Nothing like dramatic proof that austerity is a failure. Less than one month forcing Cyprus to take a “bailout” (which in reality was paid for entirely by the Cypriots) under the threat of effectively throwing them out of the Eurozone, a leaked Debt Sustainability Report shows that that the Troika will demand another €6 billion from Cyprus, increasing the total cost from €17 to €23 billion. From the Guardian:

Cypriot politicians have reacted with fury to news that the crisis-hit country will be forced to find an extra €6bn (£5bn) to contribute to its own bailout, much of which is expected to come from savers at its struggling banks.

A leaked draft of the updated rescue plan, which emerged late on Wednesday night, revealed that the total bill for the bailout has risen to €23bn, from an original estimate of €17bn, less than a month after the deal was agreed – and the entire extra cost will be imposed on Nicosia.

The worst is, as Pawel Morski demonstrated in an impressive shred of the Debt Sustainability Report is that it is ludicrously optimistic in terms of how the economy will fare with Germany having decided to kill the Cypriot international banking sector (this while the EU is funding advertising for Bulgaria, which is low tax jurisdiction, the very sin Cyprus was guilty of):

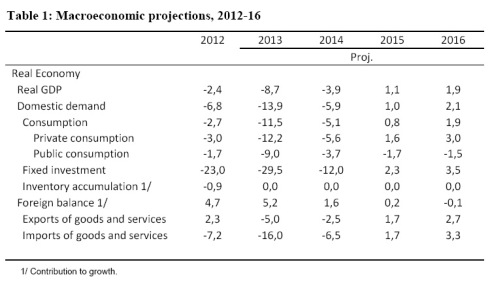

1) the economic forecasts are worse than literally laughable (table) . The drops in consumption and investment look dementedly optimistic given the events of the past month. Exports to drop a mere 5% with the destruction of the banking industry and the introduction of capital controls. The wealth effect wiping deposit worth 60% of GDP will apparently barely register on consumption – the Troika must think the deposits are all Russian. Compare with Iceland (50% drop in investment) or Latvia (40%), the former boosted by devaluation the latter by an intact financial system. Public consumption drops 9% – Iceland held the line here, and we have bitter experience from Greece on how big fiscal multipliers are. These projections cross the line from wild optimism into contemptuously half-hearted fable. This table is a bare-faced lie.

So get this, sports fans: not only did the Eurocrats underestimate how badly their little program would hurt the economy, they are continuing to underestimate how brutal it will be. Morski notes later:

The banking sector shrinks. The domestic banking industry shrinks at a stroke from 550% of GDP to 350% by a deft combination of taking people’s money and stripping the Greek operations (120% of Cypriot GDP) out and selling them to Pireaus. Given that the Greek operations were to a significant degree responsible for the disastrous GGB trades that wiped out the banks, and given that Pireaus stock rallied sharply afterwards, the Cypriots find themselves in the position of the Blackadder character who not only had a relative murdered, but had to pay to have the blood washed out of the murderer’s shirt. (excellent stuff here on how the Cypriot banks blew up, based on leaked documents).

Of course, this means at a minimum, that uninsured depositors in Laiki and the Bank of Cyprus will not get any money back.

The Troika is also demanding that Cyprus sell 2/3 of its gold. That’s a mere €400 million; this looks like gratuitous punishment, to make it clear to Cypriots that they are being reduced to penury….for what? Ambrose Evans-Pritchard argues that it is long-awaited payback (emphasis mine):

It is an interesting question why Cyprus has been treated more harshly than Greece, given that the eurozone itself set off the downward spiral by imposing de facto losses of 75pc on Greek sovereign debt held by Cypriot banks.

And, furthermore, given that these banks were pressured into buying many of those Greek bonds in the first place by the EU authorities, when it suited the Eurogroup.

You could say that this is condign punishment for the failure of Cyprus to deliver on its side of the bargain on the 2004 Annan Plan to reunite the island, divided by the Attila Line since the Turkish invasion in 1974.

Greek Cypriots gained admission to the EU on the basis of a gentleman’s agreement, then resiled from the accord. President Tassos Papadopoulis later deployed the resources of the state to secure a “No” in the referendum on the Greek side of the island. No wonder the EU is disgusted.But there again, Greece behaved just as badly. It threatened to block Polish accession to the EU unless a still-divided Cyprus was admitted, much to the fury of Berlin.

The Cyrpiots appear to be rebelling a bit against the Eurozone authorities again, despite the fact that the response last time was to rough the islanders up even more. The Financial Times reports that the ECB is ordering Cyprus not to fire the head of its central bank:

Mario Draghi, president of the European Central Bank, has warned the Cypriot government against sacking Panicos Demetriades, the central bank governor, over his handling of Cyprus’ worsening financial crisis.

In a letter addressed to the Cypriot president and speaker of parliament, the ECB head underscored the independence of EU central banks, adding that the launch of procedures that could lead to a governor’s dismissal marked “a very serious step”.A decision to remove the governor would be subject to review by the EU court of justice, he said…

The Cyprus parliament’s ethics committee said on Wednesday it would investigate Mr Demetriades’ record in the year since his appointment to determine whether he had acted against the public interest by failing to avert the collapse of Laiki Bank, the island’s second-largest lender.

If the committee rules against him, the Cyprus attorney-general would decide whether Mr Demetriades should be indicted on criminal charges.

The rift between Mr Demetriades and the government appeared to widen further on Thursday when a central bank spokesperson said the bank, not the finance ministry, should decide on the sale of gold reserves to help finance Cyprus’s €13.5bn contribution to a €23.5bn international bailout.

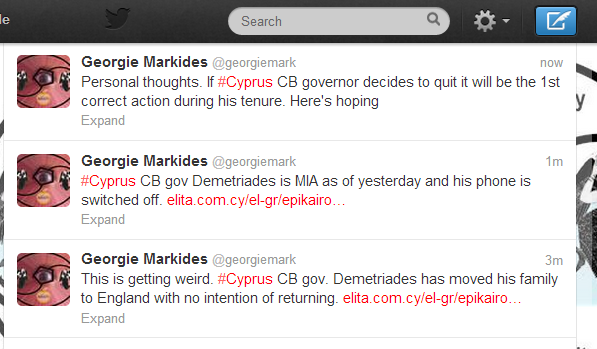

Someone might tell Draghi it isn’t clear whether Demetriades is being pushed or jumping (hat tip Antonis):

While the speed of the retrade of the Cyprus deal is dramatic, it is hardly alone in having targets fail to be met because austerity is counter-productive, leading to additional bailouts and even more exquisite economic tortures, necessitating yet more bailouts. Greece is up to three. The Troika is recommending restructuring Irish and Portuguese bailout loans by extending their maturity seven years, but it’s not clear that this will be enough to keep Portugal from needing a second rescue. Slovenia looks like an early stage Cyprus. The Netherlands have gone wobbly. And of course, Spain and Italy are on the “bailout soon” list too, but they’ve held out due to understandable reluctance to accept “conditionality” aka loss of sovereignity, complicated in Italy by the usual government instability and the rapid rise of anti-Eurozone politicians.

And that’s before we see whether the rough handling of Cyprus leads to a resumption of the slow-motion run on banks in the periphery, as those who can shift balances to banks in the Germany and safer havens. But not to worry, all those Eurobanks passed stress tests, so everything is fine, right? Unfortunately, we may find out sooner than we’d like.

The endgame: Permanent indentured servitude to the Germans.

The endgame: Permanent indentured servitude to the TNCs (transnational corporations).

Nationalism has nothing to do with it.

All of this is being facilitated by a group of Cypriot traitors who have sold out their own country:

Excellent comment. This is the point of all this as we all know. Again, neo-feudalism is now the clear and almost acknowledged goal of the buccaneer class you describe. They exist as a result of the breakdown of communities and even the nation state. What we need to do is to understand the real nature of the political struggle. The international community consisting of finance ministers, central bankers, finance oligarchs, the usual international bureaucrats from the IMF/World Bank and other organizations and the buccaneer class are the alliance that is currently shaping most international situations and are the de facto head of an emergent imperial system. Because we still think in terms of nation states I believe we miss facing up to this reality and the struggle it implies.

There is nothing new under the sun:

‘Merchants have no country. The mere spot they stand on does not constitute so strong an attachment as that from which they draw their gains.’

— Thomas Jefferson

That sounds fully plausible especially in view of every other lack of explanation. Something is going on here that is, by all standards of society, totally illegal.

As “from Mexico” correctly said, it is an international class of capitalists that is responsible, not “Germans” or any other nationality. The E.U., and the common euro currency, apply the “discipline,” a disclipline that imposes increasingly harsher policies. That they originate in this or that particular country is immaterial.

Let us also not forget that German industrialists are riding high right now not only because of the advantages they derive from the euro (i.e., eurozone export targets can’t devalue) but that their profits ride on the backs of German workers. German unions agreed to the Schröder/SPD program of a decade ago in which wages would be surpressed in exchange for (relative) security of jobs. So the German “miracle” is based on a decade of wage cuts for German workers — slow-motion austerity.

Austerity, of whatever flavor, is imposed by industrialists and financiers because it is in their collective interest, and thanks to globalization, financial policies will be harmonized in the name of “stability” and “ease of doing business.” Angela Merkel’s words are reminders that harmonization will conform to the tightest policy among them and Germany so happens to have that tightest policy.

“Let us also not forget that German industrialists are riding high right now not only because of the advantages they derive from the euro”

Fun fact: that kind of ended in 2011. Just look at German new orders: http://3.bp.blogspot.com/-Q7dV3hRBdpI/UWbXGQGgTQI/AAAAAAAAADU/LWftsKREzgc/s320/NO11-2-13.png

Germany is riding high on nothing more than the believe that it is still healthy. Unemployment still looks really good but that’s about it.

The chart you linked to shows orders on a steady decline. No argument, but the point on the currency is this: If Germany were on the DM and everybody else in the eurozone were still on their national currencies, countries like Greece could devalue, and the DM would have risen high in value against the drachma, etc., in Forex markets, thereby hurting German exports.

But the German currency, the euro, maintains its value against the currency in its eurozone export targets, the same euro, and thereby gains an advantage deriving from its currency not rising in value against other currencies, which would make its exports less competitive.

Yes of course. I agree with everything you wrote, i just wanted to show that Germany isn’t doing as well anymore as many seem to believe. I think your assessment is correct, I just wanted to add one more piece of information. I should have made that clear. Sorry about that.

If it’s up to me, I’d use whatever money that’s left, approach an investment bank and put on a huge derivatives bet that would win big if Cyprus were to leave the Eurozone. At the same time, I’d approach the Troika, take them to dinner, laugh at their jokes, pat their back, shake their hands, anything that would get some money flowing. If that works, I’ve perhaps just gotten the Troika to pay for my derivative bet.

True arbitrage.

If Cyprus leaves, the eurozone is also about to end. If it does no one will be there to repay you, I think. That is why Eurobonds would be just as save as the US’s. It just does not make sense to bet against huge economies. Their failure will wipe out Your counter parties.

Also at the moment Italy would be the safer bet, I think. With the Cyprus “rescue” Grillo will win in a landslide if there are elections again this year, which I think will happen.

Cyprus is just some kind of guinea pig and Angel of Death is playing with it and testing all kind funny stuff. Nothing good is coming from this. I dont really like to pay more taxes, that we can transfer money for these tax havens, (Well Cyprus is more like money laundering place or stop place for money before it goes to Cayman Island, but anyway…) where most of our biggest tax payers moneys are chilling, that they dont need to pay any taxes over here, where they make their big bucks. I wouldnt mind if ECB just printed money for EU and shared it that way to these countries after they stop hiding oligarchs and we close these tax havens, which are taking money of circulation in my country and making me cut my benefits, cause EU is supposed to equalize standard of living so that everybody except elite doesnt have anything. Thats called equality in modern Europe.

This whole thing is pretty problematic, cause Europe is now open market and all money can fly around, where ever it likes, so Cyprus elite doesnt really care about Cyprus, cause they can get profit for their wealth from elsewhere, like Sweden and Germany, which are making huge surpluses. There will probably not be any changes, before elite stops making profit. Unions havent really picked up, that they should work together in this case, over border lines and push wages up at least in Germany and other surplus countries. Unions just have lost their balls after 70s. Globalization have also made it harder to fight against corporations in one country. It should be world wide strike at these days. It would be amazing to see whole Europe in strike at once. You cant really beat too much debt with wage cuts. Only solution is to push wages up. Now elite have made whole Europe believe, that who will raise wages over zero percent will be next Greece. This is probably true in content of Portugal, but we really need something like unions now, before we are somewhere, where is no return without guns and bombs.

EU might have been glorious daydream, but execution have been just terrible. You just cant give government power over currency to banks without horrible consequences. Now my biggest worry are liberals, people who always just blames that its all governments fault and we must get rid of social security and charity will take care of everybody and we live in Garden of Eden ever after to the happy end. They are trying to get some footstep over here and they have always led us in to war, let it be civil or world wide, doesnt really matter for them.

We really need some supervision for this system and new Glass-Steagall act, cause invisible hand doesnt bring food on my table, when few people owns most of the land and soon air too with these crazy climate market deals. We are just not equal all from the begin, cause some guy have 100 billion and other have drunk parents, who have pair of jeans and couple of shirts. Which one have better changes in world, which doesnt give you any land or wealth in begin?

How you guys argument against these liberals, who say that everything will be okey, if theres no government or authorities. There have always been authorities and will always be its just question how righteous this authority will be or collective authority, like it should be in democracy, but i dont really believe that democracy is working too well anywhere else, than in Switzerland.

Have there ever been any true liberal nations on planet earth?

>I dont really like to pay more taxes, that we can transfer money for these tax havens, (Well Cyprus is more like money laundering place or stop place for money before it goes to Cayman Island, but anyway…) where most of our biggest tax payers moneys are chilling, that they dont need to pay any taxes over here, where they make their big bucks.

Good work, you are truly living up to your name. Did you just conveniently happen to miss the posts here on NC where it was shown pretty fucking conclusively that Cyprus was not a tax haven? Just whose water are you carrying here?

That’s assuming, of course, that they had either to begin with.

Yes I have read it.

Sorry mate, but I dont believe everything to be true, what Yves says, without any critical thinking. I would hope you to do the same. There was this little investigation http://www.icij.org/offshore, what have shown that Cyprus have been tax haven for Russian companies and many others also. For many of them its just bypass, before Cayman Islands. At least our investigate journalists found this kind pattern and released it last week.

Also Cyprus central- and commericial bank(s) didnt give for EU investigators all info, what they needed, so theres something what they wanna hide real badly.

Many Russian companies have been registered to Cyprus, so I would say its tax haven at least for Russian. (In my sense of taxes its tax haven) For rest of Europe its just money laundering place. Some of these have been even convicted of tax crimes. Europeans can also loose all traces after you put your money in Cyprus banks, cause they promise not tell anything for supervisors.

So if you wanna call Cyprus money laundering place, instead of tax haven. Great… we can do that, but i dont still think their business have been on very solid base and wont gonna miss this money laundering place and aint gonna feel sorry for bankers.

So please repeat after me: Cyprus is a washing machine.

Democracy doesn’t work very well, at this point in history, because it is too easy to manipulate public opinion and, even more important, to game the highly complex systems.

We will need a kind of decentralization and diffusion of power one way or the other. The source of all this is the gradual disintegration of communities and the growth of the idea that we are individuals first and should live to indulge ourselves first. This ethic becomes the ethic of the ruling class that sees its purpose as entirely selfish. I think this class has, it seems, lost all interest in duty and morality.

That’s assuming, of course, that they had either to begin with.

They did have a sense of morality–not always one we might align with but more than they do now. This info comes from old-time members of the establishment that I’ve met over the years. Tough? Yes, but insensitive to the good of society? No.

here we trod old paths

The united states is a republic.Not a democracy.The founding fathers had serious discussions and doubts as to what a democracy may engender.In fact,they decided against it because it was too likely to become easily influenced by fads,trends and mob rule.They chose a republic, with democratic tendencies.The thinking was that the elites(who of course would be chosen to rule the republic)were better suited to not changing every time the wind blew.They also hoped these elites would do what is right,in the long run.

Hitler too was a critic of democracy.And he proved his point, by using the democratic process, and his ability to guile and use “the big lie”, to win his place at the top…and then do whatever he wanted as was shown.

As far as decentralization, we have states rights.These were supposed to temper the federalist impulse to control everything.But now we have a ssystem borne of these well thought out objectives…and it is run amok

I personally think the ideas were good.But the “education” of generations and powerful influences who do act in concert have brought this could be great country to its knees.And made a mockery as to what the united states could be.The example we should be, is replaced by the example we are….

The elites, as people like Walter Lippman believed, should provide a guiding hand and I don’t disagree–subject of course to democratic approval–this was indeed the idea most of the Founders had. The problem is that the elites have abandoned ship and we’ve let them do that. They don’t care about society anymore at all. I agree with you on decentralization since I’m, more or less, a communitarian–the central government wants to be all things to all people and I think that tendency has been a big mistake. It’s not easy navigating the edge of chaos but we have to at least try. The central government, now hopelessly corrup, will rapidly lose the allegiance of most people. The only thing keeping it going is the mainstream media or, I should say, the imperial courtier class.

I think you mean libertarian instead of liberal.

In most places outside God’s Country (the USA for those of you who came in late) the term “liberal” still means what it meant in the 19th century: free enterprise, minimal government, private property, etc. Only here in Murka is “liberal” regarded as synonymous with left-wing. But then, the States (along with such advanced countries as Liberia and Myanmar) haven’t adopted the metric system either.

Nothing like dramatic proof that austerity is a failure.

*sighs* The left understands nothing and learns nothing. Austerity has been a resounding success. The ruling class is wealthier and more powerful than ever. The working class continues to be de-fanged and ground into dust.

The left is completely unable to understand how the most powerful people in the world think, nor what motivates them.

Agreed.

I think the Left does understand, but it is as yet unable to formulate an idea of how to counter it.

There is a margin between blindness and refusal to understand and any power – or determination, etc. – to effect change. The point is well taken.

The other problem is that the left is basically a handmaiden to the right, if right-left terms have any meaning at all, doubtful. (OECD.)

An emergence of a ‘new left’ – whatever that might be exactly – would entail a revolution, social upheaval, turning much on its head, acting outside of the conventional electoral process, rebelling against the locked down ‘democracy’ which offers no choices. (E.g. Obama-Romney, etc.) to create some new political space. Fat hopes…

No.

1. Austerity is infecting the core. Growth in Germany and France is falling. The rentiers want their interest to be paid. Strangling the economies to assure performance on debt obligations works only short term.

2. In case you missed it, the wealthy were hurt more (in % falls in income and assets) in the crisis than little people. The end game of this is a crisis. So they will give up all their gains and then some. Oh a few will cash out in time, but as we say last time. the exits get clogged plenty fast and most don’t escape before asset values tank.

The austerians are the embodiment of a classic Wall Street saying: “Little pigs get fed, big pigs get slaughtered.”

Like banger, I have been coming to the conclusion that the devastation of austerity is a feature, not a bug. Austerity leads to wealth transfer upwards, ala Shock Doctrine (assets sold off and those on top acquire them for a song).

Even though the wealthiest lost the most (at least in the early stages of the GFC), Bill Gates could lose a few Billion $ and it wouldn’t cause him any suffering, whereas to those on the bottom the loss of $100 can cause major problems.

So–that Wall Street saying about little pigs & big pigs doesn’t make sense. Is there an unspoken understanding that there’s another category, “Super Big” pigs, who will always make out like bandits in a crisis?

Are non-investor types–the 98% most likely to suffer from the crisis / austerity–not considered to be “pigs” from Wall Street’s perspective?

This is the first thing I’ve read by you that made me really confused–there must be something I’m missing.

This isn’t happening because of austerity. It is happening due to a banking crisis. It’s the same throughout Europe. Austerity is the medicine(poison?) but the disease is the global banking system. It should have failed in 2008. Until it does collapse the public interest will always be subservient to propping up these insolvent banks.

I agree with this. Neither austerity nor rapid monetary expansion can fix the problems. It is a false dichotomy. There is no good answer, only the inevitable and widespread pain to come, eventually. Economists and politicians imagine they can manage the problem if only they are given the power. That never worked in the past. We get to chose our poison, perhaps, since we cannot stand the pain of letting the disease run its natural course.

Maybe it’s a surreptitious climate-change agenda. Wreck the economies of Europe and their CO2 emissions will fall.

I think you may be right. I’ve had a sneaking suspicion that the issue of climate-change may be behind the austerity regime we seem to be in. Austerity makes no sense from the ethic of capitalism as it has evolved so far.

I don’t believe there is such a thing as economics as separate from politics. I’ve thought austerity existed as a policy to make sure those forces already entrenched in power would stay in power. If economies can be throttled down there is less instability. Workers become more docile and new ventures are discouraged.

I know for a fact that many people in senior management of international firms are aware of the probable dangers of climate-change and believe that actually doing anything about it like alternative energy, improved engineering or any rational plan will upset the balance of power which they don’t want. So throttling down the international economy maybe the only way to minimize climate-change. It is certainly logical. It just strikes me as strange that at the start of this crisis the IMF announced that the world needs austerity and every Western country fell in line.

Banger, on climate change, I agree — though I thought I was the only one who’d formed that theory.

The energy not burned in Europe will be burned elsewhere.

The year of physical euro introduction saw a huge spike in Chinese coal consumption…………

Europe is the plantation owners house , the rest of the world is its cotton fields.

Indeed, it is very logical–surely they cannot possibly be utterly ignoring science and logic when it comes to climate change while using it in their own risk-assessment matrices.

I’ve had thoughts along these lines as well. There simply aren’t enough resources on the planet for a multi-billion person population to include a large middle class. I’m not sure whether the rich and powerful have thought this through, or whether short-sighted greed and inability to admit error are simply generating the same result.

Some days, the dismal science seems more dismal than on other days.

Except of course in reality a crisis leads to environmental destruction.

It is my greatest fear that economic issues will lead countries to lose all sense of perspective and start mass in situ coal/shale extraction, which surely can be done “cheaply” enough to make it worthwhile from a short term dollars and cents (but not sense) standpoint.

Ambrose Evans-Pritchard is playing the English good guy.

A foil.

Any analysis of UK inter euro physical trade patterns would tell you whats really happening to the Eurosystem.

Gigantic wealth is flowing into the south of England.

This flow of wealth (imports) shows up as being negative to GDP.

Also look at their transport system for instance.

In my view transport & energy usage tells you much more about real capital flows (perhaps some months after the event)

A tiny railway station which has seen a 893% increase in passenger numbers in one year !

Thanks to the community campaigning for timetable changes.

http://en.wikipedia.org/wiki/Doleham_railway_station

Y2010/11 : 3,894

Y2011/12 :38,666

Dolehom consists of 10~ houses in a row and nothing else !

Its hobbit land.

Something really strange is happening in Southern England.

This sounds like a great story–I wish you’d expand on it.

@Banger

Lets say you stop the flow within Italy.

People start running out of cash …..this includes well off people.

They must sell their assets.

I imagine the Italians hold much physical gold.

The flow has not stopped in the UK

People (especially the rich) can substitute goods and services because their cash flow continues.

Therefore they do not have to sell their assets.

Where do you think the gold is flowing ?

6 billion of the UKs deficit last year was net silver inflows.

Imagine how much Gold is flowing to Hastings and other rich towns in the South of England ?

People have wealth = freetime

People get off the train in Dolehom for a countryside walk……..a lot of people………

Thanks–that explains the train station thing–is the move to Britain so large? It’s not been noted elsewhere has it? At any rate, I’ll look into it.

@Bangor

The 2012 silver trade deficit was the largest ever recorded in the UK by a wide margin.

It explained most of the rise in the UK deficit from 2011 to 2012.

Gold does not show up on the official trade books……that silver is a proxy for massive gold movements me thinks.

Now they will not show detailed UK trade data from Jan 2013……including the silver – its a secret you see.

They gave some stupid explanation of course.

In fact its probably a national security thingy now.

A lot of the data I look for is going dark anyhow.(unless you pay perhaps)

See IEA public oil market report stuff going offline.

This is a very bad sign of course.

Spanish austerity = British real goods trade deficit with Spain.

Ask yourself ? who benefits

British trade deficit with Spain (£ millions)

Y2010 : – 460

Y2011 : – 2,078

Y2012 : – 3,044

We live in a world with no final settlement.

Euro austerity transfers real resources to the UK , however inefficiently.

Europe is not what it seems.

Those data are thought provoking. Is there an unspoken Anglo-German power play happening?

@General

Yes of course.

The Germans have a production overcapacity

The Brits have a international (not domestic) fiat currency – big difference there Yves I am afraid.

Its a match made in heaven.

The North Sea powers is transfering capital (oil) north so as to remain Industrial.

The South can return to a agrarian lifestyle – now without the old skill sets and a much higher population.

Its a sort of have a nice day motherfuckers policy.

You could say that this is condign punishment for the failure of Cyprus to deliver on its side of the bargain on the 2004 Annan Plan to reunite the island, divided by the Attila Line since the Turkish invasion in 1974.

Greek Cypriots gained admission to the EU on the basis of a gentleman’s agreement, then resiled from the accord. President Tassos Papadopoulis later deployed the resources of the state to secure a “No” in the referendum on the Greek side of the island. No wonder the EU is disgusted.

But there again, Greece behaved just as badly. It threatened to block Polish accession to the EU unless a still-divided Cyprus was admitted, much to the fury of Berlin.

Petty squabbles reminiscent of Yes Minister, with Sir Humphrey and Jim Hacker? Ancient grudges settled by financial, rather than military, means? Is the right to national self-defense limited to armies with guns? It seems the Germans do not think so!

I fail to understand why Cyprus did not let a couple of banks fail and leave the Eurozone. My feeling is that staying in this nightmare zone will cost the Cypriots more in the end.

Exactly. I’m really quite surprised no one has left the Eurozone yet. Surely what Cypriots are going through has to be worse than if they had left rather than accept the terms of the first “bailout”? Assets were already frozen during the “bank holiday”, someone had to know it wasn’t going to get better (no hindsight needed). So why not?

There seems to be an implicit assumption here, common to the point of being nearly universal, that the people making these decisions have, and should have, the interest of Cypriots as their foremost concern.

Is there any reason to think that’s the case? Is is even useful to postulate a unitary Cypriot national interest at all?

Their economic mix won’t benefit much from a cheaper currency. They aren’t an agricultural exporter (soil is too crappy) and the have only certain months of the year where the weather is good enough for them to be a tourist venue, and hotels already sell out. So they would not get more tourism by cheapening their currency. And they import a lot of food and energy, which would become more expensive.

Their “export” was financial services. That does not become more attractive at a cheaper price.

They also have some foreign law jurisdiction bonds, they’d have to do a hard default.

Cypriots should leave the EU. Put all debt in the back seat. Start a new currency that is backed by government assets. They need to run a balance budget and use there new currency advantage to export their way out.

4th Reich!!

For gosh sakes, why don’t they just leave the euro already?

It can’t be much worse than what they are going to go through?

See this:

http://www.nakedcapitalism.com/2013/04/troika-demands-another-e6-billion-from-cyprus-making-rescue-bigger-than-gdp.html#comment-1197593

Maybe the difference between the bailout terms in Greece and Cyprus are because the problems are different?

Greece had a corrupt government that couldn’t afford to pay it’s debts. It’s banks were in trouble because they held government debt.

Cyprus has very large banks that are effectively bankrupt. It’s government is mostly ok, unless it’s forced to bailout the insured savers of the banks. (Or worse, ‘recapitalize the banks’…. i.e. give tax money to the banks a la TARP.)

It makes sense in a bank failure that bank equity, bondholders, and depositors take a hit before taxpayers.

It seems the gyrations of finance in the selfish Western world are exceeding viable operating characteristics.

What will it look like when the parts really start flying off this putrid bucket of anthropological shit called capitalism as a front for cumulative inheritance and private ownership of property?

You think Western banking is in trouble? Chinese banking and Japanese banking are each, for different reasons, in equal or greater trouble.

Of course, this was going to fall apart way worse and way sooner than the eurocrats projected. They basically blew up the Cypriot economy but acted like there would be only a brief hiccup in it.

And yes, the whole of the eurozone continues to go under. Again, no surprise. The EZ has half a dozen make or break problems which not only have not been resolved they have not been addressed. The EZ is deadman walking. It makes me think that the “Z” stands for zombie.

What does one expect when you base a currency on irredeemable fiat generated upon demand? Of course, systems like this will blow up. Read The Creature from Jekyll Island: A Second Look at the Federal Reserve and you will see why. Unbacked fiat currencies world wide will all follow. None will escape.

To me Cyprus is simply a microcosm of what is to come on a much larger scale in both size and scope. It is historically inevitable. Study it and then profit from its lessons as quickly as you can or you will get caught with your hand in the cookie jar too just like the banks, its depositors and the citizens of Cyprus.

“What does one expect when you base a currency on irredeemable fiat generated upon demand?”

What would you have it redeemable for? Bright shiny rocks? Yes, that makes so much more sense.

You seem to be behind the curve. The euro was run as a de facto gold standard, which is also a major reason Europe is imploding at the moment. The euro had the potential for use as a fiat currency but the fiat aspects that would have helped the current situation were not used.

A extraction of deposits from Cyprus moves real resources upwards.

From the northern banks perspective this is a success.

I don’t get Yves take on this to be honest.

How is it a failure ?

This is how it was always done.

This is infact a form of land clearance that another union engages in – the UK.

England became a Industrial giant when it drove Ireland & Western Scotland into surplus as Industry needs surplus raw materials.

There was a loss of productivity in Cattle centric / labour heavy trade for less productive but labour light cash crops known as sheep.

Sheep yes, but England also made a point of trashing Ireland’s textile industry, leaving the Irish plenty of time to grow potatoes instead. We know how that came out.

Act of union

Single european act / Maastricht Treaty

Same shit different century.

We had a war boom after the act of union ,Cork had a great time of it until…….

We had a consumer boom after Masstricht….Cork had a great time of it until…….

Then the bust 20~ years later

Then the famine 20~ years after that.

Shit goes around.

BTW, psychohistorian should have left the historian part off of his tag. Note where the majority of large investors in Cyprus have come from. Uh, communist based Russia! And you blame capitalism? The elite in Russia exploit the citizens and transfer their wealth outside of taxation from the country they exploited to a fiat EU based economy. Now their non-free market system of exploitation is failing. And some idiot spouts Communist Manifesto nonsense as a solution? Obviously a historian who ignores history. The 5th plank of conversion to Communism is: Centralization of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly.

Uh, that is what they have in the EU, US and banks all over the world now. It ain’t free market capitalism. Get a clue. The cause is conversion to Communist utopian ideology, NOT free market capitalism. The legacy of Communism is exploitation and brutality, NOT freedom or free markets!

You make it sound as if there is some great difference between Communism and the cult of the free market. There isn’t. As John Gray explains:

Communism, the cult of the free market and radical Islam: they all promised radical freedom of the will and universal freedom, but in practice delivered Hobbism.

Very interesting. What communism and the free market have in common is the deregulatory form of legal transformation (withering away of the state) and, if I understand it, radical Islam would extend religion into the state apparatus, transforming it accordingly. While I agree with Gray that radical Islamists are as modern as anyone else, I am not sure that the Hobbesian result of communism and the free market (the “right” of the stronger) would be the endgame of radical Islam, except for women.

In order to flesh this out a little bit more, I will offer another quote from Gray:

Or as a wit once roughly put it:

Capitalism is the exploitation of man by man

In Communism it is the other way round.

That probably explains all the excited gushing and burbling over Fukuyama’s article back in the early 90s. History was going to end with the “unabashed victory” of capitalism, which was naturally interpreted as “Big Bang” global finance capitalism. LOL

Ah history, that lie commonly agreed to…..the temporary delusions of the winners

tfjnow seems to have focused on my term capitalism and not the following descriptive terms like cumulative inheritance and private ownership of property.

Russia has communism just like the US has capitalism….NOT. Capitalism more than communism is a fig leaf on the current class based and inheritance controlled plutocracy and I doubt if Russia is much different behind the curtains.

What they are both exhibiting in reality are the actions of private owners of property and accumulated wealth operating as the “invisible hand” around the throat of the world’s masses.

Does anyone have a link or can explain how this whole crisis in Cyprus started? I realize the banks failed, due to their exposure to Greek debt. But why Cyprus, and why now? After all, every country had to participate in the Greek bailout. Did Cyprus have a disproportionate share?

Even if that’s the case (Greek/Cypriot ties are close, so I wouldn’t be surprised if they held a lot of Greek debt), why now? Has there been some Greek shock event in the past few months that all of a sudden caused some sort of credit event?

Given that the govt of Cyprus itself has had reasonable finances up to now, it’s a little peculiar that they’ve been throw into such chaos so suddenly right now while the rest of Europe has muddled through so far…

Very short version: Cyprus needed a bailout by June. They hadn’t taken a bailout offered (around the time of the Spanish bailout, IIRC last September). Big big mistake. They would have slipped in under the radar.

They (previous administration) requested €17 billion. The old regime was pro Russian communists. In the first week of the new pro EU president being in office, the Troika mugged the new guy. They didn’t beat up on the Commie, apparently worried about what he might do. But when they had a more complaint guy in place, they moved immediately.

I’m begiining to wonder whether all the furor over Cyprus is not just some peculiarly vicious form of smoke&mirrors being played out in order to distract attention from the real burgeoning disaster happening in Holland.

A financial crisis in the – AAA – Netherlands requiring some kind of bailout would, most likely, shatter the unity of the EU Northern Bloc. The constantly reiterated narrative of hard-working, frugal, Northerners (aka Protestants) vs. those lazy, olive eating Southerners (aka Catholics, or, maybe, Orthodox) would, I submit, take a bit of a pounding.

What Ms. Merkel, will you do then ? Going to be a bit of a difficult sell to the German public, turning your emotional story around by 180 degrees.

So … we need to be paying very close attention to all the things the EU/EZ get up to in the Netherlands until the September elections are over in Germany.

It would be a delicious piece of poetic justice if the next place Mr Dijsselbloem’s infamous (no, really truly, its not a) template gets applied is to his very own country.

You know those lazy shiftless Dutch, sitting around drinking Heinekens all day.

You know those lazy shiftless Dutch, sitting around drinking Heinekens all day.

And of course, there’s this remarkable turn of events.

http://unintentional-irony.blogspot.com/2007/02/why-barry-goldwater-lost-tennessee.html

http://www.bloomberg.com/news/2013-04-12/parties-switch-roles-over-possible-u-s-sale-of-new-deal-era-tva.html

Talk about Tricky Dick going to China…

People should really read your second link. It talks about how Obama “explores” selling the TVA to private buyers

in his Catfood Budget. I would not have thought of Obama suggesting something like that. It appears he wants to.

I hope Lambert Strether decides this link deserves elevation to co-featured link in the “links” section. Dare I hope that Yves Smith would find this suggestion by Obama . . . to sell our TVA to private buyers . . . so bad and dangerous as to deserve a Post of its very own?

The fact that the last political figure of national importance who even discussed selling off TVA was Barry Goldwater(!)back in 1964 pretty much says it all about Barack Goldwater.

There’s no subtle eleven-dimensional chess game afoot here. The guy’s a conservative, pure and simple. Doh!

See – table 4.5 for all that need to be known about the Irish & wider euro economy

We left the Sterling peg in 1979.

There is a immediate Euro Soviet push to increase productivity & keep wages static

Wages as a % of GDP

Y1980 : 70.1%

Y2002 : 46.3%

Y2011 : 51.7%

“The wage share is determined by capital intensity, technology and institutional factors.

Globally there has been a general decline in the wage share, but Ireland’s sharp decline

followed by partial recovery is unique”

http://www.nerinstitute.net/download/pdf/qef_spring_2013_web.pdf

When there is no rational wage demand credit fills the surplus hole created.

But how do you know what is rational demand when you have no rational signal ?

This causes malinvestment on a huge scale.

As soon as Germany finishes with France they will have done without firing a shot what tow wars failed to do, taken all of Europe.

A good comment was posted in response to the Ambrose column with 3 examples of why Cyprus said No to the Annan plan. Something the media never seems to explain but always chastises Cyprus on. Like they some how should have agreed to legalizing the invasion.

Here it is.

“radioctive

Today 04:35 PM

Mr. Ambrose apparently has not done his homework or deliberately misleds people about the Cyprus Anan plan for reunification.

So let it be known that the Annan plan was a Machiavellian instrument of destruction for Cyprus .

Just 3 examples from the numerous

traps in fine print , just to make absolutely clear what kind of crooks decide our fate :

1) The British Bases

in Cyprus reside on rented land for which the UK stopped paying rent 40 years

ago just because they can.With the Anan plan for reunification, a clause was inserted so that the nonpaying -bullying -renters would become

permanent owners of 2 huge beach properties

plus 1 mountain view radar site, plus the Bases would acquire offshore drilling rights for the gas & oil reserves of Cyprus for

free. Sweet eh ? A state within a state

.

2) The Cypriots would have to sign away all claims for ancestral land stolen by the Government

of Turkey .Homes ,villages ,towns .Then the Cypriots would have to tax

themselves to pay compensation to themselves

for properties stolen by the Turkish Government .Clever .

3) The Turkish

government colonized north Cyprus by vast polulation transfers from Asia ,which

is a continuing war crime .The Annan plan provided that the settlers would be

allowed to stay in the stolen properties.Within 30 – 40 years the local population would have become a

minority or left .

As it was explained by some

American officials ,the Annan plan was just the Wests’ gift to Turkey for

collaborating with the US for the destruction

of Iraq

And now with the destruction

of Syria ,Turkey will get another 30

pieces of bloody silver .

Have you ever heard about the ‘Embassy of Death’ in the 70’s ?

The Killinger ? ( Kissinger )

The Merchants of Death ?

Mr Ambrose , Reality really is

not what you hear in the news.”

Speaking of “American officials”. US wants those UK bases, while UK is less and less able to keep them going. Only trouble is, apparently, the present Cypriot constitution requires withdrawing the grounds from military usage… something about peace, love, and flowers; but Cypriots have been bankers and traders for a long time. A hopeless starving population might be persuaded to reconsider.

As usual in the real world, ‘all of the above’ is likely the most accurate answer, unless it is only an electioneering gambit by Frau Merkel.

If the main takeaway for readers about Cyprus is a story of austerity and meanness and cruelty, then that would be pat. I think there is a rest of the story. I’m dubious of the idea that a few billion in Greek loan losses caused the insolvency of the banks, which had assets a hundred times that and more. If that was the case, a Troika bailout would have been no big thing. One fact I discovered was puzzling. The big Cypriot banks were paying high interest on deposits, yes, but a they were also paying marginally higher rates for deposits of dollars than for euros. It should have been the other way around. It suggests a dollar had more utility there at the time than a euro. Why? Is it possible that, if I had a boatload of euros, and I thought the euro was going to collapse, I could deposit the euros at a Cypriot bank and borrow dollars against the collateral, take the dollars out of the country and deposit them in perhaps a London bank with at least a branch in New York? If so, then I wouldn’t care if the Cypriot bank collapsed, the loan wasn’t intended to be repaid anyway, and my boatload of money would be safe, in dollars. I don’t know the barriers to prevent this being done, but if it was possible, it could help explain all the vanishing money.