Yves here. This article is a portrait of official denial, which is then dutifully taken up and amplified by the media (well, not universally, but widely, as Ilargi’s post also demonstrates). It corroborates one of my pet theories: that we are at the end of an economic paradigm. The powers that be lack the will and imagination to do anything other than patch it up and put it back into operation. That simply assures more frequent breakdowns until the system is beyond repair.

By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth, Cross posted from Automatic Earth

Some things are simply so funny that they can’t help showing us hidden truths. As anyone who’s ever read Mark Twain or heard Groucho Marx, among many many other voices, will gladly confirm, funny things can make you think, and even reveal tragedy. Not necessarily thigh slapping stuff, just funny things. Fumbling through the Guardian’s webpages on Tuesday, I found what I find is a fine example of just that. Plus, in the very same edition, a bunch of articles that provide an equally fine perspective.

Let’s start with that perspective. You may have noticed that the domestic and international press have recently published some remarkably positive numbers for the UK economy. On the other hand, you may also have read my October series on Britain’s energy position, which is not so positive: in fact, it’s outright desperate. Moreover, the current leadership manages to come up with all the wrong answers, so Brits will be forced to learn what lies beyond desperate.

But not today. Today is bubble time, in credit and in confidence.

The Wall Street Journal quotes the European Commission:

EU More Than Doubles U.K.’s 2013 Growth Forecast

The European Commission said Tuesday the U.K. will be the fastest-growing of the major European economies this year and next, and a separate survey showed activity in the country’s services sector grew at its fastest rate in 16 years in October. The forecast and survey bode well for the U.K.’s economic prospects, indicating the recovery that began earlier this year is picking up speed.

In its autumn forecast, the European Union’s executive arm said the economy of the U.K. the largest non-euro-zone country in the EU would grow 1.3% in 2013, considerably higher than the 0.6% growth it projected in May.

“The expectation is for consumers to dip into their savings and continue spending with the outlook for real wage growth to turn positive at the end of 2014 and into 2015,” the commission said. “However, the debt burden of households remains a distinct risk to private consumption.”

Where “The expectation is for consumers to dip into their savings … “ = confidence bubble, and “the debt burden of households remains a distinct risk to private consumption” = credit bubble.

While the Guardian quotes Britain’s National Institute of Economic and Social Research:

UK growth to pick up in 2014 – NIESR

UK growth will pick up next year but the economy will remain over-dependent on squeezed consumers, a leading thinktank has warned. The National Institute of Economic and Social Research (NIESR) forecasts growth will come in at 1.4% this year and quicken to 2% next year. Both those forecasts are up by 0.2 percentage points since NIESR’s last outlook was published in August.

[..] But NIESR argued growth was not built on solid foundations. “After two years of stagnation, economic growth has returned, underpinned by an increase in consumer spending,” the thinktank said. “Consumer spending growth is necessary for an economic recovery in the UK, but a consumer-driven recovery will not be ‘balanced’, let alone one reflecting the required long-term ‘rebalancing’ towards an economy with greater net national saving.”

While the Treasury is likely to welcome a forecast of accelerating growth, the report comes as a blow to chancellor George Osborne’s push for the economy to wean itself off dependency on consumer spending. NIESR predicts the UK will have to wait until 2016 to see a positive contribution to growth from net trade.

Did you catch that? They (both government and thinktank) are actually looking for some sort of growth that leaves the British people (in their role as consumers) standing on the sideline, squeezed and all. I think you just got to, like me, be wondering A) if that’s possible, and B) what purpose that would serve in the first place. The idea, if I understand it well and put it in somewhat stark terms, seems to be to establish an economy that grows while the people become disposable. If they’re not needed for economic growth, than what use are they, right?

Not that they’re going to say it out loud; you can bet that the architects of this brilliant scheme will repeat ad infinitum that they do it to provide the people with a better future (a claim which all by itself should be funny enough to make you understand what they are really about). But it is of course implied when you say an economy must “wean itself off dependency on consumer spending”.

And don’t worry, I know that the idea is to earn money by making the economy “healthier” through increasing exports. But there’s a problem or two with the idea. First of all, every country wants to achieve that same goal. Because every country has consumers that are both to deep in debt AND don’t spend enough, to keep the party lights on. And in that context, even if you would win that battle, which is by no means a given, that means other countries must fail, and then who are you going to export your products to? Exactly, other countries with squeezed consumers, that’s who. How on earth is that a winning strategy?

And besides, what does the UK have to export anyway?

Services are booming but is this the wrong sort of economic growth?

It conjures up those blissful, carefree days when Things Could Only Get Better, and the name Lehman Brothers meant nothing to anyone in Britain outside a tiny cadre of City workers: according to the latest survey of the services sector, its companies are now more optimistic than at any time since 1997.

If this latest survey is to be believed, the services sector – long the engine of our out-of-kilter economy – is booming. Whether it has been the Funding for Lending scheme prising open the banks’ purse strings; the housing recovery helping to tempt shoppers back into the spending habit; or the halt to doom-laden headlines about the imminent collapse of the eurozone, confidence appears to have flooded back.

Looks like exporting services is the UK’s only hope. To countries that themselves already have services sectors that are as bloated as the British one. Which makes up some 77% of GDP. And while there are increasing calls throughout the western world to increase manufacturing again after decades of these nonsensical claims about building service economies or knowledge economies as the ultimate sign of being truly developed, rebuilding your manufacturing base back once you’ve lost it is very hard, and at the very least takes a lot of time.

Britain’s industrial production today accounts for just 22% of GDP. That’s all that’s left. Less than a third of the services sector. That paints the picture of a country that has squandered its independence, that is dependent on imports to a huge extent. Typical for all rich nations, US, Japan, western Europe, true, Britain is by no means alone, but still.

So making your own “things” (consumer goods, if you will) is not going to happen. And neither is producing your own food. Agriculture accounts for less than 1% of British GDP… When the food from 1000s of miles away stops coming, the United Kingdom will be royally screwed.

Personally, I simply can’t understand how a nation, a people, can let things come this far. They must attach no value whatsoever to their independence, or I can’t explain this. It all does go a ways towards explaining the prevailing blind faith in growth, though: there’s nothing else left. But faith and hope and tragedy.

Let’s get to the funny part now. The OECD came out recently with another of its reports on the quality of life in its member countries. These reports are so useless, worthless and valueless that I feel kind of embarrassed paying any attention to them, but, fortunately, that’s not really the point. Here’s the Guardian’s coverage of the report:

UK a great place to live and work, says OECD

The UK is one of best places to live and work, according to the Organisation for Economic Co-operation and Development, although income inequality has risen by more than in other countries since the global financial crisis struck in 2007.

The Paris-based thinktank has been seeking to measure wellbeing for the 34 nations of the OECD, based on aspects of life such as incomes, education, housing and security. It says the UK ranks above the OECD country average on environmental quality, personal security, jobs and earnings and housing among other measures. It is close to average for work-life balance, but below in education and skills.

That puts the UK alongside Switzerland, Australia, Nordic European countries, Canada and New Zealand in a clutch of highest-performing countries on the latest work for the OECD’s Better Life Index.

Overall, the latest part of the OECD’s attempt to find new ways to measure wellbeing beyond simple GDP numbers, paints a picture of substantial pain caused by the financial crisis.

“This report is a wake-up call to us all,” said the OECD secretary-general, Angel Gurría. “It is a reminder that the central purpose of economic policies is to improve people’s lives. We need to rethink how to place people’s needs at the heart of policy-making.”

Looking at the UK, the OECD says that over 2007 to 2011 there was a cumulative increase in real household disposable income of around 1%, while in the euro area, income dropped by 2%. The report adds: “In the OECD as a whole, the poor employment situation had a major impact on life satisfaction. This trend is not visible in the United Kingdom where, from 2007 to 2012, the percentage of British people declaring being very satisfied with their lives increased from 63% to 64%.”

A great place to live. “… the percentage of British people declaring being very satisfied with their lives increased from 63% to 64%.”.

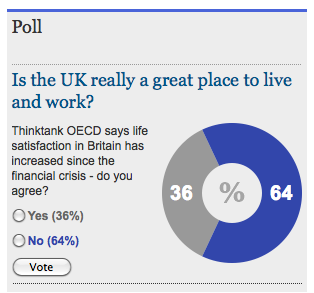

Well, maybe that depends on who you ask. Because that same 64% number also appears in a poll that the Guardian ran on its homepage. Just a bit different:

OECD Better Life Index: is the UK really a great place to live and work?

Thinktank says life satisfaction in Britain has increased since the financial crisis – do you agree?

Ha ha ha. How funny is that? The entire confidence bubble shattered in one chart. Guess a lot of Brits didn’t get the program in time. What do you mean you’re not happy, you sod? The OECD says you are! Get in line!

Again still on the same page, the Guardian tops it off with this:

‘I can’t believe it’: German expat’s reaction to UK’s ‘superior’ quality of life

The OECD claim that Britain now ranks above Germany on a number of quality of life measures took at least one German expatriate by surprise. Susann Schmiede’s first reaction was to laugh.

“It’s really surprising, I can’t believe it,” she said. Schmiede is office manager for the German Deli, which sells Westphalian pumpernickel loaves and Thuringer bratwurst sausages online and at Borough market in London.

Now 30, she studied business administration at university in Leipzig before coming to England, where she has lived on and off for five and a half years. Schmiede said it was love that brought her back to London rather than the quality of life. “My boyfriend lives here and that’s the reason I’m staying.”

[..] “Germans always think that their standard of life is not that good, but when I go home and people complain I say: ‘but you go to the doctor and you see someone straight away, you don’t have to wait until the GP gives you an appointment’.”

I know that many people will not believe things are as bad as I make them out to be. Many people in Britain simply don’t want to believe it, and those elsewhere will think: but it’s different here. What I think is that the way we’ve built our societies contains fundamental flaws, most of all where it comes to making ourselves depend on other, far-away, people, and on transport systems, to provide us with what we could easily have produced ourselves. While it may at least temporarily seem cheaper to have others do our work for us, in the end it’s inevitable that we will pay a hefty price for it. Sure, let someone else make your iPads and your flatscreen TVs for you, but never your basic necessities. That will come back to haunt you. There’s nothing that has the intrinsic value of what you can make with your own hands and grow in your own garden. But who still knows how to make or grow anything at all?

And I don’t want to keep beating on Britain, it’s a wonderful country, but it keeps on providing all these great stories about where and how things go wrong (and it seems to be making a great effort to do everything wrong), and these are stories that I think everybody all over the world should learn from. Because if we don’t learn the lesson this can teach us, and fast, and make no mistake, we face dizzyingly steep learning curves, then we will go blind into that good night, and it won’t be so gentle.

This reminds me how soon after the housing bubble burst here in Central OH a bunch of realtors took out a radio ad that claimed the economy was fine, there was no problem and everyone should continue buying and selling homes.

The whole 30 second or so ad was geared that way, as if simply saying those things somehow made them true.

It only made them look desperate and the situation even more scary.

that’s the funniest tragadevesty (it’s a word I just made up, sorry) I’ve ever heard. can you imagine people going down the roads with megaphones going “return to your jobs. keep buying homes. everything will be alright in a few weeks if we just STAY CALM!”

it’s like something out of War of the Worlds.

this is giving me flashbacks to BushII’s Just Go Shopping remark.

yegodz.

Wages are at a standstill. Yet consumer will buy more. (The EU view) sounds funny or cruel. The UK tries to improve on the EU fantasy decides that their service economy does need to serve the redundant consumers. Serve the fish?

Kind like one drunk suggests to the other drunk to climb his flashlight light up the tree. The other drunk refuses afraid that his friend will turn off the light in midair make him hit the ground hard.

Every day I wake up and do my daily grind with a — growing — sense that I really have actually gone through the looking glass. I keep an eye out for the Queen of Hearts playing croquet with a flamingo and hedgehogs.

It does genuinely feel (I wish I could be more scientific than that) as if we’ve moved into the terminal phase and are at the end. You know the end is coming, you just can’t say when. Everything in the above feature is correct.

But I too like humour, in my opinion an accurate or convincing message conveyed with a laugh is more effective than the same message said drearily.

And sometimes it can make a point far better than a long turgid argument. E.g. http://www.thedailymash.co.uk/news/society/britain-is-top-place-to-live-claims-sarcastic-thinktank-2013110680940

http://www.youtube.com/watch?v=tLCRUWCETK4

When economic activity is divorced from the social reasons for it, looting becomes easy. Growth for growth’s sake, any growth is good, is simply the embrace of cancer. We live in kleptocracies. Our political and economic systems no longer work for us. They exist, and increasingly we exist, to feed the insatiable cancer that is the 1%. This is how we are told the economy is doing great even as our lives are going to hell.

What we have is a dead-ended economy based on decades of social and environmental debt. Which has remained unpaid and the price for which has gone parabolic. Like compounded interest. The capitalist “growth” paradigm was nothing more than dead beat financiers refusing to pay down their debt. Let’s change all this. Let’s call labor ‘credit’ and capital ‘debt’ and unwind the whole mess. Labor can be loaned to capital for both principal and interest. The principal can be calculated in advance as a total sum which will earn 10% interest on all outstanding obligations. Like a mortgage? The debt owed by capital can be rolled into Labor Backed Securities which can be sold by big labor syndicates to pension funds (which will become very healthy under this new paradigm). And the new motto will be “Lots of low productivity jobs with high social and environmental value for all.” I mean, who ever gave capital the upper hand anyway?

This: “[w]hen economic activity is divorced from the social reasons for it, looting becomes easy.”

It seems that these days the “social reason” for a tremendous amount of economic activity is, in fact, looting. Bill Black does a great job of elucidating how the lack of proper governmental regulation of financial activity has allowed cheaters to prosper. Some of the most “successful” businesses of late are nothing more than economic time bombs. Their entire purpose (often perverted from the original intent of the business) is to loot as much as possible before the business inevitably collapses; not to achieve success by creating goods or services that contribute towards the betterment of society (or deriving economic benefit by investing in such successful businesses).

In the movie “Goodfellas” there is a scene describing what happens to a business (in that case a nightclub) when it “partners” with the mafia. The new “partners” have no interest in the long-term success of the business. Their only interest is how many cases of Scotch they can buy on the club’s credit without paying for it. Then, when the club can’t borrow another dollar from anyone, “you light a match, you bust the joint out”.

Not sure what to make of all this good news for the UK and OECD crud that its a great place to live.

A few pointers, the UK currently has a population of 63 million, this is expected to rise 10 million within a single generation – which is twenty years.

Not sure where everyone is going to live as we have a housing shortage and the most expensive rabbit hutches in the EU. Our consumers are also the most debt-laden in the UK, and yet here we go again with piling on the debt, be it housing or credit card – don’t look at lending figures though to manufacturing and SME’s, enough to make you cry as banks don’t lend to produce, only lend for property speculation in reality.

Oh, and forgot, in England they, that is TPTB wish to privatise our healthcare system – the USA being held up as some sort of model, well for profit its a brilliant model as most readers know.

Luckily, the new golden dawn of the UK, well precisely London and the South East may be over before its really begun to form another debt driven bubble. Basically Scotland has its independence vote in September next year, and the more the London-centric economy charges ahead on its debt binge, and the more it looks like a Tory win for 2015, the more likely that Scotland will cause a Constitutional crisis by voting “yes” to independence.

Looking at my own neck of the world in Wales, we have the lowest wages in the UK, highest levels of poverty, high levels of welfare dependency and highs where you really don’t want to come first. Funny, for such a screwed corner of the UK, Wales manufacturing sector is in reasonably good shape and is in surplus by more than £5billion per annum – obviously this all goes to London to then be given back to our National Assembly as some kind of social welfare – or that’s how Westminster and the South East thinks.

Given all this, my fellow countrymen are so browbeaten that they are amongst the most fervent “Unionists” in the Union – this despite the fact that we are treated like scam and castigated on a daily basis as being lazy and over reliant on public sector jobs.

Fact be known, Wales at least with a population of 3 million can easily feed itself, house itself and have a surplus of cash if it was independent of Westminster – try telling this to the people though.

In a nutshell, the UK economy is screwed, when we have 500,000 people who’s jobs are reliant on real estate and flipping houses, you know you have a big problem, particularly given the true levels of sales, this being very small compared to overall stock. Shame our masters in London don’t read a bit more Schiller, but that would be too much to expect, particularly when the Chancellor is engineering an unsustainable recovery for election purposes only – so expect a bubble implosion by October 2015.

Still, who am I, just a fool from Wales who want’s a free country thats more interested in its own people, rather than an orgy of global greed and money laundering on a massive scale.

Christopher Rogers said:

I think the problem transcends the UK.

“The end of capitalism” crowd may get it right this time.

Immanuel Wallerstein is part of “the end of capitalism” crowd. He gave this short interview recently to a Brazilian TV station which summarizes his position:

http://www.youtube.com/watch?v=RqZsCe-tPXo&feature=youtu.be

Even though the lead-in is in Portuguese, the interview itself is conducted in English.

I’m not at all sure we’ll see “the end of capitalism” in toto, but we sure as hell are going to see the end of capitalism as we know it.

I’m not going to rule out some new mutant form of capitalism. After all, who expected New Deal capitalism? Who expected 1950s American capitalism? They were *weird*. Who expected Scandinavian socialist capitalism?

Ilargi said:

The “idea” is called capitalism, which has been the dominant paradigm in Western Civ ever since the Dutch invented capitalism in the 16th century. New lipstick has been put on the pig — mercantilism, liberalism and now neoliberalism — but the pig is still a pig us still a pig.

More humor (from July 2009): 39% of Americans believe they are in the top 1% (19%) or will be someday (20%)

http://www.salem-news.com/articles/july272009/american_money_dj_7-27-09.php

The apparent gullibility of Americans finally led me to cease being amazed!

That the rather discredited fiction of upward mobility in the USA still holds the imagination of some is rather amusing.

Believe it or not, that’s a drop from the number who thought that in the 1980s. Used to be a majority thought they were in the 1% or would be eventually.

Ilargi says:

TINA.

I think one of the problems is that people are incapable of imagining that there really are other ways of organizing society besides the capitalistic/liberal market way of doing things.

The New York City feminist, OWS theorist and Hofstra University proffesor Silvia Federici joins India’s Arundhati Roy in the attempt to save what remains of the world’s traditional, communitarian ways of life, which the US government is conducting nothing short of a blitizkrieg against. The US government has decided that the very existence of these other models of how societies have been organized and existed sucessfully for thousands of years poses a grave threat to “the American way of life.” Federici has been mostly involved in Africa, but has now also become interested in Latin America.

She recently linked up with community activists in Guatemala for a conference. Federici was orginally slated to travel to Guatemala, but had to cancel her appearance because of threats against her life. The US deep state and its clients in Latin America play hard ball.

Much more here, unfortunately in Spanish:

http://olca.cl/articulo/nota.php?id=103721

A far more condemnatory take than even that of Ilargi on liberalism/capitalism — “totalitarian money society” it calls it — is presented in the film “La Servidumbre Moderna” (Modern Servitude).

I could not find it with English bi-lines

http://www.youtube.com/watch?v=MSujFozuZhM&list=PL726E676CFD4AA38E

we are victims of our experiences and our developed memes and mantras…

capitalism or americanism, since american capitalism/mercentalism is quite different from its european cousin…is at a sad crossroads…

puny little clowns are running the show today…

this big mess we are in has its genesis in one stupid little event…

the struggle for control of marc richs’ dirty old bank, ABN/AMRO

the baffoon at bank of america at the time, is the wonderous “man” who was brilliant enough to say out loud that “his mommy” Byrdine was giving him a hard time about things but thought he was a good man…

this is the clown who then decided to play games with derivative positions and cross party positions at LaSalle and then used his prime brokerage to undermine the Royal Bank of Scotland and Fortis and then was involved in PIK financing of certain Mortgage Banking Bankruptcies which cued up the big Paulson and company led manufactured crash of real estate and the ensuing multibillion 100 to 1 leveraged profit posititions (tax free as we all know shorting a position is a non taxable event…we do all know that right…)

Paulson worked it well, having paid tens of millions in PR to drive down the lower end of the mortgage market, even arranging for April Charney to unwittingly be one of the parties to help drive down the value of homes

http://www.responsiblelending.org/media-center/press-releases/archives/helping-americans-keep-their-homes.html

too bad that little black bear in colorado did not wait till the head of B of A was home to break into that home.

communitarianism…

that is a dirty word that republicans used to throw at eleanor roosevelt to scream about the new deal and notion that people should and could grow their own food…

during world war two in the US a huge amount of food was grown locally and is well documented. The land does not care who is in charge as long as the seeds are planted and tended to…

communitarianism has been twisted away from its genesis

THE shoot out at the ok corral

its not just an excuse for spaghatti westerns…

three months after the smoke had cleared, a young seminarian arrives, and is asked to deal with a small episcopalian congregation whose place of worship had been burned down in the chaos of tombstone…

that man was

Endicott Peabody

that Peabody, a real Peabody, the son of a Morgan Banker, and scion of THAT family…

those events would help shape his mindset

when he founded GROTON…

he would preach to his small bevy from the social register that the poor need an even break, a reasonable opportunity at success in life.

One man with one voice, chiseled by his experiences in the rebuilding of Tombstone after the chaos and greed had run its course…

Federici…urgh…with all due respects…she unfortunatly grew up in Italy, where “el Hombre” runs the show. I am sure she witnessed many disturbing things as many woman in america did at much the same time.

I dated an Italian woman who even in the 1970’s was forced into a marriage with a man she did not really care for and he also was interested in someone else.

They come to america and years later, after raising the kids, they divorce.

He eventually catches up with his original sweetheart who was also forced to marry a man she did not care for…

But the American kids were still instilled with the old world mindset and were giving their father a hard time(2009)

But Ottavia tore HER kids out a new one…screaming at them that their father had worked like a dog for them, 60 hours a week for years and that he finally found his happiness…

I dont see that Federici has the capacity to get beyond her past childhood experiences…and move forward…

And that is also a sign of the times…people stuck in their uglihoods…angry about something in their past and driven to insist the world revolves around their inability to grow…

the world is wonderously imperfect…the answers are all around you…

there has never been a better time to make a better world

not perfect…just better

“But the American kids were still instilled with the old world mindset and were giving their father a hard time(2009)”

here’s an american kid after my own heart

https://scontent-a-ord.xx.fbcdn.net/hphotos-ash3/q71/1385067_613889065339458_2124847369_n.jpg

That name, Marc Rich, just keeps coming up in these conversations about how the “developing” world is being systematically dispossessed of its natural wealth.

If you haven’t already seen it, you might find this interesting:

“That paints the picture of a country that has squandered its independence, that is dependent on imports to a huge extent. Typical for all rich nations, US, Japan, western Europe, true, Britain is by no means alone, but still”

Hello hello anybody home ?

The UK is not a country – its a banking union…indeed even before the union it was just a bank which burned other peoples far off resources…..this is what Bank of St George like operations do mate.

The UK will be fine as long as the EU remains ….The EU deflation keeps the UK going as that has been its primary function since the very beginning …the UK is the fulcrum of the EU…The EU is its modern day India.

Spot on Dork. “A rainy Caiman Islands” is the phrase I remember, can’t find where it came from, but it’s exactly right.

And yes, so long as everyone else in the Eurozone will remain so obliging as to work for us for free (well, in return for pretty pieces of paper with Queen Elizabeth II’s head on it or the electronic equivalent) then perhaps the party will go on and on. They show not the slightest sign of wising up yet.

Hello hello anybody home ?

The UK has always functioned like this….only during the 2 Great wars was it forced to invest in its own resources to a large extent.

Its merely gone back to its normal self now.

Bank of St George like operations always burn other peoples resources – as long as the EU remains in deflation it can replace declining North Sea oil & gas as the EU fossil fuel rations are transferred to the fulcrum of it centralizing banking operations.

Of course its a economic model based on a massive centralizing vortice which will eventually fail but then the bank will merely move elsewhere….Hong Kong most probably.

The Dork of Cork says:

That statement is patently false.

In 1870, before Great Britain began its long and exorable decline, it produced 31.8% of world manufacturing production (League of Nations, Industrialization and Foreign Trade).

Here’s how Aaron L. Friedberg puts it in The Weary Titan: Britain and the Experience of Relative Decline 1895-1905:

Soylent green is people…

“The expectation is for consumers to dip into their savings and continue spending with the outlook for real wage growth to turn positive at the end of 2014 and into 2015”

Free beer tomorrow!!!

Man, I hope its a nice wheat beer, or maybe a dunkel…

Ilargi says –

“The idea, if I understand it well and put it in somewhat stark terms, seems to be to establish an economy that grows while the people become disposable. If they’re not needed for economic growth, than what use are they, right?”

Disposability seems to be a central repetitive theme recently at NC, of which I am glad to read about. In the field of family therapy, we have a scholar named John Gottman, who conducted research at the University of Washington predicting when couples -divorce or when they stay. His findings suggest couples engage in a cyclic experience:

1) Negative Affect/Criticism

2) Defensiveness

3) Stonewalling

4) Contempt

At any time, repair can and does occur except when contempt is invoked. In fact, Gottman could predict divorce at above 90% rates based on watching how couples managed to repair and how quickly each invoked contempt. http://www.chinnstreetcounseling.com/zomerland/zomerland_8.shtml

Disposability and Contempt

Moving from the individual or relational system to a larger macro one, this article makes the real connection of how much contempt there is in this global system for consumers/common people. So, much so, that feelings of disposability (i.e. lack of a belongingness) are a publically voiced matter of policy. I agree with the author, relationships do not come back from this kind of wound. We all need a place to belong, feel valued, and experience a reasonable quality of life. This cannot happen when the majority of us are disposable.

Rudolf Dreikurs wrote about the importance of a sense of belongingness several decades ago. We might think about the connections between belonging, disposability and contempt as Gottman & Dreikurs have much to teach us about treating each other.

Contempt goes both ways, as I’m sure you know: Congressional ratings in America at single digit levels; Obama sinking weekly in the pols (this could reverse sporadically, but the trend is there). As Yves noted, this is about paradigm failure, the inability to solve problems -even for the 1%- on any basis which avoids generating more problems.

Sometimes something very simple can hit you right between the eyes, your mention of disposability as a publically voiced matter of policy. Utter contempt for humanity, we have seen this before, but as world policy? The general angst so many people are experiencing now is that they do feel disposable, that their lives and work have no value to TPTB, not like anything I’ve ever sensed in my fairly long life. Some try to move on from it and reshape their lives, others are just beginning to realize it as a fact. It is a great dilemma. Thanks for directing me to Gottman and Dreikurs. Alice Miller opened my eyes many years ago to causes of socio/psyhcopathy in people who have positions of power. The whole UK government needs family counseling (also the U.S!)

There is sufficient contempt that revolution is inevitable.

The only questions are the nature of the revolution and what comes after it.

Isn’t it obvious that all countries need to pursue an export-led growth strategy along with fiscal austerity, which will indubitably lead us to the promised land of full-employment, falling deficits and universal surplus? Why can’t we all just do that? Seems so obvious…

[/snark]

There are only two countries: richistan and everyoneelseria

here, we can do this! why not?

I will trade you some wool socks, and you will trade me some cotton ones. on and on like that. you will send me radishes, and I will send you tomatoes. you send me Fords and i’ll send you Fiats. after marking them up because they’re ‘unique’ and so on, we’ll all make a killing.

only thing we need to keep this ring-around-the-rosey going is totally free energy.

It sounds like the Powers That Be have realized that it’s futile to expect consumers to maintain historical rates of spending growth when they increasingly lack the money to spend. (Which in turn is because their share in the economic growth that they’ve helped create has been steadily shrinking – see stories on growing rich/poor imbalance).

Different countries have different solutions to this. The US wants consumers to increase their debt load, while the UK thinks they should live within their means while the country finds other sources of economic growth (presumably exports or something of the kind). The one solution that apparently nobody is considering is correcting the growing imbalance between rich and poor (or capital and labor, if you prefer) so that consumers actually have the money that continued economic growth requires them to spend.

That would involve letting emerging markets, who produced our stuff and got paid with debt, to now on consume what we’ve been consuming.

“The chocolate ration has been increased to 20 grams per week.” From 30 grams.

“It corroborates one of my pet theories: that we are at the end of an economic paradigm. The powers that be lack the will and imagination to do anything other than patch it up and put it back into operation. That simply assures more frequent breakdowns until the system is beyond repair.”

We’re at the end of a political paradigm, too. And I think it’s already beyond repair. It seems to take a while for people to notice, though, and therefore people wait way too long to build new political institutions.