Yves here. This post summarizes a paper that argues that derivatives, specifically credit default swaps, exacerbated the severity of the European sovereign debt tsuris. This sort of analysis deserves a wider audience, precisely because the prejudice of both neoclassical and neoliberal economists is that markets are ever and always virtuous, and that prices are never wrong unless someone is interfering (with labor unions the preferred bad example).

By Anne-Laure Delatte, Tenured researcher, CNRS, Julien Fouquau, Associate Professor, Neoma Business School, and Richard Portes Professor of Economics at London Business School. Cross posted from VoxEU

In retrospect, it is striking that the sovereign bond spreads of peripheral Eurozone countries surged while the economic conditions were gradually deteriorating. This column provides a new explanation for this phenomenon. It suggests that the markets in credit default swap indices have exacerbated shocks to economic fundamentals. The same change in fundamentals had a higher impact on the spread during the crisis period than it had previously.

The job of government bond analysts has been tough since the Eurozone crisis started. They’ve had to tell their clients a story behind every single bond spread hike since the fall of 2009. The list includes concerns over peripheral sovereigns’ public finances, deterioration of the fundamentals, financial sector credit risk, and European institutional coordination failures.

In retrospect, however, it is striking that aside from Greece, the sharp rise of peripheral sovereign bond spreads and their volatility is hard to reconcile with the underlying economic fundamentals. Spreads surged suddenly, while the economic conditions were deteriorating gradually.

- In Spain, for example, the public debt amounted to less than 60% of GDP even by end-2009.

- The Italian primary fiscal surplus implied that if interest rates had stayed low, only modest fiscal adjustment would have been necessary to service the debt.

Even invoking a broader set of news seems insufficient to explain the sudden eruption of the crisis. Unemployment and trade deficits had been increasing gradually. Weaknesses in the banking sector also appeared only gradually after the burst of property bubbles.

Non-Fundamental Factors

This suggests that some non-fundamental factor exacerbated shocks to economic fundamentals of peripheral European countries. That is, the same change in a fundamental may have had a higher impact on the spread in the crisis period than it had previously.

Previous research describes two different regimes, crisis and non-crisis, with additional fundamental factors important in the crisis regime (Aizenman et al. 2011, Gerlach et al. 2010, Montfort and Renne 2012, Favero and Missale 2011). These papers usually attribute nonlinearities to the fiscal situation. They find that yield spreads have become much more sensitive to fiscal imbalances after 2008, with a deterioration of fiscal indicators generating a significant widening of the spreads after 2008. But the crisis may have other than fiscal roots. Attributing amplification dynamics only to fiscal imbalances – an exogenous driver – is questionable in the light of recent advances in the study of financial market dynamics.

There is now extensive theoretical research stressing the importance of amplification dynamics in asset pricing, including sovereign debt markets. For example, the initial drop in asset prices will be exacerbated if it triggers fire-sale liquidations driven by the deterioration of the mark-to-market portfolio value. Relatively small shocks can imply large spillover effects (Brunnermeier and Pedersen 2009).

In our new paper (Delatte et al. 2014), we draw on recent research on financial crises to explore such dynamics in the sovereign bond markets of Eurozone peripheral countries. We explicitly test three hypotheses.

- First, the nexus between sovereigns and banks observed during the crisis (Gennaioli et al. 2010, Huizinga and Demirguc-Kunt 2010, Acharya and Steffen 2013) may have created a nonlinear relationship which goes both ways and features some amplification in the sovereign risk.

- Second, adverse liquidity effects on Eurozone banks have been documented during the crisis, including a significant fall of interbank loans after mid-2010 (Allen and Moessner 2013).

So, we examine the effects on sovereign risk of a negative externality due to fire-sale liquidation of assets by testing whether liquidity shocks have had self-reinforcing effects on sovereign bonds.

- Third, we explore the hypothesis that derivatives produce nonlinear systems (Brock et al. 2009) by investigating the effects on the sovereign price of credit default swaps (CDS), the most active credit derivative market.

Two co-authors of this paper have previously documented an adverse influence of the sovereign CDS on the underlying bond pricing when bearish investors use these instruments to express their views on the sovereign credit (Delatte et al. 2012 and Palladini and Portes 2011). But we know much less about the effects of financial sector CDS on the market’s evaluation of sovereign risk. In a down-cycle, their effect on the cash market may feed back to the sovereign risk. To explore this hypothesis, we focus on synthetic CDS indices which cover default risk on various pools of corporate entities because their standardization and liquidity make them the instrument chosen by investors to express views on market segments. We test whether a rise in CDS spreads amplifies the risk of sovereigns.

We estimate equations for the sovereign spreads of five European peripheral countries: Spain, Ireland, Italy, Portugal, and Greece over the period January 2006 to September 2012. We use a panel smooth transition regression technique, which allows us to locate when the transition to a new regime began and how fast it proceeded. Our estimates confirm the feedback loop from banks to sovereigns – the deterioration of financial names’ credit risk makes bond investors more risk-averse, so a shock to a fundamental is amplified when it is priced in the spread. This effect begins to operate in the autumn of 2010.

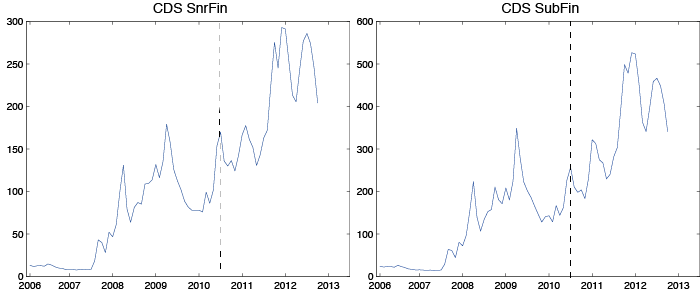

In addition, we uncover the channel through which the feedback operated, i.e. the price of two corporate CDS indices that cover financial names, i-Traxx Financials. Shocks to fundamentals are amplified when the price of financial CDS sub-indices increases. Figure 1, which plots the evolution of both financial CDS sub-indices, shows that their spreads fell from the 2009 peak to early 2010, then rose again up to autumn 2010 – the point at which the effect we identify begins to appear – and reach a second peak, significantly higher in 2012, when peripheral sovereign risk holdings of European banks put the entire Eurozone at risk.

Indeed, CDS are not only a measure of risk but also short positioning vehicles used by investors to express their views on credit. Market anecdotal evidence reports that from mid-2010, some traders have taken positions on the i-Traxx Financials to leverage their views on credit risk in the financial sector due to rising sovereign risk. As an example, ETF.com – a publication focused on financial indices – reports in June 2011: “The two indices have been closely correlated – sovereigns have bailed out banks and banks are holding government debt.” (The i-Traxx SovX Western Europe includes the 15 most liquid sovereign CDS contracts.)

The up-front principal in buying CDS indices is small or zero. These instruments create high leverage. We conjecture that the large amplification effects detected by our estimates result from the high leverage on CDS indices and their late introduction into the market. In the context of the subprime crisis, Geanakoplos (2010) stresses that the late introduction of standardized CDS contracts into the mortgage market in 2005 precipitated its downturn, because the derivatives allowed the pessimists to leverage their credit views. Similarly, standardized CDS contracts on European corporate names were introduced in 2004 when the Europe i-Traxx index was launched. One consequence was that bearish investors had an opportunity to leverage after the market reached a peak, which magnified the depression of financial name prices in the context of the feedback loop between banks and sovereigns.

The International Monetary Fund has sought to rebut arguments that the sovereign CDS markets, in particular ‘naked’ CDS contracts, could be destabilizing (e.g. Global Financial Stability Report April 2010). Recently, the Fund took a broader look and concluded: “The empirical results presented in this chapter do not support many of the negative perceptions about sovereign CDS” (Global Financial Stability Report April 2013, Ch 2). We suggest they may have been looking in the wrong place and with inadequate tools. Theory exploring the dangerous bank-sovereign loop is supported by our results, in which financial CDS index derivatives appear to play a key role. Sovereign bond investors and regulators should monitor the credit derivative market carefully.

Figure 1. Financial i-Traxx Sub-indices

Please see original post for references

Monitoring the credit derivative market is not only important but essential too otherwise we will not be calling doomsday to happen but actually embracing the same. We should not forget that in the US the real problem during 2007 economic recession was actually started from Subprime Crisis. It became a full blown economic crisis when failing of the asset class led to collapse of the derivatives that were created on the basis of this wrongly structured asset (Subprime Mortgage). In fact, I also heard that there were many derivatives in the market that were created on the prediction of weather. Therefore, monitoring and regulating credit derivative market is not only important but also essential.

Reaching for what Mitchell teaches:

Language matters! Eurozone countries are not sovereign wrt. deficit spending. The decision whether to default or not is only partially up to them.

According to the authors, there were two peaks, one in 2010, one in 2012. If I read things like:

I have an idea what might have driven up interest rates without having to grasp at derivatives.

Add to this

and again, rising interest rates in light of default/debt cuts make perfect sense. And if this was done for one Eurozone country, it could have been expected for others as well, hence the spillover effects.

Speculators are aware that the decision to default/perform a debt cut depends on the ECB (or more generally the Troika) and react to their actions and statements, no matter the macroeconomic indicators of the (fiscally none-sovereign) countries.

The fact that a country which should have been fine was driven to the brink of financial collapse suggests not just investors “expressing their views” but active (and nefarious) market manipulation. Derivatives would indeed be the cause if that’s the case because any player besides a megabank needs the kind of leverage derivatives provide to move these markets.

As far as I’m concerned, there never was any mystery, derivatives have had, and continue to have a negative affect on the world economy.

There is a very small chance that your house will burn down if only you have insured it.

OTOH, if anyone at all is allowed to purchase insurance on your house, the chances of it burning down rise sharply

I originally posted this at FDL over two years ago, March 2nd 2012;

From the Financial Times;

So the ISDA says; Hold on there Baba-Louie, there’s no event here, at least this week.

Come back next week and we’ll have a better excuse, hopefully.

It’s about time I quit hearing crickets every time I mention that the CDS market is having a profound effect on the ‘Greek debt crisis’.

The CDS market is making sellers rich and making

sophisticated investorsspeculators salivate at the prospect of reaping gigantic windfalls for no other reason than their willingness to place large wagers based on their not-so-sophisticated understanding that Greece is bound to go into default.So now that the ISDA has finally found its back against the wall, they’ve decided that there will be no pay-out because that would be a really bad thing, and off the top of their heads they say that there has been no actual credit event, so hold onto those tickets folks.

Of course that is pure hogwash, but come back next week and we’ll have a better reason.

The sellers of CDS contracts have sold their products based on all the rest of the worlds shakey sovereign debt, and they’ve sold contracts based on each others default.

If Greece defaults, the rest of dominos will fall also, and in turn all the holders of CDS contracts are going to line up at the cashiers window, and game over, the banks selling CDS default themselves.

The reason they’ve decided to stonewall on paying is not that they think they can ‘get away with it’ it’s because they must ‘get away with it’ they cannot admit the default has occured because they cannot now, and have never been capable of paying off in the event of this sort of situation.

Bill Gross’ statement reminds me of the famous line about why the gambler continues to play in the crooked dice game;

“I know it’s crooked, but it’s the only game in town.”

I’m too far gone on economics as stupid to stay long even with argument like this I agree with. Markets are far more complex than a subject that works by excluding direct observation and unsuitable evidence can cope with. It’s more or less impossible to do due diligence even on consumer products, let alone these gambling ploys.

The insurance of bets by derivatives takes place in a gambling system. All gambling systems require mug punters. This is where the money to pay off winners and fund the bookies comes from. It’s a zero-sum game. One might back joint stock venture pirates rather than dogs, but this just widens the circle one needs to draw to find the mug punters, the losers. Such systems cannot create capital, they just redistribute symbolic buying power.

A lot of people like each-way bets (there are more complex perms). These appear to give the punter more chance, but actually just let you lose quicker. The odds for on-the-nose selections are actually better. Perms don’t work, but you can sucker people into them for a 10% fee. This simply means you are betting with other people’s money. Insurance is essentially a reserve from which to pay out if the fickle finger of fate picks out your boat to sink. In a gambling system, insurance is impossible though further bet placement – otherwise there is no gambling. Derivatives are merely an attempt to drag in more mug punters who actually don’t place any bets and cover for Ponzi losses. That’s where ‘we the public’ come in. I don’t know when we’re going to wake up. They are telling us putting money in shoe-boxes and letting it breed makes us all better off. Worse, they toss us empty shoe-boxes to live in. We must give up the liquid assets to their “care”.

Life is a gamble. The dinosaurs were not well-hedged against that asteroid. And we are not hedging ourselves against the real gambles of life. The madness we can’t confront, even with decent analysis like this on derivatives, is that of trying to argue with power. We have to expose its brutality and recognise we can do better with some honest technology. Much as we must welcome research like this, we are still in the position of supplicants in the power debate. The banks are somehow “making money” even though we have stopped them selling thieving non-insurance like PPI and interest-rate swaps (supposedly). How could this be if they couldn’t make money without this thieving before? We have fewer burglars these days. They have moved on to other crimes. Why should we suspect other of banks that turned many decent people into thieves? The clerks who sold PPI to us or just added it to our loans when we weren’t looking committed fraud as surely as any scum teemer and lader I ever nicked. We are missing the sheer criminality of finance.

This was a great comment. I can’t get mine thru, no doubt because I don’t understand the labyrinth of modern finance. Your “In a gambling system, insurance is impossible through further bet placement – otherwise there is no gambling” says it all really. I’m trying to insinuate the concept that sovereignty controls the financial process not because it can afford more leverage, but because leverage controls time. Insurance is a gamble against time; sovereignty is a dedication to work through time.

I see some time connections, though at the moment don’t understand Susan’s. Lots of businesses want to buy time. We teach them to do this through cash flow and such. Robbing Peter to pay Paul is something most of us have to do at some time. Repos originated in cash flow dodges. I’ve know all kinds of decent business people who lied to their banks, used cash from credit cards to fund the business through a bad patch and a lot more. The idea wasn’t fraud, but to keep the business going until the good times came again. The intents (or better mens rea) in play now have shifted to criminal greed.

Accounts are timed to show a certain picture that pays bonuses, gets those share allocations – and this has all become not much different than a cricket player paid to bowl a no ball at a certain time. Those trainers claimed as sold when merely landed at docks may sell in the future (or not), but do pay bonuses now, do inflate stock prices now. The repo 105s claimed as sales might be covered by some real sales next year. Timing is key in all this. Sooner or later one is caught with a hole and nothing to fill it with. Being paid enough to be able to run off before holes are found is also related to time. The bonuses of the hole hiders amount to a lifetime’s earnings in a year. Timing exits to leave before hole discovery becomes key and short-term compared with days when CEO-CFO pay was low.

The manufacturing subsidies we were paying out remind me of the derivatives market. It was all about staying in business to be able to scoop the market share when the business cycle went on a rise (prices go up in a sellers’ market). Yet the great day never came. You couldn’t last long enough through burn rate time. I suspect derivatives are hiding structural obsolescence, a banking structure past its sell-by time. In the end it is all false-accounting creating false hope. None of the excess money capital is real other than in the way its control stops us doing the sensible. We need to live in a new time – modernity. Current time is a medieval derivative.

Great comment.

The same sentence Susan quoted really caught my eye, too.

JOBS

Carter-started with 80,6923 ended with 91,031—added 10,339

Reagan—91,031– 107,133–added 15,602

Bush I—107,133—109,726–added 2,593

Clinton—109,726—132,466-added 22,740

Bush II—132,466—133,631–added 1,216

Obama—133,361—134,839–added 1,208 (first term)

wikipedia

I’m confused. What do these figures mean? How do they relate to this Naked Capitalism article? Which article(s) was consulted in Wikipedia?

I see this post on derivatives, and especially on credit default swaps (CDS), as being closely intertwined with the article here about the Troika’s destruction of democracy in the EU two days ago by Don Quijones (4/16/2014), including the looting of entire nations through privatization of publicly-owned assets and other mechanisms.

Not to defend these highly manipulated and controlled financial markets being supported with public money and resources in a caricature of capitalism, but there was no transparent public market for CDS in 2007. They were all privately placed.

As an aside, peaceful civil protests, petitions, and other peaceable efforts to develop and implement alternatives democratically have been suppressed, sometimes brutally.