By Laura Gottesdiener, a journalist and the author of A Dream Foreclosed: Black America and the Fight for a Place to Call Home, published in August by Zuccotti Park Press. She is an editor for Waging Nonviolence and has written for Rolling Stone, Ms., Playboy, the Huffington Post, and other publications. She lived and worked in the People’s Kitchen during the occupation of Zuccotti Park. Cross posted from TomDispatch

Over the last year and a half, Wall Street hedge funds and private equity firms have quietly amassed an unprecedented rental empire, snapping up Queen Anne Victorians in Atlanta, brick-faced bungalows in Chicago, Spanish revivals in Phoenix. In total, these deep-pocketed investors have bought more than 200,000 cheap, mostly foreclosed houses in cities hardest hit by the economic meltdown.

Wall Street’s foreclosure crisis, which began in late 2007 and forced more than 10 million people from their homes, has created a paradoxical problem. Millions of evicted Americans need a safe place to live, even as millions of vacant, bank-owned houses are blighting neighborhoods and spurring a rise in crime. Lucky for us, Wall Street has devised a solution: It’s going to rent these foreclosed houses back to us. In the process, it’s devised a new form of securitization that could cause this whole plan to blow up — again.

Since the buying frenzy began, no company has picked up more houses than the Blackstone Group, the largest private equity firm in the world. Using a subsidiary company, Invitation Homes, Blackstone has grabbed houses at foreclosure auctions, through local brokers, and in bulk purchases directly from banks the same way a regular person might stock up on toilet paper from Costco.

In one move, it bought 1,400 houses in Atlanta in a single day. As of November, Blackstone had spent $7.5 billion to buy 40,000 mostly foreclosed houses across the country. That’s a spending rate of $100 million a week since October 2012. It recently announced plans to take the business international, beginning in foreclosure-ravaged Spain.

Few outside the finance industry have heard of Blackstone. Yet today, it’s the largest owner of single-family rental homes in the nation — and of a whole lot of other things, too. It owns part or all of the Hilton Hotel chain, Southern Cross Healthcare, Houghton Mifflin publishing house, the Weather Channel, Sea World, the arts and crafts chain Michael’s, Orangina, and dozens of other companies.

Blackstone manages more than $210 billion in assets, according to its 2012 Securities and Exchange Commission annual filing. It’s also a public company with a list of institutional owners that reads like a who’s who of companies recently implicated in lawsuits over the mortgage crisis, including Morgan Stanley, Citigroup, Deutsche Bank, UBS, Bank of America, Goldman Sachs, and of course JP Morgan Chase, which just settled a lawsuit with the Department of Justice over its risky and often illegal mortgage practices, agreeing to pay an unprecedented $13 billion fine.

In other words, if Blackstone makes money by capitalizing on the housing crisis, all these other Wall Street banks — generally regarded as the main culprits in creating the conditions that led to the foreclosure crisis in the first place — make money too.

An All-Cash Goliath

In neighborhoods across the country, many residents didn’t have to know what Blackstone was to realize that things were going seriously wrong.

Last year, Mark Alston, a real estate broker in Los Angeles, began noticing something strange happening. Home prices were rising. And they were rising fast — up 20% between October 2012 and the same month this year. In a normal market, rising home prices would mean increased demand from homebuyers. But here was the unnerving thing: the homeownership rate was dropping, the first sign for Alston that the market was somehow out of whack.

The second sign was the buyers themselves.

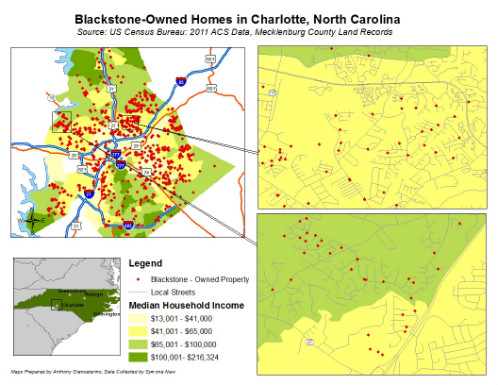

Click here to see a larger version

About 5% of Blackstone’s properties, approximately 2,000 houses, are located in the Charlotte metro area. Of those, just under 1,000 (pictured above) are in Mecklenberg County, the city’s center. (Map by Anthony Giancatarino, research by Symone New.)

“I went two years without selling to a black family, and that wasn’t for lack of trying,” says Alston, whose business is concentrated in inner-city neighborhoods where the majority of residents are African American and Hispanic. Instead, all his buyers — every last one of them — were besuited businessmen. And weirder yet, they were all paying in cash.

Between 2005 and 2009, the mortgage crisis, fueled by racially discriminatory lending practices, destroyed 53% of African American wealth and 66% of Hispanic wealth, figures that stagger the imagination. As a result, it’s safe to say that few blacks or Hispanics today are buying homes outright, in cash. Blackstone, on the other hand, doesn’t have a problem fronting the money, given its $3.6 billion credit line arranged by Deutsche Bank. This money has allowed it to outbid families who have to secure traditional financing. It’s also paved the way for the company to purchase a lot of homes very quickly, shocking local markets and driving prices up in a way that pushes even more families out of the game.

“You can’t compete with a company that’s betting on speculative future value when they’re playing with cash,” says Alston. “It’s almost like they planned this.”

In hindsight, it’s clear that the Great Recession fueled a terrific wealth and asset transfer away from ordinary Americans and to financial institutions. During that crisis, Americans lost trillions of dollars of household wealth when housing prices crashed, while banks seized about five million homes. But what’s just beginning to emerge is how, as in the recession years, the recovery itself continues to drive the process of transferring wealth and power from the bottom to the top.

From 2009-2012, the top 1% of Americans captured 95% of income gains. Now, as the housing market rebounds, billions of dollars in recovered housing wealth are flowing straight to Wall Street instead of to families and communities. Since spring 2012, just at the time when Blackstone began buying foreclosed homes in bulk, an estimated $88 billion of housing wealth accumulation has gone straight to banks or institutional investors as a result of their residential property holdings, according to an analysis by TomDispatch. And it’s a number that’s likely to just keep growing.

From 2009-2012, the top 1% of Americans captured 95% of income gains. Now, as the housing market rebounds, billions of dollars in recovered housing wealth are flowing straight to Wall Street instead of to families and communities. Since spring 2012, just at the time when Blackstone began buying foreclosed homes in bulk, an estimated $88 billion of housing wealth accumulation has gone straight to banks or institutional investors as a result of their residential property holdings, according to an analysis by TomDispatch. And it’s a number that’s likely to just keep growing.

“Institutional investors are siphoning the wealth and the ability for wealth accumulation out of underserved communities,” says Henry Wade, founder of the Arizona Association of Real Estate Brokers.

But buying homes cheap and then waiting for them to appreciate in value isn’t the only way Blackstone is making money on this deal. It wants your rental payment, too.

Securitizing Rentals

Wall Street’s rental empire is entirely new. The single-family rental industry used to be the bailiwick of small-time mom-and-pop operations. But what makes this moment unprecedented is the financial alchemy that Blackstone added. In November, after many months of hype, Blackstone released history’s first rated bond backed by securitized rental payments. And once investors tripped over themselves in a rush to get it, Blackstone’s competitors announced that they, too, would develop similar securities as soon as possible.

Depending on whom you ask, the idea of bundling rental payments and selling them off to investors is either a natural evolution of the finance industry or a fire-breathing chimera.

“This is a new frontier,” comments Ted Weinstein, a consultant in the real-estate-owned homes industry for 30 years. “It’s something I never really would have dreamt of.”

However, to anyone who went through the 2008 mortgage-backed-security crisis, this new territory will sound strangely familiar.

“It’s just like a residential mortgage-backed security,” said one hedge-fund investor whose company does business with Blackstone. When asked why the public should expect these securities to be safe, given the fact that risky mortgage-backed securities caused the 2008 collapse, he responded, “Trust me.”

For Blackstone, at least, the logic is simple. The company wants money upfront to purchase more cheap, foreclosed homes before prices rise. So it’s joined forces with JP Morgan, Credit Suisse, and Deutsche Bank to bundle the rental payments of 3,207 single-family houses and sell this bond to investors with mortgages on the underlying houses offered as collateral. This is, of course, just a test case for what could become a whole new industry of rental-backed securities.

Many major Wall Street banks are involved in the deal, according to a copy of the private pitch documents Blackstone sent to potential investors on October 31st, which was reviewed by TomDispatch. Deutsche Bank, JP Morgan, and Credit Suisse are helping market the bond. Wells Fargo is the certificate administrator. Midland Loan Services, a subsidiary of PNC Bank, is the loan servicer. (By the way, Deutsche Bank, JP Morgan Chase, Wells Fargo, and PNC Bank are all members of another clique: the list of banks foreclosing on the most families in 2013.)

According to interviews with economists, industry insiders, and housing activists, people are more or less holding their collective breath, hoping that what looks like a duck, swims like a duck, and quacks like a duck won’t crash the economy the same way the last flock of ducks did.

“You kind of just hope they know what they’re doing,” says Dean Baker, an economist with the Center for Economic and Policy Research. “That they have provisions for turnover and vacancies. But have they done that? Have they taken the appropriate care? I certainly wouldn’t count on it.” The cash flow analysis in the documents sent to investors assumes that 95% of these homes will be rented at all times, at an average monthly rent of $1,312. It’s an occupancy rate that real estate professionals describe as ambitious.

There’s one significant way, however, in which this kind of security differs from its mortgage-backed counterpart. When banks repossess mortgaged homes as collateral, there is at least the assumption (often incorrect due to botched or falsified paperwork from the banks) that the homeowner has, indeed, defaulted on her mortgage. In this case, however, if a single home-rental bond blows up, thousands of families could be evicted, whether or not they ever missed a single rental payment.

“We could well end up in that situation where you get a lot of people getting evicted… not because the tenants have fallen behind but because the landlords have fallen behind,” says Baker.

Bugs in Blackstone’s Housing Dreams

Whether these new securities are safe may boil down to the simple question of whether Blackstone proves to be a good property manager. Decent management practices will ensure high occupancy rates, predictable turnover, and increased investor confidence. Bad management will create complaints, investigations, and vacancies, all of which will increase the likelihood that Blackstone won’t have the cash flow to pay investors back.

If you ask CaDonna Porter, a tenant in one of Blackstone’s Invitation Homes properties in a suburb outside Atlanta, property management is exactly the skill that Blackstone lacks. “If I could shorten my lease — I signed a two-year lease — I definitely would,” says Porter.

The cockroaches and fat water bugs were the first problem in the Invitation Homes rental that she and her children moved into in September. Porter repeatedly filed online maintenance requests that were canceled without anyone coming to investigate the infestation. She called the company’s repairs hotline. No one answered.

The second problem arrived in an email with the subject line marked “URGENT.” Invitation Homes had failed to withdraw part of Porter’s November payment from her bank account, prompting the company to demand that she deliver the remaining payment in person, via certified funds, by five p.m. the following day or incur “the additional legal fee of $200 and dispossessory,” according to email correspondences reviewed by TomDispatch.

Porter took off from work to deliver the money order in person, only to receive an email saying that the payment had been rejected because it didn’t include the $200 late fee and an additional $75 insufficient funds fee. What followed were a maddening string of emails that recall the fraught and often fraudulent interactions between homeowners and mortgage-servicing companies. Invitation Homes repeatedly threatened to file for eviction unless Porter paid various penalty fees. She repeatedly asked the company to simply accept her month’s payment and leave her alone.

“I felt really harassed. I felt it was very unjust,” says Porter. She ultimately wrote that she would seek legal counsel, which caused Invitation Homes to immediately agree to accept the payment as “a one-time courtesy.”

Porter is still frustrated by the experience — and by the continued presence of the cockroaches. (“I put in another request today about the bugs, which will probably be canceled again.”)

A recent Huffington Post investigation and dozens of online reviews written by Invitation Homes tenants echo Porter’s frustrations. Many said maintenance requests went unanswered, while others complained that their spiffed-up houses actually had underlying structural issues.

There’s also at least one documented case of Blackstone moving into murkier legal territory. This fall, the Orlando, Florida, branch of Invitation Homes appeared to mail forged eviction notices to a homeowner named Francisco Molina, according to the Orlando Sentinel. Delivered in letter-sized manila envelopes, the fake notices claimed that an eviction had been filed against Molina in court, although the city confirmed otherwise. The kicker is that Invitation Homes didn’t even have the right to evict Molina, legally or otherwise. Blackstone’s purchase of the house had been reversed months earlier, but the company had lost track of that information.

The Great Recession of 2016?

These anecdotal stories about Invitation Homes being quick to evict tenants may prove to be the trend rather than the exception, given Blackstone’s underlying business model. Securitizing rental payments creates an intense pressure on the company to ensure that the monthly checks keep flowing. For renters, that may mean you either pay on the first of the month every month, or you’re out.

Although Blackstone has issued only one rental-payment security so far, it already seems to be putting this strict protocol into place. In Charlotte, North Carolina, for example, the company has filed eviction proceedings against a full 10% of its renters, according to a report by the Charlotte Observer.

Click here to see a larger version

About 9% of Blackstone’s properties, approximately 3,600 houses, are located in the Phoenix metro area. Most are in low- to middle-income neighborhoods. (Map by Anthony Giancatarino, research by Jose Taveras.)

Forty thousand homes add up to only a small percentage of the total national housing stock. Yet in the cities Blackstone has targeted most aggressively, the concentration of its properties is staggering. In Phoenix, Arizona, some neighborhoods have at least one, if not two or three, Blackstone-owned homes on just about every block.

This inundation has some concerned that the private equity giant, perhaps in conjunction with other institutional investors, will exercise undue influence over regional markets, pushing up rental prices because of a lack of competition. The biggest concern among many ordinary Americans, however, should be that, not too many years from now, this whole rental empire and its hot new class of securities might fail, sending the economy into an all-too-familiar tailspin.

“You’re allowing Wall Street to control a significant sector of single-family housing,” said Michael Donley, a resident of Chicago who has been investigating Blackstone’s rapidly expanding presence in his neighborhood. “But is it sustainable?” he wondered. “It could all collapse in 2016, and you’ll be worse off than in 2008.”

i wonder how long it will be before cardboard box backed securities are issued.

maintenance on Single family homes is a nightmare.

buy a 200 unit building, you fix it all teh same way.

but 100 houses, each is different.

wall street will sell these off real soon

Dear pat;

Who will Wall Street sell them off to? If they take a bath, will they transfer some or all of the loss to the public through tax write offs? If no one can afford all of these properties, will the State demolish them to prop up the prices of the remaining stock? Will housing stock stay off of the market if the ‘Investors’ can’t meet their target numbers? And, who are the major investors anyway? Where are the pension funds in all of this?

Everywhere you turn, trouble looms.

It is not that this will end badly, but how badly?

Yeah, single family homes just don’t scale well…These guys don’t have some great plan to manage these thing efficiently, there’s just more money than floating around than people want to put into the stock market. It’s all about creating some “deal” that they can sell to investors.

Sure Pat, but these guys won’t actually DO any maintenance.

This is the business model- rent people sh*tty housing, win any court cases that come up concerning standards, blacklist troublesome renters, keep deposits, spend as little money as concievably possible on maintenance, and leverage local and federal regualatory standards to suit themselves.

As an attorney, I am licking my chops at the thought of the easy money to be had representing tenants in these disputes. In my state if the tenant wins then attorney fees are paid by the landlord. Can make even a $500 case worth taking on. And you can’t robosign a repair invoice

This rent payment securitization is a way to buy time. Maybe it is a clue to PE’s real motive. Those guys are not dumb; they know exactly what is going on in the finance industry as well as the rest of the economy. Interesting that they have focused on inner city real estate and done so on the double cheap. If you believed in market fixing you might suspect that they had big plans to redevelop inner cities to make their own real estate skyrocket. And in the meantime they can pay their own expenses with the sale of bonds securitizing only the rent. The underlying mortgage holder-turned foreclosure/landlord still owns the property, right? What better place to funnel all that poorly-mapped liquidity?

This is a reasonable idea. Charlotte is a major banking center but there’s not that much gentrification happening there. The rich tend to congregate in the burbs particularly around Lake Norman. Black areas of Charlotte are considered particularly dangerous so this effort in that city would be a long-term project.

Obviously the idea of house ownership is a useless relic. I was previously interested in buying a place to live, but that’s really impossible with all the unpunished criminals who are still running the banks.

As is, I’m planning to move to a more honest country that has no problem trying and executing criminal bankers, i.e. China. That is really one policy that should be implemented in America ASAP.

How do they come up with the year 2016 as the year it may all collapse.

it’s an election year and the banks will need new frontpeoples.

What is a certificate administrator? (The role played by Wells Fargo in the article). Thank you for your attention.

Crash housing market; refuse to renegotiate mortgages; foreclose; purchase un-occupied homes as rentals; create securities based upon rental income streams; sell those securities; sell credit default swaps based upon the failure of some of the rental income streams.

Create securities based upon student loan revenue streams.

Create and sell CDO’s and CDS’s against those student loan based securities.

Create securities based upon buy-here-pay-here auto loans.

Create and sell CDO’s and CDS’s based on buy-here-pay-here auto loan securities.

This nation is being raped.

What was once a middle class is becoming a debtor-class of wage slaves, owned, bought and sold by the Rentiers.

How about a revolution? We’re way, way overdue.

Ain’t free market capitalism great. Glad to see more details of this scheme come to light. Helps to explain all the glowing monthly housing reports, which on the surface sound great. A little digging reveals who is doing great. And as a result, who isn’t.

It remains to be seen whether this scheme will work. It will take continued printing of $85 billion a month in free money to the banks, as well as a bunch of brave investors, followed by a load of willing renters. A lot of forces at play, that depend on a stable economy that by many measures is built on a house of cards.

Meanwhile, I still can’t figure out the glowing news recently on increases in construction starts. Maybe that can be explained.

Sorry kimsarah but this is definitely not free market capitalism. A key component of free market capitalism is the ability to fail….. and no one saves you.

Our financial titans and banks failed miserably and then were bailed out. Now they are using our tax dollars to buy the former homes of families who saw their lives destroyed(and now they will collect the rent of those destroyed lives)

What we have now is crony capitalism…. if you have the money and contacts you get state sponsored socialism(on the tax payers/citizens back). Both parties love this system and manipulate it all the time.

If you are a common citizen…..well you get disaster capitalism.

No “free market” at all

Austrian BS. This is just capitalists doing what they always do: scamming, swindling and hustling.

Capitalists have financially crashed markets and whole economies over and over and over again since the dawn of financial capitalism. They have never been daunted by the fear of failing. They always believe they will be able to cash out before the shit hits the fan.

The “market” doesn’t discipline itself. At all times, a large part of those markets are made up of predators. Unless government and the rule of law put a heavy and painful leash on the predatory goblins, they will run riot as always.

Austrian economists are nothing but heraldic priests and their servants.

skippy… core tenet… I screw you… its your fault.

That beeping sound you now hear is a goal post being moved.

Sorry Dave, I fear you are the one who is wrong here, and the current banking regime is very much founded on free market methodologies. The most significant of which is the elimination of government interference, regulations, other restrictions, and taxes. Not just the argument that free markets work best without government regulation, but that regulations are antithetical to a healthy and functional market. It is argued that for there to be a free market – government inference must be eliminated. Hence the term “free market” IE a market that is free from government oppression.

Others may even take it a step further arguing that once a free market is achieved, that it will not just be more efficient than with any sort of regulation, but that a truly free market will be incapable of collapse or corruption.

That was what we were told we had with the banking sector in 2006, where deregulation had lead to a “new economy”. Even when there was already evidence that the housing market was beginning to implode, industry experts testified to congress that a housing market bubble was no longer possible, given the number of new “risk management tools” that the industry had created. Experts even told the record that it was mathematically impossible for there to even be a housing bubble, and told congress they had the mathematical proofs to prove it. Proofs that were consistent with free market theory, I might add.

As for your claim that free market capitalism means being able to fail. Officially, the banks didn’t fail. It was a “liquidity crises” which was basically a clever rebranding of insolvency. When you have ton of debt, and your assets are worthless – you are insolvent – unless you argue that your worthless assets is just the result of a temporary market anomaly. This was the point of TARP, to have the government “purchase” these worthless assets and eventually sell them back to the banks at some point in the future when their value recovered. So technically the “great recession” still satisfies your condition. Officially, the banks didn’t fail, and officially the banks were not bailed out – it was just a pity loan of some kind.

I suspect that you are not fooled by this.

However, the central problem with free market theory is that I have yet to come across a consistent definition of just what a free market is, let alone how I can test for it. Free markets appear to be an impossible goal, so we can role it our year after year demanding more deregulation and tax cuts. And when those reforms fail – well, it never truly was the free market any way, so no one can argue that the recent failures discredits free market theory.

However, the reality is that we have been systematically engineering a free market economy for half a century now. And as free market reforms become more comprehensive in government policy, it’s failures become harder to ignore.

And old saying says:

He who makes no mistakes, is incapable of learning from them.

It’s getting every harder to be horrified by the actions of faceless and soulless companies run by sociopaths and staffed by lickspittles, but I am by this.

These three paragraphs say so much:

“Porter took off from work to deliver the money order in person, only to receive an email saying that the payment had been rejected because it didn’t include the $200 late fee and an additional $75 insufficient funds fee. What followed were a maddening string of emails that recall the fraught and often fraudulent interactions between homeowners and mortgage-servicing companies. Invitation Homes repeatedly threatened to file for eviction unless Porter paid various penalty fees. She repeatedly asked the company to simply accept her month’s payment and leave her alone.

“I felt really harassed. I felt it was very unjust,” says Porter. She ultimately wrote that she would seek legal counsel, which caused Invitation Homes to immediately agree to accept the payment as “a one-time courtesy.”

Porter is still frustrated by the experience — and by the continued presence of the cockroaches. (“I put in another request today about the bugs, which will probably be canceled again.”)”

Absolutely immoral/amoral actors on one hand, normal, feeling humans on the other who do as their told and then only react to being srewed over six ways from Sunday in the Kafkaesque manner these soulless criminals have adopted as their MO by saying “Oh, it seems rather unjust.”

As long as that imbalance continues, we’re all screwed.

Agreed. We need to turn the corner from saddened outrage to open revolt. IMHO, Americans will be more responsive to calls for radical change that are carefully constructed to respect the Constitution, and seem to be “restoring” a system that allowed for a strong middle-class. Even the sans-culottes first appealed to outrage over how the monarchy of Louis XVI was failing on its own terms, before they came to call for abolishing monarchy altogether.

We need to try and convict the kleptocrats for their crimes against the Constitution, and make explicit the trans-national nature of the kleptocracy. The danger, as we see in Greece, is that appeals to patriotism open the door to bigots eager to blame “others” for all the nation’s ills.

“I believe that banking institutions are more dangerous to our liberties than standing armies,” Jefferson wrote. ” If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around(these banks) will deprive the people of all property until their children wake up homeless on the continent their fathers conquered.”

-Thomas Jefferson

There’s really nothing new about this type of crime.

Here, I believe, is the right quote. Via Snopes, note well:

very strange?

I as you can see from the time stamp, I hit the submit button at 7:28am. (my browser froze, and I force-quit about 10 minutes later.)

I reposted from work at 9:10 am.

I’ve been reading off and on all day and haven’t seen this earlier comment until now, 4:55pm?

Don’t know what to think about the discrepency, I was thinking it consistant with the tension between TJ and Hamilton?

Oh, that wouldn’t be the same Southern Cross which executed a pump-and-dump operation on one of the UK’s biggest providers of senior care facilities ? http://www.theguardian.com/business/2011/jun/02/blackstone-denies-blame-for-southern-cross?INTCMP=SRCH

Literally, gramps was almost thrown out onto the street until the UK government engineered a rescue (many of the Southern Cross run facilities were utilised by counties outsourcing of their legal responsibility to provide senior care to those unable to afford a place in a private care home; the prospect of old people who were the state’s responsibility to look after being evicted created a de facto TBTF in the senior care sector which, erm… failed)

I couldn’t, then, imagine a nicer landlord.

Lambert, you’ve got some competition there !

We own several single family rentals in SC just across the state line from Charlotte. While home prices are skyrocketing, rents have not kept pace, and the demand for rental property is definitely lower than what we read in the press. We have had two houses empty for a year after putting them in pristine condition. They were both trashed by deadbeat tenants. In one house, a pit bull (they were supposed to not have pets), gnawed off the doorframe inside the front door.

The problem with the skyrocketing home prices, from our perspective, is that in SC we do not have a very broad tax base. Rental property is taxed at nearly three times the rate of owner occupied dwellings. Thus our mortgage payment, on one property, is up nearly 40% since 2005, all because property taxes have doubled. If property values continue to climb, I can foresee a time in the near future when 50% of the rent–if we were getting rent–will go to property taxes. Rents, while up sharply too, have not yet risen to their inflation adjusted level from 2001.

Before buying these single family homes twelve years ago, we had owned a duplex in the same town for thirty years. In all that time, we had to evict one person. We rented to working class folks who paid their rent on time. Property taxes remained low, probably because there was a large, paternalistic textile mill in town that supplemented everything, and more or less indirectly controlled the town’s budget. The mill supplemented teacher’s salaries, and helped pay for their graduate school directly. Our schools were–and still are–the best in the state. Things were stable. The 70s were paradise here.

Today, I find that I have to go to the magistrate often because of tenants not paying. My inclination has always been to work with people, and the truth is, we never had to do that much in the past, because they paid. I don’t work with people so much anymore. You pay or you go. There is a class of person out there whose plan is to pay for a while and then see how long they can drag things out before you evict them. They are confidence artists. You’re better off filing as soon as they are late, because the eviction process takes a month, even though on paper it should be shorter. I don’t always act as quickly as I should, but I’m learning.

I’m sorry to hear about your situation. I’m a housing provider you and was stunned to see that you pay triple the taxes on a rental as compared to a owner occupied house.

Here is Los Angeles it takes a mininmum of five months to evict a non-paying tenant under the best circumstances. I’ve had it take eight months. Meanwhile, they are free to destroy your property. I had one tenant who spent this times taking a hammer to the drywall, the windows, he even managed to destroy the new – large – and expensive deck. Police would do nothing – it was his home, and my only recourse was eviction, which of course, I had done. So you sit and wait. They also have to be served personally twice (you can lose your home here without ever having been served) so avoiding service drags it out longer.

I suppose these cretins like Black Rock will cut corners and deal with tenants outside the law – that’s what they’ve done on the two buildings I lost here in L.A. Strangely the city administariat, which comes down hard on small owners here all the time, has adopted a see no evil attitude when it comes to the big boys. (I’m sure it has nothing to do with large political donations.)

In one case I lost a building “didn’t like” the engineer and architect who drew up my plans, delaying my project another year and half while I had someone else draw up the same plans. Once I lost the building, the new flipper got to everything without plans, on an “express permit” which in the old days was for a tile job or a water heater change out (non-structural.) Go figure.

On the up side, Realty Trac reported that cash sales are starting to crater – I think it was down something like 40% month over month yesterday, so the rats are already fleeing the sinking ship. Oddly, concurrent with the cash sales fleeing, prices are dropping. Hmmm. Who’s gonna buy this stuff – which will be at best, a shoddy rehab – from these jackals.

Also I read that Deutsche Bank and Chase are of course involved in financing more sales to Private Equity. Neat Trick: Illegally foreclose, then finance the banksters to buy your inventory at inflated prices.

(The realty trac article and the reference to the banks’ financing were both at zerohedge.com yesterday.

I feel for you – I don’t know how you can compete with these bastards and their buckets of free money, especially in a low demand market. It was tough here in L.A. when demand was low during the crisis – things have picked up a bit, thankfully.

We’ll be fine. If we don’t rent the properties, and don’t get the cash flow we’d hoped for, we’ll eventually get the capital gains. We don’t owe a lot on them.

What I find really disturbing is that it appears that good tenant behavior has become rarer and rarer over time. Morals, which include paying what you owe, have declined.

five months ??? most L A tenants get defaulted after 5 DAYS…the only way a tenant can drag it out is if you hand them the way by acting like bank foreclosure lawyers and taking short cuts…bad service or a bad complaint or process is what hurts you, and if you fumble, it is smarter to drop the case and start fresh then to try to “fix it”

tenants tear up your property ? did you bother doing any research before you handed them the keys or did you just take the first warm body with cash…

owning property is a business…if you can’t afford to pay professionals then take the time to learn what you need to learn…

as to the notion there are major problems with blackstone…40000 units and a GRAND TOTAL of 35 people complaining on line…most with what appear to be phony names or stories…

when you look me up on line, you find some looping nonsense some ex girlfriend put up on a website that appears to be about helping people…

ripoffreport.com

the guy insists he is there to help people…and the part about him having all these people he uses a fronts who have been in the bent nose porno industry…simply coincidence…

and the fact that he has a “friend” in the porno industry who sued him overseas and claims a judgment but refuses to enforce it nor is willing to sell it, and in fact may not even exist…simply coincidence…and the fact that when you reverse engineer a fax number from his ICANN listings and notice that it connects to a website trying to get you to apply for bankster credit cards…simply coincidence…and when you suddenly do a review of his site and realize, considering how many people have been robosigned out of their homes that he does not seem to have many complaints…priceless…oh and the fact that he is dumb enough to edit comments if you try to have a friend file a possitive comment on his site…sad for him, it kills his immunities…

I leave it there as an idiot filter…I could do some publicity or SEO stuff to bounce it to page four on a google search but why bother..it does not cost me an ounce of money and it insures the food on my table comes from referals and not SPELL MY NAME IN CAPITAL LETTERS clowns…

The point is managing single family homes has NEVER BEEN EASIER…the problem is that most folks take a 99 dollar midnight course on the EASY MONEY in owning single family homes and then invest their credit, cash and time…would one be able to run a restaurant on 99 dollars worth of preperation…???

I know dozens of real estate investors who were stupid enough to make full and complete presentations to hf and pe money and I laughed…no different than blindly making pitches to VC $$ only to find your “idea” is being done by someone else…Blackstone and others said “thank you” to all the bafoon real estate investors who read entreprenuer magazine instead of Pensions and Investments and gave them local market data they would not have gotten from the usual useless info sources.

Blackstone is going to make a fortune, not by the idea that they are going to do a smash and grab…but because too many people drank the flavor aid and think the crash came not from derivative issues, but from the wrong people getting mortgages…

yes…there will always be people stretching to buy a home…but this low interest rate world is not some myth…it is where we shall be for the next 20 years…those who lived on the Volker Doctrine of the Raygun years when he used interest rate spikes to force national banking…duh…that was a brief moment…we are not going to see 30 year paper available over 6 percent probably in our lifetimes(unless you go greek)…that little piece of rag paper in your wallet that most americans have allowed themselves to believe is worthless has replaced GOLD…even if you don’t think it has value, the other 95% of the global population will be more than happy to take them off your hands…

If we had Japanese home loan interest rates in the US, two people working minimum wage at Bullmart would be able to qualify for a 200k loan/40 yrs(75 basis point per year) just under 500 per month…yes taxes and insurance in the first year they would need to have about a 4k sinking fund until they get the first tax refund…but it works…

so those who are sitting around thinking that stack of cash they got will get them 10% one days soon…cause its just gotta go up, i cant live on no 2 percent…sorry charlie, you are gonna have to learn to invest your money and take some risks…and that probably wont last but a few years…

the rentiers might as well step in front of a bus…its over…the boulder has made it over the summit and its all down hill from here…

the great chinese navy is using an abandoned former Ukranian (semi) aircraft carrier as their “show of force”…yeah…they tracked those b-52’s pretty good the other day…

if you think its so bad to be here in the good olde you ess of hey…there is some chinese person who would probably pay you $50,000 grand to take over your problems and asume your identity…

all is good in the garden…not perfect, but quite good…

Yeah, uh, time to talk about limits to property yet? Crikey, even Solon in Athens knew about this, back when the world was still huge instead of peanut-sized and stuffed full of people.

Naturally, the oligarchs despised Solon.

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered.”

– Thomas Jefferson

Fraud, hustling and so on are central to the American psychic makeup. One way or the other individuals and groups find some angle to exploit markets, laws, and so on and the country has, more or less, weathered these outbreaks of fraud fairly well since the first fraudsters landed in the New World centuries ago. But, in recent years, the frauds have become so gigantic and institutionalized that when the inevitable collapse comes not only the economy of the whole country suffers but that of the whole world as well.

The American economy has become too controlled by very large corporate forces so we can no longer afford to allow this level of criminality in the economy. All this, however, comes at a time when the state as a protector of the public good is declining in power. The state today has morphed into existing to preserve the rights of large corporate forces to do as they please regardless of their intentions. We have to face that fact. It’s not going to change unless the public decides that they should take responsibility as citizens to create a healthy society.

As usual, the victims of this developing scam will ultimately be the people who are rapidly becoming the untouchables in our society–the poor. We beat them up, cheat them, insult and humiliate them and then we blame them for their status and their pain. Whenever I hear people attacking the poor I think of cruel parents hitting their children and then hitting them some more because they’re crying.

$7.5 billion divided by 40,000 is $18,750 each. But the previous “home owners” weren’t allowed principal reductions so they could stay in their homes. That would have been a “moral hazard.” Are a trillion dollar initial Bush/Paulson bailout and a hundred billion a month in quantitative easing and other givaways to the corporatist rulers, which have been on going for five years and no doubt contribute, even if indirectly, to Blackstone’s buying power, a moral hazard? !!???

George,

While I don’t disagree with your comments about the Blackstone parasites, Open Office gives $7.5B divided by 40,000 as $187,500 per house.

In the Bay Area, these would all be in the ghetto if they were actually habitable. But, this seems very high per house in the south; something doesn’t pencil out unless money is being funneled to offshore accounts or some other scam.

I wonder if these renters can also be Section 8. Then you get govt support for the rental payments.

Blackstone’s assumption of 95% occupancy and an avg rent of $1,300 per month is crazy as past mortgage securitization assumptions such as “prices never fall” or never fall more than 5%.

If you can pay $1,300 per month with any kind of regularity (especially in the South), then you can generally afford a mortgage.

Since the model is there for profitability it has surface appeal and attracts investors–often speculators are not interested in “real” investment only on where the money “wants” to go. That’s the bubble mentality–once money is there it creates its own momentum and makes this form of speculation “good.”

What’s really crazy is that they’re assuming a 95% occupancy rate at the same time they have pending evictions against 10% of their tenants in their largest market! Uhh…math FAIL!

If North Carolina is anything like Montana, eviction for non-payment of rent takes, at minimum, two weeks; and in practice often more like 6-8.

This is going to turn into a huge clusterf— if these rental-backed bonds really take off with investors. Let’s all hope they blow-up before they become too common.

This is the most insane idea I have ever heard of. Having been in the real estate rehab business for over 23 years buying foreclosed properties both single and multi-family there is no way this is a profitable business model. But perhaps that why they have chosen it.

Between the roof, the appliances, the plumbing, the real estate taxes and the tenant wear and tear spread over 200,000 units the daily loses would be mind boggling. It is completely unsustainable.

That’s why they have to sell the bonds quickly.

I’ve seen these guys present (not Blackstone, but their competitors). They say they install standard kitchen equipment and bathrooms, so they aren’t dealing with different toilets and faucets. They also claim property management does scale at over 200 houses in a geographic area, that between 4 and 200 is a dead zone.

Yves, when I hear about these folks’ unanswered emails, I think of my personal experiences calling AT&T. I never get the same call center person, they claim there is nothing in my file from the last time I call. I fight thru a complex system of automated messaging & “you r in the wrong dept” transfers. This is all part of a ruse by the business to discourage me from calling and fighting. They want me to be so frustrated with the process that I don’t even both calling. And it used to not be that way. In the olden days, you went down to the local office, talked to a human face to face, and that relationship ensured you were a continuing happy customer. If the business wasn’t doing its job, the community knew and they were encouraged to clean up their act. But now, like these folks, you have no person relationship. And since the company does not reside in the community, not everyone experiences the hardship. And of course, since the folks affected are minorities, well, I don’t think I need to say what can happen in the south with minorities and their issues.

re: the last paragraph – I live near Chicago, google tells me that Mr. Donley lived in Rogers Park, which is the neighborhood at the far north end of Chicago. It has some good areas and some rough areas. I bet these banksters are trying to cash in on the bad areas.

Jefff

A Tribune article from a couple weeks ago on this subject.

I don’t se how this single family rental home model can possibly work in Chicago.

http://www.chicagotribune.com/sns-rt-blackstone-abshomerental-corrected-20131101,0,2626197.story?page=1

R.E. Bubble rev:1.0 demonstrated that single family homes are depreciating durable goods

R.E. Bubble rev:2.0 will demonstrate that they are not durable.

http://www.chicagorealestatedaily.com/article/20131114/CRED03/131119860/blackstone-real-estate-chief-high-on-home-rentals

Blackstone real estate chief high on home rentals

….Invitation Homes, Blackstone’s single-family rental company, now owns about 40,000 homes across the United States, including 2,500 in the Chicago area. Its properties here range from a three-bedroom home in his Highland Park hometown that rents for $2,450 a month to a Wheaton five-bedroom that goes for $3,600….

http://en.wikipedia.org/wiki/Highland_Park,_Illinois

http://en.wikipedia.org/wiki/Wheaton,_Illinois

This is the range for the single family home rental market the are pursuing???

One of the most absurd Crain’s articles I’ve read in memory..

A fun OT sidebar on one of BHO’s sponsors..

http://www.chicagobusiness.com/article/20130827/OPINION/130829865/

As James Pritzker becomes Jennifer, here’s what’s next

Wow. I read about Blackstone’s cash purchases in Tacoma, WA during a recent visit. The local newspaper reported same failure to maintain properties by Invitation; the same stories of tenants looking forward to the end of their leases; all in lower-income areas.

This is a classic pump-and-dump scheme. Blackstone and the banksters are yet again selling over-valued CDO-type securities based on the SAME properties underlying the MBS CDO’s that blew up in 2008 to investors unfamiliar with the single-family rental market. These bonds are doomed.

Because of the complete lack of regulation of “national banks,” thanks in large part to the Federal pre-emption of bank regulation created out of whole cloth by Justice Ginsburg back in the mid-’90’s, state investigators can do nothing. There are no doubt already CDS and “naked” CDS bets against these bonds backed by TBTF institutions, which will in due course be bailed-out by the US Treasury and the Fed.

Meanwhile, Obama and Holder look forward to the same Wall Street payday enjoyed by their cronies Geithner, Breuer, and Khuzami for failing to stop these fraudulent pump-and-dump schemes. After all, they evidently think, we Ivy Leaguers are entitled to all the “dumb money” in the world…

There’s no way that this will scale well. I smell a tax payer bailout in the wind for banks that have invested in these bonds (and/or insurance companies[AIG?]that have sold CDS on the bonds).

“Giant investment funds fuel new boom in Pierce County real estate”

http://www.thenewstribune.com/2013/10/27/2857576/giant-investment-funds-fuel-new.html

I can’t quote you the exact facts, but the fed gov’t has already agreed to bail out the first 20%-30% of loses on these investments. Someone in this community may be able to link to these agreements from 2-4 yrs ago. I only wish I could. My computer is down now and I can’t search to see if I have notes myself.

The initial money was guaranteed by the govt up front. It has just taken a few years to implement.

It’s a little funny that after extracting massive rents from the real economy, they’ve started to charge old fashioned rents too.

Well, I guess this is good for the labor market. Because this brave new tribe of landlords will need a whole new army of legbreakers and enforcers to keep the rents flowing.

The majority cannot afford these obscene housing costs, that goes for renting also. It must be nice to charge rent to pay off the price of your rented housing .The problem is not just at the top by the bankers. all rent sellers need to back off their greed that leaves few affordable housing options available. Housing costs need to fall in this present day reality of dwindling wages, and the hyper jacking up of prices for all of life’s necessities.

A good friend of mine just spent a week here getting the first chapter hammered out for the book she’s writing on the history of tenants’ rights activism. She’s been talking to me for days about the corporations buying up real estate in SF and NYC, so I was excited to see this article here at NC.

Naked Capitalism. Always on the cutting edge. Keep up the good work.

http://www.sfbg.com/politics/2013/11/26/serial-evictors-named-mapping-project#.UpVSI3ND6BI.facebook

http://www.calbuzz.com/2013/11/how-tech-elitists-are-pushing-out-sf-middle-class/

more blackstone articles (sacramento backed bond)

http://www.sacbee.com/2013/11/21/5932043/wall-street-firm-sells-bonds-backed.html

You use passive constructions a lot. “It is argued.” “We were told.” Even when you switch to active voice, you don’t make it clear to whom you refer: “Others may even,” “Experts even told…”

Who are these faceless and nameless agents who have given you some ultimate, platonic definition of “free market?” Because I don’t agree with them. I don’t think mainstream economists do either, and lest I be guilty of your same mistake I’ll give you a name: check out “Naked Economics” by Charles Wheelan.

Now that book may strike many as charming in its pre-2008 naivety… but I digress. Whatever its shortcomings, it does present a cogent, entry level discussion of the role of government in regulating and indeed, CREATING free markets.

It’s not a sophisticated or even uncommon discussion, but the importance of repeating is directly proportional to the growing prevalence of arguments such as yours in the public sphere. I don’t think we can afford to cede semantic authority to either the leftist who believes that capitalism is inherently evil and should be eliminated, or the libertarian who sincerely believes the same of government.

There is a middle road that is so common sense that I’m embarrassed to point it out. Free markets don’t exist in a vacuum. They *only* exist within the rule of law, which is maintained by a government, which – if it is to be responsive and representative – must be democratic. The argument then isn’t whether regulation is good or bad – that is simplistic and dangerous idiocy – the argument is about how much and what kind of regulation is ideal to achieve the society we desire.

Other participants in this forum get it, but not you. You get to assign “free market capitalism” your own definition, so that you can… what? Discard it? And replace it with what?

Color me skeptical.

I don’t see how you can read the above article, which you do claim to have read, and still insist that there are only 2 relevant categories of analysis here: the governing framework which regulates, and the putatively “free market” space that exists within the framework outlined by the government.

Clearly, the “Blackstone Group” is a front group for a collective of powerful financial sector actors (with deep direct ties to the governing bureaucracy) which acted upon and reordered the governing framework and which is now acting within the space (re)created by that governing framework.

This is not a “‘free’ market,” regulated by some plausibly democratic government in name of equal access participation. This is “‘Blackstone’s’ market.” Your 2 category analysis has effectively disappeared that historical fact. You don’t get to do that.

You will also probably try to tell me this is “crony capitalism,” not “capitalism.” You’ll have to work overtime if you expect to convince people there is some sort of relevant distinction there, as most capitalists will freely tell you that it is their sacred duty to rearrange the rules of society in the pursuit of profit, and that this is exactly what capitalism is.

And they do have history on their side there, if you really want to talk definitions.

In other words, you don’t get to say “free market capitalism”– Larry Kudlow, is that you?– because the “free market” as you wish to define it and “capitalism,” as capitalists both describe it and have practiced it historically, are fundamentally at odds.

Too funny.

In the category of, “context is important,” my post was meant to be a response to Code Name D November 27, 2013 at 9:44 pm. Read as such, it makes a little more sense.

For what it’s worth, I don’t claim there are only two relevent categories of analysis. Analyses of what?

Yes, I would say this article reports on another symptom of “crony capitalism,” which is the system we seem to be thouroughly enjoying today.

No, I don’t think that all capitalism must be crony capitalism. That’s transparently idiotic. And so I’m completely at a loss by your statement that the free market and capitalism are at odds…

I think we have a rather large missunderstaning engeandered by my inability to post in the correct location. Apologies for the mistake… consider it rhetorical friendly fire.