By James Boyce, a professor of economics at the University of Massachusetts, Amherst. Cross posted from Triple Crisis

Rent isn’t just the monthly check that tenants write to landlords. Economists use the term “rent seeking” to mean “using political and economic power to get a larger share of the national pie, rather than to grow the national pie,” in the words of Nobel laureate Joseph Stiglitz, who maintains that such dysfunctional activity has metastasized in the United States alongside deepening inequality.

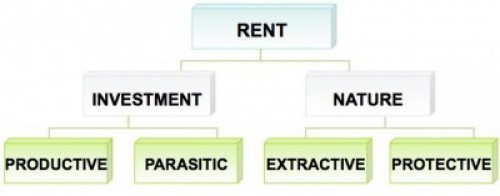

When rent inspires investment in useful things like housing, it’s productive. The economic pie grows, and the people who pay rent get something in return. When rent leads to investment in unproductive activities, like lobbying to capture wealth without creating it, it’s parasitic. Those who pay get nothing in return.

Two other types of rent originate in nature rather than in human investment. Extractive rent comes from nature as a source of raw materials. The difference between the selling price of crude oil and the cost of pumping it from the ground is an example.

Protective rent comes from nature as a sink for our wastes. In the northeastern states of the U.S., for example, the Regional Greenhouse Gas Initiative requires power plants to buy carbon permits at quarterly auctions. In this way, power companies pay rent to park CO2 emissions in the atmosphere. Similarly, green taxes on pollution now account for more than 5% of government revenue in a number of European countries. When polluters pay to use nature’s sinks, they use them less than when they’re free.

Four Types of Rent

Extractive and protective rents both originate in nature, but one promotes resource depletion, the other conservation. The resulting tension between these two types of rent from nature is becoming more visible in a warming world.

A daunting obstacle to climate policy arises from the vested interests of fossil fuel corporations in continuing to reap extractive rent. The current value of the world’s oil, coal and natural gas reserves is estimated at $27 trillion. Much of this will have to be written off if we phase out fossil fuels. “You can have a healthy fossil-fuel balance sheet, or a relatively healthy planet,” Bill McKibben observes. “You can’t have both.”

Creating protective rent by capping or taxing carbon emissions will shrink extractive rent. Fossil fuel corporations have shown themselves willing to fight hard to defend extractive rent. But the question of who will receive climate protective rent– and who will fight for it – remains up in the air.

One possibility is to return climate protective rent to the people via equal per capita dividends – a policy known as “cap and dividend” in the case of permits or “fee and dividend” in the case of taxes. Another is to give free permits to polluters and let them pocket the rent as windfall profits – a policy known as “cap and trade” but more accurately termed “cap and giveaway.” A third option is to let the government keep the money, as in the case of Europe’s green taxes.

Dividend proponents argue that recycling rent to the people is necessary to secure durable public support for climate policy as fossil fuel prices rise during the decades-long clean energy transition. Cap-and-giveaway proponents argue that surrendering the rent to fossil fuel corporations is necessary to neutralize their opposition to climate policy.

Underlying these strategies are very different beliefs about who owns nature’s sinks, and about politics. Dividends are based on the principle that the gifts of nature belong to everyone equally. Cap-and-giveaway is based on the premise that the same corporations that profit from extracting nature’s wealth ought to be paid to leave it in the ground.

Dividends make sense if we believe that it’s possible to enact a policy that benefits the majority of people financially as well as environmentally. Cap-and-giveaway makes sense if we believe that might makes right, and that the power of the people can never match the power of the corporations.

The serial defeats suffered by cap-and-trade bills in Washington have cast doubt on the political realism of “realpolitik” environmentalism. When the chips were down, the fossil fuel industry proved unwilling to buy into the new-rent-for-old deal.

The only way we’ll see a switch from extractive rents for corporations to protective rents for the public will be if ordinary people join together to make this happen. The small-d democratic politics that this will demand may seem like a quaint idea in the political climate of the early 21st century. But nothing less is required. To change the rent we get from nature, we must change who gets it.

Huh?

Yes, the people who pay land rent for shelter get something in return: a place to live.

The problem is that the people collecting the rent do absolutely nothing to earn it.

It might help if you read the post before commenting on it. I hate to tell you, but you’ve basically put your foot in your mouth and chewed in public.

Yves, you could easily make a second career in stand-up using all your responses to commentors who haven’t read the post. Priceless.

Agree.

The trouble ain’t that there is too many fools, but that the lightning ain’t distributed right. Twain “Huh?”

That particularly rich, given that Mark Twain actually understood the concept of land rent, and why leaving it mostly untaxed is a great evil, unlike fools commenting here.

Yeah, and I could make a second, third, and fourth career responding to all the people who don’t understand what land rent is.

The problem is that the environment “gets nothing in return” for either extractive nor protective rent. Its all a man made scheme wherein those with the most money profit.

It is a proven fact that if you tax extraction it only has a minimal effect effect in reducing demand other than causing the extractors to increase price forcing those lowest on the economic food chain to drop off. Re-distributing the tax to those at the bottom only allows them to continue to consume.

We are not going to solve anything using the same tools that got us into this mess. We can’t buy our way out of this. Nobody will or should get rich pretending to address the problems facing mankind and that is something that most simply can’t stomach.

Yes and no.

If you tax extraction only as a rent, all you do is change who gets the rent. So yes, you’re correct, demand is left unchanged. But you don’t change the price the end consumer pays.

So, for example, if you were able to come up with a scheme where you tax all the rent for extraction of fossil fuels, but could avoid taxing the capital investment needed to extract them, the price to the consumer would be unchanged, but the oil companies would only get a return on their capital investment, not a windfall from the oil itself. The difference would be that the taxing authority would get the windfall.

But yes, it would not discourage consumption of the fuel. The rent is always paid; the question is “to whom?”

I agree entirely. Unfortunately, but probably unintentionally, the author shows where the real problem lies when he wrote, “Protective rent comes from nature as a sink for our wastes.” That is WRONG: Protective rent comes from recognizing nature is the source of our LIFE. If we keep seeing Earth as “a sink for our wastes,” we’ll keep destroying our world — maybe somewhat more slowly, but still doing it. We must stop paying to avoid pollution, etc., and start investing in repairing Earth’s ecosystems. Only by recognizing we CANNOT live without Nature, that all living species are our relatives, and that our unique traits like intelligence give us responsibilities to the rest of life, not dominion over other species, will we survive.

I did read the post. The author clearly doesn’t understand the economic definition of rent:

If someone rents a house from a landlord, they’re paying two things: (1) for the use of the structure and other improvements, which is a return to capital; (2) for the location. The latter is economic rent.

The claim that the land rent “inspires” investment in improvements is not true and is the kind of argument that rent seekers use everywhere. (“We need patents to invest in research! We need to be able to extract oil for a royalty less than it’s actually worth, or we won’t invest in the necessary capital to extract it!”)

Sorry, Yves, I have a lot of respect for you, but you’re just dead wrong on this one.

The typical entrepreneur is no longer the bold and tireless man of Marshall, or the sly and rapacious Moneybags of Marx, but a mass of inert shareholders, indistinguishable from rentiers, who employ salaried managers to run their concerns. Edwin Arlington Robinson An Essay on Marxian Economics.

***********

What characterizes a rent-seeking economy?

Stiglitz: Much of the financial sector involves “rent-seeking” not production—An essay on rentiers

I want to tie together a couple of concepts:

1. Being a rentier is much easier than being productive. Being productive involves work, actually making things.

To be a rentier, you just send out Big Louie (sorry, your collection agents) to gather the goods. Sometimes Big Louie is your friend the local sheriff.

2. A rent-seeking economy is not productive. We have been converting to a rent-seeking economy since Reagan started sending U.S. manufacturing overseas and rewarding (with money) people who made money by moving money around (rentiers).

As Kevin Phillips points out, one of the three signs of the end of an empire is the financialization of its economy — its conversion from productivity to “financial services” — extracting fees for moving money around. (See here for Spanish, Dutch and British examples; search on “Phillips”.)

3. Rent-seekers, like most Big Money types, use their Money to buy the Law. Which means …

4. Money and Law are fungible — exchangeable for each other. Who knew?

Actually most of us did; we just haven’t said it that way. Shakespeare’s version from Hamlet: “Oft ’tis seen, the wicked prize itself buys out the law.”

Translation: You can often exchange stolen money for laws and rulings you want.

5. Rented money is called “debt” and debt collection is rent-seeking.

Look at the water example above. You have it; everyone else needs it. You thus have a special position, which you can use to collect income (economic rents) by owning the only source of what people need.

Once rent-seekers have, say, almost all the money in the world, they don’t have to make anything else. They just rent out their money.

6. The interest of rent-seekers is to make everyone else pay their debts. Since rent-seekers typically use their money to buy the law, they use their money to make debt and bankruptcy laws most favorable to them.

What’s wrong with that? This …

7. When an economic system is clogged with too much personal debt, the whole system stagnates, producing a stagnant economy and often, a demand-driven depression.

Why? Think; what happens when everyone is paying off debt and no one is buying stuff? Answer: At best, nothing happens; the economy stagnates. At worst, a downward spiral of job loss and depressionary price collapse (deflation).

Or don’t think: just look out the window. You’re watching the milder form of what happens — a debt-clogged system in which little economically is happening. (This is why public debt has to take over for personal debt, by the way, but that’s another discussion.)

8. In a system clogged by personal debt, the political Bigs — the Obamas, the Bidens and the Clintons — have to choose between the interests of the rentiers and the interests of, say, everyone else in the country.

Mostly, political Bigs choose the interests of their paymasters.

9. Thus my term — Rentier Rebellion — a political conflict in which rentiers use the political Bigs to put the squeeze on everyone else.

It kills the system, but hey … fort

unes of war, as they say.

http://americablog.com/2012/07/stiglitz-much-of-the-financial-sector-involves-rent-seeking-not-production-an-essay-on-rentiers.html

**btw, Yves has been on this forever…hope your wearing soft x-sm moccasins

Yes, so what? I already know that most if not absolutely 100% of finance is rent collection. The point is that you don’t understand that people making money off of site value is also rent collection.

From your apparent need to babble and make citations, you don’t actually know the definition of “rent”, ISTM.

We should not forget for a moment that the largest rent seeker is government, which itself produces nothing whatever apart from more bureaucratic rules, regulations, and expanded power to inflict violence on others (at home and abroad) with or without due process. It extracts that unearned rent from taxpayers who receive little in return but more wars and other violent forms of “protection”.

In the most recent IRS Taxpayer Report to Congress, the abuses of ordinary persons steadily mount:

http://www.taxpayeradvocate.irs.gov/2014ObjectivesReport/Full-Objectives-Report

An absurd comment appears at the top of this report:

What is the “crisis”? Not enough money. This by an armed agency which has not in recent memory passed muster on its annual IG review (in no small part because it notoriously has no idea where large sums of money have been spent), is largely spared any inconvenience of genuine oversight, and is relieved of any obligation to respect citizens’ rights under the US Constitution (which has no effect in tax courts), and can literally make up arbitrary “assessments” based on squishy law and treacherous behavior. And this also from an agency of the biggest debtor government in the world which must persistently borrow vast gobs of money from its economic competitors simply to stay afloat.

The salient feature of this claim is that the IRS is entirely free to do whatever it likes whenever it judges it isn’t being paid enough. Unfortunately for the citizenry, it is an iron law of bureaucracy that there is never “enough”.

Even Wall Street and the Mafia must be green with envy. And Professor Parkinson, of course, is again proven right.

Those morally stricken with grief about horrid rent-seeking behaviour should remember the fish rots from the head down.

Correction: that should have been referred to as the IRS Taxpayer Advocate Report to Congress

Although the renter may use a portion of rent for investment such use is never guaranteed.

Having lived in enough neighborhoods where the purpose of owning property was rent gouging, I’ll suggest that the example chosen is most counter intuitive.

Regards and remember to tip the bloggers.

I assume you mean “the landlord”, not “the renter”.

Of course the landlord may use it for investment. He may also use it for hookers and blow. The point isn’t what he “may use it for”; the question is whether land rent is income from investment in improvements.

Anyone who understands real estate economics knows the answer is “no”. It’s almost by definition.

Land doesn’t always enter into the equation, nor is all land about a place to live. The health insurance industry extracts rents from patients by limiting access to medical services and uses government power to entrench its position. The individual mandate contained in Obamacare is an excellent example, requiring us by law to hand our money over to that industry in exchange for less than we would have if it didn’t exist.

You miss the point. I’m not saying land always enters into the equation; for example, I despise patent trolls, and I’m well aware that the rent they collect isn’t land rent.

I’m not arguing “land rent is the only form of rent.” I’m arguing “land rent is a form of rent.”

BTW, with an equal government power to ignore the legal requirement. From page 336 of the Affordable Care Act Certified Text Final Version, published December 24, 2009:

A toothless mandate.

P.S. This is under Section 1502.

The penalty can be collected only from refunds – which most people have. My son, for instance, who fully intends to owe it, had a refund last year far more than the penalty.

So given that, it sounds like the upshot is that the law favors (intentionally or not) whatever kind of taxpayers don’t typically have refunds. Not sure who that would be or if there is such a group…?

1099 employees, perhaps. Small comfort, that.

I thought a huge fraction of people don’t even file 1040, let alone have a refund.

Love me love me love me, im a liberal…

https://www.youtube.com/watch?v=u52Oz-54VYw

No, actually, apart from being a liberal, I’m someone who understands what “economic rent” is, unlike the poster.

As a landlord, I can assure you that is not true. It’s a pain in the neck, especially since we do as much of the maintenance as we can. Of course, that assumes that you’re reasonably conscientious.

The businesses that manage rentals charge substantial fees for the service.

Granted, it’s a far from ideal way to manage housing. In the larger picture, there should be better ways, but this is the best we can do as the system stands – and at the moment, as Yves would doubtless tell you, it’s the only investment, short of millions, with a decent return.

Of course it’s true. You don’t know it’s true because you don’t understand what land rent is. You, as the landlord, do nothing to create site value. The return from site value is economic rent.

Landlord do provide value by creating and maintaining improvements.

That’s because when you own real property, you’re in a position to capture economic rents. That’s exactly why it’s so “profitable” in the colloquial sense of the word.

The oil industry rents the U.S. military as a security force but doesn’t pay for it. That’s a rent-free living arrangement.

How does that compare with subsidies for clean energy sources? Somebody can be for it or against it, but they should account for it honestly. Then they can debate “the costs”.

Having said that, I think the post author goes a bit overboard on defining cap and trade as a giveaway. The plans I’ve seen start with free credits (in some cases while in others they start at a price) then phase in a cost over time and that cost can go quite high. I’m not sure it’s useful to mischaracterize policy approaches that one disagrees with simply to score rhetorical points. That’s politics not analysis.

Also, if people get dividends in the mail from the oil industry, I’d guess there might be a lot of resistance to clean energy. Especially during the winter when it’ cold as hell outside and global warming seems ludicrous. Why stop the gravy train?

The giveaway characterization accurately portrays the deeper point in this post; namely, in a culture that believes people broadly ‘own’ the conditions for survival on the planet, the dividend arrangements make sense. In a culture that believes corporations et al ‘own’ presumptively and a priori ‘own’ the air, the water and so forth, the arrangments start and stop with market solutions among those corporations et al. The giveaway happens a priori. That there is some sort of ‘entry free’ and/or ongoing price exchange may mean, as you say, the players ‘pay something’ (i.e. not ‘free’). But, this consequence misses the larger point: It’s a giveaway.

I’m not a carbon credit fan, but your proposal helped me better understand the underlying reasoning behind it.

The problem I have now is that the system-manipulating rent seekers will do the rent seek with carbon credits, carving out exceptions for themselves and imposing burdens on competitors or new entries in the market.

It seems like rent seeking is a manipulation of the rule makers and the rules they make. A carbon credit rule would give more power to the rule makers and give the rent seekers more opportunity to create michief.

I don’t have an alternative right now. I do appreciate your rent seeking explanation. It’s a straightforward concept, but I can be a little dense sometimes.

I would like to see a article on specific problems rather then these broad stroke pieces.

This spectacular failure comes to mind

“It is one of the biggest conflicts in the history of the construction sector,” Areva Chief Operating Officer Philippe Knoche told reporters on Wednesday.

http://uk.reuters.com/article/2014/02/28/tvo-olkiluoto-idUKL6N0LX3XQ20140228

Not so many years ago this project was touted by the IEA and other neo – liberal agencies as the new model programme of multiple lowest cost contractor bids etc etc . (you end up with people who cannot pour concrete correctly)

Now the world is a rent collection sphere with millions of people doing pointless service jobs who absurdly service the needs of people who collect these rents.

Therefore the money is not available to increase or at least maintain the energy flux per person as the world is now a workforce of Avon girls.

The scarcity engine is ramping up to unheard of levels of profit taking.

There are so many assumptions in this article that I hardly know where to begin. I think I will start with “When polluters pay to use nature’s sinks, they use them less than when they’re free.” I have never seen any evidence of that. Polluters will fight tooth and nail, of course, to not pay costs, but if they are forced to, they will simply pass them on to customers, eg, us. How’s the price of gas these days, Hmm? Next is that imposition and payment of ‘protective’ rents will magically offset the damage to ‘nature’ — gee, will a big fine to TEPCO fix Fukushima? My guess is the reason that a team of international experts hasn’t been parachuted in to clean up the mess there is because *NO ONE* on earth knows how. Payments to govt will never reflect the real damage and most likely just melt away (like the mortgage ‘settlement’ bucks did). Dividends to taxpayers are simply blood money, corps give you some bucks (which, of course, comes from the customers in the first place) and you have to shut up. And the prices, set presumably by negotiation betw ‘stakeholders’? Hmm, that should work out well. Who will represent ‘nature’?

And last rant, promise, for today: Why are we still talking about ‘growth’ on a finite planet, the limits of whose carrying capacity are being assaulted from both directions? Wouldn’t stability be a better goal? And don’t get me started on what passes for ‘growth’!

Amen. No more growth please.

Everyone is stuck in the capitalist growth paradime, yet people think theyre thinking outside of it. Sad.

@Massinissa

The point of capitalistic growth is merely to increase the concentration of a select fews capital claims on the collective capital base.

Your take on pointless current growth schemes is therefore correct.

However it is dangerous to reject industrialization when so many people are now on the planet.

At current population levels it would be impossible to return to a solely agrarian existence – although it may be possible to combine the two in a hybrid fashion combining the relative advantages of both.

But to be honest we seem to be looking down into a suburban cul de sac.

Current neo liberal policies most especially seen in the EU involves dumping capital goods into hinterlands with very limited primary capacity to absorb such conduit products.

This gives the illusion of scarcity when in reality there is none.

Scarcity i.e. the going around in circles economy in search of scarce credit absorbs the inputs before they can be readily & effectively used by the great unwashed.

The simple purpose of a capitalistic system as defined by agrarian Belloc or Industrial CH Douglas is to maintain relative wealth disparities and nothing else !!!

its a quite fantastic method of social control.

Maybe, maybe not. Depends on the elasticities of supply and demand. For example, demand for gasoline is very inelastic in the short run, but not as much in the long run (e.g., people will switch to more fuel efficient cars).

Overall, though, your point is well-taken, in that the issues of rent and limits to growth aren’t the same (even if they’re slightly connected). Rent is always paid; the only question is who gets to pocket it. Limits to growth are a different matter entirely.

“Why are we still talking about ‘growth’ on a finite planet, the limits of whose carrying capacity are being assaulted from both directions? Wouldn’t stability be a better goal?”

Thank you for stating this. I’m sick of hearing that growth is the solution for nearly every economic problem, while ‘stability’ is never discussed as an alternative. Many U.S. cities rely on population growth to sustain their economies while their highways are increasingly congested and water resources can’t keep up with demand . I would like to see the mayor of a city say, “we are at optimal population, if the city continues to grow, the quality of life for our residents will decline.”

Anyone who believes this should be interested in oceanfront property I plan to sell – great value! – in the middle of the Sahara. ‘Surrendering’ rent to organizations that are driving ever-deeper to drill in ever more risky environments completely misreads the way they operate. They don’t think they are doing anything wrong, which means that even phrasing things as ‘surrender’ shows a kind of naiveté that plays straight into their modus operandi.

‘Small d’ democratic politics will require a better public understanding of real cost pricing, as well as better explanations of externalities. Those costs are very real, but at present they remain ‘invisible’ to much of the public. Once those costs are more obvious to more people, then ‘small d’ democracy might kick in.

About the article: I got as far as the diagram. It’s already clear that the definition of “rent” is profoundly confused.

I felt that too Charles, then got distracted into Yves’ hand-bagging Liberal. I wouldn’t really want to discuss rent on this basis either. What “economic rent” is is challenging, not least because most people think of stuff like renting houses or power tools when they hear the word rent.

I tend to agree with what Dork says above. I’d quite like to live in a log cabin detached from noisy neighbours (I’d accept a communal block with decent noise laws). I’d want green energy, a fibre-optic ‘wire’ and decent conservation including shared washing machines and such. Everything else is some kind of rent against me. This may sound selfish-parochial (like, say, some AAA feminists bleating about their plight rather than those expressing concern and solidarity with ‘scut-workers’). I just think, given modern technology, we could start the big data in what we actually want, admitting a certain indoctrination concerning what this is as a problem. We might get a working model of rent from this.

One can see big issues like inheritance, private property, ramping prices through scarcity and loads of wasted work in the Avonlady-to-derivatives-wrangler sector. One can see some of this doing typical 101 profit and loss and what we list as costs, the general idea being to drive these down, or treat them as exclusions (as with wages as tax credit, environmental damage as someone else’s problem). As Dork says, we can end up with people who can’t pour concrete – and I’d have to say too the savings often end up in increased finance charges.

There are adages in economics on this, like the King told his country’s economy needs decent maps to improve and then shafts it completely by hiring everyone as map-makers. What’s been going on is the deregulation of the rich along with the propaganda that capital is theirs, freeing them up to exploit highly regulated or corrupt situations.

The post’s conclusions are right, but I see no means in the model to achieve them. We haven’t even stopped the bankster bonuses. How far will I get with my claim as a former British Shipbuilder demanding a few million on the basis of “performance” because my industry cost the taxpayer much less?

Yep.

Call it what you wish, it’s all about stealing other people’s labor-value; always has been, always will be.

Not really. It’s about stealing—legalized theft–period. In principle, rent collectors could steal from owners of “true” capital, too. (Of course, the thing is that a huge fraction of “capital” is really rent-producing assets, not assets the capitalist has created and is using to add to production.)

The primary purpose of government has always been to enforce the [legal] theft of every damn thing.

After all, is there any other purpose to the organization of mankind other than facilitating the separation of the individual from his labor-valued earned?

Property absolutism is what allows costs to be externalized without the consent of others.

But it’s good to hear that humans want to become part of chimpanzee culture, where it’s okay for adults to stamp their feet and smack others around just because they have thugs who will back them up when they say “MINE”.

Your property rights are our permission and exist at the pleasure of the public consensus. Never, ever forget that.

I enjoyed both this article and the comments. Aside from the discussion of rent semantics and growth philosophy, the angle I would add is that the approach in this article seems to assume that ‘the market’ is valuing fossil fuels inappropriately, and thus, we need some sort of government action to address these market failures. I agree that there are specific areas where this is the case.

But that seems to miss the bigger picture story of environmental devastation. The problem is not a lack of government action; it is a government that is way too active in supporting the looters.

Of, by and for, even. It’s been so for several decades, and obscure thanks to the massive penetration of the mainstream conformity machine.

As a semi-educated layman I agree with people who have raised questions about the usefulness of talking about “rent” in academically specialized economystic jargonizational terms. People like me might better understand concepts like “forced truth-in-pricing” through “forced carbon taxing”. Of course the merchants of carbon will pass the tax onto the buyers of carbon. Its only fair. The buyers of carbon should not be allowed to escape the costs of buying and burning the carbon.

So-called “green” bio-carbon should be taxed at the farmgate or oil-press or wherever. The devastation caused by burning down rainforests to grow eco-desert palm oil plantations on the burned rainforests’ ashes should be figured out and charged as a tax. Fossil carbon should be taxed twice as high as bio-carbon to discourage the purchase of fossil carbon.

The money thereby raised should be spent on decarbonization efforts like restoring train/trolley/streetcar systems, mass-weatherizing of buildings, the broadscale condemnation and purchase of farmland recovered from former wetlands and the restoration of those wetlands to perform the air-carbon suckdown and bio carbon capture and storage they do so well. How much carbon has been skydumped burning the peat under the drained peat-forests of Borneo? How much of that skycarbon would be recaptured if the palm oil plantations of the former Borneo peatlands were shut down and the land re-wetted and the peat forest peat-buildup resumed?

Talk about it in terms like that which ordinary people can understand.

( And of course cornbelt ethanol should be taxed for its carbon skydumping throught the cornbelt as well. The buyers of corn ethanol should be forced to pay the entire cost of the soil-carbon burned off and skydumped to extract the corn from the soil. The corn ethanol growers would of course be paying the fossil carbon tax on whatever fossil carbon they skydump in their machines and facilities and rightfully pass that tax along with their own bio-carbon tax along to the buyer.)

“The current value of the world’s oil, coal and natural gas reserves is estimated at $27 trillion. Much of this will have to be written off if we phase out fossil fuels.”

— Stop reading, stupidity switch tripped. Hope you didn’t say anything intelligent after that. There is no way in hell energy reserves will ever be “written off”. They will be exploited until the cost of producing more exceeds the market value of the production. They will only be “written off” when they have no value. That $27 trillion will decrease to $0 or the marginal cost of production (same thing). Then we had better have an alternative, or regress to the 17th century, including population.