By Lambert Strether of Corrente.

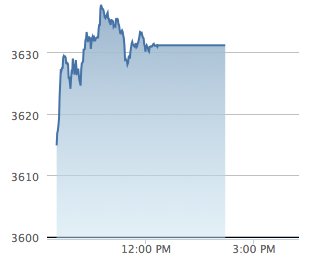

WTF? NASDAQ flatlines. Oopsie:

FT, 1:09PM Trading halted on all Nasdaq-listed stocks:

Trading in stocks listed on the Nasdaq including Apple, Google and Facebook were halted just after midday in New York as the second-largest US stock exchange by volume experienced technical issues, causing chaos and confusion among traders and market participants.

Equity and options exchanges run by NYSE Euronext, Bats Global Markets and CBOE also halted trading in Nasdaq-listed securities following Nasdaq’s notice that it was experiencing issues with “quote submission to the UTP SIP”, the system that governs the collection, processing and distribution of specific market data.

WSJ, 1:22PM: Nasdaq Market Halts Trading:

Exchange officials scrambled to resume trading and to figure out what had happened. The issue stemmed from a data feed that provides market data for Nasdaq-listed securities, exchanges said in notices sent to traders.

Regulators said they were communicating with market players but offered no details. “We are monitoring the situation and in are close contact with the exchanges,” said SEC spokesman John Nester.

AP, 1:40 PM Trading halted in Nasdaq-issued securities due to a technical issue:

Nasdaq said it wouldn’t be cancelling any open orders, but that customers could cancel orders if they wanted to.

Nasdaq sent out an update at 1 p.m. saying trading would reopen “at a time to be determined.”

The Nasdaq composite index was frozen at 3,631.17 as of 1:20 p.m. ET, up 31.38 for the day. The index is up 20 per cent so far this year.

Reuters, 1:50PM: Nasdaq halts all trading after technical problem:

All traffic through Nasdaq stopped at 12:14 p.m. EDT, the exchange said on its website, citing a problem distributing stock price quotes. The exchange, which lists about 3,200 companies, said it expects to resume trading later on Thursday.

Meanwhile, the New York Stock Exchange’s parent, NYSE Euronext, has ceased all trading in Nasdaq-listed shares at the request of Nasdaq.

Bloomberg, 1:54PM: Nasdaq Halts Trading in Stocks, Options Amid ‘Issue’:

The disruption, just two days after options markets were roiled by mistaken trades sent by Goldman Sachs Group Inc., is the latest in a series of computer malfunctions that have raised questions about the reliability of electronic markets. Nasdaq faced criticism last year when it mishandled the public debut of Facebook, causing hundreds of millions of dollars in losses for its member firms.

This is devolutionary, third-world stuff. I mean, do these guys need more money to maintain their systems?

So, WTF?

Readers?

NOTE Hat tip reader Joe.

UPDATE

BREAKING: Nasdaq Intending To Reopen Trading In Tape C Securities At 2:45pm ET

— CNBC (@CNBC) August 22, 2013

UPDATE Nasdaq to resume trading at 3:25 after more than two-hour shutdown.

UPDATE Trading resumes of Nasdaq-listed stocks:

After an afternoon marked by chaos and confusion among traders and investors, Nasdaq appeared to successfully reopen trading in roughly 2,500 US companies worth about $5.4tn at 3.25pm local time. …

The breakdown sparked immediate concerns about the plumbing which underpins the US market. It came just days after Goldman Sachs suffered a high-profile trading glitch involving its computerised trading systems.

US markets have been criticised for their high degree of fragmentation, where trading firms swap shares at millisecond speeds across 13 equity exchanges and almost 50 alternative trading platforms.

5.7 TRILLION in mkt cap locked up…’stocks are not effected’

epic

http://www.youtube.com/watch?v=AdcT0mtdg20

these algos fighting algos have caused a major problem for “investing”.

I wouldn’t be surprised if something big happened, to an important player, and NASDAQ is covering.

if NYSE is helping out, it’s probably a biggie. (can I hope it’s Goldman?)

The other day Goldman Sachs announced that they lost a few hundred million (chump change really) due to a computer error. They are, at least according to one article I read, demanding that the money be returned thus shorting the people they were trading with.

I wonder if this is part of that. Perhaps the error is larger than originally disclosed or has been repeated. In any case if NASDAQ were to choose to screw over people to benefit one big player my money would be on Goldman.

GS wants it ALL back…pull up any naz chart an you can see the swings began yesterday at 2pm

i saw this same battle on China’s mkt a couple yrs ago…GS started backing out of a huge futures mistake and while it became immediately clear they were screwed …GS called foul and told China they wouldn’t honor the trade. the chinese added an extra R to gofukyourself…last i could track was GS calling on the IMF and poof all went quiet on the western front

Canceling Erroneous Trades: You’re Asking The Wrong Questions

http://kiddynamitesworld.com/

GS will Always attempt the impossible…because we made it possible.

Why have the last two weeks seen so many websites and internet related services being disrupted? An unreported cyberwar going on perhaps?

There is no way that a server issue took down the NASDAQ. NO WAY unless the CIO is a complete boob.

I’ve been doing this kind of work for almost 20 years and just finished leading a program to redo all the network security at the FCC.

There is no way the NASDAQ has a single point of failure on a server.

These things are blades in racks and they have multiple racks I assure you. They also, I am sure, have co-located and geographically disperse failover.

I checked with a buddy at Homeland Security who works for Booze Allen and who used to work on Wall Street. He does network security and is really good. He is the guy the Fed brought in when Fedline got hacked. He thinks this is deliberate. Somebody either got to the trading software or to the software on the switches.

Someone needs to start asking serious questions. I’m watching the coverage and the anchors seem way too willing to accept the party line coming out.

Knight Capital

Fedline

Goldman yesterday

Now NASDAQ?

A security flaw is not out of the question, and you’re correct that a hardware defect would have pretty much zero impact. OTOH, any number of software flaws discovered sufficiently late in the game (i.e., after it’s been put into production) could cause similar problems. If someone noticed that order processing was being done at odds with what was actually bought and sold, that would be a good reason to bring the line down.

A QA fail requires fewer moving parts, so it’s my default assumption in the absence of more evidence. We’ll be able to speculate more fruitfully based on how they recover. If it’s a bug, they roll back to older code and get things moving fairly quickly. If it’s a breach, they have a lot more cleanup work to do and things stay down for a while.

It’s software. But we’ll never hear what it was.

I agree with you, DP. There is no way NO WAY this is a server issue. The redundancy built into these systems is extraordinary. Something’s afoot. Someone got to the switches along the pipes, and what if that’s overseas. Gee, maybe the NSA should be protecting our systems instead of culling what they think I and the commenters here might be doing.

The rise of Skynet.

So sitting here in my house, reading about this, I come to the conclusion that as dramatic as this has to be for the FIRE sector, it means absolutley doodle squat to the lives of the 99%.

What am I missing?

Schadenfreude

lol

Haw, well there is that, but still, other than that why should I care?

Not exactly seeing high frequency trading on my equity trading software today lol.

“Not exactly seeing high frequency trading on my equity trading software today lol.”

Awesome! Finally, a feature, not a bug, for the 99%. Who said God doesn’t have a sense of humor?

Not me. Or this guy—https://twitter.com/TheTweetOfGod

“I won’t be satisfied until I have enough followers to form sects that fight about how to interpret My tweets until they kill each other.” God

“You’re so vain. I bet you think this universe is about you.” God

What a joker!

Doing the Lloyd’s work: Goldman made another FUBAR trade and the NASDAQ just needs to break it out of the queue.

Just the usual free market efficiency. Mistakes were made. Move along please. Nothing to see here.

“This is devolutionary, third-world stuff.”

Right, because fortunately here in the rest of the first-world, we are blessed with computer systems that never fail! All of our systems have 100% uptime.

Chipmunk!

~

No, squirrel.

Some people think HFT is pretty squirrelly…

If squirrel, then moose is also involved.

-Boris B.

+1

http://cdn.buzznet.com/assets/users8/lea/default/cute-superman-squirrel–large-msg-1122473584-2.jpg

How they restarted the NASDAQ:

Start Me Up

Lol, Joe. I was actually expecting a lame Stones vid or parody, and I love the Stones, so I clicked. This was unexpected, and a real lol.

You got Lloydrolled :)

ugh ! I was drinking coffee when I saw this, luckily had not eaten……

Call me nostalgic but I don’t think the privatization of stock exchanges has been even remotely successful. The old model of the NYSE with $2 brokers helping to maintain liquidity seemed to work best. In the current market makers orders there are too many exchanges, no capital required to make an orderly market and what order flow there is are picke off by firms engaged in algorithmic trading.

A picture is worth a thousand words…this was no technical glitch:

http://blog.thederivativeproject.com/2013/08/22/excuse-me-sec-this-was-not-a-technical-glitch-today.aspx

Amazing that Mr. Ichan continued to Tweet all afternoon:

“Spoke to Tim. Planning dinner in September. Tim believes in buyback and is doing one. What will be discussed is magnitude.”

Ha! Good catch — “free” market inaction. Pretty ballsy. Great site, BTW.

Here are the top 10 American corporations profiting from Egypt’s military

http://www.globalpost.com/dispatch/news/regions/americas/united-states/130816/top-10-american-corporations-egypt-military-us-aid

i have to admit Deloitte thru me

oops sorree posted on wrong page

Nikkei opens +242

Speculation is only a word covering the making of money out of the manipulation of prices, instead of supplying goods and services. henry ford

I know some people here don’t like ZeroHedge (although they probably secretly read it :)), but the following from 2011 is not about gold, etc.

http://www.zerohedge.com/article/nasdaq-addition-manipulated-also-compromised

Basically someone hacked the Nasdaq system back in 2011 without doing anything. So my conspiracy theory antenna is saying that perhaps today’s situation is somewhat related.

Anyway, couldn’t happen to a nicer bunch of people.

I know absolutely nothing about what’s going on or the way these things work but as the Masters of the Universe have come more and more to rely on the slaves and serfs to actually keep things running behind the scenes while becoming less and less concerned about their well-being, it was only a matter of time before the little people began to see opportunites to raise a finger or two.

Manning and Snowden might just be the tip of the ice-berg that sinks the Titanic.

A bit of dot connecting: The latest NASDAQ fiasco provides yet one more of the many, many real world, error prone massive system examples for why the emerging NSA et al data gathering on Americans and others does NOT make anyone safer.

Hubris. (and profits of course)

I don’t really know what is going on here. And I have to wonder if any one dose know. There has been a lot of buzz about new computer systems to place trades, computers that can place trades so many thousand times a second or something.

Now if these computers were just placing trades that got stacked up in the queue, that I can understand. But that isn’t the impression I get from all the bragging. I am led to beleave that these computers actually generate these trades, deciding what to buy and what to sell. Heck, I bet these computers are even authorized to take out loans to finance these trades.

I have to wonder just how dangerous this is. Think about it, they are basically removing humans from the market itself. Workers and consumers are already irrelevant as they are just costly liability. I don’t think it’s the markets that are becoming obsolete, but human involvement in the market itself. They Skynet reference may not be too far off.

I recall some big-wig economist wining the Nobel Price for Economist (you know, the one NOT issues by the Nobel Committee) for a new economic formula used to calculate and managed the risk of mortgage backed derivatives, which was quickly intergraded into the banking computer system. This formula assumed that the price of housing would always go up.

So when certain markets started declining, the software would kick out the sale price as an error, because it was smaller than the purchase price. Well, there is not point in arguing with a computer, and even less a point in arguing with upper management. (Hay, if they tell you to divide by zero, you had better divide by zero, or they will replace you with some one else who will.) So data-personal simply re-entered the original purchase price into the sales field.

The result gave the banking sector a false impression that the markets were healthier than they were and continued to issue new mortgages, even in crashing markets, magnifying the scale of the crises.

But here is the thing. Some where, there was a computer that disagreed with the TBTF banking networks. And THAT computer won the argument, probably because its owner outranked the owners of the TBTF banking network.

But what if a similar glitch happened to the top ranking computer? Then what?

These computers appear to be placing enough trades to manipulate the market in unpredicted ways. The results probably then feed back into the formula, causing the markets to do some strange things.

Consider this possibility. Suppose they have a computer programmed to buy stocks when it preserves them to be at a bargain rate, and then sells them if it preserves them to be over-prices. The greater the bargain, the more stocks it buys and the greater the inflation, the more it sells.

If this computer had the ability to buy and sell enough shares, the result would be pinning that stock at what ever optimum price it sees. And this would not only happen automatically, but several thousand times a second. Would you buy a share that could neither go up – or down? And what would happen if a second, or a third, or a forth computer started trading on the same stock, with different strategies, and have the power and speed to carry those strategies out?

When you are playing with trillions of make-believe money, any thing can happen.

The trading halt is what one would expect when quote stuffing through an electronic exchange inadvertently becomes a DOS (denial of service) attack on NASDAQ servers.