By Stephanie Kelton, Associate Professor and Chair of the Department of Economics at the University of Missouri-Kansas City. Cross posted from New Economic Perspectives

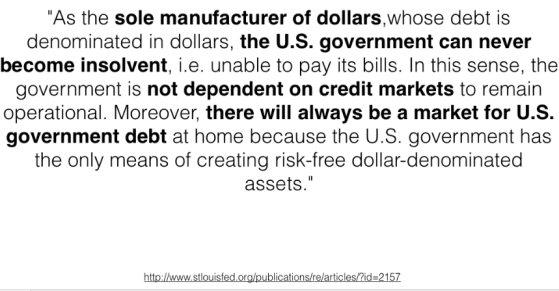

Many economists (perhaps even those who agree with us) refuse to talk about the national debt and government deficits the way we do on this blog. Instead of boldly challenging the assertion that the U.S. faces a long-run debt (or deficit) problem, headline progressives typically do what Jared Bernstein did in his column today — i.e. they pay “obligatory” tribute to the Balanced Budget Gods, thereby reinforcing the case for austerity at some point in the not-so-distant future when we will be forced to to deal with this very bad thing called the government deficit. Followers of my work here and on Twitter know that I refuse to pay homage to the Balanced Budget Gods. Instead, I prefer to shift the burden of proof onto those who contend that the U.S. faces a long-term debt or deficit problem. The first step is to establish that solvency can never be an issue for a government that spends, taxes and borrows in its own (non-convertible) currency. The following quote from the St. Louis Federal Reserve usually does the trick, but this great confession from Alan Greenspan also helps.

Greenspan’s response to Congressman Paul Ryan sets up the correct debate. Our challenge is not whether we can “afford” to make the payments we have promised to seniors, veterans, the disabled, government contractors, healthcare providers, bondholders, etc. (today, tomorrow and into the indefinite future) but whether we will be a productive enough nation to allow the government to make good on those promises without causing an inflation problem. That is the debate we should be having.

Of course, there are many other points that can be made about the role of the government deficit in our economy:

- it’s an important source of private sector profits

- it’s the source of net financial assets to the non-government sector

- it is equal to the non-government surplus, to the penny

- in its absence, a country that runs large, persistent trade deficits, would leave its private sector with large, unsustainable deficits

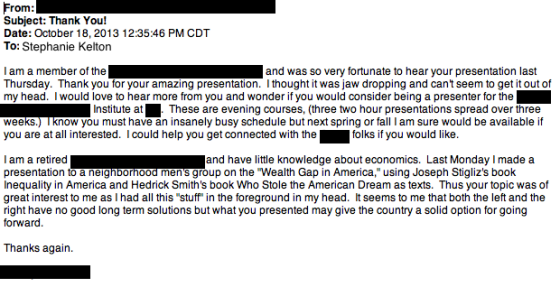

And so on. I make all of these arguments when I give public talks on this subject, and the response is always the same: Why didn’t anyone tell us this before?

The lesson? It’s okay to deviate from the progressive talking points. In fact, it’s better than okay. People will thank you. Want proof? Here’s a typical response I received just hours ago.

* Don’t Think of An Elephant is, of course, the title of George Lakoff’s brilliant book about messaging progressive values.

I have heard her speak and give even better, more insightful thoughts on the role of US debt. This is but a tidbit. There is much to learn about – especially on our “debt” actually being an essential necessary foundation to the global economy.

Nothing stated in this post talks about the effect of debt on the interest rate (and therefore $) required to service that debt. Greenspan’s comment is very carefully worded – the government could remain operational because it could print as many $ as required to service the debt, but since legally all debt must be auctioned, it would have to find buyers and therefore would be subject to the market’s valuation from which follows the interest rates on the debt. This post basically says that the US can be like Argentina, and face infinite interest rate levels (and interest payments) rather than default. Any country (Argentina, Greece, etc.) can make that claim.

If the argument is that the Fed will continue to buy all future US debt (which will require some legislative action to remove the caps) then I withdraw my observation. In the case that the Fed buys all US debt then interest rates will be controlled. However, other countries will refuse to accept dollars at the value we claim, so we better take solid steps to be independent in energy, commodities, and everything else we import now.

Maybe a good strategy would be to start and try to convince Liberal comedians like Jon Stewart, Colbert and Bill Maher. Maybe send in questions about it to “Overtime”?

“What do you say to people who say we have no long run deficit problem, like economists who adher to Modern Money Theory?”

I’m going to play the devil’s advocate to attempt to solidify my own weak thinking and in the hope that you kind folk will edify me:

If I may restate the argument presented (skipping to the end), deficit spending is a mechanism by which a state with an independent currency invests in the future, balanced against the rate of inflation, which is effectively the interest rate its citizens pay for the basket of governmental goods and services to be delivered now against future growth.

The obvious objection to this is that it is prone to the broken-window fallacy, as the far right might explain the objection to socialism if it hadn’t reduced the entire concept to a mere Pavlovian trigger. Should we permit/ask the government to routinely provide more than just public goods, especially when it increasingly fails at providing public goods in the first place?

A related objection is that of malinvestment. In the realm of public goods the Global War on Terror is a prime example of this. I concede that malinvestment risk is not exclusive or even implicit to deficit spending, but as a rule as you increase the funding of a government agency you are at the same time increasing fraud at a greater rate.

The final objection which comes to mind is that of overstimulation. The obvious example here is the policy of cheap oil which has led variously to environmental catastrophes and reserve depletion. The rational counter to this is that again stimulation does not necessarily lead to overstimulation, but the empirical evidence shows that governments fuel bubbles rather more often than they deflate them.

I look forward to comment. Flame on …

There are so many fallacies here; one hardly knows where to be begin. So let us begin.

>> deficit spending is a mechanism by which a state with an independent currency invests in the future, balanced against the rate of inflation, which is effectively the interest rate its citizens pay for the basket of governmental goods and services to be delivered now against future growth. <> The obvious objection to this is that it is prone to the broken-window fallacy, <> Should we permit/ask the government to routinely provide more than just public goods, especially when it increasingly fails at providing public goods in the first place? <> as a rule as you increase the funding of a government agency you are at the same time increasing fraud at a greater rate. <> the empirical evidence shows that governments fuel bubbles rather more often than they deflate them. <<

Yes, because government is instructed to do so by the industry that profits handsomely from those bubbles. Then later demands to be bailed out once those bubbles collapse. This is such an overt problem that financial and government solution to this problem is basically to shut their eyes really tight and pretend that bubbles don't exist.

But this is a product from policy, not deficit spending. It also exposes the hypocrisy behind the deficit hawks. Deficit spending is only a problem if it involves the public sector. But when it comes to the military and corporate welfare, suddenly deficits don't mater any more.

Okay, let’s try this again.

>> deficit spending is a mechanism by which a state with an independent currency invests in the future, balanced against the rate of inflation, which is effectively the interest rate its citizens pay for the basket of governmental goods and services to be delivered now against future growth.

But deficit spending is not detrimental to future growth, but an essential component to future growth. Say you want to expand your factory so you can double capacity. You barrow money to ad on to your building, and purchase more equipment. You can not expand without adding on to your building, and you can not do that without expending capital that must come from some where.

This is why austerity is so destructive; it chokes off capital needed to fuel further expansion, and in turn causing the economy to collapse. And the economy will contract faster than you can balance your budget. If you have a patent who is dying from mal-nourishment, you do not make him better by withholding what little food he is getting.

>> The obvious objection to this is that it is prone to the broken-window fallacy,

How dose this lead to the broken-window fallacy? This doesn’t follow.

>> Should we permit/ask the government to routinely provide more than just public goods, especially when it increasingly fails at providing public goods in the first place?

The government is the only one who can provide public goods and services. This is true by definition! And when it is argued that government’s fail and providing public services, this is always the result of willful incompetence or sabotage rather than some imagined librarian fantasy regarding the nature of government. Especially when you appoint/elect persons who are convinced governments can only fail, they will find a way to fail, and then blame their own incompetence on the machinery of government itself.

You then compound this with a strawman, “If governments can’t do public services, why should we should we ask government to provide non-public services?” This is nonsensical. Governments can only provide public services — by definition.

So the real question you are trying to get at here is what a public service is and what is a privet service?

There are things that are done better when they are done collectively, that only benefit the collective, when efficiency is detrimental, or when resources are limited.

Healthcare is a good example. Libertarians and Conservatives insist that healthcare is a commodity, and therefore should be treated as any other commodity. Like Obama said, buying healthcare is like buying a flat screen TV.

However, I would argue that this is because Libertarians and Conservatives are incapable of considering any thing that is not a commodity. In their minds, labor and education are also a commodity. Even conspectus such as freedom, liberty, and rights are treated as commodities. And so they must believe in order to justify their anti-government perspective.

But Liberals and Progressives argue that healthcare is not a commodity, and can not be treated as one, but rather it is a “right”. And not just as a right for any citizen to take advantage of, but as a seneschal function of the economy in much the same way you need the fire department to put out fires, or you risk losing the entire city to a fire. Healthcare systems demand elasticity (the opposite of efficiency), dose not function well in a competitive environment (do you really want the doctor to compete with the nurse?)

>> as a rule as you increase the funding of a government agency you are at the same time increasing fraud at a greater rate.

This is just an assertion. There is no real evidence to back it up. Corruption in government is the result of appointing/electing people who have their own interests and who are not held accountable by their own actions. Government is not an automatic corrupting agent any more than the privet sector can be immune to corruption.

>> the empirical evidence shows that governments fuel bubbles rather more often than they deflate them.

Yes, because government is instructed to do so by the industry that profits handsomely from those bubbles. Then later demands to be bailed out once those bubbles collapse. This is such an overt problem that financial and government solution to this problem is basically to shut their eyes really tight and pretend that bubbles don’t exist.

But this is a product from policy, not deficit spending. It also exposes the hypocrisy behind the deficit hawks. Deficit spending is only a problem if it involves the public sector. But when it comes to the military and corporate welfare, suddenly deficits don’t mater any more.

Yes, the whole argument seemed to me to be on the strawman-ish side once I submitted the comment. Perhaps these are the major categories of risk to deficit spending rather than the inherent flaws: Inflationary risk, inefficiency risk, malinvestment risk, risk of overstimulation.

If I’m able to gather my wits sufficiently I may attempt a more substantive reply to you.

The broken window fallacy is in itself a fallacy, as it fails to recognize the difference between a stock and a flow.

Can you expand on that interesting statement?

Well you’re familiar with the basic argument that we can’t increase our wealth by smashing windows and paying to replace them, or in the unintended consequences interpretation that funds which are used to replace the window are diverted from some other use.

This does not take into consideration that wealth, which is measured at a specific point in time and is therefore a stock, is created by a flow, a measure of spending over a period of time. Flows generated by smashing stocks of windows will, in fact, generate new wealth. It’s impossible not to. Nor from a macroeconomic perspective is it relevant what the person paying for a window might have spent her money on otherwise, given a dollar spent in a restaurant or in a shoe store do exactly the same thing. She might have maintained that money as savings stock or she might not have to pay for the window at all. What Bastiat didn’t know that we do is government spending adds net financial assets to the nongovernment sector. When $20 billion in federal disaster relief flow to New Jersey to help people devastated by a Hurricane, we get the simpfied equation of spending = income = employment = output. The output is the array of goods and services produced, new wealth generated by the destruction.

Right-libertarians will argue that if $20 billion is spent to replace $20 billion in damage then you simply end up where you started and there is no net gain in wealth, but they seem to believe those dollars evaporate once somebody buys a new window (actually they just deny the existence of multipliers); they don’t think about those dollars as a flow to the company which replaced it, which became the incomes of business owners and employees, some of which was again spent and again became another’s income, in each turnover some portion creating new stocks as it is saved or used to make purchases. In their minds the money immediately transforms into fixed wealth and then ceases to exist.

I don’ know. This sort of reasoning always strikes me as being a bit doggy. I suspect that it’s an attempt to fix the concept of wealth so that it will behave as they want it too.

Economics doesn’t make much sense to me unless I take resources and materials into account. For example, the city now has one less intact window. Even the window that replaces it must come from an inventory some where. So the economy is poorer by exactly one window. Resources must now be expended to replace that window, even the one removed from inventory.

So I think the fallacy is true at least in so far as the claim that you can not grow the economy by braking windows.

But the spending does not stop at replacing the window. It continues on until lost to financial leakages, which is where spending multipliers come in. This is not theory, we have a three year natural experiment running in Europe which indicates for every euro spent the result is 1.5 – 1.7 euros in economic activity. This is expressed as increased output of real goods and services which means greater real wealth than otherwise.

Zero ) You used the term “theory” incorrectly. In science, a “theory” is established as strongly supported explanation. If you wanted to impress me, you would have said “theory argues” or “theory states”, not “this isn’t theory, but fact.”

Of course that doesn’t impact on your argument, which is why I called it point zero.

One ) Money multipliers has been discredited. First, the multiplier effect is clearly defined by the orthodox as a function of barrowing. For there to be a multiplier, the funds used to replace the window would have to be deposited and loaned out. But as Steve Keen’s observed, the banking system doesn’t relend capital, but creates it from out of thin air from credit.

http://www.debtdeflation.com/blogs/2009/09/19/it%E2%80%99s-hard-being-a-bear-part-five-rescued/

Naked actually has a wealth of information exploring this point. Observing that Obama’s stimulus approaches and economic reconstruction are heavily dependent on this principle, manifesting with huge funds being funneled into the banking system, reinforcing their reserves and in tern encouraging lending. It is from the lending that the multiplier effect would manifest. Hence bailing out the banks was justified over bailing out the debtors. The policy failed to produce the predicted results. Banks are drowning in easy capital, but lending has not recovered. But lending was never constrained by the lack of liquidity. And barrowing is precisely how the economy got itself into this fix in the first place.

So I guess this isn’t theory after all.

Two ) Even dismissing #1. Any money multiplier effect seen from the replacement of the window, would be offset by the loss of the multiplier effect we would have seen if the store owner had spend his money on something other than replacing the window. Unless you would argue that replacing windows creates additional capital in a way not observed in other sectors of the economy.

Three ) Your evoking the multiplier effect seems to miss the point that the window-fallacy is attempting to make. The thrust behind the argument is that destruction or material loss does not result in economic growth – but actually stresses the economy. It dose result in economic activity, this is true. As you already pointed out, natural disasters are usually followed by economic booms as the community recovers and damaged systems are repaired or replaced.

But it’s clear that it’s a mistake to call this growth, but rather an economy reacting to stress. The boom happens because a modern well run economy has elasticity, with resources held in reserve specifically set aside for just such an occasion. Money that not only would not be spent had the disaster not taken place, but is conditional specifically too stress.

But in so doing, reserves are depleted in proportion to the surge in economic activity. At some point, those reserves must be replenished. That doesn’t sound like growth.

I can also point to Haiti, a very poor country that arguably has little by way of elasticity. When it was struck by earthquakes and was confronted with massive devastation, we observed a significant contraction as what little with and production capacity that it did have was destroyed by the quake or crushed by collapsing buildings. Not to mention the loss of life.

Demand for goods and services were already high before the quake. But they were largely unmet because of the lack of capital. After the quake, demand to replace destroyed buildings and infrastructure escalated, but failed to produce any economic activity in and of itself, which is precisely what the broken-window fallacy is attempting to point out.

1) You’re confusing the money multiplier with fiscal/spending multipliers.

2) If I wish to use the term “theory” in the popularly understood sense, I will.

3). Impressing you is #821,789,004 on my list of priorities. Given your rather egregious mistake regarding 1, you might want to slow down on the gotchaism.

1) If I have confused the two, then do enlighten me. I am hardly above being wrong.

2) Don’t care.

And 3) If you want to convince me that I am wrong and you are not. Then this needs to be a little higher on your list.

I am not above being wrong. In fact, that I why I come here, to learn how economics realy works. But I am not here trying to play I-goatcha. I am just asking questions.

No responds to the rest of my points?

I sincerely hope my response did not disappear into the ether after I hit the submit button. That was thirty minutes of my life I’ll never get back.

Never mind; for some reason it didn’t show for me until I looked in a different browser

“Should we permit/ask the government to routinely provide more than just public goods, especially when it increasingly fails at providing public goods in the first place?”

Anti-government government officials have, in recent decades, successfully followed the strategy outlined by the head of the US Chamber of Commerce (sorry, I don’t remember his name) in the late 1920s, not be good at providing public goods. The reason was that good government, efficient, effective government would lead people to depend upon government. So if you do not want government that fails at providing public goods, don’t elect official who will sabotage the government from within.

If you wish to claim to have weak thinking, it would be better to put that phrase in quotes, so people know you are joking – you are, aren’t you? Your Fog Index is in the post graduate college reading level.

Just from your restate the argument paragraph:

“a state with an independent currency” -> by “state” you mean nation and most nations already make or print their own money. You declare what is a basic, common, assumption, one not normally needed to say and you say it in an unusual manner with high highfalutin words. You slow down and confuse your reader as to what you are talking about – your intent, I suspect.

“invests in the future, balanced against the rate of inflation, which is effectively the interest rate its citizens pay….” -> Inflation, as used by most people, is no such thing. Inflation is simply a higher price for a good or service tomorrow than what the price is today. Your talk of interest rates, in a manner divorced from the usual link to a bank loan, is another sign of confusing the argument.

The argument presented is simply this: deficit spending by the US government is not a problem. The only potential problem is that it may cause inflation. That is all. Period. (Personally I don’t think deficit spending will cause inflation – what causes inflation is outside the scope of this argument).

Really.,.

So you are saying that supply and demand, which kelton agrees with, is a lie. So Kelton makes this almost convincing post and doesnt bother to mention anything about supply and demand. Awesome…

What happens to the price of an item when supplies go up or down alex? Why do you think this doesnt apply to dollars?

Also, the lower costs left in the hands of people and corporations are in fact a natural redistribution of wealth. Are we saying that the government is better at this when corporations have lobbiests in DC? Oops, there goes your wealth with each deficit dollar spent.

Last point, because the growth in debt is so much greater than both tax revenues and even the entire money supply, there will come a time in which the government will be unable to pay all promises. Keep in mind the US currently borrows in excess of taxes. When the government begins printing dollars without owing them, the people will be the ones begging it to stop. I suggest the young will not be interested in just chilling. And this where it doesnt matter if you are sovereign.

There are two things that cause prices to rise or what most people call inflation;

1- Money being created faster than the production of goods.

2- Constraints on the production of goods.

We definitely have #2 going on and some of #1 also.

TPTB believe that #1 can solve for #2. It can’t.

The constraints are permanent and will inevitably lead to less of everything.

“Money being created faster than the production of goods.”

You mean money being *spent* ‘faster than the production of goods’.

Don’t worry, you made a common mistake made by lots of people who don’t know what they are talking about.

No need for being rude unless thats all you got.

When I talk about money being created in the relationship to goods it goes without saying that it is spent. It also goes without saying that it has been loaned into existence as all money is but pardon me for not being specific.

Care to comment on the constraints as the primary factor in all this or would you like to keep the discussion mired in all things financial?

Private parties, and not the Fed, are the big creators of spending power. Lending creates deposits.

Any party can create credit. When you eat out or take a cab ride, that’s a credit transaction. You are given the service first and you pay later. If you have a store that runs a tab for you and you pay it once a month (as a fishmonger here did and my dry cleaner does) you’ve spent without having money to square up.

The Dutch tulip bubble and John Law’s machinations in France preceded the Fed. You don’t need a central bank to have asset bubbles. Collateralized lending will do. Getting rid of the Fed or deficit spending won’t solve that problem.

Go look at the history of our housing bubble. The Fed was TIGHTENING starting in 2004. Normally, that would have killed housing. Countrywide even forecast lower lending for 2005 v. 2004. So why did we get a toxic mortgage boom starting in 3Q 2005? Securitization (collateralized lending) + highly synthetic CDOs (a Ponzi).

Oh, and remember we had a dot com bubble when the Federal deficit was falling? Fortunately that didn’t do as much real economy damage as feared because it was not levered speculation (as in margin buyers weren’t a big part of the picture, and the exchanges would close out their positions pronto, so the losses did not blow back to dealers or the banks).

Graeber demonstrates how debt preceded money systems.

Thank you, Yves! The problem is debt, “money” loaned at interest.

What is money? Who do we want to create it? Who do we want to control the quantity of money?

Whose decisions are these?

How are the Federal Reserve, and the IMF, and the World Bank, and the European Central Bank doing?

I’m as far from Sarah Palin (politically and almost geographically) as one could possibly get, yet with regard to the international banking cartel, I must ask “How’s that workin’ for ya?”

Dont think it’s a “constraint”. I’d say is 2 things:

1) unwillingness to produce at greater losses. And deficit spending removes wealth from producers and dilutes their savings. And who wants to produce something at a loss?

2) This in turn forces producers to do anything they can to manipulate markets, including the supply of goods and services for the benefit of a few. This includes the medical industry, etc.. who lobby to the government to ransack people’s pockets. Although illegal for everyone else, they get away with it.

eeyores enigma says:

I think what you are reiterating here is what is known as the quantity theory of money. It was first discovered in the 16th century when the vast amounts of gold and silver flooded into Spain, and later the rest of Europe, from the newly-discovered Americas. The result was runaway inflation. The quantity theory of money holds, in its most elementary form, that, other things being equal, prices vary directly with the quantity of money in curculation.

Of course the quantity theory of money, in practice, has never worked as billed. For one thing, in Spain, for causes which are not understood, the inflation of wages kept pace with the inflation in the prices of goods. In the rest of Europe, for causes equally unknown, this was not true. The prices of goods far outstripped the prices of wages, which caused inordinate profits for the owners of prodcution facilities, likewise a great immiseration of labor and peasantry, but a Golden Age for capitalists, which gave birth to the age of capitalism. The age of capitalism of course went hand-in-glove with the rise of global imperialism, since depressed domestic demand meant that foreign markets must be found for superfluous domestic production that was not consumed domestically.

Thank you for the reasoned response.

I honestly believe that what you just outlined is exactly my point that economic analysis invariably discounts the physical realities of constraints and attempts to explain and solve everything as if it is just a monetary/financial issue and if it doesn’t fit then it is a mystery.

Of course financial issues can significantly exacerbate the constraints and need to be understood and dealt with but are not the problem in and of themselves.

Pushing the economy through monetary policy and finance is effective but only as long as the physical resources are there and virtually free.

eeyores enigma says:

It’s not that easy to separate man’s material life and existence from his emotive-spiritual life and existence, or the “is” from the “ought.” Man, after all, according to most contemporary ontologies, does have a free will. The truth be known is that, despite all the hubris and simplemindedness or perfidy of people like Paul Krugman, John Stuart Mill or Milton Friedman, we know almost nothing about how all this works.

Another theory of prices/inflation just as reductionist, simplistic and one-size-fits-all as the quantity theory of money is that of Milton Friedman, described here by Paul Krugman:

Of course what Friedman practiced, and what Krugman and the other high priests of neoclassical economics lauded him for, is not deemed by most philosophers of science to be science at all, but something quite different. It’s more like a blind hog finding an acorn, or a crap shooter betting his entire stack of chips on rolling a double six (one out of 36 odds) and hitting his number. As Amitai Etzioni explains:

Of course we know now that Friedman’s theories did neither a good job of predicting (other than that one lucky incident) nor explaining. But that doesn’t prevent neoclassical true believers like Krugman from ditching them. Instead they endeavor to bastardize reality so the “reality” they create (also known as lies or historical revisionism) can be made to fit the theory.

Your ripping them Mexico, bully for you.

Skippy… Maybe you would have a better time with David Friedman than I am, he just goes turtle when confronted with facts and can’t retreat into the fog.

Another problem with these highly simplistic, reductionist, one-size-fits-all theories like the quantity theory of money is that, beyond price of labor vs. goods, not even the prices of all goods respond equally across the board to the quantity of money.

I think you can see that happen today, for instance, with the price of electronic goods vs. the price of primary materials and food stuffs. The price of oil and food, for instance, is soaring while at the same time the prices of electronic goods have decreased substantially.

Beginning in the last third of the 19th century and lasting until the outbreak of WWI, just the opposite happened. Food prices hit the skids, which was a windfall for industrial workers and their employers, but immiserated farmers. But the price of industrial goods did not experience a similar depression, so industrial profits remained high.

Then during the war years of WWI and WWII just the opposite happened. The large monoplistic manufacturing industries, which during non-war time could wield their monopoly economic power and access to political power to insulate themselves from market forces, found themselves on the receiving end of government price regulation. It was much easier for the government to regulate the large monopoly firms with price controls, much less so industries made up of millions of small producers like farmers. Therefore it proved much easier for the government to regulate the prices of steel, energy and manufactured goods than farm goods, and the farmers prospered mightily, but the big monopoly firms less so.

But despite the obvious flaws of monetary policy as a cure-all to alleviate all economic ills, this did and does not prevent the paid liars and bumsuckers of the lords of capital (read +90 percent of economists), or their bought-and-paid-for politicians, from evangelizing monetary policy as if it were the greatest economic elixir ever known to humankind.

Getting blocked ain’t funny.

Anyway, reason for the impact during WWI not being as lasting and nasty is simple, markets were allowed to self clear. During the great depression, the same remedy as today (deficit spending) was used. Markets will either eventually clear, or we will find ourselves in another world war.

The weakness of smart humans is that they believe they are so smart they can do things better than nature or the way god intended. Unfortunately, nature does not make it easy for the smarty pants. Fools…

I wasn’t kidding about the weak thinking: the fuzzy conceptualisation you’ve identified is unfortunately real and not affected or feigned. I’ll get there however with helpful criticism such as yours. Thanks.

it occurred to me just the other day that folks could lend their savings to the govermint, who would take it and put it in a drawer and not touch it, just to make sure they’d get it back — if they didn’t trust the private sector to use it responsibly.

Who could blame them? If you look at all the stuff the private sector does. Lunatic business plans, graft, theft, corruption, frauds, hopeless incompetence, bankruptcies. That’s just what I can think of off the top of my head.

I look at the people I’ve met in the private sector and I compare them with government workers I’ve met and there’s no contest. The government workers, hands down, have more integrity, intelligence, gravitas, competence, self-restraint and overall capability as sober-minded stewards of society.

this way you could have government debt but no deficit, since the money is in the back of a drawer somplace until it gets paid back.

you could have a govermint with trillion of dollars in debt this way, but it’s all backed by cash stashed in a drawer in some govermint office building.

the only risk is, they might give it to the private sector “to invest”. Oh Sh*t! Talk about a bank run. hahahahah

You so crazy.

Thanks for the good laugh…

Sounds like a Post Office Bank.

* * *

On government workers, I agree.

That’s it way it works now, craazyman – the government does have cash backing cash – only that savers don’t have any savings, so the Fed takes care of that for us. ‘Course if the government did run up a debt as high as a trillion dollars, some people might say whoa! – I know what an elephant is – we have ’em in our country – but that ain’t one.

I think none of this would be a problem if the government would just let us print our own money. That way we could be sure of having some.

About Greenspan quotes. One of my pet peeves is when people quote dead economists. I happen to know that Greenspan slipped up sometimes and would say “dollars” went he meant “pesos”, and some other gaffs like banks wouldn’t screw up and he and Ben can always create inflation. (the bad kind – where your income doesn’t go up, but the price of everything does) So I think we should just let dead economists quietly lay in their graves.

I’m not US based, so I may be missing something … But it seems to me that risk free and dollar denominated are not as closely linked in Treasuries, given recent events. A whiff of counterparts risk has seeped in, borne by winds from the Hill.

Nice to read Kelton. Wanted to share my thoughts – feel free to suggest reading material that will edify me. I have recently bought ‘From Dawn to Decadence’ cited by ‘From Mexico’ in one of his/her comments and also ‘Who Stole the American Dream’ which I found in one of Kelton’s links in this article. I have great respect for Hedrick Smith. My feeling about this inflation business is, the long run prosperity from 1945-76 was accomplished by Americans making and selling products to Americans. Inflation reared its ugly head only because of the oil crisis. No one talks about this too much because they want to keep the focus on ‘loose monetary policy’ as the cause of the inflation. Volcker went around with the wages demanded by Unions in his pocket true to his calling as Wall Street Water Carrier. Greider shows in ‘The Secrets of the Temple’ – Volcker did the bidding of the ‘money-supply’ theory morons in the Fed at that time – dicking around with the money supply left right and center and it amounted to nothing but a grand failed experiment which unfortunately is something no one ever talks about today. If I remember correctly Friedman who was the founder of this theory subjected it to a spectacular test in Thatcher’s UK and when it failed he did acknowledge its failure. Today if you google this you can see how many ‘Think Tanks’ and Economists quibble and argue and obfuscate about inflation in the 1970s: ‘it started in the mid 1960s, no no, it started earlier than that – no no, there was a steady increase in money supply that caused it’ – all this BS merely to effect the sleight of hand, to distract you from focusing on oil prices. Blinder has shown conclusively (debated by that idiot De Long of course) that absent the oil and food price shocks the inflation would have never happened. You can see this very clearly in Third World economies. Most of them run into trouble purely due to one thing only, the price of oil. Oil is such a bloody fundamental input to so many things in the economy that it is next to impossible to control inflation without controlling the price of oil. This is what the clowns in the Fed under Volcker discovered in the 1970s. They could not control inflation because they could not control the price of oil. We have now had a very well run and orchestrated obfuscation circus run by the oil lobby and the 0.1% shills in the Economics and Business departments in almost all Universities to take the focus away from oil. We are still being sucked dry by the Oil lobby leaches who now operate in concert with the Wall Street parasites to fix prices. Capitalists focus on only one thing – rate of return. If anything happens to disturb this rate of return they get the vapors unsheath their machetes and start slashing at everything around them.

Sounds like an accurate summary. In 1954 we were flat broke because we had no gold. Having taken on the role of the great peace keeper with a big stick we spent it all trying to make the world function. (Catherine Graham’s autobiography about the bankruptcy ball in DC). Our bankruptcy was ignored because we were a sovereign country and we just blew off the fact that we had no gold. Except for one thing: the Saudis would not sell oil for dollars – they demanded gold. Maybe one reason we went into Vietnam because rumor had it that we spent most of our time smuggling gold and opium. When it came time to get out of Vietnam, the price of oil went thru the roof – the excuse was the sabre rattling of the Israelis, but it was probably us going off the gold standard officially. This was followed by 15 years of stagflation. A weird combination of inflation and deflation. Which was followed by trickle down Reaganomics and the fall of the USSR. Clinton was advised to balance the budget and set the stage for the collapse we are living thru now. Some people call it hyper deflation. During all those decades the “return on capital” was simply theft. By a few politically powerful people. So capitalism’s “productivity” is an undefined item. I don’t thing we have ever actually had “productivity” in the sense (Kelton’s) of “a productive enough nation to pay our bills without inflation.” I don’t think we know how to be that kind of a nation.

wow, interesting!

this tends me to think that capitalism is, in contrast to the myth they keep on selling us, not the thing that makes us a prosperous nation. not without a lot of war, smuggling, manipulation, threats, and everything else.

in other words, as long as our country has been industrial-capitalist, it has also been fascist. one can’t survive well without the other, hand in glove, Big Gov and corporate “productivity”.

this means that they are symbiotic. any dream of saving one while repealing the other is just that.

What is debt?

Debt is money that was needed but not available, so it had to be borrowed.

Why wasn’t it available? The rich like to blame the poor and like to blame the teachers and the firefighters, but the poor and the teachers and the firefighters don’t have it. The rich have it. Obviously.

Why was it needed? It was borrowed for the sustenance of the poor and the teachers and the firefighters, and then, one way or another, ended up with the rich, because they were famished for more money, and they got it.

From whom was it borrowed? The rich. Because they have all the money. It certainly wasn’t borrowed from the poor, because they have none, or the teachers or the firefighters, because they don’t have that kind of money.

So in the end, the rich still have all the money, plus all the money that had to be borrowed that ended up with the rich, plus all the money that is owed to the rich. Money that had to be borrowed because the rich have all the money.

You see where this is going: in the end the rich have all the money, and more, and everybody else has nothing, and less than nothing, because they are debt slaves to the rich.

There are two kinds of debt. The first allows the debtor to get out of debt, and can be constructive. The second forces the debtor into a cycle of increasing debt, and is destructive. It is extremely unfortunate that this distinction is almost never made.

Destructive borrowing ultimately makes the rich richer and everybody else poorer, and only allows everybody else to buy time. Borrowing solves nothing and only worsens the need for even more debt. This is national economic policy, and it is policy because the avarice of the rich demands the destruction of all others.

The one and only solution is to absolutely ensure the rich do not have all the money, by taxing them and by paying everybody else enough to repay their debts. Otherwise those debts will have to be repudiated because they cannot be repaid. There is no other way. Any policy that says otherwise is misguided at best and fraudulent and corrupt at worse, as it necessarily perpetuates the cycle of debt and impoverishment of most people to feed the endless destructive greed of the few.

Wealth and power, like water, seek their own level. Unlike water, wealth and power flow uphill, and not downhill, and unless they are controlled and impounded and diverted by the levees and dams and canals of democracy to the parched fields of the people, they will naturally run away to the seas of authoritarianism.

Alas, where is my worthy padawan Scorpio69er when I need him?

The government doesnt only borrow from the rich. In fact, the majority comes from the poor. Interesting, no?

The biggest portion comes from the fed and it come out of “nowhere”. Nowhere is the wealth stored on previously issued money. But the wealthy can hedge their losses against inflation, laborers not so much.

In essesnse, all the government does is take your money via taxes or devaluation and give it back via “social programs”. Where is the good deed?

Walter, you twine a string tight enough to slice an elephant at the knees!…i’m taking this post with me (thanks)

OH, and this one too:

Walter Map says:

October 19, 2013 at 7:37 pm

The rich are far more desperate for money than the poor. So desperate that they will rob the poor for whatever they can get. The real problem is not the desperation of the poor. It is the desperation of the rich.

Some people with OCD hoard junk, others hoard cats, and still others hoard wealth, and the more they have, the more they need. Overweening greed is a psychiatric disorder.

******

“Only a government that is rich and safe can afford to be a democracy, for democracy is the most expensive and nefarious kind of government ever heard of on earth.”

Twain

+100

“I’m taking this one with me.” -AbyNormal

Me too. Awesome comment that intuitively stands on its own! Verse from The Stolen Child is perfect.

I’m taking this with me too and passing it around. May even call into a radio talk show and read it.

“There are two kinds of debt. The first allows the debtor to get out of debt, and can be constructive. The second forces the debtor into a cycle of increasing debt, and is destructive. It is extremely unfortunate that this distinction is almost never made.”

Hmm. Surely it’s the debtor’s personal circumstances or blind fate that make the difference? Shylock rates for a person about to win the lottery might make no differnce, while even the smallest amount of bad luck could turn constructive debt into destructive.

I think if Beard were here he would say that usury itself is the problem, not distinctions in “kind” between usorious outcomes. And I think he would be right.

When Walter Map says [quote] “There are two kinds of debt. The first allows the debtor to get out of debt, and can be constructive” [end quote], could he be referring to the kind of debt Code Name D speaks of in his comment back up the thread?

One type of debt stimulates enterprise and production, the other stimulates speculation and financilization, or mere rent-seeking. The problem comes when we get too much of the latter and not enough of the former.

More than one person has written on the phenomenon:

Or:

And while we may not know exactly how to get a surfeit of the good type of debt, we sure to hell know how to get a surfeit of the bad kind of debt, and that is by letting bankers and finacniers get their hands on the levers of political power.

“There is no other way”

I’m afraid there is another way, but it involves much blood spilling and is best avoided. I hate to break the news that this is a possible outcome – improbable, yes – but late-18th Century France situation is entirely possible.

Other than that quibble, this comment is spot on.

Greenspan’s quote is interesting. I’d like to challenge this business about “risk free debt”. After all that’s happened, including the downgrading of US debt by some agencies, the deep international unpopularity of US economic policies, why do we still insist that our instruments carry no risk?

And aren’t we tremendously dependent on other nations to maintain the “risk free” label? How “risk free” would US instruments be if other nations stopped buying them so vigorously?

I say that the value of US Treasuries to the world economy aren’t in setting any sort of “risk free” rate, but are rather a measure of the strength of US empire. There’s nothing “risk free” about our position in the world, is there?

Like Roman bronze coins of 2000 years ago – essentially valueless and produceable in any desired amount, they nonetheless held a measure of fiduciary value according to the power Rome wielded over its citizens and the region.

It’s the same confidence game every time. It’s risk free because it’s risk free.

Oh, that quote is from the St. Louis Fed, not Greenspan. Mentioning Greenspan before and after the quote got me confused.

One minor addition.

Treasuries and other US debt instruments are also held by businesses within other nations. In fact, it’s businesses, not other governments, that will decide which currency to use to trade.

Other governments merely satisfy the demands for those dollars.

But if we simply supply it for our own sovereign purposes, no bonding is required. What will be required will be that the TBTFs go back to banking and give up all their arbitrage.

The main problem is in the terms used. Treasury’s aren’t really debt, they’re liabilities. What makes them risk-free is the government can not run out of currency to service those liabilities and therefore has no risk of involuntary default. Unfortunately we have Republicans, so there is a risk of voluntary default.

Ben Johannson:The main problem is in the terms used. Treasury’s aren’t really debt, they’re liabilities.

The above is nonsense. It is true that there are major terminological problems, but many get them wrong or propose to make them much worse by making imaginary distinctions, when a major thrust of MMT is to NOT hallucinate these distinctions into existence. Treasuries (& dollars) are debt and liabilities, because these two words are synonyms. (To quote Professor Kelton.)

We do not have a debt or deficit problem. We do have a problem of insufficient collection of economic rent by undertaxing rich people and big corporations and by not enforcing anti-trust. We also have a problem on the one hand of wasteful public spending on the military and on bridges to nowhere, and on the other hand insufficient public spending on urban infrastructure, basic research, health, education, pensions and other benefits for ordinary people.

See my post on the Keynesian Stimulus Spending Fallacy: http://www.huffingtonpost.com/mary-manning-cleveland/the-keynesian-stimulus-sp_b_2381801.html

Love the comment about the bronze coins. Money, even gold is just a measure of political power. Chits used to enforce simian pack dominance hierarchies.

Lakoff’s book “brilliant”? His ideas are all about messaging i.e. propaganda. And even if you take his ideas as original, they are ideas on marketing and are not interesting to me although they may be interesting to speech writers and party apparatchiks.

I’m with you on this, MM. I like Lakoff’s scholarly work a lot, but when he started shopping his ideas as a consultant, everything went rancid pretty fast, leading to atrocities like Why Mommy is a Democrat (put down your coffee).

To be fair to Kelton, Lakoff was hot stuff circa 2003 – 2006, when dewy-eyed innocents like me felt that electing more and better Democrats was the answer. (Not to say Kelton has that goal; I’m commenting on the utter inadequacy of the analytical tools we had.)

Lakoff is crap. Since “being a Democrat” these days is an exercise in duplicity (or at least in being its accessory), no amount of messaging advice is going to interrupt the real message that Democrats carry: “enjoy the Grand Bargain and the Trans-Pacific Partnership, because that’s what we voted for.”

Yesterday on Charlie Rose three international observers of finance said despite the insanity of the US there seemed to be no option for global investors other than the US. The US was slowly climbing out of its economic hole that had been made worse by the constant threat of government shut-downs and defaults. They had no idea why the US had been brought to its knees by a small rogue element. Next interview began with Charlie demanding to know why Obama had not solved financial problems by smoozing with Congress and enacting the Bowles/Simpson rule of law to cut those “entitlements”.

A capitalist economy to benefit a transnational capitalist class is nothing but a death trip. If world-society doesn’t die of poverty or disease (while it rushes to “make a living” by working for these people) first, it will fry in the coming global warming disasters. We should go AWOL from this economy as soon as we possibly can.

then we need some alternative form of economy, which implies we need an alternative form of money that does not run afoul of the “legal tender for all debts, public & private” verbiage.

either that, or we just need to start giving shit away to each other, for no other reason than that the other person can really use it.

Right! Let’s do it!

Ms. Kelton says that, contrary to myth, money didn’t start out as barter (in the Columbia video series) but maybe that is where it eventually ends up?

David Graeber’s book on debt has some good stuff on that topic.

Since the US government refuses to manufacture dollars, this alternative does not in effect, exist. The government prefers that it and the citizens borrow from finance, thereby allowing both to dig a hole that has become too deep to extract ourselves from by any means other than default.

Indeed, the US government can begin manufacturing money tomorrow and use that money to retire its own debts. However, the banks will not sit idly by and have their fortunes destroyed, they would withhold credit as they have done in the past, complaining that it is not right and fair for the government to compete with the private interests of the bankers who have done so much to obtain for the governments and their subjects so much prosperity.

And guess what? The bankers would be right!

For the government to ‘print money’ in the way the St. Louis Fed suggests would be for the government to repudiate its debts, to suggest otherwise is

a liean elephant.People need to understand that ‘growth’ is an increase in unsecured debt, that unsecured debt is the basis of our so-called prosperity which itself is nothing other than living beyond our means. Right now, the cost of doing so is breaking, that is, the country is being broken by the cost of our country’s prior success.

There are those who believe that the strategy to recover past prosperity is to re-distribute a growing amount of ‘wealth’ must understand that this wealth is the manufactured good of the banks, not the government; that real capital — the world’s resource base that our money is a claim against — has been cannibalized for a period not less than 200 years and that our troubles are the consequence of capital shortages. Better for the elites to have theirs and for the rest to starve; we would have our capital we could perhaps figure out what to do with it … no! Instead, we have the fatal course we have set for ourselves with our continuing stupidity.

Without … the courage to come out and tell ourselves the truth.

Steve said,

“People need to understand that ‘growth’ is an increase in unsecured debt, that unsecured debt is the basis of our so-called prosperity which itself is nothing other than living beyond our means.”

Humanity is not living beyond its means. It is not possible for humnanity to live beyond its means.

Everything consumed must exist and must be produced by someone.

We have a distribution problem which was masked by growth. Growth did provide opporutnities for most in society to get enough money to not revolt and get too upset (at least in the industrialized countries).

We now must solve this distribution problem and we must keep in mind the dwindling fossil fuel supplies which has powered our material production/modernity so far.

I suggest the following:

A) we start a social credit/Social dividend/guaranteed income program and give every U.S. citizen $500 per month regardless of income or regardless of any public assistance they currently receive.

B) Increase taxation to keep inflation in check. Increased taxation should include stiff consumption tax to discourage too much consumption by the rich and upper middle classes.

D) Start stringent energy conservation and run a low-grade industrial civilization with less yearly fossil fuel consumption.

C) This will buy us time to develop another cheap energy source and possibly resume growth or if we don’t find another another cheap energy source we will have time to learn how to live without machines, fertilizers and pesticides.

http://aquinums-razor.blogspot.com/2013/02/the-banking-system-and-economic-growth.html

Read more at http://www.nakedcapitalism.com/2013/10/stephanie-kelton-how-to-talk-about-debt-and-deficits-dont-think-of-an-elephant.html#VDLuec8vULqOeD6W.99

It is not possible for humnanity to live beyond its means.

Not sure about the rest of your comment, but I think that this statement should be cast in bronze and placed on the lintel above every point of ingress at every bank, library, school house, and government office in the U.S., and everywhere else. Honestly, it is sickening to contemplate the extent to which our “common sense” on matters touching upon the public fisc is utter nonsense. And not just nonsense, but easily demonstrable nonsense.

Martin,

But this general global mis-understanding is not an accident but intentionally encouraged by the ruling classes of the world in order to intellectually enslave humanity.

http://aquinums-razor.blogspot.com/2011/11/here-is-how-bankers-game-works.html

Mansoor H. Khan

I’m with you there, brother. And at least here in the U.S.A., there’s a face and name that any man or woman of knowledge and good conscience can attach to the movement to enslave us – that is, the name of the enslaver, or the slavery enabler. And that face is handsome indeed, and that name?: Barack Obama.

The devil doesn’t approach in fury and rage, giving us notice of his evil nature and wicked intent. Rather, the devil comes as a friend, an agent of good – nay, as an agent of hope and change. That we gulped at that bait shows just how ridiculous and infantilized our “progressive” culture is. Pathetic weak fish, gasping for oxygen, dying.

Martin,

The intellectual slavery imposed by the current global elite is very similar to the intellectual slavery imposed by the Church in the middle ages (i.e., no salvation outside the church!).

The knowledge (light) spread via the printing press destroyed the church I pray and hope that (inshallah) the knowledge (light) spread via the internet (printing press version II) destroys the lies about economics, banking and the monetary system spread/maintaned by the current global elite.

Mansoor H. Khan

Mate I have to say in the past we had our differences, but, I am truly encouraged by your intellectual honesty.

Skippy… I hope you can forgive me for any past events, amends Mansoor.

Skippy,

Your are Forgiven!

All Praise Belongs to Allah!

Mansoor

Kelton:”Our challenge is not whether we can “afford” to make the payments we have promised to seniors, veterans, the disabled, government contractors, healthcare providers, bondholders, etc. (today, tomorrow and into the indefinite future) but whether we will be a productive enough nation to allow the government to make good on those promises without causing an inflation problem.”

Which means that we cannot afford to make any more such promises because we are not productive enough to create and destroy vast amounts of war material and produce the promised goods/services. And perhaps we cannot afford to keep our promises, because we have made promises at a time when we had higher productivity and now we have to live up to those promises when our output is gapping. And given this inability to deliver the promised goods/services, we have to make cuts if we want to continue “supporting the troops”. It is not an issue of stock or flow, but waste. Both stocks and flows can go to waste or to wealth.

Ultimately, people trade goods/services for good/services. Money simply confuses the issue (and why we should give government the right to act unethically – paying back with nominally the same but otherwise worthless dollars – is beyond me). Think in terms of goods and services, not in terms of money; money is too elastic a concept and oftentimes thinking in money terms only creates mischief.

tiebie said:

“Ultimately, people trade goods/services for good/services.”

This statement is way too simplistic. People trade real goods and services to accumulate currency itself (without spending it for a long long long time sometimes!) or financials instruments also (like bonds). China accumulates u.s treasuries for shipping real stuff to us.

More at:

http://aquinums-razor.blogspot.com/2011/08/what-is-relationship-of-money-to.html

Mansoor H. Khan

Ultimately, people trade goods/services for good/services.

False false false! Why the hell are people so stuck on barter, a form of commerce utterly or near-utterly absent from the lives of most, but appealed to constantly as if it were as common as drinking water? It’s really kind of bizarre when you think about it.

“…whether we will be a productive enough nation to allow the government to make good on those promises without causing an inflation problem. That is the debate we should be having.”

Well said.

It has surprised me how much attention monetary policy has received when the fundamental problem of the past decade or so is the colossal waste of resources on authoritarianism and corporate welfare.

Inflation has advanced so far now over the past several years that the median worker can’t even afford the basics of a middle class lifestyle.