Yves here. I was extremely puzzled to see various US regulators make cautiously positive remarks about Bitcoin in Congressional hearings. One would expect them to be opposed. First, Bitcoin is a cash proxy without many of the inconveniences of cash, in particular, the fact that carrying lots of bills to complete large transactions can be conspicuous and inconvenient. That is terribly useful to tax evader and criminals. Second is that if it were to become terribly successful, it would compete with official currencies.

But I now have a guess as to what happened. The officialdom is prisoner of its ideology. Bitcoin is an innovation, ergo it must be good.

By Jonathan Levin, postgraduate student, University of Oxford. Cross posted from MacroBusiness

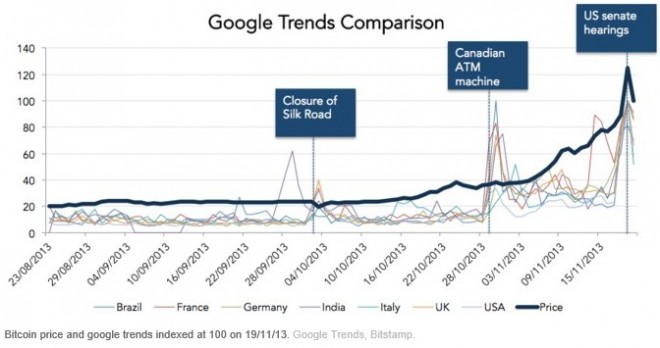

The hearings in the US senate last week were the most high profile public discussions that have taken place on the subject of virtual currencies. The US showed its openness by broadcasting the hearing, and it was watched by many Bitcoin enthusiasts around the world.

The discussion looked at the potential risks and opportunities Bitcoin and other virtual currencies pose for society, without going into any of the technical details. Senators made analogies with previous technologies and offered personal anecdotes, placing Bitcoin among inventions such as the internet and mobile phones.

Positive comments from senators, the judiciary and US financial authorities sent the price soaring to its highest price yet, reaching US$900 at one point. At the start of this year, a single coin cost less than US$15.

But the knowledge gap between legislators, law enforcement and Bitcoin developers is still vast. Coalitions of government agencies across borders are beginning to collaborate on addressing the gap. In 2012, the FBI founded the Virtual Currency Emerging Threats Working Group (VCET), which alongside the US department of justice and financial crime agency also collaborates with the UK’s National Crime Agency. However, at times these bodies seem to lack an understanding of the basic principles behind cryptographic currencies.

In Coins We Don’t trust

Bitcoin was conceived as a currency that did not require any trust between its users. As a result there is no room for a central authority able to resolve disputes and enforce laws.

Our traditional financial system has intermediaries that sit on top of the narrow supply of coins and notes in the economy, creating layers of credit services and other financial products. In these account-based systems, individuals trust these institutions – banks, building societies, pension funds, and so on – to keep their wealth safe. But, it is these same trust lines that also facilitate government tax collection and legal enforcement.

At the moment, Bitcoin’s equivalent financial intermediaries are the exchanges used to move money between digital and government-issued currencies. These centralised services use accounts to store users’ Bitcoin and government currencies and hence can be regulated like other forms of money transmission.

Since Bitcoin cannot be policed as effectively as normal money, most regulatory work is directed at exchanges. Enforcement within a peer-to-peer, distributed network is difficult. Take cash, for example. There is a reason why it is still the medium of exchange favoured by criminals across the world – without a centralised store and written records, it is harder for authorities to keep track. Likewise, in peer-to-peer file sharing networks, download portals and broadband providers are both subject to regulation and have the responsibility to manage content and user behaviour respectively.

If You’re not on the List…

This does not mean enforcement is not possible; there are considerable efforts to ensure self-regulation within the Bitcoin economy. One example is the suggestion that stolen coins should be blacklisted to prevent them from re-entering the money supply. As every Bitcoin transaction is publicly announced this is entirely feasible if the network could find a way of coming to consensus on whether the coins were actually stolen.

With the operational failures of so many exchanges and continued problems ensuring funds in online wallets are kept safe, this seems an attractive option to increase adoption of the currency. However, such moves inevitably come at the expense of true decentralisation and blacklisting is controversial among current Bitcoin users.

Without a greater appreciation of the technical details behind virtual currencies, regulation will still be limited to the exchanges that sit on top of the Bitcoin protocol. While they serve as the bottleneck between government currencies, the possibility of consumer protection or detection of illicit uses will elude the regulators.

Depending on existing legislation, countries will also vary in the ease by which they are able to adapt definitions of the currency and ownership. These details are absent from the current policy debate and actually mark the distinctive features and possible future uses of these promising currencies.

First off we should pay absolutely no attention to what politicians say, just pay attention to what they do (viz. Obomba, the king of the “credibility gap”).

Secondly, the US has already ceded any chance of leading the Bitcoin industry:

http://www.coindesk.com/us-already-ceded-dominance-bitcoin-trading/

Lastly, any scheme to “mark” Bitcoins is just a scheme to kill it. Think about it, 90% of US currency has traces of cocaine. That $20 in your pocket may have been used in a holdup in 2004. Eventually all Bitcoins would be “marked” and unspendable.

They spent 100’s of millions trying to stop movie downloading; but peer-to-peer downloads are now 40% of all net downloads, compared to just 13% for all web surfing. The people’s peer-to-peer money cannot be stopped. They can stop the interface between bank money and internet money, but that will only work as long as people still need bank money. Our company currently pays software developers in Austin, Prague, and the UK, instantaneously, with no fee. The people’s money.

If there were more than one cryptographic/peer-to-peer/people’s money, then the pairwise exchange of crypto currencies would require a centralized account-based system that would be open to government intervention, don’t you think?

No. The essential feature of the bitcoin-to-dollar exchange online is the requirement that the dollar account is part of the financial system and within the government’s jurisdiction- the government can track those dollars to and from the exchange. A crypto-to-crypto exchange doesn’t have this weakness.

I understand that but unfortunately it does not address my concern. Would the crypto-to-crypto exchange require an intermediary between peers, a market of centralized account systems for crypto-currency conversion?

“Our company currently pays software developers in Austin, Prague, and the UK, instantaneously, with no fee.”

Are they evading taxes? I think that’s the key point from the government’s perspective. If they’re using bitcoin but not so as to evade taxes then there shouldn’t be a problem.

You can only pay taxes in the state currency (give unto caesar what is caesar’s). The government can’t ask for taxes on theme-park money, unless they plan on replacing the current system with the new money.

Where’d you get that quote anyway.. I don’t see it in the preceding comments.

*In 2011, the third-largest trading site, Bitomat, lost its wallet file, which held 17,000 bitcoins worth more than $200,000 at the time.

*In the same year, the exchange MyBitcoin lost 51% of its users’ deposits, amounting to 78,000 bitcoins worth over $1 million at the time.

*In 2012, Bitcoinica was hacked and lost $220,000 worth of customer funds. Two months later, it was hacked again and lost another $90,000. As Bitcoinica attempted to repay claims, the company was hacked a final time for another loss of $320,000.

*In the fall of 2012, in what might have been the first Bitcoin Ponzi scheme, the creator of Bitcoin Savings and Trust promised returns to investors. The founder has since disappeared with 500,000 bitcoins.

~

*April 2013: Study: 45 percent of Bitcoin exchanges end up closing http://www.wired.co.uk/news/archive/2013-04/26/large-bitcoin-exchanges-attacks

funnee, smells like the same hunting ground predators have always enjoyed.

“It’s clearly a budget. It’s got lots of numbers in it.”

George W. Bush (I’m all in)

“Let me ask you one question

Is your money that good

Will it buy you forgiveness

Do you think that it could

I think you will find

When your death takes its toll

All the money you made

Will never buy back your soul”

Bob Dylan, The Bob Dylan Scrapbook: 1956-1966

It had to be Aby when the post finishes with a verse from a song from the good ‘ol days!

This post says all one needs to know about bitcoins if and until exchanges can provide protections against theft and fraud.

Really basic question: Who are the bitcoin money issuers, the people in the “people’s money”? Seems like they’d be positioned well in this setup?

The digital realm has enabled free sharing of information across the globe, LucyLulu. Now with Bitcoin and other crypto currencies, it will enable FREE trade across the globe. These are examples of people empowerment, not empowerment of the oligarchies or the status quo. If we want to evolve as a species on this planet, we have to cooperate as people, not as governments or as nations.Digitizing trade and information is leading us there, slowly but surely.At least that’s my hope, if Bitcoin is really for real.

“crypto currencies, it will enable FREE trade across the globe”…oulala, NsA boner bout ta blow!

“The world is not sliding, but galloping into a new transnational dystopia. This development has not been properly recognized outside of national security circles. It has been hidden by secrecy, complexity and scale. The internet, our greatest tool of emancipation, has been transformed into the most dangerous facilitator of totalitarianism we have ever seen. The internet is a threat to human civilization.

These transformations have come about silently, because those who know what is going on work in the global surveillance industry and have no incentives to speak out. Left to its own trajectory, within a few years, global civilization will be a postmodern surveillance dystopia, from which escape for all but the most skilled individuals will be impossible. In fact, we may already be there.

While many writers have considered what the internet means for global civilization, they are wrong. They are wrong because they do not have the sense of perspective that direct experience brings. *They are wrong because they have never met the enemy.”*

Julian Assange

until exchanges can provide protections against theft and fraud = unpickable locks, 1004 secure banks, uncounterfietable (sp?) currency= never

Good one, Abby!

Everybody knows that the dice are loaded

Everybody rolls with their fingers crossed

Everybody knows that the war is over

Everybody knows the good guys lost

Everybody knows the fight was fixed

The poor stay poor, the rich get rich

That’s how it goes

Everybody knows

Everybody knows that the boat is leaking

Everybody knows that the captain lied

Everybody got this broken feeling

Like their father or their dog just died

And everybody knows that it’s now or never

Everybody knows that it’s me or you

And everybody knows that you live forever

Ah when you’ve done a line or two

Everybody knows the deal is rotten

Old Black Joe’s still pickin’ cotton

For your ribbons and bows

Leonard Cohen

here Aby.. my favorite song to reanimate late night revelers early in the morning. Most effective when turned up to 11

https://www.youtube.com/watch?v=W25_jgiY51I

Flying Lizzards – Money

i remember that one, thanx…leave the volume where it is:

https://www.youtube.com/watch?v=-Wp088whRcY

coin’rs will never again enjoy the first line!

here Aby, you’ll enjoy this.

https://www.youtube.com/watch?v=AOLg_XY2cWA

Lhasa de Sela –De Cara A La Pared

RIP Lhasa

I’ll see you your Dylan and raise you a Harper:

http://www.youtube.com/watch?v=e0uRNyghmL8

ahh Dip you know how i feel about Ben!…great tune, thanx!!

http://www.youtube.com/watch?v=qjcYkFSylBk

“Cause I sure am usin’ you to do the things you do’

to do the things you do”…Sing It Winklevoss’

One more, for some Saturday inspiration:

(I Believe In A) Better Way

gives me chills every time…

But the knowledge gap between legislators, law enforcement and Bitcoin developers is still vast…these bodies seem to lack an understanding of the basic principles behind cryptographic currencies…

“Shhhh, don’t say a word. The suits think they are ahead of the techie crowd,” Emin Gün Sirer on “Why Da Man Loves Bitcoin,”

“The Senate just held hearings on Bitcoin yesterday, and what do you know, it turns out that the US Government has a secret crush on everyone’s favorite anti-establishment, stick-it-to-the-man, we’re-so-cool-we-reject-your-dirty-fiat-money cryptocurrency.

Let’s look a little bit into why The Man has such an unrequited love affair with our beloved cryptocurrency.

The Man loves Bitcoin because it’s a digital accounting system that must necessarily keep track of all transactions. Unlike currency we’re used to, there aren’t any coin/greenback counterparts exchanging virtual hands, ever, anywhere in Bitcoin. Instead, there is an accounting book that keeps track of all transactions between people going back to the beginning of Bitcoin time…an angel dies every time some press article refers to Bitcoin as “untraceable”. It is anything but. The whole currency is about traceability; in fact, transactions are individually traced independently by every node in the system to ensure that nobody is spending more than they earned.

The Feds love this system, because once you know the accounts belonging to Escobar-Jr, you can trace exactly from which other accounts he received his cash flows. Sure, pinning these accounts back to real people is not trivial because of the potential anonymity, but here is where the Feds have some special techniques. For one, they know that in real life, most people will go through exchanges that require some form of ID. The more commercialized and consolidated the Bitcoin space is, the easier it is for them to get at this data first-hand. And if some users avoid the exchanges and roll their own, the Feds know that real people have difficulty keeping up with all the requisite anonymity practices…For Bitcoin users reveal their IP addresses when they submit transactions, and all our ISPs have our real names on file, and we know from Snowden that the ISPs are fully compromised.

http://hackingdistributed.com/2013/11/19/why-da-man-loves-bitcoin/

“Chances are that the National Security Agency and other cyber-war ministries around the world have already cracked the hashing algorithm that keeps the currency afloat, and it is for them to choose when to unleash it. It is sort of an irony that in their flight from central bankers the Bitcoin traders subjugate themselves to cyber-war tsars who serve the same governments.” – Gideon Samid, Chief Technology Officer for BitMint, which is testing digitized U.S. dollars.

Right Kansas, and your final paragraph provides a possible alternative explanation for the extreme volatility that Bitcoiners attribute to “the free market” or Chinese party insiders seeking to buy villas in Ibezia. What better way to destroy its utility as an operating currency than to whipsaw it to death?

Staying 100% anonymous is going to be impossible anytime you have to receive a physical good in exchange for a Bitcoin- Bitcoin has this same weakness physical cash transactions have. Also, anytime you try to receive electronic dollars/pounds/Euros etc., you will also compromise your anonymity.

Claims that the hashing algorithm has been broken is basically nonsense, however. But this is surely not going to always be the case. I view this as the ultimate weakness of the system- it doesn’t seem to have the ability to upgrade the cryptography, and I think, should virtual currencies really have future, it will be replaced one day by one that has the ability to stay ahead of the code breakers.

Yves,I like your site and enjoy your views, however, Dracula has already been invited into the house in 1913 with the ferderal reserve act. Bitcoin is van Helsing and you are hesitant about inviting him into the house also because someone might get a splinter from the “open source” stake he welds?

Taxes are the price of civilization. I live in a high tax state and don’t object to that, because (gasp) I find government services are rendered well. For instance, the state insurance bureau is way more attentive and responsive than pretty much any business I deal with.

IRS is like a heat seeking hydrogen bomb…me thinks these BTC’rs never felt the fallout of COMPOUNDED INTEREST PENALTIES

“here’s a toast to Alan Turing

born in harsher, darker times

who thought outside the container

and loved outside the lines

and so the code-breaker was broken

and we’re sorry

yes now the s-word has been spoken

the official conscience woken

– very carefully scripted but at least it’s not encrypted –

and the story does suggest

a part 2 to the Turing Test:

1. can machines behave like humans?

2. can we?”

~Matt Harvey

Given that the Bitcoin algorithm sets a maximum number for bitcoins, and given that increasingly large amounts of computing power are required to mine bitcoins, if a government really wanted to control Bitcoins, why wouldn’t they just put significant amounts of their computing capacity into bitcoin mining?

They may well have done so.

I wish them luck with that. The largest supercomputer in the US currently runs at 10 tera-hashes, the largest in the world at 35 tera-hashes. The Bitcoin network currently runs at 5,000 tera-hashes, mostly using chips specifically designed just to run the Bitcoin algorithm. The government would need 51% of that power to take over the network.

I expect the various governments would use more than one computer – even more than one supercomputer. How many dedicated bitcoin-mining computers can you buy for, say, a billion dollars?

Remember, there’s more than one government in the world – I could see the Chinese government taking a less than amiable view of an underground currency. I wonder what a Stuxnet-type virus designed to attack a bitcoin server or mining computer would look like?

Here’s what Yi Gang, Deputy Governor of the People’s Bank of China said in a speech last week:

“Bitcoin is an internet trading freedom and does not directly interfere with China’s development. Ordinary people have the freedom of trade practices by participating in the network. Bitcoin is very characteristic and inspiring”.

I think they are quite happy to support anything that pokes a stick in the eye of the US and their terrifying and destructive dollar.

I don’t think the fact that it’s an “innovation” is relevant. It’s more that Bitcoin, despite having nothing but the faith of their users behind it, is a currency constructed along the lines of a goldbug’s fantasy. For new Bitcoins to be created, they must be “mined.” There is a finite supply of them, they cannot be debased, and their value has little relation to the economy they support, much like gold, which builds in a deflationary pressure.

All these attributes make it attractive to many, but volatile and thus not a practical currency in the long term. (Others have mentioned the traceability of the currency, which also may be a factor in officialdom’s lack of alarm.) I’d like to believe that this is why officialdom is not too worried, but I don’t believe they understand standard currencies either.

Volatility? Tell it to India, that has seen a 48% drop in the rupee in the last two years. Or the South Africans, who just saw the rand drop 35% in two weeks. Bitcoin is just thinly-traded for the moment, that will change.

There is no reason at all why the government cannot regulate Bitcoin, or even put it decisively out of existence whenever it chooses to.

The USG has shown that it can hack pretty much every secure system in the known universe. I am sure they can hack Bitcoin wallets and vaporize them whenever they choose to do so.

If you want to infiltrate and then roll up a criminal network, would you rather that network held its money in Swiss banks or other state currency systems with all of the political and diplomatic barriers they entail. Or would you rather that they held transaction funds in Bitcoins on some electronic system with no state protection or control?

The fact is you don’t know if what they are telling you about Bitcoin (BTC) is true or not. Given the likes of Google and Cisco, it is hard to know if they were a government operation from the start, if they were corrupted along the way, or they haven’t been leaned on hard enough yet.

You can’t hold it, or melt it to make sure it’s real and isn’t a wolf in sheep’s clothing.

It’s best to play it like a gamble. If you hit a home run, great, celebrate. If it fails, the money went for the entertainment value.

Just waiting for a coiner to say –

“It’s different this time. Buy now or forever be priced out of the market.”

Cash has no memory.

Bitcoins do.

‘A cash proxy … is terribly useful to tax evaders and criminals.‘

So are cars, computers and cell phones. Ban them!

‘If [Bitcoin] were to become terribly successful, it would compete with official currencies.’

Competition — the horror!

Considering that the official currency has been devalued to only 3 percent of its original purchasing power since a bank cartel tool over its issuance in 1913, competition would seem to be exactly what this self-serving elite needs.

Smash the Federal Reserve!

It is amusing, isn’t it, that on a site that so loathes the present financial system, the commenters reflexively despise a potential paradigm altering solutions because governments might find it difficult to give them their cut.

reflexivity? you must have this site confused with zh!

i’ve yet to read a coherent nc commenter that would support such a volatile “potential paradigm altering solution”…in these exponentially volatile times.

“Quick-loving hearts … may quickly loathe.”

Elizabeth Barrett Browning, Sonnets from the Portuguese

Competition you say?

BitCoin would be left in the dust if we had true competition in private money creation.

BitCoin is a FIXED money supply and is therefor far worse than gold which at least allows a 2% (it’s approximate mining) real growth rate.

Get ye into a Bible, Jim, I fear for your brain! You can start with Matthew 25:14-30 and see what the Lord thinks of money hoarders.

Maybe not even 2% but better than BitCoin which should put the final nails in the “deflation is good” arguments of the Austrians – those misery loving, gold worshipping, Biblically ignorant, money hoarding hypocrites. :)

And I used to call myself one till I actually got to know some well at mises.com and started reading the Bible dilegently. Kinda like that time I went with a girl friend to hear Newt Gingrich and was appalled at Republicans, up close and personal. I thought I was in a circle of Hell!

“So are cars, computers and cell phones.”

scaling up…rolled up oil paintings in cardboard tubes..

“Counterfeit money is imitation money produced without the legal sanction of the state or government.” Wiki. So what sanctions a novel form of money, so that it is not defined as counterfeit? If exchanges exist to trade bitcoin for dollars doesn’t bitcoin need to be equally sanctioned? Right now bitcoin is the quintessential fiat. You just go mine it. And nobody’s gonna pay their taxes in it. In order for bitcoin to become legit it would have to be sanctioned by more than “truth in numbers” trust – because their motto is really saying, “in speculation we trust.” Because sovereign money serves a sovereign purpose which is to fund the daily operation of the country. Bitcoin’s only (rapidly diminishing claim to legitimacy) is that it is not fiat. Please. It is the fiat of fiat. It might as well be defined as a derivative of counterfeit money.

HA!, Leave it to STO! “It is the fiat of fiat. It might as well be defined as a derivative of counterfeit money.”

[derivatives] are no more than motivated delusions in search of theoretical justification; fundamentalist tracts that acknowledged facts only when they could be accommodated to the demands of the lucrative faith. Despite their highly impressive labels and technical appearance, economic models were merely mathematized versions of the touching superstition that markets know best, both at times of tranquility and in periods of tumult.”

Yanis Varoufakis, The Global Minotaur: America, Europe and the Future of the Global Economy

If I can spend it, and it doesn’t rapidly lose purchasing power like my dollars do, then I find it very attractive. I wouldn’t be surprised if financial elite realize the same thing, and be faced with either destroying it or jumping on the bandwagon with significant amounts of money.

http://elainedianetaylor.com/bitcoin-barbarians/

If ancient peoples had a choice between gold or bitcoin, they would’ve chosen bitcoin for its ease of use.

Somebody explain to me how bitcoins are different from bills of exchange on New Orleans-to-Liverpool cotton in the nineteenth century.

Evading taxes are the least of the possible catastrophes given the propensity of sharpies to game any currency system.

Did not the big banks just fail by gaming a regulated currency and banking system by establishing unlimited peer-to-peer relationships based on questionable assets as formal guarantees or no assets at all?

Fear and apprehension often comes the new and not understood. After the initial sense of panic regarding Bitcoin, the government saw how it could be used for it’s own end. With a virtual currency they will have full control over our lives. You’re either in or you’re out. The informal economy will be left with sacks of barley to conduct trade.

I see another speculative enterprise which provides nothing productive, will not help the real economy and is another money making money from money techie game. More fictitious, digital bull destined for history’s trash heap.

Yves you still don’t understand bitcoin.

The stand alone currency aspect is the least interesting aspect of bitcoin. It is a triple entry accounting ledger. Smart contracts, mircopayments, the implications are staggering.

The core developers are very intelligently embracing regulation and the government sees revenue, plain and simple.

I’m not comfortable with a currency that is vulnerable to magnetism.

One good EMP blast, or solar flare, and you’re not going to be able to use Bitcoins to buy a bottle of water.

But it is cute how earnest the libertarian/technie nexus gets when they’re all het up about something. “If only…” is the libertarian benediction and “If you only clap louder…” will be the bitcoin valediction.

well if a solar flare fries our electronics, it’d fry bank electronic account balances too so you aren’t really better with “normal” money (assuming money would be worth much in that post apocalyptic scenario). In fact bitcoin would be pretty resistant to that, as long as it doesn’t fry all electronics around the globe, as the blockchain (the ledger of transactions) is in millions of computers by now and it’s easy to backup your personal wallet in paper or other non volatile medium. I’d say your local bank is more exposed to this risk than bitcoin.

So Tishma-Speier walks away from a billion dollar mortgage on the Peter Stuyvesant development in NYC, yet is able to continue to qualify for new loans. Joe 6 Pack walks away from a $200,000 mortgage, and his credit is dinged, making him a high risk loan candidate. Can someone explain how this works, exactly?

You could short bitcoin… oops you can’t…

The short is built in to the currency.

It’s already short.

You can naked short anything, can’t you?

Well, anything that people know can be bought and sold.

Btw, I hate naked dreams but strict honesty seems to have reduced them. I wonder if naked short sellers are exhibitionists?

I think we need to separate bitcoin from the concept of cryptocurrencies. The first is a specific implementation of the second of course, and the most popular at the moment.

The idea that you can create a digital asset that is (almost) counterfeit proof without a centralized entity is valuable and a testament to the power of human intellect. It’s possible, even likely, that it plays a part in the future.

Bitcoin as an implementation is clever and its success so far indicates interest and value in the idea itself. However it is, as other people in this thread have indicated, plagued by issues: fraud, lost currency, speculation, privacy concerns, technical scalability issues, etc. Of course this is all pretty normal for an early technical implementation of a concept and usually what happens is that you iterate over it and improve it until you have something that is good. The problem in the bitcoin community is that, mainly because of the money you can make with price speculation, people seem completely blind towards the issues. It’s became a very emotional subject (us against them) and I feel that it’s actually hampering the evolution of a very interesting idea.

Holygrail, i appreciate your post. the beginning is the hardest. many argue this is the perfect time…maybe for the idea itself but how many have the liquidity and access to implement it for the benefit of the masses? fulfilling more hustlers dreams is the introduction of CC’s under the weight of present global finance and technical manipulations.

“Hustlers of the world, there is one Mark you cannot beat: the Mark Inside.”

William S. Burroughs

we are going to have to learn & fight thru present complexities or continue to suffer consistent failures…every goddam time.

“Yesterday’s shortcuts are today’s nightmares. The race is quicker when we’re stricter. Keep your eyes on today, and declare what you may.”

Mark O’Brien

“Yesterday’s shortcuts are today’s nightmares.” Mark O’Brien

True dat. Case in point: unethical money/credit creation.

It turned out that decentralized embezzlement (fractional reserve banking) was better than a slowly growing or strictly exogenous money supply for the purpose of creating wealth but at the cost of the boom/bust cycle and unjust wealth disparity.

We CAN do far better. The only question is WILL we?

BitCoin is a money hoarders dream come true* and thus is an awful** money. Let’s have true liberty in private money creation and we’ll teach the hoarders a lesson they won’t forget.

Ironically, common stock, an IDEAL private money form receives scarcely any press aside from moi. It seems we’d rather hoard, steal, and oppress the poor than honestly share. It seems we’d rather talk about equity than allow the poor to have any.

*Till new entrants into the field provide competition.

** Progress requires investment, not money hoarding.

Taxes can/must only be paid with fiat so what difference does it make what people use for private debts taxwise IF ALL the taxes used by government are by their very nature unavoidable or very difficult to avoid?

Some “unavoidable” taxes off the top of my head:

1) a per gallon fuel tax.

2) a per acre land tax.

3) a per gallon sewage treatment tax.

4) a per mile highway tax.

5) etc. etc. etc.

That said, my heart is heavy wrt this comment. I lack my usual confidence in it’s veracity, precision, etc. and therefore my usual joy in posting.

OK, here’s a(the?) problem. I should have used “evade” rather than “avoid.” It’s ethical to avoid taxes (e.g. don’t drive and avoid fuel taxes) but unethical to evade them (e.g. use agricultural fuel for highway driving).

I feel better.

Well, the question appears…will the governments start mining the Bitcoin themselves?

The author claims that the “officialdom is prisoner of its ideology” but apparently he hasn’t thought that the US Government might have thought of mining the Bitcoin itself or might be behind its creation. I wonder who is the prisoner of their own ideologies. Politicians might have invested in Bitcoin mining or might have sons or nephews that do it.

Governments will control the bitcoin and they won’t struggle to do it.

The thing is that the governments might not be the biggest threat to the Bitcoin.

Private corporations will be. Banks, investment companies, financial companies in genere will be interested. The thing is that right now (December 2013) with 40 million dollars in equipment you can be the one who’s mining over 50% of the coins.

This means control over the Bitcoin market.

Any company with enough money can take over the Bitcoin.

Worse, more than one company might just jump in. This would make independent Bitcoin miners drop it.