By Reda Cherif, economist at the IMF, and Fuad Hasanov, economist at the IMF. Originally published at VoxEU.

Europe’s austerity-first approach has triggered research-based efforts to evaluate the effectiveness of debt-reduction strategies. This column, based on a US empirical study, suggests that an ‘austerity shock’ in a weak economy may be self-defeating. Public-debt reduction historically occurs gradually amid improved growth. If policymakers, firms and households respond as in the past, we should expect lower deficits amid higher growth and, eventually, decreasing debt ratios.

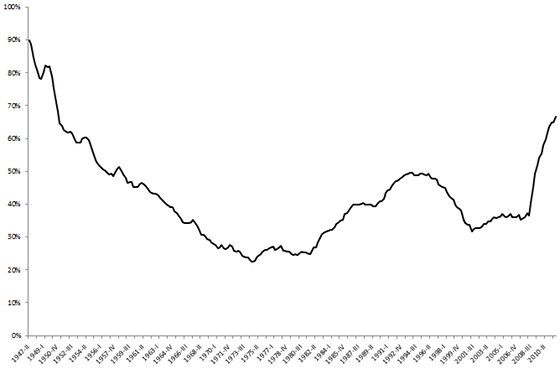

In many advanced countries, in the wake of the 2008 global financial crisis, deficits skyrocketed and public debt ballooned (see Figure 1). In fact, fiscal stimulus accounted for only a small fraction of the increase in debt, whereas collapsing revenues and higher unemployment and social benefits contributed the largest share (IMF 2011).

So, what should be done about high public debt? In our recent research, we find that fiscal consolidation and debt reduction occur gradually amid improved growth (Cherif and Hasanov 2012).1 We also show that an austerity shock (such as a sharp contraction in government spending or an increase in taxes) in a weak economic environment may be self-defeating.2 That is, there is a large risk that the debt-to-GDP ratio may be higher than in the case of a gradual fiscal-consolidation path after growth had picked up. Authors writing for Vox have argued that this point applies to Europe (see Holland and Portes 2012, De Grauwe and Ji 2013).

Figure 1. Evolution of federal debt held by public (percent of GDP, 1947:II-2011:III)

In our paper, we provide an empirical framework to analyse debt dynamics and focus on the effects of austerity, inflation, and growth shocks on reducing public debt using the US data. To study the relationship between public debt and major macroeconomic variables, we use a modified vector auto-regression framework that includes a separate debt equation as in Favero and Giavazzi (2007). The endogenous variables of the vector auto-regression model are the macro aggregates of the debt equation – primary balance, growth, average interest rate, and inflation rate. The model also includes the federal debt-to-GDP ratio (and its lags) as an exogenous variable. We compute the out-of-sample debt forecast and impulse responses of debt under different identification schemes. The impulse response to a shock is defined as the difference between the path with an initial shock and the baseline (that is, a path based on the historical pattern with innovations averaged out). We use a bootstrap methodology to compute the confidence bands.

We obtain two methodological results:

- First, we show that in our specification – a vector auto-regression with debt feedback – the projected debt ratio is stationary, whereas vector auto-regressions excluding debt could imply an explosive debt path.

- Second, we find that initial conditions affect the impulse responses of the debt ratio and their distribution due to nonlinearity introduced by the debt feedback.

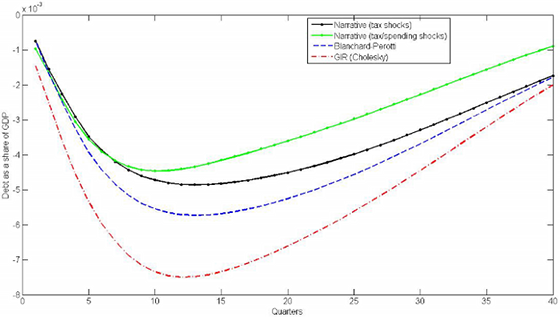

In response to an austerity shock, the public debt ratio falls and then returns to the baseline path (see Figure 2). For instance, following an exogenous reduction in the primary deficit of 4% of GDP in one year, the debt ratio falls by about 17% of GDP in about three years compared to the baseline.3 The resulting lower growth counteracts the initial austerity efforts. Furthermore, the debt ratio eventually goes back to its baseline path implying that in the long run, the debt ratio reverts to its stationary level. In the absence of a structural break, the effect of an austerity shock on debt is not persistent. The baseline median debt path converges to its long term level (about 40% of GDP) as it already incorporates the debt-reducing dynamics of the past (lower deficits amid strengthened growth).4

Figure 2. Debt impulse response: the effect of a one-standard-deviation primary-surplus shock on the debt ratio

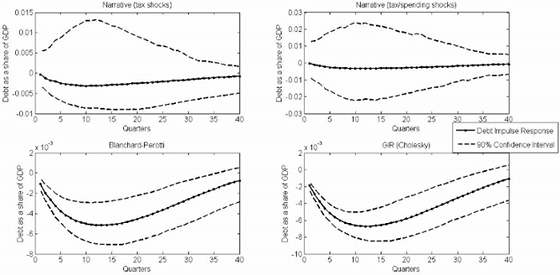

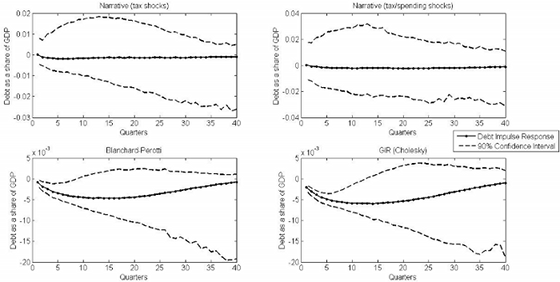

The uncertainty around the median debt path is substantial, especially in a weak economy. We compare the debt impulse response under average initial conditions or ‘normal times’ (see Figure 3) with that of 2011 initial conditions or weak economic times (see Figure 4). The impulse responses in normal times (Figure 3) show that the decline in debt is statistically significant in the first few years under Blanchard-Perotti and Choleski identification schemes. In the narrative identification, the austerity shock does not have a statistically significant effect on the debt ratio. This is true even under average or ‘normal’ conditions. Under the initial conditions prevailing in late 2011 – a weak economy, low interest rates and inflation, large deficit, and rising debt – confidence bands are wider for all identification methods than those under normal times. Moreover, the confidence interval suggests that there is a 25% chance that the debt ratio could increase in the first few years as growth deteriorates in a weak economic environment (the Blanchard-Perotti identification). Consequently, the risk of a self-defeating austerity shock is much higher in the weak economic environment than in normal times. In recessionary times, when fiscal multipliers are larger than in normal times (Auerbach and Gorodnichenko 2012), an austerity shock might result in an increasing debt ratio.

Figure 3. Debt-impulse responses to a one-standard-deviation primary-surplus shock: average initial conditions (normal times)

Figure 4. Debt impulse responses to a one-standard-deviation primary-surplus shock: initial conditions of 2011

Conclusions

Fiscal consolidation that involves a sharp reduction of the deficit in one year is risky, and a slower pace in reducing debt should be taken. If policymakers and economic agents respond to the debt buildup and their economic environment as in the past, we should expect lower deficits amid higher growth and eventually a decreasing debt ratio in the future.

References

Auerbach, A and Y Gorodnichenko (2012), “Measuring the Output Responses to Fiscal Policy”, American Economic Journal: Economic Policy 4(2), 1-27.

Cherif, R and F Hasanov (2012), “Public Debt Dynamics: The Effects of Austerity, Inflation, and Growth Shocks”, IMF working paper 12/230.

De Grauwe, Paul and Ji, Yuemei (2013), “Panic-driven austerity in the Eurozone and its implications”, VoxEU.org, 21 February.

Favero, C and F Giavazzi (2007), “Debt and the Effects of Fiscal Policy”, NBER working paper 12822.

Hall, R (2013), “Fiscal Stability of High-Debt Nations under Volatile Economic Conditions”, NBER working paper 18797.

Holland, D and J Portes (2012), “Is Austerity Self-Defeating?”, VoxEU.org, 1 November.

International Monetary Fund (2011), Fiscal Monitor: Addressing Fiscal Challenges to Reduce Economic Risks, September.

1 Hall (2013) reaches a similar conclusion.

2 See also DeLong and Summers (2012) and Holland and Portes (2012).

3 The model nonlinearity implies that the magnitude and pace of the adjustment could also matter.

4 The debt ratio path represents federal debt held by the public and does not take into account any proposed tax policy changes (e.g. retaining Bush tax cuts) and future aging or health care related costs.

Vaporized again. Have a nice day.

What’s so hard? It’s excessive private debt that is the problem and it’s deficit spending by the monetary sovereign that makes that debt payable. And:

1) Deficit spending by the monetary sovereign does NOT logically require borrowing by the monetary sovereign.

2) Deficit spending need not inflate away the debt since it can be combined with restrictions on new credit creation to avoid increases in the total money supply and yet help pay down existing debt.

The fact that fiscal austerity will have different impacts depending on the economic circumstances shouldn’t be difficult to intuit even by the dumbest policymaker. So I conclude that the driver of austerity, in the EU this years for instance, is not precisely fiscal consolidation. You can guess…

But everything’s going to plan. More specifically to this guy’s plan:

http://www.guardian.co.uk/commentisfree/2012/jun/26/robert-mundell-evil-genius-euro

Interesting.

The bottom line is that neoliberal economics in all its various intellectual and policy manifestations — the Washington Consensus, Reaganomics, Thaterisim, the Chicago School, neoclassical economics, the euro — is nothing more than a war on labor.

A war on labor, however, is also a war on demand. And this is the internal inconsistency that tears industrial capitalism apart at the seams.

The “solution” is finance capitalism. In this scheme worker borrowing replaces worker income. Consumption is maintained, but by ever-increasing debt. A burgeoning creditor class is created alongside a burgeoning debtor class.

The debtor class and the creditor class can exist in the same nation, or in separate nations. In the case of neo-imperialism, the end game is to blow a debt bubble in another nation and then use the debt, and the debor nation’s addiction to imported goods, to loot the country of its natural and/or labor resources.

But what happens when both the creditor class and the debor class exist within the same nation, as has become increasingly the case with the Anglo-American countries? Or when politics in the debtor nation preclude the seizing or exploitation of its natural or labor resources? This is when the need for the state’s instruments of violence — the police and the military — comes into play.

But even this seems like merely kicking the can down the road. The ultimate problem with the inexorable spread of neoliberalism — murdering labor and destroying internal demand nation by nation — is that it eventually runs out of nations. The dearth of demand has gone global. If every nation is governed by neoliberal precepts, where is demand to be found, either internal or external?

from NC Links today: http://citizen.typepad.com/eyesontrade/2013/05/last-week-13-latin-american-governments-gathered-in-guayaquil-ecuador-to-hatch-a-common-response-to-an-increasingly-common-m.html

dozen Latin American countries are joining a mounting effort by governments to halt, renegotiate, or leave the now-notorious investor-state system. Australia has publicly refused to sign on to the proposed expansion of the extreme regime in the Trans-Pacific Partnership FTA, despite significant U.S. pressure to do so. India has moved to abolish investor-state dispute clauses in FTAs. South Africa is re-examining its policy on investor-state disputes and has refused to renew BITs with the EU. And now Ecuador’s National Assembly is considering a bill to terminate its investor-state-embodying BIT with the United States. Last week’s conference adds another dash of momentum to this growing global push to ditch this rather radical regime.

(sandbox getting smaller)

If you haven’t already seen it, I highly recommend the following video:

The entire global banking, legal and regulatory aparatus is rigged to facilitate the stealing of undeveloped nation’s resources by criminal (and if you watch the film, this is not hyperbole, this really is what the transnational capitalist class is made up of *) enterprises.

* I recommend viewing this Jeffrey Sachs inteview from 4-30 links in conjunction with Stealing Africa, because Sachs fleshes out the existence of the criminal elite which now governs not just the underdeveloped world, but the entire world, with impunity:

http://www.youtube.com/watch?v=hCCr-uiqtAY

The “free market” — an oxymoron if there ever was one — is also rigged to favor the transnational class of criminal elites.

May I suggest a great, pretty new book? Vijay Prashad’s “The Poorer Nations”, the sequal of his “Darker Nations” book. It touches on how developing countries used to deal with these issues collectively instead of one country at a time. It also talks about how different the developing world is now that the NAM and the NIEO is all but dead. I hope, for their sake, that they are taking a page from the books of the leaders back in the day. If they got together and fought the IMF, the World Bank and the Western creditor parasites collecively they’d at least have a chance. Going up against the creditors and the institutions and governments they own and control in isolation is hopeless.

This is the best short explanation of contemporary reality I have seen. But don’t forget it is also a war against the middle class, and against small business, and against savers.

I like your observation re worker income being replaced by worker debt (or at least income augmented by debt). The same can be said for government having to supplement worker’s income with corporations like Walmart being a prime example of this phenomenon – all for the sake of shareholders and bottom line. The explosion of mergers and takeovers beginning in 80s has resulted in decades of the erosion of “good” corporate citizens to the point where we are all now feeling the full impact of workers (who should be consumers! ) being used as mere pawns. The ride is over.

— is nothing more than a war on labor. from Mexico

How did the distinction between capital and labor even arise in the first place? Is it not because small differences in circumstances, aptitudes or personality can be “leveraged” many times by allowing the so-called “creditworthy” to steal (or st best, borrow without adequate or even any compensation) the purchasing power of the non or less “creditworthy”? For the “greater good?”

Breaking News!

IMF Economists State the Obvious

Seriously though, IMF economists have been denying the obvious since at least the sixties, so this is actually a quite a major improvement.