By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth, Cross posted from Automatic Earth

Often when I want to write some simple comments on recent events, I start poking around a bit, and so much pops up that I think I should include, before long I don’t know how to start anymore, or finish, let alone appear coherent in between. Like in this case where Europe is the (intended) topic. But here goes, and I hope you distinguish a thread all the way through. Let’s start with Saxo Bank’s annual list of 10 outrageous predictions. Here are the ones that address Europe.

Ten outrageous predictions for 2014 – all of which are possible

Every December Saxo Bank publishes a list of ten outrageous predictions for the coming year. The idea is that the things on the list are unlikely and definitely not part of the consensus view, but that they are also possible.

1. EU wealth tax heralds return of Soviet-style economy

Panicking at deflation and lack of growth, the EU Commission will impose wealth taxes for anyone with savings in excess of USD or EUR 100,000 in the name of removing inequality and to secure sufficient funds to create a ‘crisis buffer’. It will be the final move towards a totalitarian European state and the low point for individual and property rights. The obvious trade is to buy hard assets and sell inflated intangible assets.

See, I don’t know that a wealth tax equals a totalitarian state. That would seem to depend on overall taxation levels. It’s perhaps politically a “clumsy” tax, but French president Hollande is a big – and vocal – champion, because he owes his throne to left-wing voters, and they like both the idea and his voicing it in public. Overall, I would say Europe has much bigger problems than a wealth tax. Certainly when I see headlines such as this one come in at Bloomberg this morning:

Accidental Tax Break Saves Wealthiest Americans $100 Billion

By shuffling his company stock in and out of more than 30 trusts, [Sheldon Adelson]’s given at least $7.9 billion to his heirs while legally avoiding about $2.8 billion in U.S. gift taxes since 2010, according to calculations based on data in Adelson’s U.S. Securities and Exchange Commission filings.

Hundreds of executives have used the technique, SEC filings show. These tax shelters may have cost the federal government more than $100 billion since 2000, says Richard Covey, the lawyer who pioneered the maneuver. That’s equivalent to about one-third of all estate and gift taxes the U.S. has collected since then.

The popularity of the shelter, known as the Walton grantor retained annuity trust, or GRAT, shows how easy it is for the wealthy to bypass estate and gift taxes. Even Covey says the practice, which involves rapidly churning assets into and out of trusts, makes a mockery of the tax code.”You can certainly say we can’t let this keep going if we’re going to have a sound system,” he says with a shrug.

If this sort of thing goes on in the US, I have no doubt it does in Europe too. Back to the Saxo list:

2. Anti-EU alliance will become the largest group in parliament

Following the European parliamentary elections in May, a pan-European, anti-EU transnational alliance will become the largest group in parliament.The new European Parliament chooses an anti-EU chairman and the European heads of state and government fail to pick a president of the European Commission, sending Europe back into political and economic turmoil.

European parliamentary elections tend to have a turnout of 10-15% in some countries. That makes them, at least potentially, easy fodder for the coalition of right-wing parties being formed right now. And why not? Percentages like that don’t look particularly strong for democratic systems to begin with. There are serious doubts about the European project in countries where unemployment and poverty are getting much worse than they’ve been in people’s living memories. Perhaps the EU brass should address those doubts instead of switching even more powers over to Brussels. They seem to be led more than anything by blind faith and ideology. And more than one can play at that game.

8. Germany in recession

Germany’s sustained outperformance will end in 2014, disappointing consensus. Years of excess thrift in Germany has seen even the US turn on the euro area’s largest economy and a coordinated plan by other key economies to reduce the excessive trade surplus cannot be ruled out. Add to this falling energy prices in the US, which induce German companies to move production to the West; lower competitiveness due to rising real wages; potential demands from the SPD, the new coalition partner, to improve the well-being of the lower and middle classes in Germany; and an emerging China that will focus more on domestic consumption following its recent Third Plenum.

Quite possible. Depends on what Angela Merkel wishes to use her next term in power for. More project Europe at the cost of the periphery is fast turning into a dangerous path. But “leaders” have been known to think themselves above the people before. And there are a few domestic issues. But the bigger ones are “pan-European”. John Mauldin:

Quick: I say “German banks,” and what’s the first thing that comes to your mind? The Bundesbank? Staid, no-nonsense central banking? The Bundesbank is all about maintaining the price of money – forget QE. Deutschebank? Big, German – must be stable and low-risk. The fact that southern Europeans are opening accounts left and right in DB must mean that DB is lower-risk than the local wild guys.

Except that they have the largest derivatives portfolio, at $70 trillion (but don’t worry because it all nets out, sort of, and of course there is no counter-party risk!), and they are the most highly leveraged bank in Europe (at 60:1 in the last tests – not a misprint), which might give you pause. Although their CEO argues that their leverage doesn’t matter. And keeps a straight face. Just saying… If something happens to DB, they are, in all likelihood, Too Big To Save, even for Germany.

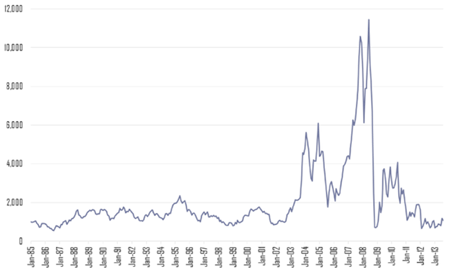

And since we haven’t seen it in a while, here’s the latest Baltic Dry Index courtesy of Mauldin. As you can see, it’s still every bit as much on life support as last time. But it may be news that it has a strong German connection.

At the top of the market, Europe financed 75% of the ships being built, and German banks financed 75% of those, or maybe as much as 50% of the world’s total. Moody’s gave us an estimate this week that German banks will face credit losses of $22 billion in 2014. “Germany’s eight major ship financiers have lent a total of €105 billion to the sector, a fifth of which are categorized as non-performing,” Only 30% of the losses have been accounted for with loan-loss provisions. That is bad enough; but if what I am being told is true, the losses could soar much higher.

German banks are still financing ships that are not making debt payments, rolling over principal and more in an effort to avoid having to write down losses. Further credit is being extended to shipping companies in the hope that they can work out the problems, as the banks do not want to go into the ship-operating business.

How bad is it? Banks are taking control of ships, marking them down to a fraction of their cost, and then financing 100% of the cost of selling them to Greek shipping companies. Can we say irony? Greek shipping families basically operate tax-free (a point I wrote about some four years ago) and take a very long-term and conservative view. They sold ships to the Germans at the top of the market for very nice premiums and are now buying them back at significant discounts.

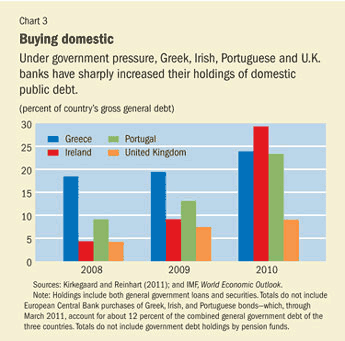

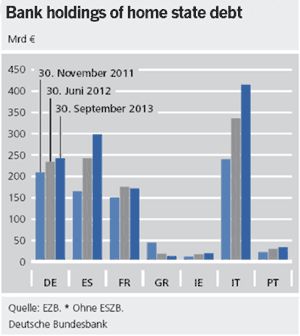

The ECB has actually provided huge amounts of capital for banks in an effort to get them to lend to businesses. But faced with regulatory risks and the significant requirement for increased reserve capital imposed by Basel III, the banks have taken the cheap money and bought their national government bonds, because the spreads are so high and the reserve capital required for making a sovereign loan is still bupkis (a technical banking term pertaining to European sovereign loan-loss provisions to insolvent governments).

So enough trouble for Germany. But even more interesting (for the sake of this article) is that Mauldin touches on a point in that last paragraph that warrants attention. I’ve written about it before, but there’s no harm in repeating it. Here’s the nutshell essence:

EU governments cannot borrow from the ECB (since it can’t buy sovereign debt outright), but banks can. So what happens is the banks do the borrowing and use the credit thus acquired to buy “their own” domestic sovereign debt. In other words, governments do de facto borrow from the ECB, but with a bank as (well-paid) middleman.

And that’s not even half the story. The banks that buy the sovereign bonds with ECB money/credit turn right around and offer those same bonds, which are listed as “safe”, or “cash good collateral”, to the ECB the next day as collateral in exchange for more loans. With which they proceed to buy more sovereign bonds, which provides wiggle room to their governments etc. It carries the strong odor of a scam, if not a Ponzi scheme.

You get the idea. The ECB knows this, Brussels knows this. All the muscular verbal blubber about not allowing the ECB to buy sovereign debt, it sure doesn’t seem to carry much value very long. And I’m being very kind there. In public, there’s a lot of talk about the strict rules governing bailouts and other support, but behind closed doors, none of these rules seem to matter.

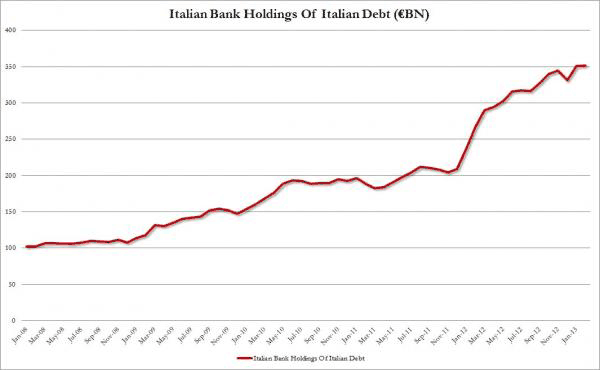

I found it hard to get one single graph to tell the story, so I’ll give you three:

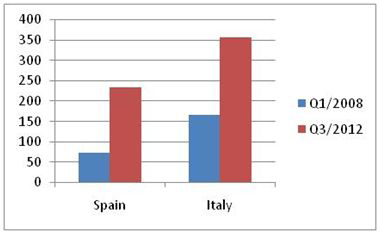

Italian Bank Holdings Of Italian Debt Rise To All Time High

Wondering why the Italian bond market has been stable and “improving” in recent months, with yields relentlessly dropping as a mysterious bidder keeps waving it all in despite the complete political void in the government and what may be months of uncertainty for the country, and despite both PIMCO and BlackRock recently announcing they are taking a pass on the blue light special offered by BTPs? Simple. As the Bank of Italy reported earlier today, total holdings of Italian bonds by Italian banks hit an all time record of €351.6 billion in February.

Why are local banks loaded to the gills in the very security that may and will blow up their balance sheets when the ECB loses control of the European sovereign risk scene as it tends to do every year? Because courtesy of ECB generosity, Italian debt continues to be “cash good collateral” with the ECB, and as a result Italian banks can’t wait to pledge and repo it with Mario Draghi in exchange for virtually full cash allotment. In other words, the more debt the Italian Tesoro issues, the more fungible cash the Italian banks have to spend on such things as padding up their cap ratios and making their balance sheets appear like medieval (any reference to Feudal Europe is purely accidental) fortresses.

As I’m letting this sink in anew, I’m starting to think the entire EU is a Ponzi scheme, but that of course could not be true: they have democratic elections, after all. As the graphs above illustrate, the rise in total holdings of Italian bonds by Italian banks makes abundantly clear that there is no way other EU countries, especially the peripheral ones, and their banks, have left this one-of-a-kind profit opportunity alone.

But not to worry, since, as we know things go in this universe, here comes the cavalry:

Euro Zone Bank Assessment to Target Sovereign Risk

Daniele Nouy, currently head of France’s banking regulator, was nominated last week by the European Central Bank to chair the board of the so-called Single Supervisory Mechanism. The board will be housed at the ECB.

Ms. Nouy’s first big task will be to handle a planned clean-up of banks’ balance sheets that will take place over the coming year, before the single supervisor assumes formal responsibility for overseeing the euro zone’s biggest lenders in November 2014. The ECB, together with national banking supervisors will review banks’ assets and conduct a new round of stress tests, hoping to identify undercapitalized institutions.

At a confirmation hearing before European lawmakers on Wednesday, Ms. Nouy said the supervisor “will look at the most risky portfolios, including sovereign risk.” She warned that banks should ensure that their government-bond portfolios have a proper risk weighting – used in calculating how much capital they need to hold – or are offset with additional capital buffers.

In doing so, Ms. Nouy went a long way to aligning herself with Germany’s central bank, which has been pushing hard for minimum risk weightings on sovereign bonds. Bundesbank President Jens Weidmann argues that this would require banks to hold more capital to cushion against potential losses on the bonds, reducing the incentive to hold such debt, and consequently break the vicious circle between bank debt and sovereign debt that has plagued the euro zone for the last four years. As the value of sovereign bonds has declined in certain countries, banks holding that debt have been weakened, requiring state aid that has put governments under strain, driving their borrowing costs higher.

However, Ms. Nouy argued the case from a different angle, saying that it was necessary to redirect banks’ resources from governments to households and companies. “We need banks to finance the economy, and if they increase their holdings of sovereign exposures they are less able to finance the economy, which is important at the present time,” Ms. Nouy said. European policy makers hope that once the capital needs of banks are identified and addressed, and the ECB starts overseeing financial institutions, banks will kickstart lending to the private sector.

Ms. Nouy’s answer was prompted by a question from a delegate from Spain, a country where the “crowding out” of private lending by government debt has been particularly severe in recent years. Since the end of 2010, Spanish banks have cut their lending to households by €86 billion ($116 billion) and their lending to companies by €263 billion, but they have increased their holdings of government bonds by €124 billion in that time, according to ECB data.

Yeah, yeah. EU policymakers claim they want Europe’s – mostly severely weakened – banks to clean up their balance sheets AND hold more reserves against assets AND start lending to the private sector. No, honestly, you may think this is a timewarp, but we’re really on the verge of 2014, not 2007, and this long since broken-beyond-repair record is what they come up with. These ideas are so contradictory, as well as outdated, that they might as well throw in a demand for world peace for good measure and place the entire discussion at the intellectual level where it belongs: that of a Miss World pageant. Which also fits in nicely with the credibility level of EU bank stress tests.

But of course that’s just “public policy”. The real policy we just saw: with the convenient artificial distance between the EU and ECB “firmly in place”, here’s what happens, and I might as well quote myself here: “The banks that buy the sovereign bonds with ECB money/credit turn right around and offer those same bonds, which are listed as “safe”, or “cash good collateral”, to the ECB the next day as collateral in exchange for more loans. With which they proceed to buy more sovereign bonds”.

Sovereign bonds from the EU periphery are highly popular, because they return good yields, while the risk that makes such yields feasible is perceived as being covered by the EU as a whole, and in particular the ECB. So banks are not only encouraged to pull this trick with “domestic” bonds, though I read somewhere that in Portugal and Spain, domestic banks now apparently hold over 70% of their “own” sovereign bonds, EU banks buy other EU nations’ bonds too to play the same game.

And while the ECB’s official policy is to make sure that “government-bond portfolios have a proper risk weighting”, the unofficial policy says something different, namely that banks have bought themselves even more political power since 2007, with the ECB loans that they buy sovereign bonds with etc., you get the picture (though perhaps I should mention the shadow banking system that can’t really do bonds, and buys stocks with its free “cash”. Record S&P anyone?).

Now, what is the real Europe? I think this Bloomberg piece for instance gives a more realistic picture than the EU brass would ever allow us, lots of joyous numbers:

Spanish Defaults Surge as Banks Forced to Come Clean

Liliana Proano Males won’t be decorating her house in Madrid this Christmas because she’s about to lose it. Males and her husband, who was fired from his job during the depths of the financial crisis in 2009, can no longer afford their mortgage. With Spain’s persistently high unemployment rate now at 26%, the couple is among the 350,000 homeowners who may be foreclosed upon by lenders in the next two years as the housing crisis worsens, according to AFES, a Madrid-based association that advises on restructuring debt. Since 2008, about 150,000 families have been hit with a foreclosure. [..]

As mortgage defaults rise, lenders will have to set aside money to cover losses, hurting profits, according to Juan Villen, head of mortgages at Spanish property web site Idealista.com. Spanish banks absorbed €87 billion ($120 billion) of impairment charges last year after Economy Minister Luis de Guindos forced them to record more defaults on loans to developers. The government took €41 billion in European assistance to shore up its failing lenders. [..]

More than 5% of Spanish residential mortgages were in default in the third quarter, up from 3.5% a year earlier, according to data released today by the Bank of Spain. The level was 0.7% in 2007, the year before the real estate market imploded. AFES estimates a rise to 6% next year. Defaults as a proportion of all loans by Spanish lenders climbed to a record 13% in October from 12.7% the previous month, the central bank said today.

Defaults are rising partly because of changes required by the Bank of Spain that force lenders to book more soured mortgages. “When the real estate bubble burst in 2008, banks used refinancing en masse to cover up non-performing residential mortgage loans,” AFES President Carlos Banos said. “Refinancing only served to draw out the situation and exacerbate the problem.” Banks refinanced mortgages and granted grace periods in return for adding financial penalties and notary expenses to the principal of loans. [..]

In April, the Bank of Spain ordered lenders to review their portfolios of refinanced loans, including mortgages, to make sure they’re classified in a uniform way. Lenders had €208 billion of loans on their books that they’d restructured or refinanced as of the end of 2012, according to the regulator.

The review led the regulator to the preliminary conclusion that classifying all refinanced loans correctly would cause a €21 billion increase in defaults. Lenders would need to generate a further €5 billion of provisions to cover the losses. The default rate for Banco Santander’s Spanish mortgages jumped to 7% in September from 3.1% in June as it reclassified loans that it had refinanced. [..]

More than 4 million people have lost their jobs since the start of the credit crunch. The International Monetary Fund predicts the jobless rate won’t fall below 25% until 2018.

As Spain’s borrowing costs in 2012 surged to the highest level since the euro was introduced in 1999, the government introduced deficit reduction measures such as wage freezes and income tax hikes that ate up disposable income. Spanish households’ average income fell for a fourth year to €23,123 in 2012 compared with €25,556 at the start of the crisis in 2008, the National Statistics Institute said on Nov. 20. That left 22% of the population below the poverty threshold.

Spanish house prices have dropped an average of 40% since the peak in 2007 … [..]

Or how about Ambrose, always good for a nice quote:

Italy’s president fears violent insurrection in 2014 but offers no remedy

Events in Italy are turning serious. President Giorgio Napolitano has warned of “widespread social tension and unrest” in 2014 as the Long Slump drags on. Those living on the margins are being drawn into “indiscriminate and violent protest, a sterile lurch towards total opposition”.

His latest speech is a veritable Jeremiad. Thousands of companies are on the “brink of collapse”. Great masses of the working people are on the dole or at risk of losing their jobs. Very high rates of youth unemployment (41%) are leading to dangerous alienation. “The recession is still biting hard, and there is a pervasive sense that it will be difficult to escape, to find a way back to full growth,” he said.

Now why might that be? Might it not have something to do with the central overriding fact that Italy has a currency overvalued by 20% or more within EMU: that it is trapped in a 1930s fixed-exchange system run a 1930s central bank that is standing idly by (for political reasons) as M3 growth stalls, credit contracts, and deflation looms?

I’m not the biggest fan of Ambrose’s analyses, but his point here is valid, and increasingly so: how much longer can Italy (and others) deal with using a currency that is valued at levels that make it seem as if the entire EU has an economy as strong as Germany has? It’s one thing for markets to presume Germany will back the entire project in one way or another, but it’s quite another for a weak economy to be forced to use a strong currency. Countries like Italy should be able to devalue their currencies, but they’re not. And as long as the richer northern EU core doesn’t address that issue, things will keep on deteriorating in the south.

The Boys from Brussels are pushing hard to seal deals to not only make it increasingly difficult for member countries to leave, but indeed take more and more powers away from the members. The claim that Eurozone countries can still conduct their own financial and economic policies is no longer truly believable. At this very moment, they’re rushing through the next piece of the scheme, under the guise of taxpayers no longer being on the hook for failing banks (though they will be for at least another 10 years):

Europe rushes to seal banking union within 48 hours

European leaders are beginning a two-day summit on Thursday in an attempt to sign off on a banking union deal before the weekend. Five years after the financial crisis struck the euro zone, European leaders are meeting in Brussels in an attempt to seal a deal that would create a single banking union in the region by 2015, envisaged as a supervisory system to police the region’s banks and financially assist (or dismantle) them if necessary.

Banking union is seen as essential in restoring investors’ faith in the euro zone after weak banks across the region, from Ireland to Spain, were hit by the financial crisis, dragging weakened sovereigns down with them. Attempts to create a single supervisory system have not been simple, however, with disagreements ranging from who was to supervise the banks – it will now be the European Central Bank – to establishing a single fund to rescue failing lenders.

Under the deal, banks will provide the cash to pay for the closure of failed lenders, giving roughly €55 billion euros ($76 billion) over 10 years. But there is no agreement as yet on how to ensure there is enough money to deal with closures while the fund is being built up, or where it falls short.

For one, the euro zone’s largest economy Germany remains very reluctant to make its taxpayers liable for losses incurred by banks in fellow euro zone countries. It wants the government of the country where a failing bank is located to cover any shortfall in rescue funds.

Instead of trying to address the issues raised by the people, and in the streets, the very attitude that creates the space in which for instance an EU-wide anti-EU right-wing coalition can operate, and grow, Brussels, and most sitting governments, turn deaf ears to both the issues and the people. Unless they radically change their attitude, a loss in the upcoming European Parliament elections six months from now may well be the least of their worries when the time comes.

It’s a massive blunder, whether born from arrogant hubris or sheer stupidity, to act as if the financial crisis is something that takes place only, or even mainly, in the boardrooms of the political and financial system. The crisis takes place in the streets, and a stubborn refusal to address it there may well cause the EU to turn into E/U in 2014.

A banking union deal in Christmas 2013…….

Means debt to us all.

PS

People still make the mistake of thinking the UK is not in the EU.

Its the fulcrum on which the EU operates.

UK balance of payments Q3 just published.

http://www.ons.gov.uk/ons/dcp171778_347294.pdf

Largest real goods deficit ever recorded : £ -29.4 Billion

Largest current account deficit ever recorded ; £ -20.7 billion

Financial derivatives , largest net settlement : £ +77.8

Of this

EU real goods trade deficit : £- 16,399 Billion.

A 1 or 2 billion injection / consumption of real goods would cause a country such as Ireland or Portugal to boom.

But we are seeing these massive trade deficits which must be serviced by non sov countries – pushing them into deflation to service this absurd extreme trading economic system.

The real costs of pointless (for most) trade is off the scale.

The UK is caught in a web of its own making.

It has successfully ensnared the entire European entrepot making it into a even more extreme entrepot post 1980 but it is fighting a losing battle with entropy.

It must continue to externalize its losses if Venice ..eh sorry the Uk is to survive.

It cannot afford to pay its miners as this would make external products unaffordable.

The latest energy trends PDF December 2013. covering Q3 2013.

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/266403/et_dec_13.pdf

Provisional figures for the third quarter of 2013 show

that coal production (including an estimate for slurry)

fell to a new record low of 2.8 million tonnes. This

was 32 per cent lower than the third quarter of 2012.

The decrease was due to a number of reasons, but

mainly the closure of several collieries/companies

since December 2012, including Aardvark, Maltby,

Daw Mill and Scottish Coal Company.

Imports of coal in the third quarter of 2013 were 12

per cent higher than in the third quarter of 2012 at

12.5 million tonnes.

This energy / labour / trade dynamic of producing derivatives to offset energy supply deficits has been with the UK since it first started to import coal and crush domestic labour post 1970.

It has stabilized its transport (liquid fuel) sector by simply driving other euro countries into surplus.

The remaining oil must flow elsewhere…….to deficit countries such as the UK & France.

“Total deliveries of the key transport fuels were stable when compared to the same period last

year. Diesel deliveries increased by 1.3 per cent and while this is a slower rate of increase than

the recent trend, diesel share of road fuels have reached 63.5 per cent, up 16 percentage

points on 10 years ago. Deliveries of aviation turbine fuel were up by 1.6 per cent”

In gas consumption we see a continued decline in gas for electricity ( the most wasteful energy practice outside of flaring)

This is happening throughout the eurozone on a truly epic scale.

“UK demand for natural gas in Q3 2013 was 8.2 per

cent lower than in the same period a year ago and

was the lowest third quarter demand since 1995.

This is largely driven by warmer temperatures

during Q3 2013 and a fall in gas demand for

electricity generation, which was lower by 10.9 per

cent in Q3 2013 compared with Q3 2012, reflecting

lower electricity generation overall.

Domestic demand for gas decreased by 11.2 per

cent, with mean temperatures in the third quarter of

2013 being warmer than in Q3 2012”

Use of gas in UK elec. generation has halved since Q3 2010

To be replaced by lower quality coal (mainly imported) but now also elec. generation is showing a big decline from average this past quarter

GwH produced by gas.

Q3 2010 : 86,579

Q3 2011 : 79,651

Q3 2012 : 48,816

Q3 2013 : 43,474

Why is there a policy of increasing the population of the British Isles ?

it is not based on any Physiocratic logic.

It is based on the banks running more and more people through a declining physical economy so as to extract the maximum yield until collapse.

The UK has traded what remains of its physical economy for claims on the world – the data is quite clear.

Regarding Saxo Bank and wealth tax. Saxo Bank is full of Randian nutters. Seriously, they are giving exemplars of Atlas Shrugged away for free.

My father has one of theirs on his bookshelf. (Fortunately he’s smart enough not to read the drivel)

Barroso always brings out that inner nationalist in me.

Every time I listen to the man I have this strange urge to kick his in.

http://www.independent.ie/irish-news/politics/eu-chief-barroso-no-batrnto kick his head in.ckdated-bank-debt-deal-for-ireland-29854504.html

Perhaps the majority of the population of Ireland under 40 is not Irish or have been born to at least one non Irish parent.

As if the opening of the economy to capital and the consequent labour flows was not a EU / London policy goal.

I say again – a declining energy per capita consumption continues as a result of a Euro free banking crisis and massive population movements from Eastern Europe and elsewhere.

We have the highest birth rate in Europe not because we think every Sperm is sacred as before,

We have a huge bulge of 30 somethings which want to have babies as normal 30 somethings tend to do.

“Thanks also to the great efforts of the Latvian people”

The Latvians in the main don’t live in F$£king Latvia.

Not a laughing matter Dork, but you have given me a belly laugh. Nemesis follows hubris, the careerist one time failure politician will get his without you having to be in the same room – As usual with lots of so called collateral damage visited on the innocent. I am sure he will be welcomed back to Portugal with open arms.

@Steve

Yes – he is quite a specimen all right.

PS those trade deficit figures is what happening to the real economy.

They may seem small relative to the hyperinflated claims which are in the trillions but a billion here and a billion there of goods is the real deal.

If for example a mere one billion Sterling was spent in Ireland on Beer consumption the place would be rocking again as the pubs remain chiefly domestically owned although this situation is changing rapidly.

We might even be good Euro stooges and recycle our piss for the burdening Irish domestic chemical industry but that would be taking the piss out of our figurehead leaders so I guess practical solutions are a no no.

It would certainly be better then driving around in circles as the English are doing.

http://en.wikipedia.org/wiki/Taking_the_piss

http://www.independent.ie/irish-news/politics/eu-chief-barroso-no-batrnto kick his head in.ckdated-bank-debt-deal-for-ireland-29854504.html

Sorry the words “kick his head in” somehow manages to corrupt my link.

But the video link is worth a view.

Although it may make you want to throw up.

http://www.independent.ie/irish-news/politics/eu-chief-barroso-no-backdated-bank-debt-deal-for-ireland-29854504.html

Europe has nothing to do with the Irish…….

In 2011, 37% of foreign nationals with new PPSNs had employment activity during the year. See table 2b.

Of the 1,148,800 foreign nationals aged 15 and over who received

PPSNs in the period 2002–2011, 310,400 recorded some employment

in Ireland during 2011.

1.148 million ……….Ireland is a small country.

many have left the (burning) building but our birth rate remains the highest in Europe chiefly for one reason.

Workers and non workers are in their 30s and are having babies in a declining energy ecosystem which is in the process of end game extraction.

Once the banking crisis is finished the banks can safely dispose of a large segment of the older Irish people which have been kept on life support merely to aid the banks books as older people cannot escape and thus their money mainly fuels domestic demand and saving.

http://www.cso.ie/en/media/csoie/releasespublications/documents/labourmarket/2011/ppsn_2011.pdf

The above Maoists are planning to arrange a killing field for us.

It will indeed be a Paddy field.

This was a surprise – that the private banks can deal with the ECB so they are simply insinuated into the process like middlemen – just like our banks are – taking their cut and buying mostly treasuries and the trickle down goes to the stock market via the shadow banking system. With their new stability regulations their banks sound stressed, like Zions over the Volcker Rule. The finalization of the EU banking union will function much like our FDIC. Etc. Sometimes I can’t tell the difference between them and us.

The bit about Germany’s shipbuilding industry was interesting – that’s probably one big reason the Germans are fiddling funds too keep Greece on life support. But from the sound of this post I do think Germany is going down the same tube as the periphery.

With no money for housing, or business lending there will be no growth. Intentionally so. What conclusion accounts for this manipulation? I think everyone at the highest level of governmental decision making has come together in the industrial world to stop growth cold. Because global warming? And parliaments and congresses are panicked because without growth capitalist economies cannot pay their prior obligations, and etc. So it is like a stealth MMT in a perverted way, serving the oligarchs only.

The plot was lost long ago. One fears they plan to dispose of us all. Dork mentions balance of payments – how quaint! London’s gold vaults are empty and the Chinese refusing all but the precious metal. I take Dork’s analysis more or less full on. This is madness and all one can fear is there is something else in the mad plan even more stupid and foul. The Middle East may be a big example.

Another end of year, another dire prediction for the EU. George Soros was wrong, AEP has been wrong, etc, etc. Not saying that they will continue to be wrong, but I have a feeling that the depth of depression in Europe has been exaggerated.

You can read this stuff for entertainment (if somebody fiinds the topic entertaining) but God Forbid don’t try to make money on it. There’s a three-headed dog in front of that dream and each mouth will eat you alive. It ate me. One head is called Doom and the other Gloom and the third head is Mordor. Each head has red glowing eyes and each mouth has teeth like razor blades. You think you can Short the Hell out of the three-headed dog, big mind stud that you are, but that’s when you realize youi’re only a meal ticket.

The purveyors of Doom & Gloom — like the 4 horsemen of the financial apocalypse, whose names I will not bring to my lips — lure the avaricious and gullible souls, like me, into the mouth of the cave and then the 3-headed dog eats us alive.

I’m posting this comment from the Underworld, in the Ring of Speculators who Tried to Short the Eurozone. Each day we have to spend money to make our magin calls, and go ever deeper into debt, and then we have to work just to pay our debts. You can never leave your desk down here, even to pee. It’s hell all right. You thought getting eaten by the dogs was bad but just wait until your pants are wet and your sitting in it.

Be careful, humans in the overworld, about what you read on the internet. Especially when you think you’re getting smarter by reading. You’re not.

Well that’s certainly entertaining, but no I am not shorting Europe, heck I am not shorting anything. It’s crazy in this day and age when tapering causes the market to go up (even if temporarily).

OK I’ll admit I’m exaggerating. I was only long the eurozone then read some Doomer & Gloomer “analyis” and iit scared me so bad I sold everything — oh, about right before it went up 30% this year.

My detailed quantitative macroeconomic research — which consists of asking my anarchist friend over at the Spanish institute what’s going on in the home country — revealed that everybody is out in the bars and nightclubs partying it up and working off the books.

You don’t get insight that by crunching numbers. Still, I let the “pros” who do intensive quant analysis using datta from the IMF, ECB, EMU, EU, BIS — persuade me my research method was unsound. That was at least 30% ago now. Not only that, my friend who just did a cruise to Spain and Italy said everybody was out shopping wherever he went.

I don’t know what to think but somebody has an active imagination and I’m not sure who.

@Notsosure

Where do you live ?

Or better yet just look at UK energy consumption figures………even during 1942 (when the battle of the Atlantic was touch and go) we did we see anything like the % declines we see now.

The 1930s do not even come close.

The UK energy data shows quite clearly that the poor are being switched off as they tend to burn fuel on electricity & heat rather then oil.

The oil / car data shows that the richer segment of English society continue to get credit to burn more oil against a decline of general society.

http://www.smmt.co.uk/2013/12/november-new-car-registrations-overtake-2012-full-year-total/

Meanwhile the French masons continue to dig tunnels under the Rhone and elsewhere.

http://www.youtube.com/watch?v=clYApA666fs

They seem to be preparing for a inflation that never comes.

The game of extraction will continue until the Irish & Greeks are no more then a historical joke rather then todays joke of the decade.

If there is to be a unified Europe, it will necessarily be totalitarian.