Yves here. On the occasion of an all-time high, a hard look at how the Dow Jones Industrial Average is constituted is in order.

By Wim Grommen, a teacher in mathematics and physics and later a trainer of programmers in Oracle software. He has also studied and written about transitions, social transformation processes, the S-curve and transitions in relation to market indices. His paper “The present crisis, a pattern: current problems associated with the end of the third industrial revolution” was accepted for an International Symposium in Valencia: “The Economic Crisis: Time for a paradigm shift, Towards a systems approach”

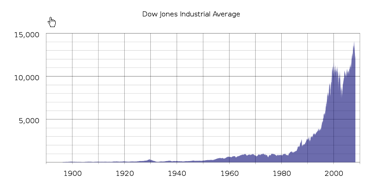

The Dow Jones Industrial Average (DJIA) Index is the only stock market index that covers both the second and the third industrial revolution. Calculating share indexes such as the Dow Jones Industrial Average and showing this index in a historical graph should therefore be a useful way to show which phase the industrial revolution is in. Changes in the DJIA shares basket, changes in the formula and stock splits during the take-off phase and acceleration phase of industrial revolutions are perfect transition-indicators. The similarities of these indicators during the last two revolutions are fascinating, but also a reason for concern. In fact the graph of the DJIA is a classic example of fictional truth, a hoax.

Transitions

Every production phase, civilization or other human invention goes through a so called transformation process. Transitions are social transformation processes that cover at least one generation. In this article I will use one such transition to demonstrate the position of our present civilization and its possible effect on stock exchange rates.

A transition has the following characteristics:

– It involves a structural change of civilization or a complex subsystem of our civilization

– It shows technological, economical, ecological, socio cultural and institutional changes at different levels that influence and enhance each other

– It is the result of slow changes (changes in supplies) and fast dynamics (flows)

A transition process is not fixed from the start because during the transition processes will adapt to the new situation. A transition is not dogmatic.

Four Transition Phases

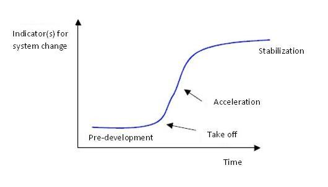

In general transitions can be seen to go through the S curve and we can distinguish four phases.

Figure 1: The four phases in a transition best visualized by means of an S curve: Pre-development, Take-off, Acceleration, Stabilization.

1. A pre development phase of a dynamic balance in which the present status does not visibly change

2. A take off phase in which the process of change starts because of changes in the system

3. An acceleration phase in which visible structural changes take place through an accumulation of socio cultural, economical, ecological and institutional changes influencing each other; in this phase we see collective learning processes, diffusion and processes of embedding

4. A stabilization phase in which the speed of sociological change slows down and a new dynamic balance is achieved through learning

A product life cycle also goes through an S curve. In that case there is a fifth phase:

5. The degeneration phase in which cost rises because of over capacity and the producer will finally withdraw from the market

When we look back into the past we see three transitions, also called industrial revolutions, taking place with far-reaching effect :

1. The first industrial revolution (1780 until circa 1850); the steam engine

2. The second industrial revolution (1870 until circa 1930); electricity, oil and the car

3. The third industrial revolution (1950 until ….); computer and microprocessor

Dow Jones Industrial Average (DJIA)

The Dow Index was first published in 1896 when it consisted of just 12 constituents and was a simple price average index in which the sum total value of the shares of the 12 constituents were simply divided by 12. As such those shares with the highest prices had the greatest influence on the movements of the index as a whole. In 1916 the Dow 12 became the Dow 20 with four companies being removed from the original twelve and twelve new companies being added. In October, 1928 the Dow 20 became the Dow 30 but the calculation of the index was changed to be the sum of the value of the shares of the 30 constituents divided by what is known as the Dow Divisor.

While the inclusion of the Dow Divisor may have seemed totally straightforward it was – and still is – anything but! Why so? Because every time the number of, or specific constituent, companies change in the index any comparison of the new index value with the old index value is impossible to make with any validity whatsoever. It is like comparing the taste of a cocktail of fruits when the number of different fruits and their distinctive flavours – keep changing. Let me explain the aforementioned as it relates to the Dow.

The False Appreciation of the Dow Explained

On the other hand, companies in the take-off or acceleration phase are added to the index. This greatly increases the chances that the index will always continue to advance rather than decline. In fact, the manner in which the Dow index is maintained actually creates a kind of pyramid scheme! All goes well as long as companies are added that are in their take-off or acceleration phase in place of companies in their stabilization or degeneration phase.

On October 1st, 1928, when the Dow was enlarged to 30 constituents, the calculation formula for the index was changed to take into account the fact that the shares of companies in the Index split on occasion. It was determined that, to allow the value of the Index to remain constant, the sum total of the share values of the 30 constituent companies would be divided by 16.67 ( called the Dow Divisor) as opposed to the previous 30.

On October 1st, 1928 the sum value of the shares of the 30 constituents of the Dow 30 was $3,984 which was then divided by 16.67 rather than 30 thereby generating an index value of 239 (3984 divided by 16.67) instead of 132.8 (3984 divided by 30) representing an increase of 80% overnight!! This action had the affect of putting dramatically more importance on the absolute dollar changes of those shares with the greatest price changes. But it didn’t stop there!

On September, 1929 the Dow divisor was adjusted yet again. This time it was reduced even further down to 10.47 as a way of better accounting for the change in the deletion and addition of constituents back in October, 1928 which, in effect, increased the October 1st, 1928 index value to 380.5 from the original 132.8 for a paper increase of 186.5%!!! From September, 1929 onwards (at least for a while) this “adjustment” had the affect – and I repeat myself – of putting even that much more importance on the absolute dollar changes of those shares with the greatest changes.

How the Dow Divisor Contributed to the Crash of ‘29

From the above analyses/explanation it is evident that the dramatic “adjustments” to the Dow Divisor (coupled with the addition/deletion of constituent companies according to which transition phase they were in) were major contributors to the dramatic increase in the Dow from 1920 until October 1929 and the following dramatic decrease in the Dow 30 from then until 1932 notwithstanding the economic conditions of the time as well.

Dow Jones Industrial Index is a Hoax

In many graphs the y-axis is a fixed unit, such as kg, meter, liter or euro. In the graphs showing the stock exchange values, this also seems to be the case because the unit shows a number of points. However, this is far from true! An index point is not a fixed unit in time and does not have any historical significance. An index is calculated on the basis of a set of shares. Every index has its own formula and the formula gives the number of points of the index. Unfortunately many people attach a lot of value to these graphs which are, however, very deceptive.

An index is calculated on the basis of a set of shares. Every index has its own formula and the formula results in the number of points of the index. However, this set of shares changes regularly. For a new period the value is based on a different set of shares. It is very strange that these different sets of shares are represented as the same unit. In less than ten years twelve of the thirty companies (i.e. 40%) in the Dow Jones were replaced. Over a period of sixteen years, twenty companies were replaced, a figure of 67%. This meant that over a very short period we were left comparing a basket of today’s apples with a basket of yesterday’s pears.

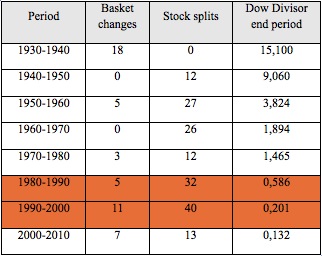

Even more disturbing is the fact that with every change in the set of shares used to calculate the number of points, the formula also changes. This is done because the index, which is the result of two different sets of shares at the moment the set is changed, must be the same for both sets at that point in time. The index graphs must be continuous lines. For example, the Dow Jones is calculated by adding the shares and dividing the result by a number. Because of changes in the set of shares and the splitting of shares the divider changes continuously. At the moment the divider is 0.15571590501117 but in 1985 this number was higher than 1. An index point in two periods of time is therefore calculated in different ways:

Dow1985 = (x1 + x2 +..+x30) / 1

Dow2014 = (x1 + x2 +.. + x30) / 0.15571590501117

In the 1990s many shares were split. To make sure the result of the calculation remained the same both the number of shares and the divider changed. An increase in share value of 1 dollar of the set of shares in 2014 results is 6.4 times more points than in 1985. The fact that in the 1990s many shares were split is probably the cause of the exponential growth of the Dow Jones index. At the moment the Dow is at 16,437 points. If we used the 1985 formula it would be at 2,559 points.

The most remarkable characteristic is of course the constantly changing set of shares. Generally speaking, the companies that are removed from the set are in a stabilization or degeneration phase. Companies in a take off phase or acceleration phase are added to the set. This greatly increases the chance that the index will rise rather than go down. This is obvious, especially when this is done during the acceleration phase of a transition. From 1980 onward 7 ICT companies (3M, AT&T, Cisco, HP, IBM, Intel, Microsoft), the engines of the latest revolution and 5 financial institutions, which always play an important role in every transition, were added to the Dow Jones.

Table 1. Changes in the Dow, stock splits and the value of the Dow Divisor after the market crash of 1929

Figure 2. Exchange rates of Dow Jones during the latest two industrial revolutions

During the last few years the rate increases have accelerated enormously.

Overview from 1997 : 20 winners in – 20 losers out, a figure of 67%>

September 23, 2013: Hewlett – Packard Co., Bank of America Inc. and Alcoa Inc. will replaced by Goldman Sachs Group Inc., Nike Inc. and Visa Inc.

Alcoa has dropped from $40 in 2007 to $8.08. Hewlett- Packard Co. has dropped from $50 in 2010 to $22.36.

Bank of America has dropped from $50 in 2007 to $14.48.

But Goldman Sachs Group Inc., Nike Inc. and Visa Inc. have risen 25%, 27% and 18% respectively in 2013.

September 20, 2012: UnitedHealth Group Inc. (UNH) replaces Kraft Foods Inc. Kraft Foods Inc. was split into two companies and was therefore deemed less representative so no longer suitable for the Dow. The share value of UnitedHealth Group Inc. had risen for two years before inclusion in the Dow by 53%.

June 8, 2009: Cisco and Travelers replaced Citigroup and General Motors. Citigroup and General Motors have received billions of dollars of U.S. government money to survive and were not representative of the Dow.

September 22, 2008: Kraft Foods Inc. replaced American International Group. American International Group was replaced after the decision of the government to take a 79.9% stake in the insurance giant. AIG was narrowly saved from destruction by an emergency loan from the Fed.

February 19, 2008: Bank of America Corp. and Chevron Corp. replaced Altria Group Inc. and Honeywell International. Altria was split into two companies and was deemed no longer suitable for the Dow. Honeywell was removed from the Dow because the role of industrial companies in the U.S. stock market in the recent years had declined and Honeywell had the smallest sales and profits among the participants in the Dow.

April 8, 2004: Verizon Communications Inc., American International Group Inc. and Pfizer Inc. replace AT & T Corp., Eastman Kodak Co. and International Paper. AIG shares had increased over 387% in the previous decade and Pfizer had an increase of more than 675& behind it. Shares of AT & T and Kodak, on the other hand, had decreases of more than 40% in the past decade and were therefore removed from the Dow.

November 1, 1999: Microsoft Corporation, Intel Corporation, SBC Communications and Home Depot Incorporated replaced Chevron Corporation, Goodyear Tire & Rubber Company, Union Carbide Corporation and Sears Roebuck.

March 17, 1997: Travelers Group, Hewlett-Packard Company, Johnson & Johnson and Wal-Mart Stores Incorporated replaced Westinghouse Electric Corporation, Texaco Incorporated, Bethlehem Steel Corporation and Woolworth Corporation.

Real truth and Fictional truth

Is the number of points that the Dow Jones now gives us a truth or a fictional truth? If a fictional truth then the number of points now says absolutely nothing about the state that the economy or society is in when compared to the past. In that case a better guide would be to look at the number of people in society that use food stamps today – That is the real truth

Doesn’t it also make so much sense that in a time when the gap between the richest and poorest is excelerating, that a basket of hand picked winners in the buy-low-sell-high game would be shooting to the moon?

The big scam of DJIA is its representation as a “market health” indicator (how Orwellian). One can become rich by providing innovation and value to society, but becoming mega-rich is all too often a parasites’ Olympics, with the gold going to the ones that share the least. Browse the DJIA and you can find a Who’s Who of the corporations lobbying the hardest for deregulating out wage, health, and public safety laws whilst quietly building up regulation and law to entrench their monopoly grip and add barriers to competition.

That why it’s the Dow-Jokes to the initiated.

Would be interested in his take on the S&P.

Better widely followed indexes are the Wilshire 5000 and the Russell 3000/Russell 1000…Or the equal-weight indexes that follow the large indexes

Dow Jones “Industrial” index? Let’s see… McDonalds manufactures hamburgers, GS and JPM manufacture fraud, Visa and WMT manufacture human misery, and KO (Coca-cola) manufactures customers for Merch, Pfizer, etc.

Sad but funny, Scott. The descent into destitution. Grommen is the math teacher I wish I had had! Not talking about the degeneration phase is like not talking about death. Just remove those stocks from the index and bury them. This makes index funds look pretty delusional in a world that doesn’t take quality into consideration. Only profit. So the Dow gets away with this magic show because it refuses to speak of the dead, and then it fudges time. “An index point is not a fixed unit in time…” it just pretends to be one in the DOW.

In your April 8 2004 Dow changes you have AT&T being replaced, yet I show that in 11-1-1999 AT&T was added and has remained since. What gives?

SBC (the former Southwest Bell) bought AT&T and kept the AT&T name in 2005: http://en.wikipedia.org/wiki/AT&T.

So it appears SBC was added in 1999 but they’ve retrospectively said it’s AT&T, since the same company is now called AT&T.

Good one, Scott!

Wouldn’t have bothered with my longer rant if I’d seen Scott’s crystal-clear statement.

Perhaps we should re-name it the DJPIA (Dow Jones Post-Industrial Average) or the DJCCA (Dow Jones Crony Capitalism Average)

Scott, you’re on a roll.

So that’s why there’s butter on his pants!

Perhaps the day of economics is over. !00 years ago there was debate on whether it could ever be separated from psychology (Weber, Schumpeter) and the conclusion was broadly in favour of social economics. We got suckered into a self-fulfilling number system instead. The clearest statement of this I ever saw was a Jasper Carrot joke. Standing in a dole queue, he reeled off the kind of shiny econobable we now get with PSBR, GDP groaf stuff, before looking around at reality and asking ‘do you give a toss’?

Impossible to give a serious critique of this material, even though the concluding lines make me agree. I doubt the DOW is the only data set and that even the food stamp thing goes far enough. I feel utterly broken by what actually goes on, and believe the “data” of our situation lies in such. I don’t mean in personal introspection, but in the wider expression of what we are all feeling, including why, say, an Ivy League graduate like Yves puts the material she presents to us together (I don’t mean to stereotype here – Yves is refreshingly ‘just Yves’). It seems, for “data” we must always run to figures. What is a food stamp recipient supposed to feel when told Facebook and various other tech stocks is leading the charge to new wealth? How is someone who has made untold millions off Whatsapp supposed to feel about all his wealth while millions of his ‘fellow’ countrymen are on food stamps? What is the ‘big data’ on such through all the figures of wealff and groaf?

Because we lack the real data, I can only hint from my own experience. I am disabled by this economic system, quite literally sometimes in terms of depression. I don’t want to be richer than others by teaching a range of drivel to young kids and lie to them about module choice being essential to their future career. I don’t want to kill off ideas the best of them might have about a fair, peaceful, green world. I don’t want to limit their discussion of motivation at work to nonsense on Maslow’s pyramid (derived from a paper on blood sugar content) or Herzberg’s limited non-experiments.

The real data flows all over us. We can put on stupid events like World Cups and the vile Formula One. We keep 50 million on food stamps in a country of fantastic wealth. We keeps kids living with Mummy because we haven’t built housing. Revolting television, internet porn, the Orwellian wars of millions killed in our name (the Falklands is a watershed here on non-reporting – we no longer see the napalmed kids, only what embedded presstitute slappers show miles from any action). WW3 took place in a continent too many see as a country. And the Eurovision Song Contest, Penelope On The Toilet (from the genius BBC series ‘Monkeydust’) and, coming soon, ‘Craazyman’s Couch’ (filmed entirely while he is out). Obama’s missus tells us (rightly) that Nigerian slavery is wrong. But it’s OK to screw the lives of millions of Syrians?

So the DOW is skewed eh?

http://www.dailymotion.com/video/x10j25i_monkey-dust-series-2-01_fun

Some realistic data on the UK post-big-bang.

Bloody H—! It’s not Sweet William and Dan Dare any more, is it!

More like the graveyard shift on booze-alley. I have used it to illustrate Goffman. Thought I wasn’t getting through until some students produced video assignments and a short play on campus life.

God that was depressingly accurate.

But a good rant because you do not want to interfere in the idealism of your young students… you could just give them this paper by Grommen – In fact, their comments would be most interesting.

They find their own ways to tell you what they really feel, once there is an understanding they can and someway past the textbook dross there are academics who have noticed education is not regurgitation. The problem today is many ‘colleagues’ haven’t read beyond what they think are basic texts rather than propaganda.

Perhaps the day of economics is over. !00 years ago there was debate on whether it could ever be separated from psychology (Weber, Schumpeter) and the conclusion was broadly in favour of social economics. We got suckered into a self-fulfilling number system instead

This reminds me of an article I read in Harper’s. It was the story of a social psychologist and his team who followed one boy closely– I think the book that came out of it was called One Boy’s Day and that does describe the entire contents. If I remember correctly, one finding was that small school size allowed average or mediocre students to shine or at least try something that they might be intimidated at in an otherwise “better” or larger school. They discussed the role of place in shaping behavior– different behavior in different town locations with adults watching over everyone whether their children or not. I guess none of this sounds particularly revolutionary (neither does it sound like the ideas were taken to heart if you consider the rural school consolidation movement that followed afterward), but the idea of going out into the field and studying one average boy so closely (I guess it is expected it was a boy) was kind of cutting edge at the time. Then the psychologist’s time sort of passed as research turned increasingly to biological basis for behavior. More physics envy I guess. Too bad.

The ‘ethnomethodology’ is very time consuming and consequently expensive. These days we have ‘big data’ alternatives, though currently mostly in the wrong hands (NSA, GCHQ, advertisers). The idea is always to try to get closer to real behaviour rather than this number-aggregate stuff. There are loads of contradictions, not least that it could all work out as a managerial work study exercise or the kind of thing we see in policy uncertainty detection. I saw a Norwegian woman brilliantly describe company mergers using only wedding photographs. I wish I had her talent to do something similar on the lust for numbers in economics. Numbers are OK if they are properly descriptive of a system.

Another good testimony to the ‘value’ of the stock market.

Playing games of chance is one thing but we definitely need a better tool for long term investment.

Ten years ago many people thought that 5% was a paltry amount of interest as they were watching many high flying funds. This helped give many pension funds unrealistic projections for growth.

Today there may be more interest in a safe 5% rate of return and that would probably be more sustainable for society as a whole.

The Fed as the fiscal agent of the Treasury could issue bonds of this nature with a similar risk as Treasuries. Except they would be backed by labor and fund a multiple of different projects that would put people to work.

cleaning up the environment

One of the examples of where statements about the economy defy common sense is that environmental responsibility costs jobs. Is it less or more work to clean up your mess or to leave it for someone else? It is just that corporations are like children on a playground, threatening to take their toys and leave if they don’t get their way.

I worked in the index world. The S&P isba reasonable index like the others. The Dow is the only one with funny calculations like that. It could in theory be used by TPTB to pretend all is well.

Despite this though, the Dow has not outperformed the s&p in the way you’d expect it to so the stupidity works both ways. So I’m all for hating the Dow. As a matter of fact I’d like to see it destroyed. But there’s no conspiracy to use the s&p or even probably the dow , to make things appear good. Indexes are actually pretty honest compared to what’s left of capitalism

I have noticed for some time that the DJIA is skewed. Compare the rate of increase over the last ten years with the performance of the general economy or even the supposed inflation rate and it is apparent that something about the DJIA is wrong. When the general economic situation is one of recession bordering on depression how can any index be increasing at over 107% in five years? DJIA five years ago=~8,000 vs today 16,585. Something that doubles in five years when the rest of the economy is mired in depression!? Sounds like a rigged game to me.

And yet there are workaday folks out there earning good money who sink their yearly tithes into 401k plans religiously. In a way it seems like a good bet as a comparison of the chart for the DJIA shows that it does increase on a regular basis. But, this is only so because the Fed keeps the fragile egos of major investors propped up with schemes like the recent Quantitative Easing.

https://www.google.com/finance?q=INDEXDJX:.DJI

Fascinating. I was unaware of this. I remember once reading that stocks that are removed from the indexes tend to outperform the ones who are left. If so, does that make a difference?

The most obvious mechanism at work is that when shares are added to an index, the index funds invested in that index have to buy them , while when they are dropped they sell them. So the former go up in price while the latter fall. Or at least that is how it used to work when I had an active interest in such matters.

re-read what he wrote.

I believe that this is the most significant takeaway:

“The most remarkable characteristic is of course the constantly changing set of shares. Generally speaking, the companies that are removed from the set are in a stabilization or degeneration phase. Companies in a take off phase or acceleration phase are added to the set. This greatly increases the chance that the index will rise rather than go down.”

So simple, and yet, such an elegant explanation. I have wondered many times if there could have been such an inherent bias built in to the way the indexes are computed (although I was never able to frame the issue as clearly as the author did above). Always assumed it would have been much too obvious an issue for the market technicians to overlook- there HAD to be certain adjustment mechanisms in place to minimize such a distortion. Oh well, what did I know…

It would be interesting to know if the same bias could also exist in the other major indexes such as the NASDAQ, S&P 500 or Russell 2000 .

the dow exists mainly cuz it’s the oldest established index….and it served as a walking product placement for Dow Jones the Company/WSJ.

and it has all its flaws b/c in the olden days, “computers” were actual human beings who did the sums invovled….and it was infinitely easier/cheaper/less labor intensive to calculate an average of 30 instead of a free-float, market-capitalization weighted index of hundreds of stocks.

It will be hoax-squared if they do the computing by Moon-landing (wink, wink) astronauts.

testing

sounds like this dude was in cash for the last few years.

and I’m not criticizing either.

pain twists the mind.

Haha.

“Buy the Hoax!”

Actually, about 10 years ago I read someone that said if you are a long term investor you should just buy a S&P500 index for this very reason. They said the indexed will be “fixed up” to cull the losers and add the winners – and doing it after the fact still beats most mutual fund managers.

Of course getting your buy timing right would still be by far the best way. But I’ve concluded you need a time machine to do that right.

some people think reality is hoax. That may well be true, but it’s only true in theory. hahaha

Still, while you can now technically say a Dow Jones Index fund is actually an ‘actively managed’ fund, the fee is (or should be) lower than other ‘actively managed’ funds.

If you go with a low cost ETF fund like Vanguard, the cost is only a couple or three tenths of a percent vs a typical no load mutual fund is usually around 1.5%.

Then in reality, provided it exists and is denominated in dollars, you would buy a S&P500 ETF – and in theory you would get “better” * diworseification, except during those singularity periods when everything and anything gets tossed in a black hole.

Happy investing and be sure to enjoy your theoretical retirement!

* I’m using “better” in a relative sense, here.

Perhaps it might be easier to point out an institution that is NOT a hoax. I can’t think of any… .

I’m drawing a blank.

“easy” it is not.

I can’t think of any either.

But they don’t index themselves with data points disconnected from real comparisons and then claim to be the engine driving the great american economy ever upward, except for the wretched 99%.

Amazing what you can do with an experience curve. One wonders how economists work out water is wet.

It’s not wet after you account for all that hot air.

Is there an index that is sorted by those companies that produce actual products of labor and those companies devoted to economic rent extraction. the FIRE sector.

I also find it somewhat odd that software companies and pharma gain so much (like a printing press) on exisiting product thru re-branding/ “new-use for the same shit” gaming. I can see the value in computational power when it comes to design and production of actual products but. as the tech bubble showed – much capital was misallocated into basic copies of questionable functionality software for the sole purpose of inflating IPO prices = that crash was caused by people not looking for new functionality in an S curve but going for the cash without looking at any fundamental gain to human progress and functionality. IE: I don’t really need software to wipe my ass.

Fiat currency is also a hoax, so it fits perfectly into the broader economic fantasy, all the time, every time. It might work, temporarily, but it is a hoax (or is it “an” hoax?). The entire charade is advanced by weaving a fiction so complex that only the “experts” who define and distribute value are credited with the ability to understand their own bullshit.

When the bullshitters start believing their own bullshit, the jig is up.

Actually, it is a ridiculous statement to say fiat currency is a hoax.Really ,it is what it is.Money.

Fiat currency is a social construct.Just like the creation of the united states of America, was a construct.

Fiat currency is the most logical form of a medium of exchange.There is no better medium of exchange.There is no commodity or natural resource that has an intrinsic value. So the best form ,for people to use to trade goods,services,or anything …is fiat currency.

To claim a metal like gold has an intrinsic value…… now that is a “hoax”. like so many others.

The supply is infinite. Game over.

Some humans capacity for harming others to gain advantage… is infinite… game over.

Skippy… money cranks being a prime offender imo…

Fabulous post. The revelation is of course symbolic of the times, where financial engineering, fraud and a healthy dose of PR are used to propagate a false sense of reality. I guess the real formula for the index is whatever it takes to keep up appearances.

An interesting analysis but I’m not sure anyone can really pin down a system that ultimately functions as a means to create more wealth for the wealthy class. The stock market (including the DJIA within it) is an enormous game with quasi-rational rules, they make sense within the context of the game, but rarely reflect reality in a comprehensive way. The ’29 crash was a crisis only because we were subject to an economic system that had rigid boundary conditions. Once those boundary conditions were broken the system collapsed. The resources were there, yet the rules would not permit their production, distribution, and consumption. This crash exposed the stock market for the shell game it represents to commoners. The same can be said for today. It would be entertaining for a single broker, economist, whatever, to explain how the stock market reflects economic realities. I imagine they would end up explaining the stock market in terms of itself not in terms of the resources and labor utilized to give it “value”. It should be said though, in the capitalist casino, the stock market is the only game where the odds are in your favor if you come to the table with enough money and the right cheat sheet.

IOW, the primary barometer of capitalism’s health is cherry-picked to favor out-performers.

Whoodathunk?!

How is this not a “fraud” as opposed to a “hoax”?

It must correlate well enough with S & P, etc., to pass some sort of ‘sniff test’ in the winter cold, but markets as a whole are now thoroughly corrupted, fed by a Fed that quite frankly ran amok, destabilizing the entire global economy again in the process, as is unfolding in front of our eyes as those areas least able to deal with globalization (Ukraine, for instance, or Greece, or much of America) never did recover from the last crisis, and are first to decline in the emergent one. Things are less stable all around than they were in 2008, but this time some very important players are going to be a lot less inclined to cooperate, and I mean beyond just Russia and China. I mean other nations, institutions – the global power elite itself is now uncertain about US leadership. This is a very big deal.

I don’t understand the authors point beyond that the Dow does not represent the state of the economy. Stocks are worth (at an instant in time) whatever somebody is willing to pay for them (at an instant in time.) Notions of intrinsic value, (how much earnings are worth, what exactly are earnings, how much the future holds and what it is worth, what risk even is,) are not fixed at all and go with the winds and tides of human society. It’s not as if someone is trying to perpetrate some monstrous deception on humanity, we deceive ourselves and than blame someone else for our enthusiasm clouded vision. Just how fragile the solid ground we walk on is, we are perpetually forgetting. As ridden with con artistry as the world is, was it not ever so? Is not the fault and the promise of our world that we are so credulous and want to believe that world is a better place than it really is?

Note to self: Buy the Dow Jones Industrial Average indexed ETF and hold forever.