By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Cross posted from Testosterone Pit.

The Bank of Japan is certainly accomplishing the worthy task of devaluing the yen by wagging its mouth and printing enormous amounts of money. From mid-September to May 23 – the day the whole construct began tottering – the yen dropped 24% against the dollar. Then the Japanese stock market took a nosedive, and the yen retraced some of its decline. But it’s still down 18%. Japan’s attack in the Currency War was supposed to make it more competitive in international trade – but that, it failed to do. In fact, the opposite occurred.

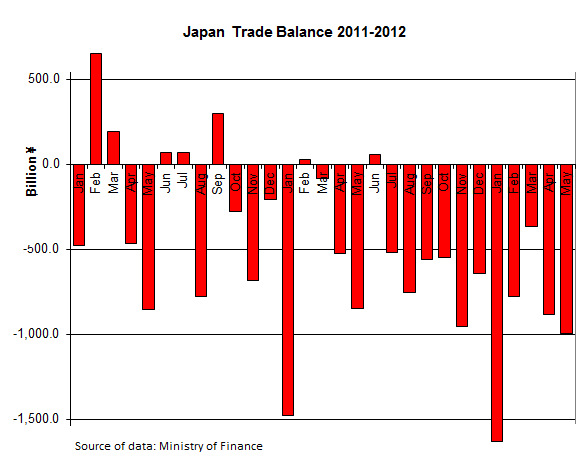

Japan’s trade deficit in May jumped 9.5% from an already awful May last year, to ¥993.9 billion ($10.5 billion), the eleventh month in a row of trade deficits, the longest period of trade deficits since the series of comparable data started in 1979, the largest deficit for any May, and the third largest trade deficit ever.

The report by the Ministry of Finance wasn’t a fluke. April had been the worst April ever, March had been the worst March, February the worst February…. The deterioration has been systematic, unrelenting, and brutal. The chart below, going back to 2011, shows how the trade deficit in each month this year was worse than in the equivalent month in 2012; and in 2012, they were worse than in 2011.

Abenomics didn’t start digging that hole. That happened years ago, gradually, through a thousand cuts and structural changes by Japan Inc., the same process that began in the US decades ago, namely offshoring production. But Abenomics is digging the hole at a more furious pace.

The weaker yen did drive up exports by 10.1% in May from prior year, but imports, which now have to be paid for with the same weaker yen, rose 10.0%, from a much larger base!

China has become Japan’s largest trading partner, and largest export market. They might hate each other and needle each other and step on each other’s toes while they dance around their various disputes, island issues, and historic massacres, but they do trade. And the trade deficit with China soared 34.8% in May to ¥410 billion.

Trade with China involves having to jump through some murky hoops, including transshipments through Hong Kong, which skew the numbers. To correct for that, we look at China and Hong Kong combined. That way, the trade deficit with both was only ¥78.4 billion. But it nevertheless jumped 29%. Part of the relentless deterioration – from May 2007, when there was a trade surplus of ¥318.5 billion.

It was a continuation of the same song: exports to Hong Kong and China rose 14.0%, but imports rose even more, 14.7%. Just how important are these two trade partners? Over a quarter of Japan’s total exports end up there, and almost a quarter of its total imports come from there.

Like its US counterparts, Japan Inc. has become expert at offshoring. Part of the motivation is the greener grass on the other side of the pond, namely cheap labor. But increasingly in huge markets like China, there has been an even more powerful logic: companies want to be closer to their customers.

As Japanese manufacturers have set up shop in China and other countries, their Japanese suppliers are under pressure to be closer to their customers. The auto industry is a prime example: when Honda sets up production plants in China, its Japanese suppliers increasingly end up following, lest they lose that business to Chinese suppliers, which many of them do anyway. Some of their products, particularly components, filter back into Japan. A type of offshoring that cannot be reversed by monkeying around with the currency.

So the usual suspects, rising imports of crude oil and LNG, have been blamed for the trade deficit, and they’re up, but the entire category of Mineral Fuels inched up only 2.7%. They’re not the big culprits.

What drove up imports the most was the second largest category, Electrical Machinery (semiconductors, telephony equipment, etc.), formerly Japan’s forte: it soared 23.7%! And the third largest category, “Other,” which includes scientific instruments, clothing, furniture, etc., rose 12.2%, with imports of apparel jumping 22.3%! Indeed, the wealth effect and corporate optimism kicked in. Consumers spent money more freely – on imported bras, purses, ties, luxury goods, and doodads. And Japan Inc. bought equipment and components, and they were all supporting the economies of Bangladesh and China. The first failure of Abenomics, and a side effect of its Currency War.

But China has its eyes riveted on the revolt in Brazil. Like all revolts, it’s about deep-seated issues and inequalities. Yet the spark that lit it – after inflation had made life too expensive – was an increase in bus fares. Read…. Currency War Rattles Brazil, Wakes Up the People

Who can ignore peak oil now?Finciailization can do only so much and allow huge population live on usuary ..but how long?

It is good thing jap population is declining and their cities will slowly get decongested….some people might return to farming and manufacture….

This piece fails to mention that while the trade deficit increased 10% over the year, the current account surplus doubled – i.e. with a weaker yen Japan gains more from earnings on foreign investment than it loses from increased import costs even before you factor in increased exports. How does one interpret this as a failure of Abenomics?

Japan’s goal is to increase domestic consumption and employment.

Japan now has the biggest foreign exchange reserves in the world. They are approximately 20% of GDP. I can’t find good data, but the official reserves almost certainly exceed private sector holdings abroad. These FX reserves are more of an economic dead weight than most observers realize. For all practical purposes, they can’t be used to spend in the domestic economy, since the BoJ would need to sell foreign currencies and buy yen. The last thing they want now is a stronger yen.

The FX reserves are in no way, shape, or form like private investments. Converting the foreign earnings (the into yen would undo the currency depreciation which most observers think is a major, if not the major, goal of Abenomics. We’ve discussed the same problem in the context of China, where its “losses” on dollar FX reserves have become a monster source of controversy at home. The reality is those were never “investments”, they were trade subsidies. If they had come in the traditional form of tariffs and subsidies, they’d have had a similar effect but not have been anywhere near as visible on a cumulative basis.

I am kind of confused about Japans economy in general.

What should it be doing?

Ignoring the advice of Western economists is always a good start. Japan is in fundamentally better shape than almost anywhere in the West.

The Japanese position has been that they’re not engaging in a currency war but stimulating domestic demand. The fact that imports have increased as much or more than exports and the trade balance remains negative seems to bear this claim out. Richter’s position seems to be that the Japanese really have declared “currency war” and that the trade figures show their undeclared currency war is failing. However, one could equally say that the fact that imports and exports both have increased proportionally, undermines the entire “currency war” premise. Then the only question that remains is whether increased demand and increased imports and a lower exchange rate is sustainable for Japan – a massive current account surplus says “yes”.

I didn’t go into it, but I’d be skeptical.

First, and I probably should have flagged this as a question at the top of the post, but with the market upheaval I wanted to get this up fast and turn to my own posts.

Classic trade literature describes a J-curve with trade when currencies are depreciated. Basically, the country can’t cut imports much/at all near term, so those costs go up immediately. But overseas buyers need time (usually quite a few months if not longer) to change buying patterns.

That’s a long winded way of saying that Wolf may be reaching a conclusion way too early. Check back in six months.

Second, Japan until the criss IMHO got away with keeping its currency unduly cheap and persuading the rest of the world it was a basket case. In reality, their domestic economy was not terrible, particularly given its sucky demographics, just not generating the really high employment that Japan had become accustomed to. So its model became to have a so-so domestic economy and a robust export sector. And the cheap yen was part of that.

The unwind of the carry trade killed it, and then China drove the yen up at further (i’d hazard that everything higher than 90 to the dollar, which was already nosebleed territory, was ALL China buying yen. This was when the US was made at China about currency manipulation. So China buying yen meant it was Japan that had to be the evil dollar buyer to keep the yen from levitating even further).

The Japanese have a long history of telling complete howlers on the trade front. Remember it was Japan that tried keeping US beef imports out by saying in all seriousness that Japanese colons couldn’t digest American beef. And Japanese still live it really small apartments and houses, and the locals tell me most Japanese have up to date tech toys and nice clothes. So how much more can they really consume even if they were to consume more? That may sound spurious, but Japan has been trying to become more of a domestic consumption led economy since the 1980s and it still has not made the transition, and the size of its residences is a BIG impediment.

I’d say that Richter may be jumping the gun. Even if the Japanese run a monthly trade deficit of -1,000B Yen a month for 2013, then that would be a -12,000B Yen drag on GDP every year. Currently, though, Japan’s GDP is (for 2012) 476,000B Yen–see attached GDP stats below.

While that knocks down GDP about 2.5%, when calculating YOY GDP growth it’s less than a 1% drag since 2012’s trade deficit was already -9,500B Yen.

If Japan’s behavior makes other big players respond in kind through serious monetary expansion, though, then it could be trouble.

http://www.econstats.com/japcab/japcab_a9.htm

FX reserves = 1.2 tril.

Priv holdings > FX reserves.

Too many factually incorrect declarations are made without accountability…

If you want to pay for a researcher to answer questions at 8 AM when I have been up all night writing for 14 hours straight, be my guest. I was asked a question about a post I did not write. I indicated I could not find the data readily and that I was by implication making a guess.

This is a comments section, hence this is understood not to be the same standard of output as a post proper. And your “too many” = one. I suggest you find someone else who provides you with a free service to abuse.

It should also be noted that the capital account includes not just income on outstanding investments but also the net of current period foreign investments and sales. Japanese retail investors were reported in Bloomberg to be liquidating foreign investments (Mrs. Wantanabe likes to speculate in foreign currencies) and investing in the stock market, which was confounding the authorities (it was enough of a volume of funds movement to at points drive the yen up).

Similarly, a lot of foreign investment has been in the form of FDI. I can tell you (conversely) from my work with Japanese companies in M&A, the overwhelming majority don’t repatriate earnings.

Can someone tell me why countries get into a position of becoming too expensive to do their own production and end up exporting their labor market? Although people are not as mobile as cash, why does cash have all the freedoms?

In my opinion, it is land/real estate (the basis of all production and living) prices that are forever being driven up that forms the seeds of imbalance. We treat our earth as if living things are secondary to the resources it provides. Most all of us have dabbled in that age old game of selling real estate to the next person to come along for more than we bought it, in turn, we pay more to someone else to buy a replacement for what we just sold – this is a zero sum game that only drives prices up for thing produced on land or require land in it’s production (everything).

Who profits off this land value rise – well it is the speculator in land? – the one who does not employ labor to capture the gain created by public investments in infrastructure that attract people to the area and push prices up – they cash out or hold out land/real estate to maximize the gain.

So, if you are a farmer that pays a thousand per acre for land – you have got to price it into your prices – – If you pay ten thousand per acre – you are priced out of producing against the farmer that paid a thousand.

The land/real estate boogy man has been bred/taught/propagandized into most of us – we have all participated in this con-job. The con job was sold to you by the Oligarchs, Kleptocrats and their minions in Realtors, Reality TV and they continue to sell the belief that rising real estate prices are a sign of economic recovery.

So – this article shows us the meta-economics…. the ripples on the water…. but IMO, does not show the rock hitting the water that caused the ripples.

Any wealth creation (real wealth requires labor in its creation…it is not money) anywhere and at anytime requires three things – Labor, real capital and LAND. Why the Land part is never discussed? Because, this is where the real money is made and, it is why different countries have a different economic basis from which to compete. The elites wish you not to know this so they may profit from your ignorance. It is why many economics schools were funded by the very rich – the rich wanted to ingrain ignorance into the fabric of our lives.

So, is China putting the breaks on easy credit to intentionally tank inflation in their stock and real estate market and hence maintain the Yuan and keep it from rising too fast, knowing that it will cause Japan (caught in the middle) to buy dollars or do whatever to keep the Yen down, and the USD will not tank on any news until China and Japan find some balance – so that suits Bernanke because the dollar will stay strong without even a whiff of inflation? And also without a whiff of improving employment. Because it will be such a mysterious and intractable problem. And oh, yea – the free trade pacts will go sailing through congress on a wave of propaganda that they will stimulate the export economy here in the US.

Upcoming Trade Balance results for June ’13 could be indicative. Recent mo/mo June changes have resulted in net positive balances. Now that Yen depreciation has been in place for a while, a negative net trade balance for June ’13 would be a bad sign for Abenomics.

I doubt we are getting the whole picture as to what is happening in Nippon (money) markets.

Unlike US, where the Fed and WallStreet plays together nicely, in Nippon markets WallSt&Co doesn’t have the same obligation to support Nippon Central Bank policy –

– so the 1trillion question is:

What is the WallSt’s play there?

Is it really the macroeconomic failure of Nippon Central Bank that brings the market swings? – as the media tries to convince us? (ha-ha!…)

This guy has figured out what is going on in Japan.

http://www.economic-undertow.com/2013/06/20/tapir-talk/

Mansoor H. Khan

Great post and explanation.