bricks and strike a painful blow. And either way gold will have a second surge.

I made a killing selling my old HS ring. I bought it for $35usd in ’74. The Catholic Church closed it down and out I went. I got over dozen times what I ‘d spent. But go direct to a smelting operator. Fortunately, Philadelphia has a lot of metal works still going strong. Industrial skillsets will always be in demand.

in 1974, the S&P 500 was 90-ish. today it’s 1560-ish.

you could’ve made just the same killing saving $20 a month in stocks for the past 40 years.

This drop is all the more surprising given that there has been a big draw-down in physical gold stocks at the COMEX this year, and a really dramatic draw-down at the J P Morgan Chase depository.

Comex gold bullion inventories have slumped 17% already in 2013, falling to just 286.6 metric tons of actual metal on April 11, the lowest since September 2009. Interestingly, the drop in Comex inventories would be the biggest for a whole year since 2001. Additionally, given the news about Rio Tinto’s landslide in their open pit mine that seriously impacted production (Bingham Canyon, one of the world’s largest open pits, produced 163,200 tonnes of copper last year, as well as 379,000 ounces of gold. But, oddly, reports and news statements focus on the copper mining, downplaying or omitting the silver and gold production loss), this drop is all the more surprising.

If I were cynical, I might interpret this as a way to bring down the gold price so that someone can replenish physical stocks on the cheap, given that futures speculators sold a significant amount of more paper gold, in an hour or two, then the entire COMEX physical gold bullion inventories. Those with concentrated short positions may have been concerned about the significant decline in COMEX gold inventories – and an increased demand for the physical metal thus concerns about counter party risk.

It appears to me that no commentator or analyst of note has given evidence that the fundamentals of the gold market have changed; pointing only to the Fed “said” that they “probably” will end U.S. bond purchases sometime in 2013. The key word is ‘probably’. But even if true, negative real interest rates and competitive currency devaluations are set to continue – two fundamental pillars supporting gold.

Odd! The end of times, pehaps?

Cynical works.

Smart :-)

Yep, i’m not willing to acccept this at face value just yet.

You should hear some of the screaming this side of the pond over the last few weeks, with no-one believing Cypriot haircuts are a one-off, and money flooding out of the Euro periphery like a motherf*cker. Serious, sober, middle-aged people are starting to worry about the safety of their savings like they never genuinelly have before.

And gold is plummetting, because the US housing market is steadying, etc etc? Well, it seems pretty wierd to me, and i can’t help but suspect another PTB move to prop up the TBTF.

I wish I’d been reading Zero hedge on the day it crashed though. Buy the Fuc*ing dips!!!

Ron Paul Rules!!!

Yea, those sober middle age people, that supposedly (notoriously?) can’t let go (of their money, hence of the existing system etc.). For some good reasons, since they have been promised nothing but catfood, but …. nothing I can *entirely* grok, being too young I guess.

I may not like it but on some level I take it as a given, this uncertainty and ephermerial nature of money and most middle class wealth, here today and gone tommorow, dust in the wind, and it’s bigger than you, and what you can do about it.

Also: weinerdog43 @ 8:02.

Empire: ‘Lack of faith disturbing’.

Gold has worth based on real demand for use in electronics and other industries – ie: worth based on real supply and demand. People and institutions buy gold to keep it out of productive use…yes jewelry is productive or, should I say, wealth creating use – its a metal after all. People who buy it to store in some vault and wait for a rise in price or short it for a drop in price are speculating on price moves outside the real economy and in the speculative (intangible value) market.

Gold is a use full metal – it is not wealth sitting in a vault somewhere (labor is needed to create wealth…fashioning jewelry, depositing on windows, forming it in electronic devices et al). Also we use fiat money not based on the value of gold.

At best, gold has a deeply imbedded psychological value but, does not have an intrinsic value beyond that placed upon it as a function of supply and real usefull wealth creating demand

The EC( European Commission) wants the countries in the EU who get and or got a bail out to sell part of their gold to help pay for their bail out. Portugal, Ireland. Italy, Greece and Spain have more than 3561 tons of gold collectively. When tons of gold hit the market for sale correlation to market indicators will not matter for the short term and maybe the long term.

Silver will go down, but silver unlike gold dose have real demand to speak of, I see silver as a hold or buy when it gets lower, if you can find it at a decent price.

Gold, as the article pointed out, has tended to be a hedge against potential catastrophe. I think most smart investors understand that catastrophe has been averted and there are “strong” men and women in charge of the world financial system, aka The Empire.

Once it was seen that the Americans roundly rejected major reforms and that the fizzling out of the Occupy protests showed there was virtually no interest in real reforms then half the battle was won. Then once austerity was imposed in Europe to an uncomplaining but passive public and Greece was savaged and the Greeks just gestured a lot and shook their fists and went on to do as they were told (sort of) and make other arrangements people began to understand that the world bureaucrats and oligarchs were free to design whatever world structure they wanted without any fear of popular resistance.

Many people here talk that we will go into this or that crisis. But they’ve been saying it for some time and nothing has happened. When you have a system entirely dominated by fiat currency you have a different system. The power of fiat currency is, to be blunt, the power of the fiat and that comes from the ability to project physical force. The dollar is what it is because, ultimately there is military force (remember, the U.S. reserves to itself, without a peep of complaint anywhere, to kill anyone it choose for any reason) to back up its value. The Euro will probably remain a strong currency because the Empire says so and it can back up its claim through force.

Any opposition that begins to rise can be swiftly put down through force (hardly ever needed–the threat is enough for these cowardly times) and through the most sophisticated systems of propaganda ever devised. The people are atomized and dependent on the large feudal corporations that serve them and communities continue to disintegrate as people trade close personal connections for connections mediated by corporate controlled electronic systems.

We are now in the Brave New World–people have voted for it with their attention and their feet. Despite complaints of libertarians–people want a secure system not “liberty.” People know when they turn on their computer or their mobile device that they will be connected to something–can they be assured that with anything else in their lives? Will their spouses, their children, their friends, really stick with them should they need them? Not with the rise of situation ethics and the continuation of the Age of Narcissism. Our kinship systems are breaking down gradually and inexorably–some still have them but can they be trusted? I think not. People now know alienation is real and have learned to live with it through the system they complain about but know that it is the only game in town.

We now have stability–it is no longer a growth model but an austerity model–which means a stagnant and steady-state system with power gradually going to the rich and the system solidifying with a permanent and hereditary aristocracy–how the world evolves will depend on them not us.

So maybe Hobbes and Hume were right after all?

Hobbes was wrong about describing the state of nature for men as being one, essentially, of war. He was drastically wrong. Human beings survived and thrived and thrive today as deeply and hardwired social and cooperative creatures. There is no such thing, in my view, as “individualism” but what does exist is alienation. As society moved from community to corporate and state structures alienation increased and was leveraged by these large-scale actors. Hobbes did have a realistic view of things though because he understood the need for authority–I prefer Burke’s view on this.

I am much more sympathetic to Hume who tended towards pragmatism.

Hobbes doesn’t have to be right, but appears right at this moment in time. The human project made huge gains in the West against Hobbesianism after WWII. But, of course, the Empire struck back beginning with Reagan and Thatcher, and have been on a roll ever since – “There is no alternative”. banger’s comment at 9:04 is a very good summary of where we are and how we got here. Thank you, banger…

Aye, Hobbes certainly seems to be having the best of the argument these days, thays for sure.

Essentially what you are saying is that not only has the Leviathan triumphed, but he’s gone global.

It’s amazing how two different people can see things so differently. Whereas you see the US Leviathan in triumphant glory, I see him in his dotage, in the twilight of his life.

“His first minute, after noon, is night.”

made me smile….

Still, I think more Hobbes and Jeremy Bentham? Arguably more philosophically aligned proponents of what, I think, Banger is empirically railing against – the ascendancy of psychological egoism.

And, then more Bentham than Hobbes? As Bentham preferred to call egoism: ‘psychological hedonism’ – the psychology of being, in this context, personally and individually more connected (both figuratively and actually) to mobiles, computers, ‘entertainment’ and remote from the collective needs (altruism) of others.

I have to agree with Mexico here, Banger. While it could go either way, I see the economic system that the US is struggling to prop up as one of marked fragility.

Its entirely possible you are right, only time will tell with this sort of thing, but I remain to be convinced.

Well, my case is fragile to be sure. But it rests mainly not on the inherent strength of the system but in the fact there is no competing force to the basic setup. There is no international labor movement, no intellectual movement connected via the internet that agrees on anything and has no interest in “doing” anything political at all. The failure of the Occupy movement closed the door to change as far as I’m concerned–I get a lot of flack for saying it failed but here’s the thing–the more people thought about the issues Occupy put forward and their notion of participatory democracy was also put forward the more contempt the average person had for it. The mainstream media was even fairly supportive (this surprised me) but normal people who work everyday were annoyed by young boho types sleeping in tents and being pissed off and indulging in bizarre rituals like the evening talks–it was style that occupy was trying to sell in a way and it is on style that they were rejected.

This proved to me that the system is not just robust structurally but psychically as well.

Youre underestimating how incredibly sudden things can be set off. There wasnt a real movement or anything that collapsed the Soviet Union, it pretty much happened spontaneously all at once. I remember hearing some journalist speaking about his recollection of speaking with some protest group in east germany that thought the Berlin Wall would fall within the year, when in fact it fell within the week. It was a very sudden, spontaneous, almost explosive political sea change that just a few years before would have been difficult to believe. Rather, many observers and even those inside the USSR had a hard time coping with the fact that it was actually happening. In retropect the Unions decline was apparent, but still, it was not at all apparent the thing would come apart as it did.

The same can be said of the so-called arab spring revolution in Egypt. There was a small bit of internet organizing, but for the most part people just started protesting. It was almost sort of spontaneous, and it completely caught Mubarak’s regime entirely off guard. Just a few weeks before such a thing would have been unthinkable to Mubarak.

Youre underestimating how really small, almost insignificant things can set off huge changes.

By the way, on the topic of Occupy, you must admit, the whole 99% vs 1% narrative has essentially taken a place in public consciousness. It was mostly a failure, but it wasnt a huge failure, and I dont think there are really any negative consequences from Occupy being attempted. It was worth a try, even if it did not accomplish anything truly tangible.

One last note. I will agree that the psychological imprinting that the current system is the only possible system (TINA and all that), is incredibly pervasive, not just in America but in much of the western world. That psychic pervasiveness, acting as a brick wall on top of peoples imaginations, is one of the, if not the the single largest, obstacles to any sort of fundamental change to the modern capitalist system.

@Massinissa,

The journalist you remember hearing sounds like Chris Hedges:

“I was with the leaders of the opposition movement in East Germany, in Leipzig, on the afternoon of November 9th, 1989, and they said that perhaps within a year, there would be free passage back and forth across the Berlin wall. In a few hours, the Berlin wall didn’t exist.”

http://markmaynard.com/2011/10/chris-hedges-on-why-occupy-wall-street-will-bring-them-all-down/

I agree with Massinissa on the potential for a revolutionary spark setting off a series of sweeping fires. It’s happenned before, back in ’89, but also in 1848, and there are a few other historical analogies you could draw. The de-colonisation in Africa in the sixties, the end of fascist/clerical fascist regimes of Spain and Portugal in the seventies, the democratisation of Latin America in the eighties. Soviet revolutions after WW1, the collapse of democracy in Europe in the thirties.

This is a historical process that happens sometimes, a domino topples and it hits another dommino. When indo-china went communist in the seventies, it was called the domino theory. (Only it’s not just a theory, it’s a fact).

The question to me is, if there was another great revolutionary sweep, are we at a 1989 moment, or is this more like Germany in 1933?

The thing I fear is that any truly significant change will be from the neo-feudal right, moving to shore-up their financial position vis-a-vis the rest of us.

@Massinissa

Yes anything is possible but the condition in Eastern Europe was entirely different don’t you see? There was a living and breathing and powerful alternative!!!!

There is no alternative and no articulation of an alternative. The left, in the West, simply stopped as if it has seen Medusa and turned to stone. There has been little development and little exploration. There is no interest in organizing and creating an alternative structure–I’ve been vociferously advocating this and there is simply no interest on the side of the American left to offer a vision or create sparks of possibilities–just complaints and rants.

Change, to the extent it comes will come from the right at least in the U.S.–my personal belief is that populist mood may well shift to the left but it will start on the right.

Id like to say Lenin didnt have any examples, but then again Lenin had a well organized small group.

Still, it was such a small group im sure it was off event he radar of insiders.

“The question to me is, if there was another great revolutionary sweep, are we at a 1989 moment, or is this more like Germany in 1933?”

I think this is unanswerable. All we can do is *try* to make it more like 1989 than like 1933.

Which way it goes will be a “butterfly effect” phenomenon; all we can do is try to make the climate more hospitable for “good” outcomes than for “bad” ones.

@Massinissa,

About Lenin’s “well organized small group” being off the radar of insiders, some think otherwise:

The whole story of the USSR is a deep mystery, especially its beginnings. Official (Liberal) historiography has it that the birth of Bolshevist rule was for the most part a spontaneous — and wonderful, according to the Lenin-revering dinosaurs of western academia — Russian affair, with just a little bit of (somewhat embarrassing, but easily dismissible) German gold. Nothing more. Any intimation that the Anglo-Americans had been involved in major “puppeteering” in the Bolshevik theater — to favor them, that is — is hissed away as conspiratorial speculation.

And yet I cannot resist the suggestion that it was so because, over and beyond only a handful of revelations which are referenced in the book (about, e.g., England’s sabotage of the czar in 1916, when it seemed that Russia was inclined to seal a separate peace with Germany), every single historical development points in that direction. If only they opened all archives to us… If you study the deportment of the Soviet Union throughout its 70-year life, you notice that it kept up a major pretense that in one form or another facilitated the East-West world condominium, whose leadership was in any case solidly in the hands of the Anglo-Americans.

http://www.larsschall.com/2012/06/10/the-business-as-usual-behind-the-slaughter/

Another piece of the puzzle assembled by Preparata is the mysterious Israel Helphand (also Helfand), otherwise known as Parvus, a well-regarded Marxist author, trusted associate of Trotsky and key mediator between the Kaiser and the Bolsheviks who arranged, starting in 1915, for the flow of German gold into Russia that funded the propaganda campaign of Lenin’s little band of anti-war Marxists. Some Russian revolutionaries grew to distrust this erratic and ‘Falstaffian’ figure, with his ‘fat, fleshy, bulldog-like head’, and Trotsky finally broke with him after discovering that Parvus was, among other things, ‘engaged in vast commercial operations in the Balkans’. It was Parvus who arranged for the sealed train filled with German bullion that — with the connivance of the German high command — brought Lenin to the Finland Station in April, 1917. No one really knows which great powers stood behind Parvus, but his actions were in tune with those of the British government. While Lenin journeyed across Germany toward Russia, Great Britain brought the Menshevik Plekhanov to the Russian capital, escorted by imperial warships, and sprung Trotsky from a jail in Nova Scotia, spiriting him to Moscow.

http://www.guidopreparata.com/chpg/McGregor.pdf

banger;

So, we’re to be the new fellahin, are we? If so, it would explain somewhat the forced devaluation of ‘culture’ in our educational system.

No we’re not. We’re something much newer. We are becoming alienated and networked at the same time–very interesting.

That’s very interesting. Can you expand on that?

Hes basically talking about how Facebook is replacing a few strong relationships with shitloads of incredibly shallow ones for many people.

Could I expand on that? Wow! Could I ever! But I will be very simple and general. Alienation is one of the chief features and main motivators of modern life. People often wonder how poor people live in underdeveloped countries–why do they smile? Are they just stupid in their poverty? No, they know how the rich live–but they are connected to their religions, their tribes, their neighbors their clans and so on. They are often very kind–hospitality is an important part of life particularly in the Middle East–even with privation it can be a good life to live in a connected society.

Alienation feeds hunger–we need things to fill up our lives–fake food, frills, toys, extended childhoods, love affairs, drugs; and thrills like water skiing, rock climbing, constant activity, relentless ambition to always be better and better and achieve higher status not just in the eyes of others–but even more in our own eyes. Encountering non-modern cultures can quickly change your viewpoint–they exist even here in the U.S., btw. I don’t want to glorify these cultures, they have their problems and they are encountering the pull of modernism and consumer culture–how they will ultimately deal with the problem should be interesting to see.

“Once it was seen that the Americans roundly rejected major reforms and that the fizzling out of the Occupy protests showed there was virtually no interest in real reforms then half the battle was won.” ~Banger

I believe you are confusing the US government and it’s leaders with “Americans.” Polling data shows that a majority of the populace supports Wall Street reform. Here’s but one example, from a Lake Research Partners poll:

” A majority (63 percent) of voters, including 61% of independents, want more government oversight of financial companies. Just 1 in 4 want less government oversight.”

And again with the “Occupy failed” meme. No tents and police beat-downs equals no movement, right? Our little Occupy (out in the middle of nowhere in a pretty conservative state) never had to ask for a single dollar in donations. As soon as there were tents people were coming up to hand us money to help the cause. We had to figure out what to do with all the donations on the fly. No support for Occupy? Whatevs, dude. People are just waiting for the opportunity.

“Many people here talk that we will go into this or that crisis. But they’ve been saying it for some time and nothing has happened.”

What, 2008 not temporally close enough for you? Yeah, five whole years since the last time the system ground to a screeching halt…And the crisis, FWIW, is on-going since then, just ask all the unemployed folks out there.

“Will their spouses, their children, their friends, really stick with them should they need them? Not with the rise of situation ethics and the continuation of the Age of Narcissism. Our kinship systems are breaking down gradually and inexorably–some still have them but can they be trusted? I think not.”

If your life experiences have led you to this conclusion, you have my deepest sympathy, seriously. I know lots of people and for most of them, friends and family are the only things that can be counted on when the excrement really hits the oscillator. Most of my friends are dirt-poor. My family is middle class. I have witnessed, and occasionally benefited from, much generosity and greatness of spirit in people from both groups.

I agree that we are all told by our commercial culture that we shouldn’t be altruistic, but people still want (and need) to help each other out, despite the best efforts of our advertisers and economists.

In the end, imho, reality always wins out over rhetoric. People cannot deny their own experience forever. When the suffering gets great enough for enough people, all of the “nothing-to-see-here” NPR stories in the world won’t be enough to stop the revolt (whatever form that takes). The PTB are leading us quickly in that direction. When enough people are barely scaping by, any little spark will be enough to start the cascading collapse.

I think you over-estimate the importance of polls. If you trust polls, in many areas Americans are center-left–yet they vote invariably center-right. They like the rhetoric of “fairness” — anybody would agree that crime is wrong–and the Wall Street people did perform blatantly criminal acts so why did the people not support Occupy? Because they would rather have stability and conformity than change even if they favored a particular change. People, when asked, if they are racists or not will usually say no–but science has proven that the vast majority of people are racists even black people. It is the unconscious that rules us not our conscious selves. That’s what PR and advertising people know and perhaps you don’t realize.

The only reason Wall Street and the Banksters avoided prosecution is because we have a quisling in the White House. And a junk yard dog at DoJ.

Of course–Obama suckered the “left” but the left wanted to be suckered. His intentions were blatantly obvious in his early appointments and his approach to health-care. In my view, anyone who supported him or voted for him last year were the quislings. There is no opposition and no left in this country to speak of–just empty gesturing.

Oh, I forgot to say about the community and friends thing–I’m not talking about myself–but what I’ve observed. Community is breaking down–friends are less reliable compared to what they were and what they are in traditional cultures (which I’ve live in). In cultures were duty is supreme life is very different than here–can be more brutal sometimes but it would be inconceivable for a community to allow people to be homeless, for example because if a brother is successful and the other brother is not then that person must be supported–if a parent is old he/she is supported by the family almost without fail or dishonor ensures which is worse than poverty. These old communities are breaking down as I write this. You are lucky if you have a support structure many people don’t.