By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Testosterone Pit.

This is precisely what shouldn’t have happened but was destined to happen: Sales of existing homes have gotten clobbered since last fall. At first, the Fiscal Cliff and the threat of a US government default – remember those zany times? – were blamed, then polar vortices were blamed even while home sales in California, where the weather had been gorgeous all winter, plunged more than elsewhere.

Then it spread to new-home sales: in April, they dropped 4.7% from a year ago, after March’s year-over-year decline of 4.9%, and February’s 2.8%. Not a good sign: the April hit was worse than February’s, when it was the weather’s fault. Yet April should be the busiest month of the year (excellent brief video by Lee Adler on this debacle).

We have already seen that in some markets, in California for example, sales have collapsed at the lower two-thirds of the price range, with the upper third thriving. People who earn median incomes are increasingly priced out of the market, and many potential first-time buyers have little chance of getting in. In San Diego, for example, sales of homes below $200,000 plunged 46% while the upper end is doing just fine. But the upper end is small, and they don’t like to buy median homes [read… Housing Bubble 2 Veers Elegantly Toward Housing Bust 2]

Yet it’s going according to the Fed’s plan. Its policies – nearly free and unlimited amounts of capital for those with access to it – have created enormous wealth in a minuscule part of the population by inflating ferocious asset bubbles, including in housing. But now electronic real-estate broker Redfin has made it official: in 2014 through April, sales of the most expensive 1% of homes have soared 21.1% year over year, while sales in the lower 99% have dropped 7.6%.

And it wasn’t the first year. In 2013, sales of 1%-homes jumped 35.7%, while sales of the other 99% rose 10.1%. And in 2012, sales of 1%-homes rose 17.5%, while the rest of the market inched up a mere 2.9%.

The downtrodden who have to make do with buying the remaining 99% of the homes, these modern hoi polloi so to speak, whose real incomes have stagnated or declined as they face the soaring home prices of the Fed’s second housing bubble in less than a decade, to be financed at still historically low mortgage rates, well, they’ve hit a wall.

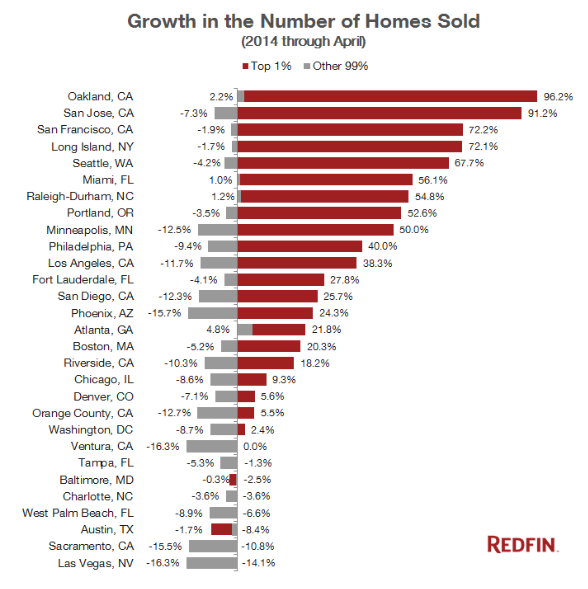

But at least luxury is thriving. In 9 of the 29 markets Redfin tracked, sales of the priciest 1% of homes jumped by over 50%. The top three were all here in the Bay Area – not surprisingly, given the miracles of the worldwide money transfer machine of IPOs and multi-billion-dollar startup acquisitions [Momentum Stock Fiasco Pricks San Francisco Housing Bubble].

In Oakland, sales of 1%-homes skyrocketed 96.2%, in San Jose 91.2%, and in San Francisco 72.2%. But in all three cities, sales of the 99% are down so far this year! So this isn’t exactly a booming housing market but a booming luxury market. A lopsided monstrosity that looks like this:

In a number of cities, including in some of the red-hottest housing markets of last summer, sales of homes in the 99% category have plunged. The worst: Los Angeles -11.7%, San Diego -12.3%, Minneapolis -12.5%, Orange County -12.7%, Sacramento -15.5%, Phoenix -15.7%, Las Vegas -16.3%, and Ventura -16.3%.

Some of these cities aren’t exactly cheap places to buy a 1%-home. In San Francisco, the median price is already over $900,000. But the minimum 1%-home? $5.35 million, according to Redfin. You’ll need enough after-tax income – if you’re not plunking down the cash you got from selling your startup – to cough up a monthly mortgage payment of $21,300. LA is second in line with the minimum 1%-home setting you back $3.65 million, or a monthly mortgage payment of $14,600. That’s the minimum. On the upper end, only the sky is the limit….

Location, location, location. Prices of 1%-homes vary by neighborhood. In my crazy San Francisco, Redfin found that Presidio Heights came out on top at $7.48 million for the average 1%-home, neck to neck with neighboring Pacific Heights at $7.18 million, and well ahead of Russian Hill at $6.53. But Presidio Heights was only the 6th most expensive neighborhood in the report, the top five all being in LA. King of the hill: Beverly Glen, where the average 1%-home costs a cool $11.86 million.

There are more expensive towns in the Bay Area, like Atherton, that could compete with the priciest neighborhoods LA has to offer. But they’re too small to make it into the stats. And these stats are a perfect illustration of what the Fed has set out to accomplish: the “Wealth Effect” – a semi-religious doctrine propagated by the Greenspan Fed and elevated to a state religion by the Bernanke Fed.

The relentless money-printing binge and zero-interest-rate policy did what it was designed to do: inflate asset bubbles and make some players rich, but not all. A home that cost $150,000 and jumps 50% in price will make the owner $75k. A home that cost $15 million and then jumps 50% will make the owner $7.5 million. A private equity firm that can borrow at near zero cost to buy up 40,000 homes might hope to gain around $5 billion. That’s how the Wealth Effect works.

The problem for the housing market is that there aren’t enough home buyers in that coddled 1%-category. The few can push up prices for a while but aren’t numerous enough to push up sales of the overall market. And they don’t like to buy median homes. Yet, as prices rise, homes move further out of reach of the 99%, and inevitably, sales drop further. At some point, something has to give. We already know from the last housing bubble and bust cycle what will give: prices. And afterwards, we’ll wonder, as we sort through the debris, how the Fed managed to sucker us into a second housing bubble and bust in just one decade.

The equation might not have gone so horribly awry if each class of college graduates had seen their incomes skyrocket in line with their student debt. But that’s a crummy joke in America. Read….This Chart Is The Fate of Housing In America As Student Loans Bankrupt A Whole Generation

Great article. QE was a money transfer to the 1%. Am I supposed to believe after 6 years of global money transfer to the 1% that income disparities just arise somehow? Hmpf, even if they do, we’re going on 6 years of deliberate upward income redistribution to the rich. Maybe the first question we should ask of anything is: “how do we prevent it from becoming a looting scheme for the 1%?” Although, I doubt QE was ever intended to be anything else.

The only places where the 99s have seen any tiny increases in homes sold from the chart above is where housing is CHEAP. Student loans weigh down young buyers everywhere and in places with expensive houses, houses have been barely affordable, entirely independent of student debt, to anyone UNDER 40! (then mostly affordable to the top 20%)

There are homeowners who didn’t want their home prices to drop as it is their biggest asset, but maintaining 2007 level bubble prices has both left younger potential homebuyers unable to buy (generational warfare) as well as led in many states to property tax increases that are driving older people on fixed incomes out of their homes (because you only realize the gain when you sell). Meanwhile those benefiting from QE have a field day and investors buy up property to rent trying to oligopoloize the rental market (because everything else in this country is an oligopoly afterall). This will either fail disastrously leaving those investors with their hands out for a bailout or will succeed disastrously (do we really want them monopolizing the rental market?).

How much money would it have taken to pay off everyone’s mortgage again, more or less than the current mess has and will cost us? Of course it would have probably just have left the people who got their mortgage paid off to feeling so rich they identify with the plutes (who also earned everything). But then nothing’s perfect.

People mostly do identify up. It’s the upper classes most useful lure to make the middle class do the upper class’ dirty work.

No wonder houses are snapped up in Detroit! I’m a daughter of the city, but it would take more than I’ve got to live there now.

Plenty of hand-wringing, whining, oh-look-dispassionate-intellectual-noticing. Not nearly enough “Goddammit I am angry at my future and my kids’ future being stolen by these thieves so I am going to wait in my Congressman’s office and give him/her a piece of my mind, I’m going to organize my local group to protest, I am going to donate money to people who are resisting, I am going to write scathing letters to the editor, I’m going to get out in the streets: I’M GOING TO DO IT ALL!”

This is the way the world ends, world ends, world ends, this is the way the world ends, not with a bang but a whimper.

I prefer:

Rage rage against the dying of the light!

C’mon you people who stopped the Vietnam War, who threw out a crook president, who completely changed a moribund society! GET OFF YOUR ASSES

It’s sad to watch so many families get priced out of decent homes. Most of the affordable inventory has been mopped up here too, and now the local appraisal district is taking its turn at putting the nail in the coffin for what’s left of the middle class while assessing more affluent property owners at only 90 cents on the dollar….

http://aaronlayman.com/2014/05/unequal-property-tax-assessments-in-katy-tx-fort-bend-county/

As someone who grew up in a town that had a population of 26,000 then jumped to 60 000 in less then ten years, I have no sympathy for the real estate market and construction industry. Thus I’m going to state something which will sound incredibly naive, perhaps down right dumb:

If new buyers can only put $10,000-$20,000 down payment on a home then why isn’t the cost of a house $10,000-$20,000? Isn’t that how the free market and supply and demand are suppose to work? Instead we get a middle man – a bank – adding $200,000 to the pot and generating a great deal of business for itself. But what productive thing does it do to merit this business? All it is doing is grossly inflating the price for its own benefit. The pathetic thing is that with fractional reserve banking they likely don’t even have this money(everyone is just pretending they do). Quite a racket. Imagine going to the grocery store and buying a loaf of bread for $20 – $2 down and $18 owed to the store, with interest on that debt. I better keep that to myself, don’t want to give the geniuses who run things any new ideas!

It makes no sense to me. Of course, I wasn’t around when this model was first created. Maybe I am dumb but is seems every economy is based on this real estate model. Perhaps it is time to have the whole thing collapse and start over again with something that makes sense. is it just me or do others have trouble seeing where the banks provide anything of value to the economy any more? What ever happened to George Bailey and the Building and Loan?

Land, materials, and labor are going to automatically make house prices in contemporary America too high for all but a small percentage of the population to pay for, cash on the barrel head. And saving money to buy is incredibly difficult with stagnant wages for most blue collar workers since the late 1960s (literally, adjusted for inflation) and the fact that bank interest on savings has failed to keep up with inflation for over a decade. Unless you want to limit home ownership to 7-10% of the population, mortgages are essential.

Which is chicken, which is egg? Credit has driven up home prices which requires more credit which drives up home prices which requires more credit …

The solution is a temporary ban on credit creation and a universal, metered bailout of the entire population with new fiat plus the elimination of all government privileges for credit creation.

You don’t sound dumb to me. How do we ever learn if we don’t ask questions?

I think that millions of us are questioning the validity of banks – which we now actually need new terms for, as my local, regional banks make loans but do not have hedge funds, don’t rehypothicate out of London, don’t own oil tankers or speculate in commodities markets, apparently don’t use tax havens, and actually need to know their customers (what a concept, eh).

Local banks may have a role.

The TBTF banks are globalism on steroids. These are not ‘banks’, although they use the term ‘bank’ as a kind of deceptive cover. They originated as banks, but they have morphed into entities that might be called commoditySpeculatingRehypothicatingTaxHavenMavenHedgistanis, or something more descriptive (and even harder to spell).

If they were competent and produced a valued good, they wouldn’t need to capture government (and international) agencies, nor would they need to be buying politicians. Without controlling the political process, it’s questionable whether they could remain economically viable.

“A home that cost $150,000 and jumps 50% in price will make the owner $75k…”

…on paper. Such gains are realized (monetized) by a relative few and will be lost by whoever happens to be holding the asset when the bubble bursts, while any liabilities resulting from refinancing (cashing out) will remain.

I “made” and “lost” $75k on my home as a result of the GFC and it’s run-up, but didn’t get hurt because I didn’t cash out. House still works fine.

This post reminds me of one of the false notes of ‘Blue Jasmine’. I was enjoying the movie, but I had to fight off cognitive dissonance, because Ginger, the San Francisco sister has a large apartment within San Francisco’s city limits and works at a grocery store. Who can buy a house in San Francisco and rent it out to a grocery store employee and not call it charity?

People who call it rent control, that’s who. Lots of fabulous apartments renting for under $800/month in San Francisco, for those who get them back when rents were lower. That’s quite doable on a grocery clerk’s salary, especially since San Francisco has a high local minimum wage and you can easily get by without a car in the city.

I remain unconvinced that Ginger hit SF 1995 and scored some sweet rent controlled housing, an 1100 square foot pad, with beautiful touches that was easily affordable on $4 or $5 above minimum wage. Maybe if Ginger was 75, one of the beats maybe, bot not someone in their late 30’s. Now if you want to argue that a film maker needs to have more than one shot in the same crummy 400 square feet or else the film will be too ugly, then I might feel embarrased by my point.

Myeand my ex-girlfriend moved into a fabulous apartment on the top of nob hill, with views all the way to the bay, back in 1995. Rent was $1250 and would be maybe $1500/mo now because rent control only allows adjustments under the inflation rate. (We’ve both moved on to other cities.) In the Mission or Noe Valley back in 1995, it was easy to find great places for under $1000. That was the nadir of the housing price bust, following the boom of the late 1980’s, and before the boom of the dotcom era.

I had forgotten how severe the mid-90’s housing crash was in California.

There is no such thing as “fractional reserve banking”. It’s an ancient way of looking at banking that may have had some relevance in analysis pre 1934, but certainly not since. It’s actually even more fun now. Banks can lend as much as they fucking please. Since, well, bank lending creates money.

Eh, sorry about this, it was supposed to be a reply to EoinW.

Banks created money under fractional reserves too only not so much. Banks should be 100% private with 100% voluntary depositors but because a Bible thumper said it first it won’t happen? Except it will, sooner or later.

“. . . something has to give . . .” alright!! That would be the 99% giving rents to the neo-aristocracy! Wake up and smell the feudal/corporatist stench.

These housing articles crying about prices declines or price increases always focus on the high end neighborhoods in Calif. San Francisco is a tiny slice of single family housing relative to the rest of the Bay Area and Calif yet it constantly pops up as an example of housing either out of control or a haven for the wealthy. These articles need to have a wider slice of American housing including the South,NE and midwest rather then focus constantly on Calif.

Good point. USA is not just CA. The profiles are not necessarily the same at all . . .

The article doesn’t mention the “tapering” of QE and its effects on asset values (houses and stocks are assets). Remember, QE is the underlying reason for the spectacular rise of the stock market since March 2009, and the increase in real estate values. There are predictions that the Fed will, sooner or later, launch QE 4, which is likely to boost asset values once again. At some unknown point in time, even with continuing quantitative easing and near-zero Fed funds rate (this rate is determined mainly by the condition of the economy rather than by the Fed’s discretion), home and stock values are likely to peak and then begin a long decline, just like what happened in Japan. With that in mind, now might be a very bad time to buy a house as an investment, especially for members of the 99 percent.

Not only because prices are unlikely to rise sufficiently, but that owning a single-family home is fraught with other risks: noisy and recalcitrant neighbors, insufficiently funded utilities (including parks), lurking danger from un-permitted structural, electrical, plumbing “improvements, clouded Title, government mandated site improvements (the sidewalk is YOUR responsibility), regular maintenance needs of at least 3% of property value, increasing transportation costs, and, of course, your pension funds in CalPERS may not be available when you need them.

Don’t forget the highly unpredictable nature of employment. I don’t know where I’ll be working in 5 years, much less 30 years! I don’t understand how anyone can bank their professional future on the ability to quickly sell their house without taking the roughest haircut of their lives.

“… without taking the roughest haircut of their lives.” That’s not a bug. It’s a feature.

The info in the post doesn’t seem to fit the title.

According to the charts and info in the post, the current (2nd) bubble is only affecting the 1% and that bubble is continuing to expand. This bubble has not burst.

The decline in number of homes sold in the 99% seems to me to be just a continuation of the original (1st) bubble bursting that started several years ago. It doesn’t seem to me like it’s a “Housing Bubble 2” collapse.

If you read the housing press, they’ll talk about how strong the market is (well until very recently) and conflate the two markets. Wolf is saying that even in the supposedly hot markets, the action is all in a tiny slice.

The bubble is in prices, not quantities sold (what the above article is about). Isn’t prices increasing but total home ownership rate decreasing what has been happening for awhile now? In bubble 1 ownership rates were also increasing. Bubble 2 is increasing prices with decreasing home home ownership. I would say this is in part because investors are buying up so many of the homes. Although I’m not sure how that would fit in the 99% versus 1% divide above since I don’t think most investor aquired homes actually are in the top 1% most expensive housing stock and the distinction between investor owned and resident owned is not made. But anyway most will consider that housing bubble 2 is collapsing if housing prices tank again regardless of what happens to % of houses sold.

i don’t see detroit mentioned anywhere.

i often watch a show on hgtv channel about people seeking a new home and they can’t afford their ready-made home, so the show convinces them to buy a fixer upper. at first they are shown a house that is ready to go. this is usually priced over $1 million. So they state their budget is 400-700k. and they can get a home for 525k and put 125k into it and still be under budget. then when they find their home, it’s always in the city with no land. and most of the cost of renovations is the buyers purchasing all new furnishings and fixtures (meaning couches, tables, chairs). the homeowners will be shown that an area is rotted and needs rebuilding. and they cringe when told it will cost $1,500 for this work.

your article made me think of this. where do these ppl get the money to make payments on such a mortgage?

Two income couples, top 20%-30% income, in a place like California or MA where the salaries with two incomes top % are enough to make payments on the mortagage (at least if you don’t have 100k in student loans or something). Don’t try this if you are a bottom 50% couple. Don’t try this on one income. And the salaries in middle America may not get you there but neither are the housing costs up there either.

I didn’t realize you could buy a house for less than $200,000 in the San Diego area — really?