By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Originally posted at MacroBusiness

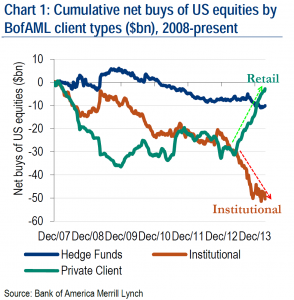

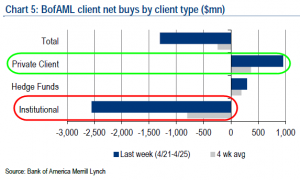

From BofAML:

Citi is in no doubt that retail has it right:

• The DJIA posted a bullish outside month in April. This is only the 3rd time that has happened since the 2009 lows (July 2009 and October 2011 being the other two). The S&P barely missed a 4th bullish month since the 2009 lows (Needed to close above 1883.97 and actually closed at 1,883.95) and the 2nd this year (February being a bullish outside month in the S&P).

• In addition the chart of the VXN (volatility of the NASDAQ) suggests that lower levels of volatility and a higher NASDAQ are also in prospect. In addition the VIX (volatility of the S&P) may well set new trend lows.

• On top of this the Dow Jones Utility Index is testing the all-time high and the Dow Jones Transportation Index has posted a record monthly close.

• While this bull market in equities is stretched at this stage it does not yet show the classic signs of a bubble top. We continue to preach “skeptical participation” while believing that an improving, self-sustaining economic recovery (despite yesterday’s GDP number) will be supportive for the Equity markets in general in the months ahead.

• While there is no doubt that some individual “high flying” stocks (NASDAQ and Biotech) have suffered some severe down moves it does not look to us that this is a broad based turn but rather a “rotational” move.

• The broad based indices (S&P 500, DJIA, DJ Transportation) all continue to look constructive and even the NDX looks set to recover its losses.

• Despite the poor GDP “print” yesterday we retain the bias (As per recent Techamental pieces) that a “self-sustaining” recovery in the US economy is actually building and that Q1, 2014 will turn out to be just a “bump in the road”

• If this is correct then we would expect that the broad based markets will continue to post higher highs in the coming months and that “Buy in May is the Equity play”

With respect, since when was a rotation from growth into defensives like utilities and transport a good sign for the underlying cycle? Trees meet woods.

Bonds agree with the 30 year still rallying hard despite a solid ISM print at 54+. Yields hit a clear new low at 3.4%, down 1.5% on the night:

That could be a bullish falling wedge pattern forming, or just a channel down! The 10 year also rallied hard, the yield dropping 4 points to 2.6% and right on its support line within a clearly bearish descending triangle pattern:

Equities look more dumb than smart to me today.

Equities look more dumb than smart to me most days. Between the incessant meddling of the elephant Banksters and their HFT …

The talk about a self sustaining recovery is really strange, considering the recession occurred in 2008-9, with systemic factors really hitting the fan as early as 2007.

That puts us at 5-7 years since the crisis and the recovery started. Instead of searching for a recovery, shouldn’t we be looking for another bubble to pop at this point?

That is, the longest period between recessions in this country is 10 years. Usually it’s 5 to 10 years between downturns.

Personally I don’t “get” the equities markets particularly at this time. But I do know this–all policies both corporate, regulatory, governmental aim to keep markets stable and moving in a generally upward direction and, so far, these policies have worked for those that count in this country. I have believed for many years now that bubbles are sustainable as long as they are relatively small and not fueled by the most blatant kinds of fraud that we saw in the early 00’s. We are now a society limping along with minor fraud and minor bubbles–we know no other form of life and, in my view, no other system than the one emerging can exist considering where we are as a culture. Smoke and mirrors can work for quite a while and the confidence fairy does actually exist.

Good points. If I can offer a suggestion in how to consider (especially U.S.) equities markets, divorce your sense of the economy from the matter and view them exclusively in terms of liquidity. While economic prospects *should* determine ongoing trajectories, that’s only because that *should* translate into according risk appetites and therefore, money flow. QE3 and its ilk have pretty much busted this relationship. Track the Fed balance sheet versus any of the broader indices, and since late 2012 the relationship is pretty much linear.

I also question the health of many firms and the broader economy when we seesaw between anemic and modest growth despite ultralow rates. It’s difficult for me to believe that enterprises that if financed at slightly higher interest would prove uneconomic are well considered to begin with. And it’s this activity, the marginal stuff that policy seems fixated on encouraging.

P.S.

I’m glad this isn’t a stock talk website, but given the quality of our hostess and thoughtfulness reflected in reader’s comments, I would love to see other participants’ perspectives about markets more regularly.

I tend to agree with you, but NC is a nice respite from the infinite “stock-talk” sites out there. It also might attract the wrong crowd, ie. people like me.

It is EZ to achieve that governmental aim of keeping the markets stable with the ability of a monetary sovereign to print as much stock-buying money as it desires.

Under MMT, the markets can never crash nor the government run of money. Only if someone fails at his job will that happen. Luckily, once the aim is clear, backed by a strong will, the elites shall triumph.

I’ve been reading stuff like this for 4 years. How much money do you want to lose before you start crying? Eventually the Doomers will be right, eventually, at some point, someday — but they have been wrong, wrong, wrong about nearly everything for 4 straight years. Wrong about the economy, wrong about the Eurozone, wrong about banks, wrong about housing, wrong about the market, wrong, wrong, wrong. Somebody might even say they really don’t have a clue what they’re talking about. Frankly, nobody seems to. This is just “postive” analysis, it’s not “normative” posturing. Then they turn to politics and write about that, since there’s no way to ever be wrong about politics, unless it’s a factor in their market predictions, and then they are wrong about it. Beware, you will waste years of your life reading macroeconomics, when you could have been absentmindedly staring out a window. And you’ll be poorer for it in every way.

Other than some niche, thoughtful long term hold, ideally w/ insider information and maybe some very dull dividend chasing, hasn’t retail stock buying proven to be essentially participation on the loosing side of wealth stripping?

If it’s only about yourself, then what you say is correct, that is, transfer wealth to yourself any which way you can [if that makes you happy]. But, if it’s about this society, this period of time will be viewed as one of the darkest in American history.

We know that the first stage of psycho-social development in newborns and infants is either to trust or to mistrust. Those children who can come to rely upon mom and dad, develop a more secure attachment via trust. Usually, data shows us that the first 5 years of child’s life is most important to their future well-being and it starts with trust according to family scientist Erik Eriksen.

However, when it comes family resource development for young, middle and aging market infants, it is buyer beware, gambling for resurrection, and trust no one. In this world, trust is a commodity from which to manipulate families 20 different ways to Tuesday from birth to death. I appreciate Smith’s question here, but the central issue for most of us involves trust and in this analysis (it seems dumb to invest our limited resources in markets, large corporations and with people) who have repeatedly abused trust. Lastly, the rocket science of the market being at all-time highs should be a cause of worry, and a lack of trust.

Shame on you once – Shame on me twice

IMO the financial markets have been and are being used as a policy tool. Never in human history have financial asset prices been pumped and supported by the public’s money and the resources of an entire nation as they have over the past five years in this “socialism for the rich” parody of capitalism. The only missing component in this broken money transmission mechanism is state ownership of the stocks of these corporate entities we are all indirectly funding for the benefit of a small segment of the population.

With their daily stick saves, the financial markets have an “Offer you can’t refuse” look and feel to them: Rising asset prices in exchange for immunity from prosecution and “QE-ZIRP Bucks” to finance stock repurchases, dividend payouts, and pump prices?

I believe these markets will follow the political cycle, and view the last two years of Dubya’s admin as the most likely template. However, the Fed’s gradual rollback in QE-ZIRP in the face of overwhelming evidence of its lack of efficacy may result in an earlier “correction” as another “taper tantrum” can be expected. Unfortunately for all of us, the “financialization” of the economy cautions one to be careful what you wish for: Increased domestic fiscal spending.

The Fed Funds Rate remains barely above zero; its trend has been downward for the last several years and will likely continue downward toward zero, with small fluctuations, especially since there’s no portent of wage inflation. As the old saying goes, “Don’t fight the Fed.”

Wait! I thought you guys hated corporations (unless they’re banks, Mr. Bill Black?)

But not so much that you won’t own them?

“Because this Fed-sponsored bubble can get even bigger before it pops, and I will know when that is and be able to get out just in time” is not a good reason to be buying (or even holding) over-valued stocks.

Our enduring obsession with the stock market as though it was an American entitlement or a source of enrichment is absolutely absurd. Face it folks, for the 99% ers, it’s about Wall Street and Washington predators who have perfected rigging to the highest levels. They’ve almost always had more computer power than any other entity on the planet and they’ve also begun to know how to use it. For good measure, they’ve written the rules for you to be completely defenseless whenever they choose to make you so. Good luck.

You have to understand money and what it represents to fully comprehend the magnitude of the fleecing that the majority of Americans have been subject to since the FED set up shop a century ago.

The equity markets are simply one expression of this manipulation.

Bankers are not your friends.

So says the major religions, Dante and some of the most famous men in history but Progressives think they can regulate them.

Question? What do you call someone who regulates theft if not a thief himself?

a politician.

Sorry all you DC boneheads that read this blog. If you read the peanut gallery that is. Sorry to piss youze off there in the swamp among the monuments of marble that we all know like back streets in the hometown of the soul. Some of youze should probably take the Hippocritic Oath — first I will do no harm (to any rich person). then I will bomb places. then I will wrap myself in the flag and go to sleep. then I will go to work for Citicorp and I will break into joyous song . . . Oh beautiful, for specious lies, for somber waves of pain, for purple mounds of misery, across the looted plain, Scamerica, Scamerica, God’s hid His face from thee, and drowned thy good in banksterhood, from sea to shining sea. . . Then I will retire to a country house.

This must have been how Mr. Carraway felt when he got back to the Midwest after his riotous excursion into the canyons of New Yawk and the lawns of Long Island under the lamps and lights and sparkling tables on Gatsby’s lawn, a little universe 100 yards wide on the shore of a night-dark sea, the illuminated faces beautiful then weird then filled with the horror of a recognition of a depraved indifference. The emotional exhaustion, the spiritual nausea, the desire for some sort of moral clarity, the hunger for something more than food, more than wine, more than money, more than glad hands and good words filled with a false hilarity. Some people would turn to nature, some to God, some to ideas of order, some to love and family, some to an unutterable pain they would polish in their souls until it was a pearl or until it killed them. Some would loaf and lay around — that’s what sounds to me like a plan, but Youtube is even better. Not that I’d be very good as a politician either, to be honest. It’s easy to criticize but sometimes you just can’t help it. LOL

Profound observations in your second paragraph, craazy. Thank you. Wish I could respond more adequately than this quote from Camus:

“Although “The Myth of Sisyphus” poses mortal problems, it sums itself up for me as a lucid invitation to live and to create, in the very midst of the desert.” —Albert Camus [ http://iheartlahs.com/wp-content/uploads/2014/02/Camus-Myth-of-Sisyphus-and-other-readings.pdf ]

Better get out that easel myself. It has been too long.

Money is a religious tenant from antiquity, see history.

Btw, David was pretty bloody himself.

For most retail the recession started in 2007. Since then it has been a roller coaster ride.

Up one month, down two, up two months, down one; always down the first three of the year.

Lots of retail stores in our industry have closed, however there are still three competitors open in our town. But on the supplier side of things not one supplier has gone under. Shows you where the profits are: distribution.

It’s only been seven years. By 1930 standards we only have another 3 to go until we will be out of it.

I’m with Craazy. This stuff has been about for years and no one seems to know anything. Retail might be buying because they are priced out of bonds by cheap money and not having the inside smarts to know when to get in and out of high yields. And who knows how to read a balance sheet and P & L now? How much of any of the accounts available concern anything real or rely on fictitious money potentially gone tomorrow? What effect is buy-back having? What leverage is involved? What are the property valuations? How much is bent accounting inflating value? And what has happened to stock markets as a means to raise money for productive investment?

My guesses are based on whether any honesty has returned and all I see is business-as-usual.

So my guess is the smart money is already gone, waiting for a crash, gone to foreign property, and overall waiting to get in before a period of big inflation.

Yep.

Emerging markets and alternative financial products other than equities, e.g. bonds, annuities, REIT, etc. The “smart money” still has equities in their portfolios, they have merely pared down the percentage. They’ve been calling bubble pricing in equities and an upcoming correction for several months now, maybe longer. Or so I’m told by people at a reputable and conservative firm that manages money and historically made above average returns for their very wealthy clients. It’s turned out to be a bad call thus far. To quote one of the financial advisors, “You might be able to predict the moves in the market, but you’re foolish to think you can predict the timing”. He says he’d rather take the smaller hit by acting too early than the big hit by missing the pop in the bubble.

OTOH,

“One can make an argument about the stock market being overvalued, but the corporate profits that should underlie valuations are certainly in pretty good shape. [snip]

As a percentage of GDP, corporate profits reached a record of 10.8%. Compared to national income, profits are nearly at a record, at 11.7%. Either way, bottom lines are in pretty good shape.”

What bubble? Corporate profits reach new record as share of GDP

Yep folks. Corporations are making fistfuls of money, money from increased productivity they aren’t sharing through hiring or raises for current employees, or even dividends to shareholders. Corporations are people, folks! And people want to hang onto their wealth. Instead those in the C-suite pad their bonuses by eliminating more highly compensated workers and positions.

The world becomes easier to understand once you forsake forever the assumption that material assets and claims against assets, including money, posses an intrinsic property called “value.” Money is not a store of value, because you can’t store what doesn’t exist.

I don’t believe the market has at all correctly discounted events in Ukraine, or the quivering debt elephant in China, or the crushing of consumer spending in Japan, or ole England, drunk on another housing bubble, or much of Europe still severely damaged or a number of other tripwires to consider. I think Yellen would at least like to finish her ‘taper’ but is not doctrinal on that point. But what I see now 5 years and 8 before that as disastrous, tragic horrors at a time real leadership could’ve gone a long way towards success and with strong public backing.

The public’s credit should ONLY be extended for the general welfare and not so the so-called creditworthy can leverage their equity or income.

As for past injustice, hand out new fiat (after banning new credit creation to keep banks from frontrunning it). Then people will have far less need to borrow in the first place!

Repeat till it sinks in: No one is worthy of stolen purchasing power!